The Cholesterol Test Market size was valued at USD 6.34 Billion in 2022 and the total Cholesterol Test Market is expected to grow at a CAGR of 8.54% from 2023 to 2029, reaching nearly USD 11.25 Billion.Cholesterol Test Market Overview:

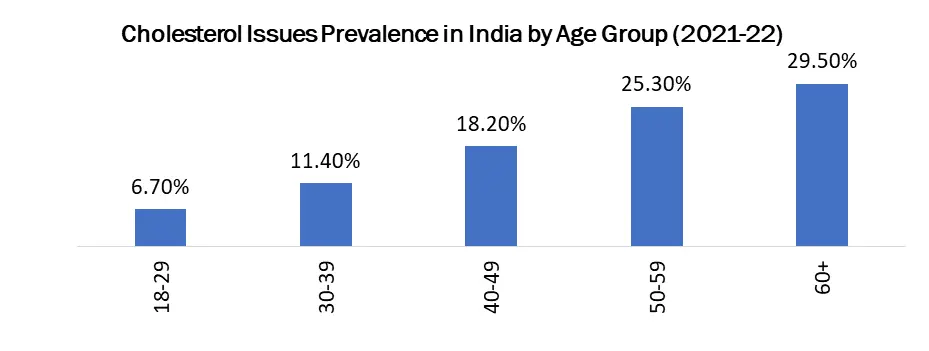

A cholesterol test, also known as a lipid panel, is a blood test that measures the levels of different types of fats, or lipids, in your blood. High cholesterol, often referred to as a "silent killer," may not cause any noticeable symptoms but is linked to 2.6 million deaths worldwide each year. Therefore, cholesterol testing plays a crucial role in determining a person's risk for heart disease and guiding preventive measures. However, certain medications, including beta-blockers and diuretics used to treat high blood pressure, steroids, hormone replacement therapy, and birth control pills, can elevate cholesterol levels and affect test results. In the United States, almost 40% of adults have high cholesterol (total blood cholesterol ≥ 200 mg/dL).To know about the Research Methodology :- Request Free Sample Report High Prevalence of Cholesterol Issues in India: In India, the prevalence of cholesterol issues varies across age groups. In 2021, the share of people with cholesterol issues was 6.7% among those aged 18-29, increasing to 11.4% for those aged 30-39. This trend continues with 18.2% of people in the 40-49 age group having cholesterol issues, rising to 25.3% for those aged 50-59. The highest prevalence is found among individuals aged 60 and above, with 29.5% having cholesterol issues. This variation in prevalence can be attributed to several factors in cholesterol test market, including age-related changes in cholesterol metabolism, lifestyle factors, and underlying health conditions. As we age, our bodies become less efficient at clearing cholesterol from the bloodstream. The people are more likely to develop unhealthy lifestyle habits, such as a poor diet and lack of exercise, as they get older. Finally, older adults are more likely to have underlying health conditions, such as diabetes and high blood pressure that can increase the risk of cholesterol issues. The high prevalence of cholesterol issues in India is a major concern, as it is a major risk factor for heart disease, stroke, and other chronic health conditions. The Indian government has taken a number of steps to address this issue, including promoting public awareness of cholesterol issues, encouraging screening for cholesterol, and providing treatment for cholesterol issues. These efforts have helped to reduce the prevalence of cholesterol issues in India, but there is still more work to be done. The objective of the report is to present a comprehensive analysis of the global cholesterol test market to the stakeholders in the industry. The past and current status of the industry with the forecasted cholesterol test market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants.

Cholesterol Test Market Dynamics:

Increasing Prevalence of Cardiovascular Diseases (CVD): The increasing prevalence of cardiovascular diseases (CVD) poses a significant global health challenge. In 2019, CVD emerged as the leading cause of death, contributing to nearly 18 million fatalities worldwide. This includes a range of conditions affecting the heart and blood vessels, including coronary artery disease, heart failure, and stroke. High cholesterol stands out as a prominent risk factor for CVD. Cholesterol, a fatty substance found in the blood, plays a crucial role in various bodily functions. However, elevated levels of low-density lipoprotein (LDL) cholesterol, often referred to as "bad" cholesterol, can lead to the formation of plaque in the arteries. This buildup narrows the arteries, restricting blood flow and increasing the risk of heart attacks and strokes. Cholesterol testing is a crucial tool in the prevention and management of CVD. By assessing the levels of different types of cholesterol in the blood, healthcare professionals can identify individuals at risk of developing cardiovascular issues. This enables early intervention and the implementation of preventive measures, such as lifestyle changes or medications, to mitigate the risk. Routine cholesterol testing plays a pivotal role in public health strategies aimed at reducing the burden of CVD. It allows for the identification of individuals with high cholesterol levels, providing an opportunity for targeted interventions to address this modifiable risk factor. Lifestyle modifications, dietary changes, and medications are among the strategies employed to manage cholesterol levels and reduce the overall risk of cardiovascular events. Rising Global Obesity Fuels High Cholesterol Risk: Obesity is a major risk factor for high cholesterol, and the prevalence of obesity is growing worldwide. Obesity, defined as an excessive amount of body fat, is a major risk factor for high cholesterol levels, which in turn increases the risk of cardiovascular diseases (CVDs). As the prevalence of obesity continues to surge worldwide, the demand for cholesterol testing is also anticipated to escalate. Obesity is associated with an imbalancse in energy intake and expenditure. When individuals consume more calories than they burn, excess energy is stored in the body as fat. This excess fat can accumulate in various tissues, including the liver, which plays a crucial role in cholesterol metabolism. Obesity disrupts the liver's ability to regulate cholesterol levels, leading to an increase in LDL (low-density lipoprotein) cholesterol, the "bad" cholesterol, and a decrease in HDL (high-density lipoprotein) cholesterol, the "good" cholesterol.The prevalence of obesity is reaching alarming levels worldwide. According to the World Health Organization (WHO), in 2022, over 650 million adults were obese. This figure is expected to continue rising, driven by factors such as urbanization, unhealthy diets, and reduced physical activity. The increasing prevalence of obesity is a significant concern for public health, as it is a major risk factor for multiple chronic diseases, including CVDs, type 2 diabetes, and certain types of cancer. CVDs, the leading cause of global mortality, are particularly linked to high cholesterol levels. Cholesterol testing plays a crucial role in identifying individuals at risk of high cholesterol and CVDs. Early detection and intervention can help prevent the development of these chronic diseases and improve overall health outcomes. Government Initiatives to Enhance Cholesterol Testing Accuracy and Reliability: Governments worldwide are taking proactive steps to elevate the quality of cholesterol testing, recognizing its crucial role in identifying individuals at risk of cardiovascular diseases (CVDs). These initiatives encompass a range of measures aimed at standardizing testing protocols, ensuring the competency of healthcare professionals, and promoting the adoption of advanced testing technologies. Governments are encouraging the adoption of advanced cholesterol testing technologies that offer enhanced accuracy and precision. These technologies, such as high-density lipoprotein (HDL) cholesterol subclass analysis and non-HDL cholesterol measurement, provide more comprehensive information about an individual's cholesterol profile, enabling more informed risk assessments and treatment decisions. Cholesterol Test Market Faces Several Challenging Factors, Including: 1. Limited access to testing: In many parts of the world, access to cholesterol testing is limited. This is due to a variety of factors, including a lack of healthcare infrastructure, high costs, and cultural barriers. As a result, many people who are at risk of high cholesterol are not getting tested. 2. Lack of awareness: Many people are not aware of the importance of cholesterol testing or the risks of high cholesterol. This lack of awareness can lead to people not getting tested or not taking their cholesterol levels seriously. 3. False positives and negatives: Cholesterol tests are not always accurate, and there is a risk of getting a false positive or false negative result. This can lead to unnecessary anxiety or a false sense of security. 4. Cost of testing: Cholesterol testing can be expensive, especially for people without health insurance. This can make it difficult for some people to get tested. 5. Difficulty in interpreting results: Cholesterol test results can be difficult to interpret for laypeople. This can lead to people not understanding their risk of heart disease. 6. Compliance with lifestyle changes: Even if people learn that they have high cholesterol, many find it difficult to make the necessary lifestyle changes to lower their cholesterol levels. This can be due to a variety of factors, such as lack of motivation, unhealthy habits, and lack of support. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the Cholesterol Test Market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Cholesterol Test Market dynamic, structure by analyzing the market segments and projecting the Cholesterol Test Market size. Clear representation of competitive analysis of key players By Test Type type, position, product portfolio, growth strategies, and regional presence in the Cholesterol Test Market make the report investor’s guide.

Cholesterol Test Market Segment Analysis:

Based on Product Type, the test kits segment held the highest share of nearly 45% of Cholesterol Test Market in 2022. This growth is attributed to rise in adoption of cholesterol test kit by health-conscious customers to check cholesterol level and availability of cholesterol test kits in the market by major players. Furthermore, lifestyle choices such as excessive alcohol consumption, smoking, and consuming full-fat dairy products and fatty meat cuts can all elevate total cholesterol levels, underscoring the importance of regular cholesterol monitoring with cholesterol kits. Test kits can be performed at home, allowing individuals to monitor their cholesterol levels without the need for a laboratory visit. This accessibility has made cholesterol testing more widespread, empowering individuals to take charge of their health. Additionally, test kits are relatively affordable compared to other cholesterol testing methods, further contributing to their dominance in the Cholesterol Test Market.By End User, Diagnostic centers hold the largest Cholesterol Test Market share in 2022 and are expected to maintain their dominance throughout the 2023-2029. This dominance stems from the comprehensive range of tests conducted at diagnostic centers to pinpoint the underlying cause of a condition. These centers encompass various types of labs, including radiology & MRI centers, imaging centers, and pathology labs. Furthermore, diagnostic centers are staffed by qualified medical personnel equipped to handle a wide spectrum of health issues. This includes experienced and skilled radiologists, pathologists, surgeons, and other medical professionals, further driving the cholesterol test market segment's growth.

Cholesterol Test Market Regional Overview:

In 2022, The North America cholesterol test market held the highest share of over 37%. The robust presence of major pharmaceutical and biopharmaceutical companies in North America stands out as a key catalyst for cholesterol test market growth. Furthermore, the escalating demand for preventive healthcare is poised to fuel cholesterol test market growth. Moreover, ongoing government and private-sector initiatives aimed at promoting healthy lifestyles are anticipated to contribute to market growth in the region during the forecast period. The well-established healthcare infrastructure, coupled with high purchasing power and an uptick in the acceptance rate of cholesterol test products, is expected to further propel cholesterol test market growth. Moreover, the increasing prevalence of cardiovascular disease in the region, coupled with heightened public awareness about disease prevention, has resulted in a surge in demand for cholesterol tests, driving overall cholesterol test market growth. High Total Cholesterol in the US: A Cause for Concern 1. Prevalence of High Cholesterol: Nearly 10% of American adults aged 20 and over have total cholesterol levels exceeding 240 mg/dL, while around 17% have HDL (good) cholesterol levels below 40 mg/dL. 2. Underutilization of Cholesterol Medication: Only slightly more than half (54.5%) of U.S. adults who could benefit from cholesterol medication are currently taking it. 3. Extent of High Cholesterol: Approximately 86 million U.S. adults aged 20 and over have total cholesterol levels above 200 mg/dL, with nearly 25 million individuals exceeding 240 mg/dL. 4. High Cholesterol in Children: Around 7% of U.S. children and adolescents between the ages of 6 and 19 have high total cholesterol. 5. The Silent Threat: High cholesterol remains asymptomatic, leaving many unaware of their elevated levels. A simple blood test can effectively assess cholesterol levels. 6. Health Risks: Elevated blood cholesterol increases the risk of heart disease, the leading cause of death, and stroke, the fifth leading cause of death. The Asia-Pacific is expected to have the highest CAGR of 8.91% over the forecast period, this development is fuelled by the presence of pharmaceutical companies in the region, coupled with rising purchasing power among the large populations of countries like China and India. Moreover, the growing elderly population and the increasing prevalence of cardiovascular diseases, including diabetes, are driving market growth. Furthermore, the Asia-Pacific region boasts a vast population base, unmet medical needs, and a growing disposable income among its inhabitants. Moreover, the surge in medical tourism and the development of healthcare infrastructure are making Asia-Pacific a lucrative market for cholesterol testing products and services. Cholesterol Test Market Competitive Landscapes: The competitive landscape section in the Cholesterol Test Market offers a deep dive into the profiles of the leading companies operating in the global market landscape. It offers captivating insights on the key developments, differential strategies, and other crucial aspects about the companies having a stronghold in Cholesterol Test Market globally. Such as: Merck KGaA Addresses Lipid Demand In a significant step to meet the growing demand for lipids, a crucial component of mRNA-based vaccines and therapeutics, Merck KGaA announced the early launch of a new high-purity synthetic cholesterol product in May 2021. This achievement, accomplished nine months ahead of schedule, underscores the company's commitment to addressing the evolving needs of the pharmaceutical industry. Abcam Expands Kits and Assays Portfolio In a strategic move to strengthen its position in the life sciences sector, Abcam, Inc., a leading provider of life sciences reagents and tools, successfully completed the acquisition of BioVision in October 2021. This acquisition expands Abcam's kits and assays portfolio, aligning with the growing demand for these products and supporting the company's strategic plan for accelerated Cholesterol Test Market growth. Rosalind Franklin University's Community Treatment Connection Expands Access to Healthcare Rosalind Franklin University's (RFU) Community Treatment Connection, in collaboration with NorthShore University Health System, has continued to provide life-saving medical treatment to underserved communities in North Chicago neighborhoods. This partnership has enabled the Care Coach, a mobile health unit equipped with licensed healthcare professionals, to offer essential services, including blood pressure control, diabetes screening, BMI measurement, cholesterol testing, and other complementary health therapies. The Care Coach has received direct funding of $680,000 from NorthShore's Community Investment Fund (CIF), ensuring its continued operation and support for the community. These strategic endeavors underscore the Cholesterol Test market commitment to diversifying product lines, innovating within segments, and adopting strategic partnerships to compete effectively in the market landscape. As consumer preferences evolve, these proactive strategies position Cholesterol Test manufacturers for sustained growth and competitiveness in the dairy market.Cholesterol Test Market Scope:Inquire Before Buying

Global Cholesterol Test Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 6.34 Bn. Forecast Period 2023 to 2029 CAGR: 8.54% Market Size in 2029: US $ 11.25 Bn. Segments Covered: by Test Type Total Cholesterol Test High-Density Lipoprotein (HDL) Cholesterol Low-Density Lipoprotein (LDL) Cholesterol Triglycerides/VLDL Cholesterol Test by Product Type Test Kits Test Strips Others by End User Hospitals Diagnostic Centers Others Cholesterol Test Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cholesterol Test Market, Key Players are

1. Abbott Laboratories 2. Danaher Corp 3. Helena Laboratories Corp 4. QuidelOrtho Corp 5. Siemens AG 6. Thermo Fisher Scientific Inc 7. Randox Laboratories Ltd 8. Sekisui Chemical Ltd 9. Alfa Wassermann Inc 10. Merck KGaA 11. Sinocare Inc 12. BECKMAN COULTER (DANAHER CORP.) 13. Horiba Ltd 14. MINDRAY 15. NOVA BIOMEDICAL 16. Roche Holding Ag (f.hoffmann-la Roche Ltd.) 17. THERMOFISHER SCIENTIFIC INC. FAQs: 1. What are the growth drivers for the Cholesterol Test market? Ans. Increasing prevalence of cardiovascular diseases (CVDs), Growing awareness of the importance of preventive healthcare etc. are expected to be the major drivers for the Cholesterol Test market. 2. What is the major restraint for the Cholesterol Test market growth? Ans. Low awareness of the benefits of cholesterol testing is expected to be the major restraining factor for the Cholesterol Test market growth. 3. Which region is expected to lead the global Cholesterol Test market during the forecast period? Ans. North America is expected to lead the global Cholesterol Test market during the forecast period. 4. What is the projected market size & and growth rate of the Cholesterol Test Market? Ans. The Cholesterol Test Market size was valued at USD 6.34 Billion in 2022 and the total Cholesterol Test Market is expected to grow at a CAGR of 8.54% from 2023 to 2029, reaching nearly USD 11.25 Billion. 5. What segments are covered in the Cholesterol Test Market report? Ans. The segments covered in the Cholesterol Test market report are Test Type, Product Type, End User, and Region.

1. Cholesterol Test Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Cholesterol Test Market: Dynamics 2.1. Preference Analysis 2.2. Cholesterol Test Market Trends by Region 2.2.1. North America Cholesterol Test Market Trends 2.2.2. Europe Cholesterol Test Market Trends 2.2.3. Asia Pacific Cholesterol Test Market Trends 2.2.4. Middle East and Africa Cholesterol Test Market Trends 2.2.5. South America Cholesterol Test Market Trends 2.3. Cholesterol Test Market Dynamics by Region 2.3.1. North America 2.3.1.1. North America Cholesterol Test Market Drivers 2.3.1.2. North America Cholesterol Test Market Restraints 2.3.1.3. North America Cholesterol Test Market Opportunities 2.3.1.4. North America Cholesterol Test Market Challenges 2.3.2. Europe 2.3.2.1. Europe Cholesterol Test Market Drivers 2.3.2.2. Europe Cholesterol Test Market Restraints 2.3.2.3. Europe Cholesterol Test Market Opportunities 2.3.2.4. Europe Cholesterol Test Market Challenges 2.3.3. Asia Pacific 2.3.3.1. Asia Pacific Cholesterol Test Market Drivers 2.3.3.2. Asia Pacific Cholesterol Test Market Restraints 2.3.3.3. Asia Pacific Cholesterol Test Market Opportunities 2.3.3.4. Asia Pacific Cholesterol Test Market Challenges 2.3.4. Middle East and Africa 2.3.4.1. Middle East and Africa Cholesterol Test Market Drivers 2.3.4.2. Middle East and Africa Cholesterol Test Market Restraints 2.3.4.3. Middle East and Africa Cholesterol Test Market Opportunities 2.3.4.4. Middle East and Africa Cholesterol Test Market Challenges 2.3.5. South America 2.3.5.1. South America Cholesterol Test Market Drivers 2.3.5.2. South America Cholesterol Test Market Restraints 2.3.5.3. South America Cholesterol Test Market Opportunities 2.3.5.4. South America Cholesterol Test Market Challenges 2.4. PORTER’s Five Forces Analysis 2.5. PESTLE Analysis 2.6. Value Chain - Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Key Opinion Leader Analysis For Cholesterol Test Industry 2.9. Analysis of Government Schemes and Initiatives For Cholesterol Test Industry 2.10. The Global Pandemic's Impact on Cholesterol Test Market 2.11. Cholesterol Test Price Trend Analysis (2021-22) 3. Cholesterol Test Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume Units) (2022-2029) 3.1. Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 3.1.1. Total Cholesterol Test 3.1.2. High-Density Lipoprotein (HDL) Cholesterol 3.1.3. Low-Density Lipoprotein (LDL) Cholesterol 3.1.4. Triglycerides/VLDL Cholesterol Test 3.2. Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 3.2.1. Cubes & Blocks 3.2.2. Slices 3.2.3. Spreads or Dips 3.2.4. Crumbles 3.2.5. Other Forms 3.3. Cholesterol Test Market Size and Forecast, by End User (2022-2029) 3.3.1.1. Hospitals 3.3.1.2. Diagnostic Centers 3.3.1.3. Others 3.4. Cholesterol Test Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Cholesterol Test Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. North America Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 4.1.1. Total Cholesterol Test 4.1.2. High-Density Lipoprotein (HDL) Cholesterol 4.1.3. Low-Density Lipoprotein (LDL) Cholesterol 4.1.4. Triglycerides/VLDL Cholesterol Test 4.2. North America Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 4.2.1. Test Kits 4.2.2. Test Strips 4.2.3. Others 4.3. North America Cholesterol Test Market Size and Forecast, by End User (2022-2029) 4.3.1.1. Hospitals 4.3.1.2. Diagnostic Centers 4.3.1.3. Others 4.4. North America Cholesterol Test Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 4.4.1.1.1. Total Cholesterol Test 4.4.1.1.2. High-Density Lipoprotein (HDL) Cholesterol 4.4.1.1.3. Low-Density Lipoprotein (LDL) Cholesterol 4.4.1.1.4. Triglycerides/VLDL Cholesterol Test 4.4.1.2. United States Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 4.4.1.2.1. Test Kits 4.4.1.2.2. Test Strips 4.4.1.2.3. Others 4.4.1.3. United States Cholesterol Test Market Size and Forecast, by End User (2022-2029) 4.4.1.3.1. Offline 4.4.1.3.1.1. Hypermarket/Supermarket 4.4.1.3.1.2. Grocery Stores 4.4.1.3.1.3. Others 4.4.1.3.2. Online store 4.4.1.3.2.1. E-commerce Platforms 4.4.1.3.2.2. Company Owned Websites 4.4.2. Canada 4.4.2.1. Canada Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 4.4.2.1.1. Total Cholesterol Test 4.4.2.1.2. High-Density Lipoprotein (HDL) Cholesterol 4.4.2.1.3. Low-Density Lipoprotein (LDL) Cholesterol 4.4.2.1.4. Triglycerides/VLDL Cholesterol Test 4.4.2.2. Canada Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 4.4.2.2.1. Test Kits 4.4.2.2.2. Test Strips 4.4.2.2.3. Others 4.4.2.3. Canada Cholesterol Test Market Size and Forecast, by End User (2022-2029) 4.4.2.3.1.1. Hospitals 4.4.2.3.1.2. Diagnostic Centers 4.4.2.3.1.3. Others 4.4.3. Mexico 4.4.3.1. Mexico Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 4.4.3.1.1. Total Cholesterol Test 4.4.3.1.2. High-Density Lipoprotein (HDL) Cholesterol 4.4.3.1.3. Low-Density Lipoprotein (LDL) Cholesterol 4.4.3.1.4. Triglycerides/VLDL Cholesterol Test 4.4.3.2. Mexico Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 4.4.3.2.1. Test Kits 4.4.3.2.2. Test Strips 4.4.3.2.3. Others 4.4.3.3. Mexico Cholesterol Test Market Size and Forecast, by End User (2022-2029) 4.4.3.3.1.1. Hospitals 4.4.3.3.1.2. Diagnostic Centers 4.4.3.3.1.3. Others 5. Europe Cholesterol Test Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. Europe Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 5.2. Europe Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 5.3. Europe Cholesterol Test Market Size and Forecast, by End User (2022-2029) 5.4. Europe Cholesterol Test Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 5.4.1.2. United Kingdom Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 5.4.1.3. United Kingdom Cholesterol Test Market Size and Forecast, by End User (2022-2029) 5.4.2. France 5.4.2.1. France Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 5.4.2.2. France Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 5.4.2.3. France Cholesterol Test Market Size and Forecast, by End User (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 5.4.3.2. Germany Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 5.4.3.3. Germany Cholesterol Test Market Size and Forecast, by End User (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 5.4.4.2. Italy Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 5.4.4.3. Italy Cholesterol Test Market Size and Forecast, by End User (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 5.4.5.2. Spain Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 5.4.5.3. Spain Cholesterol Test Market Size and Forecast, by End User (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 5.4.6.2. Sweden Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 5.4.6.3. Sweden Cholesterol Test Market Size and Forecast, by End User (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 5.4.7.2. Austria Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 5.4.7.3. Austria Cholesterol Test Market Size and Forecast, by End User (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 5.4.8.2. Rest of Europe Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 5.4.8.3. Rest of Europe Cholesterol Test Market Size and Forecast, by End User (2022-2029) 6. Asia Pacific Cholesterol Test Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 6.2. Asia Pacific Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 6.3. Asia Pacific Cholesterol Test Market Size and Forecast, by End User (2022-2029) 6.4. Asia Pacific Cholesterol Test Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 6.4.1.2. China Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 6.4.1.3. China Cholesterol Test Market Size and Forecast, by End User (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 6.4.2.2. S Korea Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 6.4.2.3. S Korea Cholesterol Test Market Size and Forecast, by End User (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 6.4.3.2. Japan Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 6.4.3.3. Japan Cholesterol Test Market Size and Forecast, by End User (2022-2029) 6.4.4. India 6.4.4.1. India Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 6.4.4.2. India Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 6.4.4.3. India Cholesterol Test Market Size and Forecast, by End User (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 6.4.5.2. Australia Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 6.4.5.3. Australia Cholesterol Test Market Size and Forecast, by End User (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 6.4.6.2. Indonesia Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 6.4.6.3. Indonesia Cholesterol Test Market Size and Forecast, by End User (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 6.4.7.2. Malaysia Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 6.4.7.3. Malaysia Cholesterol Test Market Size and Forecast, by End User (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 6.4.8.2. Vietnam Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 6.4.8.3. Vietnam Cholesterol Test Market Size and Forecast, by End User (2022-2029) 6.4.8.4. Vietnam Cholesterol Test Market Size and Forecast, by Industry Vertical(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 6.4.9.2. Taiwan Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 6.4.9.3. Taiwan Cholesterol Test Market Size and Forecast, by End User (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 6.4.10.3. Rest of Asia Pacific Cholesterol Test Market Size and Forecast, by End User (2022-2029) 7. Middle East and Africa Cholesterol Test Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 7.1. Middle East and Africa Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 7.2. Middle East and Africa Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 7.3. Middle East and Africa Cholesterol Test Market Size and Forecast, by End User (2022-2029) 7.4. Middle East and Africa Cholesterol Test Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 7.4.1.2. South Africa Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 7.4.1.3. South Africa Cholesterol Test Market Size and Forecast, by End User (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 7.4.2.2. GCC Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 7.4.2.3. GCC Cholesterol Test Market Size and Forecast, by End User (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 7.4.3.2. Nigeria Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 7.4.3.3. Nigeria Cholesterol Test Market Size and Forecast, by End User (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 7.4.4.2. Rest of ME&A Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 7.4.4.3. Rest of ME&A Cholesterol Test Market Size and Forecast, by End User (2022-2029) 8. South America Cholesterol Test Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029 8.1. South America Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 8.2. South America Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 8.3. South America Cholesterol Test Market Size and Forecast, by End User (2022-2029) 8.4. South America Cholesterol Test Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 8.4.1.2. Brazil Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 8.4.1.3. Brazil Cholesterol Test Market Size and Forecast, by End User (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 8.4.2.2. Argentina Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 8.4.2.3. Argentina Cholesterol Test Market Size and Forecast, by End User (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Cholesterol Test Market Size and Forecast, By Test Type (2022-2029) 8.4.3.2. Rest Of South America Cholesterol Test Market Size and Forecast, by Product Type (2022-2029) 8.4.3.3. Rest Of South America Cholesterol Test Market Size and Forecast, by End User (2022-2029) 9. Global Cholesterol Test Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Cholesterol Test Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Abbott Laboratories. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Danaher Corp 10.3. Helena Laboratories Corp 10.4. QuidelOrtho Corp 10.5. Siemens AG 10.6. Thermo Fisher Scientific Inc 10.7. Randox Laboratories Ltd 10.8. Sekisui Chemical Ltd 10.9. Alfa Wassermann Inc 10.10. Merck KGaA 10.11. Sinocare Inc 10.12. BECKMAN COULTER (DANAHER CORP.) 10.13. Horiba Ltd 10.14. MINDRAY 10.15. NOVA BIOMEDICAL 10.16. Roche Holding Ag (f.hoffmann-la Roche Ltd.) 10.17. THERMOFISHER SCIENTIFIC INC. 11. Key Findings 12. Industry Recommendations 13. Cholesterol Test Market: Research Methodology