The Sorbitol Market size was valued at USD 2.10 Bn in 2023 and the total Sorbitol revenue is expected to grow by 6.8 % from 2024 to 2030, reaching nearly USD 3.33 Bn by 2030.Sorbitol Market Overview

Sorbitol, a sugar alcohol derived primarily from renewable biomass resources such as corn starch–based glucose and corn steep liquor, has emerged as an important component in the global sugar substitutes and sweeteners industry. Produced through catalytic hydrogenation and electrolytic reduction of glucose, sorbitol serves as an effective sugar substitute renowned for its sweet taste and low caloric content. Its applications extend across diverse industries, including food and beverages, pharmaceuticals, personal care, and chemicals. The escalating consumer preference for low-calorie and sugar-free alternatives boosts the demand for sorbitol, particularly in the food and beverage sector. The pharmaceutical and personal care industries contribute significantly to the Sorbitol Market’s growth, as sorbitol finds versatile applications in these domains. In essence, the sorbitol market stands as a rapidly evolving and dynamic sector, driven by the global shift towards healthier alternatives, the rise in diabetes prevalence, and increasing awareness of sugar-related health concerns.To know about the Research Methodology :- Request Free Sample Report

Sorbitol Market Dynamics

Drivers Growing demand from the food and beverage industry drives sorbitol market growth. Sorbitol is largely used as a low-calorie sweetener in various Food and Beverage products. Without adding significant calories the sorbitol provides sweetness. This factor makes it an attractive option for manufacturers to develop healthier and reduced sugar alternatives. Sorbitol is a great sugar substitute used in products for people with diabetes. Sorbitol helps retain moisture and improve the texture and shelf life of food. It is mostly used in baked goods, candies, and frozen desserts to prevent them from becoming dry and sugar-free. Sorbitol tastes sweet such as sugar, making it a popular ingredient for reducing sugar content in foods while maintaining the desired flavor. Its demand is increasing in the food and beverage industry because it is a low-calorie sweetener and meets clean-label preferences. The increasing Food and beverages industry significantly helps to boost the demand for sorbitol and the result is parallelly the sorbitol market growIncreasing Demand from Pharmaceutical and Personal Care Industries Boosts the Market Growth. Sorbitol is largely used as an excipient in pharmaceutical formulations. It acts as a filler, binder, and disintegrator, contributing to the stability and overall quality of tablets, capsules, and other solid dosage forms. It also helps mask the taste of certain medications, improving patient compliance. Due to its properties, the demand for Sorbitol Increases and it helps to accelerate the growth of the Sorbitol Market Sorbitol is beneficial for personal care products because it provides miniaturization. It is used in various skincare, as well as hair care, and oral care products. Which provides smoothness, and protection to the skin, and hair. It is also used in oral care products to enhance texture and maintain moisture in the mouth, promoting a comfortable and refreshed feeling. Sorbitol plays a valuable role in these personal care products, ensuring they provide the desired benefits for the skin, hair, and oral health. Due to its functional properties sorbitol usage in the pharmaceutical and personal care industries. The surging demand for skincare products is driving increased use of sorbitol, a key ingredient. Valued for its moisture retention and texture-enhancing properties, sorbitol's popularity reflects a growing consumer focus on wellness. This trend Drives the Sorbitol Market growth, particularly within the cosmetics and personal care sector.

Restrain High Cost of Raw Materials Hampers the Market Growth Sorbitol is derived from natural sources such as corn and wheat. The price of sorbitol largely depends upon the prices of raw materials. Fluctuations in the cost of raw materials impact the pricing of sorbitol. If the price of raw material increases the production cost of the sorbitol also increases. As a result, the final price of sorbitol also increases, potentially reducing its competitiveness compared to other sweeteners or sugar substitutes. End users of sorbitol, such as food and beverage companies, are price-sensitive and seek cost-effective ingredients for their products. If the cost of sorbitol increases due to expensive raw materials, these companies may explore alternative sweeteners or sugar substitutes that offer comparable functionalities at a lower price point. These factors reduced demand for sorbitol and impacted the market growth. Fluctuations in the prices of raw materials limit the growth of the sorbitol market. The volatility of prices disrupts the supply chain and hinders Sorbitol Market growth. Opportunity Increasing demand for low-calorie and sugar-free products creates lucrative growth opportunities for the market growth. The global prevalence of diabetes is on the rise, driving the demand for sugar substitutes in diabetic-friendly products. Sorbitol, with its slow metabolism and low impact on blood glucose levels, is well-suited for diabetic individuals. Sorbitol-based alternatives are used in various food, beverage, and pharmaceutical formulations. This creates lucrative growth opportunities for the Sorbitol Market growth. The rising awareness about health significantly boosts Sorbitol Market growth. Sorbitol is a low-calorie sweetener, therefore it is used in a wide range of food and beverage products The increasing trend of diet and rising awareness of the adverse effects of excessive sugar consumption leads to demand for low-calorie and sugar-free products. The rising consumer trend and expanding the use of sorbitol in developing innovative, healthier product offerings create ample growth opportunities for the market.

Sorbitol Market Segment Analysis

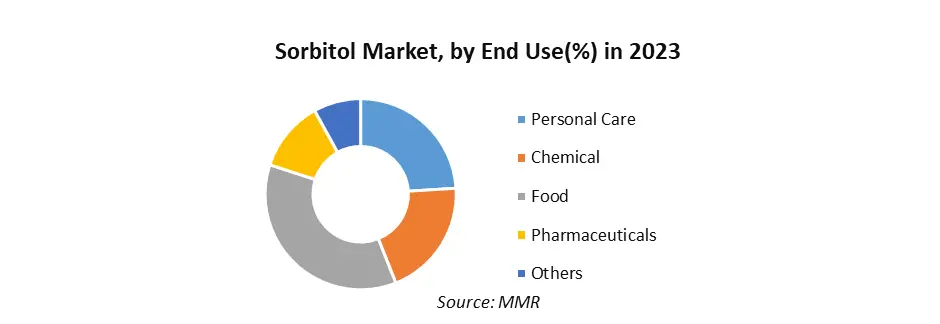

Based on the Product, the Liquid segment dominates the global Sorbitol Market in the year 2023. The liquid sorbitol is used in various formulations due to its liquid form. Liquid sorbitol is easily integrated into the formulations. In confectionery, it is used as a humectant, sweetener in beverages, and moisturizing ingredient in personal care products. Compared to other sorbitol, liquid sorbitol is easier to handle and mix into formulations. It is directly added to manufacturing processes without the need for additional processing steps like dissolving or milling. Therefore, the demand for liquid sorbitol is increasing rapidly. Additionally, Liquid sorbitol exhibits synergistic effects when combined with other ingredients. For example, it enhances the sweetness of other sweeteners and improves the texture and mouth feel of certain food products.Based on the End Use, The food segment dominates the end-use segment of the global Sorbitol Market. Sorbitol provides texture as well as some sweetness to frozen desserts Sorbitol is used in frozen desserts for diabetics where its slow rate of absorption, followed by conversion to fructose in the liver results in a prolonged, slow supply of fructose, considered to be of advantage to the diabetic. For frozen dairy desserts and mixes, FDA regulation permits sorbitol to be used as a nutritive sweetener at a level not to exceed good manufacturing practice, defined as 18 %. In candy manufacture, sorbitol is used together with sugar to increase shelf life. It also helps to improve softness, taste, and texture. In buttercreams, an additional benefit is enhanced flavor. Sorbitol is used in diabetic chocolates. Sorbitol 70% added to peanut butter has been shown to reduce dryness and crumbliness and improve spread ability. Increasing Demand from the food and beverage industry significantly boosts Sorbitol Market Growth.

Sorbitol Market Regional Insight

Asia Pacific region dominated the Sorbitol Market in the year 2023. The Asia Pacific region observed a significant growth rate in the Sorbitol Market. Countries such as China and India have emerged as major consumers and producers of sorbitol. The increasing population and rising disposable income, have driven the demand for sorbitol in the food and beverage industry. Furthermore, the growing pharmaceutical and personal care sectors in the region boosted the market growth. The region is a significant market for sorbitol due to its growing application in industries. The region has a well-established food and pharmaceutical industry, which drives the demand for sorbitol as a sugar substitute and excipient in medications. Additionally, the growing health-conscious population and increasing consumer preference for low-calorie products have further fuelled the demand for sorbitol in this region. Which has led to higher consumption of processed and convenience foods. Competitive Landscape: Sorbitol Market The Sorbitol Market is highly competitive the key players in the market are largely focusing on the development of new products, innovations, mergers, and partnerships. The Sorbitol market has witnessed significant developments, for example, Sunar Misir led the innovation by launching a technology in March 2022 to reduce sugar and calories in their Sorbitol powder product. This strategic move positions Sunar Misir to address the increasing consumer demand for healthier alternatives. Major players like Cargill, Incorporated, Ingredion, and CREMER OLEO GmbH & Co. KG have also adapted to market trends by introducing non-GMO sorbitol, aligning with the growing preference for non-GMO ingredients in the food, beverage, pharmaceutical, and cosmetics industries. Sorbitol's expanding applications contribute to its market growth. In oral care products, its slow metabolism rate proves beneficial in preventing dental issues, reinforcing its market presence. Moreover, the pharmaceutical sector utilizes sorbitol's versatility in applications such as Vitamin C production and as a nasal decongestant, showcasing its importance in the pharmaceutical industry. The chemical industry leverages sorbitol for diverse applications such as surfactant, adhesive, and plasticizer production, given its non-corrosive and stabilizing properties. This competitive analysis underscores the dynamic landscape of the Sorbitol market, driven by innovation, diversification of product portfolios, and responsiveness to evolving consumer preferences across various industries.Sorbitol Market Scope Table : Inquire Before Buying

Global Sorbitol Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.10 Bn. Forecast Period 2024 to 2030 CAGR: 6.8% Market Size in 2030: US $ 3.33 Bn. Segments Covered: by Product Liquid Crystal by Application Oral Care Vitamin C Diabetic & Dietetic Food & Beverage Surfactant Others by End User Personal Care Chemical Food Pharmaceuticals Others Sorbitol Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Sorbitol Market Key Players

1. Roquette Frères 2. American International Foods, Inc. 3. ADM 4. Cargill Incorporated 5. DuPont 6. Gulshan Polyols Ltd. 7. Merck KGaA 8. Ecogreen Oleochemicals GmbH 9. Qinhuangdao Lihua Starch Co., Ltd. 10. SPI Pharma 11. Tereos 12. Ingredion Incorporated 13. Kasyap Sweeteners, Ltd. Frequently Asked Questions: 1] What segments are covered in the Global Sorbitol Market report? Ans. The segments covered in the Sorbitol Market report are based on Products, Applications, End Users, and Regions. 2] Which region is expected to hold the highest share in the Global Sorbitol Market? Ans. The Asia Pacific region is expected to hold the highest share of the Sorbitol Market. 3] What is the market size of the Global Sorbitol Market by 2030? Ans. The market size of the Sorbitol Market by 2030 is expected to reach US$ 3.33 Bn. 4] What is the forecast period for the Global Sorbitol Market? Ans. The forecast period for the Sorbitol Market is 2024-2030. 5] What was the market size of the Global Sorbitol Market in 2023? Ans. The market size of the Sorbitol Market in 2023 was valued at US$ 2.10Bn.

1. Sorbitol Market: Research Methodology 2. Sorbitol Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Sorbitol Market: Dynamics 3.1. Sorbitol Market Trends by Region 3.1.1. North America Sorbitol Market Trends 3.1.2. Europe Sorbitol Market Trends 3.1.3. Asia Pacific Sorbitol Market Trends 3.1.4. Middle East and Africa Sorbitol Market Trends 3.1.5. South America Sorbitol Market Trends 3.2. Sorbitol Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Sorbitol Market Drivers 3.2.1.2. North America Sorbitol Market Restraints 3.2.1.3. North America Sorbitol Market Opportunities 3.2.1.4. North America Sorbitol Market Challenges 3.2.2. Europe 3.2.2.1. Europe Sorbitol Market Drivers 3.2.2.2. Europe Sorbitol Market Restraints 3.2.2.3. Europe Sorbitol Market Opportunities 3.2.2.4. Europe Sorbitol Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Sorbitol Market Drivers 3.2.3.2. Asia Pacific Sorbitol Market Restraints 3.2.3.3. Asia Pacific Sorbitol Market Opportunities 3.2.3.4. Asia Pacific Sorbitol Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Sorbitol Market Drivers 3.2.4.2. Middle East and Africa Sorbitol Market Restraints 3.2.4.3. Middle East and Africa Sorbitol Market Opportunities 3.2.4.4. Middle East and Africa Sorbitol Market Challenges 3.2.5. South America 3.2.5.1. South America Sorbitol Market Drivers 3.2.5.2. South America Sorbitol Market Restraints 3.2.5.3. South America Sorbitol Market Opportunities 3.2.5.4. South America Sorbitol Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis for Sorbitol Market 3.8. Analysis of Government Schemes and Initiatives for Sorbitol Market 3.9. The Global Pandemic Impact on Sorbitol Market 4. Sorbitol Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Sorbitol Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Liquid 4.1.2. Crystal 4.2. Sorbitol Market Size and Forecast, by Application (2023-2030) 4.2.1. Oral Care 4.2.2. Vitamin C 4.2.3. Diabetic & Dietetic Food & Beverage 4.2.4. Surfactant 4.2.5. Others 4.3. Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 4.3.1. Personal Care 4.3.2. Chemical 4.3.3. Food 4.3.4. pharmaceutical 4.3.5. Others 4.4. Sorbitol Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Sorbitol Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Sorbitol Market Size and Forecast, by Product Type (2023-2030) 5.1.1. Liquid 5.1.2. Crystal 5.2. North America Sorbitol Market Size and Forecast, by Application (2023-2030) 5.2.1. Oral Care 5.2.2. Vitamin C 5.2.3. Diabetic & Dietetic Food & Beverage 5.2.4. Surfactant 5.2.5. Others 5.3. North America Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 5.3.1. Personal Care 5.3.2. Chemical 5.3.3. Food 5.3.4. pharmaceutical 5.3.5. Others 5.4. North America Sorbitol Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Sorbitol Market Size and Forecast, by Product Type (2023-2030) 5.4.1.1.1. Liquid 5.4.1.1.2. Crystal 5.4.1.2. United States Sorbitol Market Size and Forecast, by Application (2023-2030) 5.4.1.2.1. Oral Care 5.4.1.2.2. Vitamin C 5.4.1.2.3. Diabetic & Dietetic Food & Beverage 5.4.1.2.4. Surfactant 5.4.1.2.5. Others 5.4.1.3. United States Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 5.4.1.3.1. Personal Care 5.4.1.3.2. Chemical 5.4.1.3.3. Food 5.4.1.3.4. pharmaceutical 5.4.1.3.5. Others 5.4.2. Canada 5.4.2.1. Canada Sorbitol Market Size and Forecast, by Product Type (2023-2030) 5.4.2.1.1. Liquid 5.4.2.1.2. Crystal 5.4.2.2. Canada Sorbitol Market Size and Forecast, by Application (2023-2030) 5.4.2.2.1. Oral Care 5.4.2.2.2. Vitamin C 5.4.2.2.3. Diabetic & Dietetic Food & Beverage 5.4.2.2.4. Surfactant 5.4.2.2.5. Others 5.4.2.3. Canada Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 5.4.2.3.1. Personal Care 5.4.2.3.2. Chemical 5.4.2.3.3. Food 5.4.2.3.4. pharmaceutical 5.4.2.3.5. Others 5.4.3. Mexico 5.4.3.1. Mexico Sorbitol Market Size and Forecast, by Product Type (2023-2030) 5.4.3.1.1. Liquid 5.4.3.1.2. Crystal 5.4.3.2. Mexico Sorbitol Market Size and Forecast, by Application (2023-2030) 5.4.3.2.1. Oral Care 5.4.3.2.2. Vitamin C 5.4.3.2.3. Diabetic & Dietetic Food & Beverage 5.4.3.2.4. Surfactant 5.4.3.2.5. Others 5.4.3.3. Mexico Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 5.4.3.3.1. Personal Care 5.4.3.3.2. Chemical 5.4.3.3.3. Food 5.4.3.3.4. pharmaceutical 5.4.3.3.5. Others 6. Europe Sorbitol Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Sorbitol Market Size and Forecast, by Product Type (2023-2030) 6.2. Europe Sorbitol Market Size and Forecast, by Application (2023-2030) 6.3. Europe Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 6.4. Europe Sorbitol Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Sorbitol Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2. United Kingdom Sorbitol Market Size and Forecast, by Application (2023-2030) 6.4.1.3. United Kingdom Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 6.4.2. France 6.4.2.1. France Sorbitol Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2. France Sorbitol Market Size and Forecast, by Application (2023-2030) 6.4.2.3. France Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Sorbitol Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2. Germany Sorbitol Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Germany Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Sorbitol Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2. Italy Sorbitol Market Size and Forecast, by Application (2023-2030) 6.4.4.3. Italy Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Sorbitol Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2. Spain Sorbitol Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Spain Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Sorbitol Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2. Sweden Sorbitol Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Sweden Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Sorbitol Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2. Austria Sorbitol Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Austria Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Sorbitol Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2. Rest of Europe Sorbitol Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Rest of Europe Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 7. Asia Pacific Sorbitol Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Sorbitol Market Size and Forecast, by Product Type (2023-2030) 7.2. Asia Pacific Sorbitol Market Size and Forecast, by Application (2023-2030) 7.3. Asia Pacific Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 7.4. Asia Pacific Sorbitol Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Sorbitol Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2. China Sorbitol Market Size and Forecast, by Application (2023-2030) 7.4.1.3. China Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Sorbitol Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2. S Korea Sorbitol Market Size and Forecast, by Application (2023-2030) 7.4.2.3. S Korea Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Sorbitol Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2. Japan Sorbitol Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Japan Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 7.4.4. India 7.4.4.1. India Sorbitol Market Size and Forecast, by Product Type (2023-2030) 7.4.4.2. India Sorbitol Market Size and Forecast, by Application (2023-2030) 7.4.4.3. India Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Sorbitol Market Size and Forecast, by Product Type (2023-2030) 7.4.5.2. Australia Sorbitol Market Size and Forecast, by Application (2023-2030) 7.4.5.3. Australia Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Sorbitol Market Size and Forecast, by Product Type (2023-2030) 7.4.6.2. Indonesia Sorbitol Market Size and Forecast, by Application (2023-2030) 7.4.6.3. Indonesia Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Sorbitol Market Size and Forecast, by Product Type (2023-2030) 7.4.7.2. Malaysia Sorbitol Market Size and Forecast, by Application (2023-2030) 7.4.7.3. Malaysia Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Sorbitol Market Size and Forecast, by Product Type (2023-2030) 7.4.8.2. Vietnam Sorbitol Market Size and Forecast, by Application (2023-2030) 7.4.8.3. Vietnam Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Sorbitol Market Size and Forecast, by Product Type (2023-2030) 7.4.9.2. Taiwan Sorbitol Market Size and Forecast, by Application (2023-2030) 7.4.9.3. Taiwan Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Sorbitol Market Size and Forecast, by Product Type (2023-2030) 7.4.10.2. Rest of Asia Pacific Sorbitol Market Size and Forecast, by Application (2023-2030) 7.4.10.3. Rest of Asia Pacific Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 8. Middle East and Africa Sorbitol Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Sorbitol Market Size and Forecast, by Product Type (2023-2030) 8.2. Middle East and Africa Sorbitol Market Size and Forecast, by Application (2023-2030) 8.3. Middle East and Africa Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 8.4. Middle East and Africa Sorbitol Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Sorbitol Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2. South Africa Sorbitol Market Size and Forecast, by Application (2023-2030) 8.4.1.3. South Africa Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Sorbitol Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2. GCC Sorbitol Market Size and Forecast, by Application (2023-2030) 8.4.2.3. GCC Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Sorbitol Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2. Nigeria Sorbitol Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Nigeria Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Sorbitol Market Size and Forecast, by Product Type (2023-2030) 8.4.4.2. Rest of ME&A Sorbitol Market Size and Forecast, by Application (2023-2030) 8.4.4.3. Rest of ME&A Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 9. South America Sorbitol Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Sorbitol Market Size and Forecast, by Product Type (2023-2030) 9.2. South America Sorbitol Market Size and Forecast, by Application (2023-2030) 9.3. South America Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 9.4. South America Sorbitol Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Sorbitol Market Size and Forecast, by Product Type (2023-2030) 9.4.1.2. Brazil Sorbitol Market Size and Forecast, by Application (2023-2030) 9.4.1.3. Brazil Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Sorbitol Market Size and Forecast, by Product Type (2023-2030) 9.4.2.2. Argentina Sorbitol Market Size and Forecast, by Application (2023-2030) 9.4.2.3. Argentina Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Sorbitol Market Size and Forecast, by Product Type (2023-2030) 9.4.3.2. Rest Of South America Sorbitol Market Size and Forecast, by Application (2023-2030) 9.4.3.3. Rest Of South America Sorbitol Market Size and Forecast, by End-User Industry (2023-2030) 10. Global Sorbitol Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Sorbitol Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. DuPont 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Details on Partnership 11.1.7. Recent Developments 11.2. Roquette Frères 11.3. American International Foods, Inc. 11.4. AD 11.5. Cargill Incorporated 11.6. Gulshan Polyols Ltd. 11.7. Merck KGaA 11.8. Ecogreen Oleochemicals GmbH 11.9. Qinhuangdao Lihua Starch Co., Ltd. 11.10. SPI Pharma 11.11. Tereos 11.12. Ingredion Incorporated 11.13. Kasyap Sweeteners, Ltd. 12. Key Findings 13. Industry Recommendations