The Drone Mobility Market Overview

Growing demand for futuristic cities flying automobiles is frequently shown as facilitating travel in futuristic cities, with roadways changing into aerial trails. This fantastic future has already emerged because of technological developments in airborne transportation, particularly those organized by drones. Drones, essentially unmanned aerial vehicles (UAVs), have emerged as a pivotal component in urban aerial mobility (UAM). These vehicles, equipped with communication, sensor, and positioning systems, play a crucial role in diverse applications ranging from data collection to goods delivery. Drone Mobility Market offers autonomous flight capabilities controlled from a ground station, equipped with sensors and cameras to capture real-time data during flight. They find use across various sectors including governmental, military, cinematic, and professional applications. Their ability to collect data and images in real-time has led to their utilization in traffic monitoring, disaster relief, surveillance, and more. One notable application of drones lies in freight shipments, allowing companies to transport goods efficiently and reduce traffic congestion. Though not universally applicable, drones offer a solution for companies seeking optimized shipping options, particularly in remote or inaccessible areas. Furthermore, drones are proving to be valuable tools for traffic control on roads and in cities, outpacing traditional methods such as helicopters. Their manoeuvrability, real-time surveillance capabilities, and risk reduction for operators make them a preferred choice for tasks like monitoring traffic density, responding to accidents, and patrolling areas prone to infractions. Drones contribute to reduced pollution by decreasing the number of vehicles on the road and utilizing electric power sources. They extend reach to isolated or disaster-affected areas, making them a key asset during emergencies. Additionally, their modular design facilitates maintenance, translating to cost savings in comparison to traditional transport fleets. The future of the drone mobility market through drones hinges on safety, affordability, and effective regulation. Similar to air traffic for aeroplanes, rules and control mechanisms are essential to ensure safe operations. The widespread adoption of urban drones requires collaboration among technology companies, startups, public administrations, and other stakeholders. As technological innovations continue to shape society's digitalization journey, the goal remains a sustainable, safe, and democratic urban mobility landscape.To know about the Research Methodology :- Request Free Sample Report Drone Mobility Market: A Comprehensive Analysis of the Top Players, Key Drivers, Trends, and Opportunities bundle reports 1 FPV Drone Market (Single User $ 4600) 2 Firefighting Drone Market (Single User $ 4600) 3 Military Drone Technology Market (Single User $ 4600) 4 Multirotor Drones Market (Single User $ 4600) 5 Solar Powered Drones Market (Single User $ 4600) 7 LiDAR Drone Market (Single User $ 4600)

What does a Drone Mobility Market bundle report provide?

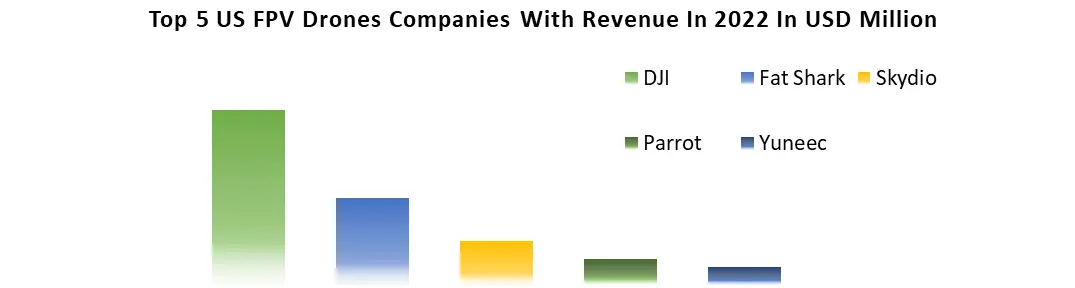

The Drone Evolution bundle's collection presents an array of in-depth reports that delve into various aspects of the evolving drone landscape. • Included within are individual reports, each delivering an extensive analysis of the Drone Evolution sector within specific regions. • The bundle's report on Drone Evolution meticulously examines the global landscape, encompassing dimensions such as drone types, technological advancements, distribution channels, applications, and user segments. • Insights provided encompass drivers of growth, imminent challenges, emerging trends, promising opportunities, potential risks, and barriers to entry within the drone industry. • The research methodology involves a thorough examination of literature concerning drone technologies, industry announcements, annual reports, and relevant documents shared by key industry players. • The report underscores the commitment of industry leaders to technological innovations as a means of establishing prominence within the global Drone Evolution realm. Key players are actively strengthening their positions in the market. • The report's objective is to deliver valuable insights and a comprehensive assessment of Drone Evolution, enabling stakeholders to make well-informed decisions and achieve a profound understanding of the dynamic market landscape. Uncover a wealth of knowledge about Drone Evolution with this cost-effective bundle, providing a treasure trove of valuable information and insights. By purchasing this budget-friendly package, you gain entry to multiple reports at a reduced cost compared to acquiring them individually. Don't miss the chance to delve into thorough analyses and valuable data on the drone industry with this discounted compilation. Report 1: FPV Drone Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts. The FPV Drone Market size was valued at USD 98.3 Million in 2022 and the total FPV Drone Market revenue is expected to grow at a CAGR of 19.03%from 2023 to 2029, reaching nearly USD 1136.56 Million. In recent years, First-Person View (FPV) drones have transitioned from being a specialized and niche group of flyers to a versatile category of remotely operated aircraft tailored for specific applications. This FPV Drone Market overview aims to provide a foundational understanding of FPV drones, encompassing their definition, applications, and the essential equipment needed to embrace the role of an FPV drone pilot. FPV drones can be broadly categorized into two major types: Freestyle and Racing. While there isn't a significant distinction between Freestyle and Racing drones, they both contribute to the diverse landscape of FPV drone usage. The popularity of drones surged notably as the accessibility and affordability of Lithium Polymer batteries (LiPo) increased, democratizing their availability to consumers. The advent of smaller, more affordable, and readily accessible commercial drones has significantly expanded the realm of drone applications. Today, drones find utility in diverse fields such as Aerial Photography, Search and Rescue operations, and Agricultural endeavours, where they're employed for crop disease detection. As the landscape of FPV drones continues to evolve, they remain at the forefront of innovation and transformation, offering a dynamic and exhilarating perspective that holds immense potential across a myriad of applications.

Segments Covered:

• By Type FPV Goggles FPV Remote Controllers Cameras Battery Flight Controller Airframe Motor Processors Others • By Application Rotor Cross Drag Racing Time Trail Others • By Application Civil Defence Transportation & Logistics Construction • By End-User Commercial Aerospace & Defense Consumer Electronics Healthcare Others Report 2: Firefighting Drone Market, Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts. Firefighting Drone Market size was valued at USD 1.19 Billion in 2022 and is expected to grow by 9.64% from 2023 to 2029, reaching nearly USD 2.27 Billion.Fire departments are leveraging the significant advantages offered by drones in various critical scenarios, particularly during structure fires and search and rescue missions. This Drone Mobility Market for Firefighting Drone report covered underscores the transformative impact of drones in these situations, detailing their functionalities and contributions. During structure fires, drones play a pivotal role in ensuring the safety of firefighters and optimizing response strategies. By deploying drones prior to sending in the personnel, the scene can be thoroughly assessed without exposing firefighters to immediate dangers. Equipped with thermal cameras, these drones identify hotspots and penetrate smoke and low light conditions, providing real-time data to operators. This data enables efficient monitoring of crew members and situational assessment, enhancing overall operational effectiveness and safety. Furthermore, drones can incorporate spotlights, supporting firefighters in dark or challenging lighting environments.

Estimates of Total Addressable Market (TAM) for Firefighting Drones (2022) Region Fire Engines Drone to Fire Engine Ratio TAM for Drones (USD Million) North America 1,700,000 2:40 17,000 Europe 1,200,000 2:40 12,000 Asia Pacific 2,000,000 2:40 20,000 Middle East & Africa 500,000 2:40 5,000 South America 300,000 2:40 3,000 Global 5,700,000 2:40 57,000 Segments Covered:

• by Type Fixed Wing Multi-rotor • by Propulsion Electric Motor Piston Engine Solar Powered Others • by Size Micro Drones Macro Drones • by Application Scene Monitoring Search and Rescue Post Fire or Disaster Assessment Firefighting Report 3: Military Drone Technology Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts. The Military Drone Technology Market size was valued at USD 12.89 billion in 2022 and has experienced substantial growth since then. It is expected to witness remarkable growth, reaching USD 26.93 billion by 2029, with an expected Compound Annual Growth Rate (CAGR) of 11.1% during the forecast period from 2022 to 2029. Since their inception during World War I, the trajectory of military drone technology has been marked by rapid advancement, transforming into an indispensable facet of contemporary warfare. This overview delves into the evolution of military drones, particularly Small Unmanned Aircraft Systems (SUAS), and their profound influence on combat and military operations.From their nascent beginnings, pilotless vehicles have evolved into sleek, agile unmanned aircraft, with SUAS emerging as a pivotal player in the military domain. These compact yet versatile platforms offer an array of capabilities, redefining the landscape of modern warfare. Their integration has sparked heightened global competition, prompting nations to channel substantial resources into bolstering their security and defense infrastructure, thereby augmenting the effectiveness of armed forces.Advancements in artificial intelligence (AI) and visual algorithms have catapulted tactical drones, such as those offered by Mistral, to the forefront of military technology. These drones, equipped with cutting-edge features, exhibit intelligent mapping capabilities for predefined geographical areas. Operating seamlessly under challenging conditions like low light and adverse weather, these drones excel in detecting and categorizing objects of interest. Their utility spans cross-border surveillance, conflict situational awareness, and intelligence gathering on border activities.

Segments Covered

• by Drone Type Fixed-Wing Drones Rotary-Wing Drones Hybrid Drones • by Payload Capacity ISR Drones Strike Drones Cargo Drones • by Range and Endurance Short-Range Drones Medium-Range Drones Long-Range Drones • by Technology and Autonomy Remote-Controlled Drones Autonomous Drones • by Application Surveillance and Reconnaissance Combat Operations Border and Maritime Security Report 4: Multirotor Drones Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts.A Multirotor Drones Market size was valued at US$ 3.82 Bn. in 2022 and the total revenue is expected to grow at 21.8 % through 2023 to 2029, reaching nearly US$ 15.23 Bn. The prevalence of multi-rotor drones as the favoured choice for aerial perspectives is a significant driver in the drone market. This drone type is particularly popular for aerial photography, filmmaking, and surveillance applications. It finds favour among both professionals and enthusiasts due to its compact size and immediate readiness for flight. The inherent ease of manufacturing multi-rotor drones positions them as the most cost-effective option in the market. These drones, equipped with multiple rotors on their frame, can be further categorized based on the rotor count on the platform – including tricopters (3 rotors), quadcopters (4 rotors), hexacopters (6 rotors), octocopters (8 rotors), and others. Leading the pack, quadcopters dominate as the most sought-after multi-rotor variant. In terms of cost, a basic drone capable of conducting effective mapping missions generally costs $1500 to $4500 AUD. The ability of multirotor drones to perform vertical take-offs and landings, akin to helicopters, is a significant market advantage. This characteristic enables these drones to operate with minimal space requirements – a small, unobstructed, level area is all that's necessary for launching. This attribute proves particularly advantageous in areas abundant with trees, foliage, or when launching from water surfaces, where the only available platform is a boat. As a market driver, the versatility and accessibility of multi-rotor drones cater to diverse operational needs, contributing to their pervasive market presence.

Segments Covered

• by Product Tricopters Quadcopters Hexacopters Octocopters • by Payload Camera Wireless HD Transmission Video System Electro-optical Sensors Wi-Fi GPS Laser Designators CBRN Sensors Others • by Application Aerial Shooting Law Enforcement Surveillance & Reconnaissance Geographical Inspection Commercial Inspection Others • by End-User Defense Sector Government Commercial Sector Report 5: Solar Powered Drones Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts. Solar Powered Drones Market size is expected to reach nearly US$ 2.91 Bn. by 2029 with a CAGR of 13% during the forecast period. The progress of autonomous technology is changing many industries and companies are now incorporating self-operating systems powered by renewable energy into their production methods. People are using solar-powered drones for remote work to enhance worker safety and protect the environment. This trend is pushing the adoption of solar-powered drones. The green movement has played a role in shaping the development of drones powered by solar energy. The use of solar-powered drones is gaining popularity for tasks like surveillance and mapping. These drones have distinct advantages over traditional ones, which makes them especially useful for these tasks. One significant advantage is that solar-powered drones are more robust than their traditional counterparts. They can handle tough weather conditions like strong winds, heavy rain, and extreme temperatures better, making them more dependable for surveillance and mapping. Additionally, solar-powered drones can fly for longer periods compared to traditional drones. Their use of solar energy provides them with almost limitless flight time, which is perfect for extended surveillance and mapping missions. As the need for renewable energy grows, solar-powered drones are becoming a popular choice due to cost savings and environmental benefits. Unlike regular aeroplanes, solar-powered drones rely on sunlight for power, allowing them to stay in the air for a long time without needing a limited supply of fuel. This unique feature makes them suitable for various tasks while aligning with the increasing focus on sustainability.Segments covered

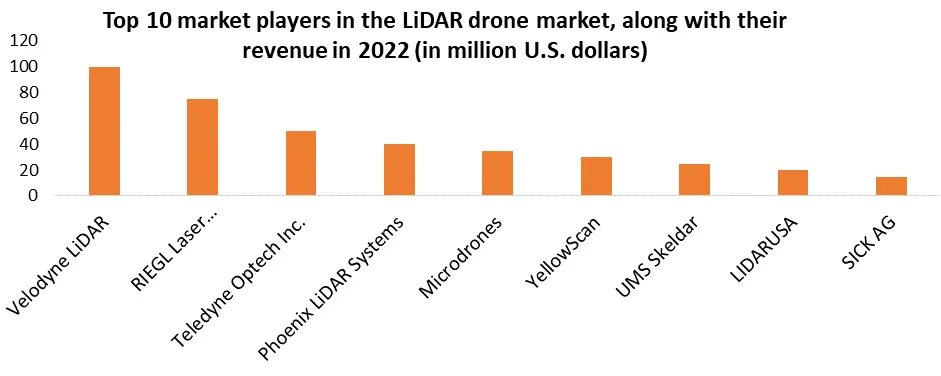

• by Type Fixed Wing Drones Multi-Rotor Drones Others • by Application Agriculture Energy Government and Defense Telecommunication Others Report 6: LiDAR Drone Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts. LiDAR Drone Market was valued at US$ 194.8 Mn. in 2022. The Global LiDAR Drone Market size is estimated to grow at a CAGR of 22.05%. The conjunction of unmanned aerial vehicles' advancements and the progression of LiDAR sensors is driving the emergence of diverse application areas where LiDAR-equipped flying devices can deliver significant value. Contemporary drones possess the potential to transform various industrial sectors, spanning from simplifying land surveying to optimizing goods transportation. When paired with the latest LiDAR technology, which is progressively compact, lightweight, and resilient – making it highly compatible for integration into drones – a compelling array of new applications unfolds. LiDAR-equipped drones have the capability to generate intricate models of historical sites, profoundly assisting in their preservation and scholarly examination. By acquiring non-intrusive, high-detail data, archaeologists can meticulously analyze and interpret ancient structures, landscapes, and artifacts, all while safeguarding these invaluable resources for the generations to come. This amalgamation of technology is propelling the market forward, opening doors to innovative possibilities across various sectors.

Segments Covered

• by Component LiDAR Lasers Navigation and Positioning Systems UAV Cameras Others • by Load Capacity Rotary-wing LiDAR Drones Fixed-wing LiDAR Drones • by Range Short Medium Long • by Application Corridor Mapping Archaeology Construction Environment Entertainment Precision Agriculture OthersDrone Mobility Market Scope: Inquire before buying

Drone Mobility Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argetina and Rest of South America)

1. Future of Mobility: Research Methodology 2. Future of Mobility: Executive Summary 3. Future of Mobility: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Future of Mobility: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. FPV Drone Market: Segmentation (by Value USD and Volume Units) 5.1. FPV Drone Market, by Component Type (2022-2029) 5.1.1. FPV Goggles 5.1.2. FPV Remote Controllers 5.1.3. Cameras 5.1.4. Battery 5.1.5. Flight Controller 5.1.6. Airframe 5.1.7. Motor 5.1.8. Processors 5.1.9. Others 5.2. FPV Drone Market, by Application (2022-2029) 5.2.1. Rotor Cross 5.2.2. Drag Racing 5.2.3. Time Trail 5.2.4. Others 5.3. FPV Drone Market, by End Use Industry (2022-2029) 5.3.1. Commercial 5.3.2. Aerospace & Defense 5.3.3. Consumer Electronics 5.3.4. Healthcare 5.3.5. Other 5.4. FPV Drone Market, by Region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 5.5. FPV Drone Market, by Region (2022-2029) 5.5.1. North America 5.5.1.1. United States 5.5.1.2. Canada 5.5.1.3. Mexico 5.5.2. Europe 5.5.2.1. UK 5.5.2.2. France 5.5.2.3. Germany 5.5.2.4. Italy 5.5.2.5. Spain 5.5.2.6. Sweden 5.5.2.7. Austria 5.5.2.8. Rest of Europe 5.5.3. Asia Pacific 5.5.3.1. China 5.5.3.2. S Korea 5.5.3.3. Japan 5.5.3.4. India 5.5.3.5. Australia 5.5.3.6. Indonesia 5.5.3.7. Malaysia 5.5.3.8. Vietnam 5.5.3.9. Taiwan 5.5.3.10. Bangladesh 5.5.3.11. Pakistan 5.5.3.12. Rest of Asia Pacific 5.5.4. Middle East and Africa 5.5.4.1. South Africa 5.5.4.2. GCC 5.5.4.3. Egypt 5.5.4.4. Nigeria 5.5.4.5. Rest of ME&A 5.5.5. South America 5.5.5.1. Brazil 5.5.5.2. Argentina 5.5.5.3. Rest of South America 6. Firefighting Drone Market: Segmentation (by Value USD and Volume Units) 6.1. Firefighting Drone Market, by Component Type (2022-2029) 6.1.1. Fixed Wing 6.1.2. Multi-rotor 6.1.3. by Propulsion 6.1.4. Electric Motor 6.1.5. Piston Engine 6.1.6. Solar Powered 6.1.7. Others 6.2. Firefighting Drone Market, by Size (2022-2029) 6.2.1. Micro Drones 6.2.2. Macro Drones 6.3. Firefighting Drone Market, by Application (2022-2029) 6.3.1. Scene Monitoring 6.3.2. Search and Rescue 6.3.3. Post Fire or Disaster Assessment 6.3.4. Firefighting 6.4. Firefighting Drone Market, by Region (2022-2029) 6.4.1. North America 6.4.2. Europe 6.4.3. Asia Pacific 6.4.4. Middle East and Africa 6.4.5. South America 6.5. 5.4. Firefighting Drone Market, by Region (2022-2029) 6.5.1. North America 6.5.1.1. United States 6.5.1.2. Canada 6.5.1.3. Mexico 6.5.2. Europe 6.5.2.1. UK 6.5.2.2. France 6.5.2.3. Germany 6.5.2.4. Italy 6.5.2.5. Spain 6.5.2.6. Sweden 6.5.2.7. Austria 6.5.2.8. Rest of Europe 6.5.3. Asia Pacific 6.5.3.1. China 6.5.3.2. S Korea 6.5.3.3. Japan 6.5.3.4. India 6.5.3.5. Australia 6.5.3.6. Indonesia 6.5.3.7. Malaysia 6.5.3.8. Vietnam 6.5.3.9. Taiwan 6.5.3.10. Bangladesh 6.5.3.11. Pakistan 6.5.3.12. Rest of Asia Pacific 6.5.4. Middle East and Africa 6.5.4.1. South Africa 6.5.4.2. GCC 6.5.4.3. Egypt 6.5.4.4. Nigeria 6.5.4.5. Rest of ME&A 6.5.5. South America 6.5.5.1. Brazil 6.5.5.2. Argentina 6.5.5.3. Rest of South America 7. Military Drone Market: Segmentation (by Value USD and Volume Units) 7.1. Military Drone Technology Market, by Drone Type (2022-2029) 7.1.1. Fixed-Wing Drones 7.1.2. Rotary-Wing Drones 7.1.3. Hybrid Drones 7.2. Military Drone Technology Market, by Payload Capacity (2022-2029) 7.2.1. ISR Drones 7.2.2. Strike Drones 7.2.3. Cargo Drones 7.3. Military Drone Technology Market, by Range and Endurance (2022-2029) 7.3.1. Short-Range Drones 7.3.2. Medium-Range Drones 7.3.3. Long-Range Drones 7.4. Military Drone Technology Market, by Technology and Autonomy (2022-2029) 7.4.1. Remote-Controlled Drones 7.4.2. Autonomous Drones 7.5. Military Drone Technology Market, by Application (2022-2029) 7.5.1. Surveillance and Reconnaissance 7.5.2. Combat Operations 7.5.3. Border and Maritime Security 7.5.4. Disaster Relief and Humanitarian Missions 7.6. Military Drone Technology Market, by Region (2022-2029) 7.6.1. North America 7.6.2. Europe 7.6.3. Asia Pacific 7.6.4. Middle East and Africa 7.6.5. South America 7.7. Military Drone Technology Market, by Region (2022-2029) 7.7.1. North America 7.7.1.1. United States 7.7.1.2. Canada 7.7.1.3. Mexico 7.7.2. Europe 7.7.2.1. UK 7.7.2.2. France 7.7.2.3. Germany 7.7.2.4. Italy 7.7.2.5. Spain 7.7.2.6. Sweden 7.7.2.7. Austria 7.7.2.8. Rest of Europe 7.7.3. Asia Pacific 7.7.3.1. China 7.7.3.2. S Korea 7.7.3.3. Japan 7.7.3.4. India 7.7.3.5. Australia 7.7.3.6. Indonesia 7.7.3.7. Malaysia 7.7.3.8. Vietnam 7.7.3.9. Taiwan 7.7.3.10. Bangladesh 7.7.3.11. Pakistan 7.7.3.12. Rest of Asia Pacific 7.7.4. Middle East and Africa 7.7.4.1. South Africa 7.7.4.2. GCC 7.7.4.3. Egypt 7.7.4.4. Nigeria 7.7.4.5. Rest of ME&A 7.7.5. South America 7.7.5.1. Brazil 7.7.5.2. Argentina 7.7.5.3. Rest of South America 8. Multirotor Drone Market: Segmentation (by Value USD and Volume Units) 8.1. Multirotor Drones Market, by Product (2022-2029) 8.1.1. Tricopters 8.1.2. Quadcopters 8.1.3. Hexacopters 8.1.4. Octocopters 8.2. Multirotor Drones Market, by Payload (2022-2029) 8.2.1. Camera 8.2.2. Wireless HD Transmission Video System 8.2.3. Electro-optical Sensors 8.2.4. Wi-Fi 8.2.5. GPS 8.2.6. Laser Designators 8.2.7. CBRN Sensors 8.2.8. Others 8.3. Multirotor Drones Market, by Application (2022-2029) 8.3.1. Aerial Shooting 8.3.2. Law Enforcement 8.3.3. Surveillance & Reconnaissance 8.3.4. Geographical Inspection 8.3.5. Commercial Inspection 8.3.6. Others 8.4. Multirotor Drones Market, by End-User (2022-2029) 8.4.1. Defense Sector 8.4.2. Government 8.4.3. Commercial Sector 8.5. Multirotor Drones Market, by Region (2022-2029) 8.5.1. North America 8.5.2. Europe 8.5.3. Asia Pacific 8.5.4. Middle East and Africa 8.5.5. South America 8.6. 5.4. Multirotor Drones Market, by Region (2022-2029) 8.6.1. North America 8.6.1.1. United States 8.6.1.2. Canada 8.6.1.3. Mexico 8.6.2. Europe 8.6.2.1. UK 8.6.2.2. France 8.6.2.3. Germany 8.6.2.4. Italy 8.6.2.5. Spain 8.6.2.6. Sweden 8.6.2.7. Austria 8.6.2.8. Rest of Europe 8.6.3. Asia Pacific 8.6.3.1. China 8.6.3.2. S Korea 8.6.3.3. Japan 8.6.3.4. India 8.6.3.5. Australia 8.6.3.6. Indonesia 8.6.3.7. Malaysia 8.6.3.8. Vietnam 8.6.3.9. Taiwan 8.6.3.10. Bangladesh 8.6.3.11. Pakistan 8.6.3.12. Rest of Asia Pacific 8.6.4. Middle East and Africa 8.6.4.1. South Africa 8.6.4.2. GCC 8.6.4.3. Egypt 8.6.4.4. Nigeria 8.6.4.5. Rest of ME&A 8.6.5. South America 8.6.5.1. Brazil 8.6.5.2. Argentina 8.6.5.3. Rest of South America 9. Solar-Powered Drone Market: Segmentation (by Value USD and Volume Units) 9.1. Solar-Powered Drones Market, by Type (2022-2029) 9.1.1. Fixed Wing Drones 9.1.2. Multi-Rotor Drones 9.1.3. Others 9.2. Solar-Powered Drones Market, by Application (2022-2029) 9.2.1. Agriculture 9.2.2. Energy 9.2.3. Government and Defense 9.2.4. Telecommunication 9.2.5. Others 9.3. Solar-Powered Drones Market, by Region (2022-2029) 9.3.1. North America 9.3.1.1. United States 9.3.1.2. Canada 9.3.1.3. Mexico 9.3.2. Europe 9.3.2.1. UK 9.3.2.2. France 9.3.2.3. Germany 9.3.2.4. Italy 9.3.2.5. Spain 9.3.2.6. Sweden 9.3.2.7. Austria 9.3.2.8. Rest of Europe 9.3.3. Asia Pacific 9.3.3.1. China 9.3.3.2. S Korea 9.3.3.3. Japan 9.3.3.4. India 9.3.3.5. Australia 9.3.3.6. Indonesia 9.3.3.7. Malaysia 9.3.3.8. Vietnam 9.3.3.9. Taiwan 9.3.3.10. Bangladesh 9.3.3.11. Pakistan 9.3.3.12. Rest of Asia Pacific 9.3.4. Middle East and Africa 9.3.4.1. South Africa 9.3.4.2. GCC 9.3.4.3. Egypt 9.3.4.4. Nigeria 9.3.4.5. Rest of ME&A 9.3.5. South America 9.3.5.1. Brazil 9.3.5.2. Argentina 9.3.5.3. Rest of South America 10. Solar-Powered Drone Market: Segmentation (by Value USD and Volume Units) 10.1. LIDAR Drone Market, by Component (2022-2029) 10.1.1. LIDAR Lasers 10.1.2. Navigation and Positioning Systems 10.1.3. UAV Cameras 10.1.4. Others 10.2. LIDAR Drone Market, by Load Capacity (2022-2029) 10.2.1. Rotary-wing LIDAR Drones 10.2.2. Fixed-wing LIDAR Drone 10.3. LIDAR Drone Market, by Range (2022-2029) 10.3.1. Short 10.3.2. Medium 10.3.3. Long 10.4. LIDAR Drone Market, by Application (2022-2029) 10.4.1. Corridor Mapping 10.4.2. Archaeology 10.4.3. Construction 10.4.4. Environment 10.4.5. Entertainment 10.4.6. Precision Agriculture 10.4.7. Others 10.5. LIDAR Drone Market, by Region (2022-2029) 10.5.1. North America 10.5.2. Europe 10.5.3. Asia Pacific 10.5.4. Middle East and Africa 10.5.5. South America 10.6. LIDAR Drone Market, by Region (2022-2029) 10.6.1. North America 10.6.1.1. United States 10.6.1.2. Canada 10.6.1.3. Mexico 10.6.2. Europe 10.6.2.1. UK 10.6.2.2. France 10.6.2.3. Germany 10.6.2.4. Italy 10.6.2.5. Spain 10.6.2.6. Sweden 10.6.2.7. Austria 10.6.2.8. Rest of Europe 10.6.3. Asia Pacific 10.6.3.1. China 10.6.3.2. S Korea 10.6.3.3. Japan 10.6.3.4. India 10.6.3.5. Australia 10.6.3.6. Indonesia 10.6.3.7. Malaysia 10.6.3.8. Vietnam 10.6.3.9. Taiwan 10.6.3.10. Bangladesh 10.6.3.11. Pakistan 10.6.3.12. Rest of Asia Pacific 10.6.4. Middle East and Africa 10.6.4.1. South Africa 10.6.4.2. GCC 10.6.4.3. Egypt 10.6.4.4. Nigeria 10.6.4.5. Rest of ME&A 10.6.5. South America 10.6.5.1. Brazil 10.6.5.2. Argentina 10.6.5.3. Rest of South America 11. Company Profile: Key players 11.1. FPV Drone Market, Key players 11.1.1. DJI (China) 11.1.1.1. Company Overview 11.1.1.2. Financial Overview 11.1.1.3. Business Portfolio 11.1.1.4. SWOT Analysis 11.1.1.5. Business Strategy 11.1.1.6. Recent Developments 11.1.2. Fat Shark (USA) 11.1.3. BetaFPV (China) 11.1.4. iFlight (China) 11.1.5. EMAX (China) 11.1.6. GEPRC (China) 11.1.7. TBS (Team BlackSheep) (Germany) 11.1.8. Holybro (China) 11.1.9. HGLRC (China) 11.1.10. Diatone (China) 11.1.11. Armattan Quads (USA) 11.1.12. Flywoo (China) 11.1.13. iFlight Green Hornet (China) 11.1.14. Iflight Nazgul (China) 11.1.15. Caddx (China) . 11.2. Firefighting Drone Market the New Era of Mobility, Key players 11.2.1. Lockheed Martin Corporation 11.2.1.1. Company Overview 11.2.1.2. Financial Overview 11.2.1.3. Business Portfolio 11.2.1.4. SWOT Analysis 11.2.1.5. Business Strategy 11.2.1.6. Recent Developments 11.2.2. Elistair 11.2.3. Harris Corporation 11.2.4. BSS Holland B.V 11.2.5. Aerones 11.2.6. Yuneec International Company Limited 11.2.7. Dronefly 11.2.8. DSLRPros 11.2.9. Draganfly Innovations Inc. 11.2.10. AeroVironment Inc. 11.3. Military Drone Technology Market, the New Paradigm in Transportation, Key players 11.3.1. General Atomics Aeronautical Systems, Inc. 11.3.1.1. Company Overview 11.3.1.2. Financial Overview 11.3.1.3. Business Portfolio 11.3.1.4. SWOT Analysis 11.3.1.5. Business Strategy 11.3.1.6. Recent Developments 11.3.2. Northrop Grumman Corporation 11.3.3. Boeing Defense, Space & Security 11.3.4. DJI Enterprise 11.3.5. Textron Inc. 11.3.6. Israel Aerospace Industries (IAI) 11.3.7. China Aerospace Science and Technology Corporation (CASC) 11.3.8. Kratos Defense & Security Solutions, Inc. 11.3.9. Airbus Defence and Space 11.3.10. Lockheed Martin Corporation 11.3.11. AeroVironment, Inc. 11.3.12. BAE Systems plc 11.3.13. Saab AB 11.3.14. Thales Group 11.3.15. Elbit Systems Ltd. 11.3.16. AeroVironment Inc. 11.3.17. Hindustan Aeronautics Ltd0020 11.4. Multirotor Drones Market, Key players 11.4.1. EchoBlue Ltd. 11.4.1.1. Company Overview 11.4.1.2. Financial Overview 11.4.1.3. Business Portfolio 11.4.1.4. SWOT Analysis 11.4.1.5. Business Strategy 11.4.1.6. Recent Developments 11.4.2. ideaForge 11.4.3. MULTIROTOR 11.4.4. SZ DJI Technology Co. Ltd. 11.4.5. Parrot SA 11.4.6. Yuneec International 11.4.7. Kespry Inc. 11.4.8. Autel Robotics 11.4.9. Skydio Inc. 11.4.10. Insitu Inc. 11.4.11. Delair 11.4.12. Guangzhou EHang Intelligent Technology Co., Ltd. 11.4.13. Aerialtronics 11.4.14. AeroVironment Inc. 11.4.15. Microdrones GmbH 11.4.16. 3D Robotics, Inc. 11.4.17. Hexagon AB 11.4.18. Dragonfly Innovations Inc. 11.4.19. CYBERHAWK Innovations Ltd. 11.4.20. Aeryon Labs 11.5. Solar Powered Drones Market, Key players 11.5.1. Airbus SE 11.5.1.1. Company Overview 11.5.1.2. Financial Overview 11.5.1.3. Business Portfolio 11.5.1.4. SWOT Analysis 11.5.1.5. Business Strategy 11.5.1.6. Recent Developments 11.5.2. Silent Falcon UAS Technologies 11.5.3. Sunbirds 11.5.4. Sunlight Photonics Inc. 11.5.5. Thales Group 11.5.6. Titan Aerospace 11.5.7. AeroVironmnet, Inc. 11.5.8. Atlantik Solar 11.5.9. Facebook (Ascenta) 11.5.10. Bye Engineering, 11.6. LiDAR Drone Market, Key players 11.6.1. Phoenix LiDAR Systems 11.6.1.1. Company Overview 11.6.1.2. Financial Overview 11.6.1.3. Business Portfolio 11.6.1.4. SWOT Analysis 11.6.1.5. Business Strategy 11.6.1.6. Recent Developments 11.6.2. RIEGL Laser Measurement Systems GmbH 11.6.3. Velodyne LiDAR, Inc 11.6.4. Teledyne Optech 11.6.5. UMS Skeldar 11.6.6. LiDARUSA 11.6.7. YellowScan 11.6.8. Geodetics, Inc 11.6.9. OnyxScan 11.6.10. Delair 11.6.11. MicroDrones 11.6.12. Livox 11.6.13. Sick AG 11.6.14. Routescene 11.6.15. NextCore 11.6.16. GreenValley International 11.6.17. Beijing SureStar Technology Co. Ltd 11.6.18. Benewake (Beijing) Co., Ltd 11.6.19. SABRE Advanced 3D Surveying Systems 11.6.20. Cepton Technologies, Inc 12. Key Findings 13. Industry Recommendation