The Asia Pacific Lithium Metal Market size was valued at USD 1035.8 Million in 2022 and the total Asia Pacific Lithium Metal Market revenue is expected to grow at a CAGR of 18.5% from 2023 to 2029, reaching nearly USD 3861.9 Million. The Asia Pacific region has witnessed significant lithium metal market growth. The growing demand for lithium metal plays a significant role in manufacturing lithium-ion batteries, which are widely used in various applications such as consumer electronics, electric vehicles, energy storage systems, and renewable energy integration. Asia’s growing renewable energy sector has contributed to the increased demand for lithium metal. China plays a crucial role in the Asia Pacific lithium metal market. It is not only the largest consumer of lithium metal but also the leading producer. The country has invested heavily in lithium production and battery manufacturing facilities to support its EV industry. China's ambitious goals of achieving carbon neutrality and dominating the EV market have further boosted the demand for lithium metal in the region. Japan and South Korea are also significant contributors to the Asia-Pacific lithium metal market. These countries have well-established automotive industries and are at the forefront of EV adoption. The Asia Pacific lithium metal market is not without challenges. One of the primary concerns is the limited availability of lithium reserves in the region. Most of the lithium resources are concentrated in countries like Australia and Chile. To overcome this issue, Asian countries have been exploring partnerships and acquisitions of lithium assets in other regions to secure a sustainable supply chain. Additionally, grid-scale lithium-ion batteries are gaining popularity for energy storage applications, further contributing to lithium metal demand. Industry experts and organizations closely monitor lithium price trends, global reserves, production, exports, and imports. These analyses provide valuable insights into the market's current state and its prospects. Major lithium mining companies and active lithium mines are monitored to assess production capacity and supply capabilities. Asia Pacific Lithium Metal Market Scope and research methodology: The Asia Pacific lithium metal market refers to geographical coverage and key aspects considered in the market analysis. It typically includes countries in the Asia Pacific region, such as China, Japan, India, and others. The research methodology involves the estimation of market size. It also covers historical market growth and future growth projections for the Asia Pacific lithium metal market. The study analyzes the competitive landscape of the Asia Pacific lithium metal market. This includes the key players, their market share, strategies, product portfolio, and recent developments. It also contains a swot analysis of major companies operating in the market. The scope encompasses the identification and analysis of market trends, drivers, challenges, and opportunities influencing the growth of the lithium metal market in the Asia Pacific region. This may include factors such as government regulations, technological advancements, environmental concerns, and industry-specific requirements. Primary and secondary research techniques are employed to collect relevant data and information on the Asia Pacific lithium metal market. The collected data is analyzed using various statistical and analytical tools to derive meaningful insights into the Asia Pacific lithium metal market. Market analysis techniques may include data triangulation, market segmentation, trend analysis, and forecasting. Research findings are validated and verified through a rigorous review process. This involves cross-checking data from multiple sources, conducting internal reviews, and seeking expert opinions to ensure accuracy and reliability. The report typically includes an executive summary, market overview, methodology, key findings, market analysis, competitive landscape, and recommendations.To know about the Research Methodology :- Request Free Sample Report

Market Dynamics:

Surge in electric vehicle (EV) adoption and the growing demand for renewable energy storage solutions The rise in electric vehicle (EV) adoption and the growing demand for renewable energy storage solutions. The rapid rise in EV adoption across the Asia Pacific region has significantly fueled the demand for lithium metal. Countries like China, Japan, and South Korea have been at the forefront of this trend. EVs, powered by lithium-ion batteries that rely on lithium metal, offer a promising solution. Storage systems are essential to store excess energy during peak production and release it during times of high demand. They store and release energy effectively, ensuring a stable supply of electricity and supporting the integration of renewable energy into the grid. The demand for lithium metal in energy storage systems has surged as countries invest in renewable energy infrastructure and aim to achieve energy independence. The increasing demand for electric vehicles (EVs). The global EV market is growing rapidly, and Asia-Pacific is one of the leading regions for EV adoption. The growing demand for consumer electronics. The increasing availability of lithium resources in the region. Technological advancements in lithium metal batteries. There have been significant technological advancements in lithium metal batteries. These advancements have made lithium metal batteries more efficient and affordable, which has further boosted the demand for these batteries. These countries' focus on developing a robust domestic supply chain has boosted the Asia Pacific lithium metal market. Despite these drivers, the industry faces challenges such as limited lithium reserves and the need for sustainable sourcing. To overcome these obstacles, Asian countries are exploring partnerships, acquisitions, and investments in lithium assets worldwide to secure a long-term and sustainable supply chain. Additionally, advancements in lithium recycling technologies and research into alternative materials are being pursued to mitigate resource limitations. The Asia Pacific lithium metal market has been primarily driven by the surge in EV adoption and the growing demand for renewable energy storage.Limited Lithium Reserves and Import Dependency Restraint for Asia Pacific Lithium Metal Market The Asia Pacific lithium metal market faces several restraints that impact its growth and development. The limited availability of lithium reserves in the region. Although countries like Australia and Chile have significant lithium resources, the Asia Pacific region heavily relies on imports to meet its growing demand. This dependency on external sources for lithium results in supply chain vulnerabilities and price fluctuations. To mitigate this restraint, Asian countries are exploring partnerships, acquisitions, and investments in lithium assets worldwide to secure a stable supply chain and reduce reliance on imports. Environmental concerns also pose a significant restraint on the Asia Pacific lithium metal market. The extraction and processing of lithium have adverse environmental impacts. Lithium mining often requires large amounts of water, and improper disposal of mining byproducts leads to water contamination and ecosystem damage. Efforts are being made to develop more sustainable and environmentally friendly lithium extraction methods, as well as recycling technologies to minimize the environmental impact of lithium mining and battery waste. Geopolitical challenges also restrain the Asia Pacific lithium metal market. As the demand for lithium metal continues to grow, competition for access to lithium resources intensifies, leading to potential geopolitical tensions. Some countries face obstacles to securing a stable supply of lithium due to political or trade-related issues. This uncertainty in the geopolitical landscape creates volatility in the lithium market and hinders the growth of the Asia Pacific region. The high costs associated with lithium production and battery manufacturing. While advancements in technology and economies of scale have helped reduce costs, lithium-ion batteries remain relatively expensive compared to conventional alternatives. This cost factor deters widespread adoption, especially in price-sensitive markets. Efforts to lower the cost of lithium-ion batteries through research and development, improved manufacturing processes, and economies of scale are underway to overcome this restraint. Limited infrastructure for charging and battery swapping stations impedes the adoption of electric vehicles, which in turn affects the demand for lithium metal. The lack of a robust charging infrastructure network makes it challenging for EV users to find convenient and accessible charging facilities. Governments and industry stakeholders are investing in the development of charging infrastructure to address this restraint and promote the widespread adoption of EVs.

Heavy Reliance on Imports Limited Lithium Reserves Pose Challenges for Asia Pacific Lithium Metal Market. The Asia Pacific region has limited domestic lithium reserves, leading to heavy reliance on imports to meet growing demand. This dependency on external sources poses supply chain vulnerabilities and price fluctuations. Japan, one of the major consumers of lithium metal, relies heavily on imports from countries like Australia and Chile to meet its lithium requirements. The extraction and processing of lithium can have adverse environmental impacts. Lithium mining requires significant amounts of water, and improper disposal of mining byproducts can lead to water contamination and ecosystem damage. The increasing scrutiny of environmental practices has led to the adoption of more sustainable and eco-friendly methods in lithium extraction, such as utilizing brine deposits and implementing recycling technologies. The Asia Pacific region is characterized by geopolitical challenges that can impact the lithium metal market. Trade disputes, political instability, and regulatory uncertainties can create barriers to the stable supply and distribution of lithium metal. Trade tensions between major economies like China and the United States have the potential to disrupt the lithium supply chain and impact market dynamics. The high production costs associated with lithium metals can be a challenge. The complex extraction process, energy-intensive production, and strict quality control requirements contribute to the overall cost, which can limit market growth. Ongoing research and development efforts to improve lithium extraction efficiency and explore alternative materials aim to reduce production costs and make lithium metals more affordable.

Asia Pacific Lithium Metal Market Segment Analysis:

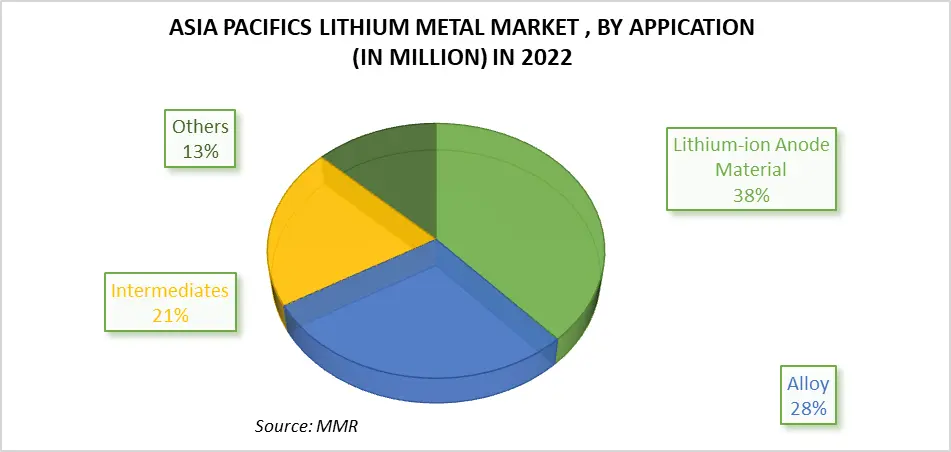

Based on Application, Lithium-ion Anode Material dominates the Asia Pacific Lithium Metal Market in 2022 and is expected to grow during the forecast period. One significant application area for lithium metal in the Asia-Pacific region is lithium-ion anode materials. The demand for lithium metal in this market is fueled by the rising popularity of lithium-ion batteries, which are used in portable electronics and battery-powered cars. Based on several lithium metal uses, the Asia Pacific lithium metal market is analyzed. The anode material is lithium metal. Electric vehicles, consumer gadgets, and energy storage devices all use these batteries. Several alloys, including those used in the aerospace, automotive, and electronic industries, are made of lithium metal. Additionally, alloys for aerospace, automotive, and electronic industries utilize lithium metal. These alloys are suited to lightweight and high-performance applications due to their strength and low density. Lithium metal is also an intermediary in chemicals and lithium compounds production. These intermediates act as precursors to a variety of products, notably lubricants, ceramics, glass, and medications. Lithium metal is processed to make lithium hydroxide, lithium carbonate, lithium chloride, and lithium bromide. The rising usage of lithium-ion batteries, the manufacturing of lithium compounds for a variety of uses, and the use of lithium alloys in various industries all contribute to the demand for lithium metal. Chemical intermediates and lithium metal used in other specialized applications both contribute to the Asia Pacific lithium metal market expansion.

Asia Pacific Lithium Metal Market Regional Insights:

China is the largest consumer and producer of lithium metal in the Asia-Pacific region. The country has been actively promoting electric vehicles and renewable energy integration, which drives demand for lithium-ion batteries and, subsequently, lithium metal. China also has a significant presence in battery manufacturing and has invested in domestic lithium production to secure a sustainable supply chain. India is emerging as a key player in the Asia Pacific lithium metal market, driven by the government's push towards sustainable mobility and renewable energy integration. The Indian government has introduced various policies and initiatives to support the lithium metal market. For instance, the National Mission on Transformative Mobility and Battery Storage aims to drive the production of advanced chemistry cell batteries, including lithium-ion batteries, in India. These initiatives create a conducive environment for the lithium metal market's growth. South Korea, known for its advanced technology and automotive industry, has a significant presence in the lithium metal market. The country is a major lithium metal consumer, driven by electric vehicles and energy storage solutions. Australia is a major producer of lithium concentrate (spodumene), supplying a substantial portion of the global lithium rock market. The country is actively working towards developing its refining capacity to reduce dependency on China. This will increase value-addition in the lithium supply chain. Australia, as the largest producer of lithium concentrate (spodumene), currently supplies approximately 86% of the global lithium rock market. However, it lacks domestic production capabilities and experience. To reduce its reliance on China, Australia is actively working towards developing its refining capacity. Traditionally, Australian spodumene is shipped to China for processing. China possesses world-class refining technology, enabling efficient and effective lithium salt production. According to Argus estimates, Chinese lithium hydroxide exports accounted for around 64% of the global total of 64,000 tons in the first half of 2022. This situation creates an inefficient market, where both the upstream spodumene and downstream refined product markets heavily depend on China's domestic economic and political conditions.Competitive Landscape Key Players in the Asia Pacific Lithium Metal Market profiled in the report include Albemarle Corporation, Alpha-En Corporation, American Elements, China Energy Lithium Co., Ganfeng Lithium Co., Ltd., Livent Corporation, Shandong Ruifu Lithium Industry Co., Ltd., Shanghai, China Lithium Industrial Co., Ltd., Shenzhen Chengxin Lithium Group Co. Ltd., The Honjo Chemical Corporation, Tianqui Lithium Industries Inc., Pilbara Minerals. This provides huge opportunities to serve many End-users & customers and expand the Asia Pacific Lithium Metal Market. Pilbara Minerals, an Australian lithium producer, has expanded its lithium production capacity through new mining projects. The company has secured offtake agreements with key battery manufacturers and is focused on strengthening its position in the Asia Pacific market. Tianqi Lithium, based in China, is a prominent player in the lithium industry. The company has a diversified portfolio of lithium assets and has focused on increasing production capacity. This is to cater to the growing lithium demand in the Asia Pacific region.

Asia Pacific Lithium Metal Market Scope: Inquire Before Buying

Asia Pacific Lithium Metal Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1035.8 Mn. Forecast Period 2023 to 2029 CAGR: 18.5% Market Size in 2029: US $ 3861.9 Mn. Segments Covered: by Source Salt Lake Brine Lithium Ores by Application Lithium-ion Anode Material Alloy Intermediates Others by End User Batteries Metal Processing Pharmaceutical Others Asia Pacific Lithium Metal Market Key Players:

1. Albemarle Corporation 2. Alpha-En Corporation 3. American Elements 4. China Energy Lithium Co., Ltd., 5. China Lithium Products Technology Co., Ltd. 6. JSC Chemical Metallurgical Plant 7. CNNC Jianzhong Nuclear Fuel Co., Ltd. 8. Ganfeng Lithium Co., Ltd., 9. Livent Corporation 10. Otto Chemie Pvt. Ltd. 11. Oxford Lab Fine Chem Llp 12. Shandong Ruifu Lithium Industry Co., Ltd. 13. Shanghai China Lithium Industrial Co., Ltd., 14. Shenzhen Chengxin Lithium Group Co. Ltd., 15. The Honjo Chemical Corporation 16. Tianqui Lithium Industries Inc. 17. Pilbara Minerals 18. Manosanthi Group of CompanyFAQs:

1. What are the growth drivers for the Market? Ans. The surge in electric vehicle (EV) adoption and the growing demand for renewable energy storage solutions: are the major driver for Asia Pacific Lithium Metal Market. 2. What is the major restraint for the Market growth? Ans. Limited Lithium Reserves and Import Dependency Restraint for Asia Pacific Lithium Metal Market. 3. Which country is expected to lead the Market during the forecast period? Ans. China is expected to lead the Asia Pacific Lithium Metal Market during the forecast period. 4. What is the projected market size & growth rate of the Market? Ans. The Asia Pacific Lithium Metal Market size was valued at USD 1035.8 Million in 2022 and the total Asia Pacific Lithium Metal Market revenue is expected to grow at a CAGR of 18.5% from 2023 to 2029, reaching nearly USD 3861.9 Million. 5. What segments are covered in the Market report? Ans. The segments covered in the Asia Pacific Lithium Metal Market report are Source, Application, End-user, and Region.

1. Asia Pacific Lithium Metal Market: Research Methodology 2. Asia Pacific Lithium Metal Market: Executive Summary 3. Asia Pacific Lithium Metal Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Market Structure 3.3.1. Market Leaders 3.3.2. Market Followers 3.3.3. Emerging Players 3.4. Consolidation of the Market 4. Asia Pacific Lithium Metal Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. Asia Pacific Lithium Metal Market: Segmentation (by Value USD and Volume Units) 5.1. Asia Pacific Lithium Metal Market, By Source (2022-2029) 5.1.1. Salt Lake Brine 5.1.2. Lithium Ores 5.2. Asia Pacific Lithium Metal Market, By Application (2022-2029) 5.2.1. Lithium-ion Anode Material 5.2.2. Alloy 5.2.3. Intermediates 5.2.4. Others 5.3. Asia Pacific Lithium Metal Market, By End-Users (2022-2029) 5.3.1. Batteries 5.3.2. Metal Processing 5.3.3. Pharmaceutical 5.3.4. Others 5.4. Asia Pacific Lithium Metal Market, by Country (2022-2029) 5.4.1. China 5.4.2. S Korea 5.4.3. Japan 5.4.4. India 5.4.5. Australia 5.4.6. Indonesia 5.4.7. Malaysia 5.4.8. Vietnam 5.4.9. Taiwan 5.4.10. Bangladesh 5.4.11. Pakistan 5.4.12. Rest of Asia Pacific 6. Company Profile: Key players 6.1. Albemarle Corporation 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. Alpha-En Corporation 6.3. American Elements 6.4. China Energy Lithium Co., Ltd., 6.5. China Lithium Products Technology Co., Ltd. 6.6. JSC Chemical Metallurgical Plant 6.7. CNNC Jianzhong Nuclear Fuel Co., Ltd. 6.8. Ganfeng Lithium Co., Ltd., 6.9. Livent Corporation, 6.10. Otto Chemie Pvt. Ltd. 6.11. Oxford Lab Fine Chem Llp 6.12. Shandong Ruifu Lithium Industry Co., Ltd. 6.13. Shanghai China Lithium Industrial Co., Ltd., 6.14. Shenzhen Chengxin Lithium Group Co. Ltd., 6.15. The Honjo Chemical Corporation 6.16. Tianqui Lithium Industries Inc., 6.17. Pilbara Minerals 6.18. Manosanthi Group Of Company 7. Key Findings 8. Industry Recommendation