The Middle East and Africa Lithium Metal Market size was valued at USD 103.6 Million in 2022 and the total Middle East and Africa Lithium Metal Market revenue is expected to grow at a CAGR of 21.9 % from 2023 to 2029, reaching nearly USD 386.2 Million. The Middle East and Africa encompassing a various range of countries holds significance for the lithium metal market. While the Middle East and Africa Lithium Metal market is in its nascent stages, the growing demand for lithium-ion batteries and the growing interest in electric vehicles and renewable energy storage systems present an opportunity to tap into its lithium resources and participate in the lithium metal market. These reserves offer a stable base for the growth of the lithium metal market in the area. The manufacture of lithium compounds like lithium carbonate and lithium hydroxide, as well as the mining of lithium, have historically been the emphasis of Africa. With limited manufacturing capabilities, lithium metal production is still in its infancy. A number of significant factors make the Middle East and Africa region an advantageous market for lithium metals. A sustainable energy future can be supported by the incorporation of lithium metal batteries into renewable energy projects, improving grid stability. Other industrial uses for lithium metal include the aerospace, electronics, and defense industries. The increase in lithium metal used in these industries is made possible by the region's expanding industrialization and emphasis on technology-driven businesses. The Middle East and Africa region presents a favorable market environment for lithium metal due to several key drivers. Developing the necessary infrastructure and advanced manufacturing capabilities for lithium metal production requires significant investment and technological expertise. These infrastructure gaps may slow down the growth of the market. Establishing clear and supportive regulatory frameworks and policies that promote sustainable lithium mining and production practices is essential. Regulatory uncertainties and a lack of standardization may pose challenges for companies looking to enter the lithium Middle East and Africa Lithium Metal market. Building a robust and reliable supply chain for lithium metal is crucial to meet growing demand. This involves securing access to lithium reserves, establishing mining operations, and establishing refining and processing facilities.Middle East and Africa Lithium Metal Market Scope and research methodology:

The scope of the research is to provide an in-depth analysis of the Middle East and African lithium metal markets. The study covers the regional market dynamics, including drivers, restraints, challenges, opportunities, and competitive landscape. It focuses on the production, applications, end-users, and sources of lithium metal within the region. The report examines key countries such as Morocco, DRC, Zimbabwe, Chile, Mali, Ghana, Namibia, and the United Arab Emirates as prominent players in the market. research assesses the market segments based on sources, applications, and end-users, and provides insights into regional trends, market size, and growth potential. research is conducted using a combination of primary and secondary sources to gather qualitative and quantitative information about the Middle East and African lithium metal market. Secondary research involves the collection of data from various sources such as industry reports, company websites, government publications, and databases to obtain information on market size, historical and forecasted data, and competitive analysis. The secondary research also provides a broader understanding of the market dynamics, regulatory frameworks, technological advancements, and industry trends. The collected data is analyzed and validated using statistical tools and models. The research report presents the findings in a comprehensive and structured manner, including charts, graphs, and tables, to provide a clear understanding of the Middle East and Africa lithium metal market.To know about the Research Methodology :- Request Free Sample Report

Market Dynamics:

Growing Renewable Energy Storage and Electric Vehicle (EV) adoption: The increasing demand for electric vehicles in the Middle East and Africa region is a significant driver for the lithium metal market. Governments and industries are promoting the shift towards EVs to reduce carbon emissions and dependence on fossil fuels. For example, the UAE aims to have 10% of all vehicles on its roads electric by 2029. The MEA's abundant solar and wind resources present opportunities for renewable energy projects. Lithium metal batteries are crucial for efficient energy storage, allowing the incorporation of renewable energy sources into the grid and supporting the transition to clean energy systems. For example, Saudi Arabia's commitment to renewable energy goals is driving the demand for lithium metal batteries for energy storage projects. Lithium metal is used in various industrial applications such as the aerospace, electronics, and defense sectors. Growing industrialization and a focus on technology-driven sectors provide opportunities for the expansion of lithium metal usage in these industries. For example, the aerospace sector in the UAE is investing in electric aircraft propulsion systems, driving the need for advanced lithium metal batteries in the Middle East and Africa Lithium Metal Market. Insufficient infrastructure hinders lithium metal production growth. Developing the necessary infrastructure for lithium metal production, including mining operations and processing facilities, requires substantial investment and technological expertise. The lack of adequate infrastructure can impede the growth of the market. Establishing clear and supportive regulatory frameworks and policies for lithium metal mining and production is crucial. Regulatory uncertainties and a lack of standardization can hinder market growth and investment. For example, the lack of comprehensive regulations for lithium mining in some African countries may discourage investors. Building a robust and reliable supply chain for lithium metals is essential to meet growing demand. This involves securing access to lithium reserves, establishing mining operations, refining and processing facilities, and logistics infrastructure. Developing advanced lithium metal production technologies and improving battery performance and safety are ongoing challenges. Investing in research and development is necessary to overcome these technological barriers in the Middle East and Africa Lithium Metal Market. Partnerships and Technology Transfer Fuel the Development of Lithium Metals in Africa. Africa, including countries like Zimbabwe and the Democratic Republic of Congo, possesses significant lithium reserves. Developing mining operations and establishing secure supply chains can unlock the potential of these resources. The region offers opportunities for international investments and partnerships to develop lithium metal production capabilities. Collaborations with established lithium mining and manufacturing companies can bring expertise and technology to the region. There is an increasing focus on sustainability in the lithium industry. Developing environmentally friendly and socially responsible mining and production practices can position the Middle East and Africa as leaders in sustainable lithium metal production. The Ewoyaa project is a spodumene project and the world's largest lithium mine, covering an area of 684 square kilometers. Atlantic Lithium holds 100% interest in the Ewoyaa Lithium project in Ghana, and Piedmont gradually controls the project through an agreement. On July 1, 2021, Piedmont signed an agreement with Atlantic Lithium to provide US$102 million in funding for the Ewoyaa Lithium project in Ghana. The growth of the lithium metal market can contribute to economic diversification efforts in the Middle East and Africa, reducing dependence on traditional industries and creating new employment opportunities.Middle East and Africa Lithium Metal Market Segment Analysis:

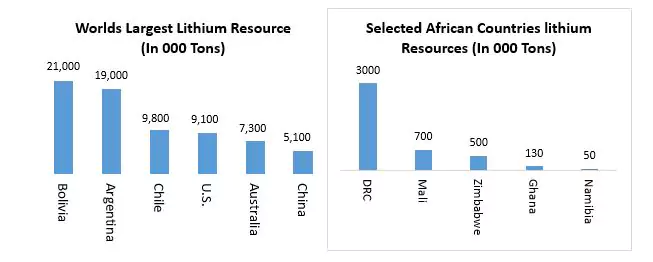

Based on Source, Salt Lake Brine dominates the Middle East and Africa Lithium Metal Market in 2022 and is expected to grow during the forecast period. Salt Lake brine is a significant source of lithium in the Middle East and Africa region. It involves the extraction of lithium from brine deposits found in salt lakes or salt flats. This provides a cost-effective method of lithium production, as it involves the evaporation of water to concentrate lithium compounds. Salt Lake brine is mainly found in countries like DRC, Zimbabwe, Chile, Mali, Ghana, and Namibia. Lithium ores, such as spodumene and petalite, are another source of lithium in the market. These ores require mining and processing to extract lithium compounds. Zimbabwe, for example, has rich lithium ore deposits in the Bikita and Kamativi regions.Based on Application, Lithium-ion Anode Material dominates the Middle East and Africa Lithium Metal Market in 2022 and is expected to grow during the forecast period. Lithium metal is used as an anode material in lithium-ion batteries. It helps to increase battery performance, energy density, and charging capabilities. The increasing demand for lithium-ion batteries for electric vehicles, portable electronics, and energy storage systems drives the growth of the Lithium-ion Anode Material segment. Intermediates refer to intermediate products derived from lithium metal. Lithium alloys are used in different industries in the aerospace and defense industries.

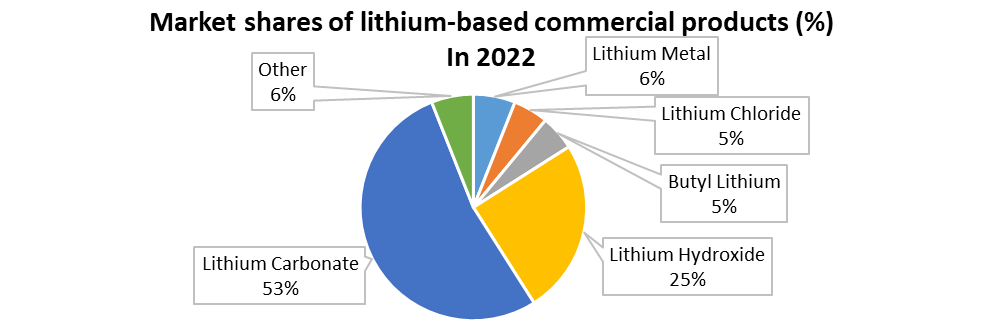

These can include lithium compounds such as lithium carbonate or lithium hydroxide. These intermediates are used in various industries, including pharmaceuticals, ceramics, glass, and lubricants. Lithium metal is utilized in the production of alloys. These alloys provide lightweight and high-strength properties, making them suitable for aerospace components and advanced materials. Lithium alloys of lithium metal may not fit into the above-mentioned segments. It could include specialized applications, research & development, or emerging applications that are still in the early stages of commercialization.

Based on End-user, In the Middle East and African lithium metal market, batteries dominate the market in 2022 and are expected to grow during the forecast period. The battery sector is a significant end-user of lithium metal. Lithium-ion batteries are widely used in electric vehicles, portable electronics, and energy storage systems. The growing adoption of electric vehicles and the increasing demand for energy storage solutions in the Middle East and Africa drive the growth of the Batteries segment. Lithium metal has applications in different metal processing industries. It is used as a heat transfer medium, a reducing agent, or as an alloying element in metal production processes. Lithium compounds derived from lithium metal have applications in the pharmaceutical industry. Lithium carbonate, for example, is used as a medication for certain mental health conditions, including bipolar disorder. The end-users of lithium metal are the ceramics industry, lubricants, glass manufacturing, and specialized applications in research & development.

Regional Insights:

South Africa holds substantial lithium reserves and has emerged as a prominent player in the global lithium supply chain in the Middle East and Africa Lithium Metal Market. Zimbabwe has one of the largest lithium deposits in the world, primarily in the Bikita and Kamativi regions. The DRC is known for its significant mineral resources, including lithium ores. The presence of these reserves offers substantial opportunities for the development of the lithium metal market in the region. However, challenges related to infrastructure, investment, and regulatory frameworks need to be addressed to unlock their full potential. Egypt, and Morocco, possess significant potential for lithium metal production. Morocco, in particular, has lithium resources and has shown interest in developing its lithium industry. With its proximity to Europe and access to key markets, North Africa has the advantage of strategic geographical positioning. The region's focus on renewable energy projects and increasing interest in electric vehicles contribute to the demand for lithium metals. The GCC countries have shown strong interest in diversifying their economies and investing in technology-driven sectors. The UAE has made significant investments in renewable energy and electric vehicle infrastructure. The UAE lacks substantial lithium resources, but it has the potential to become a significant market for lithium metals, driven by its focus on technology adoption, energy storage solutions, and the demand for electric vehicles. Other Middle Eastern countries are also exploring opportunities in the lithium metal market. Iran, for instance, has lithium resources and aims to develop its lithium industry. These countries can leverage their geographical location, market potential, and growing interest in sustainable technologies to drive the adoption of lithium metals in various applications in the Middle East and Africa Lithium Metal Market.

Competitive Landscape

Key Players of the Middle East and Africa Lithium Metal Market profiled in the report include Albemarle Corporation, SQM (Sociedad Química y Minera de Chile), Zimbabwe Lithium Company, Pilbara Minerals Limited, Lithium Americas Corp., Jiangxi Ganfeng Lithium Co., Ltd., Altura Mining Limited. This provides huge opportunities to serve many End-uses & customers and expand the market. Zimbabwe Lithium Company is a regional player focused on the development of lithium resources in Zimbabwe. The company aims to become a significant lithium producer and has exploration and mining operations in the country's lithium-rich regions. Zimbabwe Lithium Company is actively involved in the lithium supply chain, from mining to the production of lithium compounds.SQM is a Chile-based company with leading lithium producers. The company has extensive lithium resources and a strong track record in the lithium market.Middle East and Africa Lithium Metal Market Scope: Inquire before buying

Middle East and Africa Lithium Metal Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 103.6 Million. Forecast Period 2023 to 2029 CAGR: 21.9 % Market Size in 2029: USD 386.2 Million. Segments Covered: by Source Salt Lake Brine Lithium Ores by Application Lithium-ion Anode Material Alloy Intermediates Others by End-users Batteries Metal Processing Pharmaceutical Others Key Players:

1. Albemarle Corporation, 2. SQM (Sociedad Química y Minera de Chile) 3. Pilbara Minerals Limited 4. Lithium Americas Corp. 5. Zimbabwe Lithium Company 6. Jiangxi Ganfeng Lithium Co., Ltd. 7. Altura Mining Limited FAQs: 1. What are the growth drivers for the Middle East and Africa Lithium Metal Market? Ans. Growing Renewable Energy Storage and Electric Vehicle (EV) adoption are expected to be the major driver for our market. 2. What is the major restraint for the Middle East and Africa Lithium Metal Market growth? Ans. Insufficient infrastructure hinders lithium metal production growth in Middle East and Africa 3. Which country is expected to lead the global Middle East and Africa Lithium Metal Market during the forecast period? Ans. The South Africa is expected to lead the Middle East and Africa Lithium Metal Market during the forecast period. 4. What is the projected market size & growth rate of the Middle East and Africa Lithium Metal Market? Ans. The Middle East and Africa Lithium Metal Market size was valued at USD 103.6 Million in 2022 and the total Middle East and Africa Lithium Metal Market revenue is expected to grow at a CAGR of 21.9 % from 2023 to 2029, reaching nearly USD 386.2 Million. 5. What segments are covered in the Middle East and Africa Lithium Metal Market report? Ans. The segments covered in the market report are Source, Application, End-user, and Region.

1. Middle East and Africa Lithium Metal Market: Research Methodology 2. Middle East and Africa Lithium Metal Market: Executive Summary 3. Middle East and Africa Lithium Metal Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Market Structure 3.3.1. Market Leaders 3.3.2. Market Followers 3.3.3. Emerging Players 3.4. Consolidation of the Market 4. Middle East and Africa Lithium Metal Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. Middle East and Africa Lithium Metal Market: Segmentation (by Value USD and Volume Units) 5.1. Middle East and Africa Lithium Metal Market, By Source (2022-2029) 5.1.1. Salt Lake Brine 5.1.2. Lithium Ores 5.2. Middle East and Africa Lithium Metal Market, By Application (2022-2029) 5.2.1. Lithium-ion Anode Material 5.2.2. Alloy 5.2.3. Intermediates 5.2.4. Others 5.3. Middle East and Africa Lithium Metal Market, By End-Users (2022-2029) 5.3.1. Batteries 5.3.2. Metal Processing 5.3.3. Pharmaceutical 5.3.4. Others 5.4. Middle East and Africa Lithium Metal Market, by Country (2022-2029) 5.4.1. South Africa 5.4.2. GCC 5.4.3. Egypt 5.4.4. Nigeria 5.4.5. Rest of ME&A 6. Company Profile: Key players 6.1. Albemarle Corporation 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. SQM (Sociedad Química y Minera de Chile) 6.3. Pilbara Minerals Limited 6.4. Lithium Americas Corp. 6.5. Zimbabwe Lithium Company 6.6. Jiangxi Ganfeng Lithium Co., Ltd. 6.7. Altura Mining Limited 7. Key Findings 8. Industry Recommendation