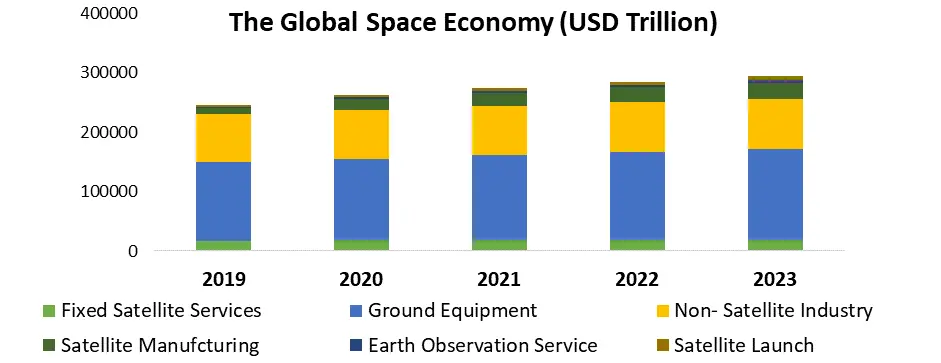

The Space Exploration And Tourism Market size was valued at USD 98.3 Million in 2022 and the total Space Exploration And Tourism Market revenue is expected to grow at a CAGR of 41.2%from 2023 to 2029, reaching nearly USD 11033.66 Million. The growing popularity of the Space Exploration And Tourism Market is due to Its opportunity for anyone to experience something trul y unique, awe-inspiring and life-changing. The appeal of space tourism is undeniable, a chance to see the world from a completely different perspective, feel weightlessness and witness the planet's beauty from a distance. According to recent surveys, interest in space tourism is not limited to the wealthy, with 38% of luxury travellers expressing interest in taking a space flight for recreational purposes. Among luxury travellers aged 16-34, that figure rises to an astounding 58%.to preserve the texture and taste of food, making them more attractive to consumers. The Space Exploration And Tourism Market industry is growing quickly due to the new start-ups driving the trend. The start-ups have spent billions of dollars on the creation of new space tourism services and technologies. Space Perspective, Blue Origin, Virgin Galactic, and SpaceX are a few of the start-ups with the highest investment levels in the space tourism industry. The need for space hotels and space tourism simulators is rising, and these businesses are creating orbital and suborbital space tourism trips. Investors are currently focusing on space developments in low earth orbit, although interest in lunar and other orbital regimes is growing. The initiative is being explored in lunar and planetary orbits by a wide spectrum of market participants in space tourism. They are increasingly investing in R&D for sophisticated technologies, robots, infrastructure, communication, and in-space transportation. The paper on space tourism included in-depth analyses of space investments, space R&D, the future of air travel, and pricing trend analysis.Space Exploration And Tourism Market: A Comprehensive Analysis of the Top Players, Key Drivers, Trends, and Opportunities bundle reports

1. North America Space Tourism Market (Single User $ 2900) 2. Asia Pacific Space Tourism Market (Single User $ 2900) 3. Europe Space Tourism Market (Single User $ 2900) 4. Middle East and Africa Tourism Market (Single User $ 2900) 5. Space Tourism Investment (Single User $ 2900)What does a bundle report provide?

1. Accessing the in-depth insight from the ‘Space Exploration And Tourism Market report will provide customers with a comprehensive understanding of the market dynamics, key trends, and future prospects in the Space Exploration And Tourism industry. It offers a detailed analysis of its history, current state, key players and what the future may hold. benefits and challenges of space tourism, its impact on society and the economy, and the ethical and environmental concerns during the forecast period, including demand, drivers, growth stimulators, spending patterns, and modernization trends across different regions. The report also covers recent developments, industry challenges, regional highlights, and major programs, providing a holistic view of the market. 2. The ‘Space Exploration And Tourism Market’ report stands out from other reports in the market due to several factors: • Exclusive Market Insights: The report provides exclusive and in-depth insights into the Space Exploration And Tourism Market, presenting a comprehensive analysis of market trends, growth drivers, challenges, and opportunities. It delves into specific aspects of the market, offering valuable information not readily available in other reports. • Unbiased and Objective Analysis: The report maintains an unbiased and objective approach to analyzing the Space Exploration And Tourism Market. It avoids promotional or biased content, ensuring that the information and conclusions presented are based solely on rigorous research and analysis. • Extensive Primary Research: The report incorporates extensive primary research, including interviews and surveys with industry experts, key stakeholders, and market participants. This primary research adds depth and credibility to the report's findings and enhances its uniqueness in comparison to reports relying solely on secondary research. • Strategy & Corporate Finance: Growth strategies, transformations, and assessment of market landscape • Emerging Market Trends: The report identifies and explores emerging trends and developments within the Space Exploration And Tourism Market. • Regional and Global Perspective: The report offers a comprehensive analysis of the Space Exploration And Tourism Market at both regional and global levels. It assesses market dynamics, consumer behaviour, and regulatory frameworks across different regions, providing a nuanced understanding of the market's regional variations and global impact. • Impact of COVID-19: The report addresses the specific impact of the COVID-19 pandemic on the Space Exploration And Tourism Market. It examines the changing consumer behaviour, supply chain disruptions, and evolving industry strategies during the pandemic. This analysis sets the report apart by providing timely and relevant insights for businesses navigating the post-pandemic landscape. • Strategic Recommendations: The report goes beyond data analysis by providing strategic recommendations and actionable insights for businesses operating in or entering the Space Exploration And Tourism Market. These recommendations offer practical guidance for market players to optimize their operations, capitalize on growth opportunities, and overcome challenges. • Visual Representation and Data Visualization: The report utilizes visual elements such as charts, graphs, and infographics to enhance data presentation and interpretation. This visual representation not only improves the overall readability of the report but also facilitates a better understanding of complex market trends and statistical data. • Customizable Format: The report offers customizable options to cater to specific client requirements. It can be tailored to focus on specific market segments, regions, or other variables of interest. This flexibility sets it apart by providing clients with tailored insights aligned with their business objectives.To know about the Research Methodology :- Request Free Sample Report

Report 1: North America Space Tourism Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts.

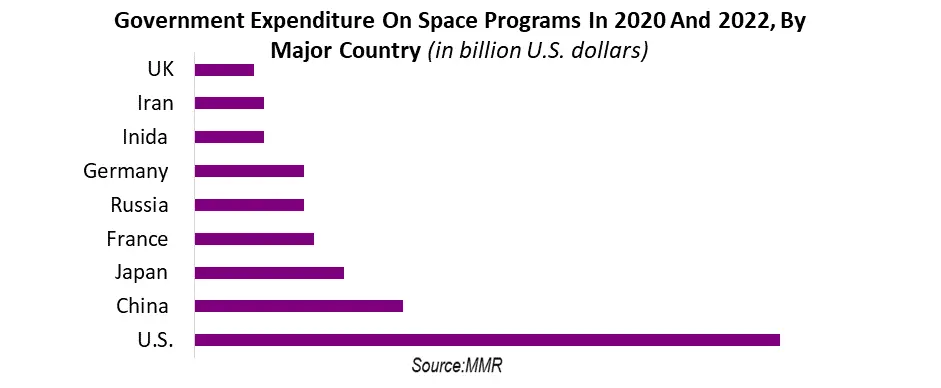

The North America Space Exploration And Tourism Market size was valued at USD 45.7095 Million in 2022 and the total North America Space Exploration And Tourism Market revenue is expected to grow at a CAGR of 46.50%from 2023 to 2029, reaching nearly USD 993.95 Million. North America is leading the way in the Space Exploration And Tourism Market, with a well-established infrastructure and an extensive research and development base. Europe, although behind America in the market, is also showing potential in the space tourism industry, with the U.K. government promising £2 million to fund horizontal space launches from the country. The U.K. has emerged as a region leader for spaceports, which could then transition into more opportunities for space tourism in Europe. However, the COVID-19 pandemic and the war in Ukraine have been detrimental to building the European Space Exploration And Tourism Market, with space activities and funding being diverted elsewhere. To keep up with the US, Europe needs to scale launch capabilities. on June 7, NASA announced its strategy to open up the International Space Station (ISS) for commercial business as part of its drive to accelerate a thriving commercial economy in LEO. Included in NASA’s sweeping announcement was welcoming the first non-astronauts onto the space station for week-long stays as early as next year at a price tag of $50 million per rider to land on the station, and $35,000 per night to stay there.

Report 2: Asia Pacific Space Tourism Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts.

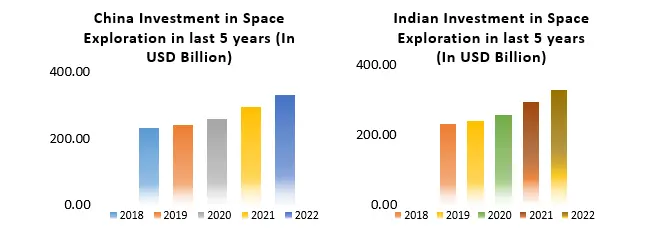

The Asia Pacific Space Exploration And Tourism Market size was valued at USD 19.90575Million in 2022 and the total Asia Pacific Space Exploration And Tourism Market revenue is expected to grow at a CAGR of 20.25%from 2023 to 2029, reaching nearly USD 87.03 Million. China, India, and Japan have all totally accepted the New Space Age to drive Space Exploration And Tourism Market. These three countries have each experienced an increase in globally competitive organizations that can readily compete with their Western counterparts and have already unveiled aggressive growth goals. Japanese Astroscale and Space, Chinese LandSpace and Galactic Energy, and Indian SatSure and Astrome Technologies are a few of these well-funded start-ups. Experts estimate that there are currently about 50 significant New Space startup space companies in Japan, 120 in China, and 50 in India. Along with the creation of new space-related companies, China, Japan, and India have all experienced significant investor profile diversification. While huge Asian governments have traditionally invested heavily in the space company, venture capital companies and non-space giant enterprises have lately made an impressive comeback. Leaders in their fields, such All-Nippon Airlines and Shimizu Corporation in Japan or high-tech massive corporations Tencent, Alibaba, and Huawei in China, have begun to invest considerably in space organizations and commit large resources to internal space-related initiatives.

Report 3: Europe Space Tourism Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts.

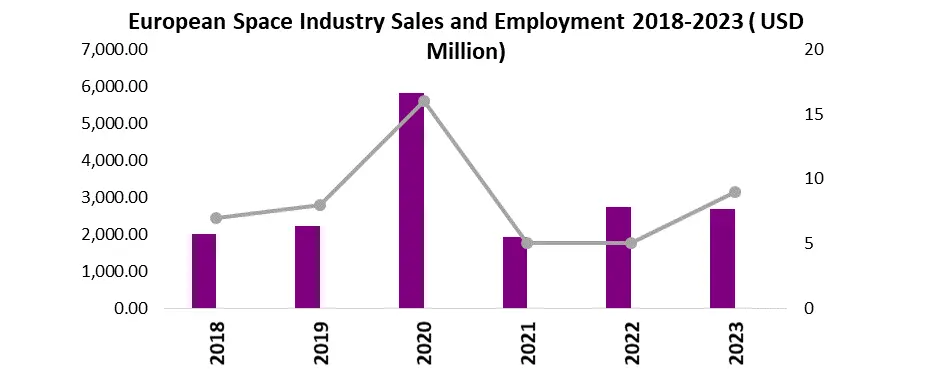

The Europe Space Exploration And Tourism Market size was valued at USD 35.8795 million in 2022 and the total Europe Space Exploration And Tourism Market revenue is expected to grow at a CAGR of 36.50%from 2023 to 2029, reaching nearly USD 432.42 Million. In Europe, the Space Exploration And Tourism Market is expected to be dominated by France and the UK during the forecast period. In the already competitive race to space between ISRO, NASA, and Elon Musk's SpaceX, a French startup market player is presently stepping up their competition. A customer would be able to take a balloon journey into space starting in 2025 for a charge starting at $132,000 (about Rs 1 crore), and then have a gourmet meal there. Six guests will be carried on 60 trips a year by the owner of the French company, which aims to stimulate the European Space Exploration And Tourism Market. The leading market participants want to provide an experience that elevates the best French cuisine, exceptional wine, and design to the absolute highest levels for those who can afford the six-figure ticket. The European Space Programme implements space activities in the fields of Earth Observation, Satellite Navigation, Connectivity, Space Research and Innovation. It encourages and supports innovation and competitiveness through investments in critical infrastructures and disruptive technologies to drive the Space Exploration And Tourism Market demand globbaly. In 2022, the European space sector successfully delivered 96 spacecraft to the launch pad, of which 13 were large satellites and 83 were small satellites. It also delivered 5 launchers for operations in Kourou.

Report 4: Middle East and Africa Space Tourism Market Size, Trend Analysis by Sector (Offering, Product Type, Application) and Forecasts.

The Middle East & Africa Space Exploration And Tourism Market size was valued at USD 13.3688 million in 2022 and the total Middle East & Africa Space Exploration And Tourism Market revenue is expected to grow at a CAGR of 13.60%from 2023 to 2029, reaching nearly USD 37.08 Million. The Middle East and Africa are witnessing a significant transformation of strategic drives in the space sector across the region, such as Saudi Arabia's evolving guidance and the UAE's remarkable Emirates Mars Mission in 2021 and the deployment of the Hope probe, to drive the Middle East & Africa Space Exploration And Tourism Market. The Middle East & Space Exploration And Tourism Market will increase primarily as a result of joint investments made by the public sector, foreign original equipment manufacturers (OEMs), and local inustry. Satellite launches, space tourism, earth observations, satellite communication, space research & development, space mining, space exploration, space debris, and manufacturing will be the key areas of growth in terms of subsectors, and satellites alone are predicted to account for 59% of the growth of the global Space Exploration And Tourism industry.While the bulk of space tourism industry activities is centred in the United States, several countries are looking to tap into the market. Virgin Galactic has forged agreements with international partners in Italy and the United Arab Emirates (UAE) to explore opportunities to fly from their spaceports and provide local access to the microgravity environment for their science, education and technology sectors.

Report 5: Space Tourism Investment Promises Extraordinary

According to Space Capital, $177.7 billion in equity was invested in the space economy over the course of the previous several years. It was dispersed across 1,343 separate space enterprises, 75% of which were American and Chinese businesses. The next countries were Singapore (6%), Britain (4%), Indonesia (3%) and India (3%), in that order. In 2020, a record-breaking $8.9 billion was spent on infrastructure (launch, satellites, logistics, etc.). The space industry includes more than simply tourists, spacecraft, and rockets. The majority of money used annually to fuel the market for space investment in space tourism are contributed by companies engaged in applications like positioning, navigation, and earth observation.

Space Exploration And Tourism Market Market Scope: Inquire before buying

Space Exploration And Tourism Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 698.3 Mn. Forecast Period 2023 to 2029 CAGR: 41.2% Market Size in 2029: US $ 11033.66 Mn. Segments Covered: by Type Outlook Orbital Sub-Orbital Others by End-User Government Commercial Other Space Exploration And Tourism Market Key Players:

1. 0-G Launch 2. Air Zero G 3. Airbus 4. Aurora Space 5. Axiom Space 6. Beijing Interstellar Glory 7. Beijing Lingkong Tianxing Technology Co. 8. Blue Origin 9. Canadian Space Agency (CSA) 10. Centre nationale d’études spatiales (CNES) 11. China National Space Agency (国家航天局) 12. Collins Aerospace 13. Defense Advanced Research Projects Agency (DARPA) 14. Deutsches Zentrum für Luft- und Raumfahrt (DLR) 15. EOS-X Space 16. European Space Agency (ESA) 17. Incredible Adventures 18. Indian Space Research Organisation (ISRO) 19. International Space Station (ISS) 20. I-space 21. Japan Aerospace Exploration Agency (JAXA) 22. Mohammed bin Rashid Space Centre (MBRSC) 23. Nanoracks 24. National Aeronautics and Space Administration (NASA) 25. Northrop Grumman Corporation (NGC) 26. Novespace 27. Orbite 28. PD Aerospace 29. Radian Space 30. Rocket Lab 31. ROSCOMOS 32. Saudi Space Commission 33. Sierra Space 34. Space Adventures 35. Space Force 36. Space Perspective 37. SpaceX 38. The Boeing Company 39. Türkiye Uzay Ajansı (TUA) 40. Vegitel 41. Virgin Galactic 42. Zero G Corporation 43. Zero2Infinity.

1. Space Exploration And Tourism Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Space Exploration And Tourism Market: Dynamics 2.1. Space Exploration And Tourism Market Trends by Region 2.1.1. North America Space Exploration And Tourism Market Trends 2.1.2. Europe Space Exploration And Tourism Market Trends 2.1.3. Asia Pacific Space Exploration And Tourism Market Trends 2.1.4. Middle East and Africa Space Exploration And Tourism Market Trends 2.1.5. South America Space Exploration And Tourism Market Trends 2.2. Space Exploration And Tourism Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Space Exploration And Tourism Market Drivers 2.2.1.2. North America Space Exploration And Tourism Market Restraints 2.2.1.3. North America Space Exploration And Tourism Market Opportunities 2.2.1.4. North America Space Exploration And Tourism Market Challenges 2.2.2. Europe 2.2.2.1. Europe Space Exploration And Tourism Market Drivers 2.2.2.2. Europe Space Exploration And Tourism Market Restraints 2.2.2.3. Europe Space Exploration And Tourism Market Opportunities 2.2.2.4. Europe Space Exploration And Tourism Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Space Exploration And Tourism Market Drivers 2.2.3.2. Asia Pacific Space Exploration And Tourism Market Restraints 2.2.3.3. Asia Pacific Space Exploration And Tourism Market Opportunities 2.2.3.4. Asia Pacific Space Exploration And Tourism Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Space Exploration And Tourism Market Drivers 2.2.4.2. Middle East and Africa Space Exploration And Tourism Market Restraints 2.2.4.3. Middle East and Africa Space Exploration And Tourism Market Opportunities 2.2.4.4. Middle East and Africa Space Exploration And Tourism Market Challenges 2.2.5. South America 2.2.5.1. South America Space Exploration And Tourism Market Drivers 2.2.5.2. South America Space Exploration And Tourism Market Restraints 2.2.5.3. South America Space Exploration And Tourism Market Opportunities 2.2.5.4. South America Space Exploration And Tourism Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Space Exploration And Tourism Industry 2.8. Analysis of Government Schemes and Initiatives For Space Exploration And Tourism Industry 2.9. Space Exploration And Tourism Market Trade Analysis 2.10. The Global Pandemic Impact on Space Exploration And Tourism Market 3. Space Exploration And Tourism Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 3.1.1. Outlook Orbital 3.1.2. Sub-Orbital 3.1.3. Others 3.2. Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 3.2.1. Government 3.2.2. Commercial 3.2.3. Other 3.3. Space Exploration And Tourism Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Space Exploration And Tourism Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 4.1.1. Outlook Orbital 4.1.2. Sub-Orbital 4.1.3. Others 4.2. North America Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 4.2.1. Government 4.2.2. Commercial 4.2.3. Other 4.3. North America Space Exploration And Tourism Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 4.3.1.1.1. Outlook Orbital 4.3.1.1.2. Sub-Orbital 4.3.1.1.3. Others 4.3.1.2. United States Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 4.3.1.2.1. Government 4.3.1.2.2. Commercial 4.3.1.2.3. Other 4.3.2. Canada 4.3.2.1. Canada Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 4.3.2.1.1. Outlook Orbital 4.3.2.1.2. Sub-Orbital 4.3.2.1.3. Others 4.3.2.2. Canada Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 4.3.2.2.1. Government 4.3.2.2.2. Commercial 4.3.2.2.3. Other 4.3.3. Mexico 4.3.3.1. Mexico Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 4.3.3.1.1. Outlook Orbital 4.3.3.1.2. Sub-Orbital 4.3.3.1.3. Others 4.3.3.2. Mexico Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 4.3.3.2.1. Government 4.3.3.2.2. Commercial 4.3.3.2.3. Other 5. Europe Space Exploration And Tourism Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 5.1. Europe Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 5.3. Europe Space Exploration And Tourism Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 5.3.1.2. United Kingdom Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 5.3.2. France 5.3.2.1. France Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 5.3.2.2. France Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 5.3.3.2. Germany Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 5.3.4.2. Italy Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 5.3.5.2. Spain Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 5.3.6.2. Sweden Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 5.3.7.2. Austria Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 5.3.8.2. Rest of Europe Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 6. Asia Pacific Space Exploration And Tourism Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 6.2. Asia Pacific Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 6.3. Asia Pacific Space Exploration And Tourism Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 6.3.1.2. China Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 6.3.2.2. S Korea Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 6.3.3.2. Japan Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.4. India 6.3.4.1. India Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 6.3.4.2. India Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 6.3.5.2. Australia Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 6.3.6.2. Indonesia Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 6.3.7.2. Malaysia Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 6.3.8.2. Vietnam Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 6.3.9.2. Taiwan Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 6.3.10.2. Rest of Asia Pacific Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 7. Middle East and Africa Space Exploration And Tourism Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 7.2. Middle East and Africa Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 7.3. Middle East and Africa Space Exploration And Tourism Market Size and Forecast, by Country (2022-2029) 7.3.1. South Africa 7.3.1.1. South Africa Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 7.3.1.2. South Africa Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 7.3.2. GCC 7.3.2.1. GCC Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 7.3.2.2. GCC Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 7.3.3. Nigeria 7.3.3.1. Nigeria Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 7.3.3.2. Nigeria Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 7.3.4.2. Rest of ME&A Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 8. South America Space Exploration And Tourism Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 8.2. South America Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 8.3. South America Space Exploration And Tourism Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 8.3.1.2. Brazil Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 8.3.2.2. Argentina Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Space Exploration And Tourism Market Size and Forecast, by Type Outlook (2022-2029) 8.3.3.2. Rest Of South America Space Exploration And Tourism Market Size and Forecast, by End-User (2022-2029) 9. Global Space Exploration And Tourism Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Space Exploration And Tourism Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. 0-G Launch 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Air Zero G 10.3. Airbus 10.4. Aurora Space 10.5. Axiom Space 10.6. Beijing Interstellar Glory 10.7. Beijing Lingkong Tianxing Technology Co. 10.8. Blue Origin 10.9. Canadian Space Agency (CSA) 10.10. Centre nationale d’études spatiales (CNES) 10.11. China National Space Agency (国家航天局) 10.12. Collins Aerospace 10.13. Defense Advanced Research Projects Agency (DARPA) 10.14. Deutsches Zentrum für Luft- und Raumfahrt (DLR) 10.15. EOS-X Space 10.16. European Space Agency (ESA) 10.17. Incredible Adventures 10.18. Indian Space Research Organisation (ISRO) 10.19. International Space Station (ISS) 10.20. I-space 10.21. Japan Aerospace Exploration Agency (JAXA) 10.22. Mohammed bin Rashid Space Centre (MBRSC) 10.23. Nanoracks 10.24. National Aeronautics and Space Administration (NASA) 10.25. Northrop Grumman Corporation (NGC) 10.26. Novespace 10.27. Orbite 10.28. PD Aerospace 10.29. Radian Space 10.30. Rocket Lab 10.31. ROSCOMOS 10.32. Saudi Space Commission 10.33. Sierra Space 10.34. Space Adventures 10.35. Space Force 10.36. Space Perspective 10.37. SpaceX 10.38. The Boeing Company 10.39. Türkiye Uzay Ajansı (TUA) 10.40. Vegitel 11. Key Findings 12. Industry Recommendations 13. Space Exploration And Tourism Market: Research Methodology 14. Terms and Glossary