The Nachos Market size was valued at USD 1.93 Bn in 2025 and the total Nachos revenue is expected to grow at a CAGR of 6.5% from 2025 to 2032, reaching nearly USD 3.01 Bn by 2032.Nachos Market Overview

Nachos are a popular Mexican-inspired snack or appetizer that typically consists of tortilla chips served with a variety of toppings. The dish originated in Mexico and has become widely enjoyed around the world. As health and wellness become more significant considerations for consumers, there is a growing demand for healthier nacho options. Producers are responding by introducing whole-grain nachos, organic varieties, and options with reduced sodium, catering to health-conscious consumers without compromising on taste. Sustainability is a trend influencing various food markets, including nachos. Producers are adopting sustainable practices in sourcing ingredients, packaging, and production processes. In recent years, the nachos industry has grown significantly, owing to a combination of cultural influences, snacking trends, and creative product options. Flavour and a variety of innovations have been critical in developing the nachos business. Factors such as cultural preferences, lifestyle trends, and the influence of global flavors may impact the dominance of a North American region in the nachos market. The popularity of nachos in the North American region influences global consumer preferences, with other regions looking to adopt similar flavors and styles. As consumer preferences continue to evolve globally, opportunities may arise for increased market share in regions where nachos are gaining popularity. The rise of snacking culture, driven by busy lifestyles, contributes to the growth of the nachos market. Nachos, with their moveable and shareable nature, align well with the demand for on-the-go snacking options.To know about the Research Methodology :- Request Free Sample Report

Nachos Market Dynamics

Nacho producers are continuously introducing new and innovative Flavors and varieties The introduction of new flavors and varieties creates excitement and interest among consumers. This leads to increased engagement as individuals seek out and try the latest and most innovative nacho options. This Rapid environment encourages repeat purchases and brand loyalty. Innovative nacho flavors appeal to a broader range of consumers with diverse taste preferences. By offering options that go beyond traditional flavors, nacho producers can attract new customers who may be looking for unique and novel snacking experiences. The Innovation in nacho flavors has significantly contributed to the overall growth of the nachos market. Nacho producers have been responding to evolving dietary trends, such as the demand for plant-based and healthier snack options. Mexico has continuously introduced the new flavor of nachos. Mexico is the world's largest producer and consumer of nachos with a market share of over 70%. In 2021, Mexico produces almost 1 million tons of nachos. And exports to over 100 countries around the world. Also, tortilla chips, melted cheese, and various toppings are widely enjoyed in Mexico. Mexican culinary traditions have significantly influenced the global nachos scene. The combination of flavors and textures in traditional Mexican dishes, such as guacamole, salsa, and various kinds of cheese, has inspired innovative nacho variations around the world. The tortilla/tostada chip category had another strong performance in 2025 growing both dollar and unit sales. Unit sales grew 2.1% to 2.4 billion units, while dollar sales had an impressive 19.1% growth resulting in $8 billion. The primary factors driving revenue growth in the nachos market include the rising demand for handy and Savory snacks, the growing popularity of Mexican cuisine, and the introduction of new and novel flavors and toppings. Furthermore, the COVID-19 widespread has changed customer tastes toward packaged shelf-stable snack options, which has increased sales of nachos and other comparable goods.Nachos Exported by Mexico to Different Countries (In 2022)

Growing Online Food Delivery Services The proliferation of online food delivery services has expanded the reach of nacho products. Consumers can easily order nachos from their favorite restaurants or food platforms, contributing to the market's growth. Customers can order nachos from their favorite local restaurants or popular chains without the need to visit the physical location, enhancing overall accessibility. Nacho producers that adapt to these trends and make their products available through online platforms can better meet the evolving needs of consumers. The United States has a well-established and widespread online food delivery ecosystem. Many consumers in the United States regularly use platforms such as DoorDash, Uber Eats, Grubhub, and others to order a variety of foods, including nachos, for home delivery. Online food delivery services enable nacho producers to reach consumers not only locally but also on a global scale. This expanded reach contributes to the globalization of food trends, including the consumption of nachos in various regions.

Countries All Over the world Nachos Exported (In Tons) United States 150,000 United Kingdom 50,000 Canada 40,000 Japan 30,000 Germany 25,000 France 20,000 Spain 15,000 Italy 10,000 China 5,000 The demand for healthier snacks is on the rise The increasing demand for healthier snacks presents a significant opportunity for the nachos market to evolve and cater to the preferences of health-conscious consumers. Create nacho products using whole-grain ingredients to offer a healthier alternative. Whole grains provide additional fiber and nutrients, aligning with the preferences of health-conscious consumers. Enhance the nutritional profile of nachos by incorporating nutrient-rich toppings such as fresh vegetables, lean proteins, and ingredients with functional benefits. This adds a healthful element to the snack. The United States and many European countries have witnessed a growing demand for healthier snack options. They focus on natural and organic ingredients, as well as reduced salt and fat content, which aligns with the preferences of European consumers. Explore healthier cooking methods for nacho preparation, such as baking or air frying. This can reduce the overall fat content while maintaining the desired crunch and flavor. Healthy cooking methods help to preserve the nutritional content of nacho ingredients including whole-grain chips and fresh toppings. This ensures that consumers can enjoy a snack that is not only tasty but also beneficial to their general health. Producer's acceptance of these methods not only meets the demand for healthier snacks but also positions themselves at the lead of a market driven by both flavor and nutritional considerations. As the nacho market continues to grow, leveraging these healthier cooking methods presents a convincing opportunity for sustained growth and consumer loyalty.

Managing Fluctuating Ingredient Prices in the Nachos Industry The nachos industry faces a persistent challenge in managing the impact of fluctuating ingredient prices, notably for key components such as corn, cheese, and toppings. Fluctuations in the prices of essential ingredients create uncertainty in production costs, impacting the overall financial stability of nacho producers. Changeable weather conditions, including droughts or excessive rainfall, can lead to variations in corn yield. This variability poses challenges for nacho producers in maintaining a consistent and reliable supply of high-quality corn. Establishing relationships with corn suppliers in diverse geographic regions helps mitigate the impact of localized weather events. Diversification provides flexibility in sourcing, reducing vulnerability to region-specific weather challenges. Collaborating with corn farmers to implement climate-resilient agricultural practices helps mitigate the impact of weather-related risks. Techniques such as precision farming and drought-resistant crop varieties enhance the resilience of the corn supply chain. Establishing relationships with multiple suppliers for key ingredients can mitigate the impact of supply chain disruptions. Diversification provides flexibility in sourcing, reducing vulnerability to fluctuations from a single supplier. Conducting regular audits and closely monitoring the performance of each supplier helps maintain accountability. Nacho producers have identified and addressed potential issues before they escalate, ensuring a reliable and resilient supply chain.

Nachos Market Segment Analysis

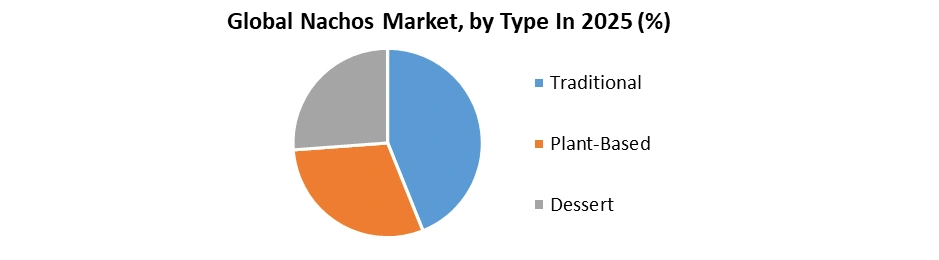

By Type, Traditional nachos, characterized by the classic combination of tortilla chips, melted cheese, and standard toppings like salsa, guacamole, and jalapeños, hold a significant position in the nachos market. Traditional nachos hold cultural significance as a staple in Mexican cuisine. The authenticity of this classic preparation contributes to its appeal, attracting consumers who seek an authentic and traditional nacho experience. Nacho producers can strategically balance tradition and innovation by offering classic nachos alongside new and creative variations. This approach caters to various consumer preferences and ensures a comprehensive product lineup. Vegan and plant-based nachos represent a significant evolution in the nachos market, responding to the growing demand for vegan and vegetarian options. The rise of vegan and plant-based nachos marks a pivotal moment in the nacho industry, reflecting the broader shift towards plant-centric eating. The United States has seen a significant increase in the popularity of plant-based foods, including nachos. Cities with vibrant food scenes, such as Los Angeles, New York, and San Francisco, often see a higher demand for innovative and diverse plant-based options, including plant-based nachos. Introduce new flavors, textures, and presentations to cater to diverse taste preferences. This current innovation keeps the product line fresh and aligns with consumer expectations for variety and excitement. Dessert nachos contribute significantly to the diversification of the nacho market. By introducing a sweet variant, producers cater to a broader audience that seeks innovative and indulgent snacking experiences beyond the Savory norm. Strategic associations, new taste combinations, and targeted advertising initiatives have optimized the influence of dessert nachos on market Nachos growth.

Regional Insights of Nachos Market

In North America, the nachos market is well established, particularly in the United States, Mexico, and Canada. North America is the largest market for nachos, accounting for over 58 % of global sales. The popularity of nachos in North America is driven by several factors, including the convenience of the food, the wide variety of nacho flavors available, and the popularity of Mexican cuisine. The popularity of nachos is deeply rooted in the cultural affinity for Mexican cuisine. Innovations such as loaded nachos with diverse toppings and plant-based options contribute to market growth. Mexico is the birthplace of nachos, it has a strong and traditional market for this snack. Street food vendors play a crucial role in shaping the nachos market in Mexico. Nachos are often available as a convenient and flavorful street food option, making them accessible to locals and tourists alike. The street food culture contributes to the social and casual enjoyment of nachos. The nachos Industry is a significant source of employment. The industry directly employs over 100,000 people and indirectly employs many more. The nacho industry also contributes significantly to the Mexican economy. In 2021, the nacho industry generated over $5 billion in revenue. Several factors contribute to Mexico’s dominance in the nacho market. for example, Mexico has a long and rich heritage of manufacturing and consuming corn tortillas, the essential ingredient in nachos. In addition, Mexico's climate is great for cultivating chili peppers, which are a popular topping for nachos. These factors mainly influence Nacho production and market growth in Mexico. In European countries, nachos have gained popularity as part of the broader trend of embracing global cuisines. Plant-based and gourmet food has grown in popularity in the United Kingdom. Nachos, particularly ones with unique toppings and high-quality ingredients, may find a niche appeal among the health-conscious and food-obsessed populations. Nachos have become a popular snack and taste in British cooking, with variations that provide to local tastes. They are often enjoyed in pubs, restaurants, and casual dining settings. European consumers have shown a strong demand for variety and novelty in their food choices. The globalization of food culture and increased exposure to international foods through travel and digital media have exposed European consumers to the demand for nachos. This global influence has played a significant role in driving the Nachos market boost. As the market continues to boost, businesses and producers in Europe are well-positioned to capitalize on the continuing popularity of nachos by offering innovative variations and staying attuned to growing consumer tastes.Competitive Landscape of Nacho Market The nacho market is characterized by continuous product innovation and a wide variety of offerings. Companies differentiate themselves by introducing new flavors, textures, and ingredient combinations. Innovations may include specialty nachos, healthier alternatives, and unique seasoning blends. Nachos are widely popular in the food service and hospitality industry, including restaurants, cinemas, stadiums, and entertainment venues. Establishing partnerships with these outlets is essential for brands to increase their reach and grow sales in the nacho market. 1. In February 2022, Frito-Lay North America, a division of PepsiCo, Inc., partnered with professional basketball player LeBron James to launch Ruffles Flamin' Hot Cheddar & Sour Cream flavored potato chips. The mashup puts a fiery spin on the brand's most well-known flavor and is the newest addition to Frito-Lay's Flamin' Hot family. 2. In December 2020, DeFrito-Lay released a 'Make Your Own' Variety Pack highlight on its direct-to-consumer website, Snacks.com. It allows customers to personalize their Frito-Lay Variety Pack (FLVP) to meet their snacking needs when shopping online. The growth of e-commerce and online food delivery platforms provides additional paths for nacho brands to reach consumers. Brands that invest in online visibility and partnerships with delivery services can tap into the convenience-oriented consumer base. Brands that offer a balance between quality and affordability can attract a wide range of consumers.

Nachos Market Scope: Inquire Before Buying

Global Nachos Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 1.93 Bn. Forecast Period 2026 to 2032 CAGR: 6.5% Market Size in 2032: USD 3.01 Bn. Segments Covered: by Type Traditional Plant-Based Dessert by Distribution Channel Retail Stores E-commerce Platforms by Application Restaurant Household Nachos Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Manufactures of Nachos

1. Pringles 2. Frito Lay 3. Grupo Bimbo 4. Cornitos 5. Nacho King 6. Conagra Brands 7. General Mills. 8. Late July Snacks 9. Ricos 10. Cornitos 11. Vans Foods 12. Gehls FAQs: 1. What is the study period of the market? Ans. The Global Nachos Market is studied from 2025-2032. 2. What is the growth rate of the Nachos Market? Ans. The Nachos Market is growing at a CAGR of 6.5 % over the forecast period. 3. What is the market size of the Nachos Market by 2032? Ans. The market size of the Nachos Market by 2032 is expected to reach USD 3.01 Bn. 4. What is the forecast period for the Nachos Market? Ans. The forecast period for the Nachos Market is 2026-2032. 5. What was the market size of the Nachos Market in 2025? Ans. The market size of the Nachos Market in 2025 was valued at USD 1.93 Bn.

1. Nachos Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Nachos Market: Dynamics 2.1. Nachos Market Trends by Region 2.1.1. Global Nachos Market Trends 2.1.2. North America Nachos Market Trends 2.1.3. Europe Nachos Market Trends 2.1.4. Asia Pacific Nachos Market Trends 2.1.5. Middle East and Africa Nachos Market Trends 2.1.6. South America Nachos Market Trends 2.1.7. Preference Analysis 2.2. Nachos Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Nachos Market Drivers 2.2.1.2. North America Nachos Market Restraints 2.2.1.3. North America Nachos Market Opportunities 2.2.1.4. North America Nachos Market Challenges 2.2.2. Europe 2.2.2.1. Europe Nachos Market Drivers 2.2.2.2. Europe Nachos Market Restraints 2.2.2.3. Europe Nachos Market Opportunities 2.2.2.4. Europe Nachos Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Nachos Market Drivers 2.2.3.2. Asia Pacific Nachos Market Restraints 2.2.3.3. Asia Pacific Nachos Market Opportunities 2.2.3.4. Asia Pacific Nachos Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Nachos Market Drivers 2.2.4.2. Middle East and Africa Nachos Market Restraints 2.2.4.3. Middle East and Africa Nachos Market Opportunities 2.2.4.4. Middle East and Africa Nachos Market Challenges 2.2.5. South America 2.2.5.1. South America Nachos Market Drivers 2.2.5.2. South America Nachos Market Restraints 2.2.5.3. South America Nachos Market Opportunities 2.2.5.4. South America Nachos Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Key Opinion Leader Analysis for Nacho Industry 2.9. Analysis of Government Schemes and Initiatives for Nachos Industry 2.10. The Global Pandemic Impact on Nachos Market 2.11. Nachos Price Trend Analysis (2021-22) 2.12. Global Nachos Market Trade Analysis (2017-2022) 2.12.1. Global Import of Nachos 2.12.1.1. Ten Largest Importer 2.12.2. Global Export of Nachos 2.12.3. Ten Largest Exporter 2.13. Production Capacity Analysis 2.13.1. Chapter Overview 2.13.2. Key Assumptions and Methodology 2.13.3. Nachos Manufacturers: Global Installed Capacity 3. Nachos Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2025-2032) 3.1. Nachos Market Size and Forecast, by Type (2025-2032) 3.1.1. Traditional 3.1.2. Plant-Based 3.1.3. Dessert 3.2. Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 3.2.1. Retail Stores 3.2.2. E-Commerce Platforms 3.3. Nachos Market Size and Forecast, by Application (2025-2032) 3.3.1. Restaurant 3.3.2. Household 3.4. Nachos Market Size and Forecast, by Region (2025-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Nachos Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2025-2032) 4.1. North America Nachos Market Size and Forecast, by Type (2025-2032) 4.1.1. Traditional 4.1.2. Plant-Based 4.1.3. Dessert 4.2. North America Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 4.2.1. Retail Stores 4.2.2. E-Commerce Platforms 4.3. North America Nachos Market Size and Forecast, by Application (2025-2032) 4.3.1. Restaurant 4.3.2. Household 4.4. North America Nachos Market Size and Forecast, by Country (2025-2032) 4.4.1. United States 4.4.1.1. United States Nachos Market Size and Forecast, by Type (2025-2032) 4.4.1.1.1. Traditional 4.4.1.1.2. Plant-Based 4.4.1.2. Dessert United States Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 4.4.1.2.1. Retail Stores 4.4.1.2.2. E-Commerce Platforms 4.4.1.3. United States Nachos Market Size and Forecast, by Application (2025-2032) 4.4.1.3.1. Restaurant 4.4.1.3.2. Household 4.4.2. Canada 4.4.2.1. Canada Nachos Market Size and Forecast, by Type (2025-2032) 4.4.2.1.1. Foundation 4.4.2.1.2. Concealer 4.4.2.1.3. Powder 4.4.2.1.4. Others 4.4.2.2. Canada Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 4.4.2.2.1. Retail Stores 4.4.2.2.2. E-Commerce Platforms 4.4.2.3. Canada Nachos Market Size and Forecast, by Application (2025-2032) 4.4.2.3.1. Restaurant 4.4.2.3.2. Household 4.4.3. Mexico 4.4.3.1. Mexico Nachos Market Size and Forecast, by Type (2025-2032) 4.4.3.1.1. Foundation 4.4.3.1.2. Concealer 4.4.3.1.3. Powder 4.4.3.1.4. Others 4.4.3.2. Mexico Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 4.4.3.2.1. Retail Stores 4.4.3.2.2. E-Commerce Platforms 4.4.3.3. Mexico Nachos Market Size and Forecast, by Application (2025-2032) 4.4.3.3.1. Restaurant 4.4.3.3.2. Household 5. Europe Nachos Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2025-2032) 5.1. Europe Nachos Market Size and Forecast, by Type (2025-2032) 5.2. Europe Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 5.3. Europe Nachos Market Size and Forecast, by Application (2025-2032) 5.4. Europe Nachos Market Size and Forecast, by Country (2025-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Nachos Market Size and Forecast, by Type (2025-2032) 5.4.1.2. United Kingdom Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.1.3. United Kingdom Nachos Market Size and Forecast, by Application (2025-2032) 5.4.2. France 5.4.2.1. France Nachos Market Size and Forecast, by Type (2025-2032) 5.4.2.2. France Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.2.3. France Nachos Market Size and Forecast, by Application (2025-2032) 5.4.3. Germany 5.4.3.1. Germany Nachos Market Size and Forecast, by Type (2025-2032) 5.4.3.2. Germany Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.3.3. Germany Nachos Market Size and Forecast, by Application (2025-2032) 5.4.4. Italy 5.4.4.1. Italy Nachos Market Size and Forecast, by Type (2025-2032) 5.4.4.2. Italy Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.4.3. Italy Nachos Market Size and Forecast, by Application (2025-2032) 5.4.5. Spain 5.4.5.1. Spain Nachos Market Size and Forecast, by Type (2025-2032) 5.4.5.2. Spain Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.5.3. Spain Nachos Market Size and Forecast, by Application (2025-2032) 5.4.6. Sweden 5.4.6.1. Sweden Nachos Market Size and Forecast, by Type (2025-2032) 5.4.6.2. Sweden Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.6.3. Sweden Nachos Market Size and Forecast, by Application (2025-2032) 5.4.7. Austria 5.4.7.1. Austria Nachos Market Size and Forecast, by Type (2025-2032) 5.4.7.2. Austria Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.7.3. Austria Nachos Market Size and Forecast, by Application (2025-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Nachos Market Size and Forecast, by Type (2025-2032) 5.4.8.2. Rest of Europe Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 5.4.8.3. Rest of Europe Nachos Market Size and Forecast, by Application (2025-2032) 6. Asia Pacific Nachos Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2025-2032) 6.1. Asia Pacific Nachos Market Size and Forecast, by Type (2025-2032) 6.2. Asia Pacific Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 6.3. Asia Pacific Nachos Market Size and Forecast, by Application (2025-2032) 6.4. Asia Pacific Nachos Market Size and Forecast, by Country (2025-2032) 6.4.1. China 6.4.1.1. China Nachos Market Size and Forecast, by Type (2025-2032) 6.4.1.2. China Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.1.3. China Nachos Market Size and Forecast, by Application (2025-2032) 6.4.2. S Korea 6.4.2.1. S Korea Nachos Market Size and Forecast, by Type (2025-2032) 6.4.2.2. S Korea Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.2.3. S Korea Nachos Market Size and Forecast, by Application (2025-2032) 6.4.3. Japan 6.4.3.1. Japan Nachos Market Size and Forecast, by Type (2025-2032) 6.4.3.2. Japan Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.3.3. Japan Nachos Market Size and Forecast, by Application (2025-2032) 6.4.4. India 6.4.4.1. India Nachos Market Size and Forecast, by Type (2025-2032) 6.4.4.2. India Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.4.3. India Nachos Market Size and Forecast, by Application (2025-2032) 6.4.5. Australia 6.4.5.1. Australia Nachos Market Size and Forecast, by Type (2025-2032) 6.4.5.2. Australia Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.5.3. Australia Nachos Market Size and Forecast, by Application (2025-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia Nachos Market Size and Forecast, by Type (2025-2032) 6.4.6.2. Indonesia Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.6.3. Indonesia Nachos Market Size and Forecast, by Application (2025-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia Nachos Market Size and Forecast, by Type (2025-2032) 6.4.7.2. Malaysia Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.7.3. Malaysia Nachos Market Size and Forecast, by Application (2025-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam Nachos Market Size and Forecast, by Type (2025-2032) 6.4.8.2. Vietnam Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.8.3. Vietnam Nachos Market Size and Forecast, by Application (2025-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan Nachos Market Size and Forecast, by Type (2025-2032) 6.4.9.2. Taiwan Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.9.3. Taiwan Nachos Market Size and Forecast, by Application (2025-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Nachos Market Size and Forecast, by Type (2025-2032) 6.4.10.2. Rest of Asia Pacific Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 6.4.10.3. Rest of Asia Pacific Nachos Market Size and Forecast, Application (2025-2032) 7. Middle East and Africa Nachos Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2025-2032 7.1. Middle East and Africa Nachos Market Size and Forecast, by Type (2025-2032) 7.2. Middle East and Africa Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 7.3. Middle East and Africa Nachos Market Size and Forecast, by Application (2025-2032) 7.4. Middle East and Africa Nachos Market Size and Forecast, by Country (2025-2032) 7.4.1. South Africa 7.4.1.1. South Africa Nachos Market Size and Forecast, by Type (2025-2032) 7.4.1.2. South Africa Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 7.4.1.3. South Africa Nachos Market Size and Forecast, by Application (2025-2032) 7.4.2. GCC 7.4.2.1. GCC Nachos Market Size and Forecast, by Type (2025-2032) 7.4.2.2. GCC Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 7.4.2.3. GCC Nachos Market Size and Forecast, by Application (2025-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria Nachos Market Size and Forecast, by Type (2025-2032) 7.4.3.2. Nigeria Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 7.4.3.3. Nigeria Nachos Market Size and Forecast, by Application (2025-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Nachos Market Size and Forecast, by Type (2025-2032) 7.4.4.2. Rest of ME&A Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 7.4.4.3. Rest of ME&A Nachos Market Size and Forecast, by Application (2025-2032) 8. South America Nachos Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2025-2032 8.1. South America Nachos Market Size and Forecast, by Type (2025-2032) 8.2. South America Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 8.3. South America Nachos Market Size and Forecast, by Application (2025-2032) 8.4. South America Nachos Market Size and Forecast, by Country (2025-2032) 8.4.1. Brazil 8.4.1.1. Brazil Nachos Market Size and Forecast, by Type (2025-2032) 8.4.1.2. Brazil Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 8.4.1.3. Brazil Nachos Market Size and Forecast, by Application (2025-2032) 8.4.2. Argentina 8.4.2.1. Argentina Nachos Market Size and Forecast, by Type (2025-2032) 8.4.2.2. Argentina Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 8.4.2.3. Argentina Nachos Market Size and Forecast, by Application (2025-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Nachos Market Size and Forecast, by Type (2025-2032) 8.4.3.2. Rest Of South America Nachos Market Size and Forecast, by Distribution Channel (2025-2032) 8.4.3.3. Rest Of South America Nachos Market Size and Forecast, by Application (2025-2032) 9. Global Nachos Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. Production Capacity 9.3.8. Production for 2022 9.3.9. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Nachos Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Pringles. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Frito Lay 10.3. Grupo Bimbo 10.4. Cornitos 10.5. Nacho King 10.6. Conagra Brands 10.7. General Mills. 10.8. Late July Snacks 10.9. Ricos 10.10. Cornitos 10.11. Vans Foods 10.12. Gehls 11. Key Findings 12. Industry Recommendations 13. Nachos Market: Research Methodology 14. Terms and Glossary