The Europe Offshore Support Vessel Market size was valued at USD 374.97 Million in 2022 and the total Europe Offshore Support Vessel Market revenue is expected to grow at a CAGR of 6.4 % from 2023 to 2029, reaching nearly USD 584.80 Million. The Europe offshore support vessel (OSV) market represents a crucial segment within the maritime industry, playing a vital role in supporting offshore oil and gas exploration, renewable energy projects, and various other activities in the continental shelf waters of Europe. This dynamic market encompasses a diverse range of vessels and services, all of which are essential for the efficient and safe operation of offshore activities. The Europe Offshore Support Vessel Market is influenced by several key factors, including the region's extensive offshore energy resources, stringent safety and environmental regulations, technological advancements, and the growing shift towards renewable energy sources. Platform supply vessels are among the most common, delivering essential supplies such as equipment, provisions, and personnel to offshore platforms and rigs. Anchor-handling tug supply vessels are specialized vessels used for towing and anchoring operations. Construction support vessels aid in the installation of subsea infrastructure, including pipelines and cables, while accommodation vessels provide living quarters for workers stationed on offshore installations.Europe Offshore Support Vessel Market Snapshot

To know about the Research Methodology :- Request Free Sample Report The discovery of new oil and gas fields, as well as the ongoing maintenance of existing infrastructure, drives demand for OSVs. The region's commitment to renewable energy sources, especially offshore wind energy, has significantly expanded the market. Offshore wind farms require specialized OSVs for turbine installation, maintenance, and transportation of components. Regulations are a central aspect of the Europe Offshore Support Vessel Market. OSV operators must adhere to international guidelines and regional regulations, including those set by the International Maritime Organization and the European Union. Compliance with these regulations necessitates constant updates to vessel designs, equipment, and crew training. Technological advancements are also shaping the Europe OSV market. Automation, digitalization, and data-driven decision-making are becoming increasingly prevalent, enhancing operational efficiency and safety. Real-time data monitoring, predictive maintenance, and remote operations are some of the technological trends that are gaining traction in the industry. The European OSV market is not immune to challenges. Fluctuations in oil prices can impact exploration and production activities, subsequently affecting OSV demand. The transition towards renewable energy sources raises questions about the future of fossil fuels and their implications for OSV operations. The Europe offshore support vessel market is a multifaceted and critical sector that underpins the success of various offshore activities, from hydrocarbon exploration to renewable energy generation. With its rich energy resources, commitment to safety and environmental standards, and the ongoing integration of advanced technologies, the Europe OSV market is poised to adapt to evolving industry dynamics while continuing to play a pivotal role in the continent's energy landscape.

Europe Offshore Support Vessel Market Scope and research methodology:

The Europe offshore support vessel market's scope encompasses a comprehensive analysis of the industry's vessels and services that support offshore operations across the European continent. The market's focus includes but is not limited to platform supply vessels, anchor-handling tug supply vessels, construction support vessels, and accommodation vessels. The study investigates the market's dynamics within the context of offshore oil and gas exploration, production, and the rapidly growing renewable energy sector, particularly offshore wind farms. The research methodology integrates both qualitative and quantitative approaches. Extensive primary research involving industry experts, stakeholders, and key market players provides insights into market trends, challenges, and opportunities. Secondary research involves collecting data from reputable sources such as industry reports, regulatory bodies, and academic publications. The gathered data is subjected to rigorous analysis, including market sizing, trend identification, and forecasting. The study takes into account macroeconomic factors, technological advancements, regulatory frameworks, and market dynamics influencing the Europe OSV market. This holistic approach ensures a thorough understanding of the market's current landscape and its projected trajectory, enabling stakeholders to make informed decisions and strategies pertaining to investments, expansion, and innovation within the Europe offshore support vessel market.Market Dynamics:

The growing focus on offshore wind farms drives the need for specialized turbine transportation vessels: The Europe Offshore Support Vessel Market experiences robust demand due to multiple factors. Exploration of offshore oil and gas reserves drives the need for vessels such as platform supply and anchor-handling tug supply vessels, crucial for transporting supplies and personnel to rigs. The rising emphasis on renewable energy, particularly offshore wind farms, propels the requirement for specialized vessels for turbine transportation and maintenance. The aging of existing installations necessitates maintenance and decommissioning, sustaining demand for construction support and decommissioning vessels. Stringent regulations enforce high safety and environmental standards, compelling the deployment of advanced vessels with cutting-edge safety features. Deepwater exploration, especially in challenging areas like the North Sea, fuels the demand for technologically sophisticated vessels. Expanding subsea infrastructure prompts the requirement for construction support vessels and remotely operated vehicles. Favorable geopolitical conditions and stable investments in Europe drive exploration and investment in offshore energy resources . Despite the renewable energy push, hydrocarbons remain significant, driven by energy demand and security concerns. Infrastructure development, including larger ports and terminals, aids efficient vessel operations. Ongoing innovations in vessel design, propulsion, automation, and digitalization heighten operational efficiency and safety, making offshore endeavors more attractive and increasing demand for offshore support vessels. Offshore wind expansion in Europe, notably driven by countries like the United Kingdom and Germany, offers a prime opportunity for the Europe Offshore Support Vessel Market. For instance, the United Kingdom's commitment to offshore wind projects has led to substantial vessel demand. This includes the Hollandse Kust Zuid (HKZ) project, where Subsea 7 recognized the potential for vessel demand for turbine transportation, installation, and subsea infrastructure support. The challenges like contract losses and unpredictable offshore conditions have highlighted the need for efficient contracting models and risk mitigation strategies.Offshore Renewable Energy Developments, Annual Wind Installations (Both Onshore And Offshore Markets) For The Period 2018-2021 In Europe

Poor Industry Economics And Inflation Affect Project Viability And Investment Decisions. The rapid growth of offshore wind projects strains the supply chain, potentially leading to delays and increased costs. Poor economics within the industry, as well as the impacts of the COVID-19 pandemic and global inflation, affect investment decisions and project viability. Fixed-price contracts and unpredictable offshore conditions expose contractors to risks, impacting profitability. The allure of higher day rates in the oil and gas sector draws vessels away from offshore wind projects, potentially affecting their timely execution. Instances of bankruptcies among leading contractors indicate financial instability within the Europe Offshore Support Vessel Market, hindering sustainable growth. For instance, supply chain constraints are evident in the offshore wind sector. The Europe Offshore Support Vessel Market faces the challenge of a strained supply chain due to rapid offshore wind expansion. As seen with Saipem's operational and commercial issues at the Neart na Gaoithe (NNG) site, this constraint results in financial losses and project delays. If these challenges persist, they will impact the timely realization of offshore wind targets and hinder the overall growth of the OSV market in Europe.

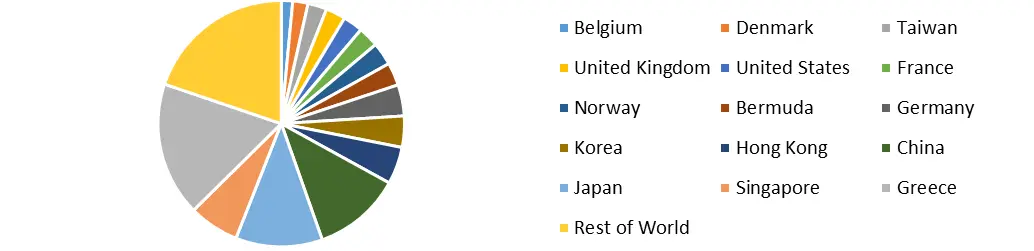

Share Of World Fleet In % Owned By Top 15 Countries In 2022

Europe Offshore Support Vessel Market Segment Analysis:

Based on End User, The Oil and Gas industry segment dominates the Europe offshore support vessel market and is expected to grow during the forecast periods. The oil and gas industry remains a significant consumer, utilizing OSVs for exploration, production, transportation, and maintenance activities. The volatile nature of oil prices and the growing emphasis on renewable energy sources, however, pose challenges to this segment's sustained growth. Offshore wind has emerged as a prominent segment, experiencing rapid expansion driven by ambitious renewable energy targets. OSVs are pivotal for transporting, installing, and maintaining turbines and subsea infrastructure, contributing to the sector's remarkable growth. The offshore support vessel plays a vital role in maritime security, border surveillance, and environmental protection. The need to monitor and secure vast offshore areas has led to increased demand for specialized vessels. Growth prospects within these segments are shaped by factors such as evolving energy policies, technological advancements, environmental regulations, and market demand. While offshore wind showcases significant potential, market resilience depends on effectively addressing challenges such as supply chain constraints, economic uncertainties, and competition from alternate sectors.Based on Water Depth, The Europe Offshore Support Vessel market is segmented based on water depth, into Shallow Water, Deep Water, and Ultra Deep Water. In shallow-water regions, OSVs predominantly serve activities like oil and gas production, maintenance, and shallow-water drilling. These areas often require vessels optimized for cost-effective operations in relatively less challenging conditions. In deep-water environments, OSVs are essential for complex subsea installations, pipeline laying, and deep-water drilling operations. The market for deep-water OSVs is influenced by the exploration of offshore hydrocarbon reserves and the expansion of subsea infrastructure. The ultra-deepwater segment involves OSVs capable of operating at extreme depths, often exceeding 1,500 meters. These vessels are crucial for intricate subsea operations, including well interventions, subsea construction, and complex underwater projects. Each segment's growth is driven by factors such as offshore energy exploration, advancements in subsea technology, and the expansion of renewable energy projects. The shallow water segment benefits from its suitability for various activities, and the deep and ultra-deepwater sectors gain traction due to their potential for high-value projects, deep-water drilling, and intricate subsea infrastructure development. The evolution of these segments depends on technological innovation, regulatory developments, and industry trends that influence offshore activities at varying water depths. Europe continues to emphasize energy diversification and sustainable practices. The market's direction within these water depth segments will be shaped by the interplay of these factors.

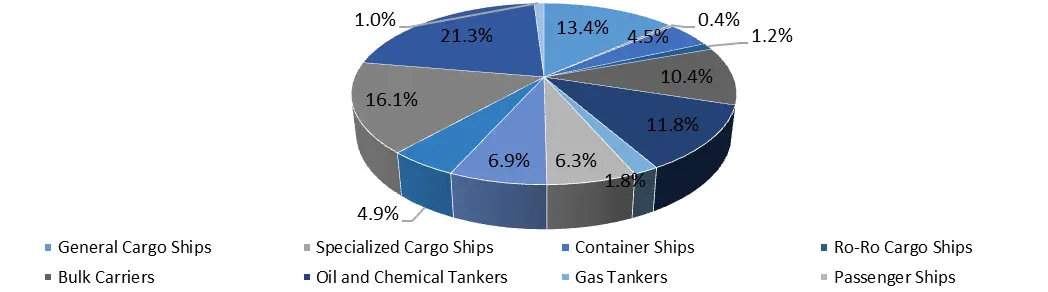

Vessel Type Crew Transfer Vessel (CTV) Service Operation Vessel (SOV) Primary Fuel Marine Fuel Oil (MFO) Marine Gas Oil (MGO) Secondary Fuel N/A Battery Electric Fuel Consumption per Hour, Transiting 320 litres/hour 1,000 litres/hour Fuel Consumption per Hour, In-field/Loitering 130 litres/hour 120 litres/hour Transit speed (average) 23 knots (42.6 km/hour) 12 knots (22.2 km/hour) World Fleet: Total Number Of Ships, By Type And Size,(%), In 2022

Europe Offshore Support Vessel Market Regional Insights:

The UK stands out as a dominant player in the Europe Offshore Support Vessel Market, particularly due to its substantial focus on offshore wind projects. The UK has set ambitious targets for offshore wind capacity, aiming to have 40 GW installed by 2030. The UK's commitment to these goals has led to a surge in demand for OSVs, including specialized vessels for turbine installation, maintenance, and subsea infrastructure support. For instance, the UK's development of offshore wind farms such as the Dogger Bank Wind Farm, Hornsea Wind Farm, and the East Anglia Wind Farm has significantly driven OSV demand. These projects require a range of vessels, from installation vessels capable of handling massive turbines to support vessels for various maintenance and logistical tasks. France has outlined plans to increase its offshore wind capacity through projects like the Saint-Nazaire Offshore Wind Farm and the Dunkirk Offshore Wind Farm. These initiatives are expected to stimulate offshore support vessel market demand in the region, mainly for installation and maintenance tasks. Germany continues to expand its offshore wind capacity, and OSV demand remains substantial in both the construction and operational phases. The UK dominates the Europe Offshore Support Vessel Market due to its extensive offshore wind endeavors and well-established projects, and other countries like France, Germany, and Italy are rapidly gaining ground. The dominance of each region can change over time as energy policies, technological advancements, and market dynamics evolve, impacting the distribution of OSV demand across the European continent.Gross Weight of Seaborne Freight Handled in all Ports, (Tonnes Per Capita), in 2022

Competitive Landscape: Key Players of the Europe Offshore Support Vessel Market profiled in the report include Bourbon Corporation SA, Bumi Armada Berhad, DOF ASA, Grupo Coremar S.A., Havila Shipping ASA, Island Offshore Management, Maersk Supply Service A/S, MMA Offshore Limited, Rem Maritime As, Seacor Marine Holdings Inc., Seam Offshore, Solstad Farstad ASA, Tidewater Inc., Vroon offshore Service Pte Ltd. This provides huge opportunities to serve many End-uses & customers and expand the Europe Offshore Support Vessel Market. August 04, 2023, Norwegian offshore vessel operator Golden Energy Offshore Services has entered into a binding Memorandum of Agreement for the acquisition of four platform supply vessels and one subsea support vessel from subsidiaries of Vroon Holding B.V. for a total consideration of $94 million. Dutch vessel owner Vroon completed the implementation of the financial restructuring for the Vroon focusing on a specialized fleet of deep-sea vessels.

Europe Offshore Support Vessel Market Scope: Inquire Before Buying

Europe Offshore Support Vessel Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 374.97 Mn. Forecast Period 2023 to 2029 CAGR: 6.4% Market Size in 2029: US $ 584.80 Mn. Segments Covered: by Vessel Type Anchor Handling Vessel Tug Supply Vessel Platform Supply Vessel Multipurpose Support Vessel Crew Vessel Chase Vessel Seismic Vessel Standby Rescue Vessel by Water Depth Shallow Water Deep Water Ultra Deep Water by End User Oil and Gas industry Offshore wind Patrolling Research and Surveying Others Europe Offshore Support Vessel Market, Key Players are:

1. Bourbon Corporation SA 2. Bumi Armada Berhad, 3. DOF ASA 4. Grupo Coremar S.A., 5. Havila Shipping ASA, 6. Island Offshore Management, 7. Maersk Supply Service A/S 8. MMA Offshore Limited 9. Rem Maritime As, 10. Seacor Marine Holdings Inc. 11. Seam Offshore 12. Solstad Farstad ASA 13. Tidewater Inc. 14. Vroon offshore Service Pte LtdFAQs:

1. What are the growth drivers for the Europe Offshore Support Vessel Market? Ans. The growing focus on offshore wind farms drives the need for specialized turbine transportation vessels drive OSV Demand. 2. What is the major restraint for the Europe Offshore Support Vessel Market growth? Ans. Poor Industry Economics and Inflation Affect Project Viability and Investment Decisions this restrains the offshore support vessel market. 3. Which country is expected to lead the Europe Offshore Support Vessel Market during the forecast period? Ans. The United Kingdom is expected to lead the Europe Offshore Support Vessel Market during the forecast period. 4. What is the projected market size & growth rate of the Europe Offshore Support Vessel Market? Ans. The Europe Offshore Support Vessel Market size was valued at USD 374.97 Million in 2022 and the total Europe Offshore Support Vessel Market revenue is expected to grow at a CAGR of 6.4 % from 2023 to 2029, reaching nearly USD 584.80 Million. 5. What segments are covered in the Europe Offshore Support Vessel Market report? Ans. The segments covered in the Europe Offshore Support Vessel Market report are Vessel Type, Water Depth, End-Users and Region.

1. Europe Offshore Support Vessel Market: Research Methodology 2. Europe Offshore Support Vessel Market: Executive Summary 3. Europe Offshore Support Vessel Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Market Structure 3.3.1. Market Leaders 3.3.2. Market Followers 3.3.3. Emerging Players 3.4. Consolidation of the Market 4. Europe Offshore Support Vessel Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. Europe Offshore Support Vessel Market: Segmentation (by Value USD and Volume Units) 5.1. Europe Offshore Support Vessel Market, By Vessel Type (2022-2029) 5.1.1. Anchor Handling Vessel 5.1.2. Tug Supply Vessel 5.1.3. Platform Supply Vessel 5.1.4. Multipurpose Support Vessel 5.1.5. Crew Vessel 5.1.6. Chase Vessel 5.1.7. Seismic Vessel Standby 5.1.8. Rescue Vessel 5.2. Europe Offshore Support Vessel Market, By Water Depth (2022-2029) 5.2.1. Shallow Water 5.2.2. Deep Water 5.2.3. Ultra Deep Water 5.3. Europe Offshore Support Vessel Market, By End User (2022-2029) 5.3.1. Oil and Gas industry 5.3.2. Offshore wind 5.3.3. Patrolling 5.3.4. Research and Surveying 5.3.5. Others 5.4. Europe Offshore Support Vessel Market, by Country (2022-2029) 5.4.1. UK 5.4.2. France 5.4.3. Germany 5.4.4. Italy 5.4.5. Spain 5.4.6. Sweden 5.4.7. Austria 5.4.8. Rest of Europe 6. Company Profile: Key players 6.1. Bourbon Corporation SA 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. Bumi Armada Berhad 6.3. DOF ASA 6.4. Grupo Coremar S.A. 6.5. Havila Shipping ASA 6.6. Island Offshore Management 6.7. Maersk Supply Service A/S 6.8. MMA Offshore Limited 6.9. Rem Maritime 6.10. Seacor Marine Holdings Inc. 6.11. Seam Offshore 6.12. Solstad Farstad ASA 6.13. Tidewater Inc. 6.14. Vroon offshore Service Pvt. Ltd 7. Key Findings 8. Industry Recommendation