The Germany Medical and Diagnostic Laboratory Service Market size was valued at USD 2.62 million in 2023. The total Germany Medical and Diagnostic Laboratory Service Market revenue is expected to grow at a CAGR of 4.6 % from 2023 to 2030, reaching nearly USD 3.59 Million.Germany Medical and Diagnostic Laboratory Service Market Analysis

The MMR report analyzes the substantial growth in the German medical and diagnostic laboratory service industry, which has been driven by technological advancements and increased healthcare spending. Rising chronic disease rates, such as diabetes, cardiovascular difficulties, and cancer, are going to raise the need for routine and specialized examinations. The use of modern technologies such as AI diagnostics and point-of-care testing is going to open up new market niches. The focus on customized medicine, which leverages genetic profiles and biomarkers, creates an opportunity for specialized diagnostic testing. The integration of laboratory information systems and automation improves efficiency, saves costs, and increases market accessibility. Profitable prospects in fast-growing markets have been found by concentrating on businesses that handle infectious diseases, high-burden chronic illnesses, and customized pharmaceutical testing. Investing in technical developments, such as AI diagnostics and molecular tests, provides significant rewards. Exploring consolidation in laboratory services or specialized products capitalizes on the growing demand for decentralized testing. Companies that provide laboratory information systems, data analytics tools, and telemedicine solutions are going to benefit from the growing digitalization of healthcare. Aging populations are driving demand for age-related disease diagnostics and customized therapy. The rising prevalence of chronic disorders such as diabetes, cardiovascular disease, and cancer drives the need for routine and specialized diagnostics. The increased focus on preventative healthcare, particularly early identification, increases diagnostic service consumption. The adoption of modern technology such as AI diagnostics and point-of-care testing increases market reach while customizing healthcare.

1. According to MMR Analysis, In 2023, an estimated 1.7 million people are living with cancer, and this number is expected to rise to 1.9 million by 2030. 2. Chronic diseases are a major driver of healthcare costs. In 2020, chronic diseases accounted for XX% of total healthcare spending in Germany. 3. An estimated 1.7 million Germans were living with cancer in 2023, up from 1.5 million in 2018. 4. Profit margins range from 10% for smaller labs to 20% for larger labs and specialized services. To know about the Research Methodology :- Request Free Sample Report Shift Towards Point-of-care Testing (POCT) The Shift towards point-of-care testing is significant, it involves conducting diagnostic tests near the patient, reducing the turnaround time for results. It is particularly crucial for conditions that require rapid diagnosis and treatment decisions. POCT gives diagnostic data quickly, reducing the waiting period from hours to minutes and allowing for timely treatment decisions in time-critical diseases including sepsis and stroke. It extends healthcare into remote communities, improving access to timely diagnosis and reducing hospital visits. Despite the early costs, POCT ultimately saves money by reducing laboratory tests and hospital admissions. Germany's healthcare system is evolving toward POCT, affecting significant areas such as diabetes, heart disease, and sepsis. Over 60% of diabetes patients use POCT blood glucose monitoring to control their illness, empowering them to care for themselves. Rapid cardiac troponin testing using POCT saves lives by allowing for earlier diagnosis and better treatment. Even sepsis, a serious and time-sensitive condition, benefits from early identification with POCT blood testing. The trend toward patient-centered, near-immediate testing has transformed German healthcare. According to MMR Research, POCT currently accounts for around 15% of the total in vitro diagnostics market in Germany, signifying its growing share within the overall diagnostics landscape.

Rising Operational Costs German medical and diagnostic laboratories are facing a significant challenge in rising operational costs. Laboratories have substantial financial issues, with increased expenses threatening their operations. The economic hardship results in reduced budgets for technological breakthroughs and difficulty obtaining critical finance. As a result, service fees are expected to increase, thereby burdening patients financially. In extreme cases, labs are forced to limit available tests, cut working hours, and postpone critical equipment improvements, reducing both accuracy and turnaround times. The effects extend to accessibility concerns, particularly for patients in remote areas and underprivileged communities who may have restricted lab access due to rising expenses. The complex interplay of these elements highlights their enormous impact on both laboratories and patients. 1. Overall healthcare expenditure in Germany is around XX billion in 2023, with laboratory services representing a significant portion.

Germany Medical and Diagnostic Laboratory Service Market Segment Analysis

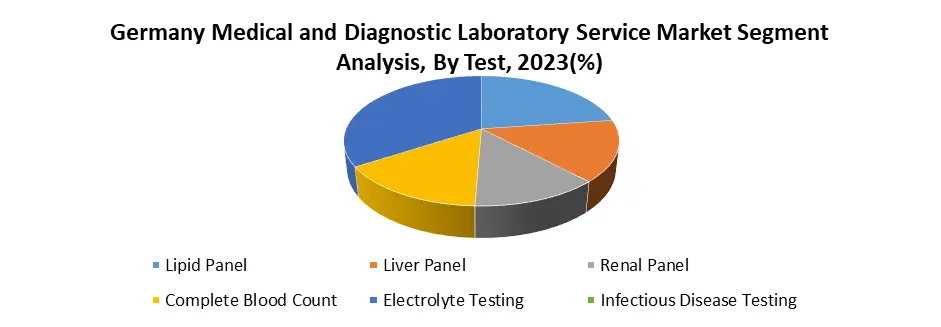

By Test, the Lipid Panel segment holds the dominant share of the German medical and Diagnostic Laboratory Service market, estimated at around 18%. The increasing focus on cardiovascular health and cholesterol management is driving the need for lipid panels. It also benefits from early identification and risk appraisal for coronary artery disease, as well as excellent treatment outcome tracking in patients with pre-existing cardiovascular problems. Technological improvements, such as automated methods and quick response times, increase the importance of lipid panels in healthcare.

Germany Medical and Diagnostic Laboratory Service Market Scope: Inquire Before Buying

Germany Medical and Diagnostic Laboratory Service Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.62 Mn. Forecast Period 2024 to 2030 CAGR: 4.6% Market Size in 2030: US $ 3.59 Mn. Segments Covered: by Test Lipid Panel Liver Panel Renal Panel Complete Blood Count Electrolyte Testing Infectious Disease Testing by Product Instruments Reagents by End User Hospital Laboratory Diagnostic Laboratory Point-of-care Testing Key Players in the Germany Medical and Diagnostic Laboratory Service Market

1. Roche Diagnostics 2. Abbott Laboratories 3. Danaher 4. Siemens Healthineers. 5. Centogene 6. Rapid Micro Biosystems 7. VitroGen FAQs: 1. What services do medical diagnostic laboratories in Germany offer? Ans. Medical diagnostic laboratories in Germany offer a range of services, including blood tests, imaging studies, pathology examinations, genetic testing, and infectious disease diagnostics. These services aid in disease diagnosis, treatment planning, and preventive healthcare. 2. Are medical diagnostic services covered by health insurance in Germany? Ans. Yes, medical diagnostic services are typically covered by health insurance in Germany. The country's healthcare system ensures that necessary diagnostic tests are reimbursed, providing financial support for individuals seeking medical examinations. 3. What is the projected market size & and growth rate of the Germany Medical AND Diagnostic Laboratory Service Market? Ans. The Germany Medical AND Diagnostic Laboratory Service Market size was valued at USD 2.62 Million in 2023. The total Germany Medical AND Diagnostic Laboratory Service market revenue is expected to grow at a CAGR of 4.6 % from 2023 to 2030, reaching nearly USD 3.59 Million By 2030.

1. Germany Medical and Diagnostic Laboratory Service Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Germany Medical and Diagnostic Laboratory Service Market: Dynamics 2.1. Germany Medical and Diagnostic Laboratory Service Market Trends 2.2. PORTER’s Five Forces Analysis 2.3. PESTLE Analysis 2.4. Value Chain Analysis 2.5. Regulatory Landscape of Germany Medical and Diagnostic Laboratory Service Market 2.6. Technological Advancements in the Australian Medical and Diagnostic Laboratory Service Market 2.7. Factors Driving the Growth of the Medical and Diagnostic Laboratory Service Market in Australia 2.8. People suffering from Cardiovascular disease in Australia 2.9. Healthcare spending in Germany 2.10. Number of Australians suffering from cancer disease 2.11. German Healthcare Systems 2.12. Profit Margin of Germany Medical and Diagnostic Laboratory Service Market 2.13. Utilization of Laboratory Testing in the German Healthcare System 2.14. Investment Opportunities in Germany's medical and diagnostic laboratory service market 2.15. Key Opinion Leader Analysis for the Australian Medical and Diagnostic Laboratory Service Industry 2.16. Germany Medical and Diagnostic Laboratory Service Market Price Trend Analysis (2022-23) 3. Germany Medical and Diagnostic Laboratory Service Market: Market Size and Forecast by Segmentation for (by Value in USD Million) (2023-2030) 3.1. Germany Medical and Diagnostic Laboratory Service Market Size and Forecast, by Test (2023-2030) 3.1.1. Lipid Panel 3.1.2. Liver Panel 3.1.3. Renal Panel 3.1.4. Complete Blood Count 3.1.5. Electrolyte Testing 3.1.6. Infectious Disease Testing 3.2. Germany Medical and Diagnostic Laboratory Service Market Size and Forecast, by Product (2023-2030) 3.2.1. Instruments 3.2.2. Reagents 3.3. Germany Medical and Diagnostic Laboratory Service Market Size and Forecast, by End User (2023-2030) 3.3.1. Hospital Laboratory 3.3.2. Diagnostic Laboratory 3.3.3. Point-of-care Testing 4. Germany Medical and Diagnostic Laboratory Service Market: Competitive Landscape 4.1. MMR Competition Matrix 4.2. Competitive Landscape 4.3. Key Players Benchmarking 4.3.1. Company Name 4.3.2. Product Segment 4.3.3. End-user Segment 4.3.4. Revenue (2023) 4.4. Market Analysis by Organized Players vs. Unorganized Players 4.4.1. Organized Players 4.4.2. Unorganized Players 4.5. Leading Germany Medical and Diagnostic Laboratory Service Market Companies, by market capitalization 4.6. Market Trends and Challenges in Australia 4.6.1. Technological Advancements 4.6.2. Affordability and Accessibility 4.6.3. Shortage of Skilled Professionals 4.7. Market Structure 4.7.1. Market Leaders 4.7.2. Market Followers 4.7.3. Emerging Players in the Market 4.7.4. Challenges 4.7.5. Mergers and Acquisitions Details 5. Company Profile: Key Players 5.1. Roche Diagnostics 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Details on Partnership 5.1.7. Potential Impact of Emerging Technologies 5.1.8. Regulatory Accreditations and Certifications Received by Them 5.1.9. Strategies Adopted by Key Players 5.1.10. Recent Developments 5.2. Abbott Laboratories 5.3. Danaher 5.4. Siemens Healthineers. 5.5. Centogene 5.6. Rapid Micro Biosystems 5.7. VitroGen 6. Industry Recommendations 7. Germany Medical and Diagnostic Laboratory Service Market: Research Methodology