Warehouse Automation System Market was valued at US$ 3.65 Bn. in 2023 and the total revenue is expected to grow at 16.5% of CAGR through 2024 to 2030, reaching nearly US$ 10.65 Bn.Warehouse Automation System Market Overview:

Automation technology in warehousing consists of the development of robotized storage, internal transport, and control systems capable of moving goods in a facility without the need for human interaction. These automated solutions are coordinated through the use of an advanced software program, such as a warehouse management system (WMS). Building smart warehouses that use digital and automated solutions to increase efficiency in logistics processes including commodities reception, product slotting, and order picking, among others, is made feasible by warehouse automation, which drives the warehouse automation system market. At the end of 2020, there were approximately 25 billion square feet of space and 150,000 warehouses globally (about twice the size of the entire city of San Antonio, TX). While there are disproportionately many warehouses in North America and Europe compared to their population, the majority of the existing warehouse footprint and future growth will be outside of these regions due to the growing middle class and increased demand for retail items in an emerging country. Nearly 180,000 will exist worldwide by the end of 2025. By that time, more than half of the world's warehouse building stock will be owned by the top five countries, the United States, Japan, India, and Germany, which drive the demand for the warehouse automation system market globally. The primary goal of the Global Warehouse Management System Market report is to provide industry investors, investment bankers, investment companies, and other stakeholders with in-depth information that will allow them to make well-informed strategic decisions about dynamics and opportunities in the Warehouse Management System market around the world.To know about the Research Methodology :- Request Free Sample Report

Competitive Landscape

Robotics and automation are becoming increasingly popular in the supply chain. Automation and Wearhouse retailers and distributors are rapidly adopting these technologies, and with further investment, the technology will continue to develop, giving even higher returns on top of labor savings and increased inventory accuracy. Leading automation organizations are currently obtaining substantial investments and market attention by acquiring growing companies, while start-up companies are either receiving investments quickly or being bought by larger players in the game.Amazon acquired KIVA Systems, KION Group acquired Dematic, Toyota acquired Bastian, Honeywell acquired Intelligrated, and Shopify acquired 6 River Systems. These are some of the largest players in the automation industry acquiring the top suppliers. ASRS (Automated Storage and Retrieval System) and AGV/AMR (Automated Guided Vehicle/Autonomous Mobile Robot) are the priority features of investment in the automation landscape. Both methods might have a significant influence on picking operations in order to stay up with the expanding e-commerce fulfillment. The warehouse automation landscape is wide, and there are many reliable solutions with experienced suppliers. However, the market is growing and start-ups are rapidly emerging and bringing new technologies, so it is important to collaborate with an industry expert. The report is not only a representation of global players but also covers the market holding of local players in each country. Market structure by country with market holding by market leaders, market followers, and local players make this report a comprehensive and insightful industry outlook. The report has covered the mergers and acquisitions, strategic alliances, joint ventures, and partnerships happening in the market by region, by investment, and their strategic intent.

Warehouse Automation System Market Dynamics:

Demand for e-commerce in warehouse to creates new opportunities Market growth is expected to be fueled by the development of electronic commerce and the resulting increase in online consumers, especially in developing countries. Online retailers can outsource services like bundling, warehousing, shipping, and other value-added services like return management and urgent package service through fulfillment service centers. A fulfillment center is the best option for retailers that have the capacity to manage inventory in-house and do not want to invest additional time in shipping. The online marketers may also operate e-commerce fulfillment services internally. Due to the various advantages given in terms of convenience, affordability, selection, and lead time, many customers prefer purchasing things online as opposed to doing so in physical stores. To deliver items from production facilities/retailers to end-users in a shorter lead time, e-commerce enterprises depend heavily on storage and shipping capabilities. Traditional warehousing required a lot of work, but in recent years, companies have started automating tasks in the lanes of modern warehouses to eliminate the need for human interaction, increase order fulfillment productivity, and shorten delivery times. For example, Amazon.com, Inc. makes use of robots in its fulfillment facilities to help employees with tasks and speed up deliveries with the help of a warehouse automation system. The location of a fulfillment center is essential to the success of e-commerce companies since the bulk of online transactions are made in urban areas and because customers are requesting faster product delivery. Players may deliver goods faster and gain customers' trust by having fulfillment facilities close to big cities that don't just store things but also handle other fulfillment tasks like sorting, packing, labeling, and shipping, which drive the demand for e-commerce in the warehouse automation system market. Investment in waremanagement systems by SMEs to drive the demand during the forecast period A warehouse management system is a complex, multifaceted software program that helps organizations in organizing and manage warehouse operations. Most warehouse management systems are built to grow up to meet the requirements of larger, more established companies. They can also be useful for a lot of small enterprises, however. these technologies can particularly help in the optimization of warehouse operations including receiving, picking, and shipping. Additionally, real-time tracking features are provided by warehouse management systems to assist smaller companies in maintaining control over their inventory levels and increasing productivity. In general, warehouse management systems are necessary for every company wishing to maximize warehouse operations and increase profitability, which creates a new opportunity for small market players to increase productivity with the help of the warehouse automation system market. For small companies, in particular, investing in a warehouse management system may be quite profitable. Small company owners may concentrate their time and attention on the company's growth instead of becoming bogged down by paperwork and logistical responsibilities by automating warehouse procedures and optimizing warehouse operations. A WMS may help the company to enhance general business procedures in addition to streamlining company warehouse operations with functions like computerized inventory management and real-time order changes. A warehouse management system (WMS) helps smaller companies to deliver more responsive customer service and save labor and transportation expenses by tracking warehouse operations like shipping and receiving in one centralized system. Cybersecurity and risk goods during storage The most prevalent risk is the loss of goods and assets as a result of criminal activity. Although high-value things such as electronics, phones, and cosmetics will always be targeted, the item's mobility and ease of robbery and hiding will be the key determinant, which hampers the warehouse automation system market. The location of a site, what it contains, and the security mechanisms in place will all influence whether it is attacked. Organizations must defend their locations and structures from external threats by employing a combination of detection and prevention methods. CCTV cameras, alarms, and control systems, particularly at points of entrance and egress, can be included, as well as a staff/visitor management system to guarantee that only those who are authorized are permitted to various locations of the site. The risks of cyber-attacks have never been higher, with many organizations depending largely on automated procedures and vast volumes of data being transmitted between individuals in the supply chain. Hackers frequently locate an entry point into the chain by assaulting the less secure pieces, allowing them access to other organizations’ systems and data, which create serious concern towered Warehouse automation systems market players.Warehouse Automation System Market Segment Analysis:

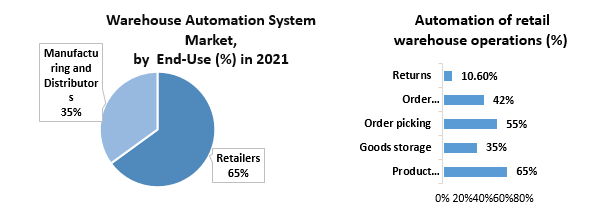

Based on Type, the Warehouse Automation System Market is segmented into hardware and software. Hardwear is expected to dominate the market during the forecast period. Significant technological developments have allowed the robotics industry to explore the untapped potential in various warehousing End-Uses while achieving an ideal operational flow and logistics efficiency, among other achievements, across the different industry verticals. Examples of these developments include sensor technologies that enable enhanced object perception and an accurate positioning system. By 2025, robotic technology will be used to complete 45% of all manufacturing operations, forecasts from Bank of America. This new trend has led to the replacement of 10,000 and 60,000 people, respectively, by automated equipment at the factories of significant companies like Foxconn Technology, a Chinese supplier for major technology manufacturers like Samsung, and Raymond Limited, a well-known Indian textile company.The growing usage of warehouse robots has been directly affected by these reasons. The market for warehouse automation system market in robots has been growing due to factors such as the development of warehouses, increased investments in warehouse automation, an increase in labor expenses globally, and the accessibility of scalable technology solutions. In spite of the unfavorable commercial rental environment, well-known logistics companies including DHL, XPO Logistics, and NFI Logistics are investing in future growth. The management of the COVID-19 pandemic was greatly helped by automation and robotics. The circumstance may also open up new future opportunities. The British online grocer Ocado wants to charge other supermarkets a license fee to use its robotic warehousing systems and home delivery technologies for goods. Since May 2020, many warehouse locations have recovered after resuming normal operations. However, the changes in the first four months of 2020 may create order delays and lead times throughout the whole warehouse robotics supply chain. Based on the End-Use, the Warehouse Automation System Market is segmented into Retailers, Manufacturing, and Distributors. Retailers are expected to dominate the warehouse automation market during the forecast period. Retail companies that sell goods and services to end users include clothes, appliance, and technology stores, as well as supermarkets, department stores, pharmacies, and eCommerce and other. In general, retail warehouses manage a large number of SKUs, which can be stored on pallets or in boxes. As a result, all processes must be improved to eliminate mistakes and ensure the availability of items to clients, which increased the demand for the warehouse automation system market. A number of retail warehouses have been created, which increased the productivity of logistic operations. For example, Spartoo, a major European company in online sales of footwear, handbags, and clothes, needed to streamline its logistics processes to grow its product catalog and raise order quantities in order to drive its global expansion. In France, the Mecalux Group established a warehouse for Spartoo, which has been developed year after year to meet rising demand. The building is outfitted with box conveyors that connect the various parts of this vast logistics hub. Another example of retail warehouse automation is the case of BH Bikes, a bike company known for its product quality and ongoing innovation. The company has a completely automated logistics facility in Vitoria, Spain, where the Mecalux Group implemented two automated storage and retrieval systems: an AS/RS for pallets and an AS/RS for boxes. Both methods make it easier to store items of various sizes and turnover, as well

Warehouse Automation System Market Regional Insights:

North America dominated the market with a 43 % share in 2023. North America is expected to witness significant growth during the forecast period. The warehouse management system market's fundamentals of distribution and storage are being significantly impacted by the tremendous development of the North American supply chain industry. The majority of these changes are caused by new technologies, which have reduced the distance between supply chain activities and customers. These technological advancements, especially those brought on by the widespread use of e-commerce, have made it possible for customers in North America to have an instantaneous and real-time demand impact on product delivery processes, which drives the warehouse automation system market. Demand for highly adaptable and flexible warehouse management systems is expected to be fueled by this real-time demand effect along with the growing multichannel distribution support business model (WMS). However, things have changed, and today's warehouse management systems are virtually entirely automated and effective in helping the warehouse manager with product monitoring at different levels of storage and distribution operations. Traditionally, warehouse management required a lot of paperwork. Current WMS implementations range from basic computer automation systems to more advanced management programs that offer improved facilities such as monitoring inventory management, order picking, and improved dock logistics capabilities. A technologically advanced region is North America. The adoption of Big Data, IoT, and Software as Service technology has been particularly strong in this area. More deployments will increase regional competition, the market for warehouse management systems as a whole will grow, and this will drive product development and innovation, which drives the warehouse automation system market. There are many different big and small warehouses, as well as 3PLs, in the North American warehouse management system market (3rd Part Logistics). These elements are creating healthy competition for jobs among the many North American businesses, which is boosting the warehouse management system market over the forecast period. The market for warehouse management systems is being driven by the existence of many oriented leaders in North America. Before entering a new market or gaining a solid footing in the current warehouse management system industry, organizations must make high-level decisions due to increasing competition and a fast-changing technological environment. Through the forecast period, the US is expected to dominate the North American warehouse management system market. There are around 9000 commercial storage buildings in the region, covering an area of about 829 million square feet. The desire for exceedingly thin profit margins by enterprises has increased due to the prevalence of such a large number of storage facilities. Therefore, players in the warehouse management system industry have been seen spending heavily on technologies like RFID and voice-assisted receiving in order to survive in such a competitive environment.Warehouse Automation System Market Scope: Inquiry Before Buying

Warehouse Automation System Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 3.65 Bn. Forecast Period 2024to 2030 CAGR: 16.5% Market Size in 2030: US$ 10.65 Bn. Segments Covered: by Component Hardware Software by Application Automotive Food & Beverage E-commerce Pharmaceutical Other by End-Use Retailers Manufacturing and Distributors Warehouse Automation System Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Warehouse Automation System Market, Key Players are

1. Dematic Corporation 2. Honeywell International Inc 3. Daifuku Co., Ltd. 4. Swisslog Holding AG 5. KION Group 6. Murata Machinery, Ltd. 7. SSI Schaefer Systems International 8. Vanderlande Industries 9. KNAPP AG 10. Beumer Group 11. TGW Logistics Group 12. Mecalux S.A. 13. SSI Schaefer 14. Fives Group 15. Kardex Group 16. Witron Logistik 17. SSI Schaefer 18. System Logistics Corporation 19. Swisslog 20. Bastian Solution Frequently Asked Questions: 1] What segments are covered in the Global Warehouse Automation System Market report? Ans. The segments covered in the Warehouse Automation System Market report are based on Components, Applications, and End Users. 2] Which region is expected to hold the highest share in the Global Warehouse Automation System Market? Ans. The North American region is expected to hold the highest share in the Warehouse Automation System Market. 3] What is the market size of the Global Warehouse Automation System Market by 2030? Ans. The market size of the Warehouse Automation System Market by 2030 is expected to reach US$ 10.65 Bn. 4] What is the forecast period for the Global Warehouse Automation System Market? Ans. The forecast period for the Warehouse Automation System Market is 2024-2030. 5] What was the market size of the Global Warehouse Automation System Market in 2023? Ans. The market size of the Warehouse Automation System Market in 2023 was valued at US$ 3.65 Bn.

1. Warehouse Automation System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Warehouse Automation System Market: Dynamics 2.1. Warehouse Automation System Market Trends 2.2. Warehouse Automation System Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Warehouse Automation System Market Drivers 2.2.1.2. North America Warehouse Automation System Market Restraints 2.2.1.3. North America Warehouse Automation System Market Opportunities 2.2.1.4. North America Warehouse Automation System Market Challenges 2.2.2. Europe 2.2.2.1. Europe Warehouse Automation System Market Drivers 2.2.2.2. Europe Warehouse Automation System Market Restraints 2.2.2.3. Europe Warehouse Automation System Market Opportunities 2.2.2.4. Europe Warehouse Automation System Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Warehouse Automation System Market Drivers 2.2.3.2. Asia Pacific Warehouse Automation System Market Restraints 2.2.3.3. Asia Pacific Warehouse Automation System Market Opportunities 2.2.3.4. Asia Pacific Warehouse Automation System Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Warehouse Automation System Market Drivers 2.2.4.2. Middle East and Africa Warehouse Automation System Market Restraints 2.2.4.3. Middle East and Africa Warehouse Automation System Market Opportunities 2.2.4.4. Middle East and Africa Warehouse Automation System Market Challenges 2.2.5. South America 2.2.5.1. South America Warehouse Automation System Market Drivers 2.2.5.2. South America Warehouse Automation System Market Restraints 2.2.5.3. South America Warehouse Automation System Market Opportunities 2.2.5.4. South America Warehouse Automation System Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Trends in Warehouse Automation 2.5.1. IoT Integration 2.5.2. Artificial Intelligence and Machine Learning 2.5.3. Robotics Advancements 2.5.4. Cloud-Based Solutions 2.6. Regulatory Landscape 2.7. Key Opinion Leader Analysis for Warehouse Automation System Industry 2.8. Analysis of Government Schemes and Initiatives for Warehouse Automation System Industry 2.9. The Global Pandemic Impact on Warehouse Automation System Market 3. Warehouse Automation System Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 3.1. Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 3.1.1. Hardware 3.1.2. Software 3.2. Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 3.2.1. Automotive 3.2.2. Food & Beverage 3.2.3. E-commerce 3.2.4. Pharmaceutical 3.2.5. Other 3.3. Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 3.3.1. Retailers 3.3.2. Manufacturing and Distributors 3.4. Warehouse Automation System Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Warehouse Automation System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 4.1.1. Hardware 4.1.2. Software 4.2. North America Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 4.2.1. Automotive 4.2.2. Food & Beverage 4.2.3. E-commerce 4.2.4. Pharmaceutical 4.2.5. Other 4.3. North America Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 4.3.1. Retailers 4.3.2. Manufacturing and Distributors 4.4. North America Warehouse Automation System Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 4.4.1.1.1. Hardware 4.4.1.1.2. Software 4.4.1.2. United States Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Automotive 4.4.1.2.2. Food & Beverage 4.4.1.2.3. E-commerce 4.4.1.2.4. Pharmaceutical 4.4.1.2.5. Other 4.4.1.3. United States Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Retailers 4.4.1.3.2. Manufacturing and Distributors 4.4.2. Canada 4.4.2.1. Canada Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 4.4.2.1.1. Hardware 4.4.2.1.2. Software</em 4.4.2.2. Canada Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Automotive 4.4.2.2.2. Food & Beverage 4.4.2.2.3. E-commerce 4.4.2.2.4. Pharmaceutical 4.4.2.2.5. Other 4.4.2.3. Canada Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Retailers 4.4.2.3.2. Manufacturing and Distributors 4.4.3. Mexico 4.4.3.1. Mexico Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 4.4.3.1.1. Hardware 4.4.3.1.2. Software 4.4.3.2. Mexico Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Automotive 4.4.3.2.2. Food & Beverage 4.4.3.2.3. E-commerce 4.4.3.2.4. Pharmaceutical 4.4.3.2.5. Other 4.4.3.3. Mexico Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Retailers 4.4.3.3.2. Manufacturing and Distributors 5. Europe Warehouse Automation System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 5.2. Europe Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 5.3. Europe Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 5.4. Europe Warehouse Automation System Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 5.4.1.2. United Kingdom Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 5.4.2.2. France Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 5.4.3.2. Germany Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 5.4.4.2. Italy Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 5.4.5.2. Spain Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 5.4.6.2. Sweden Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 5.4.7.2. Austria Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 5.4.8.2. Rest of Europe Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Warehouse Automation System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 6.2. Asia Pacific Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Warehouse Automation System Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 6.4.1.2. China Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 6.4.2.2. S Korea Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 6.4.3.2. Japan Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 6.4.4.2. India Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 6.4.5.2. Australia Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 6.4.6.2. Indonesia Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 6.4.7.2. Malaysia Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 6.4.8.2. Vietnam Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 6.4.9.2. Taiwan Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 6.4.10.2. Rest of Asia Pacific Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Warehouse Automation System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 7.2. Middle East and Africa Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Warehouse Automation System Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 7.4.1.2. South Africa Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 7.4.2.2. GCC Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 7.4.3.2. Nigeria Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 7.4.4.2. Rest of ME&A Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 8. South America Warehouse Automation System Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 8.2. South America Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 8.3. South America Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 8.4. South America Warehouse Automation System Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 8.4.1.2. Brazil Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 8.4.2.2. Argentina Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Warehouse Automation System Market Size and Forecast, by Component (2023-2030) 8.4.3.2. Rest Of South America Warehouse Automation System Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Warehouse Automation System Market Size and Forecast, by End User (2023-2030) 9. Global Warehouse Automation System Market: Competitive Landscape 9.1. Top 20 Warehouse Automation Suppliers. 9.2. MMR Competition Matrix 9.3. Competitive Landscape 9.4. Key Players Benchmarking 9.4.1. Company Name 9.4.2. Business Segment 9.4.3. End-user Segment 9.4.4. Revenue (2023) 9.4.5. Company Locations 9.5. Leading Warehouse Automation System Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Dematic Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Honeywell International Inc 10.3. Daifuku Co., Ltd. 10.4. Swisslog Holding AG 10.5. KION Group 10.6. Murata Machinery, Ltd. 10.7. SSI Schaefer Systems International 10.8. Vanderlande Industries 10.9. KNAPP AG 10.10. Beumer Group 10.11. TGW Logistics Group 10.12. Mecalux S.A. 10.13. SSI Schaefer 10.14. Fives Group 10.15. Kardex Group 10.16. Witron Logistik 10.17. SSI Schaefer 10.18. System Logistics Corporation 10.19. Swisslog 10.20. Bastian Solution 11. Key Findings 12. Industry Recommendations 13. Warehouse Automation System Market: Research Methodology