Global Specialty Fertilizers Market size was valued at USD 28.07 Bn. in 2023 and is expected to reach USD 46.58 Bn. by 2030, at a CAGR of 7.5%.Specialty Fertilizers Market Overview

Specialty fertilizers are a diverse group of fertilizers designed to feed the specific nutritional needs and growing conditions of various plants. They provide targeted nutrient delivery, improved nutrient use efficiency and customized solutions for several agricultural and horticultural applications. These are formulated with specific nutrient ratios to address the specific requirements of plants. The report includes historical data, present and future trends, competitive environment of the Specialty Fertilizers industry. The bottom-up approach was used to estimate the market size. For a deeper knowledge of Specialty Fertilizers market penetration, competitive structure, pricing and demand analysis are included in the report. The qualitative and quantitative methods are included in the report for the analysis of the data of the Specialty Fertilizers market.To know about the Research Methodology :- Request Free Sample Report

Specialty Fertilizers Market Drivers

Growing focus on sustainable agriculture to boost the Specialty Fertilizers Market growth Traditional agriculture relies on chemical fertilizers, leading to soil degradation, water pollution, and greenhouse gas emissions. Sustainable agriculture promotes specialty fertilizers that reduce environmental impact and enhance soil health. As growing awareness of the harmful effects of chemical residues on human health resulted in increasing demand for organic food. Specialty fertilizers deliver essential nutrients to plants without the use of synthetic chemicals and thus play a vital role in organic farming. To promote sustainable agricultural practices, governments are implementing regulations and offering incentives. These initiatives encourage farmers to adopt specialty fertilizers that have a lower environmental footprint. Specialty fertilizers are designed to provide specific nutrients tailored to the requirements of several crops and soil types. They improve soil fertility and enhance crop productivity leading to higher yields and better-quality produce. This factor attracts farmers to invest in specialty fertilizers to increase their agricultural operations and drive the Specialty Fertilizers Market growth. The growing research and development in specialty fertilizers fields have led to innovative products that deliver improved nutrient absorption and controlled-release capabilities. These advancements have boosted the adoption of specialty fertilizers in sustainable agriculture. Consumers are increasingly seeking sustainably produced food products and are willing to pay a premium for them. This consumer demand acts as a driver for farmers to adopt sustainable agricultural practices and uses specialty fertilizers to meet the expansion of the Specialty Fertilizers market. Through national program leadership, financial support for research, and program expansion, NIFA encourages sustainable agriculture. Through the USDA Sustainable Development Council, it partners with other federal agencies and offers competitive grant programs, a professional development program, and other services. Through rigorous peer review and competitive grant programs, NIFA is able to choose the best proposals from a wide range of institutions and organizations. Each competitive program has different requirements for applicants. For details on competitive grant programs, which are divided into AFRI (Agriculture and Food Research Initiative) competitive programs and non-AFRI competitive programs, see the Competitive Grants website.Specialty Fertilizers Market Trend

Technological advancements in specialty fertilizers Technological advancements have resulted in the development of specialty fertilizers with improved nutrient delivery mechanisms. For instance, controlled-release fertilizers gradually release nutrients over a long period of time to provide a consistent supply to plants. This method lowers the danger of over-fertilization, minimizes nutrient losses and improves nutrient usage efficiency. Applying specialty fertilizers precisely is made possible by modern technologies. Utilizing information on crop needs and soil nutrient levels, variable rate application systems deliver fertilizers in a targeted way. This precision approach ensures that nutrients are delivered where they are needed the most, optimizing plant uptake and reducing wastage. Technological advancements allow for the formulation of specialty fertilizers tailored to specific crops, soil types, and growth stages. Plants are approved to receive the correct combination of nutrients required for their optimum growth and development thanks to these specialized formulas. Such tailored fertilizers have been significantly improving crop productivity and quality and boost the Specialty Fertilizers Market. Technology is being leveraged to develop specialty fertilizers that have reduced environmental impact. This involves the use of slow-release formulations and enhanced nutrient management practices to reduce nutrient runoff and greenhouse gas emissions. These advancements align with sustainable agriculture practices and address environmental concerns. The integration of specialty fertilizers with digital agriculture technologies is gaining traction. This includes the use of sensors, data analytics and farm management software to optimize fertilizer applications. These digital tools support farmers make informed decisions, improve nutrient management, and enhance overall efficiency in fertilizer usage.Specialty Fertilizers Market Restraints

High-Cost hamper the Specialty Fertilizers Market growth Compared to conventional fertilizers, Specialty fertilizers often come with a higher price tag. This has posed challenges for farmers, particularly those with limited financial resources or operating in regions with low-profit margins. The higher cost has been impeding some farmers from adopting specialty fertilizers, especially on a large scale. Farmers require to consider the economic viability and potential return on investment when selecting fertilizers. The higher cost of specialty fertilizers needs to be compelling by their perceived advantages such as increased crop yields, improved quality and environmental sustainability. If farmers do not see a clear economic advantage in using specialty fertilizers, they have been deciding on more cost-effective options. The production processes include in manufacturing specialty fertilizers, particularly those with advanced formulations or controlled-release mechanisms, have been more complex and resource-intensive. This complexity has contributed to higher production costs, which are then passed on to the end consumers. These increased production costs have made specialty fertilizers relatively more expensive compared to conventional alternatives. As a result, the high cost of the specialty fertilizers hamper the specialty fertilizers Market growth.Specialty Fertilizers Market Regional Insights

Europe held the second-largest Specialty Fertilizers Market share and is expected to grow during the forecast period. Europe has been at the forefront of encouraging sustainable agricultural practices. Reducing agriculture's negative environmental effects and enhancing soil health are top priorities of the region. Sustainable agriculture's objectives align with specialty fertilizers, which are designed to reduce nutrient runoff, increase nutrient-use efficiency, and improve soil fertility. The growing emphasis on sustainability is driving regional Specialty Fertilizers Market growth. The usage of organic agricultural techniques has significantly increased. Organic farming minimizes the use of synthetic chemicals by relying on natural inputs. Specialty fertilizers, particularly those derived from organic sources, play a significant role in organic farming as they deliver essential nutrients in an organic as well as sustainable manner. The increasing demand for specialty fertilizers in the organic farming sectors is driving market growth in the region. In Europe, nutrient stewardship is a top concern since it attempts to optimize nutrient usage efficiency while reducing environmental effects. The ideas of nutrient stewardship are aligned with specialty fertilizers’ focused nutrient delivery and improved nutrient management practices. The emphasis on appropriate nutrient management drives the regional Speciality Industry growth. The usage of specialized fertilizers is one of the sustainable agricultural practices that are promoted by strict legislation and policies in the region. The Common Agricultural Policy (CAP) of the European Union places a strong focus on soil health, nutrient management and environmental sustainability. These regulations promote the adoption of specialty fertilizers that reduces environmental impact and enhance soil fertility, driving Specialty Fertilizers market growth. The CAP 2023-27 is a modernized policy, A greener CAP: The CAP 2023-27 supports agriculture in making a much stronger contribution to the goals of the European Green Deal: Higher green ambitions, Contribute to the Green Deal targets, Enhanced conditionality, Eco-schemes, Rural development, operational programs, climate and biodiversity. This policy encourages to sustainable agriculture and promotes the use of the Specialty Fertilizers Market.Specialty Fertilizers Market Segment Analysis

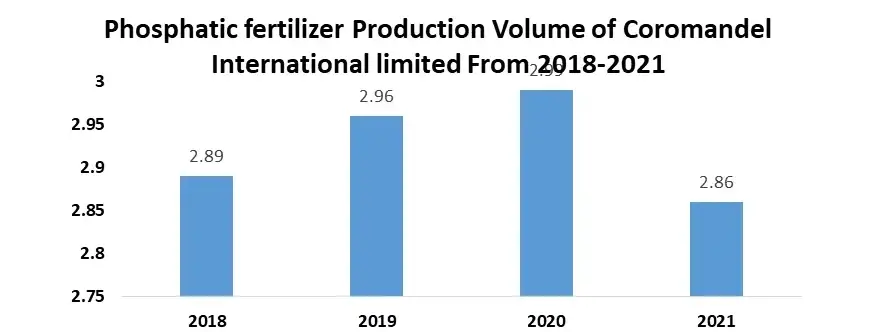

Based on Application, the market is segmented into Foliar, Soil and Fertigation. Soil held the largest Specialty Fertilizers Market share in 2023. Specialty fertilizers have been integrated into the soil, where they slowly release nutrients over time. This method ensures that plants receive an ongoing supply of nutrients, meeting their needs throughout the growing season. The slow release of nutrients from the soil enables plant roots to effectively absorb and utilize nutrients. Various types of soil and crops have been grown in soil. Specialty fertilizers are versatile and have been used in fields, gardens, and nurseries. Soil is a flexible method suitable for various crops such as cereals, fruits and vegetables. It is widely applicable in various agricultural settings, offering nutrients directly to the soil for healthy growth. Soil application ensures that nutrients are directly available in the root zone, where they have been easily absorbed by plant roots. The proximity of the nutrients to the root system enhances nutrient uptake efficiency and minimizes losses due to leaching or runoff. This direct contact with the root system encourages effective nutrient assimilation and supports healthy plant growth. Soil application aligns well with crop rotation and tillage practices commonly employed in farming systems. Farmers have been incorporating specialty fertilizers into the soil during crop rotation or tillage operations, ensuring that subsequent crops benefit from the residual nutrients. This flexibility in application timing and compatibility with existing agricultural practices makes the soil a convenient choice for many farmers.The report offers Competitive benchmarking of the Specialty Fertilizers industry through the Specialty Fertilizers Market revenue, share and size of the key players. The report provides such type of competitive landscape of all Specialty Fertilizers Key Players to assist new market entrants. It also gives information about the analysis of the Competitive Landscape in the Specialty Fertilizers Market structure, highlighting the key players and their strategies. Some of the key players are Nutrein Ltd. (Canada), Yara International ASA (Norway) , The Mosaic Company(U.S), CF Industries Holdings, Inc (U.S), OCP SA(Morocco), SQM S.A.(Chile), Israel Chemicals Ltd. (Israel), OCL Global(Netherlands), Indian Farmers Fertiliser Cooperative Limited (IFFCO) (India) , Grupa Azoty S. A.(Poland), Wilbur –Ellis Holding, Inc.(U.S), Nufarm Ltd(Australia), Coromandel International (India) and others. To enhance their product portfolio, many of the key players conducted research and development activities. Coromandel International (India) launched new fertilizer in 2021. GroShakti Plus: It is a superior complex Fertilizer with EnPhos Technology and fortified Zinc. It has the high Power to Increase the yield, coupled with superior quality Produce. It is suitable for several crops such as Cereals, Pulses, Oilseeds, Fruit and Vegetable crops, etc. It has the highest nutrient content among n: p: k fertilizers with 63% nutrients. N: P2O5: K2O in the ratio of 1:2.5:1, which is scientifically excellent for basal application. It also contains Potassium (14%) besides Nitrogen and Phosphorous help for higher quality.

Specialty Fertilizers Market Competitive Landscape

Specialty Fertilizers Market Scope: Inquire Before Buying

Global Specialty Fertilizers Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 28.07 Bn. Forecast Period 2024 to 2030 CAGR: 7.5% Market Size in 2030: US $ 46.58 Bn. Segments Covered: By Type Urea Ammonium Nitrate (UAN) Calcium Ammonium Nitrate (CAN) Monoammonium Phosphate (MAP) Sulfate of Potash (SOP) Potassium Nitrate Urea Derivatives Blends of NPK Others By Form Dry Liquid By Technology Controlled-release Fertilizers Water-soluble Fertilizers Liquid Fertilizers Micronutrients Other By Crop Type Cereals & Grains Oilseeds & Pulses Fruits & Vegetables Other By Application Fertigation Foliar Soil Specialty Fertilizers Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Specialty Fertilizers Market Key Players

1. Nutrein Ltd. (Canada) 2. Yara International ASA (Norway) 3. The Mosaic Company(U.S) 4. CF Industries Holdings, Inc (U.S) 5. OCP SA(Morocco) 6. SQM S.A.(Chile) 7. Israel Chemicals Ltd. (Israel) 8. OCL Global(Netherlands) 9. Indian Farmers Fertiliser Cooperative Limited (IFFCO) (India) 10. Grupa Azoty S. A.(Poland) 11. Wilbur –Ellis Holding, Inc.(U.S) 12. Nufarm Ltd(Australia) 13. Coromandel International (India) 14. Deepak Fertilizers and Petrochemicals Corporation Limited (India) 15. Zuari Agro Chemicals Ltd.(India) 16. Kugler Company(U.S.) 17. Kingenta Ecological Group Co., Ltd (China) 18. Brandt, Inc.(U.S.) 19. Agro Liquid(U.S.) 20. Plant Food Company, Inc.,(U.S.) 21. Koch Industries Inc.(U.S.) 22. Helena Agri-Enterprises, LLC(U.S.) 23. Valagro SpA(Italy) 24. Hebei Monband Water Soluble Fertilizer Co., Ltd. (China) 25. Haifa Group (Israel) 26. Uralechem(Russia) 27. Euro Chemical Group(Switzerland)Frequently Asked Questions:

1] What is the growth rate of the Global Specialty Fertilizers Market? Ans. The Global Specialty Fertilizers Market is growing at a significant rate of 7.5% during the forecast period. 2] Which region is expected to dominate the Global Specialty Fertilizers Market? Ans. Europe is expected to dominate the Specialty Fertilizers Market during the forecast period. 3] What is the expected Global Specialty Fertilizers Market size by 2030? Ans. The Specialty Fertilizers Market size is expected to reach USD 46.58 Bn by 2030. 4] Which are the top players in the Global Specialty Fertilizers Market? Ans. The major top players in the Global Specialty Fertilizers Market Nutrein Ltd. (Canada), Yara International ASA (Norway) , The Mosaic Company(U.S), CF Industries Holdings, Inc (U.S), OCP SA(Morocco), SQM S.A.(Chile), Israel Chemicals Ltd. (Israel), OCL Global(Netherlands), Indian Farmers Fertiliser Cooperative Limited (IFFCO) (India) , Grupa Azoty S. A.(Poland), Wilbur –Ellis Holding, Inc.(U.S), Nufarm Ltd(Australia), Coromandel International (India) and Others. 5] What are the factors driving the Global Specialty Fertilizers Market growth? Ans. The growing focus on sustainable agriculture and increased demand for organic products are expected to drive market growth during the forecast period

1. Specialty Fertilizers Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Specialty Fertilizers Market: Dynamics 2.1. Specialty Fertilizers Market Trends by Region 2.1.1. North America Specialty Fertilizers Market Trends 2.1.2. Europe Specialty Fertilizers Market Trends 2.1.3. Asia Pacific Specialty Fertilizers Market Trends 2.1.4. Middle East and Africa Specialty Fertilizers Market Trends 2.1.5. South America Specialty Fertilizers Market Trends 2.2. Specialty Fertilizers Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Specialty Fertilizers Market Drivers 2.2.1.2. North America Specialty Fertilizers Market Restraints 2.2.1.3. North America Specialty Fertilizers Market Opportunities 2.2.1.4. North America Specialty Fertilizers Market Challenges 2.2.2. Europe 2.2.2.1. Europe Specialty Fertilizers Market Drivers 2.2.2.2. Europe Specialty Fertilizers Market Restraints 2.2.2.3. Europe Specialty Fertilizers Market Opportunities 2.2.2.4. Europe Specialty Fertilizers Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Specialty Fertilizers Market Drivers 2.2.3.2. Asia Pacific Specialty Fertilizers Market Restraints 2.2.3.3. Asia Pacific Specialty Fertilizers Market Opportunities 2.2.3.4. Asia Pacific Specialty Fertilizers Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Specialty Fertilizers Market Drivers 2.2.4.2. Middle East and Africa Specialty Fertilizers Market Restraints 2.2.4.3. Middle East and Africa Specialty Fertilizers Market Opportunities 2.2.4.4. Middle East and Africa Specialty Fertilizers Market Challenges 2.2.5. South America 2.2.5.1. South America Specialty Fertilizers Market Drivers 2.2.5.2. South America Specialty Fertilizers Market Restraints 2.2.5.3. South America Specialty Fertilizers Market Opportunities 2.2.5.4. South America Specialty Fertilizers Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Specialty Fertilizers Industry 2.8. Analysis of Government Schemes and Initiatives For Specialty Fertilizers Industry 2.9. Specialty Fertilizers Market Trade Analysis 2.10. The Global Pandemic Impact on Specialty Fertilizers Market 3. Specialty Fertilizers Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 3.1.1. Urea Ammonium Nitrate (UAN) 3.1.2. Calcium Ammonium Nitrate (CAN) 3.1.3. Monoammonium Phosphate (MAP) 3.1.4. Sulfate of Potash (SOP) 3.1.5. Potassium Nitrate 3.1.6. Urea Derivatives 3.1.7. Blends of NPK 3.1.8. Others 3.2. Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 3.2.1. Dry 3.2.2. Liquid 3.3. Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 3.3.1. Controlled-release Fertilizers 3.3.2. Water-soluble Fertilizers 3.3.3. Liquid Fertilizers 3.3.4. Micronutrients 3.3.5. Other 3.4. Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 3.4.1. Cereals & Grains 3.4.2. Oilseeds & Pulses 3.4.3. Fruits & Vegetables 3.4.4. Other 3.5. Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 3.5.1. Fertigation 3.5.2. Foliar 3.5.3. Soil 3.6. Specialty Fertilizers Market Size and Forecast, by Region (2023-2030) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Specialty Fertilizers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 4.1.1. Urea Ammonium Nitrate (UAN) 4.1.2. Calcium Ammonium Nitrate (CAN) 4.1.3. Monoammonium Phosphate (MAP) 4.1.4. Sulfate of Potash (SOP) 4.1.5. Potassium Nitrate 4.1.6. Urea Derivatives 4.1.7. Blends of NPK 4.1.8. Others 4.2. North America Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 4.2.1. Dry 4.2.2. Liquid 4.3. North America Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 4.3.1. Controlled-release Fertilizers 4.3.2. Water-soluble Fertilizers 4.3.3. Liquid Fertilizers 4.3.4. Micronutrients 4.3.5. Other 4.4. North America Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 4.4.1. Cereals & Grains 4.4.2. Oilseeds & Pulses 4.4.3. Fruits & Vegetables 4.4.4. Other 4.5. North America Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 4.5.1. Fertigation 4.5.2. Foliar 4.5.3. Soil 4.6. North America Specialty Fertilizers Market Size and Forecast, by Country (2023-2030) 4.6.1. United States 4.6.1.1. United States Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 4.6.1.1.1. Urea Ammonium Nitrate (UAN) 4.6.1.1.2. Calcium Ammonium Nitrate (CAN) 4.6.1.1.3. Monoammonium Phosphate (MAP) 4.6.1.1.4. Sulfate of Potash (SOP) 4.6.1.1.5. Potassium Nitrate 4.6.1.1.6. Urea Derivatives 4.6.1.1.7. Blends of NPK 4.6.1.1.8. Others 4.6.1.2. United States Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 4.6.1.2.1. Dry 4.6.1.2.2. Liquid 4.6.1.3. United States Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 4.6.1.3.1. Controlled-release Fertilizers 4.6.1.3.2. Water-soluble Fertilizers 4.6.1.3.3. Liquid Fertilizers 4.6.1.3.4. Micronutrients 4.6.1.3.5. Other 4.6.1.4. United States Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 4.6.1.4.1. Cereals & Grains 4.6.1.4.2. Oilseeds & Pulses 4.6.1.4.3. Fruits & Vegetables 4.6.1.4.4. Other 4.6.1.5. United States Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 4.6.1.5.1. Fertigation 4.6.1.5.2. Foliar 4.6.1.5.3. Soil 4.6.2. Canada 4.6.2.1. Canada Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 4.6.2.1.1. Urea Ammonium Nitrate (UAN) 4.6.2.1.2. Calcium Ammonium Nitrate (CAN) 4.6.2.1.3. Monoammonium Phosphate (MAP) 4.6.2.1.4. Sulfate of Potash (SOP) 4.6.2.1.5. Potassium Nitrate 4.6.2.1.6. Urea Derivatives 4.6.2.1.7. Blends of NPK 4.6.2.1.8. Others 4.6.2.2. Canada Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 4.6.2.2.1. Dry 4.6.2.2.2. Liquid 4.6.2.3. Canada Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 4.6.2.3.1. Controlled-release Fertilizers 4.6.2.3.2. Water-soluble Fertilizers 4.6.2.3.3. Liquid Fertilizers 4.6.2.3.4. Micronutrients 4.6.2.3.5. Other 4.6.2.4. Canada Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 4.6.2.4.1. Cereals & Grains 4.6.2.4.2. Oilseeds & Pulses 4.6.2.4.3. Fruits & Vegetables 4.6.2.4.4. Other 4.6.2.5. Canada Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 4.6.2.5.1. Fertigation 4.6.2.5.2. Foliar 4.6.2.5.3. Soil 4.6.3. Mexico 4.6.3.1. Mexico Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 4.6.3.1.1. Urea Ammonium Nitrate (UAN) 4.6.3.1.2. Calcium Ammonium Nitrate (CAN) 4.6.3.1.3. Monoammonium Phosphate (MAP) 4.6.3.1.4. Sulfate of Potash (SOP) 4.6.3.1.5. Potassium Nitrate 4.6.3.1.6. Urea Derivatives 4.6.3.1.7. Blends of NPK 4.6.3.1.8. Others 4.6.3.2. Mexico Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 4.6.3.2.1. Dry 4.6.3.2.2. Liquid 4.6.3.3. Mexico Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 4.6.3.3.1. Controlled-release Fertilizers 4.6.3.3.2. Water-soluble Fertilizers 4.6.3.3.3. Liquid Fertilizers 4.6.3.3.4. Micronutrients 4.6.3.3.5. Other 4.6.3.4. Mexico Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 4.6.3.4.1. Cereals & Grains 4.6.3.4.2. Oilseeds & Pulses 4.6.3.4.3. Fruits & Vegetables 4.6.3.4.4. Other 4.6.3.5. Mexico Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 4.6.3.5.1. Fertigation 4.6.3.5.2. Foliar 4.6.3.5.3. Soil 5. Europe Specialty Fertilizers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 5.2. Europe Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 5.3. Europe Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 5.4. Europe Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 5.5. Europe Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 5.6. Europe Specialty Fertilizers Market Size and Forecast, by Country (2023-2030) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 5.6.1.2. United Kingdom Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 5.6.1.3. United Kingdom Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 5.6.1.4. United Kingdom Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 5.6.1.5. United Kingdom Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 5.6.2. France 5.6.2.1. France Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 5.6.2.2. France Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 5.6.2.3. France Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 5.6.2.4. France Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 5.6.2.5. France Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 5.6.3. Germany 5.6.3.1. Germany Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 5.6.3.2. Germany Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 5.6.3.3. Germany Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 5.6.3.4. Germany Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 5.6.3.5. Germany Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 5.6.4. Italy 5.6.4.1. Italy Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 5.6.4.2. Italy Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 5.6.4.3. Italy Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 5.6.4.4. Italy Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 5.6.4.5. Italy Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 5.6.5. Spain 5.6.5.1. Spain Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 5.6.5.2. Spain Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 5.6.5.3. Spain Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 5.6.5.4. Spain Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 5.6.5.5. Spain Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 5.6.6. Sweden 5.6.6.1. Sweden Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 5.6.6.2. Sweden Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 5.6.6.3. Sweden Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 5.6.6.4. Sweden Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 5.6.6.5. Sweden Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 5.6.7. Austria 5.6.7.1. Austria Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 5.6.7.2. Austria Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 5.6.7.3. Austria Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 5.6.7.4. Austria Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 5.6.7.5. Austria Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 5.6.8.2. Rest of Europe Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 5.6.8.3. Rest of Europe Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 5.6.8.4. Rest of Europe Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 5.6.8.5. Rest of Europe Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Specialty Fertilizers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 6.3. Asia Pacific Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 6.4. Asia Pacific Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 6.5. Asia Pacific Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 6.6. Asia Pacific Specialty Fertilizers Market Size and Forecast, by Country (2023-2030) 6.6.1. China 6.6.1.1. China Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 6.6.1.2. China Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 6.6.1.3. China Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 6.6.1.4. China Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 6.6.1.5. China Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 6.6.2. S Korea 6.6.2.1. S Korea Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 6.6.2.2. S Korea Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 6.6.2.3. S Korea Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 6.6.2.4. S Korea Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 6.6.2.5. S Korea Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 6.6.3. Japan 6.6.3.1. Japan Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 6.6.3.2. Japan Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 6.6.3.3. Japan Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 6.6.3.4. Japan Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 6.6.3.5. Japan Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 6.6.4. India 6.6.4.1. India Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 6.6.4.2. India Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 6.6.4.3. India Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 6.6.4.4. India Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 6.6.4.5. India Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 6.6.5. Australia 6.6.5.1. Australia Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 6.6.5.2. Australia Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 6.6.5.3. Australia Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 6.6.5.4. Australia Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 6.6.5.5. Australia Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 6.6.6. Indonesia 6.6.6.1. Indonesia Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 6.6.6.2. Indonesia Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 6.6.6.3. Indonesia Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 6.6.6.4. Indonesia Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 6.6.6.5. Indonesia Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 6.6.7. Malaysia 6.6.7.1. Malaysia Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 6.6.7.2. Malaysia Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 6.6.7.3. Malaysia Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 6.6.7.4. Malaysia Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 6.6.7.5. Malaysia Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 6.6.8. Vietnam 6.6.8.1. Vietnam Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 6.6.8.2. Vietnam Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 6.6.8.3. Vietnam Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 6.6.8.4. Vietnam Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 6.6.8.5. Vietnam Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 6.6.9. Taiwan 6.6.9.1. Taiwan Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 6.6.9.2. Taiwan Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 6.6.9.3. Taiwan Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 6.6.9.4. Taiwan Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 6.6.9.5. Taiwan Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 6.6.10.2. Rest of Asia Pacific Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 6.6.10.3. Rest of Asia Pacific Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 6.6.10.4. Rest of Asia Pacific Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 6.6.10.5. Rest of Asia Pacific Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Specialty Fertilizers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 7.3. Middle East and Africa Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 7.4. Middle East and Africa Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 7.5. Middle East and Africa Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 7.6. Middle East and Africa Specialty Fertilizers Market Size and Forecast, by Country (2023-2030) 7.6.1. South Africa 7.6.1.1. South Africa Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 7.6.1.2. South Africa Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 7.6.1.3. South Africa Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 7.6.1.4. South Africa Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 7.6.1.5. South Africa Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 7.6.2. GCC 7.6.2.1. GCC Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 7.6.2.2. GCC Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 7.6.2.3. GCC Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 7.6.2.4. GCC Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 7.6.2.5. GCC Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 7.6.3. Nigeria 7.6.3.1. Nigeria Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 7.6.3.2. Nigeria Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 7.6.3.3. Nigeria Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 7.6.3.4. Nigeria Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 7.6.3.5. Nigeria Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 7.6.4.2. Rest of ME&A Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 7.6.4.3. Rest of ME&A Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 7.6.4.4. Rest of ME&A Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 7.6.4.5. Rest of ME&A Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 8. South America Specialty Fertilizers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 8.2. South America Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 8.3. South America Specialty Fertilizers Market Size and Forecast, by Technology(2023-2030) 8.4. South America Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 8.5. South America Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 8.6. South America Specialty Fertilizers Market Size and Forecast, by Country (2023-2030) 8.6.1. Brazil 8.6.1.1. Brazil Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 8.6.1.2. Brazil Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 8.6.1.3. Brazil Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 8.6.1.4. Brazil Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 8.6.1.5. Brazil Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 8.6.2. Argentina 8.6.2.1. Argentina Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 8.6.2.2. Argentina Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 8.6.2.3. Argentina Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 8.6.2.4. Argentina Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 8.6.2.5. Argentina Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Specialty Fertilizers Market Size and Forecast, by Type (2023-2030) 8.6.3.2. Rest Of South America Specialty Fertilizers Market Size and Forecast, by Form (2023-2030) 8.6.3.3. Rest Of South America Specialty Fertilizers Market Size and Forecast, by Technology (2023-2030) 8.6.3.4. Rest Of South America Specialty Fertilizers Market Size and Forecast, by Crop Type (2023-2030) 8.6.3.5. Rest Of South America Specialty Fertilizers Market Size and Forecast, by Application (2023-2030) 9. Global Specialty Fertilizers Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Specialty Fertilizers Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Nutrein Ltd. (Canada) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Yara International ASA (Norway) 10.3. The Mosaic Company(U.S) 10.4. CF Industries Holdings, Inc (U.S) 10.5. OCP SA(Morocco) 10.6. SQM S.A.(Chile) 10.7. Israel Chemicals Ltd. (Israel) 10.8. OCL Global(Netherlands) 10.9. Indian Farmers Fertiliser Cooperative Limited (IFFCO) (India) 10.10. Grupa Azoty S. A.(Poland) 10.11. Wilbur –Ellis Holding, Inc.(U.S) 10.12. Nufarm Ltd(Australia) 10.13. Coromandel International (India) 10.14. Deepak Fertilizers and Petrochemicals Corporation Limited (India) 10.15. Zuari Agro Chemicals Ltd.(India) 10.16. Kugler Company(U.S.) 10.17. Kingenta Ecological Group Co., Ltd (China) 10.18. Brandt, Inc.(U.S.) 10.19. Agro Liquid(U.S.) 10.20. Plant Food Company, Inc.,(U.S.) 10.21. Koch Industries Inc.(U.S.) 10.22. Helena Agri-Enterprises, LLC(U.S.) 10.23. Valagro SpA(Italy) 10.24. Hebei Monband Water Soluble Fertilizer Co., Ltd. (China) 10.25. Haifa Group (Israel) 10.26. Uralechem(Russia) 10.27. Euro Chemical Group(Switzerland) 11. Key Findings 12. Industry Recommendations 13. Specialty Fertilizers Market: Research Methodology 14. Terms and Glossary