Global Passive Electronic Components Market size was valued at USD 30.93 Bn. in 2023 and the total Passive Electronic Components revenue is expected to grow by 6.03 % from 2024 to 2030, reaching nearly USD 46.60 Bn.Passive Electronic Components Market Overview:

The Passive Electronic Components Market has witnessed growth in recent years due to the extensive use of electronics in several applications. Passive Electronic Components are essential parts of electronic circuits and include resistors, capacitors, inductors and diodes. The increasing Passive Electronic Component Market Demand for electronic devices such as smartphones, laptops and other consumer electronics, has contributed to the growth of this market. The emergence of new technologies, like IoT and 5G, has further propelled the demand for Passive Electronic Components. The Asia Pacific Passive Electronic Components Market is the largest, with China being the major contributor due to the country's strong manufacturing base. The automotive industry's shift towards electric vehicles and the continuous innovation in electronic systems within automobiles have spurred the demand for passive components. The emphasis on renewable energy solutions, such as solar and wind power, also contributes to the escalating need for these components in power electronics. Market key players such as Murata Manufacturing Co. Ltd., TDK Corporation, Taiyo Yuden Co. Ltd., Panasonic Corporation, Samsung Electro-Mechanics, etc. are focused on product innovation and development, aimed at offering products with enhanced performance and higher reliability.To know about the Research Methodology :- Request Free Sample Report

Passive Electronic Components Market Dynamics

The dynamics of the Passive Electronic Components Market are intricately shaped by a multitude of factors. A primary driving force is the escalating demand for electronic devices, fueled significantly by the proliferation of smartphones, laptops, and various consumer electronics. The market is further propelled by the adoption of cutting-edge technologies such as IoT and 5G, particularly in the telecommunications sector. The automotive industry's growth and the pervasive trend towards automation and robotics across industries contribute to the increasing demand for Passive Electronic Components. Amidst these dynamics, opportunities arise in the realm of high-performance Passive Electronic Components. The surge in demand for sophisticated electronic devices necessitates components like high-frequency capacitors and inductors. Manufacturers are seizing these opportunities by investing in research and development to create innovative materials and technologies that cater to the evolving needs of the market. The burgeoning electric and hybrid vehicle industry presents a particularly promising avenue for passive electronic component manufacturers. However, the market is not without its challenges. Supply chain disruptions, trade restrictions, and the lingering impacts of the COVID-19 pandemic have led to component shortages and price increases. Manufacturing high-performance components, with their inherent complexity and time-consuming processes, poses a restraint on the market. Additionally, the presence of substitute components and the lack of standardization in the industry hinder overall market growth. The Passive Electronic Components Market faces threats from various quarters, including the emergence of substitute components such as MEMS and NEMS technologies, which offer superior performance across a broad spectrum of applications. The growing trend of outsourcing electronic component manufacturing to low-cost countries adds another layer of complexity, potentially impacting the profitability of manufacturers in the market. Navigating these challenges and seizing emerging opportunities will be pivotal for stakeholders in the evolving landscape of the Passive Electronic Components Market.Passive Electronic Components Market Segment Analysis

Based on the Type, Capacitors are the leading segment of the Passive Electronic Components Market, poised to command the largest share given their extensive application in electronic devices like smartphones, laptops, and automotive systems. Capacitors also play a crucial role in power supply circuits and audio systems. The capacitor segment is fueled by the escalating demand for energy-efficient devices and the flourishing automotive industry. Simultaneously, the Resistor segment anticipates substantial growth, finding utility in diverse applications such as temperature sensing, noise suppression, and voltage regulation. The Inductor segment projects steady growth, driven by its application in power electronics and telecommunications. The "Others" segment, encompassing components like crystals, filters, and transformers, foresees noteworthy growth due to the rising demand for high-performance electronic components. This type-centric segmentation underscores the varied and evolving nature of the Passive Electronic Components Market.Based on the Material, The Ceramic segment dominated the market in the year 2023, driven by its versatile applications in smartphones, laptops, automotive, and medical devices. Ceramic capacitors, renowned for high frequency and temperature stability, find utility in power supply circuits and audio systems. Simultaneously, the Aluminium segment anticipates substantial growth, employed in power electronics and automotive applications, particularly with the use of aluminium electrolytic capacitors in power supply circuits. Tantalum follows suit, projecting steady growth attributed to its applications in telecommunications and medical devices. Tantalum capacitors, preferred in high-performance scenarios for their stability and low leakage current, contribute to this growth. The "Others" segment, encompassing thin-film, thick-film, and metal-film resistors, is set for significant expansion due to heightened demand for high-precision electronic components. This dynamic material-centric segmentation underscores the diverse and evolving nature of the Passive Electronic Components Market.

Based on the End-User, The dynamics of the Passive Electronic Components Market are intricately shaped by its diverse end-user segmentation. Consumer Electronics segment dominated the Passive Electronic Components Market, the Automotive sector anticipates significant growth, propelled by the surge in electric vehicle adoption and the pervasive use of passive components in automotive applications like lighting, infotainment, and powertrain systems. In the Healthcare domain, steady growth is foreseen due to the increased utilization of medical devices such as MRI machines, pacemakers, and blood glucose meters, all relying on passive components. The Telecommunications segment is marked for substantial growth, fueled by the rising demand for high-speed internet and the deployment of 5G technology. Similarly, the Aerospace and Defence sectors are poised for steady expansion, given the increasing usage of passive components in crucial applications like communication, navigation, and radar systems. These dynamic segments underscore the multifaceted and evolving nature of the Passive Electronic Components Market, reflecting diverse industry demands and technological advancements.

Passive Electronic Components Market Regional Insights:

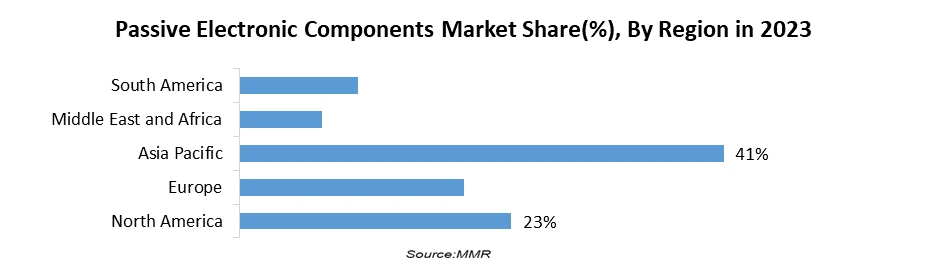

The dynamics of the Passive Electronic Components Market are prominently shaped by regional forces, with the Asia-Pacific region leading the forefront. Currently commanding a substantial 41% market share, it is poised to maintain its dominance throughout the forecast period. The region's robust growth is attributed to the soaring demand for consumer electronics and automotive applications, further fueled by the presence of key manufacturers like Murata Manufacturing Co. Ltd. and TDK Corporation. North American Passive Electronic Components Market, securing the second-highest market share of approximately 23%. Anticipated to witness significant growth, this surge is propelled by the escalating adoption of electric vehicles and the deployment of 5G technology. Europe claims the third-highest market share, with a parallel trajectory of substantial growth attributed to the increasing adoption of renewable energy and the deployment of smart grid technology. South American Passive Electronic Components Market is on track to experience noteworthy growth, primarily driven by the increasing demand for consumer electronics and automotive applications. The Middle East and African market, while expected to grow at a steady rate, is propelled by heightened investments in the construction and infrastructure sectors. These regional dynamics underscore the diverse and evolving landscape of the Passive Electronic Components Market, each region contributing uniquely to its overall trajectory.

Competitive Landscape:

The Passive Electronic Components Industry is highly competitive, with a large number of players operating in the market. The industry players range from large multinational corporations to small and medium-sized enterprises. The market is dominated by a few key players, who hold a significant share of the market, and face competition from several regional and local players. The industry has witnessed several mergers and acquisitions, as well as strategic partnerships, aimed at strengthening the market position of key players and expanding their product portfolios. For example, in 2020, Murata Manufacturing Co., Ltd. completed the acquisition of Renesas Electronics Corporation's power semiconductor business, aimed at strengthening its power electronics business. Similarly, in 2019, KEMET Corporation was acquired by Yageo Corporation, creating a global leader in the passive components industry. The industry players are also focused on product innovation and development, aimed at offering products with enhanced performance and higher reliability. The players invest heavily in research and development activities to develop new and innovative products that cater to the evolving needs of customers. In addition, the players also focus on developing environmentally friendly products that comply with regulatory standards and are safe for use. The objective of the report is to present a comprehensive analysis of the Passive Electronic Components Market including all the stakeholders of the End User. The past and current status of the End User with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the End User with a dedicated study of key players that includes market leaders, followers, and new entrants by region. PORTER, SVOR, and PESTEL analysis with the potential impact of micro-economic factors by region on the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the End User to the decision-makers. The report also helps in understanding the Passive Electronic Components Market dynamics, and structure by analyzing the market segments and projecting the Passive Electronic Components Market size. Clear representation of competitive analysis of key players by type, price, financial position, Derivatives portfolio, growth strategies, and regional presence in the Passive Electronic Components Market makes the report an investor’s guide.Passive Electronic Components Market Scope: Inquire before buying

Passive Electronic Components Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 30.93 Bn. Forecast Period 2024 to 2030 CAGR: 6.03% Market Size in 2029: US$ 46.60 Bn. Segments Covered: by Type Capacitors Resistors Inductors by Material Ceramic Aluminium Tantalum Others by End-User Consumer Electronics Automotive Healthcare Telecommunications Aerospace Defence Others Passive Electronic Components Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Passive Electronic Components Market Key Players

1. Murata Manufacturing Co. Ltd. - Japan 2. TDK Corporation - Japan 3. Taiyo Yuden Co. Ltd. - Japan 4. Panasonic Corporation - Japan 5. Samsung Electro-Mechanics - South Korea 6. Vishay Intertechnology - United States 7. KEMET Corporation - United States 8. AVX Corporation - United States 9. Walsin Technology Corporation - Taiwan 10. Yageo Corporation - Taiwan 11. Nippon Chemi-Con Corporation - Japan 12. Nichicon Corporation - Japan 13. Rubycon Corporation - Japan 14. Rohm Co. Ltd. - Japan 15. EPCOS AG - Germany 16. Koa Corporation - Japan 17. Sumida Corporation - Japan 18. Chilisin Electronics Corp. - Taiwan 19. Holy Stone Holdings Co. Ltd. - Taiwan 20. Johanson Technology Inc. - United States 21. CTS Corporation - United States 22. Pulse Electronics Corporation - United States 23. Laird PLC - United Kingdom 24. Bourns Inc. - United States 25. Diodes Incorporated - United States Frequently Asked Questions: 1] What segments are covered in the Global Passive Electronic Components Market report? Ans. The segments covered in the Market report are based on Type, Material, End-User and Region. 2] Which region is expected to hold the highest share of the Global Passive Electronic Components Market? Ans. The North American region is expected to hold the largest share of the Market, specifically in the United States. 3] What is the market size of the Global Passive Electronic Components Market by 2030? Ans. The market size of the Market by 2030 is expected to reach US$ 46.60 Bn. 4] What is the forecast period for the Global Passive Electronic Components Market? Ans. The forecast period for the Market is 2024-2030. 5] What was the market size of the Global Passive Electronic Components Market in 2023? Ans. The market size of the Market in 2023 was valued at US$ 30.93 Bn.

1. Passive Electronic Components Market: Research Methodology 2. Passive Electronic Components Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Passive Electronic Components Market: Dynamics 3.1. Passive Electronic Components Market Trends by Region 3.1.1. North America Passive Electronic Components Market Trends 3.1.2. Europe Passive Electronic Components Market Trends 3.1.3. Asia Pacific Passive Electronic Components Market Trends 3.1.4. Middle East and Africa Passive Electronic Components Market Trends 3.1.5. South America Passive Electronic Components Market Trends 3.2. Passive Electronic Components Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Passive Electronic Components Market Drivers 3.2.1.2. North America Passive Electronic Components Market Restraints 3.2.1.3. North America Passive Electronic Components Market Opportunities 3.2.1.4. North America Passive Electronic Components Market Challenges 3.2.2. Europe 3.2.2.1. Europe Passive Electronic Components Market Drivers 3.2.2.2. Europe Passive Electronic Components Market Restraints 3.2.2.3. Europe Passive Electronic Components Market Opportunities 3.2.2.4. Europe Passive Electronic Components Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Passive Electronic Components Market Drivers 3.2.3.2. Asia Pacific Passive Electronic Components Market Restraints 3.2.3.3. Asia Pacific Passive Electronic Components Market Opportunities 3.2.3.4. Asia Pacific Passive Electronic Components Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Passive Electronic Components Market Drivers 3.2.4.2. Middle East and Africa Passive Electronic Components Market Restraints 3.2.4.3. Middle East and Africa Passive Electronic Components Market Opportunities 3.2.4.4. Middle East and Africa Passive Electronic Components Market Challenges 3.2.5. South America 3.2.5.1. South America Passive Electronic Components Market Drivers 3.2.5.2. South America Passive Electronic Components Market Restraints 3.2.5.3. South America Passive Electronic Components Market Opportunities 3.2.5.4. South America Passive Electronic Components Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Passive Electronic Components Market 3.8. Analysis of Government Schemes and Initiatives For the Passive Electronic Components Market 3.9. The Global Pandemic Impact on the Passive Electronic Components Market 4. Passive Electronic Components Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume in Units) (2024-2030) 4.1. Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 4.1.1. Capacitors 4.1.2. Resistors 4.1.3. Inductors 4.2. Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 4.2.1. Ceramic 4.2.2. Aluminium 4.2.3. Tantalum 4.2.4. Others 4.3. Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 4.3.1. Consumer Electronics 4.3.2. Automotive 4.3.3. Healthcare 4.3.4. Telecommunications 4.3.5. Aerospace 4.3.6. Defence 4.3.7. Others 4.4. Passive Electronic Components Market Size and Forecast, by Region (2024-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Passive Electronic Components Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume in Units) (2024-2030) 5.1. North America Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 5.1.1. Capacitors 5.1.2. Resistors 5.1.3. Inductors 5.2. North America Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 5.2.1. Ceramic 5.2.2. Aluminium 5.2.3. Tantalum 5.2.4. Others 5.3. North America Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 5.3.1. Consumer Electronics 5.3.2. Automotive 5.3.3. Healthcare 5.3.4. Telecommunications 5.3.5. Aerospace 5.3.6. Defence 5.3.7. Others 5.4. North America Passive Electronic Components Market Size and Forecast, by Country (2024-2030) 5.4.1. United States 5.4.1.1. United States Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 5.4.1.1.1. Capacitors 5.4.1.1.2. Resistors 5.4.1.1.3. Inductors 5.4.1.2. United States Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 5.4.1.2.1. Ceramic 5.4.1.2.2. Aluminium 5.4.1.2.3. Tantalum 5.4.1.2.4. Others 5.4.1.3. United States Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 5.4.1.3.1. Consumer Electronics 5.4.1.3.2. Automotive 5.4.1.3.3. Healthcare 5.4.1.3.4. Telecommunications 5.4.1.3.5. Aerospace 5.4.1.3.6. Defence 5.4.1.3.7. Others 5.4.2. Canada 5.4.2.1. Canada Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 5.4.2.1.1. Capacitors 5.4.2.1.2. Resistors 5.4.2.1.3. Inductors 5.4.2.2. Canada Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 5.4.2.2.1. Ceramic 5.4.2.2.2. Aluminium 5.4.2.2.3. Tantalum 5.4.2.2.4. Others 5.4.2.3. Canada Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 5.4.2.3.1. Consumer Electronics 5.4.2.3.2. Automotive 5.4.2.3.3. Healthcare 5.4.2.3.4. Telecommunications 5.4.2.3.5. Aerospace 5.4.2.3.6. Defence 5.4.2.3.7. Others 5.4.3. Mexico 5.4.3.1. Mexico Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 5.4.3.1.1. Capacitors 5.4.3.1.2. Resistors 5.4.3.1.3. Inductors 5.4.3.2. Mexico Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 5.4.3.2.1. Ceramic 5.4.3.2.2. Aluminium 5.4.3.2.3. Tantalum 5.4.3.2.4. Others 5.4.3.3. Mexico Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 5.4.3.3.1. Consumer Electronics 5.4.3.3.2. Automotive 5.4.3.3.3. Healthcare 5.4.3.3.4. Telecommunications 5.4.3.3.5. Aerospace 5.4.3.3.6. Defence 5.4.3.3.7. Others 6. Europe Passive Electronic Components Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume in Units) (2024-2030) 6.1. Europe Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 6.2. Europe Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 6.3. Europe Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 6.4. Europe Passive Electronic Components Market Size and Forecast, by Country (2024-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 6.4.1.2. United Kingdom Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 6.4.1.3. United Kingdom Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 6.4.2. France 6.4.2.1. France Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 6.4.2.2. France Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 6.4.2.3. France Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 6.4.3. Germany 6.4.3.1. Germany Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 6.4.3.2. Germany Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 6.4.3.3. Germany Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 6.4.4. Italy 6.4.4.1. Italy Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 6.4.4.2. Italy Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 6.4.4.3. Italy Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 6.4.5. Spain 6.4.5.1. Spain Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 6.4.5.2. Spain Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 6.4.5.3. Spain Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 6.4.6. Sweden 6.4.6.1. Sweden Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 6.4.6.2. Sweden Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 6.4.6.3. Sweden Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 6.4.7. Austria 6.4.7.1. Austria Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 6.4.7.2. Austria Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 6.4.7.3. Austria Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 6.4.8.2. Rest of Europe Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 6.4.8.3. Rest of Europe Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 7. Asia Pacific Passive Electronic Components Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume in Units) (2024-2030) 7.1. Asia Pacific Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 7.2. Asia Pacific Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 7.3. Asia Pacific Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 7.4. Asia Pacific Passive Electronic Components Market Size and Forecast, by Country (2024-2030) 7.4.1. China 7.4.1.1. China Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 7.4.1.2. China Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 7.4.1.3. China Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 7.4.2. S Korea 7.4.2.1. S Korea Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 7.4.2.2. S Korea Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 7.4.2.3. S Korea Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 7.4.3. Japan 7.4.3.1. Japan Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 7.4.3.2. Japan Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 7.4.3.3. Japan Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 7.4.4. India 7.4.4.1. India Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 7.4.4.2. India Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 7.4.4.3. India Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 7.4.5. Australia 7.4.5.1. Australia Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 7.4.5.2. Australia Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 7.4.5.3. Australia Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 7.4.6.2. Indonesia Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 7.4.6.3. Indonesia Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 7.4.7.2. Malaysia Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 7.4.7.3. Malaysia Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 7.4.8.2. Vietnam Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 7.4.8.3. Vietnam Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 7.4.9.2. Taiwan Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 7.4.9.3. Taiwan Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 7.4.10.2. Rest of Asia Pacific Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 7.4.10.3. Rest of Asia Pacific Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 8. Middle East and Africa Passive Electronic Components Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume in Units) (2024-2030 8.1. Middle East and Africa Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 8.2. Middle East and Africa Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 8.3. Middle East and Africa Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 8.4. Middle East and Africa Passive Electronic Components Market Size and Forecast, by Country (2024-2030) 8.4.1. South Africa 8.4.1.1. South Africa Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 8.4.1.2. South Africa Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 8.4.1.3. South Africa Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 8.4.2. GCC 8.4.2.1. GCC Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 8.4.2.2. GCC Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 8.4.2.3. GCC Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 8.4.3.2. Nigeria Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 8.4.3.3. Nigeria Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 8.4.4.2. Rest of ME&A Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 8.4.4.3. Rest of ME&A Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 9. South America Passive Electronic Components Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million and Volume in Units) (2024-2030 9.1. South America Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 9.2. South America Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 9.3. South America Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 9.4. South America Passive Electronic Components Market Size and Forecast, by Country (2024-2030) 9.4.1. Brazil 9.4.1.1. Brazil Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 9.4.1.2. Brazil Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 9.4.1.3. Brazil Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 9.4.2. Argentina 9.4.2.1. Argentina Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 9.4.2.2. Argentina Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 9.4.2.3. Argentina Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Passive Electronic Components Market Size and Forecast, By Type (2024-2030) 9.4.3.2. Rest Of South America Passive Electronic Components Market Size and Forecast, By Material (2024-2030) 9.4.3.3. Rest Of South America Passive Electronic Components Market Size and Forecast, By End-User (2024-2030) 10. Global Passive Electronic Components Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Passive Electronic Components Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Murata Manufacturing Co. Ltd. 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Recent Developments 11.2. TDK Corporation 11.3. Taiyo Yuden Co. Ltd. 11.4. Panasonic Corporation 11.5. Samsung Electro-Mechanics 11.6. Vishay Intertechnology 11.7. KEMET Corporation 11.8. AVX Corporation 11.9. Walsin Technology Corporation 11.10. Yageo Corporation 11.11. Nippon Chemi-Con Corporation 11.12. Nichicon Corporation 11.13. Rubycon Corporation 11.14. Rohm Co. Ltd. 11.15. EPCOS AG 11.16. Koa Corporation 11.17. Sumida Corporation 11.18. Chilisin Electronics Corp. 11.19. Holy Stone Holdings Co. Ltd. 11.20. Johanson Technology Inc. 11.21. CTS Corporation 11.22. Pulse Electronics Corporation 11.23. Laird PLC 11.24. Bourns Inc. 11.25. Diodes Incorporated 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary