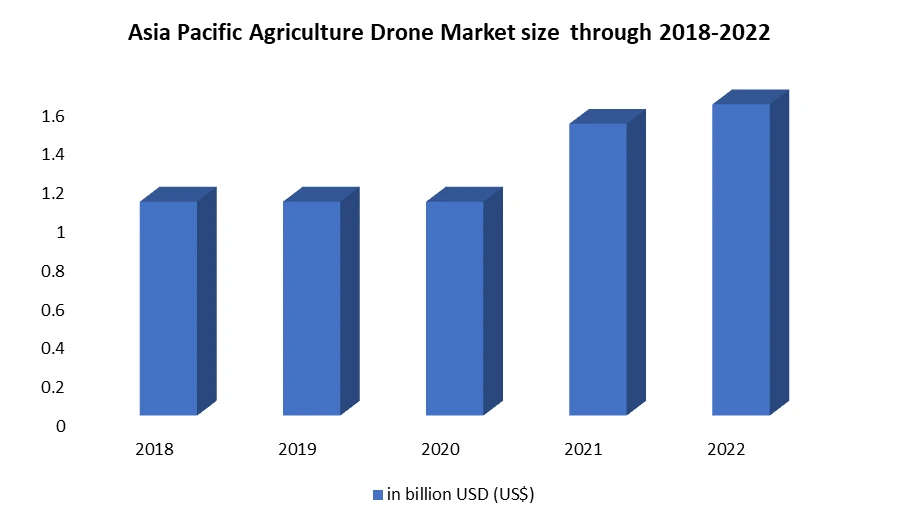

The Asia Pacific Agriculture Drone Market size was valued at USD 1.6 Billion in 2023 and the total Asia Pacific Agriculture Drone Market revenue is expected to grow at a CAGR of 3.97 % from 2024 to 2030, reaching nearly USD 2.10 Billion.Asia Pacific Agriculture Drone Market Overview

Agriculture drones are unmanned aerial vehicles used in precision farming, livestock monitoring, and other agricultural applications. They enhance productivity by providing data for informed decision-making in diverse aspects of the agricultural sector. Increasing demand for precision agriculture, and a growing need for efficient farm management boosting the growth of the Asia Pacific Agriculture Drone Market. The integration of unmanned aerial vehicles (UAVs) in agriculture has transformed traditional farming practices, offering farmers unprecedented insights into crop health, resource optimization, and overall field management. The demand is driven by the benefits these drones bring, such as enhanced crop monitoring, accurate mapping, and the ability to implement precision farming techniques. The advancements in drone technology, including improved sensors and data analytics, contribute to the Asia Pacific Agriculture Drone Market growth. Companies such as DJI, FlytBase, and Skylark Drones are pivotal players in this dynamic landscape, continually innovating to offer sophisticated and user-friendly solutions. DJI, for instance, has introduced drones equipped with high-resolution cameras and multispectral sensors, providing farmers with comprehensive data for better decision-making. Asia Pacific Agriculture Drone Market's leading players focus on data analytics, offering advanced software solutions for interpreting the vast amounts of data collected by agriculture drones.To know about the Research Methodology:-Request Free Sample Report

Asia Pacific Agriculture Drone Market Dynamics

Supportive government policies with Technological Advancements Asia Pacific Agriculture Drone Market growth The widespread adoption of precision farming practices has become important, with drones equipped with advanced sensors playing a pivotal role. For instance, SenseFly's sophisticated sensor technology enables farmers to monitor crop health, optimize irrigation, and precisely apply fertilizers. This, in turn, leads to increased yields and enhanced resource efficiency. Supportive government policies and initiatives, exemplified by India's DGCA guidelines facilitating drone usage in agriculture, contribute significantly to market growth. These policies encourage farmers to embrace drone technology for improved productivity and resource management. Government Support for Agriculture Drone Manufacturing in IndiaContinuous technological advancements in drone capabilities are another crucial growth driver. Companies like Yamaha are at the forefront, developing advanced drone models with autonomous flight capabilities and enhanced payload capacities. This ongoing innovation provides farmers with efficient and versatile solutions for various agricultural tasks. the Trend toward larger farms in the Asia Pacific region is driving the demand for agriculture drones. Larger agricultural operations benefit significantly from the efficiency gains of drones in monitoring vast areas, as observed in countries like China, where the scale of farming enterprises is growing. Escalating labor costs in countries like Japan, coupled with labor shortages, are encouraging farmers to invest in automation technologies like agriculture drones. Drones, such as those manufactured by DJI, are increasingly utilized for tasks like crop spraying, reducing dependency on manual labor and mitigating cost pressures. Increasing awareness and education about the benefits of agriculture drones, driven by initiatives from companies such as Parrot, contribute to the market's growth. Educational programs empower farmers with the knowledge and skills to effectively integrate drones into their farming practices, accelerating the adoption of this transformative technology. The impact of climate change is also a significant driver, pushing farmers to adopt precision technologies for adaptive agriculture. Drones, such as those offered by 3D Robotics, provide real-time data on changing weather patterns, enabling farmers to make informed decisions and implement climate-resilient farming practices. Collaborations between agriculture drone manufacturers and technology providers, exemplified by partnerships such as DJI and PrecisionHawk, are driving innovation. These collaborations result in integrated solutions offering comprehensive data analytics, facilitating informed decision-making for farmers in the Asia Pacific region. Increased competition among agriculture drone manufacturers, seen in efforts by key players to continuously innovate and offer cost-effective solutions, fosters market growth. Improvements in rural connectivity, exemplified by investments in countries like Australia, are creating an environment conducive to the effective deployment of agriculture drone technologies in remote farming areas. High cost of Agriculture Drone the Asia Pacific Agriculture Drone Market Growth Limited flight durations hindering the adoption of Agriculture Drone in Asia Pacific Region, as seen in models like the DGI AGRAS MG-1 with around 15 minutes of flight time, delay efficient coverage in larger agricultural operations. Affordability concerns persist, especially in developing regions like Indonesia or Bangladesh, where the cost of commercial-grade UAVs, ranging from $1,500 to $20,000, pose financial barriers for small-scale farmers. Regulatory hurdles, exemplified by India's intricate Drone Certification Scheme 2022 and restrictions on foreign-made drones, complicate the landscape for manufacturers and users. The supply and training of pilots create challenges as operators lack expertise in adhering to specific design formulations, impacting effective pesticide application. Asia Pacific Agriculture Drone Market growth outside China is limited due to the dominance of Chinese models like the DGI AGRAS MG-1. Security concerns and legislative hesitancy impede the revolutionary potential of UAV swarms, as governments are reluctant to permit widespread applications due to perceived threats. The operational integration of heavy-lifting UAVs like Carrier HX-8 and Airboard Agro 100 depends on regulatory changes, such as the Tactical Robotics Cormorant, requiring legislative revisions for agricultural spraying. Weather dependency, limited crop suitability, and equipment reliability along with human error contribute to the challenges faced by the Asia Pacific Agriculture Drone Market.

Initiatives Description Drone Airspace Map 2021 The government published the Drone Airspace Map 2021, designating approximately 90% of the Indian airspace as a green zone (up to 400 feet). It provides a clear regulatory framework for drone operations. UAS Traffic Management (UTM) Policy Structure 2021 The UAS Traffic Management policy structure was introduced to manage drone traffic efficiently. It aims to streamline drone operations and enhance safety measures in the airspace. Drone Certification Scheme 2022 The implementation of the Drone Certification Scheme 2022 facilitates drone makers in obtaining a type certificate. This scheme ensures adherence to safety and quality standards, fostering domestic drone manufacturing. Drone Import Policy 2022 The Drone Import Policy 2022 prohibits the import of foreign-made drones, encouraging reliance on domestically manufactured drones. This move supports the growth of the indigenous drone manufacturing sector. Drone (Amendment) Rules 2022 The introduction of the Drone (Amendment) Rules 2022 eliminates the requirement for a drone pilot license for drone companies. This regulatory change simplifies the operational procedures for drone businesses. 'Promoting Kisan Drones' Conference (May 2022) The Minister of Agriculture & Farmers Welfare inaugurated the ‘Promoting Kisan Drones’ conference, emphasizing government support for the use of drones in agriculture. Subsidies, up to 50%, were announced for specific categories of farmers. Ministry of Civil Aviation Drone Certification Scheme (Jan 2022) In January 2022, the Ministry of Civil Aviation introduced a drone certification scheme, ensuring minimum safety and quality standards. This initiative aims to boost domestic manufacturing and standardize drone operations. Directorate General of Foreign Trade Ban on Drone Imports The Directorate General of Foreign Trade has enforced a ban on drone imports for purposes other than R&D, defence, and security. This measure promotes indigenous drone manufacturing and self-sufficiency in the drone industry. Abolishment of Pilot License Requirement The Ministry of Civil Aviation eliminated the need for a pilot license to fly drones in India. Instead, a Remote Pilot Certificate (RPC) issued by DGCA-approved drone schools through the DigitalSky Platform is now required. Asia Pacific Agriculture Drone Market Segmentation:

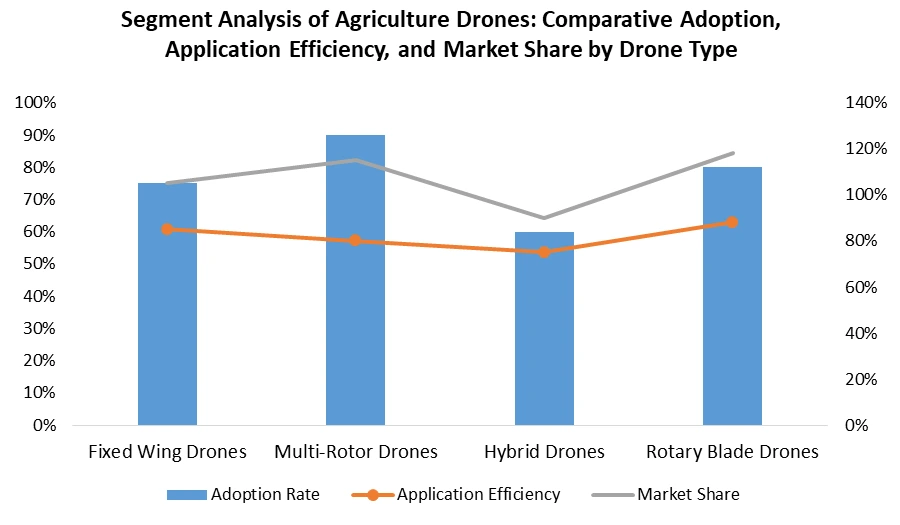

Based on Drone Types, Multi-Rotor Drones dominated the Asia Pacific Agriculture Drone Market in 2023 particularly popular in China with models like the DGI AGRAS MG-1, excel in precision spraying applications, demonstrating efficacy in small to medium-sized fields. Fixed Wing Drones, known for their endurance and long-range capabilities, are well-suited for large-scale farms, providing efficient crop monitoring and surveying. Hybrid Drones, leveraging both gasoline and battery power systems such as Thea 140, offer a balance of flight time and payload capacity, making them versatile for various agricultural tasks. Rotary Blade Drones, exemplified by Yamaha's RMAX, pioneered the industry with two-bladed rotors and are effective in precise aerial spraying. Each type caters to specific applications, such as surveillance, pesticide application, and crop health monitoring, contributing to a diverse and dynamic landscape within the Agriculture Drone Market.

Asia Pacific Agriculture Drone Market Regional Insights

China dominated the Asia Pacific Agriculture Drone Market, driven by extensive agricultural activities and technological advancements. The country's focus on precision farming and large-scale agriculture contributes significantly to drone adoption. In South Korea and Japan, supportive government policies and advanced technological infrastructures enhance market prospects. India, with its vast agricultural landscape, is witnessing a surge in drone usage, supported by government initiatives like the Directorate General of Civil Aviation's guidelines. In India, the Agriculture Drone Market is gaining momentum, driven by a combination of factors that contribute to its unique regional dynamics. The government's recognition of the potential benefits of drones across various sectors, including agriculture, has spurred the adoption of these technologies. Supportive policies, exemplified by the Directorate General of Civil Aviation's guidelines facilitating drone usage in agriculture, have provided a regulatory framework encouraging farmers to embrace drone technology for enhanced productivity and resource management. While In India, the Agriculture Drone Market is burgeoning, driven by government initiatives, including the Drone Airspace Map 2021 and the Drone Certification Scheme 2022. These policies aim to boost India into a global drone hub by 2030. The introduction of subsidies, as highlighted in the 'Promoting Kisan Drones' conference, is incentivizing drone adoption among farmers. Australia and New Zealand showcase a growing trend in agriculture drone applications, leveraging their expansive farmlands. Indonesia and Malaysia, with substantial agricultural sectors, are increasingly incorporating drones for precision farming. Emerging economies like Vietnam and Bangladesh are recognizing the potential benefits of agriculture drones, contributing to market growth. In terms of import and export, China stands out as a major manufacturing hub, producing a considerable share of the world's agriculture drones. The country not only caters to domestic demand but also exports drones globally.

Scope of the Asia Pacific Agriculture Drone Market: Inquire before buying

Asia Pacific Agriculture Drone Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.6 Bn. Forecast Period 2024 to 2030 CAGR: 3.97% Market Size in 2030: US $ 2.10 Bn. Segments Covered: by Type Fixed Wing Drones Multi-Rotor Drones Hybrid Drones Rotary Blade Drones by Component Hardware Software Services by Application Crop Monitoring Precision Agriculture Livestock Monitoring Smart Greenhouse Weather Tracking by End-User Large Farms Small and Medium-sized Farms Government Agencies Research and Development Asia Pacific Agriculture Drone Key Players:

1. Drona Aviation, Mumbai, Maharashtra, India 2. Thanos Technologies 3. Aarav Unmanned Systems, Pune 4. ideaForge, Navi Mumbai, India 5. Skylark Drones, Bengaluru, Karnataka 6. Johnnette Technologies, Noida, Uttar Pradesh 7. DJI (Dà-Jiāng Innovations, Headquarters: Shenzhen, Guangdong, China 8. Yuneec International, Kunshan, Jiangsu, China 9. Xiaomi (FIMI), Beijing, China 10. ZeroTech, Beijing, China 11. EHang, Guangzhou, Guangdong, China 12. Yamaha Motor Co, Shizuoka, Japan 13. Prodrone Co.,Nagoya, Aichi, Japan 14. SELCOM, Osaka, Japan 15. ZMP Inc., Tokyo, Japan FAQs: 1. Which country is expected to lead the Asia Pacific Agriculture Drone Market during the forecast period? Ans. China is expected to lead the Asia Pacific Agriculture Drone Market during the forecast period. 2. What is the projected market size & growth rate of the Asia Pacific Agriculture Drone Market? Ans. The Asia Pacific Agriculture Drone Market size was valued at USD 1.6 Billion in 2023 and the total Asia Pacific Agriculture Drone Market revenue is expected to grow at a CAGR of 3.97 % from 2024 to 2030, reaching nearly USD 2.10 Billion. 3. What segments are covered in the Asia Pacific Agriculture Drone Market report? Ans. The segments covered in the Asia Pacific Agriculture Drone Market report are Type, Component, Application, and End-User.

1. Asia Pacific Agriculture Drone Market: Research Methodology 2. Asia Pacific Agriculture Drone Market: Executive Summary 3. Asia Pacific Agriculture Drone Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Asia Pacific Agriculture Drone Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. Asia Pacific Agriculture Drone Market: Segmentation (by Value USD and Volume Units) 5.1. Asia Pacific Agriculture Drone Market, by Type (2023-2030) 5.1.1. Fixed Wing Drones 5.1.2. Multi-Rotor Drones 5.1.3. Hybrid Drones 5.1.4. Rotary Blade Drones 5.2. Asia Pacific Agriculture Drone Market, by Component (2023-2030) 5.2.1. Hardware 5.2.2. Software 5.2.3. Services 5.3. Asia Pacific Agriculture Drone Market, by Application (2023-2030) 5.3.1. Crop Monitoring 5.3.2. Precision Agriculture 5.3.3. Livestock Monitoring 5.3.4. Smart Greenhouse 5.3.5. Weather Tracking 5.4. Asia Pacific Agriculture Drone Market, by End-User (2023-2030) 5.4.1. Large Farms 5.4.2. Small and Medium-sized Farms 5.4.3. Government Agencies 5.4.4. Research and Development 5.5. Asia Pacific Agriculture Drone Market, by Country (2023-2030) 5.5.1. China 5.5.2. South Korea 5.5.3. Japan 5.5.4. India 5.5.5. Australia 5.5.6. Indonesia 5.5.7. Malaysia 5.5.8. Vietnam 5.5.9. Taiwan 5.5.10. Bangladesh 5.5.11. Pakistan 5.5.12. Rest of Asia Pacific 6. Company Profile: Key players 6.1. Drona Aviation, Mumbai, Maharashtra, India 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. Thanos Technologies 6.3. Aarav Unmanned Systems, Pune 6.4. ideaForge, Navi Mumbai, India 6.5. Skylark Drones, Bengaluru, Karnataka 6.6. Johnnette Technologies, Noida, Uttar Pradesh 6.7. DJI (Dà-Jiāng Innovations, Headquarters: Shenzhen, Guangdong, China 6.8. Yuneec International, Kunshan, Jiangsu, China 6.9. Xiaomi (FIMI), Beijing, China 6.10. ZeroTech, Beijing, China 6.11. EHang, Guangzhou, Guangdong, China 6.12. Yamaha Motor Co, Shizuoka, Japan 6.13. Prodrone Co.,Nagoya, Aichi, Japan 6.14. SELCOM, Osaka, Japan 6.15. ZMP Inc., Tokyo, Japan 7. Key Findings 8. Industry Recommendation