The Global Precision Swine Farming Market size was valued at USD 418 Million in 2023 and the total Precision Swine Farming revenue is expected to grow at a CAGR of 11.1 % from 2024 to 2030, reaching nearly USD 873.32 Million The Precision Swine Farming Market is experienced robust growth in recent years, driven by a confluence of factors. Precision swine farming is the Farm Size of advanced technologies such as IoT sensors, data analytics, AI, and automation in swine production, with the aim of optimizing operations, improving animal welfare, and enhancing overall farm efficiency. The market's current scenario is marked by increasing adoption due to the growing global demand for pork products, coupled with a heightened focus on sustainability and resource efficiency in agriculture. This industry's growth is further bolstered by the rising awareness of the benefits of precision farming, which includes real-time monitoring of animal health, precise feeding, and environmental control. Key players in the Precision Swine Farming Market have been actively contributing to its development through innovative solutions and strategic collaborations. These players have been investing in cutting-edge technologies to provide comprehensive farm management systems and customized solutions to swine producers. Recent developments include the integration of blockchain technology for enhanced traceability, partnerships with AI-driven analytics firms for data-driven decision-making, and the introduction of smart sensors and robotics to improve pig management. As the global swine industry seeks to address the challenges of disease control, resource efficiency, and sustainability, the Precision Swine Farming Market is poised for continued expansion, offering promising opportunities for both farmers and technology providers. For instance, in September 2023, Merck Animal Health, a division of Merck & Co., Inc., completed a minority investment in LeeO Precision Farming B.V., a digital swine traceability solution provider based in the Netherlands. Merck Animal Health will also take on the distribution of LeeO's solution in selected markets. This partnership aims to advance swine production by combining Merck Animal Health's animal health intelligence technology with LeeO's traceability platform, which monitors swine throughout their lifecycle. This collaboration reinforces Merck Animal Health's commitment to improving swine health and management through innovative traceability solutions, benefiting both animal well-being and the food supply chain.To know about the Research Methodology :- Request Free Sample Report

Global Precision Swine Farming Market Dynamics:

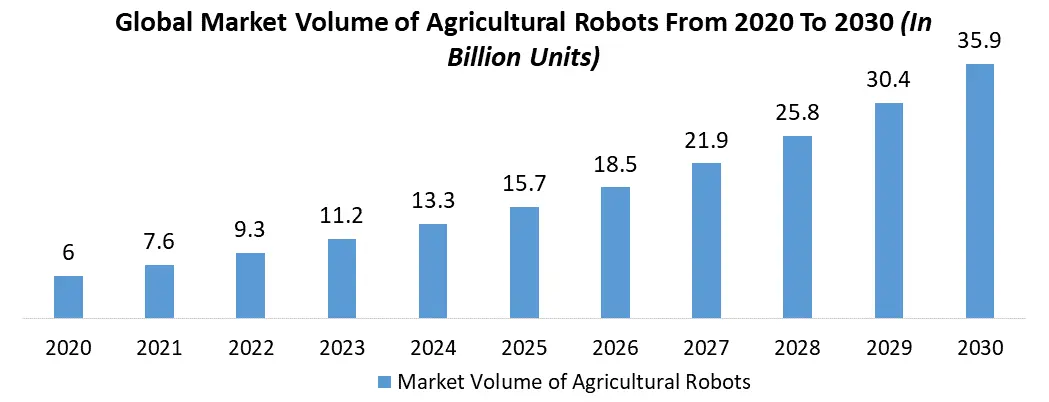

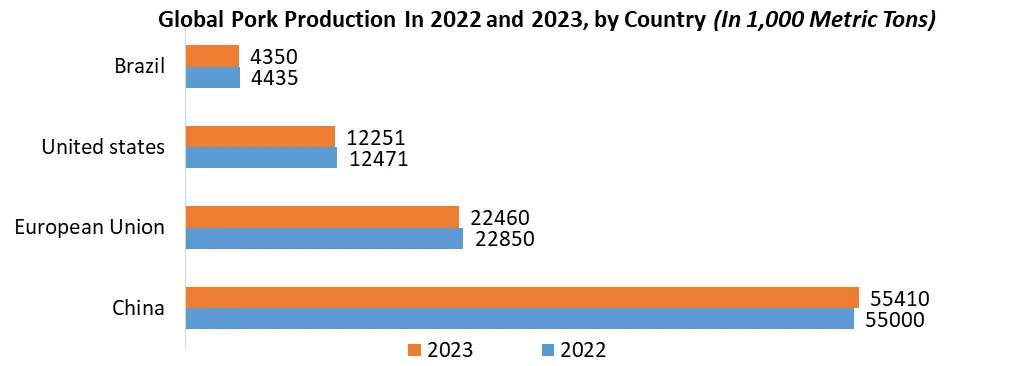

The Growth of Precision Swine Farming is Expected to Foster the Development of the Market The global demand for pork products is on the rise, driven by increasing populations and income levels. For instance, China's efforts to rebuild its swine industry following African swine fever outbreaks have led to a surge in demand for swine farming technologies. Moreover, technological advancements in precision farming, including IoT sensors and data analytics, are revolutionizing the industry. Solutions like LeeO Precision Farming B.V.'s cloud-based platform allow farmers to monitor individual pig health and optimize feeding. Additionally, environmental and sustainability concerns are pushing farms to adopt data-driven methods to reduce waste and emissions. Ethical considerations and animal welfare regulations are also influencing farming practices, with precision farming tools ensuring animal well-being. Disease management, biosecurity, and data-driven decision-making are critical drivers, particularly in early disease detection and prevention. Globalization of swine farming, government initiatives, consumer demands for transparency, and collaborative partnerships, such as Merck Animal Health's investment in LeeO, further fuel the market's growth, making precision swine farming market a vital and evolving industry. For instance, in July 2020, BASF completed the acquisition of Cloudfarms, a software company specializing in livestock farm management, traceability, and precision farming, with a particular emphasis on pig production. Cloudfarms' livestock farm management solution empowers producers worldwide to enhance the efficiency and productivity of intricate farming operations continuously. High Cost Restrains the Global Precision Swine Farming Market Demand The precision swine farming market, while promising, faces several growth restraints and challenges. The high initial investment costs act as a significant barrier for many farmers, especially smaller operations or those in developing regions, making it challenging to adopt advanced precision farming technologies. Additionally, data privacy and security concerns loom large, with the potential for unauthorized access or data breaches, raising doubts among some farmers. A lack of technical expertise poses another challenge, as mastering data analysis and technology management can be daunting. Moreover, interoperability issues among various precision farming technologies can lead to operational inefficiencies. Compliance with complex regulatory requirements in areas like data management, animal welfare, and environmental standards can also add layers of difficulty. Resistance to change from deeply ingrained traditional farming practices remains a substantial challenge, as does the limited availability of rural connectivity and infrastructure for reliable internet access. The overwhelming volume of data generated by precision farming tools can lead to decision paralysis, and there's a risk of technology obsolescence with rapid advancements. Environmental concerns surrounding energy consumption and electronic component production must be balanced with sustainability goals in the pursuit of precision farming. These challenges collectively shape the landscape of precision swine farming, emphasizing the diversity of obstacles that the industry must address to realize its full potential. Improving Swine Health Management with Ai-Enabled Soundtalks Wearable Devices Boost the Market Growth The Precision Swine Farming Market presents a range of growth opportunities poised to transform the industry. IoT-based health monitoring is one such opportunity, with companies like Nedap N.V. offering RFID ear tags and monitoring systems that track individual swine's health parameters, aiding in disease prevention and treatment. Data-driven nutritional optimization is another avenue, as seen with Ctb, Inc.'s precision feeding systems that use algorithms to tailor feed quantities, optimizing growth while reducing waste. Smart environmental control, exemplified by Vdl Agrotech Bv, allows for precise climate management in swine facilities, enhancing pig comfort and growth rates while conserving energy. Innovative disease management opportunities are abundant, with companies like Boehringer Ingelheim Animal Health USA Inc. offering vaccines and pharmaceuticals for swine health. Precision farming enables data-driven approaches to disease prevention and treatment, improving overall herd health. RFID-based traceability solutions from Guangzhou Yingzi Technology Co., Ltd. satisfy consumer demands for transparency, ensuring the traceability of pork products from farm to table. Automation and robotics, such as Hotraco's technologies, drive efficiency by automating labor-intensive tasks. Environmental sustainability is a key opportunity, with solutions like Microfan's energy-efficient ventilation systems reducing energy consumption and greenhouse gas emissions. AI-driven predictive analytics from companies like Pulse Needlefree Systems allow for proactive intervention by forecasting pig growth rates and health issues. Exploring emerging markets, particularly in countries like China, where demand for pork is high, offers significant growth potential. Finally, collaboration and partnerships, like the one between Merck Animal Health and LeeO Precision Farming B.V., demonstrate the power of industry cooperation in driving innovation and growth within the precision swine farming sector. These opportunities collectively enhance swine farming practices, animal welfare, and the industry's overall sustainability. For instance, in Jan 2023, The University of Saskatchewan (USask) has secured $5.2 million in funding for 28 innovative livestock and forage research projects. These projects cover a wide range of areas, from early detection of infectious diseases in chickens to regional influenza vaccines for pigs. The funding is provided by Saskatchewan's Agriculture Development Fund (ADF), jointly supported by provincial and federal governments. Among the projects, five, amounting to $863,000, will be conducted at the USask-owned Prairie Swine Centre, emphasizing the significance of research in the swine industry.

Precision Swine Farming Market Segment Analysis:

Based on Farm Size, the market has been divided into hardware, software, and services. Among these, the service sub-segment is projected to generate the maximum revenue. The precision swine farming market divided into several subsegments, each catering to distinct Farm Sizes and adoption levels. The precision swine farming finds extensive Farm Size in health monitoring and disease management. IoT-based solutions and real-time data analytics enable farmers to monitor the health and well-being of individual pigs, facilitating early disease detection and targeted interventions. This revolves around nutritional optimization, where data-driven precision farming systems, such as precision feeding technologies, adjust feed quantities to optimize growth, minimize waste, and enhance feed conversion ratios. Moreover, environmental control systems represent a crucial subsegment, as they offer precise management of climate variables within swine facilities, ensuring pig comfort and health while conserving energy. Additionally, traceability solutions, including RFID-based technologies, are gaining traction for transparent supply chain management and meeting consumer demands. Lastly, automation and robotics subsegments focus on labor-saving technologies that streamline tasks like feeding and waste management. Overall, these subsegments showcase the diverse Farm Sizes and growing adoption of precision swine farming practices in the industry. For instance, in June 2023, the introduction of new products at the World Pork Expo was a significant development for the precision swine farming sector. This annual event serves as a crucial platform for pork producers to explore innovative solutions that can enhance pig health and overall farm efficiency. These products range from tangible items in various sizes to cutting-edge technologies residing in the digital realm. In the context of precision swine farming, these advancements play a pivotal role as they contribute to the continuous improvement of health monitoring, disease management, and overall farm operations. The diversity in product offerings, from physical equipment to cloud-based solutions, underscores the comprehensive approach that precision swine farming takes in leveraging technology to optimize pig welfare, streamline processes, and meet the evolving demands of the industry. Based on offering, the market has been divided into farm/ barn climate control and monitoring, swine health monitoring / early disease detection, vaccination and drug delivery, swine identification and tracking, and feeding management. Among these, the swine health monitoring / early disease detection sub-segment is projected to generate the maximum revenue. The swine health monitoring and early disease detection sub-segment within the precision swine farming market is poised for substantial growth due to its critical role in safeguarding swine health and optimizing farm efficiency. With a growing emphasis on animal welfare and biosecurity measures, the adoption of advanced technologies, including IoT sensors and data analytics, enables continuous real-time monitoring of individual pig health. This capability not only allows for the early detection of diseases but also facilitates prompt intervention and treatment, preventing economic losses and ensuring swine welfare. Given the ongoing challenges posed by disease outbreaks in the global swine industry, these factors are anticipated to boost the growth of the swine health monitoring / early disease detection sub-segment during the forecast timeframe. A recent research study featured in the has revealed that the automated monitoring of piglet behavior through visual imaging can offer an effective means of early detection for enteric disorders in post-weaning piglets. This innovative method utilizes established models to analyze piglet behaviors and postures, presenting a dependable diagnostic tool for the prompt identification of enteric disorders like post-weaning colibacillosis. This early detection mechanism not only aids in swift intervention but also serves as a preventive measure to curtail the potential spread of such disorders within a group of piglets.Precision Swine Farming Market Regional Insights

The Asia Pacific region comprises several key countries, including China, Japan, South Korea, Australia, and other nations within the Rest of Asia Pacific, such as Vietnam, Thailand, Indonesia, and the Philippines. This dynamic region is poised for significant growth in the precision swine farming market during the forecasted period. The Asia Pacific region boasts a substantial population, leading to a growing demand for high-quality pork products as dietary preferences evolve. China, as one of the world's largest pork producers, is currently experiencing a surge in the demand for safe, healthy, and sustainably produced meat, emphasizing the need for advanced precision farming practices to meet these requirements. Moreover, Japan faces challenges related to land scarcity and an aging population of livestock farmers, necessitating the adoption of more efficient and technologically advanced farming methods to sustain production. Similarly, South Korea is witnessing an increasing demand for premium-quality pork, and as a significant pork importer, the country is exploring ways to mitigate risks associated with imports, further driving the demand for precision swine farming solutions. Collectively, these factors make the Asia Pacific region an exceptionally promising and attractive market for precision swine farming. The region's unique blend of population size, changing consumer preferences, and the need for advanced farming practices positions it as a lucrative hub for the adoption and growth of precision swine farming technologies.

Competitive Landscape

Prominent players in the precision swine farming market include industry leaders such as Nedap N.V. based in the Netherlands, CTB, Inc. from the United States, Merck & Co., Inc. (also from the US), Boehringer Ingelheim Animal Health USA Inc., Guangzhou Yingzi Technology Co, Ltd. in China, Hotraco in the Netherlands, and VDL Agrotech BV, among others. These established companies are strategically expanding their global footprint through agreements and collaborations. They maintain a robust presence across North America, Asia Pacific, and Europe, with well-established manufacturing facilities and extensive distribution networks in these regions. These industry leaders are actively contributing to the advancement of precision swine farming practices by leveraging their expertise and reach.Latest Development

In March 2023, Boehringer Ingelheim, a leading pharmaceutical company, unveiled an innovative precision swine farming solution. This cutting-edge solution integrates advanced sensors to collect extensive data on multiple aspects, encompassing farm conditions, animal well-being, and various farming processes within swine farms.Precision Swine Farming Industry Ecosystem

Precision Swine Farming Market Scope: Inquiry Before Buying

Precision Swine Farming Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 418 Mn. Forecast Period 2024 to 2030 CAGR: 11.1% Market Size in 2030: US $ 873.32 Mn. Segments Covered: by Farm Size Small Farms Mid-sized Farms Large Farms by Offering Farm/ barn climate control and monitoring Swine health monitoring / early disease detection Vaccination and Drug Delivery Swine Identification and Tracking Feeding Management by Application Hardware Software Services Precision Swine Farming Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Precision Swine Farming Market, Key Players:

1. CTB, Inc. (US) 2. Nedap N.V. (Netherlands) 3. Merck & Co., Inc. (US) 4. Boehringer Ingelheim Animal Health USA Inc. (US) 5. Guangzhou Yingzi Technology Co, Ltd. (China) 6. Hotraco (Netherlands) 7. VDL Agrotech BV (Netherlands) 8. AcuShot Needle Free (Canada) 9. Pulse NeedleFree Systems (US) 10. Henke Sass Wolf GmbH (Germany) 11. Big Dutchman (Germany) 12. EN-CO Software Zrt (Hungary) 13. Luda Farm AB (Sweden) 14. AGCO Corporation (US) 15. Microfan (Netherlands) 16. Hotraco 17. Fancom 18. Osborne Industries 19. Cormall 20. Skiold 21. Agromatic 22. Hog Slat 23. Maximus Systems 24. WEDA Dammann & Westerkamp GmbH (Germany) 25. OthersFAQs:

1. What are the growth drivers for the Precision Swine Farming Market? Ans. The growth drivers for the Precision Swine Farming Market include increasing global demand for pork products due to population growth and rising income levels, as well as technological advancements in precision farming techniques and data-driven solutions. 2. What is the major Opportunity for the Precision Swine Farming Market growth? Ans. A significant opportunity for the Precision Swine Farming Market is the adoption of IoT-based technologies for health monitoring, disease prevention, and data-driven decision-making in swine farming, enhancing productivity and animal welfare while meeting the growing demand for high-quality pork products in a sustainable manner. 3. Which Region is expected to lead the global Precision Swine Farming Market during the forecast period? Ans. Asia Pacific is expected to lead the Precision Swine Farming Market during the forecast period. 4. What is the projected market size and growth rate of the Precision Swine Farming Market? Ans. The Precision Swine Farming Market size was valued at USD 418 Million in 2023 and the total Precision Swine Farming Market revenue is expected to grow at a CAGR of 11.1% from 2024 to 2030, reaching nearly USD 873.32 Million. 5. What segments are covered in the Precision Swine Farming Market report? Ans. The segments covered in the Precision Swine Farming Market report are Application, Farm Size, Offering, and Region.

1. Precision Swine Farming Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 1.4. Limitations 2. Global Precision Swine Farming Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Product Segment 2.5.3. End-user Segment 2.5.4. Revenue (2023) 2.5.5. Key Development 2.5.6. Market Share 2.6. Industry Ecosystem 2.6.1. Key players in the Precision Swine Farming ecosystem 2.6.2. Role of companies in the Precision Swine Farming ecosystem 2.7. Upcoming Technological and Advancement Initiatives by Key Players 2.8. Market Structure 2.8.1. Market Leaders 2.8.2. Market Followers 2.8.3. Emerging Players 2.9. Consolidation of the Market 2.9.1. Strategic Initiatives and Developments 2.9.2. Mergers and Acquisitions 2.9.3. Collaborations and Partnerships 2.9.4. Product Launches and Innovations 3. Pricing Analysis: 3.1. Average Selling Price of Precision Swine Farming Offered by Key Players in the Market 4. Precision Swine Farming Market: Dynamics 4.1. Precision Swine Farming Market Trends 4.2. Precision Swine Farming Market: Dynamics by Region 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.3.1. Threat of New Entrants 4.3.2. Threat of Substitutes 4.3.3. Bargaining Power of Suppliers 4.3.4. Bargaining Power of Buyers 4.3.5. Intensity of Competitive Rivalry 4.4. Value Chain Analysis 4.4.1. Research and product development 4.4.2. Manufactures 4.4.3. Technology providers 4.4.4. System integrators 4.4.5. Marketing and sales 4.4.6. End users 4.5. Supply chain analysis 4.5.1. Product research and development 4.5.2. Raw material suppliers 4.5.3. Manufacturers 4.5.4. Distributors 4.5.5. End users 4.6. Technology Analysis 4.6.1. IoT 4.6.2. Improving swine health management with AI enabled sound talks wearable devices 4.7. Regulatory environment 4.8. Treads and Disruption Impacting Customer Business 4.9. Market mapping and ecosystem of precision swine farming market 4.9.1. Demand side 4.9.2. Supply side 4.10. Key Stakeholder and Buying Criteria 4.10.1. Influence of Stakeholders on the Buying Process for the Top Applications 4.10.2. Key Buying Criteria for Top Applications 4.11. Regulatory Landscape 4.11.1. Regulation by Region 4.11.2. Tariff and Taxes 4.11.3. Analysis of Government Schemes and Initiatives on the Global Precision Swine Farming Industry 4.11.4. Regulatory Bodies, Government Agencies and Other Organizations by Region 4.12. Trade Data Analysis: 4.12.1. Import/ Export of Precision Swine Farming 4.13. Patent Analysis 5. Precision Swine Farming Market: Global Market Size and Forecast by Segmentation 5.1. Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 5.1.1. Small Farms 5.1.2. Mid-sized Farms 5.1.3. Large Farms 5.2. Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 5.2.1. Farm/ barn climate control and monitoring 5.2.2. Swine health monitoring / early disease detection 5.2.3. Vaccination and Drug Delivery 5.2.4. Swine Identification and Tracking 5.2.5. Feeding Management 5.3. Other Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 5.3.1. Hardware 5.3.2. Software 5.3.3. Services 5.4. Precision Swine Farming Market Size and Forecast, by Region (2023-2030) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. South America 5.4.5. MEA 6. North America Precision Swine Farming Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 6.1. North America Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 6.1.1. Small Farms 6.1.2. Mid-sized Farms 6.1.3. Large Farms 6.2. North America Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 6.2.1. Farm/ barn climate control and monitoring 6.2.2. Swine health monitoring / early disease detection 6.2.3. Vaccination and Drug Delivery 6.2.4. Swine Identification and Tracking 6.2.5. Feeding Management 6.3. North America Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 6.3.1. Hardware 6.3.2. Software 6.3.3. Services 6.4. North America Precision Swine Farming Market Size and Forecast, by Country (2023-2030) 6.4.1. United States 6.4.1.1. United States Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 6.4.1.1.1. Small Farms 6.4.1.1.2. Mid-sized Farms 6.4.1.1.3. Large Farms 6.4.1.2. United States Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 6.4.1.2.1. Farm/ barn climate control and monitoring 6.4.1.2.2. Swine health monitoring / early disease detection 6.4.1.2.3. Vaccination and Drug Delivery 6.4.1.2.4. Swine Identification and Tracking 6.4.1.2.5. Feeding Management 6.4.1.3. United States Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 6.4.1.3.1. Hardware 6.4.1.3.2. Software 6.4.1.3.3. Services 6.4.2. Canada 6.4.2.1. Canada Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 6.4.2.1.1. Small Farms 6.4.2.1.2. Mid-sized Farms 6.4.2.1.3. Large Farms 6.4.2.2. Canada Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 6.4.2.2.1. Farm/ barn climate control and monitoring 6.4.2.2.2. Swine health monitoring / early disease detection 6.4.2.2.3. Vaccination and Drug Delivery 6.4.2.2.4. Swine Identification and Tracking 6.4.2.2.5. Feeding Management 6.4.2.3. Canada Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 6.4.2.3.1. Hardware 6.4.2.3.2. Software 6.4.2.3.3. Services 6.4.3. Mexico 6.4.3.1. Mexico Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 6.4.3.1.1. Small Farms 6.4.3.1.2. Mid-sized Farms 6.4.3.1.3. Large Farms 6.4.3.2. Mexico Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 6.4.3.2.1. Farm/ barn climate control and monitoring 6.4.3.2.2. Swine health monitoring / early disease detection 6.4.3.2.3. Vaccination and Drug Delivery 6.4.3.2.4. Swine Identification and Tracking 6.4.3.2.5. Feeding Management 6.4.3.3. Mexico Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 6.4.3.3.1. Hardware 6.4.3.3.2. Software 6.4.3.3.3. Services 7. Europe Precision Swine Farming Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 7.1. Europe Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 7.2. Europe Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 7.3. Europe Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 7.4. Europe Precision Swine Farming Market Size and Forecast, by Country (2023-2030) 7.4.1. United Kingdom 7.4.1.1. United Kingdom Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 7.4.1.2. United Kingdom Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 7.4.1.3. United Kingdom Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 7.4.2. France 7.4.2.1. France Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 7.4.2.2. France Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 7.4.2.3. France Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 7.4.3. Germany 7.4.3.1. Germany Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 7.4.3.2. Germany Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 7.4.3.3. Germany Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 7.4.4. Italy 7.4.4.1. Italy Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 7.4.4.2. Italy Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 7.4.4.3. Italy Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 7.4.5. Spain 7.4.5.1. Spain Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 7.4.5.2. Spain Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 7.4.5.3. Spain Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 7.4.6. Sweden 7.4.6.1. Sweden Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 7.4.6.2. Sweden Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 7.4.6.3. Sweden Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 7.4.7. Austria 7.4.7.1. Austria Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 7.4.7.2. Austria Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 7.4.7.3. Austria Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 7.4.8. Rest of Europe 7.4.8.1. Rest of Europe Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 7.4.8.2. Rest of Europe Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 7.4.8.3. Rest of Europe Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 8. Asia Pacific Precision Swine Farming Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 8.1. Asia Pacific Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 8.2. Asia Pacific Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 8.3. Asia Pacific Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 8.4. Asia Pacific Precision Swine Farming Market Size and Forecast, by Country (2023-2030) 8.4.1. China 8.4.1.1. China Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 8.4.1.2. China Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 8.4.1.3. China Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 8.4.2. S Korea 8.4.2.1. S Korea Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 8.4.2.2. S Korea Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 8.4.2.3. S Korea Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 8.4.3. Japan 8.4.3.1. Japan Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 8.4.3.2. Japan Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 8.4.3.3. Japan Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 8.4.4. India 8.4.4.1. India Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 8.4.4.2. India Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 8.4.4.3. India Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 8.4.5. Australia 8.4.5.1. Australia Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 8.4.5.2. Australia Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 8.4.5.3. Australia Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 8.4.6. ASEAN 8.4.6.1. ASEAN Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 8.4.6.2. ASEAN Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 8.4.6.3. ASEAN Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 8.4.7. Rest of Asia Pacific 8.4.7.1. Rest of Asia Pacific Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 8.4.7.2. Rest of Asia Pacific Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 8.4.7.3. Rest of Asia Pacific Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 9. South America Precision Swine Farming Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 9.1. South America Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 9.2. South America Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 9.3. South America Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 9.4. South America Precision Swine Farming Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 9.4.1.2. Brazil Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 9.4.1.3. Brazil Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 9.4.2.2. Argentina Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 9.4.2.3. Argentina Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 9.4.3.2. Rest Of South America Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 9.4.3.3. Rest Of South America Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 10. Middle East and Africa Precision Swine Farming Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 10.1. Middle East and Africa Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 10.2. Middle East and Africa Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 10.3. Middle East and Africa Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 10.4. Middle East and Africa Precision Swine Farming Market Size and Forecast, by Country (2023-2030) 10.4.1. South Africa 10.4.1.1. South Africa Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 10.4.1.2. South Africa Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 10.4.1.3. South Africa Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 10.4.2. GCC 10.4.2.1. GCC Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 10.4.2.2. GCC Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 10.4.2.3. GCC Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 10.4.3. Rest Of MEA 10.4.3.1. Rest Of MEA Precision Swine Farming Market Size and Forecast, by Farm Size (2023-2030) 10.4.3.2. Rest Of MEA Precision Swine Farming Market Size and Forecast, by Offering (2023-2030) 10.4.3.3. Rest Of MEA Precision Swine Farming Market Size and Forecast, by Application (2023-2030) 11. Company Profile: Key Players 11.1. CTB, Inc. (US) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis (Technological strengths and weaknesses) 11.1.5. Strategic Analysis (Recent strategic moves) 11.1.6. Recent Developments 11.2. Nedap N.V. (Netherlands) 11.3. Merck & Co., Inc. (US) 11.4. Boehringer Ingelheim Animal Health USA Inc. (US) 11.5. Guangzhou Yingzi Technology Co, Ltd. (China) 11.6. Hotraco (Netherlands) 11.7. VDL Agrotech BV (Netherlands) 11.8. AcuShot Needle Free (Canada) 11.9. Pulse NeedleFree Systems (US) 11.10. Henke Sass Wolf GmbH (Germany) 11.11. Big Dutchman (Germany) 11.12. EN-CO Software Zrt (Hungary) 11.13. Luda Farm AB (Sweden) 11.14. AGCO Corporation (US) 11.15. Microfan (Netherlands) 11.16. Hotraco 11.17. Fancom 11.18. Osborne Industries 11.19. Cormall 11.20. Skiold 11.21. Agromatic 11.22. Hog Slat 11.23. Maximus Systems 11.24. WEDA Dammann & Westerkamp GmbH (Germany) 11.25. Others 12. Key Findings and Analyst Recommendations 12.1. Attractive Opportunities for Players in the Precision Swine Farming 13. Precision Swine Farming: Research Methodology 13.1.1. Market Size estimation 13.1.1.1. Top-Down approach (Based on global market) 13.1.1.2. Bottom-Up Approach ( Based on offering, by region) 13.2. Market Breakdown & Data Triangulation