The Artificial Intelligence in Cyber Security Market size was valued at USD 22.99 billion in 2023 and the total Artificial Intelligence in Cyber Security revenue is expected to grow at a CAGR of 22.8% from 2024 to 2030, reaching nearly USD 42.77 Billion by 2030.Artificial Intelligence in Cyber Security Market Overview

Cybercrime is the greatest threat to every organisation across the globe. Artificial Intelligence in cyber security is becoming increasingly important as cyber threats evolve. Currently, there are about 6.5 billion Internet users, and the number will increase to about 7.5 Billion users by 2030.To know about the Research Methodology :- Request Free Sample Report Cybercrime is impacting businesses of all sizes and any business that wants to ensure its uptime, to ensure its reputation, and the safety of its employee and customer data, has a responsibility to invest in cybersecurity and put itself ahead of disruption. Almost half of the cyber-attacks are committed against small-to-midsized businesses (SMSs), and 60% go out of business after falling victim to data breaches. Artificial Intelligence in cyber security is transforming against cyber-attacks as it can analyse vast amounts of data, learn from past threats and predict the future. Additionally, AI-powered solutions can continuously watch over systems, networks, and endpoints, enabling prompt response and real-time visibility into any security breaches. As cyber-attacks become more frequent and complicated, businesses are searching for cutting-edge protection solutions anticipated to fuel the expansion of artificial intelligence in the cyber security market. 1. According to MMR, cybercrime costs grow by 15% per year, reaching almost USD 8 Trillion globally in 2023 and about USD 13 Trillion annually by 2030. 2. MMR analysis states the average cost of a data breach is USD 4.45 Billion in 2023. Europe is the second largest region in the AI-based cyber security market holding 25% market share in 2023. The region is steadily growing as there is a rise in cyber threats, requirements for regulatory compliance and investments in digital infrastructure. Germany, France, and the UK are the largest markets in the European region as it is a hub for financial services and emerging Fintech technology. These sectors are prime targets for cyber-attacks, leading to higher demand for AI-powered security solutions to safeguard financial data and transactions. Additionally, regulatory framework, technological innovation, and focus on data protection position it as a key player in the AI-based cybersecurity market. 1. According to MMR analysis, 88% AI will be essential for performing security tasks more efficiently.

Artificial Intelligence in Cyber Security Market Dynamics

Artificial Intelligence Security Drives Growth Automation and AI integrations have become crucial in modern corporate cyber security. AI constantly analyses vast amounts of security data, identifying emerging threats, and attack patterns. Ransomware has become a major threat to businesses and individuals, particularly concerning small and medium-sized businesses (SMBs), as they often lack the financial resources and skill set to combat the emerging cyber threat. The rapid growth in the use of decentralized finance (DeFi) services creating new opportunities for criminals is driving crypto crime. Cybercriminals are increasingly targeting cryptocurrency exchanges and users, with scams and hacks costing the world. Advanced AI solutions in cyber security are key factors driving the Artificial Intelligence in Cyber Security Market. AI-powered analytics and automation tools help organisations to easily detect and respond to cyber threats. The automation reduces the time and resources needed to identify and block cyber threats, ultimately strengthening the organization's security. Businesses and individuals must invest in cyber security, prioritize risk assessment and mitigation, and stay informed about the latest threats and trends in cyber security. 1. MMR analysis, about 64% of businesses have utilized AI for security capabilities and 29% are considering it. 2. According to MMR, ransomware damages are predicted to grow from $325 Billion in 2015 to $265 billion in 2030. 3. According to MMR analysis, the frequency of ransomware attacks on governments, businesses, consumers, and devices will continue to rise over the next 8 years and reach every two seconds by 2030.Growing Labour Crisis in AI to Navigate Cyber Security Challenges The sheer volume of cyber-attacks and security events daily by security operation centres continues to grow. The rising labour crisis in Artificial Intelligence (AI) within the field of cyber security poses a significant challenge. As the frequency and complexity of cyber-attacks increase, there is a growing demand for skilled professionals who can effectively navigate and counter threats using advanced AI technologies. However, the shortage of qualified experts in this specialized field obstructs organizations' ability to build robust defences against evolving cyber threats. Finding innovative solutions to attract, train, and retain skilled AI professionals in cyber security becomes imperative to ensure a robust and adaptive defence against the ever-evolving landscape of cyber threats. 1. According to MMR analysis, 3.5 Billion cyber security jobs remained vacant globally in 2023.

Artificial Intelligence in Cyber Security Market Segment Analysis

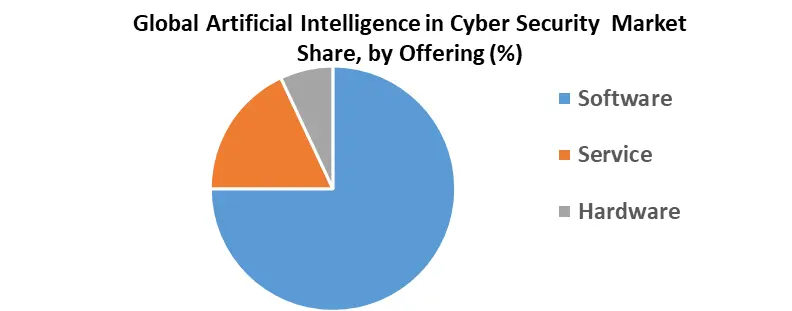

Based on Offering, the software segment holds the largest market share of about 75% in the global Artificial Intelligence in Cyber Security market in 2023. According to MMR analysis, the segment is further expected to grow at a CAGR of 22.8% during the forecast period and stands out as the dominant segment within the Artificial Intelligence in Cyber Security market. AI software caters to various security needs from endpoint protection and network defence to threat intelligence and automated incident response and creates a larger total market size. Software platforms can easily integrate new AI advancements and adapt to the evolving threat landscape, making them more attractive than static hardware solutions. Leading players in the segment include Palo Alto Networks (18.2%), McAfee (15.7%), Cisco Talos (12.1%), and IBM Security QRadar (10.5%) integrate with existing security infrastructure, allowing businesses to leverage AI capabilities. The key growth drivers include the rapid increase in cyber-attacks, the growing awareness of data privacy, and the increasing availability of skilled AI cyber security professionals.

Artificial Intelligence in Cyber Security Market Regional Insights

North America dominated the Global Artificial Intelligence in Cyber Security Market with the highest share of over 45% in 2023. The region is expected to grow at a CAGR of 22.8% during the forecast period and maintain its dominance by 2023. North America hosts a technological ecosystem with several cyber security research institutions, start-ups, and technology companies. The regulatory environment in North America, including cyber security regulations and standards, has influenced organizations to invest in advanced technology solutions. The United States, a hub for technology innovation and investment has directed funds towards cyber security start-ups and companies developing AI-driven cyber security solutions. The recognition of Artificial Intelligence’s potential to enhance cyber security has led to strategic partnerships and collaborations to propel Artificial Intelligence in Cyber Security Market. Additionally, Asia Pacific is the fastest-growing region with a significant CAGR in Artificial Intelligence in Cyber Security Market. Asia Pacific is home to a large and growing population, who are digitally active. The vast target audience is a prime aim for cyber-attacks, emphasizing the need to include Artificial Intelligence as a security measure. The rapid expansion of E-commerce, government, telecom, and healthcare are the growth areas driving the market. Artificial Intelligence in Cyber Security Market Competitive Landscapes The Global Artificial Intelligence in Cybersecurity Market is filled with companies like Palo Alto Networks, Crowdstrike, McAfee, Deepwatch, and Darktrace. These cybersecurity leaders are breaking new ground by introducing advanced technologies such as irregularity detection, threat response, self-learning algorithms, and integration with blockchain and cloud solution is driving the growth of the market. The future of the AI in Cybersecurity Market looks promising, thanks to impressive AI developments and a strong dedication to keeping the digital world secure. 1. IBM in 2023 signed a contract with the NATO Communications and Information Agency (NCI Agency) to help strengthen the Alliance's cybersecurity posture with improved security visibility and asset management across all NATO enterprise networks. 2. Cisco acquired Isovalent, a leader in open-source cloud-native networking and security, to bolster its secure networking capabilities across public clouds in 2023. 3. Palo Alto Networks Acquired Enterprise Browser Start-up Talon Cyber Security in 2023, a pioneer of Enterprise Browser technology that provides innovative, cutting-edge solutions and enables users to securely access business applications from any device, including mobile and other non-corporate devices, while delivering seamless user experiences.

Artificial Intelligence in Cybersecurity Market Scope: Inquire before buying

Global Artificial Intelligence in Cybersecurity Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 22.99 Bn. Forecast Period 2024 to 2030 CAGR: 22.8 % Market Size in 2030: US $ 42.77 Bn. Segments Covered: by offering Hardware Software Service by deployment type On-premise Cloud by security type Network Security Endpoint Security Application Security Cloud Security by technology Machine Learning Natural Language Processing Context-Aware Computing by application Identity & Access Management Risk & Compliance Management Data Loss Prevention Unified Threat Management Security & Vulnerability Management Antivirus/Antimalware Fraud Detection/Anti-Fraud Intrusion Detection/Prevention System Threat Intelligence by end user BFSI Retail and E-commerce Healthcare Automotive and Transportation Government and Defence Manufacturing Others Artificial Intelligence in Cybersecurity Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest)Artificial Intelligence in Cyber Security Market Key Players

1. Amazon Web Services, Inc. (U.S.) 2. IBM Corporation (U.S.) 3. Intel Corporation (U.S.) 4. Microsoft Corporation (U.S.) 5. Nvidia Corporation (U.S.) 6. FireEye, Inc. (U.S.) 7. Palo Alto Networks, Inc. (U.S.) 8. Juniper Networks, Inc. (U.S.) 9. Fortinet, Inc. (U.S.) 10. Cisco Systems, Inc. (U.S.) 11. Micron Technology, Inc. (U.S.) 12. Check Point Software Technologies Ltd. (U.S.) 13. Imperva, Inc. (U.S.)McAfee LLC (U.S.)LogRhythm, Inc. (U.S.) 14. Sophos Ltd. (U.S.) 15. NortonLifeLock Inc. (U.S.) 16. CrowdStrike Holdings, Inc. (U.S.) 17. Kelco (U.S.) 18. Acalvio Technologies, Inc. 19. Cylance Inc. (BlackBerry) 20. Darktrace; FireEye, Inc. 21. Intel Corp 22. LexisNexis 23. Micron Technology Inc. 24. Microsoft Corporation 25. Gen Digital Inc. 26. Palo Alto Networks, Inc. 27. Cisco Systems, Inc. 28. Samsung Electronics Co. Ltd. FAQs: 1. What are the growth drivers for the Artificial Intelligence in Cyber Security market? Ans. The technological advances in artificial intelligence, growing demand for security, and rising awareness are the growth drivers for Artificial Intelligence in the Cyber security market. 2. What are the major challenges for Artificial Intelligence in Cyber Security market growth? Ans. The growing labour crisis in Artificial intelligence is the major challenge for Artificial Intelligence in the cyber security market. 3. Which region is expected to lead the global Artificial Intelligence in Cyber Security market during the forecast period? Ans. Asia Pacific is expected to lead the global Artificial Intelligence in Cyber Security market during the forecast period. 4. What is the projected market size & and growth rate of the Artificial Intelligence in Cyber Security Market? Ans. The Artificial Intelligence in Cyber Security Market size was valued at USD 22.99 Billion in 2023 and the total Artificial Intelligence in Cyber Security revenue is expected to grow at a CAGR of 22.8% from 2024 to 2030, reaching nearly USD 42.77 Billion by 2030. 5. What segments are covered in the Artificial Intelligence in Cyber Security Market report? Ans. The segments covered in the Artificial Intelligence in Cyber Security market report are offerings, deployment mode, security type, technology application, end user, and region.

1. Artificial Intelligence in Cybersecurity Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Artificial Intelligence in Cybersecurity Market: Dynamics 2.1. Artificial Intelligence in Cybersecurity Market Trends by Region 2.1.1. North America Artificial Intelligence in Cybersecurity Market Trends 2.1.2. Europe Artificial Intelligence in Cybersecurity Market Trends 2.1.3. Asia Pacific Artificial Intelligence in Cybersecurity Market Trends 2.1.4. Middle East and Africa Artificial Intelligence in Cybersecurity Market Trends 2.1.5. South America Artificial Intelligence in Cybersecurity Market Trends 2.2. Artificial Intelligence in Cybersecurity Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Artificial Intelligence in Cybersecurity Market Drivers 2.2.1.2. North America Artificial Intelligence in Cybersecurity Market Restraints 2.2.1.3. North America Artificial Intelligence in Cybersecurity Market Opportunities 2.2.1.4. North America Artificial Intelligence in Cybersecurity Market Challenges 2.2.2. Europe 2.2.2.1. Europe Artificial Intelligence in Cybersecurity Market Drivers 2.2.2.2. Europe Artificial Intelligence in Cybersecurity Market Restraints 2.2.2.3. Europe Artificial Intelligence in Cybersecurity Market Opportunities 2.2.2.4. Europe Artificial Intelligence in Cybersecurity Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Artificial Intelligence in Cybersecurity Market Drivers 2.2.3.2. Asia Pacific Artificial Intelligence in Cybersecurity Market Restraints 2.2.3.3. Asia Pacific Artificial Intelligence in Cybersecurity Market Opportunities 2.2.3.4. Asia Pacific Artificial Intelligence in Cybersecurity Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Artificial Intelligence in Cybersecurity Market Drivers 2.2.4.2. Middle East and Africa Artificial Intelligence in Cybersecurity Market Restraints 2.2.4.3. Middle East and Africa Artificial Intelligence in Cybersecurity Market Opportunities 2.2.4.4. Middle East and Africa Artificial Intelligence in Cybersecurity Market Challenges 2.2.5. South America 2.2.5.1. South America Artificial Intelligence in Cybersecurity Market Drivers 2.2.5.2. South America Artificial Intelligence in Cybersecurity Market Restraints 2.2.5.3. South America Artificial Intelligence in Cybersecurity Market Opportunities 2.2.5.4. South America Artificial Intelligence in Cybersecurity Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Artificial Intelligence in Cybersecurity Industry 2.8. Analysis of Government Schemes and Initiatives For Artificial Intelligence in Cybersecurity Industry 2.9. Artificial Intelligence in Cybersecurity Market Trade Analysis 2.10. The Global Pandemic Impact on Artificial Intelligence in Cybersecurity Market 3. Artificial Intelligence in Cybersecurity Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 3.1.1. Hardware 3.1.2. Software 3.1.3. Service 3.2. Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 3.2.1. On-premise 3.2.2. Cloud 3.3. Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 3.3.1. Network Security 3.3.2. Endpoint Security 3.3.3. Application Security 3.3.4. Cloud Security 3.4. Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 3.4.1. Machine Learning (ML) 3.4.2. Natural Language Processing (NLP) 3.4.3. Context-aware Computing 3.5. Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 3.5.1. Identity & Access Management 3.5.2. Risk & Compliance Management 3.5.3. Data Loss Prevention 3.5.4. Unified Threat Management 3.5.5. Security & Vulnerability Management 3.5.6. Antivirus/Antimalware 3.5.7. Fraud Detection/Anti-Fraud 3.5.8. Intrusion Detection/Prevention System 3.5.9. Threat Intelligence 3.6. Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 3.6.1. BFSI 3.6.2. Retail and E-commerce 3.6.3. Healthcare 3.6.4. Automotive and Transportation 3.6.5. Government and Defence 3.6.6. Manufacturing 3.6.7. Others 3.7. Artificial Intelligence in Cybersecurity Market Size and Forecast, by Region (2023-2030) 3.7.1. North America 3.7.2. Europe 3.7.3. Asia Pacific 3.7.4. Middle East and Africa 3.7.5. South America 4. North America Artificial Intelligence in Cybersecurity Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 4.1.1. Hardware 4.1.2. Software 4.1.3. Service 4.2. North America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 4.2.1. On-premise 4.2.2. Cloud 4.3. North America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 4.3.1. Network Security 4.3.2. Endpoint Security 4.3.3. Application Security 4.3.4. Cloud Security 4.4. North America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 4.4.1. Machine Learning (ML) 4.4.2. Natural Language Processing (NLP) 4.4.3. Context-aware Computing 4.5. North America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 4.5.1. Identity & Access Management 4.5.2. Risk & Compliance Management 4.5.3. Data Loss Prevention 4.5.4. Unified Threat Management 4.5.5. Security & Vulnerability Management 4.5.6. Antivirus/Antimalware 4.5.7. Fraud Detection/Anti-Fraud 4.5.8. Intrusion Detection/Prevention System 4.5.9. Threat Intelligence 4.6. North America Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 4.6.1. BFSI 4.6.2. Retail and E-commerce 4.6.3. Healthcare 4.6.4. Automotive and Transportation 4.6.5. Government and Defence 4.6.6. Manufacturing 4.6.7. Others 4.7. North America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Country (2023-2030) 4.7.1. United States 4.7.1.1. United States Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 4.7.1.1.1. Hardware 4.7.1.1.2. Software 4.7.1.1.3. Service 4.7.1.2. United States Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 4.7.1.2.1. On-premise 4.7.1.2.2. Cloud 4.7.1.3. United States Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 4.7.1.3.1. Network Security 4.7.1.3.2. Endpoint Security 4.7.1.3.3. Application Security 4.7.1.3.4. Cloud Security 4.7.1.4. United States Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 4.7.1.4.1. Machine Learning (ML) 4.7.1.4.2. Natural Language Processing (NLP) 4.7.1.4.3. Context-aware Computing 4.7.1.5. United States Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 4.7.1.5.1. Identity & Access Management 4.7.1.5.2. Risk & Compliance Management 4.7.1.5.3. Data Loss Prevention 4.7.1.5.4. Unified Threat Management 4.7.1.5.5. Security & Vulnerability Management 4.7.1.5.6. Antivirus/Antimalware 4.7.1.5.7. Fraud Detection/Anti-Fraud 4.7.1.5.8. Intrusion Detection/Prevention System 4.7.1.5.9. Threat Intelligence 4.7.1.6. United States Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 4.7.1.6.1. BFSI 4.7.1.6.2. Retail and E-commerce 4.7.1.6.3. Healthcare 4.7.1.6.4. Automotive and Transportation 4.7.1.6.5. Government and Defence 4.7.1.6.6. Manufacturing 4.7.1.6.7. Others 4.7.2. Canada 4.7.2.1. Canada Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 4.7.2.1.1. Hardware 4.7.2.1.2. Software 4.7.2.1.3. Service 4.7.2.2. Canada Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 4.7.2.2.1. On-premise 4.7.2.2.2. Cloud 4.7.2.3. Canada Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 4.7.2.3.1. Network Security 4.7.2.3.2. Endpoint Security 4.7.2.3.3. Application Security 4.7.2.3.4. Cloud Security 4.7.2.4. Canada Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 4.7.2.4.1. Machine Learning (ML) 4.7.2.4.2. Natural Language Processing (NLP) 4.7.2.4.3. Context-aware Computing 4.7.2.5. Canada Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 4.7.2.5.1. Identity & Access Management 4.7.2.5.2. Risk & Compliance Management 4.7.2.5.3. Data Loss Prevention 4.7.2.5.4. Unified Threat Management 4.7.2.5.5. Security & Vulnerability Management 4.7.2.5.6. Antivirus/Antimalware 4.7.2.5.7. Fraud Detection/Anti-Fraud 4.7.2.5.8. Intrusion Detection/Prevention System 4.7.2.5.9. Threat Intelligence 4.7.2.6. Canada Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 4.7.2.6.1. BFSI 4.7.2.6.2. Retail and E-commerce 4.7.2.6.3. Healthcare 4.7.2.6.4. Automotive and Transportation 4.7.2.6.5. Government and Defence 4.7.2.6.6. Manufacturing 4.7.2.6.7. Others 4.7.3. Mexico 4.7.3.1. Mexico Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 4.7.3.1.1. Hardware 4.7.3.1.2. Software 4.7.3.1.3. Service 4.7.3.2. Mexico Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 4.7.3.2.1. On-premise 4.7.3.2.2. Cloud 4.7.3.3. Mexico Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 4.7.3.3.1. Network Security 4.7.3.3.2. Endpoint Security 4.7.3.3.3. Application Security 4.7.3.3.4. Cloud Security 4.7.3.4. Mexico Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 4.7.3.4.1. Machine Learning (ML) 4.7.3.4.2. Natural Language Processing (NLP) 4.7.3.4.3. Context-aware Computing 4.7.3.5. Mexico Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 4.7.3.5.1. Identity & Access Management 4.7.3.5.2. Risk & Compliance Management 4.7.3.5.3. Data Loss Prevention 4.7.3.5.4. Unified Threat Management 4.7.3.5.5. Security & Vulnerability Management 4.7.3.5.6. Antivirus/Antimalware 4.7.3.5.7. Fraud Detection/Anti-Fraud 4.7.3.5.8. Intrusion Detection/Prevention System 4.7.3.5.9. Threat Intelligence 4.7.3.6. Mexico Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 4.7.3.6.1. BFSI 4.7.3.6.2. Retail and E-commerce 4.7.3.6.3. Healthcare 4.7.3.6.4. Automotive and Transportation 4.7.3.6.5. Government and Defence 4.7.3.6.6. Manufacturing 4.7.3.6.7. Others 5. Europe Artificial Intelligence in Cybersecurity Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 5.2. Europe Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 5.3. Europe Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 5.4. Europe Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 5.5. Europe Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 5.6. Europe Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 5.7. Europe Artificial Intelligence in Cybersecurity Market Size and Forecast, by Country (2023-2030) 5.7.1. United Kingdom 5.7.1.1. United Kingdom Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 5.7.1.2. United Kingdom Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 5.7.1.3. United Kingdom Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 5.7.1.4. United Kingdom Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 5.7.1.5. United Kingdom Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 5.7.1.6. United Kingdom Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 5.7.2. France 5.7.2.1. France Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 5.7.2.2. France Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 5.7.2.3. France Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 5.7.2.4. France Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 5.7.2.5. France Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 5.7.2.6. France Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 5.7.3. Germany 5.7.3.1. Germany Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 5.7.3.2. Germany Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 5.7.3.3. Germany Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 5.7.3.4. Germany Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 5.7.3.5. Germany Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 5.7.3.6. Germany Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 5.7.4. Italy 5.7.4.1. Italy Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 5.7.4.2. Italy Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 5.7.4.3. Italy Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 5.7.4.4. Italy Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 5.7.4.5. Italy Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 5.7.4.6. Italy Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 5.7.5. Spain 5.7.5.1. Spain Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 5.7.5.2. Spain Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 5.7.5.3. Spain Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 5.7.5.4. Spain Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 5.7.5.5. Spain Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 5.7.5.6. Spain Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 5.7.6. Sweden 5.7.6.1. Sweden Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 5.7.6.2. Sweden Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 5.7.6.3. Sweden Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 5.7.6.4. Sweden Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 5.7.6.5. Sweden Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 5.7.6.6. Sweden Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 5.7.7. Austria 5.7.7.1. Austria Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 5.7.7.2. Austria Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 5.7.7.3. Austria Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 5.7.7.4. Austria Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 5.7.7.5. Austria Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 5.7.7.6. Austria Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 5.7.8. Rest of Europe 5.7.8.1. Rest of Europe Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 5.7.8.2. Rest of Europe Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 5.7.8.3. Rest of Europe Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 5.7.8.4. Rest of Europe Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 5.7.8.5. Rest of Europe Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 5.7.8.6. Rest of Europe Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Artificial Intelligence in Cybersecurity Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 6.2. Asia Pacific Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 6.3. Asia Pacific Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 6.4. Asia Pacific Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 6.5. Asia Pacific Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 6.6. Asia Pacific Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 6.7. Asia Pacific Artificial Intelligence in Cybersecurity Market Size and Forecast, by Country (2023-2030) 6.7.1. China 6.7.1.1. China Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 6.7.1.2. China Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 6.7.1.3. China Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 6.7.1.4. China Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 6.7.1.5. China Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 6.7.1.6. China Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 6.7.2. S Korea 6.7.2.1. S Korea Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 6.7.2.2. S Korea Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 6.7.2.3. S Korea Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 6.7.2.4. S Korea Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 6.7.2.5. S Korea Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 6.7.2.6. S Korea Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 6.7.3. Japan 6.7.3.1. Japan Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 6.7.3.2. Japan Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 6.7.3.3. Japan Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 6.7.3.4. Japan Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 6.7.3.5. Japan Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 6.7.3.6. Japan Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 6.7.4. India 6.7.4.1. India Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 6.7.4.2. India Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 6.7.4.3. India Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 6.7.4.4. India Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 6.7.4.5. India Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 6.7.4.6. India Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 6.7.5. Australia 6.7.5.1. Australia Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 6.7.5.2. Australia Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 6.7.5.3. Australia Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 6.7.5.4. Australia Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 6.7.5.5. Australia Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 6.7.5.6. Australia Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 6.7.6. Indonesia 6.7.6.1. Indonesia Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 6.7.6.2. Indonesia Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 6.7.6.3. Indonesia Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 6.7.6.4. Indonesia Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 6.7.6.5. Indonesia Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 6.7.6.6. Indonesia Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 6.7.7. Malaysia 6.7.7.1. Malaysia Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 6.7.7.2. Malaysia Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 6.7.7.3. Malaysia Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 6.7.7.4. Malaysia Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 6.7.7.5. Malaysia Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 6.7.7.6. Malaysia Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 6.7.8. Vietnam 6.7.8.1. Vietnam Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 6.7.8.2. Vietnam Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 6.7.8.3. Vietnam Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 6.7.8.4. Vietnam Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 6.7.8.5. Vietnam Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 6.7.8.6. Vietnam Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 6.7.9. Taiwan 6.7.9.1. Taiwan Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 6.7.9.2. Taiwan Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 6.7.9.3. Taiwan Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 6.7.9.4. Taiwan Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 6.7.9.5. Taiwan Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 6.7.9.6. Taiwan Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 6.7.10. Rest of Asia Pacific 6.7.10.1. Rest of Asia Pacific Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 6.7.10.2. Rest of Asia Pacific Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 6.7.10.3. Rest of Asia Pacific Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 6.7.10.4. Rest of Asia Pacific Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 6.7.10.5. Rest of Asia Pacific Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 6.7.10.6. Rest of Asia Pacific Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Artificial Intelligence in Cybersecurity Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 7.2. Middle East and Africa Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 7.3. Middle East and Africa Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 7.4. Middle East and Africa Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 7.5. Middle East and Africa Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 7.6. Middle East and Africa Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 7.7. Middle East and Africa Artificial Intelligence in Cybersecurity Market Size and Forecast, by Country (2023-2030) 7.7.1. South Africa 7.7.1.1. South Africa Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 7.7.1.2. South Africa Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 7.7.1.3. South Africa Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 7.7.1.4. South Africa Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 7.7.1.5. South Africa Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 7.7.1.6. South Africa Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 7.7.2. GCC 7.7.2.1. GCC Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 7.7.2.2. GCC Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 7.7.2.3. GCC Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 7.7.2.4. GCC Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 7.7.2.5. GCC Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 7.7.2.6. GCC Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 7.7.3. Nigeria 7.7.3.1. Nigeria Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 7.7.3.2. Nigeria Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 7.7.3.3. Nigeria Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 7.7.3.4. Nigeria Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 7.7.3.5. Nigeria Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 7.7.3.6. Nigeria Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 7.7.4. Rest of ME&A 7.7.4.1. Rest of ME&A Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 7.7.4.2. Rest of ME&A Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 7.7.4.3. Rest of ME&A Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 7.7.4.4. Rest of ME&A Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 7.7.4.5. Rest of ME&A Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 7.7.4.6. Rest of ME&A Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 8. South America Artificial Intelligence in Cybersecurity Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 8.2. South America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 8.3. South America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type(2023-2030) 8.4. South America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 8.5. South America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 8.6. South America Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 8.7. South America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Country (2023-2030) 8.7.1. Brazil 8.7.1.1. Brazil Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 8.7.1.2. Brazil Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 8.7.1.3. Brazil Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 8.7.1.4. Brazil Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 8.7.1.5. Brazil Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 8.7.1.6. Brazil Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 8.7.2. Argentina 8.7.2.1. Argentina Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 8.7.2.2. Argentina Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 8.7.2.3. Argentina Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 8.7.2.4. Argentina Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 8.7.2.5. Argentina Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 8.7.2.6. Argentina Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 8.7.3. Rest Of South America 8.7.3.1. Rest Of South America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Offering (2023-2030) 8.7.3.2. Rest Of South America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Deployment Type (2023-2030) 8.7.3.3. Rest Of South America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Security Type (2023-2030) 8.7.3.4. Rest Of South America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Technology (2023-2030) 8.7.3.5. Rest Of South America Artificial Intelligence in Cybersecurity Market Size and Forecast, by Application (2023-2030) 8.7.3.6. Rest Of South America Artificial Intelligence in Cybersecurity Market Size and Forecast, by End User (2023-2030) 9. Global Artificial Intelligence in Cybersecurity Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Artificial Intelligence in Cybersecurity Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Amazon Web Services, Inc. (U.S.) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. IBM Corporation (U.S.) 10.3. Intel Corporation (U.S.) 10.4. Microsoft Corporation (U.S.) 10.5. Nvidia Corporation (U.S.) 10.6. FireEye, Inc. (U.S.) 10.7. Palo Alto Networks, Inc. (U.S.) 10.8. Juniper Networks, Inc. (U.S.) 10.9. Fortinet, Inc. (U.S.) 10.10. Cisco Systems, Inc. (U.S.) 10.11. Micron Technology, Inc. (U.S.) 10.12. Check Point Software Technologies Ltd. (U.S.) 10.13. Imperva, Inc. (U.S.)McAfee LLC (U.S.)LogRhythm, Inc. (U.S.) 10.14. Sophos Ltd. (U.S.) 10.15. NortonLifeLock Inc. (U.S.) 10.16. CrowdStrike Holdings, Inc. (U.S.) 10.17. Kelco (U.S.) 10.18. Acalvio Technologies, Inc. 10.19. Cylance Inc. (BlackBerry) 10.20. Darktrace; FireEye, Inc. 10.21. Intel Corp 10.22. LexisNexis 10.23. Micron Technology Inc. 10.24. Microsoft Corporation 10.25. Gen Digital Inc. 10.26. Palo Alto Networks, Inc. 10.27. Cisco Systems, Inc. 10.28. Samsung Electronics Co. Ltd. 11. Key Findings 12. Industry Recommendations 13. Artificial Intelligence in Cybersecurity Market: Research Methodology 14. Terms and Glossary