Textured Soy Protein Market size was valued at USD 3.1 Billion in 2023 and the Textured Soy Protein Market revenue is expected to reach USD 5.81 Billion by 2030, at a CAGR of 9.4 % over the forecast period.Textured Soy Protein Market Overview

Textured soy protein (TSP) is a processed food product manufactured from either soymeal flakes, soy flour, or soy protein concentrate. It can be uncolored or caramel color and contains at least 52 percent protein on a dry basis. The global trend toward healthier lifestyles and a preference for natural and organic products has boosted the demand for Textured Soy Proteins. Consumers are seeking nutritional supplements that align with their health goals.To know about the Research Methodology :- Request Free Sample Report The Textured Soy Protein market offers a variety of Textured Soy Protein products, including Protein powders, snacks, and oils. This diversity allows consumers to choose products that suit their preferences and dietary habits. Textured Soy Proteins are not limited to a specific geographical region. The market has a global presence, with consumers across different continents showing interest in these supplements. This Textured Soy Protein Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This Textured Soy Protein Market report showcases the Textured Soy Protein market situation with Dynamics, Market Segment, Regional Analysis, and Top competitor's Market Position.

Textured Soy Protein Market Dynamics

Animal care and welfare and Health-conscious consumers with Demand for plant-based diets driving the Textured Soy Protein Market A low-cost source of protein augmented soy crop farming in emerging regions such as South America and Asia Pacific, in addition to the already extensive cultivation of soybean across the globe, has increased the availability of soy products such as textured soy proteins. Raw materials for deriving textured soy protein are therefore easy to obtain from contract farmers or oilseed crushers offering soy meal. The low processing costs associated with textured soy proteins are suitable for the operational demands of manufacturers and thereby allow the processors to spend adequately on product development as a result of these trends the cost of textured soy protein is cheaper when as a result of these trends, the cost of textured soy protein is cheaper when compared to that of other protein sources such as meat, dairy, and whey proteins. Also, the prices of conventional dairy products have increased in the recent past, and textured soy protein, being one of the major plant sources of protein, is one of the most suitable alternatives considered in the textured soy protein market. Consumer awareness of the availability of low-cost protein is a crucial element driving the global textured soy protein market forward. Another significant factor expected to drive demand for textured soy protein in the global market is the growing vegan and vegetarian population. Consumer demand is increasing. Individuals' preference for high-protein foods is another aspect driving the target market's rise. Textured soy protein is utilized as a flavor binder in a variety of cuisines because it absorbs oil, preserves moisture, and has a better texture, all of which are factors that are expected to boost its demand in the food business. Growing consumer health consciousness is expected to drive the global textured soy protein market during the forecast period. Stringent government regulations for genetically modified crops and the cultivation of genetically modified crops may be hampered by government laws. It's a factor that could stifle the global textured soy protein market's growth. Still, the introduction of flavored soy protein and the rising demand for plant-based proteins could result in significant revenue growth for businesses in the target Textured Soy Protein market.Textured Soy Protein Market Segment Analysis:

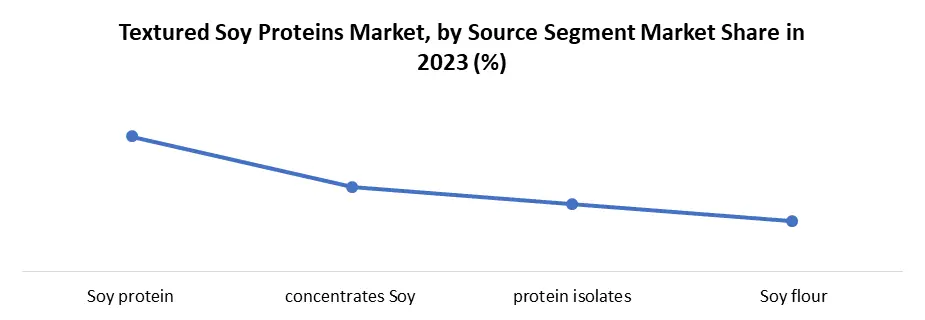

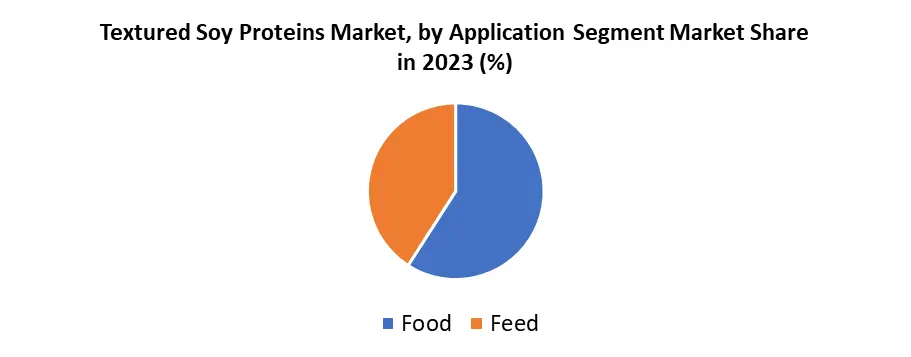

Based on product type, the global textured soy protein market is sub-segmented into non-gmo, conventional, and organic. The non-GMO segment held a huge market share of 55.8 % in 2023, owing to growing public consciousness of the dangers of genetically modified (GM) crops, as well as demand for non-GMO products is expected to boost market growth in the forecast period. Also, limitations on genetically modified soya beans in India, China, and other nations have increased demand for non-GMO crops. The organic segment is a second-dominant segment and it is expected to grow at a CAGR of XX% during the forecasting period. The growing demand for organic food products around the world is propelling this market forward. Demand for organic foods and beverages containing textured soy protein has risen as a result of people's hectic work schedules. Furthermore, as people become more health-conscious, there is a greater desire for items that are free of preservatives and additives. Based on application, the global textured soy protein market is sub-segmented into food, and feed. The food segment is the dominant segment and it held xx% of the share in 2023, owing to the growth in the number of vegan customers looking for plant-based proteins to replace meat. For healthy functioning, growth, reproduction, and metabolism, humans require a constant supply of proteins. As a result, nutritional diets with sufficient protein fibers are required in the food. As a result, the need for textured soy protein in food is increased. Soya proteins are a good source of complementary and additional proteins because they improve solubility, water absorption, viscosity, emulsification, texture, and anti-oxidation, which increases demand. Based on the source, the global textured soy protein market is sub-segmented into soy protein concentrates, soy protein isolates, and soy flour. The Soy protein concentrates segment held a large share of xx% in 2023, owing to being easily digestible, available in granule, low cost or cheaper, cholesterol-free, and spray-dried forms. They are appropriate for customers of all ages, including youngsters, pregnant and nursing ladies, and the elderly. The soy protein isolates segment was the second-largest in terms of volume because of its higher protein composition (90%), it helps to lose weight, boost energy, or build muscle. Soy protein isolate may also manage hormonal balance and lower the risk of breast cancer and heart disease. In terms of both value and volume, soy protein isolates are expected to grow at a CAGR of xx% during the forecast period.

Textured Soy Protein Market Regional Analysis

The North American market accounts for the major market share in terms of revenue and is expected to rapid growth during the estimated period. North America holds 41.32% share of the global market and demand for this region is increasing due to growing vegan adoption, combined with rising demand for vegan food products and rising soy production, particularly in emerging economies like China and India, which are driving the textured soy protein market's growth in this region. China is a major player in the global market for textured soy protein, processing 50% of the world's supply. The market is growing due to increased demand from health-conscious consumers, growing use in animal feed, and rising soybean production. The market is also expanding due to regional production of goods containing protein, and increasing exports. The Asia Pacific is expected to have the highest CAGR during the forecasting period of 2023-2029. The regional market is growing due to rising soya bean output and increased awareness of the health advantages of soya beans. China is one of the region's top consumers. It has a market share of more than 20% in the Asia Pacific region. India is a major producer and consumer of textured soy protein (TSP), also known as textured vegetable protein (TVP) or soy nuggets. TSP is made from defatted soy flour, a byproduct of soybean oil production. The flour is processed using an extrusion and drying process. The process involves de-hulling, flaking, extracting, desolventizing/drying, and grinding in a pneumatic mill to get a fine powder of white to creamish color. This powder is then passed through an extrusion and granulation system to obtain desired sizes, shapes, colors, and texture. The objective of the report is to present a comprehensive analysis of the global market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants.

Global Textured Soy Protein Market Scope: Inquire before buying

Global Textured Soy Protein Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.1 Bn. Forecast Period 2024 to 2030 CAGR: 9.4% Market Size in 2030: US $ 5.81 Bn. Segments Covered: by Product Non-GMO Conventional Organic by Application Food Feed by Source Soy protein concentrates Soy protein isolates Soy flour Global Textured Soy Protein Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Leading Textured Soy Protein Key Players Includes

1. ADM (USA) 2. Abbott Nutritionals (USA) 3. Bunge (USA) 4. Bremil Group (Brazil) 5. Cargill (USA) 6. Crown Soya Protein Group (China) 7. Roquette Frères (France) 8. Ingredion (US) 9. The Scoular Company (US) 10. Beneo (Germany) 11. DuPont de Nemours, Inc. (USA) 12. Wilmar International Limited (Singapore) 13. Victoria Group (Serbia) 14. LIVING FOODS. (India) 15. Sonic Biochem (India) Frequently Asked Questions in Textured Soy Proteins Market: 1. What is textured soy protein (TSP)? Ans: Textured soy protein is a versatile meat substitute made from soybeans. 2. What are the key factors driving the growth of the textured soy protein market? Ans: Factors such as increasing consumer preference for plant-based proteins, rising awareness about health benefits, and growth in the vegan population are driving the textured soy protein market. 3. What are the market trends and emerging developments in the textured soy protein industry? Ans: The key drivers include growing health consciousness, the rich nutrient profile of Moringa, rising demand for plant-based products, global availability, and diverse product formats. 4. What challenges does the Textured Soy Proteins Market face? Ans: Challenges include maintaining quality control and standardization, sourcing issues, regulatory compliance, and increasing competition and market saturation. 5. What opportunities exist in the Textured Soy Proteins Market? Ans: Opportunities include innovative product formulations, expansion into new markets, research and development, and partnerships and collaborations with other industry players.

1. Textured Soy Proteins Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Textured Soy Proteins Market: Dynamics 2.1. Textured Soy Proteins Market Trends by Region 2.1.1. North America Textured Soy Proteins Market Trends 2.1.2. Europe Textured Soy Proteins Market Trends 2.1.3. Asia Pacific Textured Soy Proteins Market Trends 2.1.4. Middle East and Africa Textured Soy Proteins Market Trends 2.1.5. South America Textured Soy Proteins Market Trends 2.2. Textured Soy Proteins Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Textured Soy Proteins Market Drivers 2.2.1.2. North America Textured Soy Proteins Market Restraints 2.2.1.3. North America Textured Soy Proteins Market Opportunities 2.2.1.4. North America Textured Soy Proteins Market Challenges 2.2.2. Europe 2.2.2.1. Europe Textured Soy Proteins Market Drivers 2.2.2.2. Europe Textured Soy Proteins Market Restraints 2.2.2.3. Europe Textured Soy Proteins Market Opportunities 2.2.2.4. Europe Textured Soy Proteins Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Textured Soy Proteins Market Drivers 2.2.3.2. Asia Pacific Textured Soy Proteins Market Restraints 2.2.3.3. Asia Pacific Textured Soy Proteins Market Opportunities 2.2.3.4. Asia Pacific Textured Soy Proteins Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Textured Soy Proteins Market Drivers 2.2.4.2. Middle East and Africa Textured Soy Proteins Market Restraints 2.2.4.3. Middle East and Africa Textured Soy Proteins Market Opportunities 2.2.4.4. Middle East and Africa Textured Soy Proteins Market Challenges 2.2.5. South America 2.2.5.1. South America Textured Soy Proteins Market Drivers 2.2.5.2. South America Textured Soy Proteins Market Restraints 2.2.5.3. South America Textured Soy Proteins Market Opportunities 2.2.5.4. South America Textured Soy Proteins Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Textured Soy Proteins Industry 2.8. Analysis of Government Schemes and Initiatives For Textured Soy Proteins Industry 2.9. Textured Soy Proteins Market Trade Analysis 2.10. The Global Pandemic Impact on Textured Soy Proteins Market 3. Textured Soy Proteins Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 3.1.1. Non-GMO 3.1.2. Conventional 3.1.3. Organic 3.2. Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 3.2.1. Food 3.2.2. Feed 3.3. Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 3.3.1. Soy protein concentrates 3.3.2. Soy protein isolates 3.3.3. Soy flour 3.4. Textured Soy Proteins Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Textured Soy Proteins Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 4.1.1. Non-GMO 4.1.2. Conventional 4.1.3. Organic 4.2. North America Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 4.2.1. Food 4.2.2. Feed 4.3. North America Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 4.3.1. Soy protein concentrates 4.3.2. Soy protein isolates 4.3.3. Soy flour 4.4. North America Textured Soy Proteins Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 4.4.1.1.1. Non-GMO 4.4.1.1.2. Conventional 4.4.1.1.3. Organic 4.4.1.2. United States Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Food 4.4.1.2.2. Feed 4.4.1.3. United States Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 4.4.1.3.1. Soy protein concentrates 4.4.1.3.2. Soy protein isolates 4.4.1.3.3. Soy flour 4.4.2. Canada 4.4.2.1. Canada Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 4.4.2.1.1. Non-GMO 4.4.2.1.2. Conventional 4.4.2.1.3. Organic 4.4.2.2. Canada Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Food 4.4.2.2.2. Feed 4.4.2.3. Canada Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 4.4.2.3.1. Soy protein concentrates 4.4.2.3.2. Soy protein isolates 4.4.2.3.3. Soy flour 4.4.3. Mexico 4.4.3.1. Mexico Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 4.4.3.1.1. Non-GMO 4.4.3.1.2. Conventional 4.4.3.1.3. Organic 4.4.3.2. Mexico Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Food 4.4.3.2.2. Feed 4.4.3.3. Mexico Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 4.4.3.3.1. Soy protein concentrates 4.4.3.3.2. Soy protein isolates 4.4.3.3.3. Soy flour 5. Europe Textured Soy Proteins Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 5.2. Europe Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 5.3. Europe Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 5.4. Europe Textured Soy Proteins Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 5.4.1.2. United Kingdom Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 5.4.2. France 5.4.2.1. France Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 5.4.2.2. France Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 5.4.3.2. Germany Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 5.4.4.2. Italy Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 5.4.5.2. Spain Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 5.4.6.2. Sweden Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 5.4.7.2. Austria Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 5.4.8.2. Rest of Europe Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 6. Asia Pacific Textured Soy Proteins Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 6.4. Asia Pacific Textured Soy Proteins Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 6.4.1.2. China Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 6.4.2.2. S Korea Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 6.4.3.2. Japan Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 6.4.4. India 6.4.4.1. India Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 6.4.4.2. India Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 6.4.5.2. Australia Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 6.4.6.2. Indonesia Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 6.4.7.2. Malaysia Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 6.4.8.2. Vietnam Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 6.4.9.2. Taiwan Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 6.4.10.2. Rest of Asia Pacific Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 7. Middle East and Africa Textured Soy Proteins Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 7.4. Middle East and Africa Textured Soy Proteins Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 7.4.1.2. South Africa Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 7.4.2.2. GCC Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Nigeria Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Rest of ME&A Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 8. South America Textured Soy Proteins Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 8.2. South America Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 8.3. South America Textured Soy Proteins Market Size and Forecast, by Source(2023-2030) 8.4. South America Textured Soy Proteins Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 8.4.1.2. Brazil Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 8.4.2.2. Argentina Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Textured Soy Proteins Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Rest Of South America Textured Soy Proteins Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Textured Soy Proteins Market Size and Forecast, by Source (2023-2030) 9. Global Textured Soy Proteins Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Textured Soy Proteins Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. ADM (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Abbott Nutritionals (USA) 10.3. Bunge (USA) 10.4. Bremil Group (Brazil) 10.5. Cargill (USA) 10.6. Crown Soya Protein Group (China) 10.7. Roquette Frères (France) 10.8. Ingredion (US) 10.9. The Scoular Company (US) 10.10. Beneo (Germany) 10.11. DuPont de Nemours, Inc. (USA) 10.12. Wilmar International Limited (Singapore) 10.13. Victoria Group (Serbia) 10.14. LIVING FOODS. (India) 10.15. Sonic Biochem (India) 11. Key Findings 12. Industry Recommendations 13. Textured Soy Proteins Market: Research Methodology 14. Terms and Glossary