The Asia Pacific Offshore Support Vessel Market size was valued at USD 551.43 Million in 2022 and the total Asia Pacific Offshore Support Vessel Market revenue is expected to grow at a CAGR of 6.5 % from 2023 to 2029, reaching nearly USD 860.0 Million. The Asia Pacific Offshore Support Vessel (OSV) market presents a dynamic and evolving landscape characterized by the region's significant maritime activities and burgeoning energy sector. This market encompasses a range of vessels designed to support offshore operations, including exploration, production, installation, logistics, and maintenance, across the vast expanse of Asia Pacific's oceans and seas. China, with its expanding offshore oil and gas projects in the South China Sea and its growing focus on renewable energy, drives the demand for versatile Platform Supply Vessels (PSVs) equipped with advanced features like dynamic positioning systems. These vessels facilitate the transportation of essential supplies and equipment to remote offshore installations and rigs, thus playing a fundamental role in maintaining operational efficiency. In India, where the emphasis on responsible exploration practices is paramount, seismic vessels reign supreme. These vessels conduct underwater surveys and gather geological data to identify optimal subsea areas for drilling while safeguarding the marine ecosystem. India's commitment to sustainable energy and stringent environmental protection policies bolsters the demand for cutting-edge seismic vessels equipped with state-of-the-art technology. Australia's vast offshore energy reserves and its progressive transition towards renewable energy sources contribute to the diversification of the OSV market. While the seismic vessel segment remains relevant due to its role in identifying suitable drilling locations and renewable energy installation sites, the demand for PSVs is also significant. As Australia harnesses its offshore energy potential, both vessel segments share prominence in supporting the country's energy aspirations. Indonesia, with its extensive archipelago and burgeoning oil and gas sector, showcases robust demand for OSVs, particularly PSVs. These vessels ensure the seamless transport of materials, equipment, and personnel to numerous offshore platforms, maintaining operational continuity and efficiency. Indonesia's geographical complexity and the need for efficient logistics further amplify the significance of the PSV segment. These countries drive the Asia Pacific OSV market forward, catering to diverse offshore needs and fostering technological advancements. The market's growth trajectory is influenced not only by traditional oil and gas exploration activities but also by the rising significance of offshore renewable energy, including wind farms and other green initiatives. As the global energy landscape evolves, the Asia Pacific OSV market remains a critical pillar, ensuring safe, efficient, and sustainable offshore operations while adapting to the region's changing priorities. Amidst technological innovations and environmental considerations, the market's continuous evolution will play a crucial role in shaping the future of offshore activities in the Asia Pacific region.To know about the Research Methodology :- Request Free Sample Report

Asia Pacific Offshore Support Vessel Market Scope and research methodology:

The Asia Pacific Offshore Support Vessel (OSV) Market encompasses a comprehensive analysis of the industry's pivotal components, focusing on countries like China, India, Australia, and Indonesia. This research delves into the diverse segments of OSVs, including Seismic Vessels and Platform Supply Vessels (PSVs), to capture the regional nuances of offshore energy exploration, production, and logistics. The research methodology involves a meticulous approach, including extensive primary data collection from industry experts, stakeholders, and key market players. Secondary research sources like industry reports, market databases, and scholarly articles bolster the study's foundation. The quantitative analysis aids in assessing market size, growth trends, and key drivers, while qualitative insights provide a holistic understanding of factors influencing market dynamics. To comprehensively analyze the Asia Pacific OSV Market, the research considers regional regulatory frameworks, technological advancements, economic indicators, and environmental concerns. The study integrates both historical data and future projections to provide a nuanced view of market trends and potential opportunities. By adopting a balanced blend of primary and secondary research, this study ensures a well-rounded evaluation of the Asia Pacific OSV Market, catering to stakeholders, industry players, and decision-makers seeking to understand and navigate this dynamic sector.Asia Pacific Offshore Support Vessel Market Dynamics:

Growing Offshore Exploration and Production Activities: The Asia Pacific region is witnessing increasing energy demand, which is driving extensive offshore exploration and production activities. Emerging economies like India, Indonesia, and Malaysia are investing in offshore oil and gas projects to meet their energy needs. This surge in exploration activities requires reliable transportation of personnel, equipment, and resources to and from offshore platforms, creating strong demand for OSVs. India's state-owned ONGC's multi-year contracts with OSV operators to support its offshore drilling and production activities demonstrate the growing demand for OSVs in the region. The Asia Pacific region holds significant untapped deepwater reserves. As shallow water reserves deplete, oil and gas companies are venturing into deeper waters for exploration and production. Deepwater projects necessitate specialized OSVs equipped to handle complex operations, such as deep-sea drilling, subsea installation, and ROV support. Indonesia's increasing interest in deepwater exploration off its coasts is driving the demand for OSVs capable of supporting deep-sea drilling and installation activities. Emerging Offshore Renewable Energy Sector Driving the Asia Pacific Offshore Support Vessel Market. The shift towards renewable energy sources, particularly offshore wind farms, is driving demand for OSVs that support the installation, maintenance, and transportation of components for these projects. Offshore wind farms require vessels with dynamic positioning capabilities and specialized equipment for turbine installation and maintenance. Australia's offshore wind projects in the planning stages are likely to require OSVs for various phases, including installation, maintenance, and logistical support. Many countries in the Asia Pacific are investing in developing their maritime infrastructure, including ports and offshore platforms. These developments lead to increased demand for OSVs to support construction, transportation of materials, and installation activities. Malaysia's investments in expanding its offshore platform infrastructure in the South China Sea are creating a need for OSVs to facilitate construction and ongoing operations. The demand for raw materials and minerals, coupled with advancements in deep-sea mining technologies, is leading to increased exploration and extraction activities in deep waters. OSVs are vital for transporting equipment and resources to support deep-sea mining operations. The exploration of polymetallic nodules in the Pacific Ocean by countries like China and Japan requires OSVs for resource transportation and extraction equipment installation.Asia Pacific OSV Market is Challenged Amidst Low Oil Prices and Delays: The Asia Pacific offshore support vessel (OSV) market witnessed challenges due to project delays and cancellations amidst low oil prices in 2017-2018. Rig utilization stood at 60% in 2017, highlighting the impact of languishing oil prices. Despite increasing demand, oversupply hindered industry recovery, with low day rates persisting. India's demand, led by ONGC, remained stable due to multi-year contracts. In 2019, the region faced oversupply and insufficient vessel removals. State-owned firms in countries like Malaysia, Indonesia, and India drove OSV demand, although oversupply led to competitive markets with prolonged low day rates. Major players like Santos and Inpex boosted Australia's OSV demand. COVID-19's impact hit hard in 2020, causing project cancellations, job cuts, and reduced energy demand. India weathered the pandemic, but 2021 saw operational halts due to COVID-19, pressuring production. ONGC and Oil India were urged to raise output. Vaccine programs slightly improved demand in late 2021. Australia anticipates increased plug-and-abandonment (P&A) activities for OSVs with DP-2 capabilities due to offshore development wells nearing the commissioning end. Despite a promising 2022 outlook, uncertainty looms over Russia's recent developments affecting the Asia Pacific OSV market.

Asia Pacific Offshore Support Vessel Market Segment Analysis:

Based on Vessel Type, The Platform Supply Vessel (PSV) segment dominates the Asia Pacific offshore support vessel (OSV) market due to its crucial role in providing logistics support and transportation for offshore operations. The PSV segment holds dominance in the Asia Pacific OSV market owing to its integral function in facilitating offshore exploration and production activities. PSVs are essential for transporting supplies, equipment, and personnel to oil and gas production platforms and drilling rigs. As offshore projects expand and move into deeper waters, the demand for PSVs equipped with advanced features such as dynamic positioning systems and versatile cargo capacities has significantly increased. PSVs play a pivotal role in supplying vital materials like oil, fuel, water, cement, and other essential items to offshore installations and rigs in countries like Malaysia and Australia. The capability of PSVs to assist with emergency evacuations, medical assistance, and standby duties enhances their value in ensuring operational safety. These vessels are vital for safeguarding crew members during critical operations in nations like Indonesia. PSV dominate, seismic vessels hold importance for their specialized role in underwater surveying and geology studies. As the offshore industry evolves and diversifies, both vessel types remain essential to ensure the smooth functioning of various offshore activities in the Asia Pacific region.Based on Water Depth, The Asia Pacific offshore support vessel (OSV) market is segmented by water depth into the Deep Water, Shallow Water, and Ultra Deep Water categories. The Ultra Deep Water segment dominates the market due to the region's increasing exploration activities in challenging offshore environments. The Ultra Deep Water segment holds dominance in the Asia Pacific OSV market due to the region's pursuit of untapped hydrocarbon reserves at extreme offshore depths beyond 3,000 meters. With the rise in deepwater exploration projects for oil and gas, as well as the development of offshore renewable energy installations like wind farms in deep waters, demand for OSVs equipped for ultra-deep-water operations has surged. For instance, countries like Indonesia and Malaysia are investing in deepwater exploration to discover new reserves, driving demand for specialized OSVs capable of supporting such endeavors. The growth of offshore wind energy in countries like Japan and Taiwan requires OSVs with ultra-deep-water capabilities to install and maintain wind turbines in deep waters. The Ultra Deep Water segment currently dominates, the shallow water segment remains relevant for operations closer to shore. As exploration and infrastructure projects diversify, OSV operators adapt their fleets to cater to various water depth requirements in the Asia Pacific region.

Market segment Mission types for offshore support vessels. Description Platform supply (PSV) Supply Transport dry and liquid cargoes from shore base to oil platforms. Emergency response and rescue vessels (ERRV) Standby/Rescue Standby for emergency preparedness and rescue operations near offshore installations. Anchor handling, tug, supply (AHTS) Anchor handling Towing Deploy and lift anchors for rigs. Towing rigs and vessels. Wind service operations (SOV) Maintenance Provide accommodation and easy access to offshore wind installations. Inspection, maintenance, and repair (IMR) Module handling Launch and recover subsea modules, for replacement or repair. Subsea, umbilicals, risers, land flowlines (SURF) Pipelay Lay flexible pipe and umbilicals, and tie-in with subsea modules. Operations Subsea construction Deploy and install subsea modules on the seabed. Well stimulation (WSV) WSV Stimulate well production by injection of chemicals. Light well intervention (LWI) LWI Stimulate well production by use of mechanical equipment and chemicals. Asia Pacific Offshore Support Vessel Market Regional Insights:

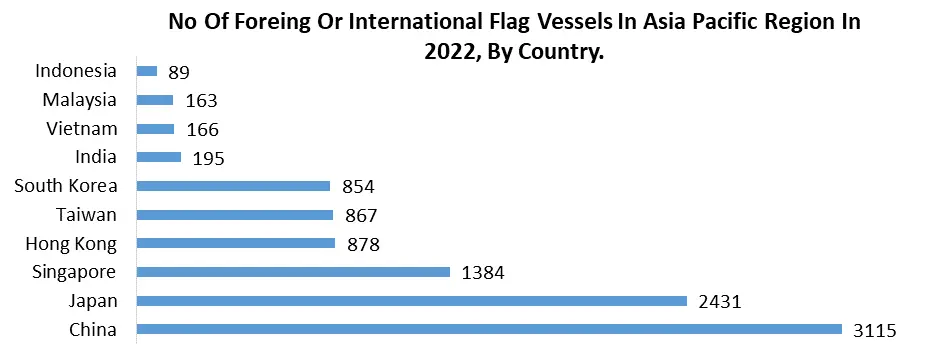

China's Offshore Support Vessel industry has witnessed substantial growth, making it a key player in the Asia Pacific OSV market. The country's focus on offshore exploration and production, as well as its growing offshore renewable energy sector, has led to a demand for versatile OSVs. In China, the Platform Supply Vessel (PSV) segment holds dominance. With the expansion of offshore oil and gas projects in the South China Sea and the country's emphasis on renewable energy, PSVs equipped with dynamic positioning systems and large cargo capacities are in high demand. These vessels facilitate the transportation of essential supplies, equipment, and personnel to offshore installations and rigs. India's OSV market is driven by its robust oil and gas sector, primarily led by the state-owned Oil and Natural Gas Corporation (ONGC). The seismic vessel segment has taken prominence in India. The country's focus on efficient exploration techniques and identifying the best subsea areas for drilling is essential to avoid ecological risks. Seismic vessels play a pivotal role in conducting underwater surveys and collecting geological data to ensure responsible drilling practices. India's emphasis on environmental protection and sustainable energy drives the demand for advanced seismic vessels with cutting-edge technology. Australia's vast offshore energy reserves and its transition towards renewable energy sources have influenced its OSV market dynamics. The country's substantial offshore oil and gas exploration activities drive demand for both seismic vessels and PSVs. As the energy landscape continues to evolve, these regional dynamics will play a crucial role in shaping the future of the Asia Pacific OSV market.

Competitive Landscape:

Key Players of the Asia Pacific Offshore Support Vessel Market profiled in the report include Bass Marine Pty Ltd., Bumi Armada Berhad, Chandra Ship Management Pvt Ltd., DOF ASA, Dolphin Offshore Enterprises India Ltd., Dredging Corporation of India Limited, Falcon Energy group, Gol Offshore, Grupo Coremar S.A., Hind Offshore. This provides huge opportunities to serve many End-uses & customers and expand the Asia Pacific Offshore Support Vessel Market. Japan Marine United Corporation has established itself as a prominent builder of offshore support vessels and ocean towing tugs, adeptly tailored to meet the specific requirements of users. With an extensive repertoire of offerings, JMU's portfolio encompasses an array of vessels, including Anchor Handling Tug Supply Vessels (AHTSV), Platform Supply Vessels (PSV), and other integral components utilized in offshore development initiatives. Informed by a comprehensive and in-depth analysis of customer demands, JMU excels at constructing offshore support vessels that stand out for their exceptional reliability, pragmatic functionality, and competitive edge. Leveraging an extensive reservoir of expertise amassed through years of ship design and construction endeavors, the company crafts vessels that seamlessly align with market needs.Asia Pacific Offshore Support Vessel Market Scope: Inquire before buying

Asia Pacific Offshore Support Vessel Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 5 Bn. Forecast Period 2023 to 2029 CAGR: 4.5% Market Size in 2029: US $ 10 Bn. Segments Covered: by Vessel Type Anchor Handling Vessel Tug Supply Vessel Platform Supply Vessel Multipurpose Support Vessel Crew Vessel Chase Vessel Seismic Vessel Standby Rescue Vessel by Water Depth Shallow Water Deep Water Ultra Deep Water by End User Oil and Gas industry Offshore wind Patrolling Research and Surveying Others Asia Pacific Offshore Support Vessel Market Key Players:

1. Bass Marine Pty Ltd. 2. Bumi Armada Berhad, 3. Chandra Ship Management Pvt Ltd. 4. DOF ASA 5. DOLPHIN OFFSHORE ENTERPRISES INDIA LTD. 6. Dredging Corporation of India Limited. 7. Falcon Energy group 8. GOL OFFSHORE 9. Grupo Coremar S.A., 10. HIND OFFSHORE. 11. Japan Marine United Corporation 12. Maersk Supply Service A/S 13. Miclyn Express Offshore 14. MMA Offshore Limited 15. Nam Cheong International Ltd. 16. OCEAN SPARKLE LIMITED. 17. PACC Offshore Services Holdings 18. Seacor Marine Holdings Inc. 19. Seam Offshore 20. Solstad Farstad ASA 21. Tag Offshore Limited. 22. The Shipping Corporation of India ltd. (SCI). 23. Tidewater Inc. 24. VARUN SHIPPING. 25. Vroon offshore Service Pte Ltd 26. Wintermar Offshore Marine GroupFAQs:

1. What are the growth drivers for the Asia Pacific Offshore Support Vessel Market? Ans. Rising offshore exploration and production activities drive OSV Demand and is expected to be the major driver for the Asia Pacific Offshore Support Vessel Market. 2. What is the major restraint for the Asia Pacific Offshore Support Vessel Market growth? Ans. Asia Pacific OSV Market is challenged during Low Oil Prices and Delays this restrains the offshore support vessel market. 3. Which country is expected to lead the Asia Pacific Offshore Support Vessel Market during the forecast period? Ans. The China is expected to lead the Asia Pacific Offshore Support Vessel Market during the forecast period. 4. What is the projected market size & growth rate of the Asia Pacific Offshore Support Vessel Market? Ans. The Asia Pacific Offshore Support Vessel Market size was valued at USD 551.43 Million in 2022 and the total Asia Pacific Offshore Support Vessel Market revenue is expected to grow at a CAGR of 6.5 % from 2023 to 2029, reaching nearly USD 860.0 Million.

1. Asia Pacific Offshore Support Vessel Market: Research Methodology 2. Asia Pacific Offshore Support Vessel Market: Executive Summary 3. Asia Pacific Offshore Support Vessel Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Market Structure 3.3.1. Market Leaders 3.3.2. Market Followers 3.3.3. Emerging Players 3.4. Consolidation of the Market 4. Asia Pacific Offshore Support Vessel Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. Asia Pacific Offshore Support Vessel Market: Segmentation (by Value USD and Volume Units) 5.1. Asia Pacific Offshore Support Vessel Market, By Vessel Type (2022-2029) 5.1.1. Anchor Handling Vessel 5.1.2. Tug Supply Vessel 5.1.3. Platform Supply Vessel 5.1.4. Multipurpose Support Vessel 5.1.5. Crew Vessel 5.1.6. Chase Vessel 5.1.7. Seismic Vessel Standby 5.1.8. Rescue Vessel 5.2. Asia Pacific Offshore Support Vessel Market, By Water Depth (2022-2029) 5.2.1. Shallow Water 5.2.2. Deep Water 5.2.3. Ultra Deep Water 5.3. Asia Pacific Offshore Support Vessel Market, By End User (2022-2029) 5.3.1. Oil and Gas industry 5.3.2. Offshore wind 5.3.3. Patrolling 5.3.4. Research and Surveying 5.3.5. Others 5.4. Asia Pacific Offshore Support Vessel Market, by Country (2022-2029) 5.4.1. China 5.4.2. South Korea 5.4.3. Japan 5.4.4. India 5.4.5. Australia 5.4.6. Indonesia 5.4.7. Malaysia 5.4.8. Vietnam 5.4.9. Taiwan 5.4.10. Bangladesh 5.4.11. Pakistan 5.4.12. Rest of Asia Pacific 6. Company Profile: Key players 6.1. Bass Marine Pty Ltd. 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. Bumi Armada Berhad, 6.3. Chandra Ship Management Pvt Ltd. 6.4. Dof Asa 6.5. DOLPHIN OFFSHORE ENTERPRISES INDIA LTD. 6.6. Dredging Corporation of India Limited. 6.7. Falcon Energy group 6.8. Gol Offshore 6.9. Grupo Coremar S.A., 6.10. Hind Offshore. 6.11. Japan Marine United Corporation 6.12. Maersk Supply Service A/S 6.13. Miclyn Express Offshore 6.14. MMA Offshore Limited 6.15. Nam Cheong International Ltd. 6.16. Ocean Sparkle Limited. 6.17. PACC Offshore Services Holdings 6.18. Seacor Marine Holdings Inc. 6.19. Seam Offshore 6.20. Solstad Farstad ASA 6.21. Tag Offshore Limited. 6.22. The Shipping Corporation of India ltd. (SCI). 6.23. Tidewater Inc. 6.24. Varun Shipping. 6.25. Vroon offshore Service Pte Ltd 6.26. Wintermar Offshore Marine Group 7. Key Findings 8. Industry Recommendation