Global Flue Gas Desulfurization Systems Market size was valued at USD 20.96 Bn. in 2022 and the total Global Flue Gas Desulfurization Systems revenue is expected to grow by 4.9% from 2023 to 2029, reaching nearly USD 29.30 Bn.Flue Gas Desulfurization Systems Market Overview

A flue gas desulfurization system is a technology that is used to eliminate sulfur dioxide (SO2) from exhaust flue gases of fossil-fuel power plants. The end-users for FGD systems are Power Generation, Chemical, Iron & Steel, Cement Manufacturing, and other industrial processes that produce significant amounts of SO2 emissions. The demand for the Flue Gas Desulfurization Systems Market is increasing as it reduces emissions and helps to free from air pollution. For instance, Mitsubishi Hitachi Industries based in Japan deals in FGD systems like seawater FGD systems and wet limestone-gypsum FGD systems to remove SO2 from flue gases generated by boilers, furnaces, and other sources.Flue Gas Desulfurization Systems Market Snapshot

To know about the Research Methodology :- Request Free Sample Report Drivers: Increasing power generation sector, Environmental Awareness, and environmental regulations to drive the market. Developed countries increasing demand for electricity has led to the construction of new energy power plants and coal-fired plants. As industrialization progressed chemical, iron & steel, and cement manufacturing were established, and hence the demand for Flue Gas Desulfurization Systems increased to control the emissions from power plants. The impact of air pollution on health and climate change had pressured industries to reduce emissions. FGD systems play a vital role in modifying the impact on the environment of certain industries. The government forced severe air pollution regulations around the world and the target of these regulations is to decrease the emissions of hazardous contaminants from power plants, and other sources. Hence, the need for the removal of toxic impurities like SOx, NOx, mercury, and particulate matter at their source becomes paramount and therefore there is a higher demand for FGDS which increases the demand for the Flue Gas Desulfurization Systems Market. Restraints: Environmental concerns and harmful industrial emissions to restraint the market Increasing consumption of energy in manufacturing plants is the major reason for harmful industrial emissions, which cannot be avoided at large. These emissions may include nitrogen oxide (NOx), sulfur oxide (SO2), sulfuric acid mist, mercury, and particulate, which may cause an adverse effect on the environment, living species, and non-living infrastructure as well. As a consequence, it is becoming vital to introduce highly efficient technologies to remove these harmful gases. In addition, increasing public pressure on regulators to mandate consideration of alternatives to coal-fired thermal generation is on the escalation. Moreover, stringent emission standards have been enforced by various governments to limit air pollution formed by industries. These rigid regulations have made compulsion for the industry players to install or upgrade existing Flue Gas Desulfurization Systems in manufacturing plants, thereby supplementing the growth of the flue gas desulfurization Flue Gas Desulfurization Systems Market. Flue Gas Desulfurization Systems Market Opportunity: Expansion in the market in developed countries and export opportunities Industrialization is increasing and energy generation capacity is also growing in developing countries which creates an opportunity for industries to expand their business. Asia Pacific countries, like China, India, and other emerging economies accounted for the highest rise in the usage of coal for power generation. Advancements in FGD technologies like continuous research and development create opportunities for cost-effective solutions. Industries that develop advanced FGD technologies to explore export opportunities to countries that are looking to improve their air quality and comply with international emission standards. There is a growing opportunity for FGD system manufacturers and providers to supply to this demand and help these nations address environmental concerns. Such all factors are expected to fuel the market growth.

Flue Gas Desulfurization Systems Market Segment Analysis:

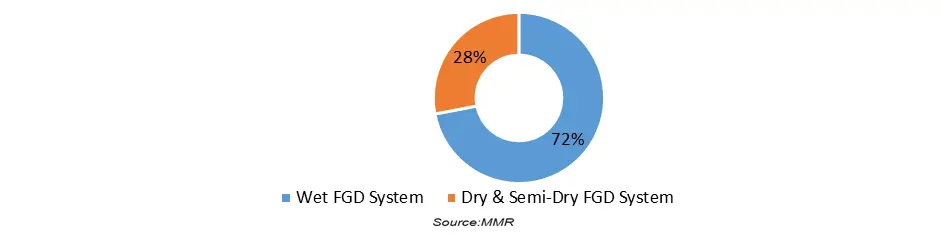

Based on the Type, The wet FGD system has dominated the Market in the year 2022 and is expected to dominate the market during the forecast period. This growth can be credited to the increased acceptance of wet FGD systems in various industries due to the high effectiveness in removing sulfur dioxide (SO2) from the flue gas. Wet FGD provides a higher degree of efficiency when it comes to removing sulfur oxide(SOx) compared to dry FGD. Along with better efficiency, the wet FGD also offers lower operating costs and more fuel flexibility. Hence, Wet FGD dominates the market over Dry and Semi-dry FGD.Flue Gas Desulfurization Systems Market Share(%), By Type in 2022

Based on the End-User, The Power Generation sector has dominated the market in the year 2022 and is expected to dominate the market during the forecast period. The goal of reducing pollution has grown the demand for the power generation industry across the world. Coal-fired power plants are creating the emissions of sulfur dioxide which produces sulfur contaminants. Sulfur trioxide, mercury, nitrous oxides, and hydrochloric acid are some of the impurities that are controlled in power generation. Hence, the increased power generation segment has dominated over other end-users. Chemical, Iron & steel, Cement Manufacturing, and others are the remaining segments.

Flue Gas Desulfurization Systems Market Share(%), By End-User(2022)

Flue Gas Desulfurization Systems Market Regional Insights:

North America has the highest Market share of 27% in the year 2022 and is expected to dominate during the forecast period. The U.S. country has led the market development in the North American region. Installations of Flue Gas Desulfurization plants and the treatment for harmful pollutants which are made by the flue gases have been increasing. The usage of power generation is increasing among people in North America. Europe held the second-largest market share of 21% in the year 2022. Germany and the U.K. are the countries that developed flue gas desulfurization technology, and most of the market growth is expected to come from these countries. APAC is anticipated to be the fastest-growing region during the forecast period as the countries like China, India, and Japan are developed countries, and demand for the power generation industry is increasing.Flue Gas Desulfurization Systems Market Share(%), By Region(2022)

The objective of the report is to present a comprehensive analysis of the Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers, and new entrants by region. PORTER, SWOT, and PESTEL analysis with the potential impact of micro-economic factors by region on the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding Market dynamics, and structure by analyzing the market segments and projecting the Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Market makes the report an investor’s guide.

Flue Gas Desulfurization Systems Market Scope: Inquire Before Buying

Global Flue Gas Desulfurization Systems Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 20.96 Bn. Forecast Period 2023 to 2029 CAGR: 4.9% Market Size in 2029: US $ 29.30 Bn. Segments Covered: by Type Wet FGD System Dry & Semi-Dry FGD System by Installation Greenfield Brownfield by End User Power Generation Chemical Iron & Steel Cement Manufacturing Others Flue Gas Desulfurization Systems Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Flue Gas Desulfurization Systems Market Key Players

1. Mitsubishi Heavy Industries[Chiyoda City, Tokyo, Japan] 2. General Electric 3. Doosan Lentjes 4. Babcock & Wilcox Enterprises[Akron, Ohio, USA] 5. Rafako 6. Siemens 7. Flsmidth 8. Hamon Corporation 9. Clyde Bergemann Power Group 10. Marsulex Environmental Technologies 11. Thermax 12. Andritz 13. Chiyoda Corporation 14. China Boqi Environmental (Holding) 15. Burns & Mcdonnell 16. Lonjing Environment Technology 17. Valmet 18. Kawasaki Heavy Industries 19. Ppel- Power Plant Engineers 20. Beijing Guodian Longyuan Environmental Engineering 21. China Everbright InternationalFrequently Asked Questions:

1] What segments are covered in the Global Flue Gas Desulfurization Systems Market report? Ans. The segments covered in the Market report are based on Type, Installation, End-User, and Region. 2] Which region is expected to hold the highest share of the Global Flue Gas Desulfurization Systems Market? Ans. The North American region is expected to hold the highest share of the Flue Gas Desulfurization Systems Market. 3] What is the market size of the Global Flue Gas Desulfurization Systems Market by 2029? Ans. The market size of the Flue Gas Desulfurization Systems Market by 2029 is expected to reach US$ 29.30 Billion. 4] What is the forecast period for the Global Flue Gas Desulfurization Systems Market? Ans. The forecast period for the Flue Gas Desulfurization Systems Market is 2023-2029. 5] What was the market size of the Global Flue Gas Desulfurization Systems Market in 2022? Ans. The market size of the Market in 2022 was valued at US$ 20.96 Billion.

1. Flue Gas Desulfurization Systems Market: Research Methodology 2. Flue Gas Desulfurization Systems Market: Executive Summary 3. Flue Gas Desulfurization Systems Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Flue Gas Desulfurization Systems Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Flue Gas Desulfurization Systems Market Size and Forecast by Segments (by Value USD) 5.1. Flue Gas Desulfurization Systems Market Size and Forecast, by Type (2022-2029) 5.1.1. Wet FGD System 5.1.2. Dry & Semi-Dry FGD System 5.2. Flue Gas Desulfurization Systems Market Size and Forecast, by Installation (2022-2029) 5.2.1. Greenfield 5.2.2. Brownfield 5.3. Flue Gas Desulfurization Systems Market Size and Forecast, by End-User (2022-2029) 5.3.1. Power Generation 5.3.2. Chemical 5.3.3. Iron & Steel 5.3.4. Cement Manufacturing 5.3.5. Others 5.4. Flue Gas Desulfurization Systems Market Size and Forecast, by Region (2022-2029) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Flue Gas Desulfurization Systems Market Size and Forecast (by Value USD) 6.1. North America Flue Gas Desulfurization Systems Market Size and Forecast, by Type (2022-2029) 6.1.1. Wet FGD System 6.1.2. Dry & Semi-Dry FGD System 6.2. North America Flue Gas Desulfurization Systems Market Size and Forecast, by Installation (2022-2029) 6.2.1. Greenfield 6.2.2. Brownfield 6.3. North America Flue Gas Desulfurization Systems Market Size and Forecast, by End-User (2022-2029) 6.3.1. Power Generation 6.3.2. Chemical 6.3.3. Iron & Steel 6.3.4. Cement Manufacturing 6.3.5. Others 6.4. North America Flue Gas Desulfurization Systems Market Size and Forecast, by Country (2022-2029) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Flue Gas Desulfurization Systems Market Size and Forecast (by Value USD) 7.1. Europe Flue Gas Desulfurization Systems Market Size and Forecast, by Type (2022-2029) 7.1.1. Wet FGD System 7.1.2. Dry & Semi-Dry FGD System 7.2. Europe Flue Gas Desulfurization Systems Market Size and Forecast, by Installation (2022-2029) 7.2.1. Greenfield 7.2.2. Brownfield 7.3. Europe Flue Gas Desulfurization Systems Market Size and Forecast, by End-User (2022-2029) 7.3.1. Power Generation 7.3.2. Chemical 7.3.3. Iron & Steel 7.3.4. Cement Manufacturing 7.3.5. Others 7.4. Europe Flue Gas Desulfurization Systems Market Size and Forecast, by Country (2022-2029) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Flue Gas Desulfurization Systems Market Size and Forecast (by Value USD) 8.1. Asia Pacific Flue Gas Desulfurization Systems Market Size and Forecast, by Type (2022-2029) 8.1.1. Wet FGD System 8.1.2. Dry & Semi-Dry FGD System 8.2. Asia Pacific Flue Gas Desulfurization Systems Market Size and Forecast, by Installation(2022-2029) 8.2.1. Greenfield 8.2.2. Brownfield 8.3. Asia Pacific Flue Gas Desulfurization Systems Market Size and Forecast, by End-User (2022-2029) 8.3.1. Power Generation 8.3.2. Chemical 8.3.3. Iron & Steel 8.3.4. Cement Manufacturing 8.3.5. Others 8.4. Asia Pacific Flue Gas Desulfurization Systems Market Size and Forecast, by Country (2022-2029) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa Flue Gas Desulfurization Systems Market Size and Forecast (by Value USD) 9.1. Middle East and Africa Flue Gas Desulfurization Systems Market Size and Forecast, by Type (2022-2029) 9.1.1. Wet FGD System 9.1.2. Dry & Semi-Dry FGD System 9.2. Middle East and Africa Flue Gas Desulfurization Systems Market Size and Forecast, by Installation (2022-2029) 9.2.1. Greenfield 9.2.2. Brownfield 9.3. Middle East and Africa Flue Gas Desulfurization Systems Market Size and Forecast, by End-User (2022-2029) 9.3.1. Power Generation 9.3.2. Chemical 9.3.3. Iron & Steel 9.3.4. Cement Manufacturing 9.3.5. Others 9.4. Middle East and Africa Flue Gas Desulfurization Systems Market Size and Forecast, by Country (2022-2029) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Flue Gas Desulfurization Systems Market Size and Forecast (by Value USD) 10.1. South America Flue Gas Desulfurization Systems Market Size and Forecast, by Type (2022-2029) 10.1.1. Wet FGD System 10.1.2. Dry & Semi-Dry FGD System 10.2. South America Flue Gas Desulfurization Systems Market Size and Forecast, by Installation (2022-2029) 10.2.1. Greenfield 10.2.2. Brownfield 10.3. South America Flue Gas Desulfurization Systems Market Size and Forecast, by End-User (2022-2029) 10.3.1. Power Generation 10.3.2. Chemical 10.3.3. Iron & Steel 10.3.4. Cement Manufacturing 10.3.5. Others 10.4. South America Flue Gas Desulfurization Systems Market Size and Forecast, by Country (2022-2029) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. Lockheed Martin Corporation 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Leonardo SpA 11.3. Thales SA 11.4. Raytheon Technologies Corp 11.5. Altitude Angel Ltd 11.6. Frequentis AG 11.7. AirMap Inc [Santa Monica, California, U.S.] 11.8. Unify NV 11.9. ANRA Technologies 11.10. OneSky Systems Inc 11.11. Airbus SE 11.12. Terra Drone Corporation 11.13. Droniq GmbH 11.14. PrecisionHawk Inc 11.15. Intelligent Automation 11.16. Analytical Graphics 11.17. SZ DJI Technology Co., Ltd. 11.18. Harris Corporation 11.19. Nova Systems 12. Key Findings 13. Industry Recommendation