The Offshore Support Vessels Industry size was valued at USD 2205.7 Million in 2022 and the total Offshore Support Vessel Market revenue is expected to grow at a CAGR of 6.5 % from 2023 to 2029, reaching nearly USD 3440 Million.Offshore Support Vessels Industry Overview:

The Offshore Support Vessel (OSV) market is pivotal for seamless offshore operations in industries like oil and gas and Renewable Energy. These specialized maritime vessels play a vital role in addressing challenges posed by changing environmental conditions and intricate operational demands. OSVs ensure the steady flow of personnel, equipment, and supplies to and from offshore platforms, curbing downtime and facilitating activities such as resupply, maintenance, and emergency response. Their significance is closely tied to the offshore energy sector's health, particularly oil, gas, and renewable projects. Despite a growing focus on environmental considerations and energy-efficient technologies, immediate operational requirements often prioritize fast, high-powered vessels over energy efficiency. This intricate market dynamic shapes OSV design and characteristics. The trend leans toward advanced, deepwater-capable vessels, with a younger fleet equipped with cutting-edge technologies. OSVs are evolving in size, efficiency, and flexibility to meet complex, distant offshore needs. Larger vessels will accommodate increased cargo and regulations, while improved fuel efficiency aligns with sustainability goals. High-specification, adaptable designs are crucial for uninterrupted operations. As offshore activities grow more intricate, OSVs play a pivotal role beyond transportation.What does the bundle’s collection provide?

1. Individual reports present a thorough analysis of the Offshore Support Vessel sector within specific regions. 2. The Offshore Support Vessel Bundle report provides a global overview of the market, encompassing factors like vessel types, water depth, and end-users. 3. The report furnishes insights into growth catalysts, impending challenges, emerging trends, opportunities, risks, and entry barriers that confront the industry. 4. The research methodology involves an exhaustive examination of product-oriented literature, industry announcements, annual reports, and pertinent documents sourced from major industry participants. 5. Noteworthy in the report is the industry players' concerted focus on technological advancements, driving their efforts to establish supremacy within the global Offshore Support Vessel market. Key players are actively providing their market positions. 6. With the intent of equipping stakeholders with well-founded decisions and a comprehensive grasp of market dynamics, the report aims to supply valuable insights and an in-depth exploration of the Offshore Support Vessel market. Explore a vast reservoir of knowledge concerning the Offshore Support Vessel market through this budget-friendly bundle, providing a valuable repository of insights and information. By acquiring this economic package, you are granted entry to a series of reports at a cost lower than acquiring them individually. Seize the chance to immerse yourself in exhaustive evaluations and priceless data concerning the Offshore Support Vessel sector with this collection offered at a discounted rate. Acquire the bundled report series titled "Sustainability and Green Practices Fueling the Future of the Offshore Support Vessels Industry," originally valued at $14500, now accessible at a reduced price of $12800. 1. North America Offshore Support Vessel market (Single User $ 2900) 2. Asia Pacific Offshore Support Vessel market (Single User $ 2900) 3. Europe Offshore Support Vessel market (Single User $ 2900) 4. Middle East and Africa Offshore Support Vessel market (Single User $ 2900) 5. South America Offshore Support Vessel market (Single User $ 2900)How this report will help you:

1. Obtain insightful knowledge to facilitate well-informed business decisions by delving into this comprehensive report that examines key trends and driving forces within the Offshore Support Vessel market. 2. Enhance your market footprint and pinpoint avenues for expansion within the Offshore Support Vessel sector using insights from this report. 3. Identify promising realms for growth and investment through an in-depth analysis of pivotal segments and significant projects detailed in this report. 4. Comprehend the influence of governmental policies on the Offshore Support Vessel market, anticipate potential policy shifts, and realign your business strategies accordingly. 5. Strategize for the future by exploring historical and projected valuations of the Offshore Support Vessel market. This aids in budgeting, resource allocation, and establishing objectives to address forecast market evolutions. 6. Devise effective risk mitigation approaches by recognizing potential obstacles, market volatility, and regulatory elements underscored in this report.To know about the Research Methodology :- Request Free Sample Report

Reports Offerings in the Bundle:

Report 1: Sustainability and Green Practices Fueling the Future OF the North America Offshore Support Vessels Industry: Industry Analysis and Forecast (2022-2029).

The North America Offshore Support Vessel Market size was valued at USD 816.11 Million in 2022 and the total North America Offshore Support Vessel Market revenue is expected to grow at a CAGR of 6.3 % from 2023 to 2029, reaching nearly USD 1272.80 Million. The offshore support vessel market is propelled by escalating offshore oil and gas exploration and production endeavors across North America. These operations necessitate the vital role of support vessels in ferrying equipment, supplies, and personnel to and from offshore platforms. The demand intensifies particularly due to the focus on deep-water and ultra-deep-water reserves in regions like Mexico, stimulating the requirement for specialized vessels capable of maneuvering in challenging and remote offshore conditions. The drive towards renewable energy sources, exemplified by offshore wind farms, further fuels market growth. These ventures rely on offshore support vessels for equipment installation, maintenance, and transportation. Investments in subsea infrastructure, encompassing pipelines, cables, and subsea installations, also amplify demand for construction and installation support vessels.Technological advancements play a pivotal role, with innovations like advanced dynamic positioning systems, robotics, and remote-operated vehicles enhancing offshore operations' safety and efficiency. Stringent environmental and safety regulations mandate specialized vessels designed for compliance, including those catering to spill response and pollution control. The persistent demand for oil and gas products, coupled with the need for secure energy sources, sustains exploration and production efforts, thus reinforcing the offshore support vessels market. Improved oil prices and market stability further encourage investments in offshore projects, driving demand for diverse vessel types. North America's economic growth, stability, and supportive government policies foster an environment conducive to offshore energy exploration and production, consequently expanding the market.

Sr. No. Vessel Type Description 1. Anchor Handling Towing and Supply (AHTS) vessels 1. Fitted for deep-water anchor handling and towing operations, equipped with a winch capable of lifting a barge or other offshore vessel anchors. 2. The main duty is to move rigs, tow barges, set anchors, and provide supply support. 3. Equipped with large cranes, winches, and large open deck space. Winch and engine capacity determine power. Higher horsepower is used to handle heavier gear. 2. Platform Supply Vessels (PSV) 1. The main purpose is to move cargo and supplies to/from offshore installations. 2. A flexible platform structure enables multiple-purpose supply cargo carrying capacity 3. Standard Type – UT755, a Rolls Royce-designed PSV, over 100 in operations 3. Multi-Purpose Service Vessel (MPSV) 1. Multi-Purpose (MPP) use 2. Equipment for sub-sea service, large cranes, winches, and/or firefighting equipment. 3. May have other equipment, such as ROV support, diving support, etc. 4. Seismic Survey Vessels 1. Survey vessels with seismic prospecting equipment, called seismic streamers. 2. Can be capable of a range of duties including survey, patrolling, fishery protection, emergency standby, pollution control, fire-fighting, salvage, towing, etc. 5. Standby and Rescue Vessels 1. Standby duties are where a vessel is waiting near offshore installations in case of emergencies, to pick up people. 2. Typically with helipad, firefighting, rescue operations, or oil recovery equipment. 3. Can accommodate a large number of passengers, up to 300 persons Report 2: Sustainability and Green Practices Fueling the Future OF the Asia Pacific Offshore Support Vessels Industry: Industry Analysis and Forecast (2022-2029).

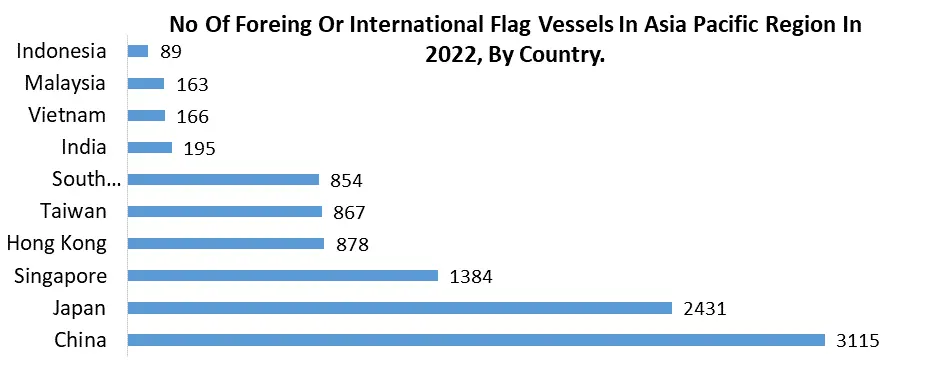

The Asia Pacific Offshore Support Vessel Market size was valued at USD 551.43 Million in 2022 and the total Asia Pacific Offshore Support Vessel Market revenue is expected to grow at a CAGR of 6.5 % from 2023 to 2029, reaching nearly USD 860.0 Million. The surge towards renewable energy sources, notably offshore wind farms, is propelling the demand for Offshore Support Vessels (OSVs) that cater to the installation, maintenance, and conveyance of components essential for these projects. The establishment of offshore wind farms necessitates OSVs with dynamic positioning capabilities and specialized equipment to facilitate turbine installation and upkeep. In Australia, impending offshore wind initiatives are poised to rely on OSVs across various phases, encompassing installation, maintenance, and logistical support. Numerous Asia Pacific nations are directing investments towards enhancing their maritime infrastructure, encompassing ports and offshore platforms. This trend results in an augmented requirement for OSVs to underpin construction, material transportation, and installation endeavors.Malaysia's endeavors to expand its offshore platform infrastructure within the South China Sea are generating a demand for OSVs to facilitate both construction and ongoing operational needs. The growing appetite for raw materials and minerals, combined with advancements in deep-sea mining technologies, is fostering escalated exploration and extraction undertakings in deep waters. OSVs play a pivotal role by facilitating the conveyance of equipment and resources indispensable for supporting deep-sea mining operations. The exploration of polymetallic nodules within the Pacific Ocean, spearheaded by countries like China and Japan, necessitates the deployment of OSVs for the transportation of resources and the installation of extraction equipment.

Report 3: Sustainability and Green Practices Fueling the Future OF the Europe Offshore Support Vessels Industry: Industry Analysis and Forecast (2022-2029).

The Europe Offshore Support Vessel Market size was valued at USD 374.97 Million in 2022 and the total Europe Offshore Support Vessel Market revenue is expected to grow at a CAGR of 6.4 % from 2023 to 2029, reaching nearly USD 584.80 Million. The Europe Offshore Support Vessel Market is thriving due to several factors. Offshore oil and gas exploration fuels demand for vessels like platform supply and anchor-handling tug supply vessels, crucial for transporting personnel and supplies to rigs. The emphasis on renewable energy, especially offshore wind farms, drives the need for specialized vessels for turbine transport and maintenance. Aging installations sustain demand for construction support and decommissioning vessels. Stringent regulations enforce safety and environmental standards, spurring advanced vessel deployment. Deepwater exploration, notably in challenging zones like the North Sea, increases demand for advanced vessels.Growing subsea infrastructure prompts construction support vessel and remotely operated vehicle demand. Favorable geopolitics and stable investments in Europe drive offshore energy exploration. Despite renewables, hydrocarbons remain vital due to energy demand. Infrastructure development enhances vessel operations, and innovations in design, propulsion, and digitalization boost efficiency and safety, elevating offshore support vessel demand. Europe's offshore wind expansion, spearheaded by the UK and Germany, offers a prime market opportunity. The UK's offshore wind commitment has driven vessel demand, as seen in the Hollandse Kust Zuid project where Subsea 7 anticipates vessel needs for turbine transport, installation, and subsea support. Challenges like contract losses emphasize efficient contracting models and risk mitigation strategies.

Report 4: Sustainability and Green Practices Fueling the Future OF the Middle East and Africa Offshore Support Vessels Industry: Industry Analysis and Forecast (2022-2029).

The Middle East and Africa Offshore Support Vessel Market size was valued at USD 264.68 Million in 2022 and the total Middle East and Africa Offshore Support Vessel Market revenue is expected to grow at a CAGR of 6.6 % from 2023 to 2029, reaching nearly USD 412.80 Million. The Middle East and Africa offshore support vessel market is expected to see substantial growth, propelled by its vital role in bolstering offshore oil and gas exploration and production. With the global oil and gas demand predicted to rise, the region foresees a notable upsurge in offshore support vessel demand within the next 3 to 5 years. Key national oil companies (NOCs) like Saudi Aramco, ADNOC, and Qatar Energy are charting expansion plans that present expansive prospects. However, this promising trajectory is not devoid of challenges. The sector grapples with intricate dynamics, including oil price impact on rates, security, and logistics intricacies. Following the success of the inaugural Offshore Support Vessel Conference, the second edition is slated for June 3-4, 2024, in Abu Dhabi, UAE. This event will unite offshore oil and gas production leaders, ship owners, shipbuilders, shipyards, and charterers. The aim is to unveil exploration and production advancements, introduce commercial trends, and spotlight emerging contracting opportunities. The conference serves as an exclusive platform for networking, collaboration, and innovation, fostering a sustainable future for the offshore support vessel sector.Industry giants are set to propel growth further. Saudi Aramco envisions a 50% expansion in its offshore support vessel fleet, potentially reaching 450 crafts. ADNOC's $548 million contract for a new main gas line at the Lower Zakum field amplifies offshore support vessel needs. Qatar Energy's initiation of 13 offshore LNG projects corresponds to a substantial demand increase. Similarly, Kuwait Oil Company's inaugural $594 million offshore drilling project will escalate offshore support vessel requirements. Amidst opportunities and challenges, the Middle East and Africa's offshore support vessel market is poised for notable expansion, underpinned by escalating oil and gas demand and ambitious NOC plans. The sector strives to navigate complexities, embrace innovation, and establish a robust foundation for a thriving offshore support vessel ecosystem.

Vessel Type Number Of Vessels Gross Tons (GRT) Anchor Handling Tug Supply (AHTS) 1800 2,797,399 Platform Supply Vessels (PSV) 1100 1,338,806 Fast Supply Vessels (FSV) 90 21,915 Total 2990 4,158,120 Report 5: Sustainability And Green Practices Fueling The Future OF The South America Offshore Support Vessels Industry: Industry Analysis And Forecast (2022-2029).

The South America Offshore Support Vessel Market size was valued at USD 198.51 Million in 2022 and the total South America Offshore Support Vessel Market revenue is expected to grow at a CAGR of 6.7 % from 2023 to 2029, reaching nearly USD 309.60 Million. Offshore oil and gas Greenfield projects are set to experience a remarkable resurgence in investment, reaching their highest levels in a decade, with Brazil and Guyana leading the charge by earmarking a combined expenditure of $30 billion. This region is fast establishing itself as a leader in both deep-water and shallow-water operations, collaborating with the North Sea and the Middle East to drive global offshore expansion. Projections by Rystad Energy indicate a significant rise in worldwide offshore oil and gas project investments, with anticipated expenditures reaching $214 billion within the next two years. The annual Greenfield capital expenditure (capex) is poised to surpass $100 billion in 2023 and 2024, marking a consecutive two-year feat unseen since 2012 and 2013. Brazil is on track to escalate spending from $20.5 billion in 2022 to $23 billion in 2023, while Guyana's investments will climb from $5 billion to $7 billion year-on-year.Key developments encompass Brazil's deployment of 16 floating, production, storage, and offloading (FPSO) units across six fields by the decade's close. These initiatives underscore offshore oil and gas production's enduring significance, particularly as global energy strategies evolve toward lower carbon-intensive methods. The sector confronts challenges. Bottlenecks in subsea umbilicals, risers, and flowlines (SURF), sub-suppliers for vital equipment, yard capacity limitations, and labor shortages pose potential hurdles. Escalating material costs and supplier price hikes could challenge project feasibility. Nevertheless, as the Latin American offshore industry gains traction and extends its influence, it remains a crucial catalyst for propelling sustainable energy transitions and curbing global carbon footprints.

The South American Offshore Support Vessel (OSV) market is distinguishable by water depth, encompassing shallow water, deep water, and ultra-deepwater segments. Deep water reigns as the dominant segment, spanning water depths from around 500 meters to 1,500 meters. Operating at these depths entails complex challenges due to harsh environmental conditions and extended distances from shore. Deep-water OSV operations support subsea activities, ROVs, and intricate drilling and production setups, necessitating specialized vessels equipped for deep-water navigation. Shallow water regions, with depths up to around 200 meters, entail less demanding operational conditions and are often close to the coast. They are apt for activities like platform supply, anchor handling, and drilling support. In contrast, ultra-deepwater, exceeding 1,500 meters in depth, poses elevated technical and logistical challenges. Operating here requires advanced vessels, equipment, and technology to manage extreme pressures, currents, and intricate subsea installations. OSVs in this segment are vital for deep-sea drilling, subsea construction, and specialized research, addressing the complexities of ultra-deepwater conditions.

Water Depth Length (meter) Bpd (In 1K) Country Shallow Water 475 110 Equatorial Guinea Deep Water 720 100 Angola 728 100 Angola 960 80 Equatorial Guinea 1221 100 Brazil 1250 100 Angola 1365 120 Malaysia 1485 100 Brazil Ultra-deep Water 1525 120 Guyana 1600 220 Guyana 1780 100 Brazil 1850 60 USA 1900 220 Guyana 1900 220 Brazil 2000 180 Brazil 2100 120 Brazil 2120 150 Brazil 2140 150 Brazil Offshore Support Vessels Industry Scope: Inquire before buying

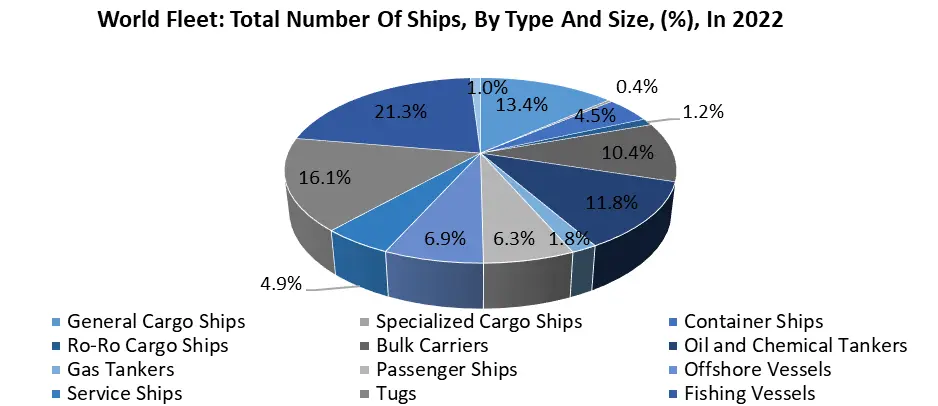

Offshore Support Vessels Industry Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 2205.7 Million Forecast Period 2023 to 2029 CAGR: 6.5% Market Size in 2029: US $ 3440 Million Segments Covered: by Vessel Type Anchor Handling Vessel Tug Supply Vessel Platform Supply Vessel Multipurpose Support Vessel Crew Vessel Chase Vessel Seismic Vessel Standby Rescue Vessel by Water Depth Shallow Water Deep Water Ultra Deep Water by End User Oil and Gas industry Offshore wind Patrolling Research and Surveying Others Offshore Support Vessel Key Players:

1. Abdon Callais Offshore LLC 2. Bass Marine Pty Ltd. 3. Bourbon Corporation SA 4. Bumi Armada Berhad, 5. Chandra Ship Management Pvt Ltd. 6. Delta Logistics Limited, 7. DOF ASA 8. DOLPHIN OFFSHORE ENTERPRISES INDIA LTD. 9. Dredging Corporation of India Limited. 10. Edison Chouest Offshore 11. Group 12. GOL OFFSHORE 13. Grupo Coremar S.A., 14. Harvey Gulf, 15. Havila Shipping ASA, 16. HIND OFFSHORE. 17. Hornbeck Offshore Services 18. Intermarine LLC, 19. Island Offshore Management, 20. Japan Marine United Corporation 21. Maersk Supply Service A/S 22. Miclyn Express Offshore 23. MMA Offshore Limited 24. Nam Cheong International Ltd. 25. OCEAN SPARKLE LIMITED. 26. PACC Offshore Services Holdings 27. Rem Maritime As, 28. Seacor Marine Holdings Inc. 29. Seam Offshore 30. Solstad Farstad ASA 31. Tag Offshore Limited. 32. The Shipping Corporation of India Ltd. (SCI). 33. Tidewater Inc. 34. Topaz Energy and Marine 35. VARUN SHIPPING. 36. Vroon Offshore Service Pte Ltd 37. Wintermar Offshore Marine GroupFAQs:

1. What are the growth drivers for the Offshore Support Vessel Market? Ans. Offshore Wind Expansion and Expanding Offshore Activities Fuel Offshore Support Vessel Demand and are expected to be the major driver for the Offshore Support Vessel Market. 2. What is the major restraint for the Offshore Support Vessel Market growth? Ans. Geopolitical Uncertainty Affects the Offshore Support Vessel Market and are expected to be the major restraints for the Offshore Support Vessel Market. 3. Which country is expected to lead the global Offshore Support Vessel Market during the forecast period? Ans. North America is expected to lead the Offshore Support Vessel Market during the forecast period. 4. What is the projected market size & and growth rate of the Offshore Support Vessel Market? Ans. The Offshore Support Vessel Market size was valued at USD 2205.7 Million in 2022 and the total Offshore Support Vessel Market revenue is expected to grow at a CAGR of 6.5 % from 2023 to 2029, reaching nearly USD 3440 Million. 5. What segments are covered in the Offshore Support Vessel Market report? Ans. The segments covered in the Offshore Support Vessel Market report are by Vessel Type, Water Depth, End-Users, and Region.

1. Offshore Support Vessels Industry: Research Methodology 2. Offshore Support Vessels Industry Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Offshore Support Vessels Industry: Dynamics 3.1 Offshore Support Vessels Industry Trends by Region 3.1.1 Global Offshore Support Vessels Industry Trends 3.1.2 North America Offshore Support Vessels Industry Trends 3.1.3 Europe Offshore Support Vessels Industry Trends 3.1.4 Asia Pacific Offshore Support Vessels Industry Trends 3.1.5 Middle East and Africa Offshore Support Vessels Industry Trends 3.1.6 South America Offshore Support Vessels Industry Trends 3.2 Offshore Support Vessels Industry Dynamics by Region 3.2.1 North America 3.2.1.1 North America Offshore Support Vessels Industry Drivers 3.2.1.2 North America Offshore Support Vessels Industry Restraints 3.2.1.3 North America Offshore Support Vessels Industry Opportunities 3.2.1.4 North America Offshore Support Vessels Industry Challenges 3.2.2 Europe 3.2.2.1 Europe Offshore Support Vessels Industry Drivers 3.2.2.2 Europe Offshore Support Vessels Industry Restraints 3.2.2.3 Europe Offshore Support Vessels Industry Opportunities 3.2.2.4 Europe Offshore Support Vessels Industry Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Offshore Support Vessels Industry Market Drivers 3.2.3.2 Asia Pacific Offshore Support Vessels Industry Restraints 3.2.3.3 Asia Pacific Offshore Support Vessels Industry Opportunities 3.2.3.4 Asia Pacific Offshore Support Vessels Industry Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Offshore Support Vessels Industry Drivers 3.2.4.2 Middle East and Africa Offshore Support Vessels Industry Restraints 3.2.4.3 Middle East and Africa Offshore Support Vessels Industry Opportunities 3.2.4.4 Middle East and Africa Offshore Support Vessels Industry Challenges 3.2.5 South America 3.2.5.1 South America Offshore Support Vessels Industry Drivers 3.2.5.2 South America Offshore Support Vessels Industry Restraints 3.2.5.3 South America Offshore Support Vessels Industry Opportunities 3.2.5.4 South America Offshore Support Vessels Industry Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives For the Offshore Support Vessel Industry 3.8 The Global Pandemic and Redefining of The Offshore Support Vessel Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 Global Offshore Support Vessel Trade Analysis (2017-2022) 3.11.1 Global Import of Offshore Support Vessel 3.11.2 Global Export of Offshore Support Vessel 3.12 Global Offshore Support Vessel Production Capacity Analysis 3.12.1 Chapter Overview 3.12.2 Key Assumptions and Methodology 3.12.3 Analysis by Size of Manufacturer 4. Global Offshore Support Vessels Industry: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 4.1 Global Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 4.1.1 Anchor Handling Vessel 4.1.2 Tug Supply Vessel 4.1.3 Platform Supply Vessel 4.1.4 Multipurpose Support Vessel 4.1.5 Crew Vessel 4.1.6 Chase Vessel 4.1.7 Seismic Vessel Standby 4.1.8 Rescue Vessel 4.2 Global Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 4.2.1 Shallow Water 4.2.2 Deep Water 4.2.3 Ultra Deep Water 4.3 Global Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 4.3.1 Oil and Gas industry 4.3.2 Offshore wind 4.3.3 Patrolling 4.3.4 Research and Surveying 4.3.5 Others 4.4 Global Offshore Support Vessels Industry Size and Forecast, by Region (2022-2029) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Offshore Support Vessels Industry Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 5.1 North America Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 5.1.1 Anchor Handling Vessel 5.1.2 Tug Supply Vessel 5.1.3 Platform Supply Vessel 5.1.4 Multipurpose Support Vessel 5.1.5 Crew Vessel 5.1.6 Chase Vessel 5.1.7 Seismic Vessel Standby 5.1.8 Rescue Vessel 5.2 North America Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 5.2.1 Shallow Water 5.2.2 Deep Water 5.2.3 Ultra Deep Water 5.3 North America Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 5.3.1 Oil and Gas industry 5.3.2 Offshore wind 5.3.3 Patrolling 5.3.4 Research and Surveying 5.3.5 Others 5.4 North America Offshore Support Vessels Industry Size and Forecast, by Country (2022-2029) 5.4.1 United States 5.4.1.1 United States Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 5.4.1.1.1 Anchor Handling Vessel 5.4.1.1.2 Tug Supply Vessel 5.4.1.1.3 Platform Supply Vessel 5.4.1.1.4 Multipurpose Support Vessel 5.4.1.1.5 Crew Vessel 5.4.1.1.6 Chase Vessel 5.4.1.1.7 Seismic Vessel Standby 5.4.1.1.8 Rescue Vessel 5.4.1.2 United States Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 5.4.1.2.1 Shallow Water 5.4.1.2.2 Deep Water 5.4.1.2.3 Ultra Deep Water 5.4.1.3 United States Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 5.4.1.3.1 Oil and Gas industry 5.4.1.3.2 Offshore wind 5.4.1.3.3 Patrolling 5.4.1.3.4 Research and Surveying 5.4.1.3.5 Others 5.4.2 Canada 5.4.2.1 Canada Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 5.4.2.1.1 Anchor Handling Vessel 5.4.2.1.2 Tug Supply Vessel 5.4.2.1.3 Platform Supply Vessel 5.4.2.1.4 Multipurpose Support Vessel 5.4.2.1.5 Crew Vessel 5.4.2.1.6 Chase Vessel 5.4.2.1.7 Seismic Vessel Standby 5.4.2.1.8 Rescue Vessel 5.4.2.2 Canada Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 5.4.2.2.1 Shallow Water 5.4.2.2.2 Deep Water 5.4.2.2.3 Ultra Deep Water 5.4.2.3 Canada Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 5.4.2.3.1 Oil and Gas industry 5.4.2.3.2 Offshore wind 5.4.2.3.3 Patrolling 5.4.2.3.4 Research and Surveying 5.4.2.3.5 Others 5.4.3 Mexico 5.4.3.1 Mexico Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 5.4.3.1.1 Anchor Handling Vessel 5.4.3.1.2 Tug Supply Vessel 5.4.3.1.3 Platform Supply Vessel 5.4.3.1.4 Multipurpose Support Vessel 5.4.3.1.5 Crew Vessel 5.4.3.1.6 Chase Vessel 5.4.3.1.7 Seismic Vessel Standby 5.4.3.1.8 Rescue Vessel 5.4.3.2 Mexico Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 5.4.3.2.1 Shallow Water 5.4.3.2.2 Deep Water 5.4.3.2.3 Ultra Deep Water 5.4.3.3 Mexico Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 5.4.3.3.1 Oil and Gas industry 5.4.3.3.2 Offshore wind 5.4.3.3.3 Patrolling 5.4.3.3.4 Research and Surveying 5.4.3.3.5 Others 6. Europe Offshore Support Vessels Industry Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 6.1 Europe Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 6.2 Europe Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 6.3 Europe Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 6.4 Europe Offshore Support Vessels Industry Size and Forecast, by Country (2022-2029) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 6.4.1.2 United Kingdom Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 6.4.1.3 United Kingdom Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 6.4.2 France 6.4.2.1 France Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 6.4.2.2 France Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 6.4.2.3 France Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 6.4.3 Germany 6.4.3.1 Germany Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 6.4.3.2 Germany Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 6.4.3.3 Germany Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 6.4.4 Italy 6.4.4.1 Italy Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 6.4.4.2 Italy Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 6.4.4.3 Italy Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 6.4.5 Spain 6.4.5.1 Spain Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 6.4.5.2 Spain Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 6.4.5.3 Spain Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 6.4.6 Sweden 6.4.6.1 Sweden Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 6.4.6.2 Sweden Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 6.4.6.3 Sweden Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 6.4.7 Austria 6.4.7.1 Austria Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 6.4.7.2 Austria Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 6.4.7.3 Austria Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 6.4.8.2 Rest of Europe Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029). 6.4.8.3 Rest of Europe Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 7. Asia Pacific Offshore Support Vessels Industry Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 7.1 Asia Pacific Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 7.2 Asia Pacific Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 7.3 Asia Pacific Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 7.4 Asia Pacific Offshore Support Vessels Industry Size and Forecast, by Country (2022-2029) 7.4.1 China 7.4.1.1 China Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 7.4.1.2 China Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 7.4.1.3 China Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 7.4.2 South Korea 7.4.2.1 S Korea Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 7.4.2.2 S Korea Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 7.4.2.3 S Korea Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 7.4.3 Japan 7.4.3.1 Japan Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 7.4.3.2 Japan Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 7.4.3.3 Japan Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 7.4.4 India 7.4.4.1 India Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 7.4.4.2 India Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 7.4.4.3 India Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 7.4.5 Australia 7.4.5.1 Australia Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 7.4.5.2 Australia Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 7.4.5.3 Australia Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 7.4.6 Indonesia 7.4.6.1 Indonesia Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 7.4.6.2 Indonesia Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 7.4.6.3 Indonesia Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 7.4.7 Malaysia 7.4.7.1 Malaysia Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 7.4.7.2 Malaysia Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 7.4.7.3 Malaysia Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 7.4.8 Vietnam 7.4.8.1 Vietnam Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 7.4.8.2 Vietnam Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 7.4.8.3 Vietnam Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 7.4.9 Taiwan 7.4.9.1 Taiwan Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 7.4.9.2 Taiwan Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 7.4.9.3 Taiwan Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 7.4.10.2 Bangladesh Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 7.4.10.3 Bangladesh Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 7.4.11 Pakistan 7.4.11.1 Pakistan Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 7.4.11.2 Pakistan Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 7.4.11.3 Pakistan Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 7.4.12.2 Rest of Asia PacificOffshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 7.4.12.3 Rest of Asia Pacific Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 8. Middle East and Africa Offshore Support Vessels Industry Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 8.1 Middle East and Africa Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 8.2 Middle East and Africa Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 8.3 Middle East and Africa Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 8.4 Middle East and Africa Offshore Support Vessels Industry Size and Forecast, by Country (2022-2029) 8.4.1 South Africa 8.4.1.1 South Africa Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 8.4.1.2 South Africa Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 8.4.1.3 South Africa Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 8.4.2 GCC 8.4.2.1 GCC Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 8.4.2.2 GCC Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 8.4.2.3 GCC Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 8.4.3 Egypt 8.4.3.1 Egypt Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 8.4.3.2 Egypt Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 8.4.3.3 Egypt Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 8.4.4 Nigeria 8.4.4.1 Nigeria Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 8.4.4.2 Nigeria Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 8.4.4.3 Nigeria Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 8.4.5.2 Rest of ME&A Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 8.4.5.3 Rest of ME&A Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 9. South America Offshore Support Vessels Industry Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 9.1 South America Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 9.2 South America Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 9.3 South America Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 9.4 South America Offshore Support Vessels Industry Size and Forecast, by Country (2022-2029) 9.4.1 Brazil 9.4.1.1 Brazil Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 9.4.1.2 Brazil Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 9.4.1.3 Brazil Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 9.4.2 Argentina 9.4.2.1 Argentina Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 9.4.2.2 Argentina Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 9.4.2.3 Argentina Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Offshore Support Vessels Industry Size and Forecast, By Vessel Type (2022-2029) 9.4.3.2 Rest Of South America Offshore Support Vessels Industry Size and Forecast, By Water Depth (2022-2029) 9.4.3.3 Rest Of South America Offshore Support Vessels Industry Size and Forecast, By End User (2022-2029) 10. Global Offshore Support Vessels Industry: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2022 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Offshore Support Vessel Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Abdon Callais Offshore LLC 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Bass Marine Pty Ltd. 11.3 Bourbon Corporation SA 11.4 Bumi Armada Berhad, 11.5 Chandra Ship Management Pvt Ltd. 11.6 Delta Logistics Limited, 11.7 DOF ASA 11.8 DOLPHIN OFFSHORE ENTERPRISES INDIA LTD. 11.9 Dredging Corporation of India Limited. 11.10 Edison Chouest Offshore 11.11 Falcon Energy Group 11.12 GOL OFFSHORE 11.13 Grupo Coremar S.A., 11.14 Harvey Gulf, 11.15 Havila Shipping ASA, 11.16 HIND OFFSHORE. 11.17 Hornbeck Offshore Services 11.18 Intermarine LLC, 11.19 Island Offshore Management, 11.20 Japan Marine United Corporation 11.21 Maersk Supply Service A/S 11.22 Miclyn Express Offshore 11.23 MMA Offshore Limited 11.24 Nam Cheong International Ltd. 11.25 OCEAN SPARKLE LIMITED. 11.26 PACC Offshore Services Holdings 11.27 Rem Maritime As, 11.28 Seacor Marine Holdings Inc. 11.29 Seam Offshore 11.30 Solstad Farstad ASA 11.31 Tag Offshore Limited. 11.32 The Shipping Corporation of India Ltd. (SCI). 11.33 Tidewater Inc. 11.34 Topaz Energy and Marine 11.35 VARUN SHIPPING. 11.36 Vroon Offshore Service Pvt Ltd 11.37 Wintermar Offshore Marine Group 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary