Power Electronics Market was valued at USD 45.6 Bn in 2023 and is expected to reach USD 67.22 Bn by 2030, at a CAGR of 5.7 % during the forecast period.Power Electronics Market Overview

Power electronics is a branch of electrical engineering that deals with the conversion, control, and management of electrical power. It involves the study and application of solid-state electronics to control the flow of electrical energy for various purposes, including conversion between different voltage and current levels, frequency conversion, and power conditioning. Key components of power electronics systems include power semiconductor devices such as diodes, transistors, thyristors, and integrated circuits, as well as passive components like capacitors and inductors. These components are used to design circuits and systems for applications such as power supplies, motor drives, renewable energy systems (such as solar inverters and wind turbine converters), electric vehicles, and many others. The increasing adoption of renewable energy sources such as solar and wind power has boosted the demand for power electronics systems for inverters, converters, and energy storage systems, which is expected to boost the Power Electronics Market growth. Power electronics facilitate the efficient conversion of DC power generated by renewables into AC power suitable for grid integration. The consumer electronics market continues to drive demand for power electronics components such as voltage regulators, DC-DC converters, and battery charging solutions. The proliferation of smartphones, tablets, laptops, and wearable devices requires efficient power management to extend battery life and improve performance. Power electronics technologies are essential for the development of smart grids, which enable bidirectional power flow, demand response, and integration of distributed energy resources. Energy storage systems, including batteries and supercapacitors, rely on power electronics for efficient energy conversion and management.To know about the Research Methodology :- Request Free Sample Report

Power Electronics Market Dynamics

Renewable Energy Integration to boost Power Electronics Market growth The increasing integration of renewable energy sources such as solar and wind power into the grid significantly drives the Power Electronics Market growth. Power electronics play a crucial role in converting the variable DC output of renewable energy sources into the stable AC power required for grid compatibility. The global shift towards cleaner and more sustainable energy sources drives demand for inverters, converters, and energy storage systems, spurring growth in the power electronics sector. The rapid electrification of transportation, driven by concerns over environmental pollution and energy security, is another significant driver of the power electronics market. Electric vehicles (EVs) rely on power electronics systems for motor drives, battery management, and on-board chargers. As governments worldwide implement stringent emission regulations and offer incentives for electric vehicle adoption, the demand for power electronics components and systems in the automotive sector continues to surge. The ongoing trend towards industrial automation and the implementation of Industry 4.0 principles propel demand for power electronics solutions in manufacturing and process industries. Power electronics devices such as motor drives, variable frequency drives (VFDs), and power supplies enable energy-efficient operation, precise control, and automation of industrial processes. The pursuit of increased productivity, energy efficiency, and cost savings drives investment in power electronics technologies across industrial sectors. The development of smart grids and the integration of energy storage systems represent significant opportunities for the power electronics market. Smart grid technologies leverage power electronics for bidirectional power flow, demand response, and integration of renewable energy sources and distributed energy resources. Energy storage systems, including batteries and supercapacitors, rely on power electronics for efficient energy conversion, storage, and management. As governments and utilities worldwide invest in grid modernization and energy storage deployment, the demand for power electronics solutions in this segment is expected to grow rapidly. Complexity and Integration Challenges to limit Power electronics Market growth Power electronics systems are inherently complex, involving various components, control algorithms, and integration requirements. Designing, installing, and maintaining these systems is challenging, requiring specialized expertise and engineering resources. Integration challenges arise when combining power electronics with existing infrastructure or other technologies, leading to compatibility issues and performance limitations, which significantly restraints the Power Electronics Market growth. The deployment of power electronics solutions often requires significant upfront investment, especially for large-scale applications such as renewable energy projects, electric vehicle charging infrastructure, and industrial automation systems. High initial capital costs deter potential adopters, particularly in markets with limited financial resources or uncertain returns on investment. Power electronics components and systems operate reliably under a wide range of operating conditions, including temperature fluctuations, voltage transients, and mechanical stresses. Reliability and durability concerns, such as component failure, thermal management issues, and degradation over time undermine confidence in power electronics solutions, especially in safety-critical applications like automotive and aerospace. Interoperability and standardization play a crucial role in ensuring compatibility and seamless integration of power electronics systems with existing infrastructure and devices. Interoperability issues and lack of standardization across different manufacturers or technologies hinder interoperability, limit product interchangeability, and fragment the Power Electronics market. Standardization efforts and industry collaboration are needed to address these challenges and foster interoperability.Power Electronics Market Segment Analysis

Based on Material, the market is segmented into Silicon, Silicon Carbide, Gallium Nitride, and Others. Silicon segment dominated the market in 2023 and is expected to hold the largest Power Electronics Market share over the forecast period. Silicon has been the dominant material used in power electronics for several decades due to its well-established manufacturing processes, reliability, and relatively low cost compared to other semiconductor materials. Silicon-based semiconductor devices are the building blocks of power electronics circuits. These devices include diodes, transistors (bipolar junction transistors - BJTs, metal-oxide-semiconductor field-effect transistors - MOSFETs, insulated gate bipolar transistors - IGBTs), thyristors, and integrated circuits (ICs) used for control and protection functions. These devices are used in various power conversion and control applications across industries. Despite the emergence of SiC and GaN technologies, silicon-based power devices continue to dominate the market due to their cost-effectiveness and reliability. However, the adoption of SiC and GaN devices is growing, particularly in applications where their performance benefits justify the higher cost. The silicon segment remains significant in the power electronics market and is expected to coexist with SiC and GaN technologies for the foreseeable future, catering to a wide range of applications and market segments.Based on Device Type, the market is segmented into Power Discrete, Power Modules, and Power ICs. Power ICs segment dominated the market in 2023 and is expected to hold the largest Power Electronics Market share over the forecast period. The "Power ICs" segment in the power electronics industry are integrated circuits (ICs) specifically designed to control, manage, and regulate power within electronic systems. These ICs are compact, highly efficient, and offer advanced functionality for various power management applications. Power ICs play a crucial role in optimizing energy efficiency, improving system reliability, and reducing overall system size and cost. Power ICs integrate multiple power semiconductor devices, control circuits, and protection features into a single chip. They perform a wide range of functions, including voltage regulation, current sensing, switching, protection against overvoltage, overcurrent, and over temperature conditions, and power factor correction (PFC). Power ICs are designed to meet specific power management requirements in different applications, from low-power consumer electronics to high-power industrial systems, which is expected to boost the Power Electronics Industry growth.

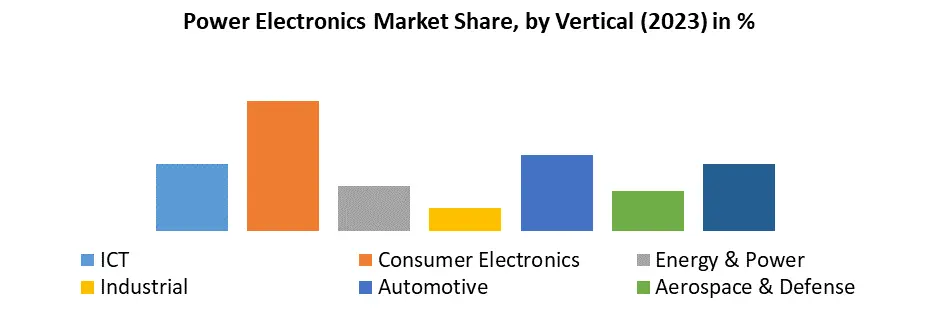

Based on Vertical, the market is segmented into ICT, Consumer Electronics, Energy & Power, Industrial, Automotive, Aerospace & Defense, and Others. The consumer Electronics segment dominated the market in 2023 and is expected to hold the largest Power Electronics Market share over the forecast period. Consumer electronics are the application of power electronics technologies in devices and products used by consumers for personal, entertainment, and communication purposes. This segment encompasses a wide range of electronic devices commonly found in households, offices, and recreational settings. Consumer demand for smaller, lighter, and more portable devices drives the miniaturization of power electronics components and the integration of power management functions into compact chips. The adoption of wireless charging technology eliminates the need for wired connections and enhances convenience for consumers, driving the integration of wireless charging circuits in smartphones, wearables, and other portable devices.

Power Electronics Market Regional Analysis

Expanding Renewable Energy Sector to boost Asia Pacific Power Electronics Market growth The APAC region is witnessing rapid growth in the renewable energy sector, particularly in countries with abundant solar and wind resources such as China, India, Japan, and Australia. Power electronics solutions are essential for integrating renewable energy sources into the grid, managing fluctuations in power output, and ensuring grid stability. In India, for instance, the government's ambitious renewable energy targets are driving investments in solar inverters, wind turbine converters, and energy storage systems. The electrification of transportation is a significant driver of the power electronics market in APAC, driven by concerns over air pollution, energy security, and the need to reduce greenhouse gas emissions. Countries like China and Japan are leading the way in electric vehicle (EV) adoption, with supportive policies, incentives, and infrastructure development. This trend fuels demand for power electronics components such as motor drives, battery management systems, and charging infrastructure. The APAC region is a major consumer electronics market, with countries like China, South Korea, and Japan being key manufacturing hubs and consumer markets. The growing demand for smartphones, tablets, laptops, and other consumer electronics devices drives the need for power electronics components such as voltage regulators, DC-DC converters, and battery management systems, which significantly boost the Asia Pacific Power Electronics Market growth. China, in particular, has a vast consumer electronics market driven by its large population and rising disposable income levels. Governments and utilities in APAC countries are investing in smart grid infrastructure to improve energy efficiency, enhance grid reliability, and integrate renewable energy sources. Power electronics technologies play a crucial role in smart grid applications such as advanced metering infrastructure (AMI), distribution automation, and grid-scale energy storage. Countries like Japan and South Korea are pioneers in smart grid deployment, driving demand for power electronics solutions in these markets.Power Electronics Market Scope: Inquiry Before Buying

Power Electronics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 45.6 Bn. Forecast Period 2024 to 2030 CAGR: 5.7% Market Size in 2030: US $ 67.22 Bn. Segments Covered: by Material Silicon Silicon Carbide Gallium Nitride Others by Device Type Power Discrete Power Modules Power ICs by Application Power Management Drives UPS Rail Traction Transportation Renewable Energy Others by Vertical ICT Consumer Electronics Energy & Power Industrial Automotive Aerospace & Defense Others Power Electronics Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Power Electronics Key Players Include:

North America: 1. Texas Instruments - Dallas, Texas, USA 2. Analog Devices - Norwood, Massachusetts, USA 3. Maxim Integrated - San Jose, California, USA 4. ON Semiconductor - Phoenix, Arizona, USA 5. Microchip Technology - Chandler, Arizona, USA 6. Cree, Inc. - Durham, North Carolina, USA 7. Vishay Intertechnology - Malvern, Pennsylvania, USA Europe: 8. Infineon Technologies - Neubiberg, Germany 9. STMicroelectronics - Geneva, Switzerland 10. NXP Semiconductors - Eindhoven, Netherlands 11. Renesas Electronics - Tokyo, Japan 12. ABB - Zurich, Switzerland 13. Schneider Electric - Rueil-Malmaison, France 14. Siemens - Munich, Germany Asia Pacific: 15. Mitsubishi Electric - Tokyo, Japan 16. Toshiba Corporation - Tokyo, Japan 17. Fuji Electric - Tokyo, Japan 18. Panasonic Corporation - Osaka, Japan 19. Hitachi, Ltd. - Tokyo, Japan 20. Samsung Electronics - Suwon, South Korea 21. LG Electronics - Seoul, South Korea 22. Huawei Technologies - Shenzhen, China 23. BYD Company Limited - Shenzhen, China 24. China Electronics Corporation (CEC) - Beijing, China 25. CRRC Corporation Limited - Beijing, China 26. TBEA Co., Ltd. - Xinjiang, China 27. CHINT Group Corporation - Wenzhou, China 28. Sungrow Power Supply - Hefei, China 29. Trina Solar - Changzhou, China 30. Envision Energy - Shanghai, ChinaFrequently asked Questions:

1. What is power electronics? Ans: Power electronics is a branch of electrical engineering focusing on the conversion, control, and management of electrical power using solid-state electronics components. 2. What are the main applications of power electronics? Ans: Power electronics finds applications in power supplies, motor drives, renewable energy systems (such as solar inverters and wind turbine converters), electric vehicles, and consumer electronics. 3. What drives the demand for power electronics in the automotive sector? Ans: The rapid electrification of transportation, driven by environmental concerns and government regulations, leads to increased demand for power electronics systems in electric vehicles for motor drives, battery management, and charging. 4. Which regions are driving the growth of the power electronics market? Ans: Regions like Asia Pacific witness significant growth due to expanding renewable energy sectors, electrification of transportation, and consumer electronics demand, particularly in countries like China, India, and Japan. 5. What challenges does the power electronics market face? Ans: Challenges include complexity in system design, integration issues, reliability concerns, and interoperability issues, which require specialized expertise, upfront investment, and industry collaboration to address effectively.

1. Power Electronics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Power Electronics Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Product Segment 2.3.3. End-user Segment 2.3.4. Revenue (2023) 2.3.5. Company Locations 2.4. Power Electronics Market Companies Share 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Power Electronics Market: Dynamics 3.1. Power Electronics Market Trends by Region 3.1.1. North America Power Electronics Market Trends 3.1.2. Europe Power Electronics Market Trends 3.1.3. Asia Pacific Power Electronics Market Trends 3.1.4. Middle East and Africa Power Electronics Market Trends 3.1.5. South America Power Electronics Market Trends 3.2. Power Electronics Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Power Electronics Market Drivers 3.2.1.2. North America Power Electronics Market Restraints 3.2.1.3. North America Power Electronics Market Opportunities 3.2.1.4. North America Power Electronics Market Challenges 3.2.2. Europe 3.2.2.1. Europe Power Electronics Market Drivers 3.2.2.2. Europe Power Electronics Market Restraints 3.2.2.3. Europe Power Electronics Market Opportunities 3.2.2.4. Europe Power Electronics Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Power Electronics Market Drivers 3.2.3.2. Asia Pacific Power Electronics Market Restraints 3.2.3.3. Asia Pacific Power Electronics Market Opportunities 3.2.3.4. Asia Pacific Power Electronics Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Power Electronics Market Drivers 3.2.4.2. Middle East and Africa Power Electronics Market Restraints 3.2.4.3. Middle East and Africa Power Electronics Market Opportunities 3.2.4.4. Middle East and Africa Power Electronics Market Challenges 3.2.5. South America 3.2.5.1. South America Power Electronics Market Drivers 3.2.5.2. South America Power Electronics Market Restraints 3.2.5.3. South America Power Electronics Market Opportunities 3.2.5.4. South America Power Electronics Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Value Chain Analysis 3.6. Technological Roadmap 3.7. Regulatory Landscape by Region 3.7.1. North America 3.7.2. Europe 3.7.3. Asia Pacific 3.7.4. Middle East and Africa 3.7.5. South America 3.8. Key Opinion Leader Analysis for Power Electronics Industry 3.9. Analysis of Government Schemes and Initiatives for Power Electronics Industry 3.10. The Global Pandemic Impact on Power Electronics Market 4. Power Electronics Market: Global Market Size and Forecast by Segmentation by (by Value) (2023-2030) 4.1. Power Electronics Market Size and Forecast, By Material (2023-2030) 4.1.1.1. Silicon 4.1.1.2. Silicon Carbide 4.1.1.3. Gallium Nitride 4.1.1.4. Others 4.2. Power Electronics Market Size and Forecast, By Device Type (2023-2030) 4.2.1. Power Discrete 4.2.2. Power Modules 4.2.3. Power ICs 4.3. Power Electronics Market Size and Forecast, By Application (2023-2030) 4.3.1. Power Management 4.3.2. Drives 4.3.3. UPS 4.3.4. Rail Traction 4.3.5. Transportation 4.3.6. Renewable Energy 4.3.7. Others 4.4. Power Electronics Market Size and Forecast, By Vertical (2023-2030) 4.4.1. ICT 4.4.2. Consumer Electronics 4.4.3. Energy & Power 4.4.4. Industrial 4.4.5. Automotive 4.4.6. Aerospace & Defense 4.4.7. Others 4.5. Power Electronics Market Size and Forecast, by region (2023-2030) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Power Electronics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Power Electronics Market Size and Forecast, By Material(2023-2030) 5.1.1.1. Silicon 5.1.1.2. Silicon Carbide 5.1.1.3. Gallium Nitride 5.1.1.4. Others 5.2. North America Power Electronics Market Size and Forecast, By Device Type (2023-2030) 5.2.1. Power Discrete 5.2.2. Power Modules 5.2.3. Power ICs 5.3. North America Power Electronics Market Size and Forecast, By Application (2023-2030) 5.3.1. Power Management 5.3.2. Drives 5.3.3. UPS 5.3.4. Rail Traction 5.3.5. Transportation 5.3.6. Renewable Energy 5.3.7. Others 5.4. North America Power Electronics Market Size and Forecast, By Vertical (2023-2030) 5.4.1. ICT 5.4.2. Consumer Electronics 5.4.3. Energy & Power 5.4.4. Industrial 5.4.5. Automotive 5.4.6. Aerospace & Defense 5.4.7. Others 5.5. North America Power Electronics Market Size and Forecast, by Country (2023-2030) 5.5.1. United States 5.5.1.1. United States Power Electronics Market Size and Forecast, By Material(2023-2030) 5.5.1.1.1. Silicon 5.5.1.1.2. Silicon Carbide 5.5.1.1.3. Gallium Nitride 5.5.1.1.4. Others 5.5.1.2. United States Power Electronics Market Size and Forecast, By Device Type (2023-2030) 5.5.1.2.1. Power Discrete 5.5.1.2.2. Power Modules 5.5.1.2.3. Power ICs 5.5.1.3. United States Power Electronics Market Size and Forecast, By Application (2023-2030) 5.5.1.3.1. Power Management 5.5.1.3.2. Drives 5.5.1.3.3. UPS 5.5.1.3.4. Rail Traction 5.5.1.3.5. Transportation 5.5.1.3.6. Renewable Energy 5.5.1.3.7. Others 5.5.1.4. United States Power Electronics Market Size and Forecast, By Vertical (2023-2030) 5.5.1.4.1. ICT 5.5.1.4.2. Consumer Electronics 5.5.1.4.3. Energy & Power 5.5.1.4.4. Industrial 5.5.1.4.5. Automotive 5.5.1.4.6. Aerospace & Defense 5.5.1.4.7. Others 5.5.2. Canada 5.5.2.1. Canada Power Electronics Market Size and Forecast, By Material(2023-2030) 5.5.2.1.1.1. Silicon 5.5.2.1.1.2. Silicon Carbide 5.5.2.1.1.3. Gallium Nitride 5.5.2.1.1.4. Others 5.5.2.2. Canada Power Electronics Market Size and Forecast, By Device Type (2023-2030) 5.5.2.2.1. Power Discrete 5.5.2.2.2. Power Modules 5.5.2.2.3. Power ICs 5.5.2.3. Canada Power Electronics Market Size and Forecast, By Application (2023-2030) 5.5.2.3.1. Power Management 5.5.2.3.2. Drives 5.5.2.3.3. UPS 5.5.2.3.4. Rail Traction 5.5.2.3.5. Transportation 5.5.2.3.6. Renewable Energy 5.5.2.3.7. Others 5.5.2.4. Canada Power Electronics Market Size and Forecast, By Vertical (2023-2030) 5.5.2.4.1. ICT 5.5.2.4.2. Consumer Electronics 5.5.2.4.3. Energy & Power 5.5.2.4.4. Industrial 5.5.2.4.5. Automotive 5.5.2.4.6. Aerospace & Defense 5.5.2.4.7. Others 5.5.3. Mexico 5.5.3.1. Mexico Power Electronics Market Size and Forecast, By Material(2023-2030) 5.5.3.1.1.1. Silicon 5.5.3.1.1.2. Silicon Carbide 5.5.3.1.1.3. Gallium Nitride 5.5.3.1.1.4. Others 5.5.3.2. Mexico Power Electronics Market Size and Forecast, By Device Type (2023-2030) 5.5.3.2.1. Power Discrete 5.5.3.2.2. Power Modules 5.5.3.2.3. Power ICs 5.5.3.3. Mexico Power Electronics Market Size and Forecast, By Application (2023-2030) 5.5.3.3.1. Power Management 5.5.3.3.2. Drives 5.5.3.3.3. UPS 5.5.3.3.4. Rail Traction 5.5.3.3.5. Transportation 5.5.3.3.6. Renewable Energy 5.5.3.3.7. Others 5.5.3.4. Mexico Power Electronics Market Size and Forecast, By Vertical (2023-2030) 5.5.3.4.1. ICT 5.5.3.4.2. Consumer Electronics 5.5.3.4.3. Energy & Power 5.5.3.4.4. Industrial 5.5.3.4.5. Automotive 5.5.3.4.6. Aerospace & Defense 5.5.3.4.7. Others 6. Europe Power Electronics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Power Electronics Market Size and Forecast, By Material(2023-2030) 6.2. Europe Power Electronics Market Size and Forecast, By Device Type (2023-2030) 6.3. Europe Power Electronics Market Size and Forecast, By Application (2023-2030) 6.4. Europe Power Electronics Market Size and Forecast, By Vertical (2023-2030) 6.5. Europe Power Electronics Market Size and Forecast, by Country (2023-2030) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Power Electronics Market Size and Forecast, By Material(2023-2030) 6.5.1.2. United Kingdom Power Electronics Market Size and Forecast, By Device Type (2023-2030) 6.5.1.3. United Kingdom Power Electronics Market Size and Forecast, By Application (2023-2030) 6.5.1.4. United Kingdom Power Electronics Market Size and Forecast, By Vertical (2023-2030) 6.5.2. France 6.5.2.1. France Power Electronics Market Size and Forecast, By Material(2023-2030) 6.5.2.2. France Power Electronics Market Size and Forecast, By Device Type (2023-2030) 6.5.2.3. France Power Electronics Market Size and Forecast, By Application (2023-2030) 6.5.2.4. France Power Electronics Market Size and Forecast, By Vertical (2023-2030) 6.5.3. Germany 6.5.3.1. Germany Power Electronics Market Size and Forecast, By Material(2023-2030) 6.5.3.2. Germany Power Electronics Market Size and Forecast, By Device Type (2023-2030) 6.5.3.3. Germany Power Electronics Market Size and Forecast, By Application (2023-2030) 6.5.3.4. Germany Power Electronics Market Size and Forecast, By Vertical (2023-2030) 6.5.4. Italy 6.5.4.1. Italy Power Electronics Market Size and Forecast, By Material(2023-2030) 6.5.4.2. Italy Power Electronics Market Size and Forecast, By Device Type (2023-2030) 6.5.4.3. Italy Power Electronics Market Size and Forecast, By Application (2023-2030) 6.5.4.4. Italy Power Electronics Market Size and Forecast, By Vertical (2023-2030) 6.5.5. Spain 6.5.5.1. Spain Power Electronics Market Size and Forecast, By Material(2023-2030) 6.5.5.2. Spain Power Electronics Market Size and Forecast, By Device Type (2023-2030) 6.5.5.3. Spain Power Electronics Market Size and Forecast, By Application (2023-2030) 6.5.5.4. Spain Power Electronics Market Size and Forecast, By Vertical (2023-2030) 6.5.6. Sweden 6.5.6.1. Sweden Power Electronics Market Size and Forecast, By Material(2023-2030) 6.5.6.2. Sweden Power Electronics Market Size and Forecast, By Device Type (2023-2030) 6.5.6.3. Sweden Power Electronics Market Size and Forecast, By Application (2023-2030) 6.5.6.4. Sweden Power Electronics Market Size and Forecast, By Vertical(2023-2030) 6.5.7. Austria 6.5.7.1. Austria Power Electronics Market Size and Forecast, By Material(2023-2030) 6.5.7.2. Austria Power Electronics Market Size and Forecast, By Device Type (2023-2030) 6.5.7.3. Austria Power Electronics Market Size and Forecast, By Application (2023-2030) 6.5.7.4. Austria Power Electronics Market Size and Forecast, By Vertical (2023-2030) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Power Electronics Market Size and Forecast, By Material(2023-2030) 6.5.8.2. Rest of Europe Power Electronics Market Size and Forecast, By Device Type (2023-2030) 6.5.8.3. Rest of Europe Power Electronics Market Size and Forecast, By Application (2023-2030) 6.5.8.4. Rest of Europe Power Electronics Market Size and Forecast, By Vertical(2023-2030) 7. Asia Pacific Power Electronics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Power Electronics Market Size and Forecast, By Material(2023-2030) 7.2. Asia Pacific Power Electronics Market Size and Forecast, By Device Type (2023-2030) 7.3. Asia Pacific Power Electronics Market Size and Forecast, By Application (2023-2030) 7.4. Asia Pacific Power Electronics Market Size and Forecast, By Vertical(2023-2030) 7.5. Asia Pacific Power Electronics Market Size and Forecast, by Country (2023-2030) 7.5.1. China 7.5.1.1. China Power Electronics Market Size and Forecast, By Material(2023-2030) 7.5.1.2. China Power Electronics Market Size and Forecast, By Device Type (2023-2030) 7.5.1.3. China Power Electronics Market Size and Forecast, By Application (2023-2030) 7.5.1.4. China Power Electronics Market Size and Forecast, By Vertical(2023-2030) 7.5.2. S Korea 7.5.2.1. S Korea Power Electronics Market Size and Forecast, By Material(2023-2030) 7.5.2.2. S Korea Power Electronics Market Size and Forecast, By Device Type (2023-2030) 7.5.2.3. S Korea Power Electronics Market Size and Forecast, By Application (2023-2030) 7.5.2.4. S Korea Power Electronics Market Size and Forecast, By Vertical(2023-2030) 7.5.3. Japan 7.5.3.1. Japan Power Electronics Market Size and Forecast, By Material(2023-2030) 7.5.3.2. Japan Power Electronics Market Size and Forecast, By Device Type (2023-2030) 7.5.3.3. Japan Power Electronics Market Size and Forecast, By Application (2023-2030) 7.5.3.4. Japan Power Electronics Market Size and Forecast, By Vertical(2023-2030) 7.5.4. India 7.5.4.1. India Power Electronics Market Size and Forecast, By Material(2023-2030) 7.5.4.2. India Power Electronics Market Size and Forecast, By Device Type (2023-2030) 7.5.4.3. India Power Electronics Market Size and Forecast, By Application (2023-2030) 7.5.4.4. India Power Electronics Market Size and Forecast, By Vertical(2023-2030) 7.5.5. Australia 7.5.5.1. Australia Power Electronics Market Size and Forecast, By Material(2023-2030) 7.5.5.2. Australia Power Electronics Market Size and Forecast, By Device Type (2023-2030) 7.5.5.3. Australia Power Electronics Market Size and Forecast, By Application (2023-2030) 7.5.5.4. Australia Power Electronics Market Size and Forecast, By Vertical(2023-2030) 7.5.6. Indonesia 7.5.6.1. Indonesia Power Electronics Market Size and Forecast, By Material(2023-2030) 7.5.6.2. Indonesia Power Electronics Market Size and Forecast, By Device Type (2023-2030) 7.5.6.3. Indonesia Power Electronics Market Size and Forecast, By Application (2023-2030) 7.5.6.4. Indonesia Power Electronics Market Size and Forecast, By Vertical(2023-2030) 7.5.7. Malaysia 7.5.7.1. Malaysia Power Electronics Market Size and Forecast, By Material(2023-2030) 7.5.7.2. Malaysia Power Electronics Market Size and Forecast, By Device Type (2023-2030) 7.5.7.3. Malaysia Power Electronics Market Size and Forecast, By Application (2023-2030) 7.5.7.4. Malaysia Power Electronics Market Size and Forecast, By Vertical(2023-2030) 7.5.8. Vietnam 7.5.8.1. Vietnam Power Electronics Market Size and Forecast, By Material(2023-2030) 7.5.8.2. Vietnam Power Electronics Market Size and Forecast, By Device Type (2023-2030) 7.5.8.3. Vietnam Power Electronics Market Size and Forecast, By Application (2023-2030) 7.5.8.4. Vietnam Power Electronics Market Size and Forecast, By Vertical (2023-2030) 7.5.9. Taiwan 7.5.9.1. Taiwan Power Electronics Market Size and Forecast, By Material(2023-2030) 7.5.9.2. Taiwan Power Electronics Market Size and Forecast, By Device Type (2023-2030) 7.5.9.3. Taiwan Power Electronics Market Size and Forecast, By Application (2023-2030) 7.5.9.4. Taiwan Power Electronics Market Size and Forecast, By Vertical(2023-2030) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Power Electronics Market Size and Forecast, By Material(2023-2030) 7.5.10.2. Rest of Asia Pacific Power Electronics Market Size and Forecast, By Device Type (2023-2030) 7.5.10.3. Rest of Asia Pacific Power Electronics Market Size and Forecast, By Application (2023-2030) 7.5.10.4. Rest of Asia Pacific Power Electronics Market Size and Forecast, By Vertical (2023-2030) 8. Middle East and Africa Power Electronics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Power Electronics Market Size and Forecast, By Material(2023-2030) 8.2. Middle East and Africa Power Electronics Market Size and Forecast, By Device Type (2023-2030) 8.3. Middle East and Africa Power Electronics Market Size and Forecast, By Application (2023-2030) 8.4. Middle East and Africa Power Electronics Market Size and Forecast, By Vertical(2023-2030) 8.5. Middle East and Africa Power Electronics Market Size and Forecast, by Country (2023-2030) 8.5.1. South Africa 8.5.1.1. South Africa Power Electronics Market Size and Forecast, By Material(2023-2030) 8.5.1.2. South Africa Power Electronics Market Size and Forecast, By Device Type (2023-2030) 8.5.1.3. South Africa Power Electronics Market Size and Forecast, By Application (2023-2030) 8.5.1.4. South Africa Power Electronics Market Size and Forecast, By Vertical(2023-2030) 8.5.2. GCC 8.5.2.1. GCC Power Electronics Market Size and Forecast, By Material(2023-2030) 8.5.2.2. GCC Power Electronics Market Size and Forecast, By Device Type (2023-2030) 8.5.2.3. GCC Power Electronics Market Size and Forecast, By Application (2023-2030) 8.5.2.4. GCC Power Electronics Market Size and Forecast, By Vertical(2023-2030) 8.5.3. Nigeria 8.5.3.1. Nigeria Power Electronics Market Size and Forecast, By Material(2023-2030) 8.5.3.2. Nigeria Power Electronics Market Size and Forecast, By Device Type (2023-2030) 8.5.3.3. Nigeria Power Electronics Market Size and Forecast, By Application (2023-2030) 8.5.3.4. Nigeria Power Electronics Market Size and Forecast, By Vertical(2023-2030) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Power Electronics Market Size and Forecast, By Material(2023-2030) 8.5.4.2. Rest of ME&A Power Electronics Market Size and Forecast, By Device Type (2023-2030) 8.5.4.3. Rest of ME&A Power Electronics Market Size and Forecast, By Application (2023-2030) 8.5.4.4. Rest of ME&A Power Electronics Market Size and Forecast, By Vertical (2023-2030) 9. South America Power Electronics Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Power Electronics Market Size and Forecast, By Material(2023-2030) 9.2. South America Power Electronics Market Size and Forecast, By Device Type (2023-2030) 9.3. South America Power Electronics Market Size and Forecast, By Application (2023-2030) 9.4. South America Power Electronics Market Size and Forecast, By Vertical (2023-2030) 9.5. South America Power Electronics Market Size and Forecast, by Country (2023-2030) 9.5.1. Brazil 9.5.1.1. Brazil Power Electronics Market Size and Forecast, By Material(2023-2030) 9.5.1.2. Brazil Power Electronics Market Size and Forecast, By Device Type (2023-2030) 9.5.1.3. Brazil Power Electronics Market Size and Forecast, By Application (2023-2030) 9.5.1.4. Brazil Power Electronics Market Size and Forecast, By Vertical (2023-2030) 9.5.2. Argentina 9.5.2.1. Argentina Power Electronics Market Size and Forecast, By Material(2023-2030) 9.5.2.2. Argentina Power Electronics Market Size and Forecast, By Device Type (2023-2030) 9.5.2.3. Argentina Power Electronics Market Size and Forecast, By Application (2023-2030) 9.5.2.4. Argentina Power Electronics Market Size and Forecast, By Vertical (2023-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Power Electronics Market Size and Forecast, By Material(2023-2030) 9.5.3.2. Rest Of South America Power Electronics Market Size and Forecast, By Device Type (2023-2030) 9.5.3.3. Rest Of South America Power Electronics Market Size and Forecast, By Application (2023-2030) 9.5.3.4. Rest Of South America Power Electronics Market Size and Forecast, By Vertical (2023-2030) 10. Company Profile: Key Players 10.1. Texas Instruments - Dallas, Texas, USA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Analog Devices - Norwood, Massachusetts, USA 10.3. Maxim Integrated - San Jose, California, USA 10.4. ON Semiconductor - Phoenix, Arizona, USA 10.5. Microchip Technology - Chandler, Arizona, USA 10.6. Cree, Inc. - Durham, North Carolina, USA 10.7. Vishay Intertechnology - Malvern, Pennsylvania, USA 10.8. Infineon Technologies - Neubiberg, Germany 10.9. STMicroelectronics - Geneva, Switzerland 10.10. NXP Semiconductors - Eindhoven, Netherlands 10.11. Renesas Electronics - Tokyo, Japan 10.12. ABB - Zurich, Switzerland 10.13. Schneider Electric - Rueil-Malmaison, France 10.14. Siemens - Munich, Germany 10.15. Mitsubishi Electric - Tokyo, Japan 10.16. Toshiba Corporation - Tokyo, Japan 10.17. Fuji Electric - Tokyo, Japan 10.18. Panasonic Corporation - Osaka, Japan 10.19. Hitachi, Ltd. - Tokyo, Japan 10.20. Samsung Electronics - Suwon, South Korea 10.21. LG Electronics - Seoul, South Korea 10.22. Huawei Technologies - Shenzhen, China 10.23. BYD Company Limited - Shenzhen, China 10.24. China Electronics Corporation (CEC) - Beijing, China 10.25. CRRC Corporation Limited - Beijing, China 10.26. TBEA Co., Ltd. - Xinjiang, China 10.27. CHINT Group Corporation - Wenzhou, China 10.28. Sungrow Power Supply - Hefei, China 10.29. Trina Solar - Changzhou, China 10.30. Envision Energy - Shanghai, China 11. Key Findings and Analyst Recommendations 12. Power Electronics Market: Research Methodology