The Pollution Absorbing Bricks Market size was valued at USD 438 Billion in 2023 and the total pollution-absorbing bricks revenue is expected to grow at a CAGR of 7.4% from 2024 to 2030, reaching nearly USD 721.94 Billion in 2030.Pollution Absorbing Bricks Market Overview

The report provides a comprehensive analysis of key market trends, challenges, and opportunities. It explores the dynamics of eco-friendly construction materials designed to combat air pollution and enhance urban air quality. Also, it evaluates market drivers such as rising environmental concerns and government regulations, along with challenges like high initial costs and limited awareness. The report also highlights opportunities arising from growing demand in residential, commercial, and public infrastructure sectors. Additionally, it examines the competitive landscape, profiling key players and assessing their market strategies and product portfolios. Through insightful analysis, this report aims to guide stakeholders in capitalizing on the burgeoning Pollution Absorbing Bricks market. The Pollution Absorbing Bricks market is driven by demand from both residential and non-residential sectors. Residential users want cleaner indoor air, whereas non-residential projects including public buildings and infrastructure prioritize better outside air quality. The focus on green construction certifications like LEED and BREEAM increases demand for environmentally friendly materials like pollution-absorbing bricks. Advances in material science, such as bio-based, recycled, and low-carbon materials, improve the sustainability of these bricks. Also, rising governmental and private investment in R&D, pilot projects, and infrastructure enhancements helps to drive market growth. To capitalize on rising demand, investments in production facilities and distribution networks for pollution-absorbing bricks are critical. In addition, sponsoring innovative research into new materials and capabilities might provide a competitive advantage. Collaborating with construction firms that specialize in green building projects provides market access. Also, focusing on effective recycling and sustainable production processes attracts environmentally concerned investors, ensuring long-term market sustainability and profitability. These strategic methods, which include manufacturing, technological development, project collaborations, and sustainability programs, are critical to profiting from the growing demand for pollution-absorbing bricks.To know about the Research Methodology :- Request Free Sample Report

Pollution Absorbing Bricks Market Dynamics

Green Building Certifications Green building certifications examine a building's environmental performance, taking into account elements such as energy efficiency, sustainable material consumption, water resource impacts, and indoor air quality. LEED, which is popular in the United States and Canada, and BREEAM, which is popular in the United Kingdom and around the world, both have different rating levels, ranging from Certified to Platinum for LEED and Pass to Outstanding for BREEAM. These programs promote environmentally sensitive construction techniques around the world. The increasing popularity of green building certifications is driving up demand for pollution-absorbing bricks for a variety of compelling reasons. For example, these certifications frequently encourage the use of sustainable materials, including pollution-absorbing bricks, by allowing buildings to score points for combining recycled, low-VOC, and bio-based materials. Second, because green building certifications value interior air quality, pollution-absorbing bricks play an important part in improving it by effectively filtering pollutants from the air. Third, with rising standards such as LEED v4, there is a greater emphasis on determining the embodied environmental impact of building materials throughout their lives. Pollution-absorbing bricks stand out in this regard since they have a lesser environmental imprint because of their use of recycled materials and lower energy usage during manufacturing.Urbanization and Infrastructure Development Pollution-absorbing bricks effectively trap and neutralize air pollutants such as nitrogen oxides, sulfur oxides, and dust particles, resulting in cleaner urban air and improved public health. They also provide noise reduction benefits, resulting in quieter urban areas and improved community well-being. These bricks readily fit into current infrastructure projects, such as noise barriers and building facades, giving a long-term solution to pollution. Also, the range of finishes and hues ensures aesthetic appeal in urban design, providing both functionality and visual attractiveness. The pollution-absorbing bricks market in Asia Pacific is expected to grow rapidly, owing to rising urbanization and government emphasis on sustainable infrastructure. While the residential sector continues to dominate the market, the non-residential sector, which includes infrastructure projects and public spaces, is expected to grow significantly. In India, the government's dedication to clean air and sustainable infrastructure is resulting in high demand for pollution-absorbing bricks in large construction projects. At the same time, cities in China, such as Beijing and Shanghai, are aggressively seeking methods to improve air quality, with pollution-absorbing bricks emerging as a promising option. In Europe, the European Union's emphasis on green building practices and rigorous air quality standards encourages the use of environmentally friendly materials such as pollution-absorbing bricks in construction projects. Installation and Maintenance Challenges of Pollution-Absorbing Bricks Insufficient knowledge in installing Pollution Absorbing Bricks has the potential to contribute to poor installation due to a lack of experienced workers and set rules. Uncertain long-term maintenance requirements raise questions regarding practicality and expense, potentially impeding adoption. Manufacturer-specific variations in composition and performance make it difficult to select, install, and maintain these bricks consistently. The lack of industry-wide standards exacerbates the situation. These problems underscore the significance of filling knowledge gaps, specifying maintenance requirements, and encouraging standardization to ensure the optimal use of Pollution Absorbing Bricks in sustainable construction methods. Improper installation and unforeseen maintenance requirements might drive up project expenses, discouraging potential users. Buyers are sometimes turned off by concerns about long-term performance as a result of poor maintenance procedures. The slow acceptance by construction firms and developers is possibly due to confusing installation and maintenance methods, resulting in restricted market penetration. Addressing these concerns through clear rules and education efforts is critical to encouraging the widespread adoption and use of Pollution Absorbing Bricks in construction projects, thereby promoting sustainable building practices.

Pollution Absorbing Bricks Market Segment Analysis

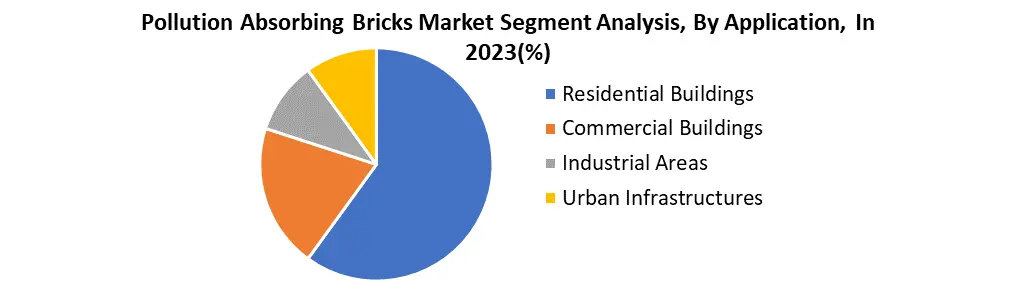

By Application, the Residential buildings segment has the highest market share, by 2023, it accounts for almost 60%. Pollution-absorbing bricks have the largest market share because of their broad use in numerous sectors, including single-family homes and apartments. Their ability to adapt appeals to a broad range of potential consumers, which contributes to their market dominance. The market for pollution-absorbing bricks is growing rapidly because of a variety of causes. Growing disposable wealth, combined with increased knowledge of sustainable living practices and rising health concerns, is driving demand for cleaner indoor air. The increased awareness and demand are major factors driving the market growth trajectory for pollution-absorbing bricks. Government measures, such as tax breaks and subsidies for green building practices, operate as drivers of market penetration in this segment. These incentives stimulate adoption by mitigating the higher initial costs of pollution-absorbing bricks, making them more easily integrated into sustainable construction projects.

Pollution Absorbing Bricks Market Regional Insights

North America dominates the global pollution-absorbing bricks market thanks to a variety of factors. Growing environmental awareness increases demand for eco-friendly products such as these bricks. Supportive regulations in the United States and Canada encourage sustainable construction, creating a positive market climate. Technological developments by North American companies broaden the range of options available to consumers. Also, the region's mature construction industry creates a strong market for incorporating pollution-absorbing bricks into both new and existing buildings. These factors contribute to North America's leading role in driving global adoption of pollution-absorbing bricks. Green Clay Industries and Airzyme Inc. have secured funding for R&D to improve the performance and price of next-generation pollution-absorbing bricks. Large-scale trial projects demonstrate the bricks' real-world effectiveness, giving potential user’s confidence. Municipalities and government organizations are increasingly using pollution-absorbing bricks in public infrastructure projects like noise barriers and building facades. These activities demonstrate a rising commitment to utilizing new solutions for environmental sustainability, which encourages the use of pollution-absorbing bricks across multiple sectors. In the United States, strong government measures to promote sustainable infrastructure and green building practices drive demand for creative solutions such as pollution-absorbing bricks. Similarly, Canada's emphasis on environmental sustainability and growing awareness of air quality issues makes it a suitable environment for the implementation of these bricks. Both countries prioritize environmentally friendly construction materials, which is supporting the expansion of the pollution-absorbing bricks market and contributing to larger initiatives to address environmental issues in the North American area.Pollution Absorbing Bricks Market Competitive Landscape

Green Clay Industries, based in the United States, is known for its "Air Quality Brick," which has a titanium dioxide covering that absorbs pollutants and turns them into harmless compounds. In Canada, Airzyme Inc. sells "BREATHE Bricks" laced with photocatalytic chemicals that degrade pollutants when exposed to sunshine. Pavegen Ltd., based in the United Kingdom, specializes in kinetic energy-harvesting pavements that also absorb pollution. Italcementi in Italy has created "TX Active" air-purifying concrete blocks utilizing photocatalytic technology. Lafarge in France offers "Dynamis" concrete blocks with photocatalytic capabilities for air purification, demonstrating a global effort to develop novel solutions for environmental sustainability. 1. Green Clay Industries received $5 Billion in financing in 2023 to grow its research and development efforts for next-generation bricks, to improve performance and price. The investment is expected to result in more advanced and accessible solutions to environmental sustainability. 2. In 2022, Airzyme Inc. developed "BREATHE Pave" sidewalk tiles, which combine pollution-absorbing and energy-harvesting characteristics, increasing their product line into new uses and perhaps broadening market reach. 3. In 2021, Pavegen Ltd. partnered with Dubai Municipality to prototype kinetic energy-harvesting pavements with air purification features, demonstrating practical implementation and encouraging uptake in public infrastructure projects. Italcementi's 2020 rollout of "TX Active" blocks in Milan helped to improve urban air quality, demonstrating real-world impact. 4. In 2019, Lafarge deployed "Dynamis" blocks in several European cities, including Paris and Lyon, growing the availability and awareness of pollution-absorbing technologies. In 2020, Italcementi introduced "TX Active" blocks in Milan, which greatly improved urban air quality and demonstrated tangible real-world impact. In 2019, Lafarge implemented "Dynamis" blocks in European cities including Paris and Lyon, growing the availability and understanding of pollution-reducing solutions.Pollution Absorbing Bricks Market Scope: Inquiry Before Buying

Pollution Absorbing Bricks Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 438 Bn. Forecast Period 2024 to 2030 CAGR: 7.4% Market Size in 2030: US $ 721.94 Bn. Segments Covered: by Application Residential Buildings Commercial Buildings Industrial Areas Urban Infrastructures by Material Type Concrete Clay Silica Gel Pollution Absorbing Bricks Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players in the Pollution Absorbing Bricks Market

1. Airzyme Inc. (Canada) 2. Pavegen Ltd. (UK) 3. Italcementi (Italy) 4. Lafarge (France) 5. Wienerberger (Austria) 6. Ecobrick Alliance Earth Enterprise (Indonesia) 7. Ramtsilo Bricks & Construction (South Africa) 8. Midwest Block & Brick (US) 9. Brampton Brick (Canada) 10. General Shale Inc. (US)’ 11. Triangle Brick Co. 12. Hindawi 13. edition.cnn 14. pghbricks 15. cpcb.nic 16. manobyte 17. illustrarch 18. archdaily 19. panasonic 20. dezeenFAQs:

1. How do pollution-absorbing bricks work? Ans. Pollution-absorbing bricks contain photocatalytic materials, such as titanium dioxide, that react with sunlight to catalyze chemical reactions. These reactions break down airborne pollutants, such as nitrogen oxides and volatile organic compounds (VOCs), into harmless substances, contributing to cleaner air. 2. Are pollution-absorbing bricks cost-effective? Ans. The cost-effectiveness of pollution-absorbing bricks depends on factors such as material costs, installation expenses, and long-term benefits, including energy savings and improved public health. While initial costs may be higher than conventional bricks, the long-term environmental and economic benefits often outweigh the upfront investment. 3. What is the projected market size & and growth rate of the Pollution-absorbing bricks Market? Ans. The Pollution-absorbing bricks Market size was valued at USD 438 Billion in 2023 and the total Pollution absorbing bricks revenue is expected to grow at a CAGR of 7.4% from 2023 to 2030, reaching nearly USD 721.94 Billion in 2030. 4. What segments are covered in the Pollution Absorbing Bricks Market report? Ans. The segments covered in the Pollution-absorbing bricks market by Application and Material Type.

1. Pollution absorbing bricks Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Pollution absorbing bricks Market: Dynamics 2.1. Pollution Absorbing Bricks Market Trends by Region 2.1.1. North America Pollution Absorbing Bricks Market Trends 2.1.2. Europe Pollution Absorbing Bricks Market Trends 2.1.3. Asia Pacific Pollution Absorbing Bricks Market Trends 2.1.4. Middle East and Africa Pollution Absorbing Bricks Market Trends 2.1.5. South America Pollution Absorbing Bricks Market Trends 2.2. Pollution Absorbing Bricks Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Pollution Absorbing Bricks Market Drivers 2.2.1.2. North America Pollution Absorbing Bricks Market Restraints 2.2.1.3. North America Pollution Absorbing Bricks Market Opportunities 2.2.1.4. North America Pollution Absorbing Bricks Market Challenges 2.2.2. Europe 2.2.2.1. Europe Pollution Absorbing Bricks Market Drivers 2.2.2.2. Europe Pollution Absorbing Bricks Market Restraints 2.2.2.3. Europe Pollution Absorbing Bricks Market Opportunities 2.2.2.4. Europe Pollution Absorbing Bricks Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Pollution Absorbing Bricks Market Drivers 2.2.3.2. Asia Pacific Pollution Absorbing Bricks Market Restraints 2.2.3.3. Asia Pacific Pollution Absorbing Bricks Market Opportunities 2.2.3.4. Asia Pacific Pollution Absorbing Bricks Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Pollution Absorbing Bricks Market Drivers 2.2.4.2. Middle East and Africa Pollution Absorbing Bricks Market Restraints 2.2.4.3. Middle East and Africa Pollution Absorbing Bricks Market Opportunities 2.2.4.4. Middle East and Africa Pollution Absorbing Bricks Market Challenges 2.2.5. South America 2.2.5.1. South America Pollution Absorbing Bricks Market Drivers 2.2.5.2. South America Pollution Absorbing Bricks Market Restraints 2.2.5.3. South America Pollution Absorbing Bricks Market Opportunities 2.2.5.4. South America Pollution Absorbing Bricks Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technological Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Clinical Trial Analysis for Pollution Absorbing Bricks 2.8. Key Opinion Leader Analysis for the Pollution Absorbing Bricks Industry 2.9. Analysis of Government Schemes and Initiatives for the Pollution-Absorbing Bricks Industry 3. Pollution Absorbing Bricks Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 3.1. Global Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 3.1.1. Residential Buildings 3.1.2. Commercial Buildings 3.1.3. Industrial Areas 3.1.4. Urban Infrastructures 3.2. Global Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 3.2.1. Concrete 3.2.2. Clay 3.2.3. Silica Gel 3.3. Global Pollution absorbing bricks Market Size and Forecast, by region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Pollution Absorbing Bricks Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 4.1. North America Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 4.1.1. Residential Buildings 4.1.2. Commercial Buildings 4.1.3. Industrial Areas 4.1.4. Urban Infrastructures 4.2. North America Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 4.2.1. Concrete 4.2.2. Clay 4.2.3. Silica Gel 4.3. United States 4.4. United States Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 4.4.1. Residential Buildings 4.4.2. Commercial Buildings 4.4.3. Industrial Areas 4.4.4. Urban Infrastructures 4.5. United States Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 4.5.1. Concrete 4.5.2. Clay 4.5.3. Silica Gel 4.6. Canada 4.7. Canada Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 4.7.1. Residential Buildings 4.7.2. Commercial Buildings 4.7.3. Industrial Areas 4.7.4. Urban Infrastructures 4.8. Canada Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 4.8.1. Concrete 4.8.2. Clay 4.8.3. Silica Gel 4.9. Mexico 4.10. Mexico Pollution absorbing bricks Market Size and Forecast, by Application (2023-2030) 4.10.1. Residential Buildings 4.10.2. Commercial Buildings 4.10.3. Industrial Areas 4.10.4. Urban Infrastructures 4.11. Mexico Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 4.11.1. Concrete 4.11.2. Clay 4.11.3. Silica Gel 5. Europe Pollution Absorbing Bricks Market Size and Forecast by Segmentation (by Value in USD Billion) (2022-2029) 5.1. Europe Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 5.2. Europe Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 5.2.1. United Kingdom 5.2.1.1. United Kingdom Pollution absorbing bricks Market Size and Forecast, by Application (2023-2030) 5.2.1.2. United Kingdom Pollution absorbing bricks Market Size and Forecast, by Material Type (2023-2030) 5.2.2. France 5.2.2.1. France Pollution absorbing bricks Market Size and Forecast, by Application (2023-2030) 5.2.2.2. France Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 5.2.3. Germany 5.2.3.1. Germany Pollution absorbing bricks Market Size and Forecast, by Application (2023-2030) 5.2.3.2. Germany Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 5.2.4. Italy 5.2.4.1. Italy Pollution absorbing bricks Market Size and Forecast, by Application (2023-2030) 5.2.4.2. Italy Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 5.2.5. Spain 5.2.5.1. Spain Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 5.2.5.2. Spain Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 5.2.6. Sweden 5.2.6.1. Sweden Pollution absorbing bricks Market Size and Forecast, by Application (2023-2030) 5.2.6.2. Sweden Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 5.2.7. Austria 5.2.7.1. Austria Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 5.2.7.2. Austria Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 5.2.8. Rest of Europe 5.2.8.1. Rest of Europe Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 5.2.8.2. Rest of Europe Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 6. Asia Pacific Pollution Absorbing Bricks Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 6.1. Asia Pacific Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 6.3. Asia Pacific Pollution Absorbing Bricks Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Pollution absorbing bricks Market Size and Forecast, by Application (2023-2030) 6.3.1.2. China Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 6.3.2.2. S Korea Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Pollution absorbing bricks Market Size and Forecast, by Application (2023-2030) 6.3.3.2. Japan Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 6.3.4. India 6.3.4.1. India Pollution absorbing bricks Market Size and Forecast, by Application (2023-2030) 6.3.4.2. India Pollution absorbing bricks Market Size and Forecast, by Material Type (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Pollution absorbing bricks Market Size and Forecast, by Application (2023-2030) 6.3.5.2. Australia Pollution absorbing bricks Market Size and Forecast, by Material Type (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Pollution absorbing bricks Market Size and Forecast, by Application (2023-2030) 6.3.6.2. Indonesia Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Pollution absorbing bricks Market Size and Forecast, by Application (2023-2030) 6.3.7.2. Malaysia Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 6.3.8.2. Vietnam Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 6.3.9.2. Taiwan Pollution Absorbing Bricks Market Size and Forecast, by Material Type 2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 6.3.10.2. Rest of Asia Pacific Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 7. The Middle East and Africa Pollution Absorbing Bricks Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 7.1. Middle East and Africa Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 7.2.1. South Africa 7.2.1.1. South Africa Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 7.2.1.2. South Africa Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 7.2.2. GCC 7.2.2.1. GCC Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 7.2.2.2. GCC Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 7.2.3. Rest of ME&A 7.2.3.1. Rest of ME&A Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 7.2.3.2. Rest of ME&A Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 8. South America Pollution Absorbing Bricks Market Size and Forecast by Segmentation (by Value in USD Billion) (2023-2030) 8.1. South America Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 8.2. South America Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 8.2.1. Brazil 8.2.1.1. Brazil Pollution absorbing bricks Market Size and Forecast, by Application (2023-2030) 8.2.1.2. Brazil Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 8.2.2. Argentina 8.2.2.1. Argentina Pollution absorbing bricks Market Size and Forecast, by Application (2023-2030) 8.2.2.2. Argentina Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 8.2.3. Rest Of South America 8.2.3.1. Rest of South America Pollution Absorbing Bricks Market Size and Forecast, by Application (2023-2030) 8.2.3.2. Rest of South America Pollution Absorbing Bricks Market Size and Forecast, by Material Type (2023-2030) 9. Global Pollution Absorbing Bricks Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Pollution absorbing bricks Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Airzyme Inc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Pavegen Ltd. (UK) 10.3. Italcementi (Italy) 10.4. Lafarge (France) 10.5. Wienerberger (Austria) 10.6. Ecobrick Alliance Earth Enterprise (Indonesia) 10.7. Ramtsilo Bricks & Construction (South Africa) 10.8. Midwest Block & Brick (US) 10.9. Brampton Brick (Canada) 10.10. General Shale Inc. (US)’ 10.11. Triangle Brick Co. 10.12. Hindawi 10.13. edition.cnn 10.14. pghbricks 10.15. cpcb.nic 10.16. manobyte 10.17. illustrarch 10.18. archdaily 10.19. panasonic 10.20. dezeen 11. Key Findings 12. Industry Recommendations 13. Pollution Absorbing Bricks Market: Research Methodology