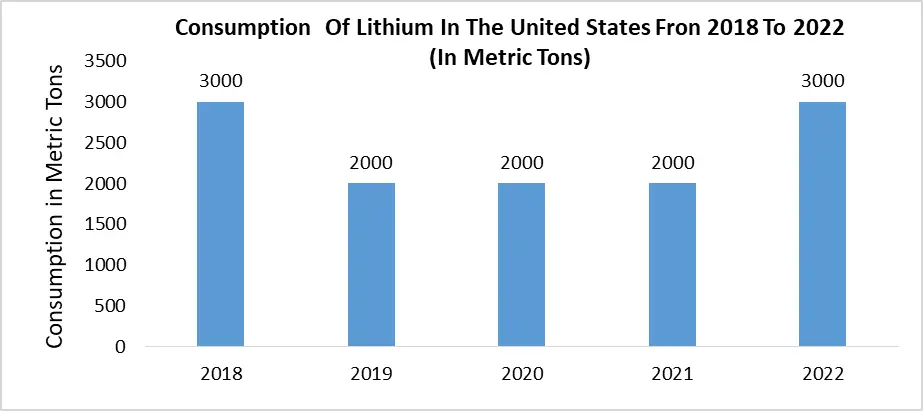

The North America Lithium Metal Market size was valued at USD 414.3 Million in 2022 and the total North America Lithium Metal Market revenue is expected to grow at a CAGR of 19.8 % from 2023 to 2029, reaching nearly USD 1544.7 Million. North America is a significant player in the lithium metal market, with a focus on both production and consumption. North America has several active lithium mines and projects. The United States and Canada contribute to lithium production in the region. These facilities extract lithium from brine deposits and hard rock sources. Canada also has lithium resources in Quebec and Ontario, where production focuses on spodumene ore. North American lithium metal demand is increasing due to EV adoption and favorable government policies. North America's focus on renewable energy and energy storage systems supports lithium metal demand. It aids grid stability and supports renewable energy integration into the existing infrastructure. In the North American lithium metal market, several key players contribute to the production and supply chain. Companies like Albemarle Corporation, Livent Corporation, and Lithium Americas Corp are actively involved in lithium extraction, production, and distribution. These companies strive to enhance their production capacities and maintain a sustainable supply chain to meet lithium metal demand. Market trends in the North American lithium metal market include sustainable production practices and exploration of existing lithium resources. Environmental concerns associated with traditional lithium extraction methods have led to an increased emphasis on eco-friendly mining and processing techniques. Companies are adopting responsible mining practices and investing in technologies that minimize lithium production's ecological impact. The North American region plays a significant role in the global lithium metal market. The region's focus on electric vehicle adoption, renewable energy, and sustainable production practices drives lithium metal demand. Key players in the region strive to enhance production capacity and maintain a sustainable supply chain. Exploration of upcoming lithium resources further enhances the region's market position. North America Lithium Metal Market Scope and research methodology: The North America Lithium Metal Market report provides a comprehensive analysis of the market for stakeholders in the Lithium metal industry. It covers various aspects such as technology, application, and industry verticals. The research methodology involves analyzing product-type literature, industry releases, annual reports, and other relevant documents of key industry participants. The report highlights industry players’ focus on technological advancements to establish dominance in the North America Lithium Metal Market. Key players are also strengthening their market positions. The report aims to offer valuable insights and an in-depth analysis of the North America Lithium Metal Market to assist stakeholders in making informed decisions and understanding market dynamics.To know about the Research Methodology :- Request Free Sample Report

Market Dynamics:

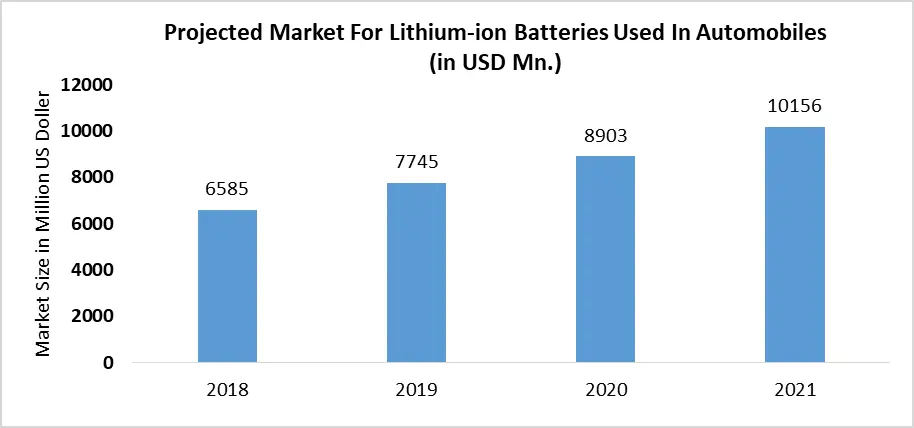

Advancements in Battery Technology Fuel North America's Lithium Metal Market: The North America Lithium Metal Market is driven by various factors that contribute to its growth and development. These drivers encompass the increasing demand for electric vehicles (EVs), the growing emphasis on renewable energy sources, favorable government policies and incentives, advancements in lithium-ion battery technology, and the expanding energy storage market. Let's explore each driver. EV adoption is a significant driver of the North America Lithium Metal Market. These batteries store excess energy generated during peak production periods and release it during high demand. This supports the integration of renewable energy into the grid. The increasing focus on renewable energy strengthens lithium metal demand in the region. Governments in North America are implementing favorable policies and offering incentives to promote EVs and renewable energy systems. These policies include tax credits, subsidies, grants, and rebates, which significantly reduce the upfront costs of purchasing EVs and installing renewable energy systems. Such initiatives encourage consumers and businesses to transition to sustainable alternatives, driving the demand for lithium metal. Lithium-ion battery technology advancements contribute to the North America Lithium Metal Market growth. These advancements lead to more efficient utilization of lithium metal in battery systems, thereby enhancing overall performance and driving market demand. Ongoing innovations, such as solid-state batteries and lithium-metal-based secondary batteries, further boost lithium metal demand. The expanding energy storage market drives lithium metal demand in North America.Lithium Metal Production Raises Environmental Concerns in North America. The North America Lithium Metal Market is influenced by geopolitical factors. The majority of lithium reserves are concentrated in a few countries, and this uneven distribution leads to supply chain vulnerabilities. Geopolitical tensions, trade disputes, or changes in government policies disrupt lithium metal availability and pricing. Dependence on lithium imports from other regions, particularly those with unstable political climates, poses risks to North America's stability and growth. Lithium metal is highly reactive and poses safety risks during production, transportation, and use. Thermal runaways, fires, and explosions associated with lithium-ion batteries have gained attention in recent years. Safety concerns impact consumer confidence and slow down lithium-ion battery adoption, mainly in industries such as automotive and energy storage. Stringent safety regulations, robust quality control measures, and continuous improvements in battery technology are necessary to address concerns and to ensure lithium metal safety and reliability. Lithium metal production and extraction can have environmental impacts. Traditional lithium extraction methods, such as open-pit mining and evaporation ponds, may result in deforestation, water contamination, and habitat destruction. However, stringent environmental regulations and responsible mining practices can pose challenges and increase production costs. This impacts the growth of the North America Lithium Metal Market.

North America Lithium Metal Market Segment Analysis:

Based on Application, Lithium-ion Anode Material dominates the North America Lithium Metal Market in 2022 and is expected to grow during the forecast period. Lithium-ion batteries are widely used in various industries, including electric vehicles, consumer electronics, and energy storage systems. As the demand for these applications grows, the need for lithium-ion anode materials, lithium metal, increases. Lithium-ion anode materials store and release lithium ions during battery charge and discharge cycles, allowing reliable and long-lasting power. The demand for lithium metal in anode materials has been significant due to its unique properties and ability to enhance energy storage capacity and battery performance. A significant part of the growth of electric vehicles and the adoption of energy storage systems is driving the dominance of lithium-ion anode materials. The North America Lithium Metal Market is driven by demand for electric vehicles and energy storage systems. Lithium metal's unique properties make it a crucial component in lithium-ion anode materials, enabling higher energy storage capacity and better battery performance to meet these applications' requirements.Based on End-user, In the North American lithium metal market, batteries dominate the market in 2022 and are expected to grow during the forecast period. As governments and consumers prioritize clean transportation and electric mobility, lithium-ion battery demand has skyrocketed. Lithium metal enhances battery performance, such as higher energy density and longer cycle life, making it indispensable for EV manufacturers. The energy grid storage sector heavily relies on lithium-ion batteries to store excess renewable energy and balance supply-demand fluctuations. Grid-scale energy storage systems, such as those used in renewable energy plants or residential energy storage solutions, contribute significantly to the dominance of the battery segment in the North American lithium metal market. While the battery segment is dominant, it is imperative to note that other end-user segments also contribute to lithium metal demand in North America. Metal processing applications, such as the production of specialized alloys for the aerospace or defense industries, utilize lithium metal. The pharmaceutical sector utilizes lithium compounds for mental health disorders. The battery segment, driven by the increasing adoption of EVs and energy grid storage systems, is the dominant end-user segment in the North American lithium metal market. Other segments, such as metal processing and pharmaceuticals, also play a significant role in driving lithium metal demand in the region.

North America Lithium Metal Market Regional Insights:

The North America Lithium Metal Market is characterized by regional insights that encompass market dynamics, trends, production capacity, demand drivers, and key players in the region. The United States is a significant player in the North America Lithium Metal Market. This is with a focus on lithium-ion battery production, electric vehicles (EVs), and renewable energy adoption. The growing demand for EVs, supported by government initiatives and consumer preferences for sustainable transportation, drives lithium-ion batteries and lithium metals. The United States also emphasizes renewable energy sources, which further boosts demand for energy storage systems utilizing lithium metal-based batteries. Canada has a growing presence in the Market, with significant lithium resources and ongoing mining projects. The country's lithium reserves are concentrated in Quebec and Ontario. The Canadian government's support for the clean energy transition and commitment to reducing greenhouse gas emissions provides a conducive environment for the growth of the lithium metal market. Mexico is emerging as a promising market for the Market. The country is investing in lithium exploration and development projects to increase lithium production capacity. Mexico's focus on electric mobility and renewable energy integration drives lithium-ion batteries and lithium metals. The Mexican government has implemented policies and incentives to promote EV adoption and support a sustainable energy ecosystem.Competitive Landscape Key Players of the North America Lithium Metal Market profiled in the report include Albemarle Corporation, Alpha-En Corporation, American Elements, China Energy Lithium Co., Ganfeng Lithium Co., Ltd., Li-Metal Corp., Livent Corporation, Pure Lithium, Sion Power Corporation., and Spectrum Chemical, Lithium Americas, TRU Group Inc. This provides huge opportunities to serve many End-uses & customers and expand the North America Lithium Metal Market. On 31 Jan 2023, General Motors Co. and Lithium Americas to Develop U.S.-Sourced Lithium Production through a $650 Million Equity Investment and Supply Agreement. General Motors Co. and Lithium Americas Corp. announced that they would jointly invest in developing the Thacker Pass mine in Nevada. This is the largest known lithium mine in the United States and the third biggest in the world. Under the agreement, GM will invest $650 million in Lithium Americas. This represents the largest-ever investment by an automaker in producing battery raw materials. On Jun 28, 2022, Albemarle Corp. executives announced a bold expansion plan. The company plans to increase lithium production to five times the current level, to 500,000 MT per year, by 2030. Albemarle expects global lithium demand to reach 3.2 million MT per year by 2030. The company has also announced a key step towards this expansion: the establishment of a 100,000-mt-per-year lithium processing plant in the US a plant that already produces as much as the company's current total production which is a clear indication of the company's long-term bullishness about the prospects for the US electric vehicle industry.

North America Lithium Metal Market Scope: Inquire Before Buying

North America Lithium Metal Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 141.3 Mn. Forecast Period 2023 to 2029 CAGR: 19.8% Market Size in 2029: US $ 1544.7 Mn. Segments Covered: by Source Salt Lake Brine Lithium Ores by Application Lithium-ion Anode Material Alloy Intermediates Others by End Users Batteries Metal Processing Pharmaceutical Others North America Lithium Metal Market Key Players:

1. Albemarle Corporation, 2. Alpha-En Corporation 3. American Elements 4. China Energy Lithium Co. 5. Ganfeng Lithium Co., Ltd. 6. Li-Metal Corp. 7. Livent Corporation, 8. Pure Lithium 9. Sion Power Corporation. 10. Spectrum Chemical 11. Lithium Americas 12. TRU Group IncFAQs:

1. What are the growth drivers for the Market? Ans. Advancements in Battery Technology Fuel are expected to be the major driver for our North America Lithium Metal Market. 2. What is the major restraint for the North America Lithium Metal Market growth? Ans. Lithium Metal Production Raises Environmental Concerns in North America, restrain the North American Lithium Metal Market: 3. Which country is expected to lead the global Market during the forecast period? Ans. The United States is expected to lead the Market during the forecast period. 4. What is the projected market size & growth rate of the Market? Ans. The Market size was valued at USD 414.3 Million in 2022 and the total Market revenue is expected to grow at a CAGR of 19.8 % from 2023 to 2029, reaching nearly USD 1544.7 Million. 5. What segments are covered in the Market report? Ans. The segments covered in the Market report are Source, Application, End-user, and Region.

1. North America Lithium Metal Market: Research Methodology 2. North America Lithium Metal Market: Executive Summary 3. North America Lithium Metal Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Market Structure 3.3.1. Market Leaders 3.3.2. Market Followers 3.3.3. Emerging Players 3.4. Consolidation of the Market 4. North America Lithium Metal Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. North America Lithium Metal Market: Segmentation (by Value USD and Volume Units) 5.1. North America Lithium Metal Market, By Source (2022-2029) 5.1.1. Salt Lake Brine 5.1.2. Lithium Ores 5.2. North America Lithium Metal Market, By Application (2022-2029) 5.2.1. Lithium-ion Anode Material 5.2.2. Alloy 5.2.3. Intermediates 5.2.4. Others 5.3. North America Lithium Metal Market, By End-Users (2022-2029) 5.3.1. Batteries 5.3.2. Metal Processing 5.3.3. Pharmaceutical 5.3.4. Others 5.4. North America Lithium Metal Market, by Country (2022-2029) 5.4.1. United States 5.4.2. Canada 5.4.3. Mexico 6. Company Profile: Key players 6.1. Albemarle Corporation 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. Alpha-En Corporation 6.3. American Elements 6.4. China Energy Lithium Co. 6.5. Ganfeng Lithium Co., Ltd. 6.6. Li-Metal Corp. 6.7. Livent Corporation, 6.8. Pure Lithium 6.9. Sion Power Corporation. 6.10. Spectrum Chemical 6.11. Lithium Americas 6.12. TRU Group Inc 7. Key Findings 8. Industry Recommendation