Organic Olive Oil Market size was valued at USD 14.22 Bn in 2022 and expected to reach USD 17.83 Bn by 2029, at a CAGR of 3.29 % Organic Olive Oil is produced from olives that are grown without the use of synthetic pesticides or fertilizers and are processed using only natural methods. The Organic Olive Oil market has experienced significant growth in recent years, by rising consumer demand for healthier and more sustainable food products. The market for organic olive oil is expected to continue to grow in the coming years, as consumers become more aware of the benefits of organic food products and seek out healthier alternatives to traditional cooking oils. Organic Olive Oil products are now widely consumed across the globe, finding their way into a variety of goods such as food, cosmetics, medicine, soap, and even traditional lamps. People all over the world regularly consume products like extra virgin olive oil for their potential therapeutic benefits.To know about the Research Methodology :- Request Free Sample Report

Organic Olive Oil Market Scope & Methodology

The organic olive oil market includes all types of olive oil that are certified organic, meaning they are produced using organic farming methods and are free from synthetic pesticides and fertilizers. The market includes various grades of olive oil, such as extra virgin, virgin, and refined olive oil, as well as flavored olive oils that are infused with natural herbs or fruits. The market is segmented by distribution channels, including supermarkets and hypermarkets, specialty stores, online retailers, and others. It is also segmented by application, such as cooking, dipping, dressings and sauces, and others. The market size and trends for the organic olive oil market were analyzed using a combination of primary and secondary research methods. Primary research included interviews with key industry players, including organic olive oil producers, distributors, and retailers. Secondary research involved a comprehensive analysis of industry reports, press releases, and company websites. To estimate the market size, various factors were taken into consideration, including the production and consumption trends of organic olive oil, the demand for healthier and sustainable food products, and the growth of e-commerce platforms for the sale of organic food products. Market projections were based on historical data, current trends, and future market opportunities and challenges. Data analysis was performed using statistical tools, such as correlation analysis, and factor analysis, to identify key drivers and restraints impacting the organic olive oil market. The study also included a SWOT analysis of major players in the market, including their strengths, weaknesses, opportunities, and threats, to provide a comprehensive understanding of the market dynamics.Organic Olive Oil Market Dynamics

Increasing Consumer Demand for Healthier and Sustainable Food Products One of the primary drivers of the organic olive oil market is the increasing consumer demand for healthier and sustainable food products. Organic olive oil is considered to be a healthier alternative to other cooking oils, as it is high in monounsaturated fats and antioxidants, and is produced without the use of synthetic pesticides or fertilizers. Additionally, organic farming methods are considered to be more sustainable and better for the environment, which is an important consideration for many consumers. Rising Awareness about the Health Benefits of Olive Oil has been associated with several health benefits, including reducing the risk of heart disease, improving cognitive function, and promoting healthy skin. As consumers become more aware of these health benefits, they are more likely to seek out organic olive oil as a healthy alternative to other cooking oils. Growing Trend of Using Olive Oil in Cooking and Food Preparation Olive oil is a versatile cooking oil that is used in a variety of dishes, from salads and dressings to sautéing and frying. As the popularity of the Mediterranean and other healthy cuisines continues to grow, the demand for olive oil as a cooking ingredient is also increasing. Organic olive oil is preferred by many consumers as it is considered to be of higher quality and free from harmful chemicals. Increasing Availability of Organic Olive Oil products has increased in recent years, as more producers have entered the market to meet growing demand. This has resulted in increased competition and lower prices for consumers, making organic olive oil a more accessible and affordable option for many. Government Support for Organic Farming Practices as, many governments around the world have introduced policies and programs to support organic farming practices, including those used in the production of organic olive oil. This has helped to increase the supply of organic olive oil and has made it easier for producers to meet organic certification requirements. Price Fluctuation The price of organic olive oil is often subject to significant fluctuations due to factors such as weather conditions, production levels, and global demand. This can make it difficult for producers to predict pricing and can impact their profitability. Additionally, higher prices for organic olive oil can make it less accessible and affordable for consumers, which could impact demand. Counterfeit organic olive oil products It is a significant issue in the market, as it can undermine consumer trust in the authenticity and quality of organic olive oil. These products are often sold at lower prices than authentic organic olive oil, which can impact the profitability of legitimate producers. While organic olive oil is considered to be a healthier alternative to many other vegetable oils, such as soybean or canola oil, there is still competition from other vegetable oils in the market. These oils are often cheaper to produce and can be more widely available, which can impact the demand for organic olive oil. Increasing Awareness and Demand for Organic Products As consumers become more aware of the benefits of organic products, including organic olive oil, there is likely to be a continued increase in demand for these products. This presents an opportunity for producers to expand their production and distribution networks to meet this growing demand. There are several emerging markets for organic olive oil, including Asia and South America. As these markets continue to grow and develop, there is an opportunity for producers to enter these markets and expand their customer base. Product innovation, such as the development of new flavors or packaging formats, can help to differentiate organic olive oil products from competitors and increase demand. Additionally, innovations in production processes, such as the use of advanced technology, help to improve the efficiency and quality of production. Increased Focus on Sustainability Sustainability is becoming an increasingly important factor for consumers when making purchasing decisions. As a result, there is an opportunity for producers to focus on sustainable production methods and to promote their environmentally friendly practices to attract consumers who prioritize sustainability. The health and wellness trend is expected to continue to grow in the coming years, and organic olive oil is well-positioned to benefit from this trend. Producers can capitalize on this trend by promoting the health benefits of organic olive oil and developing products that cater to health-conscious consumers.Organic Olive Oil Market Segmentation Analysis

By Product Type: Organic Olive Oil is available in many types such as Extra Virgin Olive Oil as it processed form of olive oil that preserves its natural antioxidants and vitamins which are often lost during processing which makes it healthier than regular Olive Oil. Pomace Olive Oil is also high in monosaturated fatty acid which makes it rich and helps to reduce some cardiovascular diseases. It is also good for cooking because it has a high smoking point. Olive pomace oil has a high heat tolerance and doesn't lose any of its nutrients.By End-User: Olive Pomace Oil has been refined, it has a higher heat tolerance than other cold-pressed oils. This means that it is used for hot-fill manufacturing in the food processing industry. Olive Oil possesses moisturizing properties and is said to be great for the hair and skin it does not affect or remove natural oils from the skin. Olive Oil is used as a vehicle for oily suspensions for injections and topically as a demulcent and emollient in creams or ointments in the pharmaceutical industry. By Distribution Channel: In 2021, B2B suppliers dominated the organic olive oil market with the largest revenue share of $355.2 million. It is expected to grow at a CAGR of 8.4% and reach $800.3 million by 2029. B2B is a preferred sales channel for organic olive oil due to the convenience of ordering in bulk and the potential for volume discounts. Organic olive oil is valued by consumers for its high content of monounsaturated fats, which offer numerous health benefits. It is used as an ingredient in food and beverage production and is the preferred option over other oils. Additionally, it is employed in cosmetics, cooking oil, and flavored beverages. The dominance of B2B suppliers is expected to support the expansion of the organic olive oil market in the future. By Application: Olive oil is an excellent ingredient for marinades and sauces to enhance the flavour of chicken, beef, and fish. Its unique and mild flavour also makes it a popular choice for making healthy dips like hummus or salsa. Olive oil is frequently used as a healthy preservative in homemade sauces or dips, making it a versatile and practical ingredient in the kitchen. By Packaging: Packaging directly influences olive oil quality by protecting the product from both oxygen and light. The shelf life of the oils exposed to intense artificial light and diffused daylight is shorter than that of oils kept in the dark. Materials that have been used for olive oil packaging include glass, metals (tin-coated steel), and more recently plastics and plastics-coated paperboard. Among plastics, polyethylene terephthalate (PET) has captured a large portion of the olive oil retail market.

Organic Olive Oil Market Competitive Landscape Analysis:

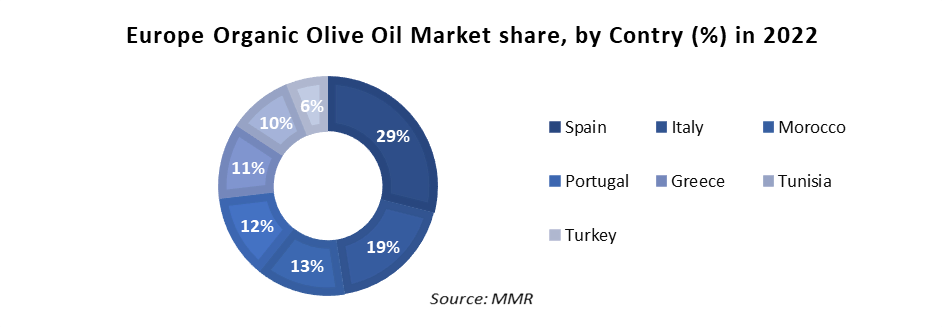

The report includes a detailed analysis of the competitive landscape of the Organic Olive Oil market, including the market share of major players, new product launches, partnerships, and collaborations. Spain is the world's largest producer, manufacturing almost half of the world's olive oil. Other large producers are Italy, Greece, Tunisia, Turkey, and Morocco. California Olive Ranch, Lucini Italia, Colavita, La Tourangelle, Mueloliva, Bionaturae, O-Live, Jovial Foods, Deoleo S.A., Sovena Group, Salov Group, Olitalia S.p.A., Gallo Worldwide, Pietro Coricelli S.p.A., Grupo Ybarra Alimentación, Minerva S.A., Carapelli Firenze S.p.A., and La Española Alimentaria Alcoyana S.A. California Olive Ranch Company is one of the largest producers of organic olive oil in the United States. They offer a wide range of organic olive oils, including extra virgin olive oil, blended olive oil, and flavored olive oil. California Olive Ranch, the largest American olive oil producer, announced its acquisition of Lucini Italia, a producer, and importer of Italian extra virgin olive oils. Colavita acquired the O Olive Oil & Vinegar brand and business assets on April 10, 2023. La Tourangelle Company produces organic extra virgin olive oil sourced from Spain, Tunisia, and California. Mueloliva is a Spanish company that is a major producer of organic olive oil. Bionaturae: It is an Italian Company that produces organic extra virgin olive oil. They also offer a variety of other organic products, such as pasta, tomato sauce, and fruit spreads. O-Live produces organic extra virgin olive oil sourced from Chile. They offer a range of organic oils, including avocado oil and grapeseed oil. Jovial Foods: Jovial Foods is another Italian company that produces organic extra virgin olive oil. They also offer a variety of other organic products, such as pasta and cookies. These are just a few of the many companies that are competing in the organic olive oil market. With the increasing demand for organic and healthy food products, we can expect to see more companies entering this market in the future.

Regional Analysis of the Organic Olive Oil Market:

Europe is the largest market for olive oil, accounting for around 70% of global consumption. The major producers and exporters of olive oil in Europe include Spain, Italy, and Greece. The market in Europe is mature, with high levels of consumption and a focus on quality and authenticity. North America and Asia-Pacific are also significant markets for olive oil, with the United States, Canada, Australia, and Japan being major consumers. The market in North America is growing rapidly, due to the increasing popularity of Mediterranean cuisine and the growing awareness of the health benefits of olive oil. While Europe remains the largest market for olive oil, the market in Asia-Pacific is growing rapidly. The largest producers of virgin olive oil are China, the U.S., Brazil, Germany, and Mexico in the Asia-Pacific region. The key players in the Asia-Pacific market include Deoleo S.A., Borges Mediterranean Group, Sovena Group, Ybarra Alimentacion S.A., and Grupo Sos, among others.Organic Olive Oil Market Scope: Inquire before buying

Organic Olive Oil Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 14.22 Bn Forecast Period 2023 to 2029 CAGR: 3.29 % Market Size in 2029: USD 17.83 Bn Segments Covered: by Product Type 1. Extra Virgin Olive Oil 2. Pomace Olive Oil 3. Flavoured Olive Oil 4. Refined Olive Oil 5. Virgin Olive Oil by End-User 1. Food Processing 2. Cosmetics & Personal Care 3. Food Service 4. Pharmaceuticals 5. Other by Distribution Channel 1. B2b & B2c 2. Hypermarkets/Supermarkets 3. Online Retails 4. Grocery Stores by Application 1. Cooking 2. Dipping 3. Dressing 4. Sauces 5. Others by Packaging 1. Opaque & Dark Glass 2. Tinplate Cans 3. Stainless Steel 4. Plastic Contains 5. Aluminium Bottles Organic Olive Oil Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Organic Olive Oil Market, Key Players are

1. California Olive Ranch 2. Lucini Italia, 3. Colavita, 4. La Tourangelle, 5. Mueloliva, 6. Bionaturae, 7. O-Live, 8. Jovial Foods, 9. Deoleo S.A., 10. Sovena Group, 11. Salov Group, 12. Olitalia S.p.A., 13. Gallo Worldwide, 14. Pietro Coricelli S.p.A., 15. Grupo Ybarra Alimentación, 16. Minerva S.A., 17. Carapelli Firenze S.p.A., 18. La Española Alimentaria Alcoyana S.A.Frequently asked questions about Organic Olive Oil Market

1. What are the current issues related to olive oil industry? Ans: Labor shortages, supply chain issues, rising energy costs and extreme backups at ports across the globe, particularly those in America. 2. What is the market potential for olive oil? Ans:The global olive oil market was valued at USD 13.84 billion in 2021 and is expected to grow at a CAGR of 3.33% during the forecast period. 3. Who is the biggest consumer of olive oil? Ans:Greece has by far the largest per capita consumption of olive oil worldwide 4. What impacts the demand for olive oil? Ans:As populations grow, there is an increased demand for all types of food products, including olive oil. 5. Which country is the biggest supplier of olive oil? Ans:Spain is the largest producer and exporter of olive oil in the world

1. Organic Olive Oil Market: Research Methodology 2. Organic Olive Oil Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Organic Olive Oil Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Organic Olive Oil Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Organic Olive Oil Market Segmentation 4.1 Organic Olive Oil Market, by Product Type (2022-2029) • Extra Virgin Olive Oil • Pomace Olive Oil • Flavoured Olive Oil • Refined Olive Oil • Virgin Olive Oil 4.2 Organic Olive Oil Market, by End-user (2022-2029) • Food Processing • Cosmetics & Personal Care • Food Service • Pharmaceuticals • Other 4.3 Organic Olive Oil Market, by Distribution Channel (2022-2029) • B2b & B2c • Hypermarkets/Supermarkets • Online Retails • Grocery Stores 4.4 Organic Olive Oil Market, by Application (2022-2029) • Cooking • Dipping • Dressing • Sauces • Others 4.5 Organic Olive Oil Market, by Packaging (2022-2029) • Opaque & Dark Glass • Tinplate Cans • Stainless Steel • Plastic Contains • Aluminium Bottles 5. North America Organic Olive Oil Market (2022-2029) 5.1 North America Organic Olive Oil Market, by Product Type (2022-2029) • Extra Virgin Olive Oil • Pomace Olive Oil • Flavoured Olive Oil • Refined Olive Oil • Virgin Olive Oil 5.2 North America Organic Olive Oil Market, by End-user (2022-2029) • Food Processing • Cosmetics & Personal Care • Food Service • Pharmaceuticals • Other 5.3 North America Organic Olive Oil Market, by Distribution Channel (2022-2029) • B2b & B2c • Hypermarkets/Supermarkets • Online Retails • Grocery Stores 5.4 North America Organic Olive Oil Market, by Application (2022-2029) • Cooking • Dipping • Dressing • Sauces • Others 5.5 North America Organic Olive Oil Market, by Packaging (2022-2029) • Opaque & Dark Glass • Tinplate Cans • Stainless Steel • Plastic Contains • Aluminium Bottles 5.6 North America Organic Olive Oil Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Organic Olive Oil Market (2022-2029) 6.1. European Organic Olive Oil Market, by Product Type (2022-2029) 6.2. European Organic Olive Oil Market, by End-user (2022-2029) 6.3. European Organic Olive Oil Market, by Distribution Channel (2022-2029) 6.4. European Organic Olive Oil Market, by Application (2022-2029) 6.5. European Organic Olive Oil Market, by Packaging (2022-2029) 6.6. European Organic Olive Oil Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Organic Olive Oil Market (2022-2029) 7.1. Asia Pacific Organic Olive Oil Market, by Product Type (2022-2029) 7.2. Asia Pacific Organic Olive Oil Market, by End-user (2022-2029) 7.3. Asia Pacific Organic Olive Oil Market, by Distribution Channel (2022-2029) 7.4. Asia Pacific Organic Olive Oil Market, by Application (2022-2029) 7.5. Asia Pacific Organic Olive Oil Market, by Packaging (2022-2029) 7.6. Asia Pacific Organic Olive Oil Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASIAN • Rest Of APAC 8. Middle East and Africa Organic Olive Oil Market (2022-2029) 8.1 Middle East and Africa Organic Olive Oil Market, by Product Type (2022-2029) 8.2. Middle East and Africa Organic Olive Oil Market, by End-user (2022-2029) 8.3. Middle East and Africa Organic Olive Oil Market, by Distribution Channel (2022-2029) 8.4. Middle East and Africa Organic Olive Oil Market, by Application (2022-2029) 8.5. Middle East and Africa Organic Olive Oil Market, by Packaging (2022-2029) 8.6. Middle East and Africa Organic Olive Oil Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Organic Olive Oil Market (2022-2029) 9.1. South America Organic Olive Oil Market, by Product Type (2022-2029) 9.2. South America Organic Olive Oil Market, by End-user (2022-2029) 9.3. South America Organic Olive Oil Market, by Distribution Channel (2022-2029) 9.4. South America Organic Olive Oil Market, by Application (2022-2029) 9.5. South America Organic Olive Oil Market, by Packaging (2022-2029) 9.6. South America Organic Olive Oil Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. California Olive Ranch 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.1 Lucini Italia, 10.2 Colavita, 10.3 La Tourangelle, 10.4 Mueloliva, 10.5 Bionaturae, 10.6 O-Live, 10.7 Jovial Foods, 10.8 Deoleo S.A., 10.9 Sovena Group, 10.10 Salov Group, 10.11 Olitalia S.p.A., 10.12 Gallo Worldwide, 10.13 Pietro Coricelli S.p.A., 10.14 Grupo Ybarra Alimentación, 10.15 Minerva S.A., 10.16 Carapelli Firenze S.p.A., 10.17 La Española Alimentaria Alcoyana S.A.