The Asia Pacific Space Tourism Market size was valued at USD 19.90575Million in 2022 and the total Asia Pacific Space Tourism Market revenue is expected to grow at a CAGR of 20.25%from 2023 to 2029, reaching nearly USD 87.03 Million. Japan, India and China have fully entered into the New Space era. Each of these three countries has witnessed the emergence of internationally competitive actors, easily rivalling their Western counterparts and having already unfolded aggressive expansion strategies. Among these well-funded start-ups can be counted as the Japanese Astroscale and ispace, the Chinese LandSpace and Galactic Energy or the Indian SatSure and Astrome Technologies drive the market demand. The commercialization of space is rapidly growing, generating opportunities for market players and Asian governments. The global space economy has developed to nearly $470 billion in 2021, with the Asia-Pacific region emerging as a significant Asia-Pacific market player. Countries like India, Japan, Australia and South Korea are creating innovations in the space industry and collaborating with the United States to drive the Asia Pacific Space Tourism Market. The lack of regulation and governance in the space industry poses challenges for governments and policymakers, which restrain the space tourism market growth during the forecast period. Private companies, particularly "NewSpace" entities like SpaceX, are primarily the way in space launches and services such as satellite collections for internet connectivity and space tourism. While these advances offer electrifying opportunities, they also advance concerns. The growing amount of space debris poses risks both in orbit and on Earth's surface, which hamper the Asia Pacific Space Tourism Market growth during the forecast period. Customers looking for space-related products and services may encounter confusion about their eco-friendly impact and how they pay to the future of humanity. The influence dynamics in space are shifting, with China's Tiangong space station and emerging data-related concerns with technologies like Hewlett Packard Enterprise's Spaceborne Computer-2. The environmental impact of space activities, including rocket launches and space tourism flights, is also a pressing issue, with significant carbon dioxide emissions and expected harmful effects on the environment. The report covered a detailed analysis of the Asia Pacific Space Tourism Market new public schemes, new entrants, new industrial set-ups, and new private investments. The detailed combination of these trends is leading to a deep transformation of the space sector characterised by a growing investment, an increasingly more prominent involvement of private actors and the emergence of a more business-oriented leadership.Asia Pacific Space Tourism Market Snapshot

To know about the Research Methodology :- Request Free Sample Report

Asia Pacific Space Tourism Market Dynamics:

Governmental initiatives to foster the development of New Space In the Asian region, there corroborates to be rising public awareness about the importance of the government’s role in supporting the growth of a robust and commercially competitive space industry. The various contributions compiled in this report show a diversity of measures taken by Asian governments to support a developed and commercially competitive space industry. In China, the driving factor of the Asia Pacific Space Tourism Market is the emergence of New Space companies has been the reduction of private investment rules in the space sector in 2014 by the “The State Council's Guidelines on Investment and Financing Mechanism Encouraging Social Investment in Innovation and Key Areas".7F 8 Whereas, before 2014, savings were primarily coming from the State, from 2015 to 2019, the number of Chinese Asia Pacific Space Tourism Market players investing in space more than quadrupled (from 24 to 100).8F 9 The focus of the Chinese government on building a robust commercial space ecosystem was repeated and reinforced as part of the National Development and Reform Commission’s 2015 “National Civil Space Infrastructure Medium and Long-Term Development Plan of 2015-2025”. The primary role of ISRO at the same time as the lead national space R&D organisation and the main regulatory agency, is a double-edged sword for the Indian space industry. Benefitting from ISRO’s strength and stability while ensuring a free and open domestic space Asia Pacific Space Tourism Market is at the centre of Indian national space policies to drive the Asia Pacific Space Tourism Market. In particular, the two draft policies released in 2020 provide a bright outlook on the future of the Indian space industry. The “Spacecom Policy, 2020” aims to support the emergence of businesses focussing on setting up a communication infrastructure in geostationary and low-Earth orbits, as well as necessary ground stations. Then, the “Space-Based Remote Sensing Policy of India, 2020” proposes to simplify access to satellite remote sensing data by clarifying data sensitivity levels and related licensing processes. In South Korea, the government enacted several support policies, including a Space Industry Strategy that aims to expand the size of the space industry from 2.7 trillion won in 2016 to 3.7 trillion won13F 14 in 2021 by expanding the private-led space industry market, creating new industries to grow the Asia Pacific Space Tourism Market, strengthening the global competitiveness of space companies. In Malaysia, the government has released a set of policies and strategies for the development of an indigenous space industry. The “Malaysia Aerospace Industry Blueprint 2030”, the “Malaysia Space Exploration 2030” and the “National Space Policy 2030” have outlined a comprehensive ecosystem development plan aiming for the country to “be one of the aerospace nations by 2030”, by relying on support to both the upstream and downstream segments of the space economy, on human capital development and on international cooperationGovernment Initiative for Asian Countries in Asia Pacific Space Tourism Market 2020 to 2023

Examine collaboration and competition in space developments among Japan, China Australia, India and other key countries The Asia Pacific space tourism industry is driven by China's highly competitive market activities, which use the United States as their standard rather than other Asian space powers. Beijing is simultaneously promoting its creative civil space initiatives as cooperative, although China-led. This makes China appear less aggressive and positions it as an alternative to the United States for countries that want to participate in space exploration but require a more advanced partner to do so. This plan to launch individuals is not an independent accomplishment; rather, it is a component of China's human space exploration program, which aims to build and run a space station in low Earth orbit. It is planning to complete its construction by 2024 whereupon it could emerge as the sole operating space station, given the current uncertainty amongst ISS partners in funding that space station to 2024 and beyond, which drive the Asia Pacific Space Tourism Market growth. By offering access to its space station to fellow states, once built, China is trying to enhance its stakes and reputation in the international space technology arena. Asia Pacific Space Tourism Market is driven by space agencies of Russia and Europe have which already developed close ties with China in this area and have also carried out many tests involving human space exploration. Although these conversations are still in the planning stage, the trio also agreed that sending people back to the Moon was important. However, subject to Chinese official sanction, Chinese space experts have stated that they are aiming for manned lunar landings by 2036. Such an accomplishment would strengthen China's leadership in space exploration and show a significant improvement over India and Japan. A possible exception is India, which might privately be hoping it can catch up eventually. India is independent as a matter of principle. It punches well above its weight in terms of both the country’s overall development level and what it achieves with a small budget, but it’s not generally on the cutting edge the way China and Japan are. India will build a ground station in Vietnam to help countries from the region gain quick and secured access to its satellite data gathered across the region for quick response during national disasters. Japan helped Vietnam conduct experiments on board the ISS, trained its human resources, organised the 20th Asia-Pacific Regional Space Agency Forum (APSRAF) in 2013 and helped it launch a small satellite. Likely, Japan will further expand its cooperation with other South East Asian countries. Although India and Japan lack strength in demonstrating complex robotic and human space missions, they possess the determination and commitment towards using space technology for the benefit of human development, a perspective shared by many developing countries. Japan and NASA and ESA work very closely on space flight. JAXA is a very useful partner because it is a key component of the International Space Station and completely supports the Artemis lunar program. At the same time, Japan has developed its own market niche in cutting-edge asteroid missions that will promote growth in the Asia Pacific Space Tourism Market and open doors for Japanese space tourism businesses. Japan is likely seen as South Korea's counterpart and standard. One area of cutting-edge technology where South Korea falls behind is space. It just began an intensive attempt to catch up, although it is far behind and has a limited budget. The competitiveness amongst Asia Pacific Space Tourism Market competitors was thoroughly examined in the Asia Pacific Space Tourism Market report.

Asia Pacific Space Tourism Market Segment

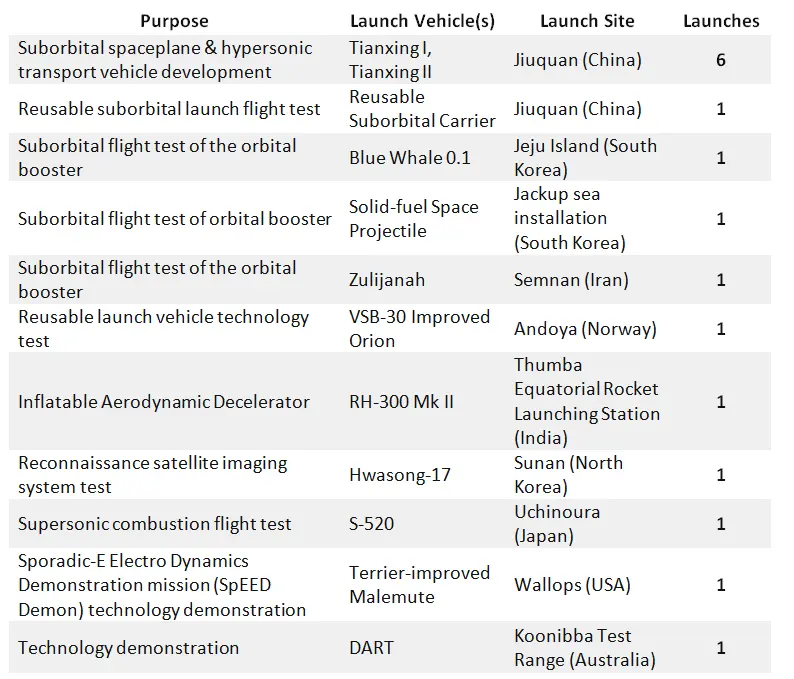

By Type Outlook: the Asia Pacific Space Tourism Market is segmented into Orbital, Sub-Orbital and Other. Sub-orbital type outlook held the largest market share in 2022. Companies and government agencies in Iran, South Korea and China have launched a total of 10 suborbital rockets to support the advancement of multiple new launch vehicles during the first eight months of 2022. During the forecast period, there were two suborbital launches of future orbital boosters in South Korea, which drive the Asia Pacific Space Tourism Market. Iran also showed a suborbital test of an orbital rocket. India launched an inflatable aerodynamic decelerator to recover spent rocket stages and land spacecraft on other creations. A total of 16 out of 34 suborbital launches that were not focused on missile tests were focused on emerging new technologies and launch vehicles. Seven launches were directed in China, two in South Korea, and one apiece in Australia, Japan, Iran, North Korea, Norway, India and the United States. Asia Pacific Space Tourism Market players’ focus is to develop a suborbital space plane capable of carrying tourists and microgravity trials on suborbital flights. A later alternative would be a high-speed transport that would fly between distant locations on Earth in less than two hours. On Sept. 3, the Indian Space Research Organisation (ISRO) launched an inflatable aerodynamic decelerator (IAD) aboard an RH-300 Mk II sounding rocket from the Thumba Equatorial Rocket Launching Station.Suborbital Launches for Launch Vehicle & Technology Development - January – Sept. 10, 2022

Asia Pacific Space Tourism Market Regional Insights:

China is expected to dominate the Asia Pacific Space Tourism Market during the forecast period. China has made significant trends in the space industry and has expressed interest in space tourism. The country focused on developing its own space tourism industry and has plans for suborbital and orbital flights, which increases demand for the space tourism market. Chinese companies like Space Adventures and Galactic Energy are working on commercial spaceflight projects to drive the Asia Pacific Space Tourism Market demand globally. Government expenditure on space programs in 2020 and 2022, by major country(in billion U.S. dollars)Government expenditure on space programs in 2020 and 2022, by major country (in billion U.S. dollars)

India and Japan, with their remarkable space capabilities, are unable to challenge China’s dominance in the robotic exploration of the Solar System. China’s Change robotic lunar exploration programme is technically and programmatically superior to India’s ad hoc lunar and Mars robotic missions, or Japan’s exploration of the Moon and near-Earth objects. With the help of the Chang’e programme, China is not only copying the achievements of the Cold War space competitors but is generating several space firsts independently to drive the China space tourism market. The planned Chang’e-4 mission to land and explore the surface on the far side of the Moon is an example. China is also allowing for challenging Indian and Japanese deep space missions by demonstrating complex mission objectives on Mars and beyond. These accomplishments will get hard China’s respect in the international arena as a technologically advanced nation as well as help the Chinese Communist Party enhance its standing in the eyes of Chinese citizens to increase demand for the Asia Pacific Space Tourism Market. However, China struggles to maintain the desired positive momentum owing to its overall security-driven attitude towards outer space. It considers outer space as a high ground that needs to be clashed for and dominated to ensure winning wars under the conditions of “informatisation”. This perspective has led to China’s demonstration of a destructive anti-satellite (ASAT) test in 2007 that added thousands of debris to an already overfilled space environment. Some of the like-minded countries such as India and Japan should reach out to both established and emerging space players and transfer the urgent need to support peaceful uses of outer space. Efforts to revitalise the global order on space safety, sustainability and security need to be sustained and supported. Meanwhile, India and Japan have started various programmes to allocate benefits from outer space exploration to countries that have created method space technology as indispensable for economic development to increase the Asia Pacific Space Tourism Market demand during the forecast period. India has initiated the construction of a communications satellite that can be used by all the countries in the South Asian Association for Regional Cooperation (SAARC) that includes Bangladesh, Afghanistan and Sri Lanka. It has launched civilian, commercial and academic satellites for many South East Asian countries like Indonesia and Singapore.

Asia Pacific Space Tourism Market Scope: Inquire Before Buying

Asia Pacific Space Tourism Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 19.9057 Mn. Forecast Period 2023 to 2029 CAGR: 20.25% Market Size in 2029: US $ 87.03 Mn. Segments Covered: by Type Outlook Orbital Sub-Orbital Others by End User Government Commercial Other Asia Pacific Space Tourism Market by Country:

1. China 2. S Korea 3. Japan 4. India 5. Australia 6. Indonesia 7. Malaysia 8. Vietnam 9. Taiwan 10. Bangladesh 11. Pakistan 12. Rest of Asia PacificAsia Pacific Space Tourism Market Key Players:

1. Interstellar Technologies Inc. (Japan) 2. PD Aerospace (Japan) 3. Space Adventures Asia (China) 4. Galactic Energy (China) 5. LinkSpace (China) 6. Tianzhou-1 Aerospace Science and Technology Co., Ltd. (China) 7. Sky and Space Global (Australia) 8. Gilmour Space Technologies (Australia)FAQs:

1. What are the growth drivers for the Asia Pacific Space Tourism Market? Ans. The growing popularity of sub-orbita travel is to be the major driver for the Asia Pacific Space Tourism Market. 2. What is the major restraint for the Asia Pacific Space Tourism Market growth? Ans. Growing environmental negative impact are expected to be the major restraining factor for the Asia Pacific Space Tourism Market growth. 3. Which country is expected to lead the global Asia Pacific Space Tourism Market during the forecast period? Ans. China is expected to lead the Asia Pacific Space Tourism Market during the forecast period. 4. What is the projected Europe Asia Pacific Space Tourism Market size & growth rate of the Asia Pacific Space Tourism Market? Ans. The Asia Pacific Space Tourism Market size was valued at USD 19.90575Million in 2022 and the total Anime revenue is expected to grow at a CAGR of 20.25% from 2023 to 2029, reaching nearly USD 87.03 Million. 5. What segments are covered in the Asia Pacific Space Tourism Market report? Ans. The segments covered in the Asia Pacific Space Tourism Market report are Type Outlook, End-User type, and Region

1. Asia Pacific Space Tourism Market: Research Methodology 2. Asia Pacific Space Tourism Market: Executive Summary 3. Asia Pacific Space Tourism Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Asia Pacific Space Tourism Market: Dynamics 4.1. Market Trends by Country 4.2. Market Drivers by Country 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape 5. Asia Pacific Space Tourism Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Asia Pacific Space Tourism Market Size and Forecast, by Type Outlook (2022-2029) 5.1.1. Orbital 5.1.2. Sub-Orbital 5.1.3. Others 5.2. Asia Pacific Space Tourism Market Size and Forecast, by End-User(2022-2029) 5.2.1. Government 5.2.2. Commercial 5.2.3. Other 5.3. Asia Pacific Asia Pacific Space Tourism Market Size and Forecast, by Country (2022-2029) 5.3.1. Asia Pacific 5.3.2. China 5.3.3. S Korea 5.3.4. Japan 5.3.5. India 5.3.6. Australia 5.3.7. Indonesia 5.3.8. Malaysia 5.3.9. Vietnam 5.3.10. Taiwan 5.3.11. Bangladesh 5.3.12. Pakistan 5.3.13. Rest of Asia Pacific 6. Company Profile: Key players 6.1. Interstellar Technologies Inc. (Japan) 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. PD Aerospace (Japan) 6.3. Space Adventures Asia (China) 6.4. Galactic Energy (China) 6.5. LinkSpace (China) 6.6. Tianzhou-1 Aerospace Science and Technology Co., Ltd. (China) 6.7. Sky and Space Global (Australia) 6.8. Gilmour Space Technologies (Australia) 7. Key Findings 8. Industry Recommendation