Erectile Dysfunction Drugs Market size was valued at USD 3.98 Bn in 2024, and the Global Erectile Dysfunction Drugs Market revenue is expected to grow at a CAGR of 8.5 % from 2025 to 2032, reaching nearly USD 7.64Bn. Erectile dysfunction (ED) characterizes the inability to attain or sustain an erection adequate for satisfactory sexual performance. It's a prevalent condition, affecting over 12 million men in the United States. Vascular, neurologic, psychological, and hormonal factors can underlie this condition. Common contributors to ED encompass diabetes mellitus, hypertension, hyperlipidemia, obesity, testosterone deficiency, and treatments for prostate cancer. Psychological causes such as performance anxiety and relationship issues are also frequent. Certain medications and substance use can either induce or worsen ED, with antidepressants and tobacco being primary culprits. Around 52 percent of men experience some form of ED, and that total ED increases from about 5 to 15 percent between ages 40 and 70. Notably, ED is linked to heightened cardiovascular disease risk, particularly in men with metabolic syndrome. Lifestyle adjustments like quitting smoking, regular exercise, weight management, and better management of diabetes, hypertension, and hyperlipidemia are recommended initial interventions. Oral phosphodiesterase-5 inhibitors are the primary treatment for ED. These can be ineffective, second-line options include alprostadil and vacuum devices. In cases where other treatments yield no success, surgically implanted penile prostheses remain an option. Counseling is advisable for men with psychogenic ED.To know about the Research Methodology :- Request Free Sample Report Currently, Erectile Dysfunction Drugs Market experiences a consistent increase in demand due to the rising incidence of erectile dysfunction globally. The market's growth is propelled by factors such as an aging population, lifestyle changes leading to higher prevalence of chronic diseases like diabetes and hypertension, psychological stressors, and an increased awareness among individuals seeking effective treatments. Major pharmaceutical companies are actively involved in research and development to introduce innovative drugs and therapies, thus significantly impacting the Erectile Dysfunction Drugs market dynamics. Recent advancements include novel formulations, alternate delivery methods, and the development of more potent and longer-lasting drugs, aiming to enhance efficacy and improve patient compliance. Key players like Pfizer, Eli Lilly, Bayer AG, and Vivus, among others, have been at the lead of introducing groundbreaking treatments and therapies, contributing to the Erectile Dysfunction Drugs market's growth.

Erectile Dysfunction Drugs Market Dynamics:

Aging Population, Lifestyle Factors, and Evolving Treatment Landscape Erectile Dysfunction Drugs Market Trends The Erectile Dysfunction Drugs Market is experiencing substantial growth driven by various influential factors. The aging global population contributes significantly as advancing age correlates with a higher prevalence of erectile dysfunction. For instance, in the United States, the expanding aging demographic has led to increased demand for ED drugs like sildenafil (Viagra) and tadalafil (Cialis). Lifestyle-related diseases such as diabetes, obesity, and hypertension play a pivotal role, influencing the market's trajectory by escalating the incidence of ED worldwide. Lifestyle changes and stressors also contribute, with psychological factors substantially impacting erectile dysfunction rates. Moreover, increased awareness, reduced stigma, and growing acceptance of seeking treatment for sexual health issues drive market growth. Technological advancements in drug development, regulatory support, and approvals for new therapies like avanafil (Stendra) further stimulate market expansion. The trend towards over-the-counter availability and strategic collaborations among pharmaceutical companies significantly shape the market landscape, enhancing accessibility, awareness, and product portfolios within the Erectile Dysfunction Drugs Market growth. For instance, In June 2023, the FDA approved MED3000 (Eroxon), a topical gel treatment for ED, for over-the-counter sale. This provides a faster-acting option compared to oral medications, though prescription drugs remain essential for certain cases. Pharmaceutical Giants Revenue Streams Erectile Dysfunction Drugs Market Drug Sales and Market Share Dynamics The market for Erectile Dysfunction (ED) drugs revolves significantly around oral medications, predominantly phosphodiesterase-5 inhibitors (PDE5Is) like sildenafil (Viagra), tadalafil (Cialis), and vardenafil (Levitra). Pfizer's Viagra, perhaps the most iconic ED medication, revolutionized the treatment landscape since its introduction. Its success paved the way for Eli Lilly's Cialis and Bayer's Levitra, creating a competitive market segment for orally administered medications. These drugs hold prominence due to their ease of administration, consumer familiarity, and efficacy in treating ED, catering to a broad consumer base seeking convenience and privacy in managing their condition. The less prevalent, injectable medications like alprostadil (Caverject) or intraurethral suppositories such as Muse offer an alternative for individuals unresponsive to oral treatments. Pfizer and Eli Lilly have ventured into this domain, providing options for patients do not respond to oral medications. However, injectable formulations, often perceived as more invasive, complex, and less convenient, hold a smaller market share, primarily serving a niche group of patients with specific needs or preferences. Injectable medications, owing to their mode of administration, predominantly target hospital pharmacies. Alprostadil injections, administered in a clinical setting, find usage in cases where oral medications prove ineffective. Pfizer and Eli Lilly, among others, distribute their injectable formulations primarily through hospital pharmacies, focusing on healthcare facilities catering to severe ED cases requiring on-site administration. Oral medications dominate retail pharmacy distribution channels, led by companies like Pfizer, Eli Lilly, and Bayer. These drugs, easily self-administered, offer discretion and accessibility, making them preferred choices among consumers. Their presence in retail pharmacy chains ensures widespread availability and easy access for individuals seeking treatment for ED, contributing significantly to the Erectile Dysfunction Drugs market share and revenue for these pharmaceutical giants. The emergence of online pharmacies has reshaped the landscape for ED medications. Companies like Hims & Hers, Roman (now Ro), and BlueChew leverage digital platforms to provide telemedicine consultations and direct-to-consumer deliveries of ED drugs. These platforms cater to a growing market seeking convenience, privacy, and discreet access to ED medications without in-person visits to healthcare providers or traditional pharmacies. The convenience factor and ease of obtaining prescriptions online have attracted consumers, especially those uncomfortable discussing ED in person or seeking more private solutions. Pfizer's Viagra, the pioneering ED drug, established a strong foothold in both retail and online pharmacy channels, setting a benchmark for competitors. Eli Lilly's Cialis, renowned for its longer duration of action, secured its place in the market alongside Viagra. Bayer's Levitra, while less dominant, carved its niche with a differentiating profile for Erectile Dysfunction Drugs Market growth. Navigating Complexities Challenges and Constraints in the Erectile Dysfunction Drugs Market Patent expirations and the subsequent influx of generic alternatives, notably observed in medications introduce heightened competition, leading to pricing pressures and diminished market share for original drugs. Safety concerns linked with ED medications, such as headaches or severe cardiovascular complications associated with phosphodiesterase-5 inhibitors (PDE5Is) significantly impact consumer trust and acceptance, shaping market dynamics. Moreover, the limited efficacy of these drugs in specific patient groups, reluctance stemming from societal taboos, and psychological barriers surrounding ED treatment present hurdles in the Erectile Dysfunction Drugs market penetration and addressing diverse consumer needs. Stringent regulatory approvals for new therapies, coupled with high healthcare costs, also impede market expansion, while the availability and preference for alternative therapies or non-pharmacological interventions pose competitive challenges to medication-based treatments. These challenges collectively shape a complex landscape for pharmaceutical companies, prompting continuous innovation and patient-centric approaches to navigate and address the multifarious constraints within the ED Drugs Market.Erectile Dysfunction Drugs Market Segment Analysis:

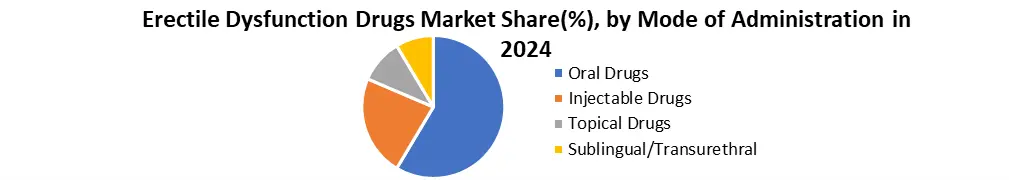

Based on Products, Erectile Dysfunction Drugs market has been divided into Sildenafil, Tadalafil, Udenafil, Avanafil, and Others. Among these, the Sildenafil sub-segment is projected to generate the maximum revenue. The Sildenafil sub-segment witnessed the highest revenue in 2024. The Erectile Dysfunction Drugs Market is segmented into various categories, among which the Sildenafil sub-segment stands out as a pivotal revenue generator. Sildenafil, renowned by its brand name Viagra, has been a revolutionary drug since its inception, transforming the landscape of ED treatment. Based on Mode of Applications, Erectile Dysfunction Drugs Market is segmented into Oral Drugs, Injectable Drugs, Topical Drugs, Sublingual/Transurethral in 2024. Among them, Oral drugs dominate the erectile dysfunction drugs market due to their ease of administration, non-invasive nature, rapid onset of action, and wide availability. Medications like sildenafil (Viagra) and tadalafil (Cialis) are preferred first-line treatments, driving higher adoption compared to injectables, topical, or transurethral options, which are often reserved for non-responders.

Erectile Dysfunction Drugs Market Regional Insight:

North America region dominated the Erectile Dysfunction Drugs Market in the year 2023, and is expected to continue its dominance during the forecast period. The North American market for Erectile Dysfunction (ED) Drugs includes a diverse landscape shaped by several influential factors, including consumer behavior, regulatory frameworks, technological advancements, and healthcare infrastructure across countries like the United States and Canada. Within this region, the prevalence of ED is notable, affecting a substantial portion of the male population and driving the demand for effective treatment options. The United States stands as a key contributor to the North America Erectile Dysfunction Drugs Market. Factors such as a large aging population, lifestyle-related diseases like diabetes and hypertension, and increasing awareness of ED treatment options propel market growth. Pharmaceutical companies, including Pfizer, Eli Lilly, and others, have a significant presence, offering a wide array of medications like sildenafil (Viagra), tadalafil (Cialis), and vardenafil (Levitra) through various distribution channels, including retail pharmacies and online platforms. Additionally, the FDA's stringent regulatory environment influences drug approvals and market dynamics, ensuring safety and efficacy in ED treatments. In Canada, the ED Drugs Market experiences similar trends but within a more regulated healthcare system. Pharmaceutical companies adhere to Health Canada's regulations, ensuring compliance and approval for medications like sildenafil (Viagra) or tadalafil (Cialis). The Canadian market shares similarities with the United States, witnessing a rise in ED prevalence due to lifestyle factors, an aging population, and increased awareness. Retail pharmacies, hospitals, and online pharmacies play essential roles in distribution, ensuring accessibility to ED medications across various provinces. Competitive Landscape: 1. In 2021, a partnership emerged between Greenstone, a Pfizer Inc. subsidiary, and Roman, a digital men's health clinic. Within this collaboration, Roman is set to provide Greenstone's generic Viagra (sildenafil) tablets for addressing erectile dysfunction. This strategic alliance aims to facilitate the expansion of the company's pharmaceuticals sector.Global Erectile Dysfunction Drugs Market Scope: Inquire before buying

Erectile Dysfunction Drugs Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 3.98 Bn. Forecast Period 2025 to 2032 CAGR: 8.5% Market Size in 2032: USD 7.64 Bn. Segments Covered: by Product Sildenafil Tadalafil Udenafil Avanafil Others by Mode of Administration Oral Drugs Injectable Drugs Topical Drugs Sublingual/Transurethral by Distribution Channel Hospital Pharmacy Retail Pharmacy Online Pharmacy Erectile Dysfunction Drugs Market Key Players:

North America 1. Pfizer, Inc. (United States) 2. Eli Lilly and Company (United States) 3. Apricus Biosciences Inc. (United States) 4. VIVUS Inc. (United States) 5. Meda Pharmaceuticals Inc. (United States) 6. Johnson & Johnson (United States) 7. Actavis Generics (now Allergan plc) (United States) Europe 8. Bayer AG (Germany) 9. Teva Pharmaceutical Industries Ltd. (Israel) 10. Futura Medical PLC (United Kingdom) 11. GlaxoSmithKline PLC (United Kingdom) 12. Sandoz International GmbH (Germany) 13. Hexal AG (Germany) Asia Pacific 14. Dr. Reddy's Laboratories Ltd. (India) 15. SK Chemicals Co. Ltd. (South Korea) 16. Dong-A Pharmaceutical Co. Ltd. (South Korea)FAQ:

1] What segments are covered in the Global Erectile Dysfunction Drugs Market report? Ans. The segments covered in the Erectile Dysfunction Drugs Market report are based on Drug Treatment, Mode of Administration, and Distribution Channels. 2] Which region is expected to hold the highest share in the Global Erectile Dysfunction Drugs Market? Ans. The North America region is expected to hold the highest share in the Erectile Dysfunction Drugs Market. 3] What is the market size of the Global Erectile Dysfunction Drugs Market by 2032? Ans. The market size of the Erectile Dysfunction Drugs Market by 2032 is expected to reach USD 7.64 Bn. 4] Who are the top key players in the Erectile Dysfunction Drugs Market? Ans. Pfizer Inc. (United States), Eli Lilly and Company (United States), and Bayer AG (Germany) are the top key players in the Erectile Dysfunction Drugs Market. 5] What was the market size of the Global Erectile Dysfunction Drugs Market in 2024? Ans. The market size of the Erectile Dysfunction Drugs Market in 2024 was valued at USD 3.98 Bn.

1. Erectile Dysfunction Drugs Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Erectile Dysfunction Drugs Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Erectile Dysfunction Drugs Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Erectile Dysfunction Drugs Market: Dynamics 3.1. Erectile Dysfunction Drugs Market Trends by Region 3.1.1. North America Erectile Dysfunction Drugs Market Trends 3.1.2. Europe Erectile Dysfunction Drugs Market Trends 3.1.3. Asia Pacific Erectile Dysfunction Drugs Market Trends 3.1.4. Middle East and Africa Erectile Dysfunction Drugs Market Trends 3.1.5. South America Erectile Dysfunction Drugs Market Trends 3.2. Erectile Dysfunction Drugs Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Erectile Dysfunction Drugs Market Drivers 3.2.1.2. North America Erectile Dysfunction Drugs Market Restraints 3.2.1.3. North America Erectile Dysfunction Drugs Market Opportunities 3.2.1.4. North America Erectile Dysfunction Drugs Market Challenges 3.2.2. Europe 3.2.2.1. Europe Erectile Dysfunction Drugs Market Drivers 3.2.2.2. Europe Erectile Dysfunction Drugs Market Restraints 3.2.2.3. Europe Erectile Dysfunction Drugs Market Opportunities 3.2.2.4. Europe Erectile Dysfunction Drugs Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Erectile Dysfunction Drugs Market Drivers 3.2.3.2. Asia Pacific Erectile Dysfunction Drugs Market Restraints 3.2.3.3. Asia Pacific Erectile Dysfunction Drugs Market Opportunities 3.2.3.4. Asia Pacific Erectile Dysfunction Drugs Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Erectile Dysfunction Drugs Market Drivers 3.2.4.2. Middle East and Africa Erectile Dysfunction Drugs Market Restraints 3.2.4.3. Middle East and Africa Erectile Dysfunction Drugs Market Opportunities 3.2.4.4. Middle East and Africa Erectile Dysfunction Drugs Market Challenges 3.2.5. South America 3.2.5.1. South America Erectile Dysfunction Drugs Market Drivers 3.2.5.2. South America Erectile Dysfunction Drugs Market Restraints 3.2.5.3. South America Erectile Dysfunction Drugs Market Opportunities 3.2.5.4. South America Erectile Dysfunction Drugs Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Erectile Dysfunction Drugs Industry 3.8. Analysis of Government Schemes and Initiatives For Erectile Dysfunction Drugs Industry 3.9. Erectile Dysfunction Drugs Market Trade Analysis 3.10. The Global Pandemic Impact on Erectile Dysfunction Drugs Market 4. Erectile Dysfunction Drugs Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 4.1.1. Sildenafil 4.1.2. Tadalafil 4.1.3. Udenafil 4.1.4. Avanafil 4.1.5. Others 4.2. Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 4.2.1. Oral Drugs 4.2.2. Injectable Drugs 4.2.3. Topical Drugs 4.2.4. Sublingual/Transurethral 4.3. Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 4.3.1. Hospital Pharmacy 4.3.2. Retail Pharmacy 4.3.3. Online Pharmacy 4.4. Erectile Dysfunction Drugs Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Erectile Dysfunction Drugs Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 5.1.1. Sildenafil 5.1.2. Tadalafil 5.1.3. Udenafil 5.1.4. Avanafil 5.1.5. Others 5.2. North America Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 5.2.1. Oral Drugs 5.2.2. Injectable Drugs 5.2.3. Topical Drugs 5.2.4. Sublingual/Transurethral 5.3. North America Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.1. Hospital Pharmacy 5.3.2. Retail Pharmacy 5.3.3. Online Pharmacy 5.4. North America Erectile Dysfunction Drugs Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 5.4.1.1.1. Sildenafil 5.4.1.1.2. Tadalafil 5.4.1.1.3. Udenafil 5.4.1.1.4. Avanafil 5.4.1.1.5. Others 5.4.1.2. United States Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 5.4.1.2.1. Oral Drugs 5.4.1.2.2. Injectable Drugs 5.4.1.2.3. Topical Drugs 5.4.1.2.4. Sublingual/Transurethral 5.4.1.3. United States Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.1.3.1. Hospital Pharmacy 5.4.1.3.2. Retail Pharmacy 5.4.1.3.3. Online Pharmacy 5.4.2. Canada 5.4.2.1. Canada Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 5.4.2.1.1. Sildenafil 5.4.2.1.2. Tadalafil 5.4.2.1.3. Udenafil 5.4.2.1.4. Avanafil 5.4.2.1.5. Others 5.4.2.2. Canada Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 5.4.2.2.1. Oral Drugs 5.4.2.2.2. Injectable Drugs 5.4.2.2.3. Topical Drugs 5.4.2.2.4. Sublingual/Transurethral 5.4.2.3. Canada Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.2.3.1. Hospital Pharmacy 5.4.2.3.2. Retail Pharmacy 5.4.2.3.3. Online Pharmacy 5.4.3. Mexico 5.4.3.1. Mexico Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 5.4.3.1.1. Sildenafil 5.4.3.1.2. Tadalafil 5.4.3.1.3. Udenafil 5.4.3.1.4. Avanafil 5.4.3.1.5. Others 5.4.3.2. Mexico Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 5.4.3.2.1. Oral Drugs 5.4.3.2.2. Injectable Drugs 5.4.3.2.3. Topical Drugs 5.4.3.2.4. Sublingual/Transurethral 5.4.3.3. Mexico Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.3.3.1. Hospital Pharmacy 5.4.3.3.2. Retail Pharmacy 5.4.3.3.3. Online Pharmacy 6. Europe Erectile Dysfunction Drugs Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 6.2. Europe Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 6.3. Europe Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 6.4. Europe Erectile Dysfunction Drugs Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 6.4.1.2. United Kingdom Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 6.4.1.3. United Kingdom Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.2. France 6.4.2.1. France Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 6.4.2.2. France Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 6.4.2.3. France Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 6.4.3.2. Germany Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 6.4.3.3. Germany Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 6.4.4.2. Italy Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 6.4.4.3. Italy Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 6.4.5.2. Spain Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 6.4.5.3. Spain Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 6.4.6.2. Sweden Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 6.4.6.3. Sweden Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 6.4.7.2. Austria Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 6.4.7.3. Austria Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 6.4.8.2. Rest of Europe Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 6.4.8.3. Rest of Europe Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 7. Asia Pacific Erectile Dysfunction Drugs Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 7.2. Asia Pacific Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 7.3. Asia Pacific Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 7.4. Asia Pacific Erectile Dysfunction Drugs Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 7.4.1.2. China Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 7.4.1.3. China Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 7.4.2.2. S Korea Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 7.4.2.3. S Korea Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 7.4.3.2. Japan Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 7.4.3.3. Japan Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.4. India 7.4.4.1. India Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 7.4.4.2. India Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 7.4.4.3. India Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 7.4.5.2. Australia Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 7.4.5.3. Australia Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 7.4.6.2. Indonesia Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 7.4.6.3. Indonesia Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.7. Malaysia 7.4.7.1. Malaysia Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 7.4.7.2. Malaysia Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 7.4.7.3. Malaysia Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.8. Vietnam 7.4.8.1. Vietnam Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 7.4.8.2. Vietnam Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 7.4.8.3. Vietnam Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.9. Taiwan 7.4.9.1. Taiwan Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 7.4.9.2. Taiwan Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 7.4.9.3. Taiwan Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 7.4.10.2. Rest of Asia Pacific Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 7.4.10.3. Rest of Asia Pacific Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 8. Middle East and Africa Erectile Dysfunction Drugs Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 8.2. Middle East and Africa Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 8.3. Middle East and Africa Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 8.4. Middle East and Africa Erectile Dysfunction Drugs Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 8.4.1.2. South Africa Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 8.4.1.3. South Africa Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 8.4.2.2. GCC Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 8.4.2.3. GCC Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 8.4.3.2. Nigeria Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 8.4.3.3. Nigeria Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 8.4.4.2. Rest of ME&A Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 8.4.4.3. Rest of ME&A Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 9. South America Erectile Dysfunction Drugs Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 9.2. South America Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 9.3. South America Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel(2024-2032) 9.4. South America Erectile Dysfunction Drugs Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 9.4.1.2. Brazil Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 9.4.1.3. Brazil Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 9.4.2.2. Argentina Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 9.4.2.3. Argentina Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Erectile Dysfunction Drugs Market Size and Forecast, by Product (2024-2032) 9.4.3.2. Rest Of South America Erectile Dysfunction Drugs Market Size and Forecast, by Mode of Administration (2024-2032) 9.4.3.3. Rest Of South America Erectile Dysfunction Drugs Market Size and Forecast, by Distribution Channel (2024-2032) 10. Company Profile: Key Players 10.1. Pfizer, Inc. (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Eli Lilly and Company (United States) 10.3. Apricus Biosciences Inc. (United States) 10.4. VIVUS Inc. (United States) 10.5. Meda Pharmaceuticals Inc. (United States) 10.6. Johnson & Johnson (United States) 10.7. Actavis Generics (now Allergan plc) (United States) 10.8. Bayer AG (Germany) 10.9. Teva Pharmaceutical Industries Ltd. (Israel) 10.10. Futura Medical PLC (United Kingdom) 10.11. GlaxoSmithKline PLC (United Kingdom) 10.12. Sandoz International GmbH (Germany) 10.13. Hexal AG (Germany) 10.14. Dr. Reddy's Laboratories Ltd. (India) 10.15. SK Chemicals Co. Ltd. (South Korea) 10.16. Dong-A Pharmaceutical Co. Ltd. (South Korea) 11. Key Findings 12. Industry Recommendations 13. Erectile Dysfunction Drugs Market: Research Methodology 14. Terms and Glossary