The Global Waste Management Market size was valued at USD 446.89 Billion in 2023 and the total Waste Management revenue is expected to grow at a CAGR of 5.3% from 2024 to 2030, reaching nearly USD 641.50 Billion.Waste Management Market Overview

The waste management market has experienced robust global growth, driven by factors such as urbanization, industrialization, and heightened environmental awareness. According to MMR reports, the waste management market is expected to continue growing, driven by the increasing need for efficient waste-handling solutions. Waste management is the process of transporting, collecting, and disposing of waste materials, commonly referred to as garbage or trash. Waste collection, transportation, treatment, and disposal, as well as waste management process monitoring and control, waste-related legislation, technology, and economic systems, are all included. Waste can be solid, liquid, or gaseous, with various disposal and management strategies for each. The primary factor is the increasing global awareness of environmental issues and the growing emphasis on sustainable practices. Environmental consciousness drives demand for sustainable waste management solutions and encourages the adoption of eco-friendly practices. The objective of the report is to present a comprehensive analysis of the global market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. The waste management market is expected to grow further with increased urbanization and industrialization, rising environmental concerns, and the adoption of sustainable waste management practices.To know about the Research Methodology :- Request Free Sample Report

Waste Management Market Dynamics

Technological Developments in Waste-to-energy Technological advancements in waste-to-energy play a significant role in the waste management market, it offers innovative solutions to address both environmental and energy-related challenges. Waste-to-energy is the technology used to convert garbage into energy by gasification or incineration is known as waste-to-energy technology. By 2030, waste-to-energy (WTE) is expected to have a $52.9 billion global market size. This is because Renewable resources are replacing coal to minimize carbon content. Incineration is the process of burning hazardous material at high temperatures to destroy contaminants. China has circulating fluidized bed (CFB) incineration units. They have around 28 operating CFB units, the most current of which was built in 2012 and handles more than 800 tonnes/day. A new factory is being built in Shenzhen that will have a capacity of 5000 metric tonnes per day and will be the world's largest WTE facility. Waste gasification is a chemical process that involves heating waste in a low-oxygen atmosphere until it decomposes into its constituent molecules. Although gasification is a more sophisticated process than trash incineration, the reactors used in both are very similar. In contrast to trash incineration, gasification technology converts MSW into smaller molecules and destroys pollutants such as dioxins and furans. A gasification facility Energos (part of ENER-G) in Manchester, UK, provides a cost-effective alternative to WTE's huge combustion technology. This facility can process MSW, industrial, and commercial garbage and has a handling capacity of up to 78,000 tons per year.The Internet of Things (IoT) has been increasingly employed in waste management to enhance efficiency, reduce costs, and improve overall sustainability. Traditional waste collection techniques follow predetermined routes and schedules. As a result, garbage collection trucks frequently empty waste bins while they are still empty or before they begin to overflow. Waste bin tracking in real-time is made possible by IoT-based waste management. This allows for timely waste collection and disposal while avoiding overflowing dumpsters. IoT-based temperature sensors monitor the temperatures of dumpsters to prevent explosions and fires. Moreover, RFID tags used in garbage trucks allow tracking of the location of these vehicles. This provides companies with highly relevant data that enables better decision-making and plan optimization. Sensorita, a Norwegian firm, creates IoT-enabled sensors for garbage containers. Machine learning is used by the sensors to provide users with data-driven insights regarding their container fleet. This enables waste management firms to save expenses while also ensuring optimum asset usage. They can also use the sensors to cut carbon emissions for more sustainable trash management. MUSA is an Indonesian start-up that provides a trash management IoT monitoring solution. It includes modules for sensor and data aggregation, analytics, and centralized environmental data management. Circular waste management guarantees that there is as little waste as possible by reusing and repurposing old products into new raw materials or products. This enables the most efficient use of materials rather than their disposal before end-of-life. Instead of the take-make-dispose paradigm, corporations are now designing products with many lifecycles. They use their manufacturing waste to produce new items. Furthermore, waste-to-energy (WTE) plants convert solid waste into steam for the creation of power. Sustainable packaging is also implemented by brands by sourcing eco-friendly materials with a low environmental impact. Opportunities in the Waste Management Market Growing Various Upcoming Recycling and Waste Management Companies Paper can be recycled to make reusable materials like recycled paper goods and paper pulp. This type of business is profitable since the demand for recycled paper goods in workplaces and homes is increasing. Plastic recycling involves gathering, sorting, and processing plastic material into reusable items. Rubber recycling is crucial to waste management. The procedure reduces the quantity of rubber that ends up in landfills or the natural environment, where it might harm the ecology. Europe recycles around 92% of its end-of-life tires. E-waste management is responsible for the processing, collection, and disposal of electronic trash, such as old and broken gadgets including laptops, televisions, and phones. E-waste is a growing problem as it accounts for above 50 million metric tons globally every year.

Green Construction Waste Management Market Green construction waste management plays a crucial role in promoting sustainability within the construction industry. The construction industry in Malaysia has been quite robust for the last few years as evidenced by the double-digit growth. The construction industry is recognized as one of the key industries that contributes 10% to the nation’s gross domestic product (GDP). With the country’s move towards the status of a developed nation by 2020, the number of construction projects is expected to increase significantly. The demands in implementing major infrastructure projects, together with the construction of commercial buildings and housing development programs, will produce a large amount of construction waste. Restraints for the Waste Management Market Municipal solid waste (MSW) Waste management companies provide collection services for municipal solid waste. This involves the regular pickup and transportation of waste from residential and commercial areas to processing facilities. MSW is commonly known as trash or garbage. In 2010, 250 million tons of MSW were generated in the United States. MSW includes organic wastes such as paper, cardboard, food, yard trimmings, and plastics, and inorganic wastes such as metal and glass. Advancements in technology, such as the use of IoT sensors and data analytics, are increasingly applied to manage municipal solid waste more efficiently. These technologies help optimize collection routes, monitor fill levels in bins, and improve overall waste management processes. Municipal solid waste (MSW) is diverse and a major source of concern for human and environmental health. According to an MMR study, global MSW production will reach 3.2 billion tons by 2050. Rather than being regarded as waste, MSW can be regarded as a critical resource for producing energy, fuel, and valuable chemical compounds through thermochemical conversions.

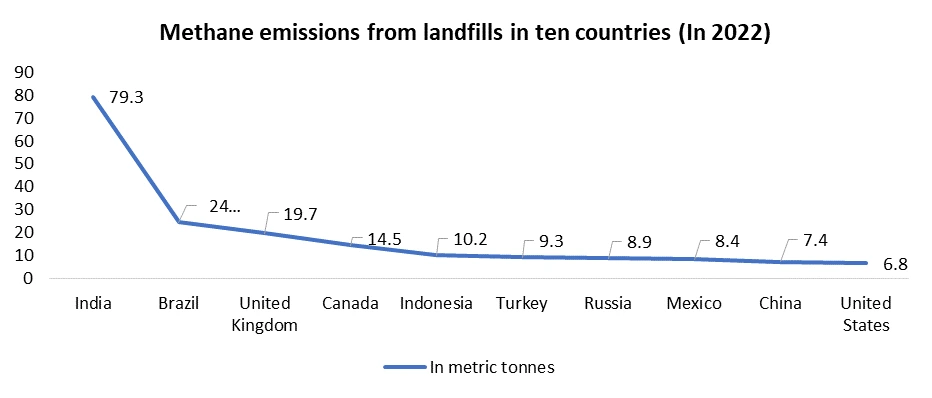

The limited space for landfills The limited space for landfills is a critical issue within the waste management market, especially in densely populated urban areas where available land is scarce. Rapid urbanization and population growth contribute to increased urban trash generation. The difficulty of locating suitable sites for traditional landfill operations is exacerbated by the scarcity of available land. Landfills have become a necessity for disposing of significant amounts of Municipal Solid Waste (MSW). Landfills have traditionally been seen as the ultimate solution for storing trash at the lowest possible cost. The everyday disposal of tons of rubbish without any treatment or segregation results in mounds at landfill sites. Landfills are often unscientific in developing nations like India, causing problems such as air pollution from trash burning at landfill sites, groundwater pollution, and soil deterioration. Governments and environmental agencies often provide incentives for businesses and municipalities to adopt innovative waste management practices, fostering the development and implementation of alternative methods. Landfill methane emissions are a major environmental hazard that contributes to climate change. Methane is a powerful greenhouse gas that is released during the breakdown of organic waste in landfills, posing both environmental and public health concerns. Landfill methane emissions can lead to poor air quality. Although methane is not dangerous in and of itself, its combustion byproducts and the presence of other air pollutants in landfill gas can have a severe impact on local air quality.

Waste Management Market Segment Analysis

Based on Waste Type, the global waste management market is segmented as E-waste, Plastic waste, Bio-medical waste, Hazardous waste, and Others. During the forecast period, the E-waste segment is expected to lead the waste management market. Electrically powered component garbage is included in e-waste. Computers, consumer electronics, and refrigerators are examples of these appliances. E-waste is a mix of useful and harmful elements that must be handled with care and recycled. As a result, e-waste treatment has become more important around the world to protect the environment from the harmful impacts of elements like lead and plastics. Next-generation items are made from recycled materials. Based on Service Type, the global waste management market is segmented as landfill, Recycling, Incineration, Open dumping, Composting, and anaerobic digestion. The increased need to dispose of waste that cannot be recycled is driving the rise of the landfill industry. Landfills have many advantages, including providing good energy sources, being an environmentally friendly choice, keeping cities, towns, and districts clean, and assisting in the segregation of hazardous waste. They are also a considerably less expensive waste management solution. During the expected period, the landfill segment in the Asia Pacific is expected to grow at a CAGR of 8.21%. Based on the End-use Industry, Demand for waste management services from the residential segment is expected to be driven by an ever-increasing population and large solid waste creation. Waste created by home end users can be utilized to generate energy in garbage-to-energy plants, which burn solid waste to produce steam in a boiler, as well as to generate electricity. The increase of industrial establishment in developing countries with international trade and development in the field of science and technology has gained the attention of many developed countries.Waste Management Market Regional Insights

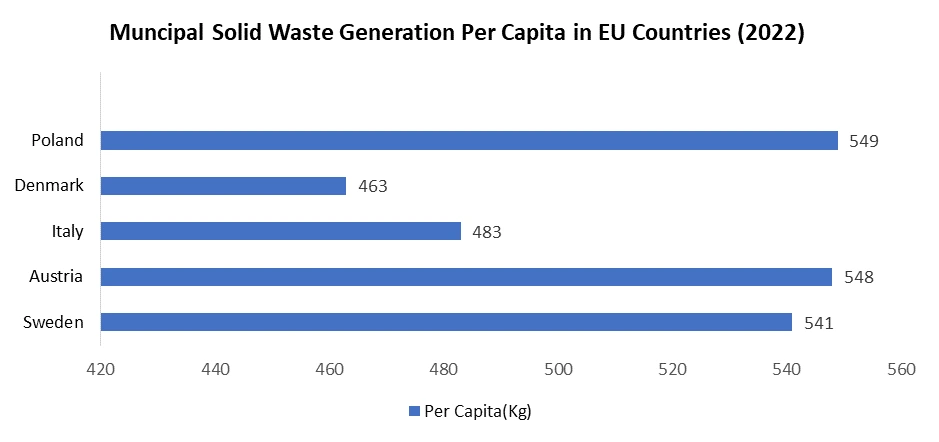

Asia-Pacific is the dominant player in Waste Management. Rapid urbanization, demographic increase, and economic development are altering the Asian-Pacific landscape and producing massive amounts of garbage. Increased municipal solid trash is most visible in low- and middle-income countries, where consumption was formerly minimal. Asia spending on urban around US$ 2 billion on urban waste management per year, this amount will increase to about US$47 billion in 2025. Indonesia and the Philippines as well as parts of China and India are the Asian countries facing the greatest waste management challenge, based on projected waste generation rates and relative affluence to deal with the problem. Today, the urban areas of Asia produce about 760,000 tonnes of municipal solid waste (MSW) per day, or approximately 2.7 million m3 per day. In 2025, this figure will increase to 1.8 million tonnes of waste per day or 5.2 million m3 per day. Local governments in Asia currently spend about US $25 billion per year on urban solid waste management. This amount is used to collect more than 90 percent of the waste in high-income countries, between 50 to 80 percent in middle-income countries, and only 30 to 60 percent in low-income countries. Low-income countries have the lowest proportion of urban populations and garbage. generation rates ranging from Per capita, 0.4 to 0.9 kilogram per day. As GNP rises towards the middle. spectrum of income, per capita waste the rate of generation is likewise increasing. 0.5 to 1.1 kg per day is the average. The high-income, as projected, countries with the highest generation rates range from Per capita, 1.1 to 5.07 kg per day.The total waste generated in the EU (European Union), which includes the waste from all economic activities and households amounted to 2.5 million tonnes in 2023. This translates to around 5.3 tons per person in the EU population. While residential rubbish receives a lot of attention, it only accounts for little more than 8% of total waste, compared to more than 36% generated by construction and more than 28% generated by mining and quarrying. Together the waste from mining and quarrying and construction and demolition is classified as major mineral waste and accounts for almost three-quarters (74%) of all waste. Mining and quarrying activities are relatively big in Romania, Finland, Sweden, and Bulgaria, whereas construction and demolition activities produce large volumes of major mineral waste in Luxembourg, accounting for 86%-90% of total garbage. Estonia was still dominating in Europe when large mineral waste was excluded. mostly as a result of energy generation based on oil shale

Competitive Landscape of the Waste Management Market

The waste management market features a competitive landscape with a mix of established players, regional companies, and emerging startups. The waste management market includes a wide range of services and solutions aimed at assembling, transporting, processing, recycling, and disposing of various types of waste. This includes municipal solid waste, industrial waste, electronic waste, and hazardous waste. Companies such as Waste Management, Inc., Veolia Environment S.A., Republic Services, Inc., and Suez SA stand out as global leaders, offering comprehensive waste management services on an international scale. The waste management market's competitive landscape is characterized by a balance between established industry giants and emerging players eager to make a mark through innovation and sustainability. In May 2021, SUEZ and Eramet, a major player in the extraction and valuation of metals, agreed to expand their collaboration in the area of recycling end-of-life electric car batteries. This collaboration aims to provide a high-performance, cost-effective, and long-term battery recycling solution for the European market. In March 2021, Veolia collaborated with Groupe Renault, a vehicle and van manufacturer, and Solvay, a chemical and plastics company, to enable the circular economy of EV battery metals in Europe through closed-loop recycling. The concept of the circular economy has gained prominence in the waste management industry. Key players are actively promoting and participating in circular economy models, aiming to minimize waste generation and maximize resource recovery. Companies that can successfully negotiate regulatory frameworks, embrace technological breakthroughs and support circular economy practices will be well-positioned for long-term success in this ever-changing market.Waste Management Market Scope: Inquire before buying

Waste Management Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 446.89 Bn. Forecast Period 2024 to 2030 CAGR: 5.3% Market Size in 2030: US $ 641.50 Bn. Segments Covered: by Waste Type E-waste Plastic waste Bio-medical waste Hazardous waste Others by Service Type Landfill Recycling Incineration Open Dumping Composition & Anaerobic Digestion by End-use Industry Commercial Industrial Residential Waste Management Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Waste Management Market, Key Players:

1. Clean Harbors Inc. 2. Daiseki Co. Ltd. 3. Waste Management Inc. 4. Suez Environment S.A. 5. Advanced Disposal Services 6. Veolia Environment S.A 7. Republic Services Inc. 8. Covanta 9. Remondis AG & Co. Kg 10.Biffa Group 11.Hitachi Zosen Corporation 12.Green Conversions 13.Amec Foster Wheeler 14.Xcel Energy, Recology 15.Keppel Segher 16.Plasco Conversions 17.Wheelabrator Technologies 18.Nexans 19.China Everbright International 20.Cleanaway 21.Sims Metal Management 22.Stericycle Frequently Asked Questions: 1. What is the study period of the market? Ans. The Global Waste Management Market is studied from 2023-2030. 2. What is the growth rate of the Waste Management Market? Ans. The Waste Management Market is growing at a CAGR of 5.3% over the forecast period. 3. What is the market size of the Waste Management Market by 2030? Ans. The market size of the Waste Management Market by 2030 is expected to reach USD 609.22 Bn. 4. What is the forecast period for the Waste Management Market? Ans. The forecast period for the Waste Management Market is 2024-2030. 5. What was the market size of the Waste Management Market in 2023? Ans. The market size of the Waste Management Market in 2023 was valued at USD 446.89 Bn.

1. Waste Management Market: Research Methodology 2. Waste Management Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Waste Management Market: Dynamics 3.1 Waste Management Market Trends by Region 3.1.1 North America Waste Management Market Trends 3.1.2 Europe Waste Management Market Trends 3.1.3 Asia Pacific Waste Management Market Trends 3.1.4 Middle East and Africa Waste Management Market Trends 3.1.5 South America Waste Management Market Trends 3.2 Waste Management Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Waste Management Market Drivers 3.2.1.2 North America Waste Management Market Restraints 3.2.1.3 North America Waste Management Market Opportunities 3.2.1.4 North America Waste Management Market Challenges 3.2.2 Europe 3.2.2.1 Europe Waste Management Market Drivers 3.2.2.2 Europe Waste Management Market Restraints 3.2.2.3 Europe Waste Management Market Opportunities 3.2.2.4 Europe Waste Management Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Waste Management Market Market Drivers 3.2.3.2 Asia Pacific Waste Management Market Restraints 3.2.3.3 Asia Pacific Waste Management Market Opportunities 3.2.3.4 Asia Pacific Waste Management Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Waste Management Market Drivers 3.2.4.2 Middle East and Africa Waste Management Market Restraints 3.2.4.3 Middle East and Africa Waste Management Market Opportunities 3.2.4.4 Middle East and Africa Waste Management Market Challenges 3.2.5 South America 3.2.5.1 South America Waste Management Market Drivers 3.2.5.2 South America Waste Management Market Restraints 3.2.5.3 South America Waste Management Market Opportunities 3.2.5.4 South America Waste Management Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Regulatory Landscape by Region 3.5.1 North America 3.5.2 Europe 3.5.3 Asia Pacific 3.5.4 Middle East and Africa 3.5.5 South America 3.6 Analysis of Government Schemes and Initiatives for the Waste Management Industry 3.7 The Pandemic and Redefining of The Waste Management Industry Landscape 4. Global Waste Management Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 4.1 Global Waste Management Market Size and Forecast, by Type (2023-2030) 4.1.1 E-Waste 4.1.2 Plastic Waste 4.1.3 Bio-medical Waste 4.1.4 Hazardous Waste 4.1.5 Others 4.2 Global Waste Management Market Size and Forecast, by Service (2023-2030) 4.2.1 Landfill 4.2.2 Recycling 4.2.3 Incineration 4.2.4 Open Dumping 4.2.5 Composition & Anaerobic Digestion 4.3 Global Waste Management Market Size and Forecast, by End-Use (2023-2030) 4.3.1 Commercial 4.3.2 Industrial 4.3.3 Residential 4.4 Global Waste Management Market Size and Forecast, by Region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Waste Management Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 5.1 North America Waste Management Market Size and Forecast, by Type (2023-2030) 5.1.1 E-Waste 5.1.2 Plastic Waste 5.1.3 Bio-medical Waste 5.1.4 Hazardous Waste 5.1.5 Others 5.2 North America Waste Management Market Size and Forecast, by Service (2023-2030) 5.2.1 Landfill 5.2.2 Recycling 5.2.3 Incineration 5.2.4 Open Dumping 5.2.5 Composition & Anaerobic Digestion 5.3 North America Waste Management Market Size and Forecast, by End-Use (2023-2030) 5.3.1 Commercial 5.3.2 Industrial 5.3.3 Residential 5.4 North America Waste Management Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Waste Management Market Size and Forecast, by Type (2023-2030) 5.4.1.1.1 E-Waste 5.4.1.1.2 Plastic Waste 5.4.1.1.3 Bio-medical Waste 5.4.1.1.4 Hazardous Waste 5.4.1.1.5 Others 5.4.1.2 United States Waste Management Market Size and Forecast, by Service (2023-2030) 5.4.1.2.1 Landfill 5.4.1.2.2 Recycling 5.4.1.2.3 Incineration 5.4.1.2.4 Open Dumping 5.4.1.2.5 Composition & Anaerobic Digestion 5.4.1.3 United States Waste Management Market Size and Forecast, by End-Use (2023-2030) 5.4.1.3.1 Commercial 5.4.1.3.2 Industrial 5.4.1.3.3 Residential 5.4.1.3.4 Canada 5.4.1.4 Canada Waste Management Market Size and Forecast, by Type (2023-2030) 5.4.1.4.1 E-Waste 5.4.1.4.2 Plastic Waste 5.4.1.4.3 Bio-medical Waste 5.4.1.4.4 Hazardous Waste 5.4.1.5 Others Canada Waste Management Market Size and Forecast, by Service (2023-2030) 5.4.1.5.1 Landfill 5.4.1.5.2 Recycling 5.4.1.5.3 Incineration 5.4.1.5.4 Open Dumping 5.4.1.5.5 Composition & Anaerobic Digestion 5.4.1.6 Canada Waste Management Market Size and Forecast, by End-Use (2023-2030) 5.4.1.6.1 Commercial 5.4.1.6.2 Industrial 5.4.1.6.3 Residential 5.4.1.6.4 Canada 5.4.2 Mexico 5.4.2.1 Mexico Waste Management Market Size and Forecast, by Type (2023-2030) 5.4.2.1.1 E-Waste 5.4.2.1.2 Plastic Waste 5.4.2.1.3 Bio-medical Waste 5.4.2.1.4 Hazardous Waste 5.4.2.2 Mexico Waste Management Market Size and Forecast, by Service (2023-2030) 5.4.2.2.1 Landfill 5.4.2.2.2 Recycling 5.4.2.2.3 Incineration 5.4.2.2.4 Open Dumping 5.4.2.2.5 Composition & Anaerobic Digestion 5.4.2.3 Mexico Waste Management Market Size and Forecast, by End-Use (2023-2030) 5.4.2.3.1 Commercial 5.4.2.3.2 Industrial 5.4.2.3.3 Residential 5.4.2.3.4 Canada 6. Europe Waste Management Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 6.1 Europe Waste Management Market Size and Forecast, by Type (2023-2030) 6.2 Europe Waste Management Market Size and Forecast, by Service (2023-2030) 6.3 Europe Waste Management Market Size and Forecast, by End-Use (2023-2030) 6.4 Europe Waste Management Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Waste Management Market Size and Forecast, by Type (2023-2030) 6.4.1.2 United Kingdom Waste Management Market Size and Forecast, by Service (2023-2030) 6.4.1.3 United Kingdom Waste Management Market Size and Forecast, by End-Use (2023-2030) 6.4.2 France 6.4.2.1 France Waste Management Market Size and Forecast, by Type (2023-2030) 6.4.2.2 France Waste Management Market Size and Forecast, by Service (2023-2030) 6.4.2.3 France Waste Management Market Size and Forecast, by End-Use (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Waste Management Market Size and Forecast, by Type (2023-2030) 6.4.3.2 Germany Waste Management Market Size and Forecast, by Service (2023-2030) 6.4.3.3 Germany Waste Management Market Size and Forecast, by End-Use (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Waste Management Market Size and Forecast, by Type (2023-2030) 6.4.4.2 Italy Waste Management Market Size and Forecast, by Service (2023-2030) 6.4.4.3 Italy Waste Management Market Size and Forecast, by End-Use (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Waste Management Market Size and Forecast, by Type (2023-2030) 6.4.5.2 Spain Waste Management Market Size and Forecast, by Service (2023-2030) 6.4.5.3 Spain Waste Management Market Size and Forecast, by End-Use (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Waste Management Market Size and Forecast, by Type (2023-2030) 6.4.6.2 Sweden Waste Management Market Size and Forecast, by Service (2023-2030) 6.4.6.3 Sweden Waste Management Market Size and Forecast, by End-Use (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Waste Management Market Size and Forecast, by Type (2023-2030) 6.4.7.2 Austria Waste Management Market Size and Forecast, by Service (2023-2030) 6.4.7.3 Austria Waste Management Market Size and Forecast, by End-Use (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Waste Management Market Size and Forecast, by Type (2023-2030) 6.4.8.2 Rest of Europe Waste Management Market Size and Forecast, by Service (2023-2030). 6.4.8.3 Rest of Europe Waste Management Market Size and Forecast, by End-Use (2023-2030) 7. Asia Pacific Waste Management Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 7.1 Asia Pacific Waste Management Market Size and Forecast, by Type (2023-2030) 7.2 Asia Pacific Waste Management Market Size and Forecast, by Service (2023-2030) 7.3 Asia Pacific Waste Management Market Size and Forecast, by End-Use (2023-2030) 7.4 Asia Pacific Waste Management Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Waste Management Market Size and Forecast, by Type (2023-2030) 7.4.1.2 China Waste Management Market Size and Forecast, by Service (2023-2030) 7.4.1.3 China Waste Management Market Size and Forecast, by End-Use (2023-2030) 7.4.2 South Korea 7.4.2.1 S Korea Waste Management Market Size and Forecast, by Type (2023-2030) 7.4.2.2 S Korea Waste Management Market Size and Forecast, by Service (2023-2030) 7.4.2.3 S Korea Waste Management Market Size and Forecast, by End-Use (2023-2030) 7.4.3 japan japan 7.4.3.1 Japan Waste Management Market Size and Forecast, by Type (2023-2030) 7.4.3.2 Japan Waste Management Market Size and Forecast, by Service (2023-2030) 7.4.3.3 Japan Waste Management Market Size and Forecast, by End-Use (2023-2030) 7.4.4 India 7.4.4.1 India Waste Management Market Size and Forecast, by Type (2023-2030) 7.4.4.2 India Waste Management Market Size and Forecast, by Service (2023-2030) 7.4.4.3 India Waste Management Market Size and Forecast, by End-Use (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Waste Management Market Size and Forecast, by Type (2023-2030) 7.4.5.2 Australia Waste Management Market Size and Forecast, by Service (2023-2030) 7.4.5.3 Australia Waste Management Market Size and Forecast, by End-Use (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Waste Management Market Size and Forecast, by Type (2023-2030) 7.4.6.2 Indonesia Waste Management Market Size and Forecast, by Service (2023-2030) 7.4.6.3 Indonesia Waste Management Market Size and Forecast, by End-Use (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Waste Management Market Size and Forecast, by Type (2023-2030) 7.4.7.2 Malaysia Waste Management Market Size and Forecast, by Service (2023-2030) 7.4.7.3 Malaysia Waste Management Market Size and Forecast, by End-Use (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Waste Management Market Size and Forecast, by Type (2023-2030) 7.4.8.2 Vietnam Waste Management Market Size and Forecast, by Service (2023-2030) 7.4.8.3 Vietnam Waste Management Market Size and Forecast, by End-Use (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Waste Management Market Size and Forecast, by Type (2023-2030) 7.4.9.2 Taiwan Waste Management Market Size and Forecast, by Service (2023-2030) 7.4.9.3 Taiwan Waste Management Market Size and Forecast, by End-Use (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Waste Management Market Size and Forecast, by Type (2023-2030) 7.4.10.2 Bangladesh Waste Management Market Size and Forecast, by Service (2023-2030) 7.4.10.3 Bangladesh Waste Management Market Size and Forecast, by End-Use (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Waste Management Market Size and Forecast, by Type (2023-2030) 7.4.11.2 Pakistan Waste Management Market Size and Forecast, by Service (2023-2030) 7.4.11.3 Pakistan Waste Management Market Size and Forecast, by End-Use (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Waste Management Market Size and Forecast, by Type (2023-2030) 7.4.12.2 Rest of Asia PacificWaste Management Market Size and Forecast, by Service (2023-2030) 7.4.12.3 Rest of Asia Pacific Waste Management Market Size and Forecast, by End-Use (2023-2030) 8. Middle East and Africa Waste Management Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 8.1 Middle East and Africa Waste Management Market Size and Forecast, by Type (2023-2030) 8.2 Middle East and Africa Waste Management Market Size and Forecast, by Service (2023-2030) 8.3 Middle East and Africa Waste Management Market Size and Forecast, by End-Use (2023-2030) 8.4 Middle East and Africa Waste Management Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Waste Management Market Size and Forecast, by Type (2023-2030) 8.4.1.2 South Africa Waste Management Market Size and Forecast, by Service (2023-2030) 8.4.1.3 South Africa Waste Management Market Size and Forecast, by End-Use (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Waste Management Market Size and Forecast, by Type (2023-2030) 8.4.2.2 GCC Waste Management Market Size and Forecast, by Service (2023-2030) 8.4.2.3 GCC Waste Management Market Size and Forecast, by End-Use (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Waste Management Market Size and Forecast, by Type (2023-2030) 8.4.3.2 Egypt Waste Management Market Size and Forecast, by Service (2023-2030) 8.4.3.3 Egypt Waste Management Market Size and Forecast, by End-Use (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Waste Management Market Size and Forecast, by Type (2023-2030) 8.4.4.2 Nigeria Waste Management Market Size and Forecast, by Service (2023-2030) 8.4.4.3 Nigeria Waste Management Market Size and Forecast, by End-Use (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Waste Management Market Size and Forecast, by Type (2023-2030) 8.4.5.2 Rest of ME&A Waste Management Market Size and Forecast, by Service (2023-2030) 8.4.5.3 Rest of ME&A Waste Management Market Size and Forecast, by End-Use (2023-2030) 9. South America Waste Management Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2023-2030) 9.1 South America Waste Management Market Size and Forecast, by Type (2023-2030) 9.2 South America Waste Management Market Size and Forecast, by Service (2023-2030) 9.3 South America Waste Management Market Size and Forecast, by End-Use (2023-2030) 9.4 South America Waste Management Market Size and Forecast, by Country (2023-2030) 9.4.1 brazilBrazil 9.4.1.1 Brazil Waste Management Market Size and Forecast, by Type (2023-2030) 9.4.1.2 Brazil Waste Management Market Size and Forecast, by Service (2023-2030) 9.4.1.3 Brazil Waste Management Market Size and Forecast, by End-Use (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Waste Management Market Size and Forecast, by Type (2023-2030) 9.4.2.2 Argentina Waste Management Market Size and Forecast, by Service (2023-2030) 9.4.2.3 Argentina Waste Management Market Size and Forecast, by End-Use (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Waste Management Market Size and Forecast, by Type (2023-2030) 9.4.3.2 Rest Of South America Waste Management Market Size and Forecast, by Service (2023-2030) 9.4.3.3 Rest Of South America Waste Management Market Size and Forecast, by End-Use (2023-2030) 10. Global Waste Management Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2022 10.3.9 No. of Stores 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Waste Management Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Clean Harbors Inc. 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Daiseki Co. Ltd. 11.3 Waste Management Inc. 11.4 Suez Environment S.A. 11.5 Advanced Disposal Services 11.6 Veolia Environment S.A 11.7 Republic Services Inc. 11.8 Covanta 11.9 Remondis AG & Co. Kg 11.10 Biffa Group 11.11 Hitachi Zosen Corporation 11.12 Green Conversions 11.13 Amec Foster Wheeler 11.14 Xcel Energy, Recology 11.15 Keppel Segher 11.16 16.Plasco Conversions 11.17 Wheelabrator Technologies 11.18 Nexans 11.19.China Everbright International 11.20 Cleanaway 11.21 Sims Metal Management 11.22 Stericycle 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary