The Global Buffer Preparation Market size was valued at USD 3.40 Bn in 2022 and is expected to reach USD 5.9 Bn by 2029, at a CAGR of 8.1 %.Overview of the Buffer Preparation Market

Buffers play a crucial role in pharmaceutical manufacturing processes by serving as aqueous solutions designed to regulate the pH levels in the Buffer Preparation Market. They are an essential component responsible for upholding the stability of both biologics and small molecules at various stages of production, as well as in their final presentation. Buffers find extensive application in a range of upstream and downstream bioprocesses, serving diverse purposes such as maintaining consistent pH levels in cultures, enhancing the yield of desired products, ensuring specific purification conditions, and stabilizing the final product while preserving its functional attributes. The graphical representation and structural exclusive information showed the dominating region of the Buffer Preparation Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Buffer Preparation Market.To know about the Research Methodology :- Request Free Sample Report Buffer Preparation Market Dynamics Elevated demand in biopharmaceutical manufacturing and augmented bioprocessing capacities are the major drivers of the buffer preparation market The burgeoning biopharmaceutical sector, with a specific focus on producing monoclonal antibodies, vaccines, and cell therapies, is the impetus behind the need for buffer preparation systems in the Buffer Preparation Market. These systems play an indispensable role in maintaining precise pH levels during bioprocessing. The escalating emphasis on streamlining bioprocessing workflows and curtailing production expenditures is fostering the adoption of automated buffer preparation systems. These systems augment process efficiency, diminish human errors, and mitigate batch-to-batch disparities in the Buffer Preparation Market. Rigorous regulatory directives governing drug manufacturing, particularly those pertaining to quality and uniformity, are compelling the uptake of buffer preparation systems. These systems substantiate compliance with regulatory standards and facilitate meticulous documentation and traceability. Continuous advancements in automation, robotics, and digitalization are augmenting the capabilities of buffer preparation systems in the Buffer Preparation Market. Their integration with process control systems and the development of user-friendly interfaces render them more appealing to manufacturers. The expansion of bio-manufacturing facilities to cater to the surging demand for biologics is creating opportunities for providers of buffer preparation systems. Large-scale facilities necessitate efficient buffer preparation solutions to underpin their production volumes. Bioprocess Intensification and Emerging Markets in the biopharmaceutical industry are creating more opportunities in the buffer preparation market There is an escalating requirement for buffer preparation systems that can be tailored to meet the specific demands of diverse bioprocessing applications. Systems capable of adapting to varying production scales are particularly sought after. The biopharmaceutical industry's expansion into emerging markets presents substantial growth potential for manufacturers of buffer preparation systems. These regions are witnessing heightened investments in pharmaceutical manufacturing infrastructure in the Buffer Preparation Industry. In pursuit of heightened productivity and reduced production timelines, buffer preparation systems that support continuous and intensified bioprocessing are gaining traction. These systems enable swifter and more efficient production. Offering maintenance and service contracts for buffer preparation systems can be a lucrative business proposition. Biopharmaceutical manufacturers often seek long-term support to ensure the reliability and performance of their systems. Sustained innovation in buffer preparation technology, including the formulation of novel buffer compositions and environmentally sustainable solutions, can unveil fresh avenues for Buffer Preparation market expansion.

Buffer Preparation Market Segment Analysis

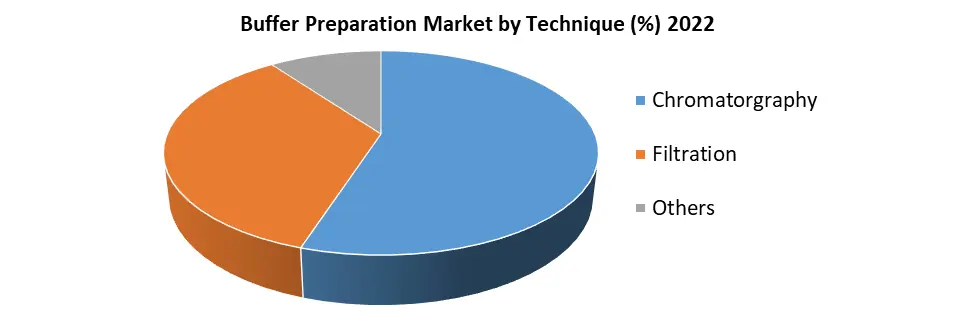

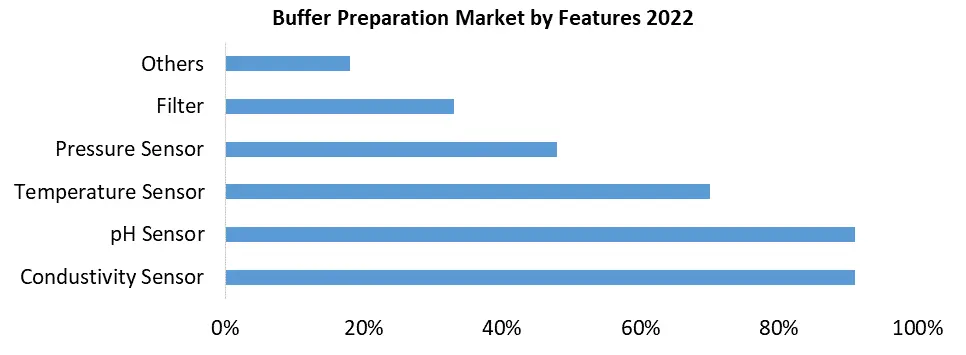

by Type, The Buffer Preparation Market can be classified into two primary categories based on type: Tank and Whole Unit systems. Tank-based systems predominantly focus on the storage and mixing of buffer solutions, while whole-unit systems offer a comprehensive, integrated approach to buffer preparation. This segmentation empowers customers to make informed choices, selecting between standalone tanks or all-encompassing buffer preparation units that align with their specific operational needs and facility constraints in the Buffer Preparation Market. The mobility of buffer preparation systems is a pivotal consideration for end-users. Segmentation by mobility options distinguishes between Mobile and Stationary systems. Mobile systems offer flexibility, being easily transportable within a facility, while Stationary systems are permanently fixed in place. This differentiation enables end-users to align their choice with their operational needs and facility layout, optimizing workflow efficiency in the Buffer Preparation Market. The Buffer Preparation Market can also be segmented by end-user, catering to the varied industries and sectors that employ these systems. End-users encompass pharmaceutical companies, biotechnology firms, and contract manufacturing organizations, research laboratories, and academic institutions, reflecting the extensive array of entities relying on buffer preparation systems for their bioprocessing undertakings. This segmentation acknowledges and addresses the unique demands of each sector, ensuring the provision of tailored solutions in the market.By Technique: Within this Buffer Preparation Market, segmentation by technique encompasses Chromatography, Filtration, and other methods. These techniques represent the diverse approaches employed in buffer preparation, highlighting the adaptability of available systems to cater to distinct bioprocessing requirements in the Buffer Preparation Market. Chromatography-based systems are instrumental in separation and purification processes, while Filtration-based systems play a critical role in particle removal and sterilization. Buffer preparation systems are delineated based on their features, including the inclusion of various sensors and filters. Notable features encompass Conductivity Sensors for measuring solution conductivity, pH Sensors for monitoring pH levels, Temperature Sensors for maintaining optimal temperature conditions, Pressure Sensors for ensuring controlled pressure, Filters for impurity removal, and other supplementary functionalities. This segmentation empowers users to select systems tailored to their precise monitoring and control prerequisites in the Buffer Preparation Market. Segmentation by application encompasses the diverse purposes for which buffer preparation systems find utility in bioprocessing. Applications span a wide spectrum, encompassing upstream processes such as cell culture and fermentation, as well as downstream processes like purification and formulation. This segmentation empowers users to identify systems that harmonize with their specific bioprocessing requirements, ensuring optimal performance in the Buffer Preparation Market.

Buffer Preparation Market Regional Analysis

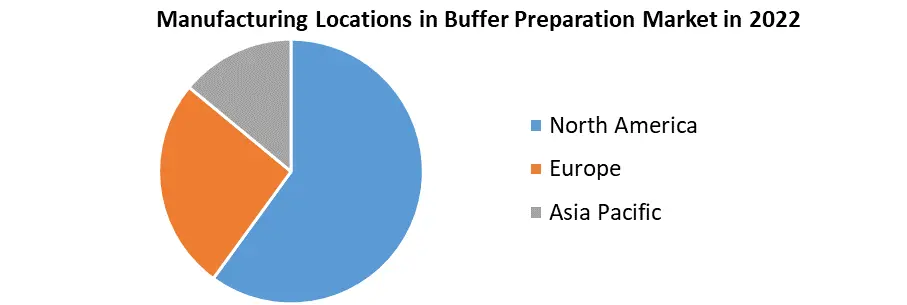

This regional analysis provides insights into the Buffer Preparation Market, offering a comprehensive breakdown of market shares in three key regions: North America, Europe, and Asia Pacific. Each region's Buffer Preparation Market dynamics and contributing factors are examined to elucidate their respective market presence. North America, particularly the United States, is renowned for hosting a flourishing biotechnology and pharmaceutical sector. This Buffer Preparation industry's reliance on buffer preparation solutions is profound, given the integral role buffers play in a myriad of laboratory and manufacturing processes. The region's ongoing research and development endeavors within the life sciences sector, encompassing genomics, proteomics, and drug discovery, necessitate the deployment of precise buffer solutions for experiments and assays. Consequently, the demand for buffer preparation products and services remains consistently high. Laboratories and manufacturing facilities in North America adhere to stringent quality standards and regulatory requirements. This mandates the utilization of reliable buffer preparation techniques to ensure the attainment of precise and reproducible results. North America is home to numerous well-established companies specializing in buffer preparation products and services. Their prominent presence significantly contributes to the region's dominance within the Buffer Preparation Market. Europe houses a thriving biopharmaceutical industry, encompassing numerous companies engaged in the production of biologics and pharmaceuticals. Buffer preparation is an indispensable facet of their manufacturing processes, propelling demand within the region. Europe is distinguished by its array of prestigious academic and research institutions, which conduct extensive life sciences research. These institutions rely on buffer solutions for diverse experiments and Techniquedies, stimulating buffer preparation market growth. Collaborative ventures between European companies and research institutions foster innovation and fuel demand for buffer preparation solutions, enhancing Europe's market standing. European regulatory authorities uphold stringent quality and safety standards, resulting in a consistent requirement for high-quality buffer solutions in the region.

Buffer Preparation Market Competitive Landscape

Thermo Fisher Scientific launches the EXENT solution with IVDR certification. The EXENT Solution enables clinical laboratories to measure, quantify, and track specific endogenous M-proteins and exogenous therapeutic monoclonal antibodies with enhanced analytical sensitivity and specificity in serum. The EXENT Solution is easy to implement in routine laboratory use and features three integrated modules: EXENT-iP 500, an automated sample preparation instrument; EXENT-iX 500, a Matrix Assisted Laser Desorption Ionization Time of Flight Mass Spectrometer (MALDI-ToF MS); and EXENT-iQ, an intelligent and intuitive workflow software, including data review.The analyzer is combined with the EXENT Immunoglobulin Isotypes (GAM) immunoassay, a highly sensitive and specific immunoassay for measuring and quantifying IgG, IgA, and IgM. Thermo Fisher Scientific completed the acquisition of CorEvitas, LLC (“CorEvitas”), a leading provider of regulatory-grade, real-world evidence for approved medical treatments and therapies, from Audax Private Equity (“Audax”), for $912.5 million in cash. Thermo Fisher announced the agreement to acquire CorEvitas on July 6, 2023. Real-world evidence is the collection and use of patient health care utilization and outcomes data gathered through routine clinical care. This is a high-growth Buffer preparation market segment as pharmaceutical and biotechnology customers, as well as regulating bodies, are increasingly looking to monitor and evaluate the safety of approved therapies and examine their effectiveness and value in the post-approval setting in the market.

Buffer Preparation Market Scope: Inquiry Before Buying

Buffer Preparation Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 3.4 Bn. Forecast Period 2023 to 2029 CAGR: 8.1% Market Size in 2029: US $ 5.9 Bn. Segments Covered: by Type Tank Whole Unit by Feature Conductivity Sensor pH Sensor Temperature Sensor Pressure Sensor Filter Other by Technique Chromatography Filtration Others by Mobility Option Mobile Stationary by Application Cell Culture Fermentation Procedures by End-User Pharmaceuticals Companies Biotechnology Firms Contract Manufacturing Organization Research laboratories Academic Institution Buffer Preparation Market, by Regions

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players of the Buffer Preparation Market

1. Merck KGaA, 2. Thermo Fisher Scientific Inc. 3. Avantor, Inc. 4. Lonza Group Ltd 5. Bio-Rad Laboratories, Inc. 6. Sartorius AG 7. Corning Inc. 8. Becton 9. Dickinson and Company 10. GE Healthcare 11. Promega Corporation 12. Asahi Kasei 13. Avantor 14. Canvax 15. Cytiva 16. Pall Corporation 17. UniogenFrequently Asked Questions

1. What is the Buffer Preparation Market? Ans: he market involves the production and supply of buffer solutions used in various scientific, biotechnological, and pharmaceutical applications to maintain stable pH levels and support chemical reactions. 2. What are the key drivers of the Buffer Preparation Market? Ans: Key drivers include the growth of the biopharmaceutical and biotechnology industries, increased research and development activities, and the need for precise and reproducible laboratory results. 3. What is the market size for the Buffer Preparation Market? Ans: The market CAGR 8.1 % with 5.9 Bn in 2029. 4. What regions are driving the Buffer Preparation Market's growth? Ans: North America leads with a significant market share, followed by Europe and Asia Pacific, due to their robust life sciences sectors. 5. Who are the major players in the market? Ans: Key players include Thermo Fisher Scientific, Merck KGaA, GE Healthcare, Avantor, and Lonza Group, among others.

1. Buffer Preparation Market: Research Methodology 2. Buffer Preparation Market: Executive Summary 3. Buffer Preparation Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Buffer Preparation Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. Buffer Preparation Market: Segmentation (by Value USD and Volume Units) 5.1. Buffer Preparation Market, by Type (2022-2029) 5.1.1. Tank 5.1.2. Whole Unit 5.2. Buffer Preparation Market, by Feature (2022-2029) 5.2.1. Conductivity Sensor 5.2.2. pH Sensor 5.2.3. Temperature Sensor 5.2.4. Pressure Sensor 5.2.5. Filter 5.2.6. Other 5.3. Buffer Preparation Market, by Technique (2022-2029) 5.3.1. Chromatography 5.3.2. Filtration 5.3.3. Others 5.4. Buffer Preparation Market, by Mobility Option (2022-2029) 5.4.1. Mobile 5.4.2. Stationary 5.5. Buffer Preparation Market, by Application (2022-2029) 5.5.1. Cell Culture 5.5.2. Fermentation Procedures 5.6. Buffer Preparation Market, by End-User (2022-2029) 5.6.1. Pharmaceuticals Companies 5.6.2. Biotechnology Firms 5.6.3. Contract Manufacturing Organization 5.6.4. Research laboratories 5.6.5. Academic Institution 5.7. Buffer Preparation Market, by Region (2022-2029) 5.7.1. North America 5.7.2. Europe 5.7.3. Asia Pacific 5.7.4. Middle East and Africa 5.7.5. South America 6. North America Buffer Preparation Market (by Value USD and Volume Units) 6.1. North America Buffer Preparation Market, by Type (2022-2029) 6.1.1. Tank 6.1.2. Whole Unit 6.2. North America Buffer Preparation Market, by Feature (2022-2029) 6.2.1. Conductivity Sensor 6.2.2. pH Sensor 6.2.3. Temperature Sensor 6.2.4. Pressure Sensor 6.2.5. Filter 6.2.6. Other 6.3. North America Buffer Preparation Market, by Technique (2022-2029) 6.3.1. Chromatography 6.3.2. Filtration 6.3.3. Others 6.4. North America Buffer Preparation Market, by Mobility Option (2022-2029) 6.4.1. Mobile 6.4.2. Stationary 6.5. North America Buffer Preparation Market, by Application (2022-2029) 6.5.1. Cell Culture 6.5.2. Fermentation Procedure 6.6. North America Buffer Preparation Market, by End-User (2022-2029) 6.6.1. Pharmaceuticals Companies 6.6.2. Biotechnology Firms 6.6.3. Contract Manufacturing Organization 6.6.4. Research laboratories 6.6.5. Academic Institution 6.7. North America Buffer Preparation Market, by Country (2022-2029) 6.7.1. United States 6.7.2. Canada 6.7.3. Mexico 7. Europe Buffer Preparation Market (by Value USD and Volume Units) 7.1. Europe Buffer Preparation Market, by Type (2022-2029) 7.2. Europe Buffer Preparation Market, by Feature (2022-2029) 7.3. Europe Buffer Preparation Market, by Technique (2022-2029) 7.4. Europe Buffer Preparation Market, by Mobility Option (2022-2029) 7.5. Europe Buffer Preparation Market, by Application (2022-2029) 7.6. Europe Buffer Preparation Market, by End-User (2022-2029) 7.7. Europe Buffer Preparation Market, by Country (2022-2029) 7.7.1. UK 7.7.2. France 7.7.3. Germany 7.7.4. Italy 7.7.5. Spain 7.7.6. Sweden 7.7.7. Austria 7.7.8. Rest of Europe 8. Asia Pacific Buffer Preparation Market (by Value USD and Volume Units) 8.1. Asia Pacific Buffer Preparation Market, by Type (2022-2029) 8.2. Asia Pacific Buffer Preparation Market, by Feature (2022-2029) 8.3. Asia Pacific Buffer Preparation Market, by Technique (2022-2029) 8.4. Asia Pacific Buffer Preparation Market, by Mobility Option (2022-2029) 8.5. Asia Pacific Buffer Preparation Market, by Application (2022-2029) 8.6. Asia Pacific Buffer Preparation Market, by End-User (2022-2029) 8.7. Asia Pacific Buffer Preparation Market, by Country (2022-2029) 8.7.1. China 8.7.2. S Korea 8.7.3. Japan 8.7.4. India 8.7.5. Australia 8.7.6. Indonesia 8.7.7. Malaysia 8.7.8. Vietnam 8.7.9. Taiwan 8.7.10. Bangladesh 8.7.11. Pakistan 8.7.12. Rest of Asia Pacific 9. Middle East and Africa Buffer Preparation Market (by Value USD and Volume Units) 9.1. Middle East and Africa Buffer Preparation Market, by Type (2022-2029) 9.2. Middle East and Africa Buffer Preparation Market, by Feature (2022-2029) 9.3. Middle East and Africa Buffer Preparation Market, by Technique (2022-2029) 9.4. Middle East and Africa Buffer Preparation Market, by Mobility Option (2022-2029) 9.5. Middle East and Africa Buffer Preparation Market, by Application (2022-2029) 9.6. Middle East and Africa Buffer Preparation Market, by End-User (2022-2029) 9.7. Middle East and Africa Buffer Preparation Market, by Country (2022-2029) 9.7.1. South Africa 9.7.2. GCC 9.7.3. Egypt 9.7.4. Nigeria 9.7.5. Rest of ME&A 10. South America Buffer Preparation Market (by Value USD and Volume Units) 10.1. South America Buffer Preparation Market, by Type (2022-2029) 10.2. South America Buffer Preparation Market, by Feature (2022-2029) 10.3. South America Buffer Preparation Market, by Technique (2022-2029) 10.4. South America Buffer Preparation Market, by Mobility Option (2022-2029) 10.5. South America Buffer Preparation Market, by Application (2022-2029) 10.6. South America Buffer Preparation Market, by End-User (2022-2029) 10.7. South America Buffer Preparation Market, by Country (2022-2029) 10.7.1. Brazil 10.7.2. Argentina 10.7.3. Rest of South America 11. Company Profile: Key players 11.1. Merck KGaA 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Thermo Fisher Scientific Inc. 11.3. Avantor, Inc. 11.4. Lonza Group Ltd 11.5. Bio-Rad Laboratories, Inc. 11.6. Sartorius AG 11.7. Corning Inc. 11.8. Becton 11.9. Dickinson and Company 11.10. GE Healthcare 11.11. Promega Corporation 11.12. Asahi Kasei 11.13. Avantor 11.14. Canvax 11.15. Cytiva 11.16. Pall Corporation 11.17. Uniogen 12. Key Findings 13. Industry Recommendation