Laboratory Information Management System Market has valued at US$ 1.25 Bn. in 2022. The Global Laboratory Information Management System Market size is estimated to grow at a CAGR of 13.2% over the forecast period.Laboratory Information Management System Market Overview:

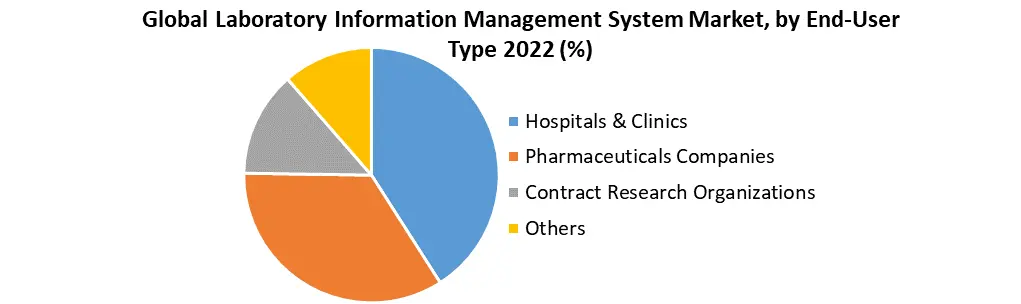

The Laboratory Information Management System Market analyzes and forecasts the market size in terms of value for the market (Billion). Further, the Laboratory Information Management System Market is segmented by Deployment Type, Component, End-User, and Region. Based on Deployment Type, the market is segmented into Cloud-Based Delivery Mode, Web-Based Delivery Mode, and On-Premise Delivery Mode. Based on Component, the market is divided into Software and Services and based on End-User, the market is divided into Hospitals & Clinics, Pharmaceuticals Companies, Contract Research Organizations, and Others. North America is the dominant player in the market. The report thoroughly analyzes market drivers, limitations, and opportunities. The presentation of facts and figures gives key data for the historical period. The report explores the different segments and data that have been provided by market participants and regions. A laboratory information management system (LIMS) also known as a laboratory information system is a software-based solution that supports current laboratory operations. Workflow management along with data processing and tracking are essential LIMS functionalities. Its application in controlled clinical contexts is supported by the architecture’s flexibility and data exchange interfaces. The capabilities and application of LIMS have developed from simple tracking to enterprise resource planning tools that control several areas of laboratory informatics.To know about the Research Methodology :- Request Free Sample Report 2022 is considered as a base year to forecast the market from 2023 to 2029. 2022’s market size is estimated on real numbers and outputs of the key players and major players across the globe. The past seven years' trends are considered while forecasting the market through 2029. 2020 is a year of exception and analysis, especially with the impact of lockdown by region.

Laboratory Information Management System Market Dynamics:

Laboratories are Increasingly Adopting Automation An increasing strategy to reduce human involvement in laboratory processes is laboratory automation. The use of specialized workstations and system software to automate typical laboratory procedures increases laboratory productivity and frees researchers to focus on key activities, and reduces the risk of human mistakes. Laboratory information management systems (LIMS) are being adopted by laboratories more frequently to uphold strict regulatory compliance, boost productivity, and efficiency, and promote data security and integrity. Fully automated, semi-automated, and manual activities, have error rates of 1-5 percent, 1-10 percent, and 10-30 percent, according to a study published in the Journal of Lab Automation. Total laboratory automation, digital workstations, and automated analyzers are all being used more commonly in laboratories, enabling staff to reassign tasks and make contributions. The large amounts of data produced by laboratory systems are driving up the demand for efficient data processing, analysis, and sharing techniques, emphasizing the need for effective and affordable solutions like the LIMS. The factor fueling the growth of the market for laboratory information management systems is the rising demand for data integration. Increasing Use of LIMS to Meet Strict Regulatory Requirements Pharmaceuticals and biotechnology firms are under instance pressure to follow harsh regulatory requirements for preclinical and clinical testing before bringing new medications to market in several different nations. For example, regulatory requirements in the pharmaceutical and biotech sectors like 21 CFR Part 11 and Clinical Laboratory Improvement Amendments (CLIA) include documentation and audit trails from research and development and testing to production and quality controls. In addition to this law, it is also necessary to bear the rules for acceptable labeling and advertising. Most laboratories are rapidly implementing LIMS to automate their workflows and bear strict regulatory standards as a result of these data management and security consent. Because they are simple to configure with laboratory systems to capture and update data, these systems assist laboratories in meeting regulatory standards without sacrificing process adaptability. During the forecast period, this is anticipated to enhance the need for LIMS in laboratories serving the target sectors. Expensive Maintenance and Servicing Fees The high LIMS maintenance and service costs are an important market limitation. Industry analysts claim that the maintenance costs of IT systems are more than the actual cost of the product. The cost of service and maintenance, which includes adapting the software to changing user needs, is recurring and accounts for roughly 20 to 30 percent of the overall cost of ownership. The expenditure associated with training and implementation adds up to about 15% of the final cost. These issues make it challenging for many small and medium-sized laboratories to invest in these systems, which restricts their adoption. The impact of this restriction is anticipated to lessen during the forecast period with the development of cloud-based LIMS products. Emerging markets have Significant Growth Potential Major emerging markets for LIMS include China, India, Japan, Singapore, Brazil, and the Middle East. The great potential for suppliers unable to fulfill the standards imposed and developed markets like the US exists in these countries because they lack appropriate standards and governmental control. For low-cost production, several biopharma players are also moving their manufacturing facilities to Asia. Asia is experiencing a considerable increase in demand for informatics solutions. The COVID-19 pandemic has forced participants in developed markets, like the US and Europe to lessen their reliance on Asia Nations and return to domestic operations. Confronting Issues with Informative Software It has become more crucial than ever for the laboratory to optimize its workflows due to the constantly evolving nature of procedure and technology. The dynamic nature of processes necessitates the automation of more adaptable solutions and the ability of LIMS to interface with lab and production equipment. While major players are increasingly using automated tools that call for modern, sophisticated interfaces, other small businesses use tools that are ten years old and need a different kind of interface. One of the biggest challenges facing LIMS suppliers is providing solutions that are compatible with various laboratory and production systems. It is incredibly difficult for suppliers to develop solutions that satisfy the unique needs of user companies.Laboratory Information Management System Market Segment Analysis

Based on Product, technical considerations are chief when purchasing a lab informatics solution. The organization evaluates the requirements of the solution and the IT infrastructure. This allows enterprises to choose between local, web-based, and cloud-based solutions. The cloud-based product segment dominated the market in 2022 and accounted for more than 42.5% of the sales. The segment is anticipated to maintain its leading position and grow at the fastest CAGR during the forecast period. Data can be accessed from multiple locations, multiple systems, and multiple branches. These are the key factors that contribute to the dominance of cloud-based segments. In addition to this, reduces IT staff, low-cost data management, and ease of deployment are other factors driving the growth of the segment.

Laboratory Information Management System Market Regional Insights:

North America accounted for the largest portion of the revenue in 2022. It holds more than 45% and its dominance is attributed to the favorable regulations that make laboratory automation adoption easier, like EHR programs. Other factors contributing to the region’s high proportion include the presence of cutting-edge infrastructure, increased government financing, and rising demand for genetic research. Asia Pacific is anticipated to experience the highest growth among all regional markets during the forecast period because of the rising number of CROs that offer LIMS in this region. The objective of the report is to present a comprehensive analysis of the global Laboratory Information Management System Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Laboratory Information Management System Market dynamic, and structure by analyzing the market segments and projecting the Laboratory Information Management System Market size. Clear representation of competitive analysis of key players by Design, price, financial position, product portfolio, growth strategies, and regional presence in the Laboratory Information Management System Market make the report investor’s guide.Laboratory Information Management System Market Scope: Inquire before buying

Global Laboratory Information Management System Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1.25 Bn. Forecast Period 2023 to 2029 CAGR: 13.2% Market Size in 2029: US $ 2.98 Bn. Segments Covered: by Deployment Type Cloud-Based Delivery Mode On-Premises Delivery Mode Web-Based Delivery Mode by End-User Hospitals & Clinics Pharmaceuticals Companies Contract Research Organizations Others by Component Software Services Laboratory Information Management System Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Laboratory Information Management System Market Key Players:

1.Abbott Laboratories (US) 2.Autoscribe Informatics (US) 3.Computing Solutions Inc. (US) 4.Ilumina Inc. (US) 5.LabLynx Inc. (US) 6.LabVantage Solutions Inc. (US) 7.LabWare Inc. (US) 8.PerkinElmer Inc. (US) 9.Shimadzu Corp. (Japan 10.Thermo Fisher Scientific Inc. (US) 11.Agilent Technologies Inc. (US) 12.Dassault Systemes (France) 13.Labworks LLC (US) 14.Accelerated Technology Laboratories (US) Frequently asked questions: 1. What is the market growth of the Laboratory Information Management System Market? Ans. The Laboratory Information Management System Market was valued at USD 1.25 Billion in 2022 and is expected to reach USD 2.98 Billion by 2029, at a CAGR of 13.2% during the forecast period. 2. Which are the major key players in the Laboratory Information Management System Market? Ans. The key players in this market include Computing Solutions Inc., Ilumina Inc., LabLynx Inc., LabVantage Solutions Inc, and Abbott Laboratories. 3. Which region is anticipated to account for the largest market share? Ans. North America is anticipated to dominate the Laboratory Information Management System Market. 4. What is the forecast period for the Laboratory Information Management System Market? Ans. The forecast period for the Laboratory Information Management System Market is from 2023 to 2029. 5. What is the segment in which the Laboratory Information Management System Market is divided? Ans. The Laboratory Information Management System Market is fragmented based on Deployment Type, End-User, and Component. It is also divided on basis of different regions.

1. Global Laboratory Information Management System Market Size: Research Methodology 2. Global Laboratory Information Management System Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Laboratory Information Management System Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Laboratory Information Management System Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • The Asia Pacific • The Middle East and Africa • Latin America 3.12. COVID-19 Impact 4. Global Laboratory Information Management System Market Size Segmentation 4.1. Global Laboratory Information Management System Market Size, by Deployment Type (2022-2029) • Cloud-Based Delivery Mode • On-Premises Delivery Mode • Web-Based Delivery Mode 4.2. Global Laboratory Information Management System Market Size, by End-User (2022-2029) • Hospitals & Clinics • Pharmaceuticals Companies • Contract Research Organizations • Others 4.3. Global Laboratory Information Management System Market Size, by Component (2022-2029) • Software • Services 5. North America Laboratory Information Management System Market (2022-2029) 5.1. North America Laboratory Information Management System Market Size, by Deployment Type (2022-2029) • Cloud-Based Delivery Mode • On-Premises Delivery Mode • Web-Based Delivery Mode 5.2. North America Laboratory Information Management System Market Size, by End-User (2022-2029) • Hospitals & Clinics • Pharmaceuticals Companies • Contract Research Organizations • Others 5.3. North America Laboratory Information Management System Market Size, by Component (2022-2029) • Software • Services 5.4. North America Laboratory Information Management System Market, by Country (2022-2029) • The United States • Canada • Mexico 6. European Laboratory Information Management System Market (2022-2029) 6.1. European Laboratory Information Management System Market, by Deployment Type (2022-2029) 6.2. European Laboratory Information Management System Market, by End-User (2022-2029) 6.3. European Laboratory Information Management System Market, by Component (2022-2029) 6.4. European Laboratory Information Management System Market, by Country (2022-2029) • the UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Laboratory Information Management System Market (2022-2029) 7.1. Asia Pacific Laboratory Information Management System Market, by Deployment Type (2022-2029) 7.2. Asia Pacific Laboratory Information Management System Market, by End-User (2022-2029) 7.3. Asia Pacific Laboratory Information Management System Market, by Component (2022-2029) 7.4. Asia Pacific Laboratory Information Management System Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASIAN • Rest Of APAC 8. The Middle East and Africa Laboratory Information Management System Market (2022-2029) 8.1. The Middle East and Africa Laboratory Information Management System Market, by Deployment Type (2022-2029) 8.2. The Middle East and Africa Laboratory Information Management System Market, by End-User (2022-2029) 8.3. The Middle East and Africa Laboratory Information Management System Market, by Component (2022-2029) 8.4. The Middle East and Africa Laboratory Information Management System Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. Latin America Laboratory Information Management System Market (2022-2029) 9.1. Latin America Laboratory Information Management System Market, by Deployment Type (2022-2029) 9.2. Latin America Laboratory Information Management System Market, by End-User (2022-2029) 9.3. Latin America Laboratory Information Management System Market, by Component (2022-2029) 9.4. Latin America Laboratory Information Management System Market, by Country (2022-2029) • Brazil • Argentina • Rest of Latin America 10. Company Profile: Key players 10.1. Abbott Laboratories 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Autoscribe Informatics 10.3. Computing Solutions Inc. 10.4. Ilumina Inc. 10.5. LabLynx Inc. 10.6. LabVantage Solutions Inc. 10.7. LabWare Inc. 10.8. PerkinElmer Inc. 10.9. Shimadzu Corp. 10.10. Thermo Fisher Scientific Inc. 10.11. Agilent Technologies Inc. 10.12. Dassault Systemes 10.13. Labworks LLC 10.14. Accelerated Technology Laboratories