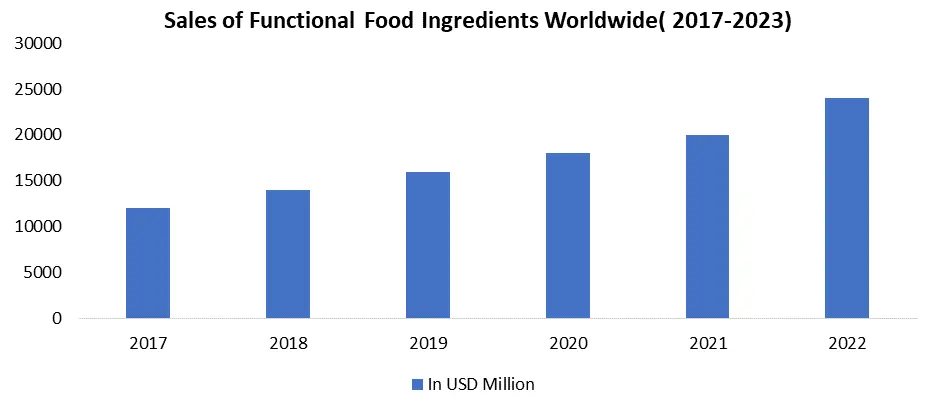

The Global Functional Ingredients Market size was valued at USD 97.9 Billion in 2022 and the total Functional Ingredients revenue is expected to grow at a CAGR of 6.9 % from 2023 to 2029, reaching nearly USD 156.18 Billion.Functional Ingredients Market Overview

A bioactive substance that is capable of being used in the production of functional food products is known as a functional ingredient. Plant-based proteins, botanical extracts, and superfoods are being combined into products to provide the increasing number of consumers adopting plant-centric lifestyles. As more people adopt plant-centric diets, the trend of integrating functional compounds derived from plants continues to rise. Vegetarian, vegan, and flexitarian lifestyles are becoming more popular, which is estimated to increase demand for plant-based products. There is expected to be a growing market for clean-label products with useful compounds derived from plants. Customers are going to give preference to goods with clear lists of components and no artificial additions, supporting the clean label movement overall. Developments in nutritional research are going to promote an integrated approach to health, focusing on the benefits of implementing several plant-based components that work effectively. Superfood blends are beneficial to customers who are looking for comprehensive health assistance because they are designed to address multiple aspects of well-being. The increased awareness and attention to health and wellness create a tremendous opportunity for functional additives. As information about the importance of a healthy lifestyle becomes more accessible, consumers are expected to become increasingly conscious of their well-being. Functional ingredients become integral components of daily dietary routines. As consumers recognize the long-term benefits of incorporating health-promoting ingredients, the market for functional ingredients will grow, becoming a standard part of consumers' everyday choices. The use of functional compounds is going to rise as health monitoring technologies advance. Customers who track their health using wearable technology and health apps are likely to search for solutions that support their objectives, which creates the Functional Ingredients market's continued growth.To know about the Research Methodology :- Request Free Sample Report

Functional Ingredients Market Dynamics

Preventive Healthcare Approach The growing awareness of the link between diet and health has led consumers to accept a preventive healthcare approach. The adoption of a preventive healthcare approach significantly contributes to the increased demand for products containing functional ingredients. Consumers are actively seeking out foods and beverages that not only provide basic nutrition but also offer health-promoting benefits, driving the growth of the functional ingredients market. The focus on preventative healthcare encourages innovation in the development of functional meals. Several Industries are investing in R&D to generate unique solutions that focus on specific health issues by integrating a variety of functional components with known benefits for health. The preventive healthcare approach is possible to continue as a central theme in consumer decision-making. As individuals prioritize health and well-being, the demand for functional ingredients persists, driving continued growth in the market. Preventive healthcare is expected to remain an important factor in consumer decision-making. As people focus on their health and well-being, the demand for functional ingredients is going to keep rising and driving the Functional Ingredients market growth in the forecast period. Technological advancements in food science and ingredient processing enable the creation of more stable and bioavailable formulations. This is capable of enhancing the efficacy of functional compounds in products, driving market growth substantially. Innovation in Product Development Continuous functional ingredient development boosts market competitiveness. Several Industries are actively investing in R&D to create unique and effective formulas to get advantages over their competitors. The ability to provide unique and innovative functional ingredients captures the interest of consumers and develops loyalty to the company. Innovations often involve technological advancements in ingredient processing and formulation. This not only improves the efficacy of functional ingredients but also enhances their stability, bioavailability, and other key characteristics. Technologically advanced solutions contribute to the overall quality of products. Nanotechnology has been applied to enhance the bioavailability of certain functional ingredients. For instance, Nanoemulsions of bioactive compounds such as curcumin or omega-3 fatty acids have been developed. These nanosized particles increase solubility and absorption, improving the bioavailability of these beneficial components in the body. Nutraceuticals and other combinations of food and drugs are growing in the Functional Ingredients market. Functional component innovations are capable of resulting in the development of nutraceutical products with preventive and therapeutic health benefits.Taste and Texture Optimization Functional additives, particularly those with health advantages, are capable of adding unusual flavors or sensations to products. It is difficult to balance the presence of these substances while keeping the required sensations of the ultimate product. Products in the Functional Ingredients market often compete based on different health advantages. Manufacturers are unable to differentiate their products if taste and texture optimization worries have not been properly addressed, causing a loss of market share. The primary objective of investing in research and development (R&D) for formulation optimization is to enhance the overall quality of products in the Functional Ingredients market. Implement natural and less processed materials into clean-label recipes. This enhances the product's all-around attractiveness by conforming to consumer tastes and developing a more authentic flavor and texture characteristic.

Trends Consumers Survey Results (%) Impact on Market Clean Label 85% High Plant-Based 78% High Sustainable Sourcing 72% High Functional Benefits 68% Medium Natural Ingredients 65% Medium Free-From Claims 60% Low Functional Ingredients Market Segment Analysis

By Type, Prebiotics and Probiotics segments dominate the Functional Ingredients market and are expected to grow during the forecast period. The prebiotics market is experiencing robust growth due to increasing awareness of gut health benefits. Consumer interest in functional foods and beverages that support digestive health is a primary driver. Increased consumer awareness translates to a better understanding of gut health. Consumers are learning about the intricate relationship between the gut microbiome, digestion, and overall well-being, creating a demand for products that support a healthy gut. The versatility of prebiotics allows their incorporation into various food and beverage products. As food manufacturers explore innovative ways to introduce prebiotics into a wide range of items, from dairy products to cereals, the market experiences diversification and growth. Ongoing research aims to identify new and diverse prebiotic compounds beyond commonly known ones like inulin and oligosaccharides. This research increases the variety of prebiotics available in the market also providing opportunities for innovative product formulations. NutraInnovations Corp., a leading player in the nutrition and wellness industry, has been the lead of prebiotic research. Researchers of NutraInnovations discovered a novel prebiotic compound derived from a lesser-known plant source. This discovery opens up opportunities for companies to include this unique prebiotic in functional foods, growing the Segment's diversity.

Functional Ingredients Market Regional Insights

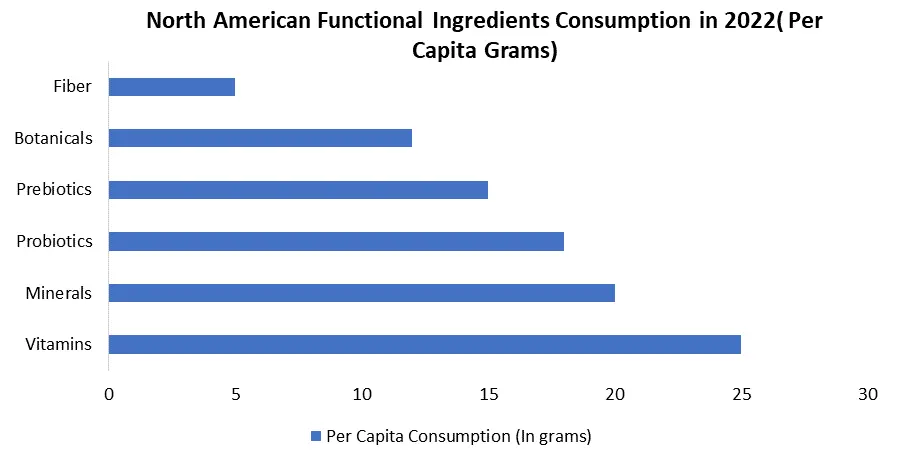

North America region held the largest market share in terms of revenue and dominated the global Functional Ingredients market in the forecast period. The North American region held the largest market share in terms of revenue and dominated the global Functional Ingredients market in the forecast period. Due to rising consumer demand for healthier and more functional food items, North America has a significant demand for functional ingredients. Growing health and well-being awareness among North American consumers has led to a preference for foods and beverages that contain functional ingredients. Rising consumer demand for products with functional components such as probiotics, antioxidants, and omega-3 fatty acids is a result of increased awareness of the influence of nutrition on health, which increases the Functional Ingredients Market. The food and beverage sector in the area is strong and constantly innovating to satisfy the needs of customers. Manufacturers are investing money in R&D to launch new goods with improved nutritional qualities. With the increasing importance on clean eating, companies are formulating products with fewer additives and preservatives. For example, a company launched a new line of snacks that uses natural sweeteners and minimal processing to demand of consumers who are looking for healthy and minimally processed options. Several Food Industries in Canada's Functional Ingredients market are increasingly identifying the value of indigenous ingredients that have been part of traditional diets for generations. This trend involves including unique elements such as certain berries or plant extracts with well-documented health benefits. Canadian Industries are expected to form relationships with local Indigenous people to harvest wild berries such as blueberries, lingonberries, and cloudberries sustainably. These berries are not only high in nutrition, but they are also a significant part of Indigenous diets and traditions. The consumption of indigenous substances offers Canadian Functional Ingredients businesses a possible competitive advantage in the international Functional Ingredients Market. Products with different cultural and nutritional profiles find the demand among global consumers seeking unique and health-conscious options.

Functional Ingredients Market Competitive Landscape

Ensuring the quality and purity of functional ingredients is crucial for competitiveness. Companies that prioritize sourcing high-quality ingredients and maintain stringent quality control processes build trust with consumers who prioritize clean, safe, and effective products. Consumers are becoming more aware of the environmental and moral effects of their shopping decisions. Companies that accept sustainability earn the trust and loyalty of environmentally conscientious customers. This trust promotes long-term customer connections as well as loyalty to a company. Sustainable and ethical sourcing sets companies apart in a crowded market. It provides a unique selling proposition that differentiates products and brands, attracting consumers who actively try to find products associated with their values. This differentiation has been a key factor in a competitive Functional Ingredients Market In May 2022, Cargill declared that it would sponsor Cubiq Foods' growth of alternative fat ingredients in the United States. Cubiq Foods regards Cargill as a significant partner, supplying critical components for its plant-based products. Cubiq Foods' investment is the first stage in a relationship that also involves a product development plan and a commercial agreement to market and distribute the company's products. As a result of the acquisition, Cubiq Foods will be able to expand its commercial and manufacturing activities in the United States and Europe, as well as offer new products to a larger client base.1. In November 2021, ADM acquired Deerland Probiotics & Enzymes to meet consumer demand for functional food ingredients through the development of innovative products.

2. In July 2021, the important player Kerry Group, an Irish-based food giant, declared that it was acquiring the company Biosearch Life for only $150 million. Furthermore, by acquiring this company, the corporation will be able to increase its line of healthy ingredients such as omega-3 and probiotics. The growth of its healthy component portfolio improves its functional foods and proactive health ingredient capabilities. Biosearch Life, on the other hand, is a biotechnology firm established in Spain that manufactures healthy natural substances such as Probiotics, Omega-3, and Botanical Extracts.

Functional Ingredients Market Scope: Inquiry Before Buying

Functional Ingredients Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 97.9 Bn. Forecast Period 2023 to 2029 CAGR: 6.9% Market Size in 2029: US $ 156.18 Bn. Segments Covered: by Type Prebiotics and Probiotics Antioxidants Proteins & amino acids Carotenoids Vitamins Minerals by Source Natural Synthetic by Application Food and Beverages Dietary Supplements Pharmaceuticals Functional Ingredients Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Functional Ingredients Market Key Manufacturer

1. Cargill (US) 2. Archer Daniels Midland Company (US) 3. Koninklijke DSM N.V. (Netherlands) 4. DowDuPont (US) 5. BASF SE (Germany) 6. Arla Foods (Denmark) 7. Royal Cosun (Netherlands) 8. Ingredion Incorporated (US) 9. Arla Foods (Denmark) 10. Tate & Lyle (US) 11. Ajinomoto (Japan) 12. Kerry Group (Ireland) 13. BENEO (Germany) 14. Chr. Hansen (Denmark) 15. Kemin Industries (US) 16.Roquette Frères (France) 17. Ingredion Incorporated 18. Golden Grain Group Limited 19. FMC Corporation 20. Omega Protein Corporation 21. NutriBioticFAQs:

1. What are the growth drivers for the Functional Ingredients market? Ans. The global importance of health and wellness has led consumers to try to find products that promote a healthy lifestyle. Functional ingredients, known for their potential health benefits, line up with this trend, driving market growth. 2. What is the major restraint for the Functional Ingredients market growth? Ans. Functional ingredients, especially those associated with health benefits, impart distinct tastes or textures to products. Balancing the incorporation of these ingredients with maintaining the desired sensory qualities of the end product poses a significant challenge. 3. Which region is expected to lead the global Functional Ingredients market during the forecast period? Ans. North America is expected to lead the global Functional Ingredients market during the forecast period. 4. What is the projected market size & growth rate of the Functional Ingredients Market? Ans. The Global Functional Ingredients Market size was valued at USD 97.9 Billion in 2022 and the total Functional Ingredients revenue is expected to grow at a CAGR of 6.9 % from 2023 to 2029, reaching nearly USD 156.18 Billion. 5. What segments are covered in the Functional Ingredients Market report? Ans. The segments covered in the Functional Ingredients market report are product Type, Source, and Application.

1. Functional Ingredients Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Functional Ingredients Market: Dynamics 2.1. Functional Ingredients Market Trends by Region 2.1.1. North America Functional Ingredients Market Trends 2.1.2. Europe Functional Ingredients Market Trends 2.1.3. Asia Pacific Functional Ingredients Market Trends 2.1.4. Middle East and Africa Functional Ingredients Market Trends 2.1.5. South America Functional Ingredients Market Trends 2.1.6. Preference Analysis 2.2. Functional Ingredients Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Functional Ingredients Market Drivers 2.2.1.2. North America Functional Ingredients Market Restraints 2.2.1.3. North America Functional Ingredients Market Opportunities 2.2.1.4. North America Functional Ingredients Market Challenges 2.2.2. Europe 2.2.2.1. Europe Functional Ingredients Market Drivers 2.2.2.2. Europe Functional Ingredients Market Restraints 2.2.2.3. Europe Functional Ingredients Market Opportunities 2.2.2.4. Europe Functional Ingredients Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Functional Ingredients Market Drivers 2.2.3.2. Asia Pacific Functional Ingredients Market Restraints 2.2.3.3. Asia Pacific Functional Ingredients Market Opportunities 2.2.3.4. Asia Pacific Functional Ingredients Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Functional Ingredients Market Drivers 2.2.4.2. Middle East and Africa Functional Ingredients Market Restraints 2.2.4.3. Middle East and Africa Functional Ingredients Market Opportunities 2.2.4.4. Middle East and Africa Functional Ingredients Market Challenges 2.2.5. South America 2.2.5.1. South America Functional Ingredients Market Drivers 2.2.5.2. South America Functional Ingredients Market Restraints 2.2.5.3. South America Functional Ingredients Market Opportunities 2.2.5.4. South America Functional Ingredients Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Regulatory Landscape by Region 2.5.1. North America 2.5.2. Europe 2.5.3. Asia Pacific 2.5.4. Middle East and Africa 2.5.5. South America 2.6. Key Opinion Leader Analysis for Functional Ingredients Industry 2.7. Analysis of Government Schemes and Initiatives for Functional Ingredients Industry 3. Functional Ingredients Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2022-2029) 3.1. Functional Ingredients Market Size and Forecast, by Type (2022-2029) 3.1.1. Prebiotics and Probiotics 3.1.2. Antioxidants 3.1.3. Proteins & amino acids 3.1.4. Carotenoids 3.1.5. Vitamins 3.1.6. Minerals 3.2. Functional Ingredients Market Size and Forecast, by Source (2022-2029) 3.2.1. Natural 3.2.2. Synthetic 3.3. Functional Ingredients Market Size and Forecast, by Application (2022-2029) 3.3.1. Food and Beverages 3.3.2. Dietary supplements 3.3.3. Pharmaceuticals 3.4. Functional Ingredients Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Functional Ingredients Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. North America Functional Ingredients Market Size and Forecast, by Type (2022-2029) 4.1.1. Prebiotics and Probiotics 4.1.2. Antioxidants 4.1.3. Proteins & amino acids 4.1.4. Carotenoids 4.1.5. Vitamins 4.1.6. Minerals 4.2. North America Functional Ingredients Market Size and Forecast, by Source (2022-2029) 4.2.1. Natural 4.2.2. Synthetic 4.3. North America Functional Ingredients Market Size and Forecast, by Application (2022-2029) 4.3.1. Food and Beverages 4.3.2. Dietary supplements 4.3.3. Pharmaceuticals 4.4. North America Functional Ingredients Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Functional Ingredients Market Size and Forecast, by Type (2022-2029) 4.4.1.1.1. Prebiotics and Probiotics 4.4.1.1.2. Antioxidants 4.4.1.1.3. Proteins & amino acids 4.4.1.1.4. Carotenoids 4.4.1.1.5. Vitamins 4.4.1.1.6. Minerals 4.4.1.2. United States Functional Ingredients Market Size and Forecast, by Source (2022-2029) 4.4.1.2.1. Natural 4.4.1.2.2. Synthetic 4.4.1.3. United States Functional Ingredients Market Size and Forecast, by Application (2022-2029) 4.4.1.3.1. Food and Beverages 4.4.1.3.2. Dietary supplements 4.4.1.3.3. Pharmaceuticals 4.4.2. Canada 4.4.2.1. Canada Functional Ingredients Market Size and Forecast, by Type (2022-2029) 4.4.2.1.1. Prebiotics and Probiotics 4.4.2.1.2. Antioxidants 4.4.2.1.3. Proteins & amino acids 4.4.2.1.4. Carotenoids 4.4.2.1.5. Vitamins 4.4.2.1.6. Minerals 4.4.2.2. Canada Functional Ingredients Market Size and Forecast, by Source (2022-2029) 4.4.2.2.1. Natural 4.4.2.2.2. Synthetic 4.4.2.3. Canada Functional Ingredients Market Size and Forecast, by Application (2022-2029) 4.4.2.3.1. Food and Beverages 4.4.2.3.2. Dietary supplements 4.4.2.3.3. Pharmaceuticals 4.4.3. Mexico 4.4.3.1. Mexico Functional Ingredients Market Size and Forecast, by Type (2022-2029) 4.4.3.1.1. Prebiotics and Probiotics 4.4.3.1.2. Antioxidants 4.4.3.1.3. Proteins & amino acids 4.4.3.1.4. Carotenoids 4.4.3.1.5. Vitamins 4.4.3.1.6. Minerals 4.4.3.2. Mexico Functional Ingredients Market Size and Forecast, by Source (2022-2029) 4.4.3.2.1. Natural 4.4.3.2.2. Synthetic 4.4.3.3. Mexico Functional Ingredients Market Size and Forecast, by Application (2022-2029) 4.4.3.3.1. Food and Beverages 4.4.3.3.2. Dietary supplements 4.4.3.3.3. Pharmaceuticals 5. Europe Functional Ingredients Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. Europe Functional Ingredients Market Size and Forecast, by Type (2022-2029) 5.2. Europe Functional Ingredients Market Size and Forecast, by Source (2022-2029) 5.3. Europe Functional Ingredients Market Size and Forecast, by Application (2022-2029) 5.4. Europe Functional Ingredients Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Functional Ingredients Market Size and Forecast, by Type (2022-2029) 5.4.1.2. United Kingdom Functional Ingredients Market Size and Forecast, by Source (2022-2029) 5.4.1.3. United Kingdom Functional Ingredients Market Size and Forecast, by Application (2022-2029) 5.4.2. France 5.4.2.1. France Functional Ingredients Market Size and Forecast, by Type (2022-2029) 5.4.2.2. France Functional Ingredients Market Size and Forecast, by Source (2022-2029) 5.4.2.3. France Functional Ingredients Market Size and Forecast, by Application (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Functional Ingredients Market Size and Forecast, by Type (2022-2029) 5.4.3.2. Germany Functional Ingredients Market Size and Forecast, by Source (2022-2029) 5.4.3.3. Germany Functional Ingredients Market Size and Forecast, by Application (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Functional Ingredients Market Size and Forecast, by Type (2022-2029) 5.4.4.2. Italy Functional Ingredients Market Size and Forecast, by Source (2022-2029) 5.4.4.3. Italy Functional Ingredients Market Size and Forecast, by Application (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Functional Ingredients Market Size and Forecast, by Type (2022-2029) 5.4.5.2. Spain Functional Ingredients Market Size and Forecast, by Source (2022-2029) 5.4.5.3. Spain Functional Ingredients Market Size and Forecast, by Application (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Functional Ingredients Market Size and Forecast, by Type (2022-2029) 5.4.6.2. Sweden Functional Ingredients Market Size and Forecast, by Source (2022-2029) 5.4.6.3. Sweden Functional Ingredients Market Size and Forecast, by Application (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Functional Ingredients Market Size and Forecast, by Type (2022-2029) 5.4.7.2. Austria Functional Ingredients Market Size and Forecast, by Source (2022-2029) 5.4.7.3. Austria Functional Ingredients Market Size and Forecast, by Application (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Functional Ingredients Market Size and Forecast, by Type (2022-2029) 5.4.8.2. Rest of Europe Functional Ingredients Market Size and Forecast, by Source (2022-2029) 5.4.8.3. Rest of Europe Functional Ingredients Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Functional Ingredients Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Functional Ingredients Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Functional Ingredients Market Size and Forecast, by Source (2022-2029) 6.3. Asia Pacific Functional Ingredients Market Size and Forecast, by Application (2022-2029) 6.4. Asia Pacific Functional Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.1. China 6.4.1.1. China Functional Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.1.2. China Functional Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.1.3. China Functional Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Functional Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.2.2. S Korea Functional Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.2.3. S Korea Functional Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Functional Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.3.2. Japan Functional Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.3.3. Japan Functional Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.4. India 6.4.4.1. India Functional Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.4.2. India Functional Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.4.3. India Functional Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Functional Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.5.2. Australia Functional Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.5.3. Australia Functional Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Functional Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.6.2. Indonesia Functional Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.6.3. Indonesia Functional Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Functional Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.7.2. Malaysia Functional Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.7.3. Malaysia Functional Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Functional Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.8.2. Vietnam Functional Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.8.3. Vietnam Functional Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Functional Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.9.2. Taiwan Functional Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.9.3. Taiwan Functional Ingredients Market Size and Forecast, by Application (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Functional Ingredients Market Size and Forecast, by Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Functional Ingredients Market Size and Forecast, by Source (2022-2029) 6.4.10.3. Rest of Asia Pacific Functional Ingredients Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa Functional Ingredients Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 7.1. Middle East and Africa Functional Ingredients Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Functional Ingredients Market Size and Forecast, by Source (2022-2029) 7.3. Middle East and Africa Functional Ingredients Market Size and Forecast, by Application (2022-2029) 7.4. Middle East and Africa Functional Ingredients Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Functional Ingredients Market Size and Forecast, by Type (2022-2029) 7.4.1.2. South Africa Functional Ingredients Market Size and Forecast, by Source (2022-2029) 7.4.1.3. South Africa Functional Ingredients Market Size and Forecast, by Application (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Functional Ingredients Market Size and Forecast, by Type (2022-2029) 7.4.2.2. GCC Functional Ingredients Market Size and Forecast, by Source (2022-2029) 7.4.2.3. GCC Functional Ingredients Market Size and Forecast, by Application (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Functional Ingredients Market Size and Forecast, by Type (2022-2029) 7.4.3.2. Nigeria Functional Ingredients Market Size and Forecast, by Source (2022-2029) 7.4.3.3. Nigeria Functional Ingredients Market Size and Forecast, by Application (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Functional Ingredients Market Size and Forecast, by Type (2022-2029) 7.4.4.2. Rest of ME&A Functional Ingredients Market Size and Forecast, by Source (2022-2029) 7.4.4.3. Rest of ME&A Functional Ingredients Market Size and Forecast, by Application (2022-2029) 8. South America Functional Ingredients Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 8.1. South America Functional Ingredients Market Size and Forecast, by Type (2022-2029) 8.2. South America Functional Ingredients Market Size and Forecast, by Source (2022-2029) 8.3. South America Functional Ingredients Market Size and Forecast, by Application (2022-2029) 8.4. South America Functional Ingredients Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Functional Ingredients Market Size and Forecast, by Type (2022-2029) 8.4.1.2. Brazil Functional Ingredients Market Size and Forecast, by Source (2022-2029) 8.4.1.3. Brazil Functional Ingredients Market Size and Forecast, by Application (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Functional Ingredients Market Size and Forecast, by Type (2022-2029) 8.4.2.2. Argentina Functional Ingredients Market Size and Forecast, by Source (2022-2029) 8.4.2.3. Argentina Functional Ingredients Market Size and Forecast, by Application (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Functional Ingredients Market Size and Forecast, by Type (2022-2029) 8.4.3.2. Rest Of South America Functional Ingredients Market Size and Forecast, by Source (2022-2029) 8.4.3.3. Rest Of South America Functional Ingredients Market Size and Forecast, by Application (2022-2029) 9. Global Functional Ingredients Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. SKU Details 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Functional Ingredients Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Cargill (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Archer Daniels Midland Company (US) 10.3. Koninklijke DSM N.V. (Netherlands) 10.4. DowDuPont (US) 10.5. BASF SE (Germany) 10.6. Arla Foods (Denmark) 10.7. Royal Cosun (Netherlands) 10.8. Ingredion Incorporated (US) 10.9. Arla Foods (Denmark) 10.10. Tate & Lyle (US) 10.11. Ajinomoto (Japan) 10.12. Kerry Group (Ireland) 10.13. BENEO (Germany) 10.14. Chr. Hansen (Denmark) 10.15. Kemin Industries (US) 10.16. Roquette Frères (France) 10.17. Ingredion Incorporated 10.18. Golden Grain Group Limited 10.19. FMC Corporation 10.20. Omega Protein Corporation 10.21. NutriBiotic 11. Key Findings 12. Industry Recommendations 13. Functional Ingredients Market: Research Methodology