The North America Offshore Support Vessel Market size was valued at USD 816.11 Million in 2022 and the total North America Offshore Support Vessel Market revenue is expected to grow at a CAGR of 6.3 % from 2023 to 2029, reaching nearly USD 1272.80 Million. The North America Offshore Support Vessel (OSV) market has experienced remarkable growth over the past decades, paralleling the expansion of the region's offshore oil and gas industries. These OSVs play a crucial role in supporting a diverse array of operations, from seismic surveys to platform supply, anchor handling, construction, diving support, and inspection, maintenance, and repair activities. Seismic survey ships, equipped with specialized technology for underwater geological mapping, form the cornerstone of this market. Platform supply vessels facilitate the transportation of essential equipment, liquids, and materials to offshore rigs and platforms, often enduring challenging sea conditions. Anchor-handling tug supply vessels demonstrate versatile capabilities by managing anchors, towing rigs, and providing platform supplies.North America Offshore Support Vessel Market Snapshot

To know about the Research Methodology :- Request Free Sample Report Offshore construction vessels, with their advanced equipment and substantial crane capacity, contribute significantly to subsea construction, installation, and maintenance projects. Diving support vessels enable underwater operations, including maintenance and inspection of subsea infrastructure. Inspection, maintenance, and repair vessels offer multifunctional capacities, such as well stimulation and remotely operated vehicle (ROV) operations. ROV support vessels, equipped with dynamic positioning systems and redundancy features, facilitate precise and efficient ROV operations. This multifaceted and technically advanced North American Offshore Support Vessel market underscores the pivotal role these vessels play in the region's offshore energy sector. They exemplify the industry's commitment to innovation and operational efficiency, supporting the exploration, production, and maintenance of vital offshore resources. North America Offshore Support Vessel Market Scope and research methodology: The North America Offshore Support Vessel (OSV) market encompasses a comprehensive and dynamic landscape within the offshore oil and gas industry. The scope of this study involves a thorough analysis of various types of OSVs, including platform supply vessels, anchor handling tug supply vessels, offshore construction vessels, diving support vessels, inspection, maintenance, and repair vessels, operating across the North American region. The study involves extensive data collection from primary and secondary sources, including industry reports, company websites, regulatory bodies, and academic publications. Market trends, demand drivers, technological advancements, and competitive dynamics are rigorously examined to provide a holistic view of the market's current state and future prospects. A quantitative analysis is conducted, encompassing market size, growth rates, and revenue projections. Qualitative insights are derived through interviews with key industry stakeholders, experts, and professionals, shedding light on challenges, opportunities, and emerging trends. The research methodology also encompasses a comparative analysis of OSV types, market segments, and geographical regions within North America. Factors such as regulatory frameworks, environmental considerations, and economic indicators are integrated to provide a comprehensive assessment. The scope and research methodology of this study enable a comprehensive understanding of the North America Offshore Support Vessel market, facilitating informed decision-making for industry players, investors, and stakeholders. Market Dynamics: Rising offshore exploration and production activities drive OSV Demand Increasing offshore oil and gas exploration and production activities in North America drive the demand for offshore support vessels, as these vessels are essential for transporting equipment, supplies, and personnel from offshore platforms. The growing focus on deep-water and ultra-deep-water reserves in Mexico and other regions stimulates the demand for specialized vessels capable of operating in challenging and remote offshore environments. The shift towards renewable energy sources, such as offshore wind farms, requires offshore support vessels for the installation, maintenance, and transportation of equipment, contributing to market growth. Increasing investments in subsea infrastructure, including pipelines, cables, and subsea installations, lead to higher demand for construction and installation support vessels. The need for inspecting, repairing, and maintaining existing offshore infrastructure, including platforms and pipelines, drives the demand for inspection, maintenance, and repair of vessels. Technological innovations, such as advanced dynamic positioning systems, robotics, and remote-operated vehicles, enhance the efficiency and safety of offshore operations, boosting the demand for vessels equipped with these technologies. Strict environmental and safety regulations in the offshore industry necessitate the use of specialized vessels for compliance, such as those designed for spill response and pollution control. The ongoing demand for oil and gas products, coupled with the need for secure and reliable energy sources, continues to drive exploration and production activities, thus supporting the offshore support vessels market. Improved oil prices and market stability encourage renewed investments in offshore projects, leading to increased demand for various types of offshore support vessels. Economic growth and stability in North America, along with supportive government policies and incentives, create a conducive environment for offshore energy exploration and production, contributing to market expansion.

Area & Volume Distribution For An AHTS Vessel, Meter Square, (In 2022)

Crucial Role of North American OSVs in Offshore Wind Operations: North American offshore support vessels are vital for offshore wind farm construction, maintenance, and operation. Specialized OSVs with lifting and installation capabilities transport and set up wind turbine components. Aging offshore infrastructure offers decommissioning and abandonment opportunities, where advanced dismantling OSVs safely remove old structures. Ongoing subsea pipeline and equipment maintenance drives demand for ROV-equipped OSVs. Next-gen OSVs with advanced dynamic positioning support intricate subsea construction. CCS adoption creates prospects for CO2 transport and storage OSVs. Sensor-equipped OSVs gather real-time ocean data for environmental monitoring. LNG bunkering OSVs aid cleaner shipping and fuel distribution, while specialized OSVs enable deep-sea mining and hydrogen transport in emerging industries. Eco-friendly OSVs resonate with sustainability goals, catering to the demand for environmentally responsible offshore operations. Economic Uncertainties and Global Crises Affect North America's Offshore Support Vessel Utilization Fluctuations in global oil prices lead to uncertainty in exploration and production activities, impacting the demand for OSVs. Stringent regulatory compliance is another challenge. Evolving environmental and safety regulations necessitate costly modifications to vessels and operational practices, potentially affecting profitability. The market experiences saturation due to the influx of new vessels and intense competition. Oversupply of OSVs leads to reduced utilization rates and downward pressure on pricing. Economic uncertainties, such as economic downturns or global crises, diminish energy demand and investment in offshore projects, affecting OSV utilization and revenue streams. High capital costs associated with acquiring and maintaining advanced vessels may limit market entry for smaller players. The growing focus on environmental sustainability presents a challenge as well. Increasing public awareness and environmental concerns could lead to opposition to offshore drilling and exploration activities, potentially impacting the demand for OSVs. Operational challenges include adverse weather conditions, challenging offshore environments, and the need for continuous technological upgrades to meet industry demands. The ongoing energy transition towards renewable sources might lead to a gradual decline in traditional oil and gas activities, potentially impacting the demand for OSVs specialized in fossil fuel operations that disrupts offshore operations and hinders market growth.

North America Offshore Support Vessel Market Segment Analysis:

Based on Vessel Type, The Tug Supply Vessel segment experienced significant growth and dominance in the North America Offshore Support Vessel market compared to the Anchor Handling Vessel and Other segments. The North America Offshore Support Vessel (OSV) Market Segment Analysis comprises several key segments that cater to various maritime operations. Among these segments, the dominating segment is the tug supply vessel, exemplified by its critical role in facilitating offshore operations. Tug Supply Vessels play a dominant role in the North America OSV market. These versatile vessels combine towing capabilities with supply duties, making them essential for anchor handling, rig and platform positioning, and cargo transportation. TSVs ensure the safe and precise movement of large structures in offshore environments. For instance, during the installation of an offshore platform, a TSV provides the necessary towing force to position the structure accurately, while also carrying essential supplies for crew and operations. Anchor handling vessels specialize in managing anchors and mooring chains for drilling rigs and platforms. They ensure secure anchoring and relocation of these structures. For example, when a drilling rig needs to be moved to a new location, an anchor-handling vessel assists in retrieving and repositioning its anchors. Multipurpose support vessels offer versatility by combining various functions like supply, anchor handling, and subsea operations. These vessels accommodate a wide range of offshore tasks, enhancing operational efficiency. Crew vessels are vital for transporting personnel to and from offshore installations, ensuring a steady workforce rotation. They contribute to the seamless functioning of offshore projects by maintaining an efficient crew change schedule. Seismic vessels stand on standby to conduct detailed surveys of the seabed, which aids in geological mapping. These vessels are critical for collecting essential data for oil and gas exploration, leading to informed decision-making in drilling operations.Based on End User, the North America Offshore Support Vessel Market is segmented into Oil and Gas industry, offshore wind, Patrolling, Research and Surveying, and others. The Oil and Gas Industry stands as the dominant force due to its extensive offshore activities in 2022. The oil and gas sector significantly drives the North American OSV market in the forecast period. These vessels play a crucial role in transporting equipment, supplies, and personnel to offshore drilling rigs and production platforms. For instance, OSVs transport drilling consumables, provide anchor handling for rigs and conduct inspection and repair activities on subsea infrastructure. The offshore wind segment is rapidly gaining traction, creating demand for OSVs involved in the installation, maintenance, and operation of offshore wind farms. These vessels transport wind turbine components, personnel, and equipment, contributing to the growth of renewable energy sources. OSVs used for patrolling purposes contribute to offshore security, surveillance, and environmental monitoring. They help ensure compliance with regulations, safety standards, and the protection of marine ecosystems. OSVs are essential for research and surveying operations, enabling data collection for geological studies, oceanography, and environmental assessments. They facilitate scientific exploration and data acquisition in remote offshore locations.

Sr. No Vessel Type Description 1. Anchor Handling Towing and Supply (AHTS) vessels 1. Fitted for deep-water anchor handling and towing operations, equipped with a winch capable to lift a barge or other offshore vessels anchors. 2. Main duty is to move rigs, tow barges, setting anchors, and provide supply support. 3. Equipped with large cranes, winches, and large open deck space. Winch and engine capacity determines power. Higher horse power is used to handle heavier gear. 2. Platform Supply Vessels (PSV) 1. Main purpose is to move cargoes and supplies to/from offshore installations. 2. Flexible platform structure, enables multiple-purpose supply cargo carrying capacity 3. Standard Type – UT755, a Rolls Royce designed PSV, over 100 in operations 3. Multi-Purpose Service Vessel (MPSV) 1. Multi-Purpose (MPP) use 2. Equipment for sub-sea service, large crane, winches, and/or firefighting equipment. 3. May have other equipment, such as ROV support, diving support, etc. 4. Seismic Survey Vessels 1. Survey vessel with seismic prospecting equipment, called seismic streamers. 2. Can be capable of a range of duties including survey, patrolling, fishery protection, emergency standby, pollution control, fire-fighting, salvage, towing, etc. 5. Standby and Rescue Vessels 1. Standby duties are where a vessel is waiting near offshore installations in case of emergencies, to pick up people. 2. Typically with helipad, fire fighting, rescue operations, or oil recovery equipment. 3.Can accommodate up a large number of passengers, up to 300 persons North America Offshore Support Vessel Market, By End-User, (In 2022)

North America Offshore Support Vessel Market Regional Insights:

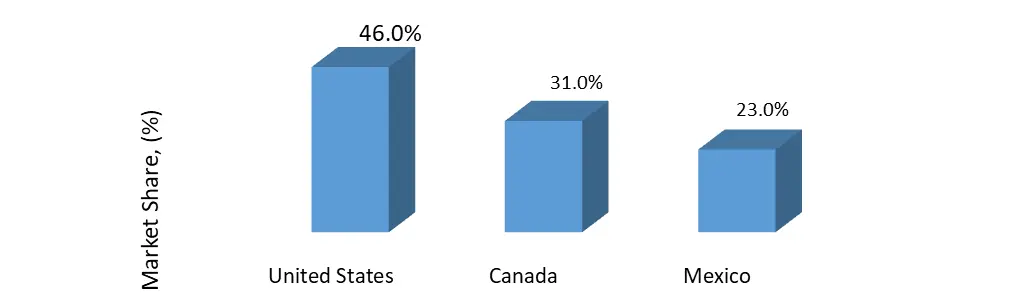

The North America Offshore Support Vessel (OSV) Market exhibits a diverse regional landscape encompassing the United States, Canada, and Mexico. The United States holds the largest share of the North America OSV market, driven by its extensive offshore oil and gas operations in Mexico. The country's well-established energy industry demands a wide range of OSVs for exploration, production, maintenance, and decommissioning activities. Advanced technological capabilities, substantial investments, and a robust regulatory environment characterize the U.S. market. The push towards renewable energy, including offshore wind projects along the Atlantic coast, introduces growth opportunities for OSVs in the offshore support vessels market. Regulatory compliance and environmental concerns, especially in sensitive regions like Alaska, pose challenges. Canada's OSV market is influenced primarily by its offshore activities in the Atlantic and Arctic regions. The Atlantic offshore sector involves OSVs in support of oil and gas operations, similar to the U.S., while the Arctic presents unique challenges due to extreme weather conditions and environmental sensitivities. The country's growing interest in offshore wind development further diversifies OSV demand. Economic considerations, indigenous rights, and environmental safeguards shape the trajectory of offshore activities in Canada. Mexico's OSV market is rapidly evolving due to increasing offshore exploration and production activities in its territorial waters. Market expansion is driven by the country's energy reforms, which attract foreign investments and technological expertise. The demand for OSVs is notably influenced by deepwater and ultra-deepwater reserves, necessitating specialized vessels. Regulatory changes and efforts to enhance operational safety are critical for sustainable growth in Mexico's OSV market.The North America Offshore Support Vessel Market Share,By Country (%), in 2022

Competitive Landscape Key Players of the North America Offshore Support Vessel Market profiled in the report include Abdon Callais Offshore LLC, Delta Logistics Limited, DOF ASA, Edison Chouest Offshore, Falcon Energy group, Harvey Gulf, Hornbeck Offshore Services, Intermarine LLC, Maersk Supply Service A/S, Seacor Marine Holdings Inc., Seam Offshore, Tidewater Inc. This provides huge opportunities to serve many End-uses & customers and expand the North America Offshore Support Vessel Market.

North America Offshore Support Vessel Market Scope: Inquire Before Buying

North America Offshore Support Vessel Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 816.11 Mn. Forecast Period 2023 to 2029 CAGR: 6.3% Market Size in 2029: US $ 1272.8 Mn. Segments Covered: by Vessel Type Anchor Handling Vessel Tug Supply Vessel Platform Supply Vessel Multipurpose Support Vessel Crew Vessel Chase Vessel Seismic Vessel Standby Rescue Vessel by Water Depth Shallow Water Deep Water Ultra Deep Water by End User Oil and Gas industry Offshore wind Patrolling Research and Surveying Others North America Offshore Support Vessel Market, Key Players are

1. Abdon Callais Offshore LLC 2. Delta Logistics Limited, 3. DOF ASA 4. Falcon Energy group 5. Harvey Gulf, 6. Hornbeck Offshore Services 7. Intermarine LLC, 8. Maersk Supply Service A/S 9. Seacor Marine Holdings Inc. 10. Seam Offshore 11. Tidewater Inc.FAQs:

1. What are the growth drivers for the North America Offshore Support Vessel Market? Ans. Rising offshore exploration and production activities drive OSV Demand and is expected to be the major driver for the North America Offshore Support Vessel Market. 2. What is the major restraint for the North America Offshore Support Vessel Market growth? Ans. Economic Uncertainties and Global Crises Affect North America's Offshore Support Vessel Utilization restrain the North American Offshore Support Vessel market: 3. Which country is expected to lead the global North America Offshore Support Vessel Market during the forecast period? Ans. The United States is expected to lead the North America Offshore Support Vessel Market during the forecast period. 4. What is the projected market size & growth rate of the North America Offshore Support Vessel Market? Ans. The North America Offshore Support Vessel Market size was valued at USD 816.11 Million in 2022 and the total North America Offshore Support Vessel Market revenue is expected to grow at a CAGR of 6.3 % from 2023 to 2029, reaching nearly USD 1272.80 Million. 5. What segments are covered in the North America Offshore Support Vessel Market report? Ans. The segments covered in the North America Offshore Support Vessel Market report are Vessel Type, Water Depth, End-Users and Region.

1. North America Offshore Support Vessel Market: Research Methodology 2. North America Offshore Support Vessel Market: Executive Summary 3. North America Offshore Support Vessel Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Market Structure 3.3.1. Market Leaders 3.3.2. Market Followers 3.3.3. Emerging Players 3.4. Consolidation of the Market 4. North America Offshore Support Vessel Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. North America Offshore Support Vessel Market: Segmentation (by Value USD and Volume Units) 5.1. North America Offshore Support Vessel Market, By Vessel Type (2022-2029) 5.1.1. Anchor Handling Vessel 5.1.2. Tug Supply Vessel 5.1.3. Platform Supply Vessel 5.1.4. Multipurpose Support Vessel 5.1.5. Crew Vessel 5.1.6. Chase Vessel 5.1.7. Seismic Vessel Standby 5.1.8. Rescue Vessel 5.2. North America Offshore Support Vessel Market, By Water Depth (2022-2029) 5.2.1. Shallow Water 5.2.2. Deep Water 5.2.3. Ultra Deep Water 5.3. North America Offshore Support Vessel Market, By End User (2022-2029) 5.3.1. Oil and Gas industry 5.3.2. Offshore wind 5.3.3. Patrolling 5.3.4. Research and Surveying 5.3.5. Others 5.4. North America Offshore Support Vessel Market, by Country (2022-2029) 5.4.1. United States 5.4.2. Canada 5.4.3. Mexico 6. Company Profile: Key players 6.1. Abdon Callais Offshore LLC 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. Delta Logistics Limited, 6.3. DOF ASA 6.4. Edison Chouest Offshore 6.5. Falcon Energy group 6.6. Harvey Gulf, 6.7. Hornbeck Offshore Services 6.8. Intermarine LLC, 6.9. Maersk Supply Service A/S 6.10. Seacor Marine Holdings Inc. 6.11. Seam Offshore 6.12. Tidewater Inc. 7. Key Findings 8. Industry Recommendation