The Global Microgreen Market size was valued at USD 1.55 Bn in 2022 and the market is expected to reach USD 3.37 Bn at a CAGR of 11.76 % by 2029Microgreen Market Overview

Microgreens are small tender plants as their name defines ’micro’ means tiny and ’green’ depicts the plant. These are an exotic genre of edible greens which have been popularized as a great culinary trend. Microgreens are used both as favoring and garnishing agents as well as visual components due to their delicate textures, flavors, and colors in ’Fine Dine’ though people do not know much about their nutritional status and merits. A microgreen is 2.5–7.6 cm long tender and delicate shoots with a single or often a pair of open cotyledons leaves therefore, these cannot be strictly called ’sprouts’. Alzheimer's disease and other kinds of dementia are becoming more common among the elderly in emerging countries, where the population is rapidly ageing. By 2020, it is anticipated that 70 percent of the world's population aged 60 and up would be residing in emerging economies, with India accounting for 14.2 percent. Incidence rates of Alzheimer's disease have been found to be lower in Asian nations than in the industrialized world. Despite the availability of dementia prevalence research from Asian nations such as India, there is a scarcity of incidence data, especially from selective long-term studies. The China market dominated the Asia Pacific Microgreens Market by Country in 2021 and would continue to be a dominant market till 2028. Soybean sprouts, which have been grown in Asia since ancient times, have now found their way into Western cuisine. Factors affecting seeds and produce contamination as well as seed treatment measure for the effective control of microbial growth of plants. Microgreens are grown in soil or soil substitutes compared to sprouts, under light and thus is less susceptible to get contaminate. Many of the microgreen crops are quite popular and are used as ingredients in homes, in kitchen gardens, and commercially.To know about the Research Methodology :- Request Free Sample Report

Microgreen Market Dynamics

Increasing popularity of Microgreen in Cuisines This rise in the use of Microgreen is increased because of the growing awareness of the health benefits of Microgreen products. The growing awareness of eating more healthy food and cuisine has been a key driving factor for the microgreen market growth thus raising the microgreen market share. The health benefits of Microgreen products include providing vital nutrients like ascorbic acid, phylloquinone, and carotenoids in our bodies. Dishes such as avocado toast, microgreen salad with lemon-tahini dressing, microgreen pizza, smoothies, and soup are some of the most famous food dishes where the products are used. The major purpose of using this product in dishes is to enhance the taste, texture, and appearance of dishes which is preferred by chefs worldwide. In addition to the use of this product in dishes for taste, also provide with health benefits such as being rich in polyphenols, an antioxidant linked to lower the risk of heart disease and Alzheimer’s disease.The use of popular types of microgreens such as cauliflower, broccoli, cabbage, and radish used in home-cooked products raises the market growth. Microgreens, often called ’vegetable confetti’ is an emerging class of specialty crop produced from seeds of grains, herbs, or vegetables. High price and risk of short life Microgreens are becoming well-known for their use by chefs and gaining popularity in the retail market. However, the higher price of this product than the traditional full-grown vegetable is a major restraining factor for the growth of the market. In addition to this, the climate condition due to the changing and growing environment is a major challenge in producing microgreens. Consequently, the microgreens industry is facing various setbacks including product recalls from Salmonella and Listeria food poisoning outbreaks. In addition, the short shelf-life of microgreens is a serious challenge for getting microgreens to market, this is driving studies in several post-harvest treatments. Many microgreens can sprout within a short life span of 3-4 days and reach a full maturity level in just 10- 20 days, this growth rate depends on the temperature condition. The rise in temperature, humidity, and shelf life are the major factors affecting the production of microgreens.

Trends in the microgreen market

The Global Microgreens market is driven by the increasing public awareness of health issues and the use of indoor farming techniques. However, the market is also constantly being influenced by rapid development in technology, product innovation, and diversification in some countries. Cultivated species are used for sprouting, being appreciated for several peculiar traits: vivid colors (i.e., red for red basil; green for spinach), intense smells (i.e. aromatic herbs), and pleasant textures (juicy for sunflower and beet; crunchy for celery), and variable tastes. With the increased collaboration and emergence of new products, the Global Microgreens market is changing rapidly. This factor is driving the demand and allowing Microgreen products to be introduced in the market with innovations. Farms should begin growing some of the more commonly grown microgreens, including spring mixes, and arugula. After gaining feedback from consumers and through discussions with local chefs, Solutions Farms can choose to add or remove varieties from its product offerings.Price volatility of microgreens in the market Microgreens might confuse customers because there are no existing rules for labeling or defining them. The high price of some microgreens is a problem for the industry. Since growing microgreens requires more time and money than increasing other types of food, they tend to be more expensive. The roots are often affected by fungus and mold. The mold is darker, and heavier and covers bare soil or the surrounding seeds. It is root hair and is part of the natural process of germination and growth. There is a distinct difference between root hairs and mold. Root hair is light and typically surrounds the root area.

Microgreen Market Segment Analysis

Based on Type, the microgreen market is driven by the rise in use of broccoli in diet and daily food dishes. The microgreens are easy to grow since they are harvested at the first level and harvested and can be effortless. These are very quick to harvest in just two weeks, the microgreens are ready to eat. Being very quick to harvest and ready to eat, microgreens are packed with flavor and loaded with nutrients. Due to their richness in flavor, these microgreens are chefs' favorite and add texture to their dishes. Microgreen food products such as broccoli have various benefits on human health. The use of broccoli in a daily eating routine supports cardiovascular health, provides anti-cancer properties, and anti-aging properties, and boosts brain function.Broccoli is a good source of minerals and calcium, which are important for bone health and increasing bone density. In addition to this, other microgreen food products such as cabbage provide increased efficacy of the immune system and reduce inflammation. Peas provide aid in anemia, cancer prevention, and overall health. Basil is enriched with vitamins C and K, minerals, iron, and calcium, lowering the risk of cancer and promoting heart health. Microgreens are also available in different colors and textures, which represent different health compounds present called phytochemicals. The color can be used to detect the nutrients present in microgreens such as red symbolizes antioxidants, blue and purple provide anthocyanin, and green vegetables with carotenoids.

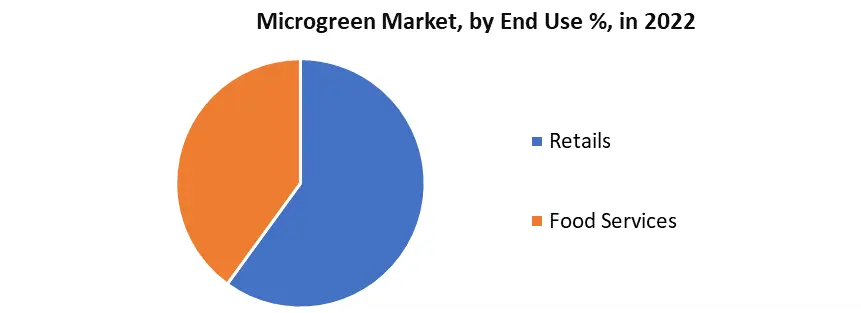

Based on End Use, the Microgreen product market has witnessed a rise in sales, due to the two main end uses in the food and beverages industry. Retail and food services are the reason behind the increasing surge in market growth. Retail stores have seen a growth in sales of microgreen products due to rising awareness of health benefits and use in home-cooked meals. This microgreen adds a unique flavor to the cooked dishes with increased food texture. Food services providing facilities like restaurants and hotels have made a rise in the use of microgreen items. This is chef’s best-known secret ingredient adding a burst of flavor and enhancing the representation of dishes by garnishing them with sauces and desserts. Microgreens are such a versatile item that can be used in sandwiches and wraps, and in smoothies and juices.

Microgreen Market Regional Analysis

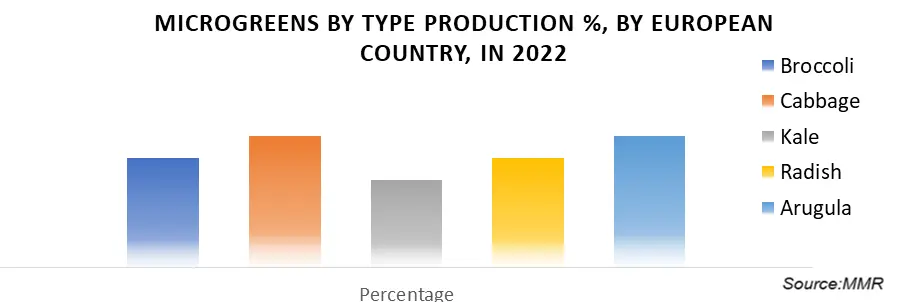

North America has witnessed the rise in demand in use of microgreens and the largest market for Microgreens. This region is followed by Europe and Asia-Pacific. Microgreens, with their versatility and health benefits, align well with the preferences of urban consumers. The interest of people in fresh and nutritional foods has been in demand due to the rising interest in a healthy life and beautiful looks. The demand is not only for processed foods that include microgreens but also for greens, shows a broader shift toward healthier and more diverse dietary choices in urban regions of North America. The increased awareness of their health benefits, as the Microgreens are packed and enriched with essential, healthy nutrients such as vitamins, antioxidants, phytonutrients (ascorbic acid), and minerals is the driving factor for growth.North America produces mostly the two popular types of Microgreens- Broccoli and Cabbage. The production of this microgreen is the largest in the United States, with California being the leading producer. California accounts for 92 % of the largest production of broccoli in North America. Cabbage microgreens are a good source of vitamins A, C, and K, in addition to these vitamins they also include iron and calcium. Canada is the largest producer of cabbage in North America. With the rise in the retail market, the availability of microgreens is more and more accessible to consumers. The increasing number of restaurants and chefs in this region prefer Microgreens to add flavor and texture to their dishes, which raises the demand for Microgreens and continues to grow. The European region has increased production of microgreens accounts for the second largest market due to the increased use of indoor farming practices. The rapid surge in technological advancement and growing popularity of health consciousness drives the market growth. Countries such as Germany and France are the major producers of broccoli, accounting for 50 % of production capacity. European food dishes are served with fresh microgreens, which adds flavor, taste, and texture dishes. This is helping to drive the demand for microgreens in restaurants. Increasing the consumer base for health consciousness makes use of microgreens for their nutritional content. Other European countries such as Italy, Spain, the United Kingdom, and the Netherlands are the major producers of other microgreen types including cabbage, kale, radish, and arugula. Government regulations in the European Region have raised initiatives to produce organic microgreen products. The European Food Safety Authority has laid regulations for maintaining the hygiene, quality, and freshness of food items.

Competitive Landscape

In October 2021, Aero Farms expanded its distribution network in the Northeast and New England, including New Jersey, New York, Connecticut, Massachusetts, and Rhode Island, with the launch of more than 350 Stop & Shop stores. The Aero Farms team of plant scientists, nutritionists, and culinary experts select the most flavorful varietals of microgreens and perfect them in our award-winning indoor vertical farms to bring you the most flavorful greens packed with nutrients and all mapped along our signature Flavor Spectrum. With the increasing collaboration and emergence of new products, the Global Microgreens market is changing rapidly. Primarily driven by Increasing public awareness of health issues and the use of indoor farming techniques. Though the market is highly competitive with approximately over 200 participants, few global players control the dominant share and country-niche players hold a significant share.Microgreen Market Scope: Inquiry Before Buying

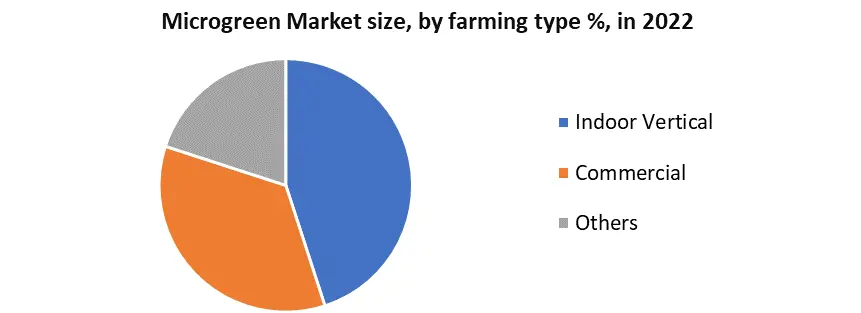

Microgreen Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1.55 Bn. Forecast Period 2023 to 2029 CAGR: 11.76% Market Size in 2029: US $ 3.37 Bn. Segments Covered: by Type Broccoli Cabbage Cauliflower Arugula Peas Basil Radish Other by Farming Indoor Vertical Farming Commercial Farming Others by Distribution Channel Retail Stores Online Farmers Market Others by End-use Food Services Retail Others Microgreen Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players in Microgreen Market

1. Farm Box Green 2. Aero Farms 3. Chef’s Garden 4. Good leaf Farms 5. Living Earth Farms 6. Gotham Farms 7. Fresh Origin 8. Teshuva Agricultural 9. Madar Farms 10. Bowery Farming 11. Metro MicrogreensFrequently Asked Questions:

1. Which region has the largest share in Global Microgreen Market? Ans: North America region held the highest share in 2022. 2. What is the growth rate of Global Microgreen Market? Ans: The Global Microgreen Market is growing at a CAGR of 11.76% during forecasting period 2023-2029. 3. What is scope of the Global Microgreen Market report? Ans: Global Microgreen Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. What is the study period of this Market? Ans: The Global Microgreen Market is studied from 2022 to 2029.

1. Microgreen Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Microgreen Market: Dynamics 2.1. Microgreen Market Trends by Region 2.1.1. North America Microgreen Market Trends 2.1.2. Europe Microgreen Market Trends 2.1.3. Asia Pacific Microgreen Market Trends 2.1.4. Middle East and Africa Microgreen Market Trends 2.1.5. South America Microgreen Market Trends 2.2. Microgreen Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Microgreen Market Drivers 2.2.1.2. North America Microgreen Market Restraints 2.2.1.3. North America Microgreen Market Opportunities 2.2.1.4. North America Microgreen Market Challenges 2.2.2. Europe 2.2.2.1. Europe Microgreen Market Drivers 2.2.2.2. Europe Microgreen Market Restraints 2.2.2.3. Europe Microgreen Market Opportunities 2.2.2.4. Europe Microgreen Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Microgreen Market Drivers 2.2.3.2. Asia Pacific Microgreen Market Restraints 2.2.3.3. Asia Pacific Microgreen Market Opportunities 2.2.3.4. Asia Pacific Microgreen Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Microgreen Market Drivers 2.2.4.2. Middle East and Africa Microgreen Market Restraints 2.2.4.3. Middle East and Africa Microgreen Market Opportunities 2.2.4.4. Middle East and Africa Microgreen Market Challenges 2.2.5. South America 2.2.5.1. South America Microgreen Market Drivers 2.2.5.2. South America Microgreen Market Restraints 2.2.5.3. South America Microgreen Market Opportunities 2.2.5.4. South America Microgreen Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Microgreen Industry 2.8. Analysis of Government Schemes and Initiatives For Microgreen Industry 2.9. Microgreen Market Trade Analysis 2.10. The Global Pandemic Impact on Microgreen Market 3. Microgreen Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Microgreen Market Size and Forecast, by Type (2023-2030) 3.1.1. Broccoli 3.1.2. Cabbage 3.1.3. Cauliflower 3.1.4. Arugula 3.1.5. Peas 3.1.6. Basil 3.1.7. Radish 3.1.8. Other 3.2. Microgreen Market Size and Forecast, by Farming (2023-2030) 3.2.1. Indoor Vertical Farming 3.2.2. Commercial Farming 3.2.3. Others 3.3. Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. Retail Stores 3.3.2. Online 3.3.3. Farmers Market 3.3.4. Others 3.4. Microgreen Market Size and Forecast, by End-Use (2023-2030) 3.4.1. Food & Beverages 3.4.2. Retail 3.4.3. Others 3.5. Microgreen Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Microgreen Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Microgreen Market Size and Forecast, by Type (2023-2030) 4.1.1. Broccoli 4.1.2. Cabbage 4.1.3. Cauliflower 4.1.4. Arugula 4.1.5. Peas 4.1.6. Basil 4.1.7. Radish 4.1.8. Other 4.2. North America Microgreen Market Size and Forecast, by Farming (2023-2030) 4.2.1. Indoor Vertical Farming 4.2.2. Commercial Farming 4.2.3. Others 4.3. North America Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. Retail Stores 4.3.2. Online 4.3.3. Farmers Market 4.3.4. Others 4.4. North America Microgreen Market Size and Forecast, by End-Use (2023-2030) 4.4.1. Food & Beverages 4.4.2. Retail 4.4.3. Others 4.5. North America Microgreen Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Microgreen Market Size and Forecast, by Type (2023-2030) 4.5.1.1.1. Broccoli 4.5.1.1.2. Cabbage 4.5.1.1.3. Cauliflower 4.5.1.1.4. Arugula 4.5.1.1.5. Peas 4.5.1.1.6. Basil 4.5.1.1.7. Radish 4.5.1.1.8. Other 4.5.1.2. United States Microgreen Market Size and Forecast, by Farming (2023-2030) 4.5.1.2.1. Indoor Vertical Farming 4.5.1.2.2. Commercial Farming 4.5.1.2.3. Others 4.5.1.3. United States Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 4.5.1.3.1. Retail Stores 4.5.1.3.2. Online 4.5.1.3.3. Farmers Market 4.5.1.3.4. Others 4.5.1.4. United States Microgreen Market Size and Forecast, by End-Use (2023-2030) 4.5.1.4.1. Food & Beverages 4.5.1.4.2. Retail 4.5.1.4.3. Others 4.5.2. Canada 4.5.2.1. Canada Microgreen Market Size and Forecast, by Type (2023-2030) 4.5.2.1.1. Broccoli 4.5.2.1.2. Cabbage 4.5.2.1.3. Cauliflower 4.5.2.1.4. Arugula 4.5.2.1.5. Peas 4.5.2.1.6. Basil 4.5.2.1.7. Radish 4.5.2.1.8. Other 4.5.2.2. Canada Microgreen Market Size and Forecast, by Farming (2023-2030) 4.5.2.2.1. Indoor Vertical Farming 4.5.2.2.2. Commercial Farming 4.5.2.2.3. Others 4.5.2.3. Canada Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 4.5.2.3.1. Retail Stores 4.5.2.3.2. Online 4.5.2.3.3. Farmers Market 4.5.2.3.4. Others 4.5.2.4. Canada Microgreen Market Size and Forecast, by End-Use (2023-2030) 4.5.2.4.1. Food & Beverages 4.5.2.4.2. Retail 4.5.2.4.3. Others 4.5.3. Mexico 4.5.3.1. Mexico Microgreen Market Size and Forecast, by Type (2023-2030) 4.5.3.1.1. Broccoli 4.5.3.1.2. Cabbage 4.5.3.1.3. Cauliflower 4.5.3.1.4. Arugula 4.5.3.1.5. Peas 4.5.3.1.6. Basil 4.5.3.1.7. Radish 4.5.3.1.8. Other 4.5.3.2. Mexico Microgreen Market Size and Forecast, by Farming (2023-2030) 4.5.3.2.1. Indoor Vertical Farming 4.5.3.2.2. Commercial Farming 4.5.3.2.3. Others 4.5.3.3. Mexico Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 4.5.3.3.1. Retail Stores 4.5.3.3.2. Online 4.5.3.3.3. Farmers Market 4.5.3.3.4. Others 4.5.3.4. Mexico Microgreen Market Size and Forecast, by End-Use (2023-2030) 4.5.3.4.1. Food & Beverages 4.5.3.4.2. Retail 4.5.3.4.3. Others 5. Europe Microgreen Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Microgreen Market Size and Forecast, by Type (2023-2030) 5.2. Europe Microgreen Market Size and Forecast, by Farming (2023-2030) 5.3. Europe Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Microgreen Market Size and Forecast, by End-Use (2023-2030) 5.5. Europe Microgreen Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Microgreen Market Size and Forecast, by Type (2023-2030) 5.5.1.2. United Kingdom Microgreen Market Size and Forecast, by Farming (2023-2030) 5.5.1.3. United Kingdom Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.1.4. United Kingdom Microgreen Market Size and Forecast, by End-Use (2023-2030) 5.5.2. France 5.5.2.1. France Microgreen Market Size and Forecast, by Type (2023-2030) 5.5.2.2. France Microgreen Market Size and Forecast, by Farming (2023-2030) 5.5.2.3. France Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.2.4. France Microgreen Market Size and Forecast, by End-Use (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Microgreen Market Size and Forecast, by Type (2023-2030) 5.5.3.2. Germany Microgreen Market Size and Forecast, by Farming (2023-2030) 5.5.3.3. Germany Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.3.4. Germany Microgreen Market Size and Forecast, by End-Use (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Microgreen Market Size and Forecast, by Type (2023-2030) 5.5.4.2. Italy Microgreen Market Size and Forecast, by Farming (2023-2030) 5.5.4.3. Italy Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.4.4. Italy Microgreen Market Size and Forecast, by End-Use (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Microgreen Market Size and Forecast, by Type (2023-2030) 5.5.5.2. Spain Microgreen Market Size and Forecast, by Farming (2023-2030) 5.5.5.3. Spain Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.5.4. Spain Microgreen Market Size and Forecast, by End-Use (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Microgreen Market Size and Forecast, by Type (2023-2030) 5.5.6.2. Sweden Microgreen Market Size and Forecast, by Farming (2023-2030) 5.5.6.3. Sweden Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.6.4. Sweden Microgreen Market Size and Forecast, by End-Use (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Microgreen Market Size and Forecast, by Type (2023-2030) 5.5.7.2. Austria Microgreen Market Size and Forecast, by Farming (2023-2030) 5.5.7.3. Austria Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.7.4. Austria Microgreen Market Size and Forecast, by End-Use (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Microgreen Market Size and Forecast, by Type (2023-2030) 5.5.8.2. Rest of Europe Microgreen Market Size and Forecast, by Farming (2023-2030) 5.5.8.3. Rest of Europe Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 5.5.8.4. Rest of Europe Microgreen Market Size and Forecast, by End-Use (2023-2030) 6. Asia Pacific Microgreen Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Microgreen Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Microgreen Market Size and Forecast, by Farming (2023-2030) 6.3. Asia Pacific Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Microgreen Market Size and Forecast, by End-Use (2023-2030) 6.5. Asia Pacific Microgreen Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Microgreen Market Size and Forecast, by Type (2023-2030) 6.5.1.2. China Microgreen Market Size and Forecast, by Farming (2023-2030) 6.5.1.3. China Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.1.4. China Microgreen Market Size and Forecast, by End-Use (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Microgreen Market Size and Forecast, by Type (2023-2030) 6.5.2.2. S Korea Microgreen Market Size and Forecast, by Farming (2023-2030) 6.5.2.3. S Korea Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.2.4. S Korea Microgreen Market Size and Forecast, by End-Use (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Microgreen Market Size and Forecast, by Type (2023-2030) 6.5.3.2. Japan Microgreen Market Size and Forecast, by Farming (2023-2030) 6.5.3.3. Japan Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.3.4. Japan Microgreen Market Size and Forecast, by End-Use (2023-2030) 6.5.4. India 6.5.4.1. India Microgreen Market Size and Forecast, by Type (2023-2030) 6.5.4.2. India Microgreen Market Size and Forecast, by Farming (2023-2030) 6.5.4.3. India Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.4.4. India Microgreen Market Size and Forecast, by End-Use (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Microgreen Market Size and Forecast, by Type (2023-2030) 6.5.5.2. Australia Microgreen Market Size and Forecast, by Farming (2023-2030) 6.5.5.3. Australia Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.5.4. Australia Microgreen Market Size and Forecast, by End-Use (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Microgreen Market Size and Forecast, by Type (2023-2030) 6.5.6.2. Indonesia Microgreen Market Size and Forecast, by Farming (2023-2030) 6.5.6.3. Indonesia Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.6.4. Indonesia Microgreen Market Size and Forecast, by End-Use (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Microgreen Market Size and Forecast, by Type (2023-2030) 6.5.7.2. Malaysia Microgreen Market Size and Forecast, by Farming (2023-2030) 6.5.7.3. Malaysia Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.7.4. Malaysia Microgreen Market Size and Forecast, by End-Use (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Microgreen Market Size and Forecast, by Type (2023-2030) 6.5.8.2. Vietnam Microgreen Market Size and Forecast, by Farming (2023-2030) 6.5.8.3. Vietnam Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.8.4. Vietnam Microgreen Market Size and Forecast, by End-Use (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Microgreen Market Size and Forecast, by Type (2023-2030) 6.5.9.2. Taiwan Microgreen Market Size and Forecast, by Farming (2023-2030) 6.5.9.3. Taiwan Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.9.4. Taiwan Microgreen Market Size and Forecast, by End-Use (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Microgreen Market Size and Forecast, by Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Microgreen Market Size and Forecast, by Farming (2023-2030) 6.5.10.3. Rest of Asia Pacific Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 6.5.10.4. Rest of Asia Pacific Microgreen Market Size and Forecast, by End-Use (2023-2030) 7. Middle East and Africa Microgreen Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Microgreen Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Microgreen Market Size and Forecast, by Farming (2023-2030) 7.3. Middle East and Africa Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Microgreen Market Size and Forecast, by End-Use (2023-2030) 7.5. Middle East and Africa Microgreen Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Microgreen Market Size and Forecast, by Type (2023-2030) 7.5.1.2. South Africa Microgreen Market Size and Forecast, by Farming (2023-2030) 7.5.1.3. South Africa Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.1.4. South Africa Microgreen Market Size and Forecast, by End-Use (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Microgreen Market Size and Forecast, by Type (2023-2030) 7.5.2.2. GCC Microgreen Market Size and Forecast, by Farming (2023-2030) 7.5.2.3. GCC Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.2.4. GCC Microgreen Market Size and Forecast, by End-Use (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Microgreen Market Size and Forecast, by Type (2023-2030) 7.5.3.2. Nigeria Microgreen Market Size and Forecast, by Farming (2023-2030) 7.5.3.3. Nigeria Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.3.4. Nigeria Microgreen Market Size and Forecast, by End-Use (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Microgreen Market Size and Forecast, by Type (2023-2030) 7.5.4.2. Rest of ME&A Microgreen Market Size and Forecast, by Farming (2023-2030) 7.5.4.3. Rest of ME&A Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 7.5.4.4. Rest of ME&A Microgreen Market Size and Forecast, by End-Use (2023-2030) 8. South America Microgreen Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Microgreen Market Size and Forecast, by Type (2023-2030) 8.2. South America Microgreen Market Size and Forecast, by Farming (2023-2030) 8.3. South America Microgreen Market Size and Forecast, by Distribution Channel(2023-2030) 8.4. South America Microgreen Market Size and Forecast, by End-Use (2023-2030) 8.5. South America Microgreen Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Microgreen Market Size and Forecast, by Type (2023-2030) 8.5.1.2. Brazil Microgreen Market Size and Forecast, by Farming (2023-2030) 8.5.1.3. Brazil Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 8.5.1.4. Brazil Microgreen Market Size and Forecast, by End-Use (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Microgreen Market Size and Forecast, by Type (2023-2030) 8.5.2.2. Argentina Microgreen Market Size and Forecast, by Farming (2023-2030) 8.5.2.3. Argentina Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 8.5.2.4. Argentina Microgreen Market Size and Forecast, by End-Use (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Microgreen Market Size and Forecast, by Type (2023-2030) 8.5.3.2. Rest Of South America Microgreen Market Size and Forecast, by Farming (2023-2030) 8.5.3.3. Rest Of South America Microgreen Market Size and Forecast, by Distribution Channel (2023-2030) 8.5.3.4. Rest Of South America Microgreen Market Size and Forecast, by End-Use (2023-2030) 9. Global Microgreen Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Microgreen Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Farm Box Green 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Aero Farms 10.3. Chef’s Garden 10.4. Good leaf Farms 10.5. Living Earth Farms 10.6. Gotham Farms 10.7. Fresh Origin 10.8. Teshuva Agricultural 10.9. Madar Farms 10.10. Bowery Farming 10.11. Metro Microgreens 11. Key Findings 12. Industry Recommendations 13. Microgreen Market: Research Methodology 14. Terms and Glossary