Middle East and Africa Offshore Support Vessel Market size was valued at USD 300.77 Million in 2024 and the total Middle East and Africa Offshore Support Vessel Market revenue is expected to grow at a CAGR of 6.6 % from 2025 to 2032, reaching nearly USD 501.53 Million. The Middle East and Africa offshore support vessel market is experiencing robust demand, with a capacity utilization rate of 85%, surpassing the current supply. Industry experts predict the region to enter an OSV "Super Cycle." Existing vessels are returning to service, and the shortage is intensified by the high demand, notably in the Middle East and Africa. While the financing environment for new builds remains challenging, particularly in Europe where environmental considerations are prominent, select shipyards have limited access to substantial financing. Experts debate the source of additional vessels required to meet demand, with existing markets expected to provide the initial supply surge. Age restrictions on vessels will also be relaxed, fueling the expansion. Saudi Arabia's strong local banking relationships and long-term charters contribute to its standout position in the region. Renewables are affecting OSV fleet capacity for green initiatives, leading to a need for contract model adjustments to facilitate decarbonisation efforts. Middle East demand remains stable, driven by drilling and field development projects. The region's relatively low break-even prices, ongoing projects, and national oil companies' influence contribute to its resilience amid oil price fluctuations. Short-to-medium-term growth opportunities are anticipated in the Middle East offshore support vessel market over the forecast years.Middle East and Africa Offshore Support Vessel Market Scope and research methodology:

The Middle East and Africa Offshore Support Vessel Market analysis encompasses a comprehensive exploration of the maritime sector's dynamic landscape, focusing on OSV operations and trends within the region. The scope of this study includes the evaluation of key countries' contributions, industry segments, market drivers, challenges, and growth opportunities. It delves into OSV's role in supporting diverse sectors like oil and gas, offshore wind, patrolling, research, and surveying. The study aims to provide a holistic understanding of market dynamics and regional influences, guiding stakeholders in making informed decisions. The research methodology involves a combination of extensive primary and secondary data collection. Primary sources include industry experts, company representatives, and market players, providing valuable insights and real-time perspectives. Secondary sources encompass industry reports, government publications, and reputable databases, contributing to data validation and analysis. Quantitative and qualitative analysis techniques are employed to assess market trends, growth rates, market share, and regional influences. The synthesis of this information yields a comprehensive overview of the Middle East and Africa Offshore Support Vessel Market, enabling accurate forecasts, strategic planning, and informed decision-making.To know about the Research Methodology :- Request Free Sample Report

Middle East and Africa Offshore Support Vessel Market Dynamics:

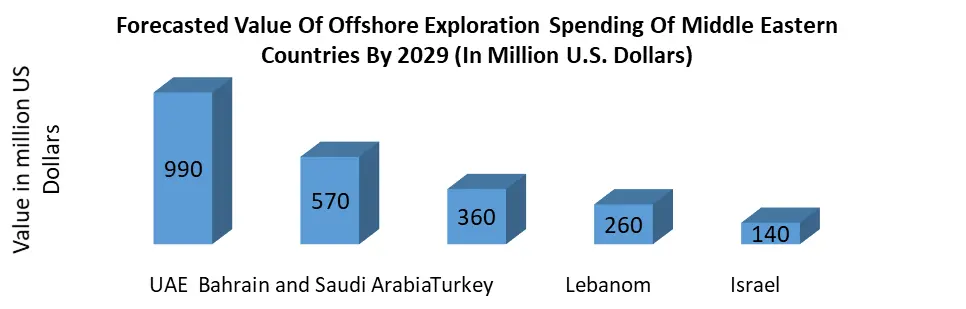

Growing National Oil Companies (NOC) Expansion Drives the Offshore Support Vessel Surge: The market is poised for substantial growth due to its pivotal role in supporting offshore oil and gas exploration and production activities. As the global demand for oil and gas continues to rise, the region anticipates a remarkable surge in offshore support vessel demand over the next 3 to 5 years. The expansion plans of key national oil companies (NOCs) like Saudi Aramco, ADNOC, and Qatar Energy present vast opportunities. This promising landscape is not without challenges. The offshore support vessel sector faces intricate dynamics that necessitate a comprehensive grasp of market intricacies, operator requisites, technological innovations, and regulatory compliance. Challenges encompass the influence of oil prices on daily rates, regional market idiosyncrasies, financial considerations, security concerns, and logistical complexities. Building upon the triumph of the inaugural Offshore Support Vessel Conference, the second edition is scheduled for June 3-4, 2024, in Abu Dhabi, UAE. The event will convene leaders in offshore oil and gas production, ship-owners, shipbuilders, shipyards, and charterers. These stakeholders will unveil the latest developments in offshore exploration and production ventures, introduce innovative commercial trends, and highlight emerging contracting prospects for offshore support vessels. The conference stands as an exclusive platform for fostering networking, collaboration, and innovation, all geared towards nurturing a prosperous and sustainable future for the offshore support vessel sector. Key industry players are primed to drive this growth further. Saudi Aramco, for instance, envisions a 50% expansion in its offshore support vessel fleet, potentially increasing the total count to around 450 crafts. ADNOC has awarded a substantial $548 million contract for a new main gas line at the Lower Zakum field, elevating the requirement for offshore support vessels in the region. Qatar Energy's initiation of 13 new offshore LNG projects translates to a substantial upswing in offshore support vessel demand. Similarly, Kuwait Oil Company's debut offshore drilling endeavor, valued at $594 million, will propel the demand for offshore support vessels to facilitate the project's logistical needs. The market is poised for significant growth, driven by the soaring demand for oil and gas, ambitious NOC expansion plans, and an evolving industry landscape. As opportunities align with challenges, the sector seeks to navigate complexities, harness innovation, and establish a robust foundation for a prosperous offshore support vessel ecosystem.Expansive Horizons of Middle East & Africa Offshore Support Vessel Market Poised for Dynamic Growth: The Middle East and Africa offshore support vessel market presents a compelling array of opportunities as it experiences dynamic growth and evolution. With a projected compound annual growth rate of 5% over the next 5 years, the regional market is anticipated to play a significant role in the global maritime landscape, estimated to be valued at $412.80 million by 2029. These opportunities are underscored by the region's expanding oil and gas exploration and production projects, bolstered by the participation of key national oil companies such as ADNOC. The region's strategic location, rich reserves, and ambitious economic diversification initiatives contribute to the OSV sector's vitality. The Offshore Support Vessels Conference, scheduled for 14-15 June 2023 in Abu Dhabi and supported by prominent industry players and organizations, serves as a focal point for stakeholders. This platform facilitates insightful discussions on pertinent topics, including emerging opportunities, operational challenges, sustainability, and technological advancements. The conference's diverse panel discussions will explore avenues for improving operational efficiency, implementing best practices in safety, reducing costs, and addressing environmental concerns. These conversations are essential for harnessing innovation, enhancing vessel capabilities, and promoting sustainability throughout the lifecycle of offshore support vessels. With the backing of influential sponsors and participants, including ADNOC, the event offers a unique opportunity for maritime industry professionals, ship-owners, operators, and stakeholders to network, collaborate, and glean insights into the transformative trends shaping the Middle East and Africa Offshore Support Vessel Market. As the region's demand for energy resources persists, this conference stands as a gateway to a future of growth, innovation, and sustainable practices in the offshore support vessel sector. Geopolitical Uncertainties are Challenges in the Middle East and Africa Offshore Support Vessel Market: Regulatory complexities and compliance standards pose challenges, as differing regulations across the region necessitate adaptable strategies. Volatile oil prices have a direct impact on the industry's profitability, affecting contract rates and overall demand for OSV services. Geopolitical instability in certain areas can disrupt operations and investment confidence, potentially hindering market growth. Infrastructure limitations, especially in emerging African markets, can impede efficient vessel operations and logistics. Financing hurdles and capital constraints can affect new builds and fleet expansion, influencing the industry's ability to meet escalating demands. The transitioning energy landscape, driven by increasing environmental concerns and renewable energy initiatives, may necessitate a shift in the focus of OSV services. Human capital development remains vital, as a skilled workforce is required to operate technologically advanced vessels and address evolving operational challenges. Maintenance and operational costs also impact profitability, particularly for aging vessels that require substantial investments. Balancing these constraints against the market's opportunities necessitates strategic foresight and collaboration among industry stakeholders to ensure a sustainable and prosperous future for the Middle East and Africa Offshore Support Vessel Market.

Middle East and Africa Offshore Support Vessel Market Segment Analysis:

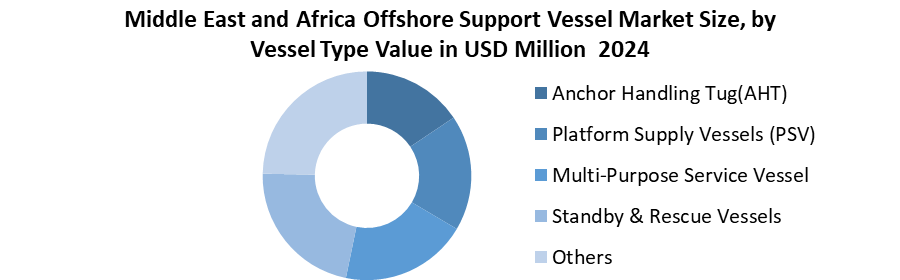

By Vessel Type, The Middle East and Africa offshore support vessel market is dominated by Platform Supply Vessels (PSVs) and Anchor Handling Tug Supply (AHTS) vessels, which together account for over 70% of the regional OSV fleet as of 2024. PSVs are in high demand for transporting drilling fluids, equipment, and personnel to offshore platforms, particularly in the Persian Gulf and offshore West Africa. AHTS vessels are essential for towing rigs and handling anchors in deep and ultra-deep-water operations, especially in Angola, Nigeria, and Saudi Arabia. Multi-Purpose Support Vessels (MPSVs), which serve subsea construction, inspection, maintenance, and repair roles, are gaining ground with the growing complexity of offshore fields and currently hold a 12–15% share. Standby & Rescue Vessels, vital for emergency response and safety assurance, represent around 8–10% of the fleet. The “Others” category comprising accommodation barges, diving support vessels (DSVs), and well-stimulation crafts holds a smaller but critical niche share of 5–7%, especially in long-duration offshore projects. Fleet modernization and demand for vessels with dynamic positioning capabilities are further influencing vessel type preferences in this region.

Middle East and Africa Offshore Support Vessel Market Regional Insights:

The Middle East and Africa (MEA) region is witnessing significant growth and innovation in the Offshore Support Vessel (OSV) market, driven by diverse economic activities, expanding energy sectors, and evolving maritime infrastructure. The United Arab Emirates (UAE) emerges as a dominating force in the Middle East and Africa OSV market. The UAE's well-developed maritime infrastructure, including ports, shipyards, and operational expertise, positions it as a key contributor to the sector's growth. Dubai, in particular, showcases its influence as a global maritime hub, attracting international players and fostering innovation in the OSV industry. The UAE's strategic location, economic stability, and commitment to sustainable maritime practices continue to drive its dominance in the MEA OSV market. With its strategic location, world-class port facilities, and progressive maritime regulations, the UAE is a preferred base for OSV operations. Dubai, in particular, boasts a well-established maritime cluster, including shipyards, operators, and service providers. The city's status as a global trade and business center reinforces its position as a key player in the regional OSV market. Egypt's offshore activities, predominantly in the Mediterranean Sea, contribute to the MEA OSV market's diversity. The country's expanding oil and gas exploration and production initiatives are driving demand for OSVs to support drilling, production, and transportation operations. As Egypt seeks to bolster its energy independence and tap into its offshore resources, the Middle East and Africa Offshore Support Vessel Market plays a crucial role in ensuring efficient logistics and operational support. Africa, as a continent rich in natural resources, offers substantial opportunities for the OSV market. Countries along the western coast of Africa, such as Nigeria, Angola, and Ghana, are known for their thriving oil and gas sectors. These nations drive demand for OSVs to support exploration, production, and export operations. Nigeria, with its substantial offshore activities in the Niger Delta region, is a significant player in the OSV market, requiring vessels for various tasks, including patrolling, cargo transportation, and personnel transfers.

Competitive Landscape

Key Players of the market profiled in the report include Bumi Armada Berhad, Falcon Energy group, Miclyn Express Offshore, MMA Offshore Limited, Seacor Marine Holdings Inc., Tidewater Inc., Topaz Energy and Marine. This provides huge opportunities to serve many End-uses & customers and expand the market. MMA Privilege secured a contract as the primary support vessel for CNR International's MODEC development project in the Baobab Field Offshore Côte d'Ivoire, Africa. It provided offshore support, accommodation, and catering to the MV-10 Floating Production Storage Facility, excelling in operational performance and maintaining exemplary safety with no recordable injuries. MMA Centurion and MMA Chieftain are under long-term contracts in the Middle East, serving drilling rigs from Tanajib Offshore Base, KSA. Operating in the Central and North Safaniya oil fields, they support 5-8 jack-up rigs, conducting frequent cargo runs for general deck cargo, mud, Safra, barite/cement, water, and fuel. Equipped with modern technology, efficient propulsion, and substantial tonnage, MMA's AHT and AHTS vessels excel in anchor handling, towage, and dynamic positioning, ensuring safe operations alongside offshore facilities. Their versatile capabilities include varied bollard pull capacities, hydraulic shark jaws, towing pins, and ample cargo space.Middle East and Africa Offshore Support Vessel Market Scope: Inquire before buying

Middle East and Africa Offshore Support Vessel Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 300.77 Million Forecast Period 2025 to 2032 CAGR: 6.6% Market Size in 2032: USD 501.53 Million. Segments Covered: by Vessel Type Casual Footwear Mass Footwear Active/Sport Footwear Leather Footwear Non-Leather Footwear by Water Depth Leather Rubber Synthetic Others by End User Online Retail Department Stores Specialty Stores Supermarkets Brand Outlets Others Middle East and Africa Offshore Support Vessel Key Players:

1. ZMI Holdings 2. P&O Maritime 3. Rawabi Vallianz Offshore Services (RVOS) 4. Gulf Marine Services (GMS) 5. Marine Platforms Limited (MPL) 6. Tidewater Inc. 7. SEACOR Marine 8. Vallianz Holdings Ltd. 9. BOURBON 10. Halul Offshore Services Company 11. Ocean Marine Services LLC 12. Tethys Plantgeria Ltd. 13. OthersFAQs:

1. What are the growth drivers for the Middle East and Africa Offshore Support Vessel Market? Ans. Growing National Oil Companies (NOC) Expansion Drives the Offshore Support Vessel Surge and is expected to be the major driver for the Middle East and Africa Offshore Support Vessel Market. 2. What is the major Opportunity for the Middle East and Africa Offshore Support Vessel Market growth? Ans. Expansive Horizons of Middle East & Africa Offshore Support Vessel Market Poised for Dynamic Growth. 3. Which country is expected to lead the Middle East and Africa Offshore Support Vessel Market during the forecast period? Ans. The United Arab Emirates is expected to lead the MEA Offshore Support Vessel Market during the forecast period. 4. What is the projected market size & growth rate of the Middle East and Africa Offshore Support Vessel Market? Ans. The Middle East and Africa Offshore Support Vessel Market size was valued at USD 264.68 Million in 2022 and the total MEA market revenue is expected to grow at a CAGR of 6.6 % from 2023 to 2029, reaching nearly USD 412.80 Million. 5. What segments are covered in the Middle East and Africa Offshore Support Vessel Market report? Ans. The segments covered in the MEA Offshore Support Vessel Market report are Vessel Type, Water Depth, End-Users and Region.

1. Middle East and Africa Offshore Support Vessel Market: Executive Summary 1. Executive Summary 1.1.1. Market Size (2024) & Forecast (2025-2032), 1.1.2. Market Size (USD) (Value) and Market Share (%) - By Segments, and Country 2. Middle East and Africa Offshore Support Vessel Market: Competitive Landscape 2.1 MMR Competition Matrix 2.2 Middle East and Africa Offshore Support Vessel Market : Competitive Positioning 2.3 Key Players Benchmarking 2.3.1. Company Name 2.3.2. Headquarter 2.3.3. Technological Innovation 2.3.4. Safety and Compliance Standards 2.3.5. End-User Segment 2.3.6. Revenue (2024) 2.3.7. Market Share (%) 2.3.8. Geographical Presence 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Middle East and Africa Offshore Support Vessel Market: Dynamics 3.1 Market Trends 3.2 Market Dynamics 3.2.1 Drivers 3.2.2 Restraints 3.2.3 Opportunities 3.2.4 Challenges 3.3 PORTER’s Five Forces Analysis 3.4 PESTLE Analysis 3.5 Regulatory & Compliance Landscape 3.5.1 Maritime Regulations for Crewboat Operations 3.5.2 Local Content Policies & Their Impact on Crewboat Market 3.5.3 Environmental & Emission Control Regulations Affecting the Fleet 4 Charter Rate and Pricing Trends 4.1 Average Day Rates by Vessel Category (2019–2024) 4.2 Rate Forecasts by Region and Vessel Class (2025–2032) 4.3 Seasonal Rate Fluctuations and Utilization Trends 5 Investment & Financial Analysis 5.1 Recent Investments in Crewboat Fleets 5.2 Offshore Oil & Gas Trends Impacting Crewboat Demand 5.3 Profitability & Cost Structures for Crewboat Operators 5.4 Fleet Financing Options & Leasing Trends 6 Technological Advancements 6.1 Digitalization & IoT Integration 6.2 Hybrid & Electric Propulsion Systems 6.3 Autonomous & Remote-Controlled Vessels 6.4 Advanced Dynamic Positioning (DP) Systems 7 Sustainability Initiatives 7.1 Adoption of Low-Emission and Hybrid Vessels 7.2 Fuel Efficiency and Emission Reduction Programs 7.3 Waste Management and Marine Ecosystem Protection 7.4 Renewable Energy Integration and Support for Offshore Wind 8 Port Infrastructure and Logistics Overview 8.1 Key Ports Supporting OSV Operations 8.2 Logistics Efficiency and Turnaround Times 8.3 Customs, Fueling, and Offshore Service Hubs 9 Middle East and Africa OSV Fleet Profile 9.1 Active Fleet Size by Vessel Type 9.2 Age Profile and Replacement Needs 9.3 Local vs. Foreign-Owned Vessel Presence 10 Middle East and Africa Offshore Support Vessel Market: Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 10.1 Middle East and Africa Offshore Support Vessel Market Size and Forecast, By Vessel Type (2024-2032) 10.1.1 Anchor Handling Tug(AHT) 10.1.2 Platform Supply Vessels (PSV) 10.1.3 Multi-Purpose Service Vessel 10.1.4 Standby & Rescue Vessels 10.1.5 Others 10.2 Middle East and Africa Offshore Support Vessel Market Size and Forecast, By Water Depth (2024-2032) 10.2.1 Shallow Water 10.2.2 Deepwater 10.2.3 Ultra-Deepwater 10.3 Middle East and Africa Offshore Support Vessel Market Size and Forecast, By End-Users (2024-2032) 10.3.1 Oil and Gas 10.3.2 Offshore wind 10.3.3 Patrolling 10.3.4 Research and Surveying 10.3.5 Others 10.4 Middle East and Africa Offshore Support Vessel Market Size and Forecast, by Country (2024-2032) 10.4.1 South Africa 10.4.2 GCC 10.4.3 Nigeria 10.4.4 Egypt 10.4.5 Iran 10.4.6 Saudi Arabia 10.4.7 United Arab Emirates 10.4.8 Oman 10.4.9 Qatar 10.4.10 Rest of MEA 11 Company Profile: Key Players 11.1 ZMI Holdings 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Recent Developments 11.2 P&O Maritime 11.3 Rawabi Vallianz Offshore Services (RVOS) 11.4 Gulf Marine Services (GMS) 11.5 Marine Platforms Limited (MPL) 11.6 Tidewater Inc. 11.7 SEACOR Marine 11.8 Vallianz Holdings Ltd. 11.9 BOURBON 11.10 Halul Offshore Services Company 11.11 Ocean Marine Services LLC 11.12 Tethys Plantgeria Ltd. 12 Key Findings 13 Strategic Recommendations 13.1 Middle East and Africa Expansion Strategies for OSV Operators 13.2 Partnerships with NOCs and EPC Contractors 13.3 Fleet Modernization and Digital Upgrades 13.4 Risk Mitigation – Regulatory, Operational, and Fuel Price Exposure 14 Middle East and Africa Offshore Support Vessel Market – Research Methodology