The Lithium Metal Industry size was valued at USD 2497.93 Million in 2023 and the total Lithium Metal revenue is expected to grow at a CAGR of 20.7% from 2024 to 2030, reaching nearly USD 9322.50 Million.Lithium Metal Industry Overview:

The Lithium Metal Industry is experiencing substantial growth due to the surging demand for lithium-ion batteries in electric vehicles (EVs), energy grid storage, and electronic devices. The shift towards electric mobility and increased EV adoption globally are major drivers of this demand. Lithium-ion batteries are preferred by EV manufacturers for their high energy density, long lifespan, and lightweight characteristics, driving lithium metal demand. Additionally, grid-scale lithium-ion battery systems like Tesla's Power Wall and Power Pack are revolutionizing energy storage solutions and further contributing to market expansion. Apart from EVs and energy storage, lithium metal finds applications in the aerospace, defense, automotive, and HVAC sectors due to its lightweight and high-strength properties. The growing aerospace industry and defense modernization initiatives drive lithium metal demand in these sectors. Lithium chloride's hygroscopic properties make it valuable in air conditioning and industrial drying systems. Lithium carbonate is used in medications for bipolar disorder and manic depression. Lithium metal serves various industrial applications, including optics, glassware, ceramics, and lubricants, due to its unique properties. As lithium consumption continues to rise and supply capacity faces limitations, there are concerns about potential supply shortages and significant price increases in the market.To know about the Research Methodology :- Request Free Sample Report

What does the bundle’s collection provide?

1. The collection includes individual reports that offer a comprehensive analysis of the lithium metal industry in specific regions. 2. The Lithium metal bundle report examines the global Lithium Metal Industry. It covers various aspects such as type, products, distribution channel, category, and end-users. 3. Included in the report are insights into growth drivers, upcoming challenges, trends, opportunities, risks, and entry barriers facing the industry. 4. The research methodology involves a detailed analysis of product-type literature, industry releases, annual reports, and other relevant documents from key industry participants. 5. The report emphasizes industry players' focus on technological advancements to establish dominance in the global Lithium Metal Industry. Key players are actively strengthening their market positions. 6. The report aims to provide valuable insights and an in-depth analysis of the Lithium Metal Industry, assisting stakeholders in making informed decisions and gaining a comprehensive understanding of market dynamics. Unlock a wealth of knowledge about the Lithium Metal Industry with this economical bundle, offering a treasure trove of valuable information and insights. By purchasing this cost-effective package, you gain access to multiple reports at a reduced price than buying them individually. Don't miss out on the opportunity to delve into comprehensive analyses and valuable data on the lithium metal industry with this discounted collection. The Future of Energy Storage and Transportation in the Lithium Metal Industry report bundle worth US$ 14000 can now be purchased at a reduced price of UD$ 12000 1. North America Lithium Metal Market (Single User $ 2900) 2. Asia Pacific Lithium Metal Market (Single User $ 2900) 3. Europe Lithium Metal Market (Single User $ 2900) 4. Middle East and Africa Lithium Metal Market (Single User $ 2900) 5. South America Lithium Metal Market (Single User $ 2900)How this report will help you:

1. The report helps you to Gain valuable insights and make informed decisions for your business with this comprehensive report covering the main trends and drivers of the Lithium Metal Industry. 2. The report helps you to expand your market presence and identify growth opportunities in the lithium metal industry using this report. 3. The report helps you to discover potential areas for growth and investment with a detailed analysis of key sectors and major projects provided in this report. 4. Understand the impact of government policies on the Lithium Metal Industry, anticipate policy changes, and align your business strategies accordingly. 5. Plan for the future with historical and forecasted valuations of the Lithium Metal Industry. This will assist with budgeting, resource allocation, and goal-setting for upcoming market developments. 6. Implement effective risk mitigation strategies by identifying potential challenges, market volatility, and regulatory factors highlighted in this report.Reports Offerings in the Bundle:

Report 1: North America Lithium Metal Market Powering the Future of Energy Storage and Transportation: Industry Analysis and Forecast (2024-2030).

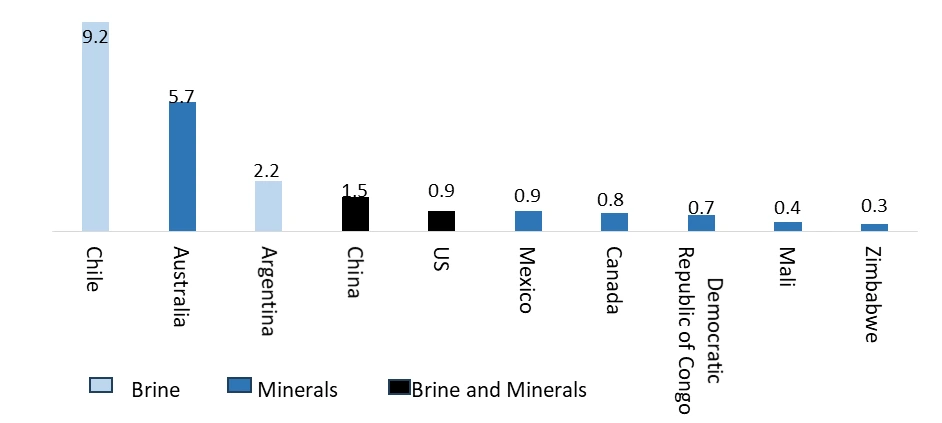

The North America Lithium Metal Industry size was valued at USD 414.3 Million in and the total North America Lithium Metal Industry revenue is expected to grow at a CAGR of 19.8 % from 2024 to 2030, reaching nearly USD 1544.7 Million. North America is a significant player in the Lithium Metal Industry, with a focus on both production and consumption. North America has several active lithium mines and projects. The United States and Canada contribute to lithium production in the region. These facilities extract lithium from brine deposits and hard rock sources. In North America, the salt lake brine segment dominates the regional Lithium Metal Industry. This shift towards brine sources has been driven by their cost-effectiveness and ability to yield a larger volume of lithium production than hard rock sources. Salt lake brine extraction involves obtaining lithium-enriched brines from saltwater lakes or underground reservoirs and then concentrating the lithium content through an evaporation process. Salt Lake brine production in North America includes Nevada in the United States. In addition, there are significant contributions from Chile and Bolivia in South America. Additionally, Argentina and Tibet also play a role in the regional brine segment. The lithium ores segment involves extracting lithium from hard rock minerals. Historically, lithium production in North America has been predominantly sourced from lithium ores found in Australia, China, and Canada. In North America, the dominance of the salt lake brine segment in the Lithium Metal Industry is due to its cost-effectiveness and the substantial lithium production potential from brine sources in the region.Countries with largest lithium reserves, In 2023, (In Mn. Metric Tons)

Report 2: Asia Pacific Lithium Metal Market Powering the Future of Energy Storage and Transportation: Industry Analysis and Forecast (2024-2030).

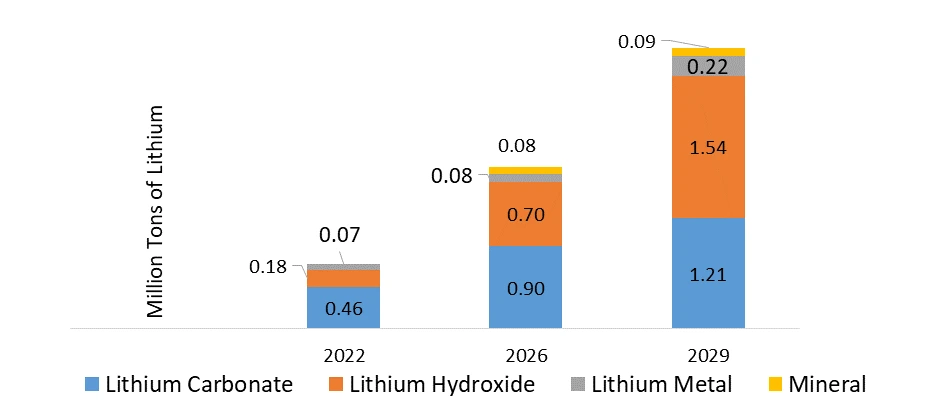

The Asia Pacific Lithium Metal Industry size was valued at USD 1035.8 Million in and the total Asia Pacific Lithium Metal Industry revenue is expected to grow at a CAGR of 18.5% from 2024 to 2030, reaching nearly USD 3861.9 Million. The Asia Pacific Lithium Metal Industry has several driving factors that influence its growth and development. The key drivers are the region's increasing demand for lithium due to the rapid adoption of electric vehicles (EVs) and the rising need for energy storage solutions. As countries in the Asia Pacific transition towards sustainable transportation and renewable energy, lithium-ion batteries are increasing. Asian countries are actively seeking partnerships, acquisitions, and investments in lithium assets worldwide to secure a stable supply chain. This will reduce import dependence. Efforts are being made to develop more sustainable and environmentally friendly lithium extraction methods and recycling technologies. This is to address environmental concerns related to lithium mining and battery waste. The limited availability of lithium reserves in the region necessitates reliance on external sources, leading to supply chain vulnerabilities and price fluctuations. Geopolitical challenges also create uncertainties in securing a stable lithium supply, given the intensifying competition for resources. High production and design costs hinder widespread adoption, especially in price-sensitive markets. The lack of a robust charging infrastructure network for EVs impedes adoption, affecting lithium metal demand. Addressing these challenges and driving factors is crucial for the Asia Pacific Lithium Metal Industry to fully capitalize on growing demand. This will enable it to contribute to the region's sustainable energy goals.Projected Refined Demand By Products, (In Million Tons) In 2023

Report 3: Europe Lithium Metal Market Powering the Future of Energy Storage and Transportation: Industry Analysis and Forecast (2024-2023).

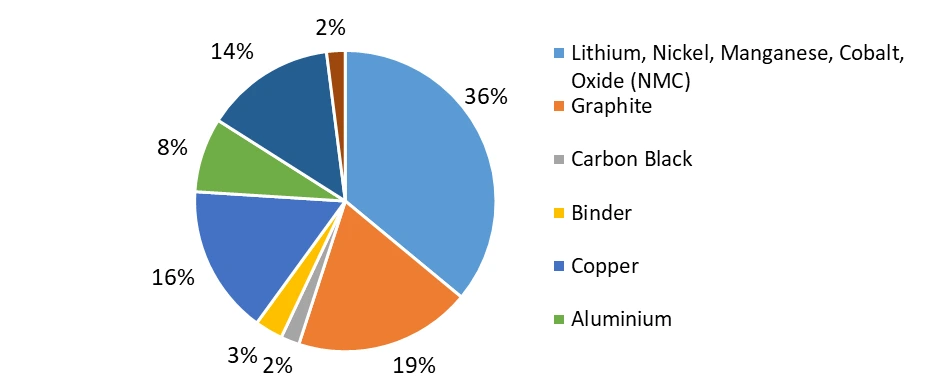

The Europe Lithium Metal Industry size was valued at USD 310.7 Million in and the total Europe Lithium Metal Industry revenue is expected to grow at a CAGR of 20.6 % from 2024 to 2030, reaching nearly USD 1158.6 Million. The European Lithium Metal Industry is experiencing remarkable growth, fueled by rising demand for lithium-ion batteries in electric vehicles, renewable energy storage systems, and portable electronics. Mining often consumes large amounts of water, and improper disposal of mining by-products can lead to water contamination and ecosystem damage. Concerns about waste management and recycling of lithium-ion batteries raise further environmental issues. Europe's strong focus on sustainability necessitates addressing these sustainability challenges through the development of more eco-friendly lithium extraction methods and recycling technologies. As the region pushes for domestic lithium supply, technological advancements, and supportive government policies, sustainable practices are becoming increasingly important in the lithium metal industry.lithium-Ion Cell Composititon (%) in the year 2023

Report 4: Middle East and Africa Lithium Metal Market Powering the Future of Energy Storage and Transportation: Industry Analysis and Forecast (2024-2030).

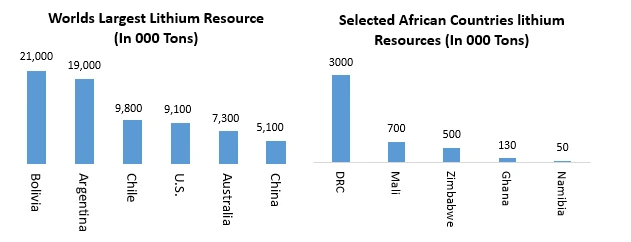

The Middle East and Africa Lithium Metal Industry size was valued at USD 103.6 Million in and the total Middle East and Africa Lithium Metal Industry revenue is expected to grow at a CAGR of 21.9 % from 2024 to 2030, reaching nearly USD 386.2 Million. The African continent presents substantial opportunities for the global lithium supply chain, with notable reserves in South Africa, Zimbabwe, and the Democratic Republic of Congo (DRC). South Africa has emerged as a prominent player, while Zimbabwe's Bikita and Kamativi regions boast some of the world's largest lithium deposits. However, unlocking the region's full potential requires addressing challenges related to infrastructure, investment, and regulatory frameworks. Moving to North Africa, Egypt, and Morocco shows significant promise in lithium metal production. Morocco, in particular, has expressed interest in developing its lithium industry, benefitting from its strategic geographical position and proximity to key markets in Europe. The region's focus on renewable energy projects and electric vehicles further fuels lithium metal demand. In Gulf countries, such as the UAE, there is a strong commitment to diversifying their economies and investing in technology-driven sectors. Other Middle Eastern countries, like Iran, also possess lithium resources and aim to develop their lithium industry. They capitalize on their geographical location, market potential, and growing interest in sustainable technologies. It is crucial to address infrastructure, regulatory, and investment challenges in the African and Middle Eastern regions to fully develop the Lithium Metal Industry.

Report 5: South America Lithium Metal Market Powering the Future of Energy Storage and Transportation: Industry Analysis and Forecast (2024-2030).

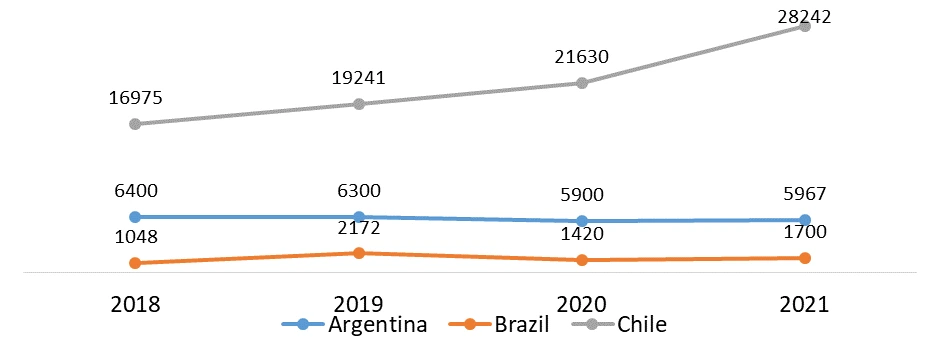

The South America Lithium Metal Industry size was valued at USD 207.2 Million in and is expected to grow at a CAGR of 22.8 % from 2024 to 2030, reaching nearly USD 772.4 Million. South America is rich in substantial lithium reserves, particularly in Chile, Argentina, and Brazil, making it a key region in the global lithium supply chain. These countries offer favorable geological conditions and established infrastructure for lithium extraction and processing, attracting significant investment from major mining companies. Chile stands out as a major player in the South American Lithium Metal Industry. It boasts abundant lithium resources in the Salar de Atacama. Its strong position is attributed to favorable geological conditions and a well-developed mining infrastructure. Argentina also holds a significant position on the market, with notable lithium reserves in the Salinas Grandes and Hombre Muerto regions. The country actively promotes lithium exploration and development through favorable policies, drawing domestic and international investments. Brazil is emerging as a potential player, with significant lithium reserves in Minas Gerais. The country is focused on developing its lithium resources and attracting investments in extraction and processing facilities. Brazil's automotive and energy sectors are projected to drive market growth further.Lithium Production from 2018 to 2023, (In tons)

Lithium Metal Industry Scope: Inquire before buying

Lithium Metal Industry Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 2497.93 Million. Forecast Period 2024 to 2030 CAGR: 20.7% Market Size in 2030: USD 9322.50 Million. Segments Covered: by Source Salt Lake Brine Lithium Ores by Application Lithium-ion Anode Material Alloy Intermediates Others by End-users Batteries Metal Processing Pharmaceutical Others Lithium Metal Industry Key Players:

1. Albemarle Corporation 2. Alpha-En Corporation 3. Altura Mining Limited 4. American Elements 5. China Energy Lithium Co. 6. China Lithium Products Technology Co., Ltd. 7. CNNC Jianzhong Nuclear Fuel Co., Ltd. 8. European Lithium 9. European Metals Holding 10. Galaxy Resources Limited 11. Jiangxi Ganfeng Lithium Co., Ltd. 12. JSC Chemical Metallurgical Plant 13. Li-Metal Corp. 14. Lithium Americas Corp. 15. Livent Corporation 16. Manosanthi Group of Company 17. Otto Chemie Pvt. Ltd. 18. Oxford Lab Fine Chem Llp 19. Pilbara Minerals Limited 20. Pure Lithium 21. Shandong Ruifu Lithium Industry Co., Ltd. 22. Shanghai China Lithium Industrial Co., Ltd., 23. Shenzhen Chengxin Lithium Group Co. Ltd., 24. Sion Power Corporation. 25. Spectrum Chemical 26. SQM (Sociedad Química y Minera de Chile) 27. The Honjo Chemical Corporation 28. Tianqui Lithium Industries Inc., 29. TRU Group Inc 30. Zimbabwe Lithium CompanyFAQs:

1. What are the growth drivers for the Lithium Metal Industry? Ans. Electric Vehicle Adoption and Accelerated Adoption of Next-Generation Lithium Batteries Drives Lithium Metal Industry Growth. 2. What is the major restraint for the Lithium Metal Industry growth? Ans. High Production Costs Impact Lithium Metal's Competitiveness is a major restraining factor for the Lithium Metal Industry growth. 3. Which region is expected to lead the global Lithium Metal Industry during the forecast period? Ans. Asia Pacific is expected to lead the global Lithium Metal Industry during the forecast period. 4. What was the Global Lithium Metal Industry size in 2023? Ans: The Global Lithium Metal Industry size was USD 2497.93 Million in 2023. 5. What segments are covered in the Lithium Metal Industry report? Ans. The segments covered in the Lithium Metal Industry report are Source, Application, End-use, and Region.

1. Lithium Metal Industry: Research Methodology 2. Lithium Metal Industry: Executive Summary 3. Lithium Metal Industry: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Lithium Metal Industry: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Lithium Metal Industry: Segmentation (by Value USD and Volume Units) 5.1. Lithium Metal Industry, by Source (2023-2030) 5.1.1. Salt Lake Brine 5.1.2. Lithium Ores 5.2. Lithium Metal Industry, by Application (2023-2030) 5.2.1. Lithium-ion Anode Material 5.2.2. Alloy 5.2.3. Intermediates 5.2.4. Others 5.3. Lithium Metal Industry, by End-Users (2023-2030) 5.3.1. Batteries 5.3.2. Metal Processing 5.3.3. Pharmaceutical 5.3.4. Others 5.4. Lithium Metal Industry, by Region (2023-2030) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Lithium Metal Industry (by Value USD and Volume Units) 6.1. North America Lithium Metal Industry, by Source (2023-2030) 6.1.1. Salt Lake Brine 6.1.2. Lithium Ores 6.2. North America Lithium Metal Industry, by Application (2023-2030) 6.2.1. Lithium-ion Anode Material 6.2.2. Alloy 6.2.3. Intermediates 6.2.4. Others 6.3. North America Lithium Metal Industry, by End-Users (2023-2030) 6.3.1. Batteries 6.3.2. Metal Processing 6.3.3. Pharmaceutical 6.3.4. Others 6.4. North America Lithium Metal Industry, by Country (2023-2030) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Lithium Metal Industry (by Value USD and Volume Units) 7.1. Europe Lithium Metal Industry, by Source (2023-2030) 7.2. Europe Lithium Metal Industry, by Application (2023-2030) 7.3. Europe Lithium Metal Industry, by End-Users (2023-2030) 7.4. Europe Lithium Metal Industry, by Country (2023-2030) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Lithium Metal Industry (by Value USD and Volume Units) 8.1. Asia Pacific Lithium Metal Industry, by Source (2023-2030) 8.2. Asia Pacific Lithium Metal Industry, by Application (2023-2030) 8.3. Asia Pacific Lithium Metal Industry, by End-Users (2023-2030) 8.4. Asia Pacific Lithium Metal Industry, by Country (2023-2030) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa Lithium Metal Industry (by Value USD and Volume Units) 9.1. Middle East and Africa Lithium Metal Industry, by Source (2023-2030) 9.2. Middle East and Africa Lithium Metal Industry, by Application (2023-2030) 9.3. Middle East and Africa Lithium Metal Industry, by End-Users (2023-2030) 9.4. Middle East and Africa Lithium Metal Industry, by Country (2023-2030) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Lithium Metal Industry (by Value USD and Volume Units) 10.1. South America Lithium Metal Industry, by Source (2023-2030) 10.2. South America Lithium Metal Industry, by Application (2023-2030) 10.3. South America Lithium Metal Industry, by End-Users (2023-2030) 10.4. South America Lithium Metal Industry, by Country (2023-2030) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. Albemarle Corporation 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Alpha-En Corporation 11.3. Altura Mining Limited 11.4. American Elements 11.5. China Energy Lithium Co. 11.6. China Lithium Products Technology Co., Ltd. 11.7. CNNC Jianzhong Nuclear Fuel Co., Ltd. 11.8. European Lithium 11.9. European Metals Holding 11.10. Galaxy Resources Limited 11.11. Jiangxi Ganfeng Lithium Co., Ltd. 11.12. JSC Chemical Metallurgical Plant 11.13. Li-Metal Corp. 11.14. Lithium Americas Corp. 11.15. Livent Corporation 11.16. Manosanthi Group of Company 11.17. Otto Chemie Pvt. Ltd. 11.18. Oxford Lab Fine Chem Llp 11.19. Pilbara Minerals Limited 11.20. Pure Lithium 11.21. Shandong Ruifu Lithium Industry Co., Ltd. 11.22. Shanghai China Lithium Industrial Co., Ltd., 11.23. Shenzhen Chengxin Lithium Group Co. Ltd., 11.24. Sion Power Corporation. 11.25. Spectrum Chemical 11.26. SQM (Sociedad Química y Minera de Chile) 11.27. The Honjo Chemical Corporation 11.28. Tianqui Lithium Industries Inc., 11.29. TRU Group Inc 11.30. Zimbabwe Lithium Company 12. Key Findings 13. Industry Recommendation