Global Polymers Market for Cosmetic Ingredients was valued at US$ 615.86 Bn in 2022 is expected to reach US$ 860.82 Bn by the end of 2029 at a CAGR of 4.90% from 2023 to 2029.Polymers Market for Cosmetic Ingredients Overview:

Development in nano-science and polymer science have improved the shelf life and performance of cosmetic ingredients and personal care Functions. Synthetic polymers, organic polymer, and natural polymers are extensively used in cosmetic & personal care Functions to increasing the functioning quantity by adding new ingredients and polymers. Natural polymers such as xanthan, pectin, agar, carrageenan, and polysaccharides are extensively used in thickening agents as it helps in improving the viscosity of cosmetic Functions.To know about the Research Methodology :- Request Free Sample Report The development of Hydrophilic and hydrophobic polymers into thermally responsive systems and star copolymers has led to an increase in the usage of natural polymers in personal care Functions. Polymer innovations in the cosmetic industry such as 3-D make-up printing, for instance, the Mink 3D printer create its custom-colored makeup and FDA approval for polymer ingredients have created many lucrative opportunities for market growth. The personal care and cosmetic industry is expected to grow at a CAGR of xx% during the forecast period, the market growth is driven by the increasing consumers of cosmetic Functions especially in the Asia Pacific, increasing investment in the personal care and cosmetic industry, diverse applications such as emulsifier, foam stabilizers, and destabilizer, anti-microbial, associative thickeners, fixatives, formers, conditioners, and rheology modifiers. Other factors that have fuelled the market growth is the extensive usage of polymers in the manufacturing of sun care, skincare, film former, toiletries, color cosmetic, and hair fixative. However, factors such as the negative impact of synthetic cosmetic Functions and polymers on humans may restrain the market growth. In addition, strict regulations on harmful chemical ingredients may restrain the market growth. The report has profiled twelve key players in the market from different regions. However, the report has considered all market leaders, followers, and new entrants with investors while analyzing the market and estimating the size of the same. The manufacturing environment in each region is different and the focus is given on the regional impact on the cost of manufacturing, polymer supply chain, availability of raw materials, labor cost, availability of advanced technology, and trusted vendors analyzed and the report has come up with recommendations for a future hot spot in the Asia Pacific region. Major country’s policies regarding manufacturing and their impact on the Polymers Market for Cosmetic Ingredients demand are covered in the report.

Polymers Market for Cosmetic Ingredients Driver

Growing Demand for Sustainable and Natural Cosmetic Products Drives Polymers Market in the Cosmetic Ingredients Industry The cosmetic industry is witnessing a significant shift towards sustainable and natural products, driven by consumer awareness regarding the environmental impact of traditional cosmetics and the potential harm caused by certain synthetic ingredients. This growing demand for eco-friendly and natural cosmetic products has become a major driver for the polymers market in the cosmetic ingredients industry. Polymers play a vital role in formulating sustainable cosmetics, offering benefits such as enhanced stability, improved texture, and prolonged shelf life to various cosmetic products like lotions, creams, and hair care items. As consumers increasingly prefer natural ingredients, cosmetic companies are investing in polymer research and development to create innovative polymer-based formulations that cater to these preferences. These polymers not only provide functional benefits but also align with the industry's sustainability goals, making them a key driver in the evolving cosmetic ingredients market. Technological Advancements Fuel Innovation and Growth in the Polymers Market for Cosmetic Ingredients Rapid technological advancements in polymer science and material engineering have opened new avenues for innovation in the cosmetic industry. Scientists and researchers are continually developing novel polymers with unique properties that enhance the performance of cosmetic products. These innovations include polymers that offer a controlled release of active ingredients, improve skin adhesion, and provide superior protection against environmental factors. Such advancements enable cosmetic companies to create high-quality, specialized products that cater to specific consumer needs, driving the growth of the polymers market in the cosmetic ingredients industry. Significant strides in polymer science and material engineering have ushered in a new era of innovation within the cosmetic industry. Researchers and scientists are continuously pioneering novel polymers endowed with unique properties, enhancing the efficacy of cosmetic products. Polymer innovations range from polymers ensuring controlled release of active ingredients to bolstering skin adhesion and providing robust protection against environmental factors. These advancements empower cosmetic companies to craft high-quality, tailored products meeting specific consumer demands, thereby propelling the polymers market in the cosmetic ingredients industry. Additionally, the focus on eco-friendly and biodegradable polymers, addressing concerns about plastic pollution, acts as a catalyst for industry growth. Polymer production and Collaboration between cosmetic companies and polymer manufacturers, coupled with the development of sustainable polymers, fuel this progress. As investments pour into cutting-edge research, consumers are presented with a diverse array of innovative and sustainable cosmetic offerings, reshaping the market landscape.Polymers Market for Cosmetic Ingredients Restraint

A major restraint impacting the polymers market for cosmetic ingredients is the growing emphasis on environmental sustainability, driven by consumer awareness and regulatory pressure. The cosmetic industry faces demands to reduce plastic usage and embrace eco-friendly alternatives, leading to the exploration of biodegradable polymers and environmentally conscious materials. However, the development of these alternatives requires extensive research and often results in higher production costs, complicating the polymer production and supply chain. Furthermore, ensuring the performance, stability, and safety of sustainable polymers presents significant challenges. Navigating these complexities hampers market growth and innovation, as companies struggle to meet stringent environmental standards and consumer expectations in both polymer production and the supply chain.

Polymers Market for Cosmetic Ingredients Segment Analysis

The synthetic polymer segment is expected to grow at a CAGR of xx% during the forecast period. By type, in 2022, the global synthetic polymers segment was xx% and it is estimated to reach xx% by 2029. Synthetic polymers in hair Functions include natural substances such as polysaccharides, including starch and cellulose derivatives, natural gums, and hydrolysed proteins. Synthetic hair-friendly polymers include polyvinyl pyrrolidone and acetate, polyvinyl amides, polyacrylates and polymethacrylates, polyurethanes, and silicones. They are often cheaper than natural polymers, can be produced on a large scale with uniformity, and have a long shelf time. The synthetic polymers most commonly found in cosmetics are acrylic acid-based polymers, polyacrylamides, silicon, and alkaline oxide-based homopolymers and copolymers. Natural polymers are the second-largest segment, the market is driven by the factors such as consumer awareness towards health and its wide variety of applications in cosmetics.

Polymers Market for Cosmetic Ingredients Regional Insights:

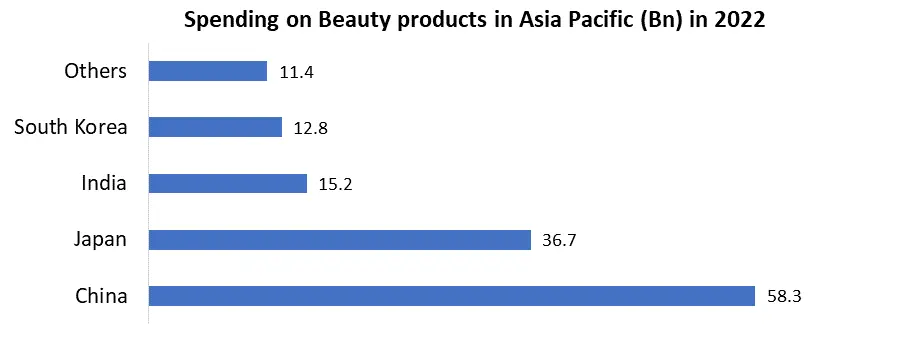

Asia Pacific is expected to grow at a CAGR of xx% during the forecast period and is expected to reach xx% market share by 2029 In the Asia Pacific, the rising no of consumers of cosmetic Functions and new Function launches are driving the market growth. Key players are focusing on these regions as there is a growth in the cosmetic & and personal care industry in countries like India, China, Malaysia, Vietnam, and South Korea. In these countries, the consumer’s adoption of foreign brands is more than regional brands. Rising per capita disposable income and consumer awareness towards health have created many lucrative opportunities for market growth. The objective of the report is to present a comprehensive analysis of the global market including all the stakeholders of the industry. The past and current status of the industry with forecasting market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers, and new entrants. PORTER, SVOR, and PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding global Market dynamics, and structure by analyzing the market segments and projecting a global Market clear representation of competitive analysis of key players by price, financial position, detection and equipment portfolio, growth strategies, and regional presence in the global Market make the report investor’s guide.Polymers Market for Cosmetic Ingredients Scope: Inquiry Before Buying

Polymers Market for Cosmetic Ingredients Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 615.86 Bn. Forecast Period 2023 to 2029 CAGR: 4.90% Market Size in 2029: US $ 860.82 Bn. Segments Covered: by Function Film Forming Gelling Agents Fixatives Thickeners Emulsifiers Foam Stabilizers Conditioners by Type Synthetic polymers Silicone Nylon PVC plastic Teflon Bakelite Natural polymers Rubber Amber Protein Cellulose Polymers Market for Cosmetic Ingredients, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Polymers Market for Cosmetic Ingredients, Key Players are

1. BASF SE 2. Akzonobel N.V. 3. Croda International Plc 4. The Dow Chemical Company 5. Eastman Chemical Company 6. Ashland Inc. 7. Lubrizol Corporation 8. Eastman Chemical Company 9. Dow Chemical Company (US) 10. AkzoNobel N.V. 11. Clariant AG 12. OtherFrequently asked questions:

1. What is the market growth of the Polymers Market for Cosmetic Ingredients? Ans. The Polymers Market for Cosmetic Ingredients was valued at USD 615.86 Bn in 2022 and is expected to reach USD 860.82 Bn by 2029, at a CAGR of 4.90 % during the forecast period. 2. Which region has the largest share in the Global Polymers Market for Cosmetic Ingredients? Ans: Asia Pacific region holds the highest share in 2022. 3. What is scope of the Global Polymers Market for Cosmetic Ingredients report? Ans: Global Polymers Market for Cosmetic Ingredients report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period 4. What is the forecast period for the Polymers Market for Cosmetic Ingredients? Ans. The forecast period for the Polymers Market for Cosmetic Ingredients is from 2023 to 2029. 5. Who are the key players in Global Polymers Market for Cosmetic Ingredients? Ans: The important key players in the Global Polymers Market for Cosmetic Ingredients are – BASF SE, Akzonobel N.V., Croda International Plc, The Dow Chemical Company, Eastman Chemical Company, Ashland Inc., Lubrizol Corporation, Eastman Chemical Company, Dow Chemical Company (US), AkzoNobel N.V., Clariant AG, and Other

1. Polymers Market for Cosmetic Ingredients Introduction 1.1 Study Assumption and Market Definition 1.2 Scope of the Study 1.3 Executive Summary 2. Polymers Market for Cosmetic Ingredients: Dynamics 2.1 Polymers Market for Cosmetic Ingredients Trends by Region 2.1.1 Global 2.1.2 North America 2.1.3 Europe 2.1.4 Asia Pacific 2.1.5 Middle East and Africa 2.1.6 South America 2.2 Polymers Market for Cosmetic Ingredients Drivers by Region 2.2.1 Global 2.2.2 North America 2.2.3 Europe 2.2.4 Asia Pacific 2.2.5 Middle East and Africa 2.2.6 South America 2.3 Polymers Market for Cosmetic Ingredients Restraints 2.4 Polymers Market for Cosmetic Ingredients Opportunities 2.5 Polymers Market for Cosmetic Ingredients Challenges 2.6 PORTER’s Five Forces Analysis 2.6.1 Bargaining Power Of Suppliers 2.6.2 Bargaining Power Of Buyers 2.6.3 Threat Of New Entrants 2.6.4 Threat Of Substitutes 2.6.5 Intensity Of Rivalry 2.7 PESTLE Analysis 2.8 Value Chain Analysis 2.9 Regulatory Landscape by Region 2.9.1 Global 2.9.2 North America 2.9.3 Europe 2.9.4 Asia Pacific 2.9.5 Middle East and Africa 2.9.6 South America 2.10 Analysis of Government Schemes and Initiatives For Polymers Market for Cosmetic Ingredients Industry 2.11 The Global Pandemic and Redefining of The Polymers Market for Cosmetic Ingredients Industry Landscape 2.12 Price Trend Analysis 2.13 Technological Road Map 2.14 Global Catheters Trade Analysis (2017-2022) 2.14.1 Global Import of Catheters 2.14.1.1 Ten largest Importer 2.14.2 Global Export of Catheters 2.14.2.1 Ten largest Exporter 2.15 Polymers Market for Cosmetic Ingredients Functioning Capacity Analysis 2.15.1 Chapter Overview 2.15.2 Key Assumptions and Methodology 2.15.3 polymers market for cosmetic ingredients manufacturers: Global Installed Capacity 2.15.4 Analysis by Size of Manufacturer 2.15.5 Analysis by Demand Side 2.15.6 Analysis by Supply Side 3. Polymers Market for Cosmetic Ingredients: Global Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 3.1 Global Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 3.1.1 Film Forming 3.1.2 Gelling Agents 3.1.3 Fixatives 3.1.4 Thickeners 3.1.5 Emulsifiers 3.1.6 Foam Stabilizers 3.1.7 Conditioners 3.2 Global Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 3.2.1 Synthetic polymers 3.2.2 Silicone 3.2.3 Nylon 3.2.4 PVC plastic 3.2.5 Teflon 3.2.6 Bakelite 3.2.7 Natural polymers 3.2.8 Rubber 3.2.9 Amber 3.2.10 Protein 3.2.11 Cellulose 3.3 Global Polymers Market for Cosmetic Ingredients, by Region (2022-2029) 3.3.1 North America 3.3.2 Europe 3.3.3 Asia Pacific 3.3.4 Middle East and Africa 3.3.5 South America 4. North America Polymers Market for Cosmetic Ingredients Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 4.1 North America Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 4.1.1 Film Forming 4.1.2 Gelling Agents 4.1.3 Fixatives 4.1.4 Thickeners 4.1.5 Emulsifiers 4.1.6 Foam Stabilizers 4.1.7 Conditioners 4.2 North America Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 4.2.1 Synthetic polymers 4.2.2 Silicone 4.2.3 Nylon 4.2.4 PVC plastic 4.2.5 Teflon 4.2.6 Bakelite 4.2.7 Natural polymers 4.2.8 Rubber 4.2.9 Amber 4.2.10 Protein 4.2.11 Cellulose 4.3 North America Polymers Market for Cosmetic Ingredients, by Country (2022-2029) 4.3.1 United States 4.3.1.1 United States Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 4.3.1.1.1 Film Forming 4.3.1.1.2 Gelling Agents 4.3.1.1.3 Fixatives 4.3.1.1.4 Thickeners 4.3.1.1.5 Emulsifiers 4.3.1.1.6 Foam Stabilizers 4.3.1.1.7 Conditioners 4.3.1.2 United States Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 4.3.1.2.1 Synthetic polymers 4.3.1.2.2 Silicone 4.3.1.2.3 Nylon 4.3.1.2.4 PVC plastic 4.3.1.2.5 Teflon 4.3.1.2.6 Bakelite 4.3.1.2.7 Natural polymers 4.3.1.2.8 Rubber 4.3.1.2.9 Amber 4.3.1.2.10 Protein 4.3.1.2.11 Cellulose 4.3.2 Canada 4.3.2.1 Canada Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 4.3.2.1.1 Film Forming 4.3.2.1.2 Gelling Agents 4.3.2.1.3 Fixatives 4.3.2.1.4 Thickeners 4.3.2.1.5 Emulsifiers 4.3.2.1.6 Foam Stabilizers 4.3.2.1.7 Conditioners 4.3.2.2 Canada Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 4.3.2.2.1 Synthetic polymers 4.3.2.2.2 Silicone 4.3.2.2.3 Nylon 4.3.2.2.4 PVC plastic 4.3.2.2.5 Teflon 4.3.2.2.6 Bakelite 4.3.2.2.7 Natural polymers 4.3.2.2.8 Rubber 4.3.2.2.9 Amber 4.3.2.2.10 Protein 4.3.2.2.11 Cellulose 4.3.3 Mexico 4.3.3.1 Mexico Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 4.3.3.1.1 Film Forming 4.3.3.1.2 Gelling Agents 4.3.3.1.3 Fixatives 4.3.3.1.4 Thickeners 4.3.3.1.5 Emulsifiers 4.3.3.1.6 Foam Stabilizers 4.3.3.1.7 Conditioners 4.3.3.2 Mexico Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 4.3.3.2.1 Synthetic polymers 4.3.3.2.2 Silicone 4.3.3.2.3 Nylon 4.3.3.2.4 PVC plastic 4.3.3.2.5 Teflon 4.3.3.2.6 Bakelite 4.3.3.2.7 Natural polymers 4.3.3.2.8 Rubber 4.3.3.2.9 Amber 4.3.3.2.10 Protein 4.3.3.2.11 Cellulose 5. Europe Polymers Market for Cosmetic Ingredients Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 5.1 Europe Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 5.2 Europe Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 5.3 Europe Polymers Market for Cosmetic Ingredients, by Country (2022-2029) 5.3.1 United Kingdom 5.3.1.1 United Kingdom Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 5.3.1.2 United Kingdom Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 5.3.2 France 5.3.2.1 France Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 5.3.2.2 France Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 5.3.3 Germany 5.3.3.1 Germany Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 5.3.3.2 Germany Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 5.3.4 Italy 5.3.4.1 Italy Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 5.3.4.2 Italy Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 5.3.5 Spain 5.3.5.1 Spain Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 5.3.5.2 Spain Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 5.3.6 Sweden 5.3.6.1 Sweden Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 5.3.6.2 Sweden Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 5.3.7 Austria 5.3.7.1 Austria Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 5.3.7.2 Austria Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 5.3.8 Rest of Europe 5.3.8.1 Rest of Europe Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 5.3.8.2 Rest of Europe Polymers Market for Cosmetic Ingredients, by Type (2022-2029). 6. Asia Pacific Polymers Market for Cosmetic Ingredients Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 6.1 Asia Pacific Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 6.2 Asia Pacific Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 6.3 Asia Pacific Polymers Market for Cosmetic Ingredients, by Country (2022-2029) 6.3.1 China 6.3.1.1 China Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 6.3.1.2 China Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 6.3.2 South Korea 6.3.2.1 S Korea Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 6.3.2.2 S Korea Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 6.3.3 Japan 6.3.3.1 Japan Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 6.3.3.2 Japan Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 6.3.4 India 6.3.4.1 India Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 6.3.4.2 India Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 6.3.5 Australia 6.3.5.1 Australia Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 6.3.5.2 Australia Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 6.3.6 Indonesia 6.3.6.1 Indonesia Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 6.3.6.2 Indonesia Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 6.3.7 Malaysia 6.3.7.1 Malaysia Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 6.3.7.2 Malaysia Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 6.3.8 Vietnam 6.3.8.1 Vietnam Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 6.3.8.2 Vietnam Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 6.3.9 Taiwan 6.3.9.1 Taiwan Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 6.3.9.2 Taiwan Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 6.3.10 Bangladesh 6.3.10.1 Bangladesh Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 6.3.10.2 Bangladesh Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 6.3.11 Pakistan 6.3.11.1 Pakistan Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 6.3.11.2 Pakistan Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 6.3.12 Rest of Asia Pacific 6.3.12.1 Rest of Asia Pacific Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 6.3.12.2 Rest of Asia Pacific Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 7. Middle East and Africa Polymers Market for Cosmetic Ingredients Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 7.1 Middle East and Africa Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 7.2 Middle East and Africa Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 7.3 Middle East and Africa Polymers Market for Cosmetic Ingredients, by Country (2022-2029) 7.3.1 South Africa 7.3.1.1 South Africa Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 7.3.1.2 South Africa Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 7.3.2 GCC 7.3.2.1 GCC Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 7.3.2.2 GCC Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 7.3.3 Egypt 7.3.3.1 Egypt Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 7.3.3.2 Egypt Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 7.3.4 Nigeria 7.3.4.1 Nigeria Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 7.3.4.2 Nigeria Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 7.3.5 Rest of ME&A 7.3.5.1 Rest of ME&A Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 7.3.5.2 Rest of ME&A Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 8. South America Polymers Market for Cosmetic Ingredients Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 8.1 South America Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 8.2 South America Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 8.3 South America Polymers Market for Cosmetic Ingredients, by Country (2022-2029) 8.3.1 Brazil 8.3.1.1 Brazil Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 8.3.1.2 Brazil Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 8.3.2 Argentina 8.3.2.1 Argentina Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 8.3.2.2 Argentina Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 8.3.3 Rest Of South America 8.3.3.1 Rest Of South America Polymers Market for Cosmetic Ingredients, by Function (2022-2029) 8.3.3.2 Rest Of South America Polymers Market for Cosmetic Ingredients, by Type (2022-2029) 9. Global Polymers Market for Cosmetic Ingredients: Competitive Landscape 9.1 MMR Competition Matrix 9.2 Competitive Landscape 9.3 Key Players Benchmarking 9.3.1 Company Name 9.3.2 Function Segment 9.3.3 End-user Segment 9.3.4 Revenue (2022) 9.3.5 Manufacturing Locations 9.3.6 SKU Details 9.3.7 Functionion Capacity 9.3.8 Functionion for 2022 9.3.9 No. of Stores 9.4 Market Analysis by Organized Players vs. Unorganized Players 9.4.1 Organized Players 9.4.2 Unorganized Players 9.5 Leading Polymers Market for Cosmetic Ingredients Global Companies, by market capitalization 9.6 Market Structure 9.6.1 Market Leaders 9.6.2 Market Followers 9.6.3 Emerging Players 9.7 Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1 BASF SE 10.1.1 Company Overview 10.1.2 Business Portfolio 10.1.3 Financial Overview 10.1.4 SWOT Analysis 10.1.5 Strategic Analysis 10.1.6 Scale of Operation (small, medium, and large) 10.1.7 Details on Partnership 10.1.8 Regulatory Accreditations and Certifications Received by Them 10.1.9 Awards Received by the Firm 10.1.10 Recent Developments 10.2 Akzonobel N.V. 10.3 Croda International Plc 10.4 The Dow Chemical Company 10.5 Eastman Chemical Company 10.6 Ashland Inc. 10.7 Lubrizol Corporation 10.8 Eastman Chemical Company 10.9 Dow Chemical Company (US) 10.10 AkzoNobel N.V. 10.11 Clariant AG 10.12 Other 11. Key Findings 12. Industry Recommendations 13. Polymers Market for Cosmetic Ingredients: Research Methodology 14. Terms and Glossary