Global Bulimia Nervosa Market size expected to hit USD 749.39 Mn by 2030 from USD 529.04 Mn in 2023 at a CAGR of 5.1% during the forecast periodBulimia Nervosa Market Overview

Bulimia Nervosa is a type of eating disorder characterized by eating a large amount of food in a short period of time. The bulimia nervosa again differentiated into two types: purging and non-purging based on the eating behavior. The lack of control over eating, the secrecy surrounding eating, eating unusually large amounts of food and the Disappearance of food are some of the symptoms of Bulimia Nervosa Disorder. The increased awareness and the advancements in the diagnostic are expected to propel the growth of the Bulimia Nervosa Market. The report includes all the necessary details, which are expected to help the businesses to grow.To know about the Research Methodology :- Request Free Sample Report

Bulimia Nervosa Market Dynamics

Market Drivers Behind the increase of bulimia nervosa eating disorder there are diverse reasons linked with each other and cause bulimia nervosa prevalence in the surrounding. The cultural shifts, westernization, technological advances and a trend of an ideal body shape and size across the world have created an eating disorder in both males and females. The report states that almost 70 million people suffer from various types of eating disorders. The above factors have increased the prevalence of bulimia nervosa, which is expected to propel the global Bulimia Nervosa Market Penetration in the major geographic regions. The Global Impact of Westernization of Culture Expected to Boost Bulimia Nervosa Market Most people travel to Europe and Western countries to study and to travel around the world and get influenced by Western culture and habits. This population is mostly from Asia Pacific, the region with an increased prevalence of eating disorders. Eating disorders like bulimia nervosa are not culture-bound or specific but more culture reactive. Influence of Media Expected to Market Penetration Globally It is observed that body positivity and eating disorder recovery accounts become more prominent in 2020 and 2021. The growing urge in mostly young populations to establish their online presence on social media and their continuous comparison with others is expected to lead toward increased body dissatisfaction and trigger body dysmorphia, which are powerful contributing factors to the development of eating disorders. These are the major factors, which are expected to drive the Bulimia Nervosa Market. In cases where self-image is impaired and individuals compare themselves to the “beautiful people” they see on Instagram, Facebook and Twitter, social media can be a strong triggering factor in the rise of bulimia nervosa and other eating disorders. The major Bulimia Nervosa Key Companies are also using social media to spread awareness regarding the rising incidences of eating disorders across the world. In the past several decades, the world has seen increasing industrialization and urbanization and research from 2011, by some medical journals and organizations showed that the influence of media has correlated with an increasing growth rate of the Bulimia Nervosa Industry due to feelings of negative body image and dissatisfaction in both males and females. The Bulimia Nervosa Market Penetration rate has different numbers and reasons in different cultures. The South African National Health and Nutrition Examination Survey states that females aged 10 to 14 years had a negative body image. Up to 68% and 17% of females in that age group believed they were fat, which is expected to drive the Bulimia Nervosa Market Share. Market Restraints The Bulimia Nervosa Market report data has been collected through primary and secondary research methods to analyze it with SWOT analysis and PORTER’s five force model. The analysis provides data regarding the factors driving the market growth, limiting the Bulimia Nervosa Market Size and new opportunities for major Bulimia Nervosa Key Companies in the top five geographic regions. The shortage of specific treatments and the availability of various therapies are expected to impede the growth of the Bulimia Nervosa Industry. Also, the people and the health personnel are not that aware of the eating disorder, which is expected to be another limiting factor for the industry.Bulimia Nervosa Market Regional Insights

North America is expected to grow significantly throughout the forecast period in Bulimia Nervosa Market. Bulimia Nervosa is one of the types of eating disorder. The report states that global Bulimia Nervosa has increased to 7.8 percent in the past two decades. In the United States, almost half of Americans know someone with bulimia nervosa which is an eating disorder. Bulimia nervosa is very common in America among young women, which is 3.8 percent more than men, which is 1.5 percent. These factors are expected to drive North America Bulimia Nervosa Market. The region’s growth is also supported by the growing investment and research and development in Bulimia Nervosa Industry by major Bulimia Nervosa Key Players. A new trend in the region has been observed the Bulimia nervosa disorder among teens is doubled during and after the COVID-19 pandemic. This trend is concerning the health department of the country since eating disorders are among the most deadly of all mental health diagnoses, and teens with eating disorders are at higher risk for suicide than the general population. These factors are expected to drive North America Bulimia Nervosa Market. Europe’s Bulimia Nervosa Market is expected to boost during the forecast period as per the report’s data almost 1.25 million people in the United Kingdom have an eating disorder, a collective of conditions characterized by atypical and harmful eating behaviors. According to the British eating disorder charity Beat, bulimia nervosa has the highest mortality rate of any psychiatric condition. Under the European Union regulations, many diet products are not referred to as drugs or food supplements but are considered medical devices. This allows sell of diet pills and shakes with very less marketing restrictions. These products include indigestible dietary fibers such as litramine and glucomannan, which swell up in the stomach and cause the user to feel fuller. This is expected to increase the eating disorders such as bulimia Nervosa among people and respectively drive the growth of the Bulimia Nervosa Market. Asia Pacific is expected to emerge as the best region with lucrative opportunities for major Bulimia Nervosa Key Players in the Bulimia Nervosa Industry. The MMR research provides data regarding bulimia nervosa in the Bulimia Nervosa Market Report, which said that Japan has the highest prevalence of eating disorders in Asia Pacific followed by Hong Kong, Singapore, Taiwan and South Korea. A recently published study reported that a total of 10,542 Taiwanese have bulimia nervosa and the prevalence of bulimia nervosa in Japan is 1.03 percent in the age group of 20-24. These factors have been increasing the Bulimia Nervosa Market Share in the Asia Pacific. In summary, each of the four Asian countries discussed has seen a dramatic increase in the number of individuals diagnosed with an eating disorder. Given the growing numbers, it is important that eating disorders research continues to expand beyond the United States and Western Europe where much of the research to date has been based. Thankfully, Taiwan, Japan, South Korea, and Singapore have resources available for providers, patients, and families within their counties that promote awareness and treatment of eating disorders.Bulimia Nervosa Market Competitive Landscape

Takeda Pharmaceutical Company Ltd, Sunovion Pharmaceuticals Inc., H. Lundbeck A/S, Orexigen Therapeutics, Inc. and Novo Nordisk A/S are some of the major Bulimia Nervosa Key Players. The report involves data regarding mergers and acquisitions, recent announcements and investments by major Bulimia Nervosa Key Companies. Recently, Takeda Pharmaceutical Co. Ltd. acquired PvP Biologics Inc. for a prenegotiated up-front payment as well as development and regulatory milestones of up to US$330 million. PvP Biologics is a San Diego-based company developing an oral enzyme for treating celiac disease and bulimia nervosa disorder. These acquisitions are expected to boost not only the medical field but the Bulimia Nervosa Market Growth. The report provides a detailed analysis of the industry through Bulimia Nervosa Competitive Benchmarking, which includes Bulimia Nervosa Market Size, Bulimia Nervosa Market Share and Bulimia Nervosa Market Revenue.

Bulimia Nervosa Market Segment Analysis

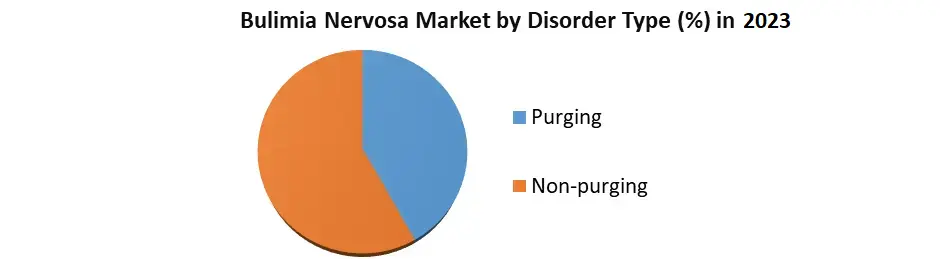

Based on Disorder Type, Non-purging is expected to have the highest prevalence in Bulimia Nervosa Market during the forecast period. People with non-purging bulimia have other behaviors or symptoms such as exercise or fasting to compensate for food consumed. These behaviors are considered excessive or extreme and can be disruptive to a person’s daily life. The trend of exercising and intermittent fasting is expected to change the eating patterns of people, which is expected to convert to Bulimia Nervosa Disorder. Both the two sub-types of bulimia nervosa have serious side effects and risks to health and possess serious long-lasting consequences. These are the factors that are expected to increase the share of the segment in the growing Bulimia Nervosa Industry. Both purging and non-purging behaviors can impact psychological, social and mental health. The thoughts and feelings are expected to hamper damage to a person’s self-health. Purging and non-purging behaviors are expected to increase the risk of chronic health conditions. Based on the End User, The hospitals and Clinics segment held the largest revenue share in the Bulimia Nervosa Market in 2023 and is expected to dominate the market throughout the forecast period. Hospitals are the bases of the healthcare system to provide diagnostics of any disorder and cure them before reaching the severe stage. In bulimia nervosa disorder, most people are not aware that they are having an eating disorder. An eating disorder has many reasons behind it such as mental instability, psychological problem and a developed habit of intermittent fasting, which later might become a non-purging Bulimia Nervosa Disorder. Thus, the proper guidance and diagnosis of it is much needed and hospitals and clinics help impressively in this. All these factors are expected to propel the growth of the Bulimia Nervosa Market. Some of the Bulimia Nervosa Key Players have their own hospitals and clinics.Bulimia Nervosa Market Scope: Inquire before buying

Bulimia Nervosa Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 529.04 Mn. Forecast Period 2024 to 2030 CAGR: 5.1% Market Size in 2030: US $ 749.39 Mn. Segments Covered: by Disorder Type 1.Purging 2.Non-purging by Drug Class 1.Antidepressant 2.Anticonvulsant 3.Others by Route of Administration 1.Oral 2.Intravenous 3.Others by End-User 1.Hospitals and Clinics 2.Homecare Settings 3.Specialty Centers 4.Others Bulimia Nervosa Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Bulimia Nervosa Key Players include:

1.Takeda Pharmaceutical Company Ltd 2. Sunovion Pharmaceuticals Inc. 3. H. Lundbeck A/S 4. Orexigen Therapeutics, Inc. 5.Novo Nordisk A/S 6. Eli Lilly and Company 7. Jazz Pharmaceuticals Inc. 8.VIVUS Inc. 9.Bausch & Lomb Incorporated 10.Apotex Inc. 11.Somerset Therapeutics, LLC 12. Mylan N.V. 13.Teva Pharmaceuticals Industries Ltd. 14.. Pfizer Inc. 15.Sun Pharmaceutical Industries Ltd. 16.Amneal Pharmaceutical LLC. 17. AbbVie Inc. 18. GlaxoSmithKline Plc 19. Dr. Reddy’s Laboratories Ltd. 20.Lupin Pharmaceuticals, Inc. 21.Aurobindo Pharma 22.AstraZeneca 23. Bristol-Myers Squibb Company 24.Johnson & Johnson Services, Inc. Frequently Asked Questions: 1] What is the growth rate of the Bulimia Nervosa Market? Ans. The Bulimia Nervosa Market is growing at a CAGR of 5.1% during the forecast period. 2] Which region is expected to dominate the Bulimia Nervosa Market? Ans. North America is expected to dominate the Bulimia Nervosa Market during the forecast period from 2024 to 2030 3] What is the expected Bulimia Nervosa Market size by 2030? Ans. The size of the Bulimia Nervosa Market by 2030 is expected to reach USD 749.39 Mn. 4] Who are the top players in the Bulimia Nervosa Market? Ans. The major key players in the Bulimia Nervosa Market are Takeda Pharmaceutical Company Ltd, Sunovion Pharmaceuticals Inc., H. Lundbeck A/S, Orexigen Therapeutics, Inc. and Novo Nordisk A/S. 5] Which factors contributed to the growth of the Bulimia Nervosa Market in 2023? Ans. The Bulimia Nervosa Market is expected to grow due to the rising prevalence of eating disorders across the world.

1. Bulimia Nervosa Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Bulimia Nervosa Market: Dynamics 2.1. Bulimia Nervosa Market Trends by Region 2.1.1. North America Bulimia Nervosa Market Trends 2.1.2. Europe Bulimia Nervosa Market Trends 2.1.3. Asia Pacific Bulimia Nervosa Market Trends 2.1.4. Middle East and Africa Bulimia Nervosa Market Trends 2.1.5. South America Bulimia Nervosa Market Trends 2.2. Bulimia Nervosa Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Bulimia Nervosa Market Drivers 2.2.1.2. North America Bulimia Nervosa Market Restraints 2.2.1.3. North America Bulimia Nervosa Market Opportunities 2.2.1.4. North America Bulimia Nervosa Market Challenges 2.2.2. Europe 2.2.2.1. Europe Bulimia Nervosa Market Drivers 2.2.2.2. Europe Bulimia Nervosa Market Restraints 2.2.2.3. Europe Bulimia Nervosa Market Opportunities 2.2.2.4. Europe Bulimia Nervosa Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Bulimia Nervosa Market Drivers 2.2.3.2. Asia Pacific Bulimia Nervosa Market Restraints 2.2.3.3. Asia Pacific Bulimia Nervosa Market Opportunities 2.2.3.4. Asia Pacific Bulimia Nervosa Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Bulimia Nervosa Market Drivers 2.2.4.2. Middle East and Africa Bulimia Nervosa Market Restraints 2.2.4.3. Middle East and Africa Bulimia Nervosa Market Opportunities 2.2.4.4. Middle East and Africa Bulimia Nervosa Market Challenges 2.2.5. South America 2.2.5.1. South America Bulimia Nervosa Market Drivers 2.2.5.2. South America Bulimia Nervosa Market Restraints 2.2.5.3. South America Bulimia Nervosa Market Opportunities 2.2.5.4. South America Bulimia Nervosa Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Bulimia Nervosa Industry 2.8. Analysis of Government Schemes and Initiatives For Bulimia Nervosa Industry 2.9. Bulimia Nervosa Market Trade Analysis 2.10. The Global Pandemic Impact on Bulimia Nervosa Market 3. Bulimia Nervosa Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 3.1.1. Purging 3.1.2. Non-purging 3.2. Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 3.2.1. Antidepressant 3.2.2. Anticonvulsant 3.2.3. Others 3.3. Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 3.3.1. Oral 3.3.2. Intravenous 3.3.3. Others 3.4. Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 3.4.1. Hospitals and Clinics 3.4.2. Homecare Settings 3.4.3. Specialty Centers 3.4.4. Others 3.5. Bulimia Nervosa Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Bulimia Nervosa Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 4.1.1. Purging 4.1.2. Non-purging 4.2. North America Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 4.2.1. Antidepressant 4.2.2. Anticonvulsant 4.2.3. Others 4.3. North America Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 4.3.1. Oral 4.3.2. Intravenous 4.3.3. Others 4.4. North America Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 4.4.1. Hospitals and Clinics 4.4.2. Homecare Settings 4.4.3. Specialty Centers 4.4.4. Others 4.7. North America Bulimia Nervosa Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 4.5.1.1.1. Purging 4.5.1.1.2. Non-purging 4.5.1.2. United States Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 4.5.1.2.1. Antidepressant 4.5.1.2.2. Anticonvulsant 4.5.1.2.3. Others 4.5.1.3. United States Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 4.5.1.3.1. Oral 4.5.1.3.2. Intravenous 4.5.1.3.3. Others 4.5.1.4. United States Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 4.5.1.4.1. Hospitals and Clinics 4.5.1.4.2. Homecare Settings 4.5.1.4.3. Specialty Centers 4.5.1.4.4. Others 4.5.2. Canada 4.5.2.1. Canada Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 4.5.2.1.1. Purging 4.5.2.1.2. Non-purging 4.5.2.2. Canada Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 4.5.2.2.1. Antidepressant 4.5.2.2.2. Anticonvulsant 4.5.2.2.3. Others 4.5.2.3. Canada Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 4.5.2.3.1. Oral 4.5.2.3.2. Intravenous 4.5.2.3.3. Others 4.5.2.4. Canada Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 4.5.2.4.1. Hospitals and Clinics 4.5.2.4.2. Homecare Settings 4.5.2.4.3. Specialty Centers 4.5.2.4.4. Others 4.5.3. Mexico 4.5.3.1. Mexico Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 4.5.3.1.1. Purging 4.5.3.1.2. Non-purging 4.5.3.2. Mexico Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 4.5.3.2.1. Antidepressant 4.5.3.2.2. Anticonvulsant 4.5.3.2.3. Others 4.5.3.3. Mexico Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 4.5.3.3.1. Oral 4.5.3.3.2. Intravenous 4.5.3.3.3. Others 4.5.3.4. Mexico Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 4.5.3.4.1. Hospitals and Clinics 4.5.3.4.2. Homecare Settings 4.5.3.4.3. Specialty Centers 4.5.3.4.4. Others 5. Europe Bulimia Nervosa Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 5.2. Europe Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 5.3. Europe Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 5.4. Europe Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 5.5. Europe Bulimia Nervosa Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 5.5.1.2. United Kingdom Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 5.5.1.3. United Kingdom Bulimia Nervosa Market Size and Forecast, by Route of Administration(2023-2030) 5.5.1.4. United Kingdom Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 5.5.2. France 5.5.2.1. France Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 5.5.2.2. France Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 5.5.2.3. France Bulimia Nervosa Market Size and Forecast, by Route of Administration(2023-2030) 5.5.2.4. France Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 5.5.3.2. Germany Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 5.5.3.3. Germany Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 5.5.3.4. Germany Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 5.5.4.2. Italy Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 5.5.4.3. Italy Bulimia Nervosa Market Size and Forecast, by Route of Administration(2023-2030) 5.5.4.4. Italy Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 5.5.5.2. Spain Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 5.5.5.3. Spain Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 5.5.5.4. Spain Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 5.5.6.2. Sweden Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 5.5.6.3. Sweden Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 5.5.6.4. Sweden Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 5.5.7.2. Austria Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 5.5.7.3. Austria Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 5.5.7.4. Austria Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 5.5.8.2. Rest of Europe Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 5.5.8.3. Rest of Europe Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 5.5.8.4. Rest of Europe Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 6. Asia Pacific Bulimia Nervosa Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 6.2. Asia Pacific Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 6.3. Asia Pacific Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 6.4. Asia Pacific Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 6.5. Asia Pacific Bulimia Nervosa Market Size and Forecast, by Country (2023-2030) 6.7.1. China 6.5.1.1. China Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 6.5.1.2. China Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 6.5.1.3. China Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 6.5.1.4. China Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 6.5.2.2. S Korea Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 6.5.2.3. S Korea Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 6.5.2.4. S Korea Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 6.5.3.2. Japan Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 6.5.3.3. Japan Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 6.5.3.4. Japan Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 6.5.4. India 6.5.4.1. India Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 6.5.4.2. India Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 6.5.4.3. India Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 6.5.4.4. India Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 6.5.5.2. Australia Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 6.5.5.3. Australia Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 6.5.5.4. Australia Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 6.5.6.2. Indonesia Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 6.5.6.3. Indonesia Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 6.5.6.4. Indonesia Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 6.5.7.2. Malaysia Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 6.5.7.3. Malaysia Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 6.5.7.4. Malaysia Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 6.5.8.2. Vietnam Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 6.5.8.3. Vietnam Bulimia Nervosa Market Size and Forecast, by Route of Administration(2023-2030) 6.5.8.4. Vietnam Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 6.5.9.2. Taiwan Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 6.5.9.3. Taiwan Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 6.5.9.4. Taiwan Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 6.5.10.3. Rest of Asia Pacific Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 6.5.10.4. Rest of Asia Pacific Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 7. Middle East and Africa Bulimia Nervosa Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 7.2. Middle East and Africa Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 7.3. Middle East and Africa Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 7.4. Middle East and Africa Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 7.5. Middle East and Africa Bulimia Nervosa Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 7.5.1.2. South Africa Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 7.5.1.3. South Africa Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 7.5.1.4. South Africa Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 7.5.2.2. GCC Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 7.5.2.3. GCC Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 7.5.2.4. GCC Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 7.5.3.2. Nigeria Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 7.5.3.3. Nigeria Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 7.5.3.4. Nigeria Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 7.5.4.2. Rest of ME&A Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 7.5.4.3. Rest of ME&A Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 7.5.4.4. Rest of ME&A Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 8. South America Bulimia Nervosa Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 8.2. South America Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 8.3. South America Bulimia Nervosa Market Size and Forecast, by Route of Administration(2023-2030) 8.4. South America Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 8.5. South America Bulimia Nervosa Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 8.5.1.2. Brazil Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 8.5.1.3. Brazil Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 8.5.1.4. Brazil Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 8.5.2.2. Argentina Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 8.5.2.3. Argentina Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 8.5.2.4. Argentina Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Bulimia Nervosa Market Size and Forecast, by Disorder Type (2023-2030) 8.5.3.2. Rest Of South America Bulimia Nervosa Market Size and Forecast, by Drug Class (2023-2030) 8.5.3.3. Rest Of South America Bulimia Nervosa Market Size and Forecast, by Route of Administration (2023-2030) 8.5.3.4. Rest Of South America Bulimia Nervosa Market Size and Forecast, by End-User (2023-2030) 9. Global Bulimia Nervosa Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Bulimia Nervosa Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Takeda Pharmaceutical Company Ltd 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Sunovion Pharmaceuticals Inc. 10.3. H. Lundbeck A/S 10.4. Orexigen Therapeutics, Inc. 10.5. Novo Nordisk A/S 10.6. Eli Lilly and Company 10.7. Jazz Pharmaceuticals Inc. 10.8. VIVUS Inc. 10.9. Bausch & Lomb Incorporated 10.10. Apotex Inc. 10.11. Somerset Therapeutics, LLC 10.12. Mylan N.V. 10.13. Teva Pharmaceuticals Industries Ltd. 10.14. Pfizer Inc. 10.15. Sun Pharmaceutical Industries Ltd. 10.16. Amneal Pharmaceutical LLC. 10.17. AbbVie Inc. 10.18. GlaxoSmithKline Plc 10.19. Dr. Reddy’s Laboratories Ltd. 10.20. Lupin Pharmaceuticals, Inc. 10.21. Aurobindo Pharma 10.22. AstraZeneca 10.23. Bristol-Myers Squibb Company 10.24. Johnson & Johnson Services, Inc. 11. Key Findings 12. Industry Recommendations 13. Bulimia Nervosa Market: Research Methodology 14. Terms and Glossary