The Medical Imaging Market size was valued at USD 33.75 Bn in 2023 and market revenue is growing at a CAGR of 4.5 % from 2023 to 2030, reaching nearly USD 45.93 Bn by 2030.Medical Imaging Market Overview:

The medical imaging market has undergone rapid evolution, becoming a cornerstone of modern medicine essential for diagnosis and treatment across a spectrum of diseases. Various technologies, including ultrasonography, x-rays, mammography, computed tomography (CT scans), and nuclear medicine, comprise this field. Their significance spans diverse medical settings and all tiers of healthcare, providing indispensable diagnostic capabilities, disease progression assessment, and treatment response monitoring. Advancements in medical imaging technologies have yielded improved image quality, faster scan times, and enhanced diagnostic capabilities helping to boost the Medical Imaging Market. Integration of artificial intelligence (AI) and machine learning algorithms is revolutionizing medical imaging by enabling automated image analysis, interpretation, and workflow optimization. AI-based tools detect lesions, reconstruct images, and perform predictive analytics, augmenting healthcare providers' capabilities and enhancing patient care. Despite these advancements, a significant challenge persists in many low and lower-middle-income countries, where the affordability of imaging equipment is prohibitive, compounded by a scarcity of trained healthcare professionals proficient in their operation. To address this issue, the World Health Organization (WHO) collaborates closely with partners and manufacturers to devise technical solutions tailored for enhanced diagnostic imaging services, particularly in remote areas. The WHO and its partners institute training programs to equip healthcare workers with necessary skills in utilizing and managing medical imaging technologies, with a strong emphasis on ensuring patient safety. Through these concerted efforts, strides are being made to bridge the gap in access to quality medical imaging services, ultimately contributing to more equitable healthcare delivery across the world. This factor also significantly helps to escalate the Medical Imaging Market growth.To know about the Research Methodology :- Request Free Sample Report

Medical Imaging Market: Dynamics

Driver Increase in Chronic Diseases Boosts the Medical Imaging Market Growth The correlation between the rise in chronic diseases and the growth of the medical imaging market makes sense. As chronic conditions become more prevalent, the demand for diagnostic tools like medical imaging increases. These technologies play an important role in the early detection, accurate diagnosis, and monitoring of various chronic illnesses, ranging from cardiovascular diseases to cancer. The advancement of medical imaging technologies, such as MRI, CT scans, ultrasound, and PET scans, has significantly improved ability to detect and diagnose chronic conditions at earlier stages when they are more treatable. As populations age and lifestyles change, the incidence of chronic diseases tends to increase, further driving the medical imaging services Market. Ongoing technological advancements in medical imaging, such as improved image resolution, faster scanning times, and the development of hybrid imaging modalities, continue to expand the capabilities and applications of these technologies in diagnosing and managing chronic diseases. The rising incidence of chronic illnesses and the expanding elderly demographic are driving the demand for advanced medical imaging technologies. By 2050, the United States is expected to see a nearly twofold increase in individuals over 50 with at least one chronic condition, along with a substantial rise in those with multiple ailments. This underscores the urgent need for rapid and accurate diagnostic tools to enable timely intervention and treatment. The global population is undergoing a significant demographic shift, with a projected 16% of the world's population aged over 65 by 2050, up from 9% in 2019. This demographic trend brings heightened health concerns, leading to a growing demand for medical imaging solutions capable of addressing age-related conditions and supporting effective healthcare management. In response to these factors, the Medical Imaging Market is expected to experience substantial growth as it adapts to meet the evolving healthcare needs of an aging population burdened by increasing chronic disease prevalence.Restrain Regulatory Compliance Limits the Medical Imaging Market Growth Regulatory compliance impedes the growth of the medical imaging market by imposing significant costs and administrative burdens on imaging facilities. Compliance requirements, such as FDA approvals and accreditation standards, necessitate substantial investments in equipment, training, and documentation, diverting financial resources from growth initiatives. Stringent regulatory frameworks create barriers to entry for new market entrants and stifle innovation by delaying product development and increasing time-to-market. Geographic variability in regulatory requirements adds complexity to market entry and distribution strategies, limiting growth opportunities. Non-compliance risks, including fines, legal liabilities, and reputational damage, further deter investment and growth in the imaging market. Despite these challenges, regulatory oversight is crucial for ensuring patient safety and maintaining quality standards. Balancing regulatory requirements with the need for innovation and market growth is essential to fostering a regulatory environment conducive to the sustainable development of the medical imaging market. Regulatory Overview of Medical Imaging Equipment in the United States

Opportunity Technological advancements in medical imaging have revolutionized diagnostic capabilities, leading to improved patient outcomes and enhanced clinical decision-making. Innovations across various imaging modalities, such as MRI, CT scans, ultrasound, and PET scans, have significantly enhanced image quality, resolution, and speed, enabling clinicians to visualize anatomical structures and pathological changes with greater precision and accuracy. The development of high-field MRI systems with stronger magnetic fields and advanced coil designs, resulting in higher spatial resolution, faster scan times, and improved tissue contrast. These innovations allow for more detailed imaging of the brain, spine, joints, and soft tissues, facilitating early detection and characterization of neurological disorders, musculoskeletal injuries, and oncological conditions. Advancements in CT imaging technology, such as multidetector CT (MDCT) scanners and dual-energy CT (DECT) imaging, have led to faster acquisition times, reduced radiation doses, and enhanced tissue differentiation, which is expected to present an opportunity for the Medical Imaging Market growth. MDCT enables rapid volumetric imaging of organs and blood vessels, while DECT provides additional information on tissue composition and functional parameters, aiding in the diagnosis and staging of cardiovascular diseases, cancer, and other pathologies. Ultrasound technology has also undergone significant advancements, including the development of high-frequency transducers, 3D/4D imaging capabilities, and contrast-enhanced ultrasound techniques. These innovations enable detailed visualization of fetal anatomy during prenatal screening, precise guidance for interventional procedures, and real-time assessment of cardiac function, liver lesions, and vascular abnormalities. The integration of artificial intelligence (AI) and machine learning algorithms into medical imaging workflows holds promise for automating image analysis, improving diagnostic accuracy, and enhancing clinical productivity. AI-driven image reconstruction techniques, computer-aided detection systems, and predictive analytics tools have the potential to revolutionize image interpretation, streamline workflow efficiency, and optimize resource utilization in medical imaging departments. Technological advancements in medical imaging continue to drive innovation, expand clinical capabilities, and improve patient care across a wide range of medical specialties, setting the stage for further growth and development in the field.

Regulatory Body U.S. Food and Drug Administration (FDA) Responsible Division Division of Radiological Health within the Center for Devices and Radiological Health (CDRH) Equipment Covered Non-ionizing, radiation-emitting medical devices, including MRI systems and medical x-ray imaging equipment Regulations Title 21, Subchapter J, Parts 1000 through 1050 of the Code of Federal Regulations Specific Requirements Compliance with radiological health requirements Performance Standards Established performance standards and guidelines for medical x-ray imaging equipment Compliance Verification Manufacturers and importers must follow Electronic Product Radiation Control (EPRC) regulations and procedures or provide a declaration of conformity to equivalent International Electrotechnical Commission (IEC) standards Objective Ensuring safety and effectiveness of medical imaging equipment Medical Imaging Market Segment Analysis

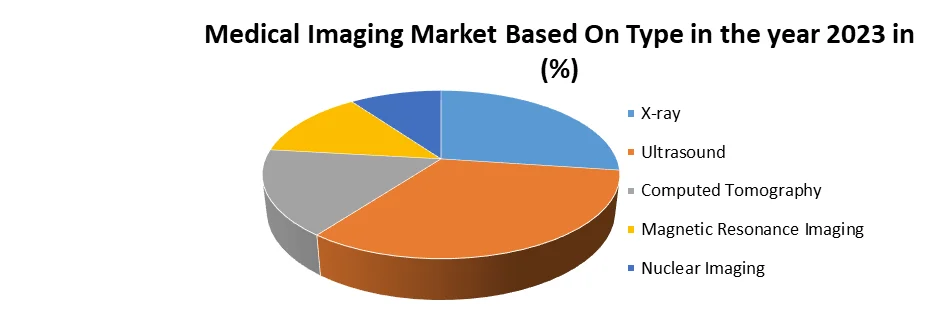

Based on Type, The Ultrasound segment dominated the type segment of the Medical Imaging Market in the year 2023. The ultrasound segment has emerged as a dominant force in the medical imaging industry due to its unique combination of safety, versatility, portability, real-time capabilities, and cost-effectiveness. Ultrasound imaging is non-invasive and does not involve ionizing radiation, making it safer for patients of all ages, including pregnant women and children. Its versatility allows for visualization of various anatomical structures and physiological processes across multiple medical specialties, from obstetrics and gynaecology to cardiology and emergency medicine. The portability of ultrasound equipment has revolutionized healthcare delivery by enabling point-of-care imaging in diverse clinical settings, including remote and resource-limited areas. Real-time imaging capabilities provide instant feedback, allowing clinicians to visualize dynamic processes such as blood flow and fetal development in real-time, guiding interventions and clinical decision-making. Ultrasound imaging is cost-effective compared to other imaging modalities like MRI and CT scans, making it accessible to a wide range of healthcare facilities. Technological advancements, such as 3D/4D imaging and contrast-enhanced ultrasound, continue to expand the applications of ultrasound, further solidifying its dominance in the Medical Imaging Market as an indispensable diagnostic and interventional tool.

Medical Imaging Market: Regional Analysis

North America dominated the Medical Imaging Market in the year 2023. North America's supremacy in the medical imaging industry stems from its multifaceted strengths. The region boasts a sophisticated healthcare infrastructure characterized by an extensive network of hospitals, clinics, imaging centers, and research institutions. This Strong foundation facilitates widespread accessibility to medical imaging services, fostering the adoption of advanced technologies across diverse healthcare settings. The United States and Canada stand as global pioneers in technological innovation, particularly in the field of medical imaging. Industry giants such as Siemens Healthineers, GE Healthcare, and Philips Healthcare, headquartered in North America, spearheaded the development and integration of cutting-edge imaging solutions, positioning the region at the forefront of the market. North America's substantial healthcare expenditure, among the highest globally, underscores its commitment to investing in medical imaging equipment, infrastructure, and research. This significant financial backing, coupled with the region's affluent population and comprehensive health insurance coverage, fuels the demand for diagnostic imaging services, driving market growth. The region’s leadership in medical imaging is further buoyed by its thriving research ecosystem, comprising prestigious academic institutions, renowned medical centers, and dynamic healthcare organizations. Collaborative efforts between industry, academia, and government entities drive innovation and foster groundbreaking advancements in imaging technology. The region benefits from a conducive regulatory environment, particularly in the United States, where the FDA sets stringent yet transparent standards for the development, approval, and commercialization of medical imaging devices. This regulatory oversight ensures the safety, efficacy, and quality of imaging products, instilling confidence in the Medical Imaging Market.Medical Imaging Market Scope: Inquire before buying

Medical Imaging Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 33.75 Bn. Forecast Period 2024 to 2030 CAGR: 4.5% Market Size in 2030: US $ 45.93 Bn. Segments Covered: by Type X-ray Ultrasound Computed Tomography Magnetic Resonance Imaging Nuclear Imaging by Application Cardiology Neurology Orthopedics Gynecology Oncology Others by End-user Hospitals Diagnostic Imaging Centers Ambulatory Imaging Centers Others Medical Imaging Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Medical Imaging Market Key Players:

North America 1. GE Healthcare (United States) 2. Hologic, Inc. (United States) 3. Carestream Health (United States) 4. Varian Medical Systems (United States) 5. Bruker Corporation (United States) Europe 1. Siemens Healthineers (Germany) 2. Philips Healthcare (Netherlands) 3. Agfa (Gevaert Group (Belgium) 4. Esaote S.p.A. (Italy) 5. Ziehm Imaging GmbH (Germany) 6. Medtronic plc (Ireland) Asia Pacific 1. Canon Medical Systems Corporation (Japan) 2. Fujifilm Holdings Corporation (Japan) 3. Hitachi Healthcare (Japan) 4. Samsung Medison (South Korea) 5. Shimadzu Corporation (Japan) 6. Konica Minolta, Inc. (Japan) 7. Mindray Medical International Limited (China) 8. Canon Inc. (Japan) Frequently Asked Questions 1] What segments are covered in the Global Medical Imaging Market report? Ans. The segments covered in the Medical Imaging Market report are based on, Type, Application, End User, and Regions. 2] Which region is expected to hold the highest share of the Global Medical Imaging Market? Ans. The North America region is expected to hold the highest share of the Medical Imaging Market. 3] What is the market size of the Global Medical Imaging Market by 2030? Ans. The market size of the Medical Imaging Market by 2030 is expected to reach US$ 45.93 Bn. 4] What was the market size of the Global Medical Imaging Market in 2023? Ans. The market size of the Medical Imaging Market in 2023 was valued at US$ 33.75Bn. 5] Key players in the Medical Imaging Market. Ans. GE Healthcare (United States), Hologic, Inc. (United States), Carestream Health (United States), Varian Medical Systems (United States) and Bruker Corporation (United States)

1. Medical Imaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Medical Imaging Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Product Segment 2.3.3. End User Segment 2.3.4. Revenue (2023) 2.3.5. Company Locations 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Medical Imaging Market: Dynamics 3.1. Medical Imaging Market Trends by Region 3.1.1. North America Medical Imaging Market Trends 3.1.2. Europe Medical Imaging Market Trends 3.1.3. Asia Pacific Medical Imaging Market Trends 3.1.4. Middle East and Africa Medical Imaging Market Trends 3.1.5. South America Medical Imaging Market Trends 3.2. Medical Imaging Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Medical Imaging Market Drivers 3.2.1.2. North America Medical Imaging Market Restraints 3.2.1.3. North America Medical Imaging Market Opportunities 3.2.1.4. North America Medical Imaging Market Challenges 3.2.2. Europe 3.2.2.1. Europe Medical Imaging Market Drivers 3.2.2.2. Europe Medical Imaging Market Restraints 3.2.2.3. Europe Medical Imaging Market Opportunities 3.2.2.4. Europe Medical Imaging Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Medical Imaging Market Drivers 3.2.3.2. Asia Pacific Medical Imaging Market Restraints 3.2.3.3. Asia Pacific Medical Imaging Market Opportunities 3.2.3.4. Asia Pacific Medical Imaging Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Medical Imaging Market Drivers 3.2.4.2. Middle East and Africa Medical Imaging Market Restraints 3.2.4.3. Middle East and Africa Medical Imaging Market Opportunities 3.2.4.4. Middle East and Africa Medical Imaging Market Challenges 3.2.5. South America 3.2.5.1. South America Medical Imaging Market Drivers 3.2.5.2. South America Medical Imaging Market Restraints 3.2.5.3. South America Medical Imaging Market Opportunities 3.2.5.4. South America Medical Imaging Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis for Medical Imaging Industry 3.8. Analysis of Government Schemes and Initiatives for Medical Imaging Industry 3.9. Medical Imaging Market Trade Analysis 4. Medical Imaging Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Medical Imaging Market Size and Forecast, by Type (2023-2030) 4.1.1. X-ray 4.1.2. Ultrasound 4.1.3. Computed Tomography 4.1.4. Magnetic Resonance Imaging 4.1.5. Nuclear Imaging 4.2. Medical Imaging Market Size and Forecast, by Application (2023-2030) 4.2.1. Cardiology 4.2.2. Neurology 4.2.3. Orthopedics 4.2.4. Gynaecology 4.2.5. Oncology 4.2.6. Others 4.3. Medical Imaging Market Size and Forecast, by End User (2023-2030) 4.3.1. Hospitals 4.3.2. Diagnostic Imaging Centers 4.3.3. Ambulatory Imaging Centers 4.3.4. Others. 4.4. Medical Imaging Market Size and Forecast, by region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Medical Imaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Medical Imaging Market Size and Forecast, by Type (2023-2030) 5.1.1. X-ray 5.1.2. Ultrasound 5.1.3. Computed Tomography 5.1.4. Magnetic Resonance Imaging 5.1.5. Nuclear Imaging 5.2. North America Medical Imaging Market Size and Forecast, by Application (2023-2030) 5.2.1. Cardiology 5.2.2. Neurology 5.2.3. Orthopedics 5.2.4. Gynaecology 5.2.5. Oncology 5.2.6. Others 5.3. North America Medical Imaging Market Size and Forecast, by End User (2023-2030) 5.3.1. Hospitals 5.3.2. Diagnostic Imaging Centers 5.3.3. Ambulatory Imaging Centers 5.3.4. Others. 5.4. North America Medical Imaging Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Medical Imaging Market Size and Forecast, by Type (2023-2030) 5.4.1.1.1. X-ray 5.4.1.1.2. Ultrasound 5.4.1.1.3. Computed Tomography 5.4.1.1.4. Magnetic Resonance Imaging 5.4.1.1.5. Nuclear Imaging 5.4.1.2. United States Medical Imaging Market Size and Forecast, by Application (2023-2030) 5.4.1.2.1. Cardiology 5.4.1.2.2. Neurology 5.4.1.2.3. Orthopedics 5.4.1.2.4. Gynaecology 5.4.1.2.5. Oncology 5.4.1.2.6. Others 5.4.1.3. United States Medical Imaging Market Size and Forecast, by End User (2023-2030) 5.4.1.3.1. Hospitals 5.4.1.3.2. Diagnostic Imaging Centers 5.4.1.3.3. Ambulatory Imaging Centers 5.4.1.3.4. Others. 5.4.2. Canada 5.4.2.1. Canada Medical Imaging Market Size and Forecast, by Type (2023-2030) 5.4.2.1.1. X-ray 5.4.2.1.2. Ultrasound 5.4.2.1.3. Computed Tomography 5.4.2.1.4. Magnetic Resonance Imaging 5.4.2.1.5. Nuclear Imaging 5.4.2.2. Canada Medical Imaging Market Size and Forecast, by Application (2023-2030) 5.4.2.2.1. Cardiology 5.4.2.2.2. Neurology 5.4.2.2.3. Orthopedics 5.4.2.2.4. Gynaecology 5.4.2.2.5. Oncology 5.4.2.2.6. Others 5.4.2.3. Canada Medical Imaging Market Size and Forecast, by End User (2023-2030) 5.4.2.3.1. Hospitals 5.4.2.3.2. Diagnostic Imaging Centers 5.4.2.3.3. Ambulatory Imaging Centers 5.4.2.3.4. Others. 5.4.3. Mexico 5.4.3.1. Mexico Medical Imaging Market Size and Forecast, by Type (2023-2030) 5.4.3.1.1. X-ray 5.4.3.1.2. Ultrasound 5.4.3.1.3. Computed Tomography 5.4.3.1.4. Magnetic Resonance Imaging 5.4.3.1.5. Nuclear Imaging 5.4.3.2. Mexico Medical Imaging Market Size and Forecast, by Application (2023-2030) 5.4.3.2.1. Cardiology 5.4.3.2.2. Neurology 5.4.3.2.3. Orthopedics 5.4.3.2.4. Gynaecology 5.4.3.2.5. Oncology 5.4.3.2.6. Others 5.4.3.3. Mexico Medical Imaging Market Size and Forecast, by End User (2023-2030) 5.4.3.3.1. Hospitals 5.4.3.3.2. Diagnostic Imaging Centers 5.4.3.3.3. Ambulatory Imaging Centers 5.4.3.3.4. Others. 6. Europe Medical Imaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Medical Imaging Market Size and Forecast, by Type (2023-2030) 6.2. Europe Medical Imaging Market Size and Forecast, by Application (2023-2030) 6.3. Europe Medical Imaging Market Size and Forecast, by End User (2023-2030) 6.4. Europe Medical Imaging Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Medical Imaging Market Size and Forecast, by Type (2023-2030) 6.4.1.2. United Kingdom Medical Imaging Market Size and Forecast, by Application (2023-2030) 6.4.1.3. United Kingdom Medical Imaging Market Size and Forecast, by End User (2023-2030) 6.4.2. France 6.4.2.1. France Medical Imaging Market Size and Forecast, by Type (2023-2030) 6.4.2.2. France Medical Imaging Market Size and Forecast, by Application (2023-2030) 6.4.2.3. France Medical Imaging Market Size and Forecast, by End User (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Medical Imaging Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Germany Medical Imaging Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Germany Medical Imaging Market Size and Forecast, by End User (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Medical Imaging Market Size and Forecast, by Type (2023-2030) 6.4.4.2. Italy Medical Imaging Market Size and Forecast, by Application (2023-2030) 6.4.4.3. Italy Medical Imaging Market Size and Forecast, by End User (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Medical Imaging Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Spain Medical Imaging Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Spain Medical Imaging Market Size and Forecast, by End User (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Medical Imaging Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Sweden Medical Imaging Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Sweden Medical Imaging Market Size and Forecast, by End User (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Medical Imaging Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Austria Medical Imaging Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Austria Medical Imaging Market Size and Forecast, by End User (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Medical Imaging Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Rest of Europe Medical Imaging Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Rest of Europe Medical Imaging Market Size and Forecast, by End User (2023-2030) 7. Asia Pacific Medical Imaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Medical Imaging Market Size and Forecast, by Type (2023-2030) 7.2. Asia Pacific Medical Imaging Market Size and Forecast, by Application (2023-2030) 7.3. Asia Pacific Medical Imaging Market Size and Forecast, by End User (2023-2030) 7.4. Asia Pacific Medical Imaging Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Medical Imaging Market Size and Forecast, by Type (2023-2030) 7.4.1.2. China Medical Imaging Market Size and Forecast, by Application (2023-2030) 7.4.1.3. China Medical Imaging Market Size and Forecast, by End User (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Medical Imaging Market Size and Forecast, by Type (2023-2030) 7.4.2.2. S Korea Medical Imaging Market Size and Forecast, by Application (2023-2030) 7.4.2.3. S Korea Medical Imaging Market Size and Forecast, by End User (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Medical Imaging Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Japan Medical Imaging Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Japan Medical Imaging Market Size and Forecast, by End User (2023-2030) 7.4.4. India 7.4.4.1. India Medical Imaging Market Size and Forecast, by Type (2023-2030) 7.4.4.2. India Medical Imaging Market Size and Forecast, by Application (2023-2030) 7.4.4.3. India Medical Imaging Market Size and Forecast, by End User (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Medical Imaging Market Size and Forecast, by Type (2023-2030) 7.4.5.2. Australia Medical Imaging Market Size and Forecast, by Application (2023-2030) 7.4.5.3. Australia Medical Imaging Market Size and Forecast, by End User (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Medical Imaging Market Size and Forecast, by Type (2023-2030) 7.4.6.2. Indonesia Medical Imaging Market Size and Forecast, by Application (2023-2030) 7.4.6.3. Indonesia Medical Imaging Market Size and Forecast, by End User (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Medical Imaging Market Size and Forecast, by Type (2023-2030) 7.4.7.2. Malaysia Medical Imaging Market Size and Forecast, by Application (2023-2030) 7.4.7.3. Malaysia Medical Imaging Market Size and Forecast, by End User (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Medical Imaging Market Size and Forecast, by Type (2023-2030) 7.4.8.2. Vietnam Medical Imaging Market Size and Forecast, by Application (2023-2030) 7.4.8.3. Vietnam Medical Imaging Market Size and Forecast, by End User (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Medical Imaging Market Size and Forecast, by Type (2023-2030) 7.4.9.2. Taiwan Medical Imaging Market Size and Forecast, by Application (2023-2030) 7.4.9.3. Taiwan Medical Imaging Market Size and Forecast, by End User (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Medical Imaging Market Size and Forecast, by Type (2023-2030) 7.4.10.2. Rest of Asia Pacific Medical Imaging Market Size and Forecast, by Application (2023-2030) 7.4.10.3. Rest of Asia Pacific Medical Imaging Market Size and Forecast, by End User (2023-2030) 8. Middle East and Africa Medical Imaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Medical Imaging Market Size and Forecast, by Type (2023-2030) 8.2. Middle East and Africa Medical Imaging Market Size and Forecast, by Application (2023-2030) 8.3. Middle East and Africa Medical Imaging Market Size and Forecast, by End User (2023-2030) 8.4. Middle East and Africa Medical Imaging Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Medical Imaging Market Size and Forecast, by Type (2023-2030) 8.4.1.2. South Africa Medical Imaging Market Size and Forecast, by Application (2023-2030) 8.4.1.3. South Africa Medical Imaging Market Size and Forecast, by End User (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Medical Imaging Market Size and Forecast, by Type (2023-2030) 8.4.2.2. GCC Medical Imaging Market Size and Forecast, by Application (2023-2030) 8.4.2.3. GCC Medical Imaging Market Size and Forecast, by End User (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Medical Imaging Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Nigeria Medical Imaging Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Nigeria Medical Imaging Market Size and Forecast, by End User (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Medical Imaging Market Size and Forecast, by Type (2023-2030) 8.4.4.2. Rest of ME&A Medical Imaging Market Size and Forecast, by Application (2023-2030) 8.4.4.3. Rest of ME&A Medical Imaging Market Size and Forecast, by End User (2023-2030) 9. South America Medical Imaging Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Medical Imaging Market Size and Forecast, by Type (2023-2030) 9.2. South America Medical Imaging Market Size and Forecast, by Application (2023-2030) 9.3. South America Medical Imaging Market Size and Forecast, by End User (2023-2030) 9.4. South America Medical Imaging Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Medical Imaging Market Size and Forecast, by Type (2023-2030) 9.4.1.2. Brazil Medical Imaging Market Size and Forecast, by Application (2023-2030) 9.4.1.3. Brazil Medical Imaging Market Size and Forecast, by End User (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Medical Imaging Market Size and Forecast, by Type (2023-2030) 9.4.2.2. Argentina Medical Imaging Market Size and Forecast, by Application (2023-2030) 9.4.2.3. Argentina Medical Imaging Market Size and Forecast, by End User (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Medical Imaging Market Size and Forecast, by Type (2023-2030) 9.4.3.2. Rest Of South America Medical Imaging Market Size and Forecast, by Application (2023-2030) 9.4.3.3. Rest Of South America Medical Imaging Market Size and Forecast, by End User (2023-2030) 10. Company Profile: Key Players 10.1. GE Healthcare 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Details on Partnership 10.1.7. Recent Developments 10.2. Siemens Healthineers (Germany) 10.3. Philips Healthcare (Netherlands) 10.4. Canon Medical Systems Corporation (Japan)_ 10.5. Fujifilm Holdings Corporation (Japan) 10.6. Hologic, Inc. (United States) 10.7. Hitachi Healthcare (Japan) 10.8. Carestream Health (United States) 10.9. Samsung Medison (South Korea) 10.10. Shimadzu Corporation (Japan) 10.11. Agfa (Gevaert Group (Belgium) 10.12. Konica Minolta, Inc. (Japan) 10.13. Esaote S.p.A. (Italy) 10.14. Varian Medical Systems (United States) 10.15. Bruker Corporation (United States) 10.16. Mindray Medical International Limited (China) 10.17. Ziehm Imaging GmbH (Germany) 10.18. Medtronic plc (Ireland) 10.19. Canon Inc. (Japan) 11. Key Findings 12. Industry Recommendations 13. Medical Imaging Market: Research Methodology