Plant Based Ham Market size was valued at USD 453.42 million in 2022 and expected to reach USD 1060.12 million by 2029, at a CAGR of 12.89%.Plant Based Ham Market Overview

Plant based ham is made from alternative protein sources such as soy, wheat or pea protein. It aims to mimic the taste and texture of regular ham, while offering a more economical and ethical alternative. Many people are switching to plant-based meat to reduce their environmental impact, improve health or for ethical reasons. Using vegetable composts can reduce carbon dioxide emissions, conserve water and other natural resources, and promote a more sustainable environment. These factors are the main drivers of the growing plant-based ham market. The factory-based ham market is still relatively new and growing, and manufacturers are constantly innovating new products to reach a wider audience.To know about the Research Methodology :- Request Free Sample Report The Plant Based Ham Market is highly competitive and fragmented. Leading players in this market are Lightlife Foods, Tofurky, Gardein, Beyond Meat, Impossible Foods, The Vegetarian Butcher, and Nestlé. Market leaders are focused on product development, strategic alliances, and distribution expansion to gain a competitive advantage. The global market for plant based ham is dominated by the North American region. The top players in North America are Hain Celestial CanadaULC TofurkyCo., Inc. Lightlife Foods Inc. Vbites Foods Ltd Plant-based hams.

Plant Based Ham Market Scope & Research Methodology

The report highlights the competitive market view, segment analysis based on the Product Type, Distribution channel and Region. First, the market overview describes the market trends, key market drivers, market restraints, opportunities, and challenges for the Plant Based Ham Market. The Market is segmented by Product Type into Slices and Strips, Rolls and Roasts. Market also segmented by Distribution Channel includes supermarkets & hypermarkets, Convenience store, Online Retail Stores and others. The market size and trends for the Plant Based Ham Market were analysed by using both primary and secondary data. Top down approach is used to estimate market size of the Plant Based Ham Market. The Plant Based Ham Market is highly competitive and fragmented with several major players competing for market share. Market leaders are focused on product development, strategic alliances, and distribution expansion to gain a competitive advantage. The market is characterized by the presence of both traditional food companies that are expanding into plant-based alternatives and start-ups that focus on plant-based meat alternatives. Leading players in this market are Lightlife Foods, Tofurky, Gardein, Beyond Meat, Impossible Foods, The Vegetarian Butcher, Nestlé.Plant Based Ham Market Dynamics

Market Drivers

Increasing demand for vegan and vegetarian options: Rising demand for vegan and vegetarian choices is expected to promote expansion in the plant-based ham market. As more individuals adopt plant-based diets for health, environmental, and ethical reasons, there is a growing demand for meat alternatives that match traditional flavours and experiences. This trend is set to benefit plant-based ham, which has the ability to give a familiar flavour experience without the usage of animal components. Furthermore, as food innovation improves the flavour and texture of plant-based meats, it is anticipated to attract a broader customer base, raising demand for plant-based ham products. According to the Vegetarian Resource Group's 2021 study, there are now over 9.8 million vegans and vegetarians in the United States. This figure is expected increased during forecasted period. Invention & Innovation: The emergence of innovative and inventive plant-based ham products will accelerate the growth of plant-based ham. Food Industry innovations can result in products that closely resemble the flavour, texture, and appearance of traditional hams, making them more appealing to consumers looking for a convincing meat substitute. On the other hand, new tastes, a higher nutritional profile, and a more versatile product format can broaden the usage of plant-based hams and attract a wider audience and culinary applications. These developments not only respond to the changing desires of plant-based and flexible consumers, but they also inspire meat-eaters to investigate and embrace plant-based alternatives. This, in turn, encourages the development of vegetable hams. Government regulation and incentives Government regulation and incentives can help drive plant-based hams demand and market growth. For example, supporting regulations such as plant-based product labelling requirements can increase consumer confidence and make it simpler for people looking for vegan or vegetarian hams to find plant-based options. Incentives such as plant protein subsidies or tax incentives that encourage companies to invest in sustainable and animal-friendly food technologies can also reduce production costs. This could make plant-based meat more affordable and available to a wider range of consumers. These government measures can also help manufacturers invest in research and development, expand product lines and encourage market growth as consumer preferences change and sustainability goals evolve. Market Trends Plant-based diets are becoming increasingly popular among youngsters, which is a major market development in the plant-based ham market. Plant-based diets are becoming more popular among youngsters for health, environmental and ethical reasons. They are more aware of the influence of their dietary choices on the environment and animal welfare. Manufacturers are responding to this trend by creating novel plant-based ham products that cater to youngsters taste preferences and values, fueling growth in the plant-based ham market. Consumers are becoming increasingly worried about meat production's environmental impact. Plant-based ham appeals to eco-conscious consumers due to its smaller carbon footprint and resource consumption. Manufacturers are continuously working to enhance the taste and texture of plant-primarily based totally ham products. To make extra practical meat replacements, they may be experimenting with new components and processing procedures. The Plant Based Ham market is becoming increasingly popular, offering an increasing variety of flavours, presentation options (slices, deli slices, etc.) and packages to meet the needs of different consumers and cooking styles.Market Opportunities

The Plant Based Ham Market is a rapidly growing market with a lot of potential. The market is expected to grow in the coming years, and companies that can take advantage of these opportunities are well positioned to succeed. In China, 15% of consumers consume plant-based ham daily. There are opportunities for plant-based ham brands to increase market share and widen the consumer base. More than half of consumers would like to try plant-based ham with multiple plant protein sources, so brands should focus on product innovation with plant ingredients that consumers are interested in. 51% of Thai consumers would be prefers to eat more plant-based ham if it tasted like meat to them. To appeal to a broader consumer base, plant-based brands must focus on innovation and creating foods that successfully mimic the taste and texture of animal meat. There is an opportunity to create an online store and e-commerce site to sell your plant based ham products directly to customers. Design engaging websites, provide easy shipping options, and look into subscription options for recurring revenue. Exporting plant-based hams to international markets is also an excellent strategy to expand your business. However, while entering a new market, it is critical to examine each country's demands, tastes, and rules. Market Challenges/ Restraints The Plant Based Ham Market offers promising opportunities, but also several challenges for producers and companies in the sector. One major challenge is imitating taste and texture. Creating plant-based ham products that mimic the taste, texture and mouth feel of traditional ham can be technically demanding and requires constant research and development. In addition, consumer expectations are high, and potential taste or texture deficiencies can hinder adoption. Cost is also an issue, since some plant-based ingredients might be more expensive than traditional meat, resulting in higher retail pricing. In addition, competition is intensifying and many companies are entering the market, so companies need to effectively differentiate their products through branding, marketing and innovation. Finally, as public awareness of plant-based alternatives rises, education and awareness initiatives to tell consumers of the health, environmental, and ethical benefits of choosing plant-based ham are still required. To overcome all these challenges organisation requires a combination of technological advances, effective marketing strategies and a commitment to improving product quality and affordability to meet changing consumer demands in the plant-based ham market.Plant Based Ham Market Segmentation

By Product Type Based on product type, The Plant Based Ham Market is segmented into Slices and Strips, Rolls and Roasts. The Slices and Strips segment held over 60% of the market share and is anticipated to maintain its dominance with a anticipated CAGR of 8.6 % during the forecasted period. This is due its ease of use and versatility. This is due to its ease of use and versatility. It can be used in various foods such as sandwiches, salads, wraps, etc. It is also a high source of protein and fiber. Sliced plant-based ham offers a soft, chewy texture. These slices warm up quickly because of their large, open surface area. They also release flavours more clearly when used in food preparation. In addition, plant-based hams are available in multiple distribution channels due to their broad consumer base. All these factors contribute to the significant growth of the segment. The roller segment is projected to grow moderately, while the roasts segment is projected to grow at highest rate. Both segments are growing due to the increasing popularity of plant based products and the development of new and innovative products. By Distribution Channel On the basis of the distribution channel, the plant based ham market is divided into supermarkets and hypermarkets, convenience stores, online retail stores and others.Plant Based Ham Market, by Distribution Channel in 2022(%)

The Supermarket and hypermarket held over 55% of the market share and is expected to grow during forecasted period (2022-2029). This is mainly because increasing consumer preferences towards Supermarkets and hypermarkets. As Supermarkets and Hypermarkets provides wide variety of plat-based ham products such as Slices and strips, rolls and roasts. And they are conveniently located in the major cities. The Convenience Stores held over 20% of the market share and is anticipated to maintain its dominance with an anticipated CAGR of 6.5% during the estimate period. Online Retail Stores also plays a significant role in the distribution of plant based ham.

Regional Insights

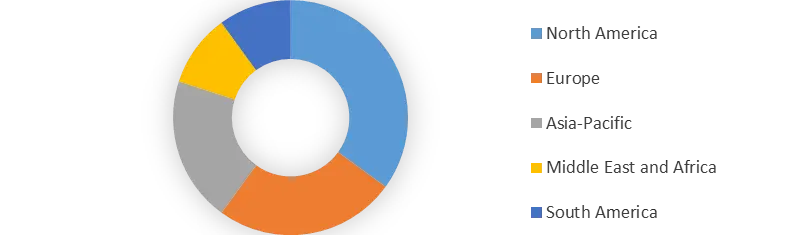

The global Plant Based Ham Market segmented into North America, Europe, Asia-Pacific, Middle East and Africa and South America. The global market for plant based ham is dominated by the North American region with anticipated CAGR 11.3%. This growth of plant based ham market is driven by increasing investment in the plant based food industry, particularly plant based hams, as well as frequent product launches. The plant based ham market in North America is driven by the increasing awareness of environmental issues and the increasing number of health conscious consumers. In 2019, retail sales of plant foods in the United States increased by 11% compared to the year before, reaching a market value of $4.5 billion, according to a report by the “PLANT Based Foods Association.” The demand for plant-based hams has been driven by a shift in consumer preferences towards healthier alternatives to traditional meat and meat products, as well as a decrease in the consumption of animal-based food. In North America, there are several start-ups as well as established players in the plant-based ham industry. The top players in North America are Hain Celestial CanadaULC TofurkyCo., Inc. Lightlife Foods Inc. Vbites Foods Ltd Plant-based hams People from North America are aware of the negative consequences of eating meat all the time because of the many public awareness and promotion campaigns. The growing number of vegans in North America is another reason why people are looking for plant based ham products. The European market has the second-largest market share due to the presence of a comparable number of vegetarian and vegan consumers in comparison to North America. Europe has become a major consumer of ham slices, strips, buns and roasts. A report published by The Smart Protein Project claimed that sales of plant-based foods in Germany increased by 97 percent between 2018 and 2020, with a corresponding 80 percent increase in sales volume. Consumer preferences for a plant-based diet have contributed to an increase in plant-based protein consumption in the United Kingdom, as indicated by trends in retail chains and hotels and resorts across the country.Plant Based Ham Market, by Region in(%)

Competitive Landscape

The Plant Based Ham Market is highly competitive and fragmented with several major players competing for market share. Market leaders are focused on product development, strategic alliances, and distribution expansion to gain a competitive advantage. The market is characterized by the presence of both traditional food companies that are expanding into plant-based alternatives and start-ups that focus on plant-based meat alternatives. Leading players in this market are Lightlife Foods, Tofurky, Gardein, Beyond Meat, Impossible Foods, The Vegetarian Butcher, Nestlé. The Plant Based Ham Market is constantly expanding and new players regularly enter the market. Market leaders are constantly innovating and creating new products that satisfy consumer needs. New players are also entering the market with innovative ideas and products, which are driving the market growth. Some of the emerging players in plant based ham market are Simply Good Foods, Zebra Foods, Gourmet Evolution etc., These companies are new to the industry, but growing rapidly. They target specific niches and use cutting-edge marketing techniques to increase their market share.Plant Based Ham Market Scope : Inquire Before Buying

Global Plant Based Ham Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 453.42 Mn. Forecast Period 2023 to 2029 CAGR: 12.89% Market Size in 2029: US $ 1060.12 Mn. Segments Covered: by Product Type Slices and Strips Rolls Roasts by Distribution Channel Supermarkets & Hypermarkets Convenience Stores Online Retail Store Plant Based Ham Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Plant Based Ham Market, Key Players are

1. Tofurky 2. Nestlé 3. Gardein 4. Alpha Foods 5. Quorn Foods 6. The Vegetarian Butcher 7. Loma Linda 8. Sunfed Meats 9. Vivera 10. Field Roast 11. Herbivorous Butcher 12. Lightlife Foods 13. Sophie's Kitchen 14. Before the Butcher 15. The Very Good Butchers 16. Yves Veggie Cuisine 17. Plant Chef 18. Fable Food 19. Hooray Foods 20. Vbites Food 21. Gourmet Evolution 22. Meliora Foods 23. Zebra Food 24. No Evil Foods 25. Light Life Foods 26. Hain Celestial Canada.Frequently Asked Questions:

1] What segments are covered in the Global Plant Based Ham Market report? Ans. The segments covered in the Plant Based Ham Market report are based on Product Type, Distribution Channel and Region. 2] Which region dominated the Global Plant Based Ham Market in 2022? Ans. The North America region dominated the global Plant Based Ham Market in 2022. 3] What is the market size of the Global Plant Based Ham Market by 2029? Ans. The market size of the Plant Based Ham Market by 2029 is expected to reach USD 1060.12 million. 4] What is the forecast period for the Global Plant Based Ham Market? Ans. The forecast period for the Plant Based Ham Market is 2023-2029. 5] What was the market size of the Global Plant Based Ham Market in 2022? Ans. The market size of the Plant Based Ham Market in 2022 was valued at USD 453.42 Million.

1. Plant Based Ham Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Plant Based Ham Market: Dynamics 2.1. Plant Based Ham Market Trends by Region 2.1.1. Global Plant Based Ham Market Trends 2.1.2. North America Plant Based Ham Market Trends 2.1.3. Europe Plant Based Ham Market Trends 2.1.4. Asia Pacific Plant Based Ham Market Trends 2.1.5. Middle East and Africa Plant Based Ham Market Trends 2.1.6. South America Plant Based Ham Market Trends 2.1.7. Preference Analysis 2.2. Plant Based Ham Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Plant Based Ham Market Drivers 2.2.1.2. North America Plant Based Ham Market Restraints 2.2.1.3. North America Plant Based Ham Market Opportunities 2.2.1.4. North America Plant Based Ham Market Challenges 2.2.2. Europe 2.2.2.1. Europe Plant Based Ham Market Drivers 2.2.2.2. Europe Plant Based Ham Market Restraints 2.2.2.3. Europe Plant Based Ham Market Opportunities 2.2.2.4. Europe Plant Based Ham Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Plant Based Ham Market Drivers 2.2.3.2. Asia Pacific Plant Based Ham Market Restraints 2.2.3.3. Asia Pacific Plant Based Ham Market Opportunities 2.2.3.4. Asia Pacific Plant Based Ham Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Plant Based Ham Market Drivers 2.2.4.2. Middle East and Africa Plant Based Ham Market Restraints 2.2.4.3. Middle East and Africa Plant Based Ham Market Opportunities 2.2.4.4. Middle East and Africa Plant Based Ham Market Challenges 2.2.5. South America 2.2.5.1. South America Plant Based Ham Market Drivers 2.2.5.2. South America Plant Based Ham Market Restraints 2.2.5.3. South America Plant Based Ham Market Opportunities 2.2.5.4. South America Plant Based Ham Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Key Opinion Leader Analysis For Allogeneic Cell Therapy Industry 2.9. Analysis of Government Schemes and Initiatives For Plant Based Ham Industry 2.10. The Global Pandemic Impact on Plant Based Ham Market 2.11. Plant Based Ham Price Trend Analysis (2021-22) 2.12. Global Plant Based Ham Market Trade Analysis (2017-2022) 2.12.1. Global Import of Coffee 2.12.1.1. Ten Largest Importer 2.12.2. Global Export of Coffee 2.12.3. Ten Largest Exporter 2.13. Production Capacity Analysis 2.13.1. Chapter Overview 2.13.2. Key Assumptions and Methodology 2.13.3. Plant Based Ham Manufacturers: Global Installed Capacity 3. Plant Based Ham Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2022-2029) 3.1. Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 3.1.1. Slices and Strips 3.1.2. Rolls 3.1.3. Roasts 3.2. Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 3.2.1. Supermarkets & Hypermarkets 3.2.2. Convenience Store 3.2.3. Online Retail Stores 3.2.4. others 3.3. Plant Based Ham Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Plant Based Ham Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 4.1. North America Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 4.1.1. Slices and Strips 4.1.2. Rolls 4.1.3. Roasts 4.2. North America Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 4.2.1. Supermarkets & Hypermarkets 4.2.2. Convenience Store 4.2.3. Online Retail Stores 4.2.4. Others 4.2.5. 4.3. North America Plant Based Ham Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 4.3.1.1.1. Slices and Strips 4.3.1.1.2. Rolls 4.3.1.1.3. Roasts 4.3.1.2. United States Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.1.2.1. Supermarkets & Hypermarkets 4.3.1.2.2. Convenience Store 4.3.1.2.3. Online Retail Stores 4.3.1.2.4. Others 4.3.2. Canada 4.3.2.1. Canada Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 4.3.2.1.1. Slices and Strips 4.3.2.1.2. Rolls 4.3.2.1.3. Roasts 4.3.2.2. Canada Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.2.2.1. Supermarkets & Hypermarkets 4.3.2.2.2. Convenience Store 4.3.2.2.3. Online Retail Stores 4.3.2.2.4. Others 4.3.3. Mexico 4.3.3.1. Mexico Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 4.3.3.1.1. Slices and Strips 4.3.3.1.2. Rolls 4.3.3.1.3. Roasts 4.3.3.2. Mexico Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.3.2.1. Supermarkets & Hypermarkets 4.3.3.2.2. Convenience Store 4.3.3.2.3. Online Retail Stores 4.3.3.2.4. Others 5. Europe Plant Based Ham Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. Europe Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 5.2. Europe Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 5.3. Europe Plant Based Ham Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 5.3.1.2. United Kingdom Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.2. France 5.3.2.1. France Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 5.3.2.2. France Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 5.3.3.2. Germany Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 5.3.4.2. Italy Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 5.3.5.2. Spain Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 5.3.6.2. Sweden Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 5.3.7.2. Austria Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 5.3.8.2. Rest of Europe Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Plant Based Ham Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 6.2. Asia Pacific Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 6.3. Asia Pacific Plant Based Ham Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 6.3.1.2. China Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 6.3.2.2. S Korea Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 6.3.3.2. Japan Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.4. India 6.3.4.1. India Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 6.3.4.2. India Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.4.3. India Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 6.3.5.2. Australia Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 6.3.6.2. Indonesia Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 6.3.7.2. Malaysia Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 6.3.8.2. Vietnam Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 6.3.9.2. Taiwan Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 6.3.10.2. Rest of Asia Pacific Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Plant Based Ham Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 7.1. Middle East and Africa Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 7.2. Middle East and Africa Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 7.3. Middle East and Africa Plant Based Ham Market Size and Forecast, by Country (2022-2029) 7.3.1. South Africa 7.3.1.1. South Africa Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 7.3.1.2. South Africa Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 7.3.2. GCC 7.3.2.1. GCC Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 7.3.2.2. GCC Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 7.3.3. Nigeria 7.3.3.1. Nigeria Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 7.3.3.2. Nigeria Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 7.3.4.2. Rest of ME&A Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Plant Based Ham Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. South America Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 8.2. South America Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 8.3. South America Plant Based Ham Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 8.3.1.2. Brazil Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 8.3.2.2. Argentina Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Plant Based Ham Market Size and Forecast, by Product Type (2022-2029) 8.3.3.2. Rest Of South America Plant Based Ham Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Plant Based Ham Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Type Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. Production Capacity 9.3.8. Production for 2022 9.3.9. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Plant Based Ham Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Tofurky 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Nestlé 10.3. Gardein 10.4. Alpha Foods 10.5. Quorn Foods 10.6. The Vegetarian Butcher 10.7. Loma Linda 10.8. Sunfed Meats 10.9. Vivera 10.10. Field Roast 10.11. Herbivorous Butcher 10.12. Lightlife Foods 10.13. Sophie's Kitchen 10.14. Before the Butcher 10.15. The Very Good Butchers 10.16. Yves Veggie Cuisine 10.17. Plant Chef 10.18. Fable Food 10.19. Hooray Foods 10.20. Vbites Food 10.21. Gourmet Evolution 10.22. Meliora Foods 10.23. Zebra Food 10.24. No Evil Foods 10.25. Light Life Foods 10.26. Hain Celestial Canada. 11. Key Findings 12. Industry Recommendations 13. Plant Based Ham Market: Research Methodology 14. Terms and Glossary