Global Technical Textile Market size was valued at USD 220.17 Bn in 2023 and is expected to reach USD 340.52 Bn by 2030, at a CAGR of 7.01 %.Overview

Technical textiles are a fusion of advanced materials and technology, purposefully crafted to serve distinct functions. Also, Technical textiles are defined as textile materials and products used primarily for their technical performance and functional properties rather than their aesthetic or decorative characteristics. Used in diverse applications such as agriculture, healthcare, construction, automotive, and apparel, these textiles serve various end-users, including farmers, medical professionals, construction workers, automobile manufacturers, and fashion enthusiasts. Agrotech variants shield crops, Meditech versions include surgical gowns, Geotech options are crucial in civil engineering, while Mobiltech iterations enhance automotive safety. Buildtech choices contribute to construction robustness, Hometech alternatives elevate home furnishings, and Clothtech varieties offer performance advantages in sportswear. The adaptability of technical textiles fuels innovation, meeting industry-specific requirements with precision. The development industrialization and growth of each sector have majorly contributed to the Technical Textile Market growth.To know about the Research Methodology:-Request Free Sample Report

Technical Textile Market Dynamics

The Innovations in Material Science and Increasing Demand for High-Performance Materials to Drive the Market Growth Nanotechnology has transformed the textile industry, ushering in a new era of innovation and value addition. Nanocoatings have endowed fabrics with superior functionalities, nanofibers have elevated strength and comfort, while nanosensors have birthed smart textiles. Nanoparticles have paved the way for eco-friendly and sustainable fabrics. This integration has not only sparked advancements in wearable electronics but has also increased progress in various cutting-edge applications. The collaboration of advanced materials and nanotechnology has propelled innovation in technical textiles, enhancing properties like durability, flexibility, and specialized functionalities. Breakthroughs in material science are driving the creation of textiles with heightened strength, flame resistance, and conductivity, meeting the evolving demands across diverse industries. Such factor is expected to drive the market Technical Textile Market. However, among these strides, a commitment to environmental sustainability remains paramount for the textile industry's continued progress. Techniques such as electrospinning create nanofibers, while coating technologies involve applying nanoparticles directly through printing or impregnation. These nanoparticles imbue textiles with antimicrobial, UV-resistant, electrically conductive, optical, hydrophobic, and flame-retardant properties. Also, nanomaterial-based smart devices integrated into textiles enable functions such as energy harvesting, sensing, drug release, and optics. Nanofibers, characterized by exceptional strength and breathability, contribute to lighter and more flexible textile designs without compromising comfort. Their integration enhances mechanical properties, making textiles suitable for applications in sportswear, where durability is crucial. In composites, carbon nanofibers (CNFs) find application, offering superior strength-to-weight ratios in industries such as aerospace and automotive to increase the Technical Textile Market demand globally. The sportswear sector benefits from nanofibers derived from synthetic polymers, ensuring fabrics withstand repeated stretching and movement during physical activities. Nanotechnology's impact on technical textiles extends beyond innovation, fostering sustainable and eco-friendly solutions in line with evolving consumer and environmental expectations. Technical Textile Industry in India: The textile sector contributes significantly to the output of the Technical Textile manufacturing sector and is the 2nd largest employer in India. The industry has recently advanced up the value chain and expanded into technical textiles. The government is actively encouraging research and innovation in technical textiles to boost exports and the sector's worldwide competitiveness.India's trade in technical textile products has been rapidly expanding, and the country has become a net exporter. India's exports of technical textile products increased by 28.4% (YoY) from US$ 2.21 billion in 2020-21 to US$ 2.85 billion in 2021-22, while imports increased by 44% (YoY) from US$ 1.7 billion in 2020-21 to US$ 2.46 billion in 2021-22. Along with MMF fabrics and MMF clothing, the manufacturing Linked Incentive (PLI) scheme was introduced to encourage domestic manufacturing of technical textiles. Of the 67 applications received, 17 were solely for technical textiles with a planned investment of US$ 744.22 million (Rs. 6,351 crore) and 16 were combined with technical textiles with a expected investment of US$ 672.55 million (Rs. 5,517 crore). The Growth of the Automotive Industry to Boost the Market The automotive sector's constant pursuit of safety and comfort has led to a surge in the use of technical textiles. From airbags to upholstery fabrics with enhanced durability and aesthetics, technical textiles play a pivotal role in meeting the evolving demands of the automotive industry, contributing to Technical Textile Market growth. The demand for Technical Textile Market in the automotive sector is witnessing a surge, driven by emerging applications and manufacturers' pursuit of enhanced comfort, safety, and reduced weight. As reported by Textiles Intelligence, the average weight of textile materials in a mid-size car has increased to 30kg, 50% more than in 2000, aligning with efforts to boost fuel efficiency and reduce emissions. Technical textiles offer weight reduction opportunities, such as Lineo's FlaxPreg sandwich panel composites, achieving a 50% weight reduction compared to traditional materials. ELeather, an artificial leather material, contributes to a 40% weight reduction. The growing interest in new energy vehicles (NEVs) necessitates improved acoustic comfort, driving innovations like Adler Pelzer Group's EVO package. Despite recent challenges from the COVID-19 pandemic and geopolitical disruptions, the trajectory indicates sustained growth and evolution in the automotive technical textiles sector. Today, there are many more applications of technical textiles and nonwovens inside the car. The global Technical Textile Market is expected to witness high growth on account of the rising automobile production, particularly in Asian countries such as India, China, Indonesia, and Thailand. In addition, increasing penetration of technical textiles in the automotive industry to cater to high-performance applications is also expected to drive global demand. Textiles used in automotive applications are helmets, seatbelts, interior carpets, sun visors, car body covers, airbags, tire cords, and headliners.

Rise in Disruption of supply chains to Restrain the Market Growth In the Technical Textile Market, the formidable challenge of intricate and disrupted supply chains emerges as a critical growth restraint. Global events, be it pandemics or geopolitical tensions, act as catalysts, disrupting the seamless flow of raw materials and finished products. The resulting bottleneck effect imposes constraints on production schedules, leading to increased lead times and escalated costs. This intricate scenario poses a significant challenge for companies in the Technical Textile sector, hindering their ability to meet growing demand efficiently. Successfully navigating these supply chain snags demands strategic resilience and adaptive capabilities, essential for mitigating risks and ensuring sustained growth in this dynamic market. Simultaneously, the Technical Textile industry grapples with growth impediments arising from evolving and stringent regulatory frameworks. Compliance with a myriad of international standards and regulations stands as a formidable challenge for Technical Textile Market players. Effectively navigating this intricate regulatory landscape requires substantial investments in research, development, and testing to ensure seamless product adherence. The time and resources allocated to compliance processes may, however, impede the speed of innovation and market entry for new products. Striking the right balance between innovation and regulatory conformity becomes a delicate strategic act, as companies strive to keep pace with advancements while unwaveringly meeting global standards. Changing Shift Towards Integration of Smart Textile to Create Lucrative Opportunity for Market Growth In the healthcare sector, Smart textiles, situated at the nexus of fashion, technology, and engineering, are witnessing a surge in demand driven by wearable devices. The Technical Textile Market is undergoing a paradigm shift with the integration of smart textiles. The surge in medical textiles, featuring antibacterial fabrics and wearable monitoring devices, presents a transformative opportunity. These textiles, endowed with functionalities such as advanced wound care, infection control, and real-time health monitoring, are meeting the escalating demand for non-invasive healthcare solutions. Coupled with a growing aging population, the market potential is poised for significant expansion. As the medical sector enthusiastically embraces these innovations, the Technical Textile Market stands at the forefront of redefining patient care and medical practices. Also, in the military, these textiles provide advanced protection and communication capabilities. Advancements in chemical engineering have expanded their applications, enabled remote healthcare monitoring and optimized athletic training programs, making smart textiles pivotal in shaping the future of various industries. Eco-friendly solutions are another key opportunity of market growth. For instance, textiles made from recycled materials and bio-based fibers, are gaining popularity across the world. The increasing consumer preference for sustainable products aligns seamlessly with the industry's shift towards green initiatives. As a result, this trend not only meets consumer expectations but also boosts the Technical Textile Market size.

Technical Textile Market Segment Analysis

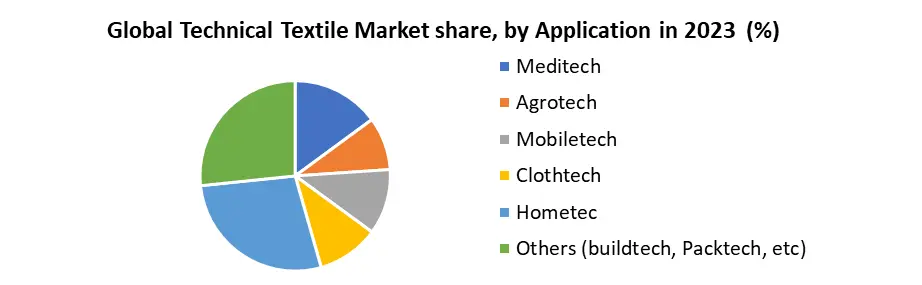

The global Technical Textile Market is segmented into product type, material type, application and region. based on region the market is segmented into major five regions such as North America, Europe, Asia Pacific, MEA and South America. By Application Based on the application, the hometech textile industry held the largest Technical Textile Market share in 2023. This surge was primarily influenced by heightened demand from households, encompassing various needs like cushioning materials, furniture, floor and wall coverings, and fireproofing. The positive trend is poised to continue as residential construction, especially in emerging economies, is on the rise. Anticipated to witness substantial growth, Indutech textiles showcase superior properties su durability and strength, making them ideal for industrial applications. The forecasted period highlights a significant uptick in demand for industrial textiles, driven by the need for items like decatising cloth, bolting cloth, drive belts, and printed circuit boards across diverse industries. Emerging economies, marked by increasing populations, rising birth rates, and aging demographics, are set to propel the demand for hygienic and personal care medical equipment, fostering positive growth in the Medtech textile market and the industry at large. The agro segment benefits from advanced technology adoption in agriculture, promoting high crop yields. Simultaneously, Buildtech sees a boost from escalating construction activities in residential and commercial domains. This multifaceted growth narrative underscores the dynamic landscape of the textile industry.

Technical Textile Market Regional Insight

Asia Pacific held the largest Technical Textile Market share in 2022 and is emerging as a powerhouse in the Technical Textile Market. Factors influenced by regional growth are robust industrialization, technological advancements, and a burgeoning population. China and India lead the region in textile manufacturing, with a focus on innovation and efficiency. Technical textiles are textile products that have technical performance and functionality as their primary focus. The end usage of these products caters to a wide array of sectors including construction, agriculture, aerospace, automotive, healthcare, protective gear, home care, among others. The increase in demand for technical textiles in sectors such as automotive, construction, and healthcare propels the market forward. The favorable government initiatives supporting the textile industry contribute to the region's dominance. The adoption of smart textiles and sustainable practices further solidifies Asia Pacific's position, presenting a landscape ripe for continued growth and technological evolution. In North America, the Technical Textile Market is characterized by a sophisticated and mature ecosystem. The region boasts a strong emphasis on research and development, leading to cutting-edge advancements in technical textiles. The automotive and aerospace industries, in particular, drive demand for high-performance textiles. Additionally, the growing awareness of sustainable practices fuels the market's expansion, with a focus on eco-friendly materials and processes. Collaborations between industry players and research institutions contribute to the region's innovative edge. As North America continues to prioritize technological excellence and sustainability, the Technical Textile Industry in this region is poised for sustained growth and resilience in the face of evolving market dynamics.Technical Textile Market Scope: Inquire before buying

Global Technical Textile Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 220.17 Bn. Forecast Period 2024 to 2030 CAGR: 7.01% Market Size in 2030: US $ 340.52 Bn. Segments Covered: by Product Type Woven Knitted Non-Woven by Material Type Natural Fiber Synthetic Polymer Metal Mineral Regenerated Fiber by Application Meditech Agrotech Mobiletech Clothtech Hometech Others (buildtec, packtech, geotech, etc) Technical Textile Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)Technical Textile Key Players by Region

Europe: 1. Ahlstrom-MunksjOyj - Finland 2. American & Efird LLC - United Kingdom 3. Asahi Kasei Corporation - Germany 4. DowDuPont - Switzerland 5. DSM Dyneema BV - Netherlands 6. Freudenberg SE – Germany 7. Borgers SE & Co. KGaA - Germany 8. Global Synthetics Pty. Ltd. - United Kingdom 9. GSE Environmental, Inc. - United Kingdom 10. Hanes Geo Components - United Kingdom 11. Huesker Synthetic GmbH - Germany 12. Johns Manville - Germany 13. Kimberly-Clark Worldwide, Inc. - United Kingdom North America: 14. 3M - United States 15. Berry Global Group - United States 16. Agru America, Inc. - United States 17. Belton Industries, Inc. - United States 18. Global Synthetics Pty. Ltd. - United States 19. Milliken & Company - United States 20. NAUE Geosynthetics Limited - United States 21. Officine Maccaferri S.p.A. - United States Asia Pacific: 22. Hindoostan Composite Solutions - India 23. Kimberly-Clark Worldwide, Inc. - Australia 24. Lenzing Plastics GmbH & Co KG - China 25. SKAPS Industries - India 26. SRF Limited - India 27. Teijin Limited - Japan Frequently Asked Questions: 1] What is the growth rate of the Global Technical Textile Market? Ans. The Global Technical Textile Market is growing at a significant rate of 7.01 % during the forecast period. 2] Which region is expected to dominate the Global Technical Textile Market? Ans. APAC is expected to dominate the Technical Textile Market during the forecast period. 3] What is the expected Global Technical Textile Market size by 2030? Ans. The Technical Textile Market size is expected to reach USD 340.52 Bn by 2030. 4] Which are the top players in the Global Technical Textile Market? Ans. The major top players in the Global Technical Textile Market are Ahlstrom-MunksjOyj, American & Efird LLC and others. 5] What are the factors driving the Global Technical Textile Market growth? Ans. The innovations in material science and increasing demand for high-performance materials is expected to drive the market growth. 6] Which country held the largest Global Technical Textile Market share in 2023? Ans. The Inda held the largest Technical Textile Market share in 2023.

1. Technical Textile Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Technical Textile Market: Dynamics 2.1. Technical Textile Market Trends by Region 2.1.1. North America Technical Textile Market Trends 2.1.2. Europe Technical Textile Market Trends 2.1.3. Asia Pacific Technical Textile Market Trends 2.1.4. Middle East and Africa Technical Textile Market Trends 2.1.5. South America Technical Textile Market Trends 2.2. Technical Textile Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Technical Textile Market Drivers 2.2.1.2. North America Technical Textile Market Restraints 2.2.1.3. North America Technical Textile Market Opportunities 2.2.1.4. North America Technical Textile Market Challenges 2.2.2. Europe 2.2.2.1. Europe Technical Textile Market Drivers 2.2.2.2. Europe Technical Textile Market Restraints 2.2.2.3. Europe Technical Textile Market Opportunities 2.2.2.4. Europe Technical Textile Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Technical Textile Market Drivers 2.2.3.2. Asia Pacific Technical Textile Market Restraints 2.2.3.3. Asia Pacific Technical Textile Market Opportunities 2.2.3.4. Asia Pacific Technical Textile Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Technical Textile Market Drivers 2.2.4.2. Middle East and Africa Technical Textile Market Restraints 2.2.4.3. Middle East and Africa Technical Textile Market Opportunities 2.2.4.4. Middle East and Africa Technical Textile Market Challenges 2.2.5. South America 2.2.5.1. South America Technical Textile Market Drivers 2.2.5.2. South America Technical Textile Market Restraints 2.2.5.3. South America Technical Textile Market Opportunities 2.2.5.4. South America Technical Textile Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Technical Textile Industry 2.8. Analysis of Government Schemes and Initiatives For Technical Textile Industry 2.9. The Global Pandemic Impact on Technical Textile Market 3. Technical Textile Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn) (2023-2030) 3.1. Technical Textile Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Woven 3.1.2. Knitted 3.1.3. Non-Woven 3.2. Technical Textile Market Size and Forecast, by Material Type (2023-2030) 3.2.1. Natural Fiber 3.2.2. Synthetic Polymer 3.2.3. Metal 3.2.4. Mineral 3.2.5. Regenerated Fiber 3.3. Technical Textile Market Size and Forecast, by Application (2023-2030) 3.3.1. Meditech 3.3.2. Agrotech 3.3.3. Mobiletech 3.3.4. Clothtech 3.3.5. Hometech 3.3.6. Others (buildtec, packtech, geotech, etc) 3.4. Technical Textile Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Technical Textile Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Technical Textile Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Woven 4.1.2. Knitted 4.1.3. Non-Woven 4.2. North America Technical Textile Market Size and Forecast, by Material Type (2023-2030) 4.2.1. Natural Fiber 4.2.2. Synthetic Polymer 4.2.3. Metal 4.2.4. Mineral 4.2.5. Regenerated Fiber 4.3. North America Technical Textile Market Size and Forecast, by Application (2023-2030) 4.3.1. Meditech 4.3.2. Agrotech 4.3.3. Mobiletech 4.3.4. Clothtech 4.3.5. Hometech 4.3.6. Others (buildtec, packtech, geotech, etc) 4.4. North America Technical Textile Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Technical Textile Market Size and Forecast, by Product Type (2023-2030) 4.4.1.1.1. Woven 4.4.1.1.2. Knitted 4.4.1.1.3. Non-Woven 4.4.1.2. United States Technical Textile Market Size and Forecast, by Material Type (2023-2030) 4.4.1.2.1. Natural Fiber 4.4.1.2.2. Synthetic Polymer 4.4.1.2.3. Metal 4.4.1.2.4. Mineral 4.4.1.2.5. Regenerated Fiber 4.4.1.3. United States Technical Textile Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Meditech 4.4.1.3.2. Agrotech 4.4.1.3.3. Mobiletech 4.4.1.3.4. Clothtech 4.4.1.3.5. Hometech 4.4.1.3.6. Others (buildtec, packtech, geotech, etc) 4.4.2. Canada 4.4.2.1. Canada Technical Textile Market Size and Forecast, by Product Type (2023-2030) 4.4.2.1.1. Woven 4.4.2.1.2. Knitted 4.4.2.1.3. Non-Woven 4.4.2.2. Canada Technical Textile Market Size and Forecast, by Material Type (2023-2030) 4.4.2.2.1. Natural Fiber 4.4.2.2.2. Synthetic Polymer 4.4.2.2.3. Metal 4.4.2.2.4. Mineral 4.4.2.2.5. Regenerated Fiber 4.4.2.3. Canada Technical Textile Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Meditech 4.4.2.3.2. Agrotech 4.4.2.3.3. Mobiletech 4.4.2.3.4. Clothtech 4.4.2.3.5. Hometech 4.4.2.3.6. Others (buildtec, packtech, geotech, etc) 4.4.3. Mexico 4.4.3.1. Mexico Technical Textile Market Size and Forecast, by Product Type (2023-2030) 4.4.3.1.1. Woven 4.4.3.1.2. Knitted 4.4.3.1.3. Non-Woven 4.4.3.2. Mexico Technical Textile Market Size and Forecast, by Material Type (2023-2030) 4.4.3.2.1. Natural Fiber 4.4.3.2.2. Synthetic Polymer 4.4.3.2.3. Metal 4.4.3.2.4. Mineral 4.4.3.2.5. Regenerated Fiber 4.4.3.3. Mexico Technical Textile Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Meditech 4.4.3.3.2. Agrotech 4.4.3.3.3. Mobiletech 4.4.3.3.4. Clothtech 4.4.3.3.5. Hometech 4.4.3.3.6. Others (buildtec, packtech, geotech, etc) 5. Europe Technical Textile Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Technical Textile Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Technical Textile Market Size and Forecast, by Material Type (2023-2030) 5.3. Europe Technical Textile Market Size and Forecast, by Application (2023-2030) 5.4. Europe Technical Textile Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Technical Textile Market Size and Forecast, by Product Type (2023-2030) 5.4.1.2. United Kingdom Technical Textile Market Size and Forecast, by Material Type (2023-2030) 5.4.1.3. United Kingdom Technical Textile Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Technical Textile Market Size and Forecast, by Product Type (2023-2030) 5.4.2.2. France Technical Textile Market Size and Forecast, by Material Type (2023-2030) 5.4.2.3. France Technical Textile Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Technical Textile Market Size and Forecast, by Product Type (2023-2030) 5.4.3.2. Germany Technical Textile Market Size and Forecast, by Material Type (2023-2030) 5.4.3.3. Germany Technical Textile Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Technical Textile Market Size and Forecast, by Product Type (2023-2030) 5.4.4.2. Italy Technical Textile Market Size and Forecast, by Material Type (2023-2030) 5.4.4.3. Italy Technical Textile Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Technical Textile Market Size and Forecast, by Product Type (2023-2030) 5.4.5.2. Spain Technical Textile Market Size and Forecast, by Material Type (2023-2030) 5.4.5.3. Spain Technical Textile Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Technical Textile Market Size and Forecast, by Product Type (2023-2030) 5.4.6.2. Sweden Technical Textile Market Size and Forecast, by Material Type (2023-2030) 5.4.6.3. Sweden Technical Textile Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Technical Textile Market Size and Forecast, by Product Type (2023-2030) 5.4.7.2. Austria Technical Textile Market Size and Forecast, by Material Type (2023-2030) 5.4.7.3. Austria Technical Textile Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Technical Textile Market Size and Forecast, by Product Type (2023-2030) 5.4.8.2. Rest of Europe Technical Textile Market Size and Forecast, by Material Type (2023-2030) 5.4.8.3. Rest of Europe Technical Textile Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Technical Textile Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Technical Textile Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Technical Textile Market Size and Forecast, by Material Type (2023-2030) 6.3. Asia Pacific Technical Textile Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Technical Textile Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Technical Textile Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2. China Technical Textile Market Size and Forecast, by Material Type (2023-2030) 6.4.1.3. China Technical Textile Market Size and Forecast, by Application (2023-2030) 6.4.2. China Technical Textile Market Size and Forecast, by Material Type (2023-2030) S Korea 6.4.2.1. S Korea Technical Textile Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2. S Korea Technical Textile Market Size and Forecast, by Material Type (2023-2030) 6.4.2.3. S Korea Technical Textile Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Technical Textile Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2. Japan Technical Textile Market Size and Forecast, by Material Type (2023-2030) 6.4.3.3. Japan Technical Textile Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Technical Textile Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2. India Technical Textile Market Size and Forecast, by Material Type (2023-2030) 6.4.4.3. India Technical Textile Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Technical Textile Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Australia Technical Textile Market Size and Forecast, by Material Type (2023-2030) 6.4.5.3. Australia Technical Textile Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Technical Textile Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Indonesia Technical Textile Market Size and Forecast, by Material Type (2023-2030) 6.4.6.3. Indonesia Technical Textile Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Technical Textile Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Malaysia Technical Textile Market Size and Forecast, by Material Type (2023-2030) 6.4.7.3. Malaysia Technical Textile Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Technical Textile Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Vietnam Technical Textile Market Size and Forecast, by Material Type (2023-2030) 6.4.8.3. Vietnam Technical Textile Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Technical Textile Market Size and Forecast, by Product Type (2023-2030) 6.4.9.2. Taiwan Technical Textile Market Size and Forecast, by Material Type (2023-2030) 6.4.9.3. Taiwan Technical Textile Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Technical Textile Market Size and Forecast, by Product Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Technical Textile Market Size and Forecast, by Material Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Technical Textile Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Technical Textile Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa Technical Textile Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Technical Textile Market Size and Forecast, by Material Type (2023-2030) 7.3. Middle East and Africa Technical Textile Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Technical Textile Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Technical Textile Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2. South Africa Technical Textile Market Size and Forecast, by Material Type (2023-2030) 7.4.1.3. South Africa Technical Textile Market Size and Forecast, by Application (2023-2030) 7.4.1.4. GCC GCC Technical Textile Market Size and Forecast, by Product Type (2023-2030) 7.4.1.5. GCC Technical Textile Market Size and Forecast, by Material Type (2023-2030) 7.4.1.6. GCC Technical Textile Market Size and Forecast, by Application (2023-2030) 7.4.2. Nigeria 7.4.2.1. Nigeria Technical Textile Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2. Nigeria Technical Textile Market Size and Forecast, by Material Type (2023-2030) 7.4.2.3. Nigeria Technical Textile Market Size and Forecast, by Application (2023-2030) 7.4.3. Rest of ME&A 7.4.3.1. Rest of ME&A Technical Textile Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2. Rest of ME&A Technical Textile Market Size and Forecast, by Material Type (2023-2030) 7.4.3.3. Rest of ME&A Technical Textile Market Size and Forecast, by Application (2023-2030) 8. South America Technical Textile Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. South America Technical Textile Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Technical Textile Market Size and Forecast, by Material Type (2023-2030) 8.3. South America Technical Textile Market Size and Forecast, by Application (2023-2030) 8.4. South America Technical Textile Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Technical Textile Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2. Brazil Technical Textile Market Size and Forecast, by Material Type (2023-2030) 8.4.1.3. Brazil Technical Textile Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Technical Textile Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2. Argentina Technical Textile Market Size and Forecast, by Material Type (2023-2030) 8.4.2.3. Argentina Technical Textile Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest of South America Technical Textile Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Rest of South America Technical Textile Market Size and Forecast, by Material Type (2023-2030) 8.4.3.3. Rest of South America Technical Textile Market Size and Forecast, by Application (2023-2030) 9. Global Technical Textile Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Technical Textile Market Companies, by Market Capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Ahlstrom-MunksjOyj - Finland 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. American & Efird LLC - United Kingdom 10.3. Asahi Kasei Corporation - Germany 10.4. DowDuPont - Switzerland 10.5. DSM Dyneema BV - Netherlands 10.6. Freudenberg SE – Germany 10.7. BorgersSE & Co. KGaA - Germany 10.8. Global Synthetics Pty. Ltd. - United Kingdom 10.9. GSE Environmental, Inc. - United Kingdom 10.10. Hanes Geo Components - United Kingdom 10.11. Huesker Synthetic GmbH - Germany 10.12. Johns Manville - Germany 10.13. Kimberly-Clark Worldwide, Inc. - United Kingdom 10.14. 3M - United States 10.15. Berry Global Group - United States 10.16. Agru America, Inc. - United States 10.17. Belton Industries, Inc. - United States 10.18. Global Synthetics Pty. Ltd. - United States 10.19. Milliken & Company - United States 10.20. NAUE Geosynthetics Limited - United States 10.21. Officine Maccaferri S.p.A. - United States 10.22. Hindoostan Composite Solutions - India 10.23. Kimberly-Clark Worldwide, Inc. - Australia 10.24. Lenzing Plastics GmbH & Co KG - China 10.25. SKAPS Industries - India 10.26. SRF Limited - India 10.27. Teijin Limited - Japan 11. Key Findings 12. Industry Recommendations 13. Technical Textile Market: Research Methodology