The Optical Fiber Raw Material Market size was valued at USD 0.9 Billion in 2022 and the total Optical Fiber Raw Material Market revenue is expected to grow at a CAGR of 11.8% from 2023 to 2029, reaching nearly USD 2.20 Billion. Optical fibers, which are slender strands made of glass or plastic with a diameter similar to that of a human hair, are used for transmitting data using light pulses between two endpoints. Bundles of optical fibers are arranged to form optical fiber cables, which are used to transmit data across the globe, including under the ocean surface. In a fiber optic communication system, cables made of optical fibers connect data links containing lasers and light detectors. To transmit information, an analogue electronic signal is converted into digital pulses of laser light, which travel through the optical fiber to another data link, where a light detector reconverts them into an electronic signal. The Optical Fiber Raw Material Market is high in demand thanks to 5G and IoT this will aid the industry to continue to grow during the forecast period. 2019 saw a de-growth in optical fibre cable installations. 2019 saw 480 million fibre-km installations v/s 500 million fibre-km installations in 2018, mainly due to a demand decrease in China. Also, Indian telecom players cut their capex spending in 2019 owing to their financial problems. India is just 25% fiberized (v/s 60% global avg and US/China being >60% fiberized). Demand in India is yet to come. This led to perform inventory build-up followed by price correction in 2019. Global demand for preform in 2017 was 15,300 tons (i.e. ~450 million kilometres). China accounted for half of the volume, producing ~7,500 tons of preform. Back of envelope conversion to length is that 10,000 tons translate into ~300 million kilometres of preforms and drive the Optical Fiber Raw Material Market demand. The report covered the detailed analysis of market trends and challenges faced by manufacturers in each region also, the report covered the micro details of local as well as key Optical Fiber Raw Material Market players with their investment plans and Optical Fiber Raw Material Market strategy by each country.To know about the Research Methodology :- Request Free Sample Report

Optical Fiber Raw Material Market Dynamics:

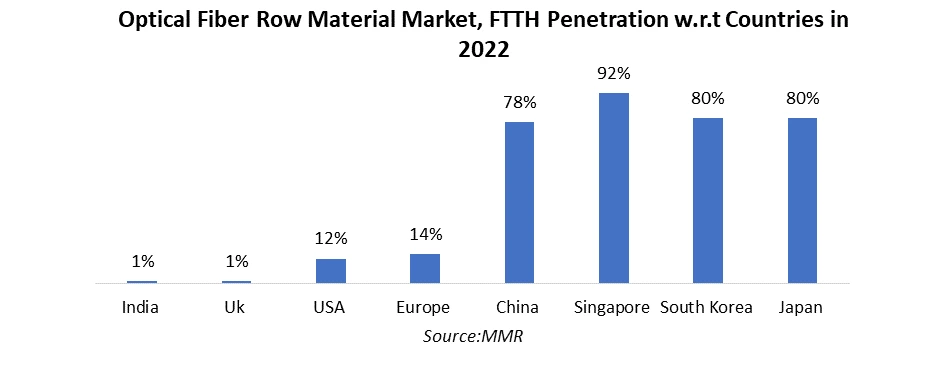

Optical Fibre Price and Value Chain Analysis After the Chinese New Year in 2022, the price of basic materials unexpectedly increased, causing concern throughout the industry. This was due to the early recovery of China's economy causing a mismatch in supply and demand for Optical Fiber Raw Material industrial raw materials and commodities. Additionally, capacity reduction for some basic materials resulted in insufficient production, creating a gap between supply and demand and driving up prices. The rising price of basic materials makes people feel "horrified." Public information shows that compared with the beginning of 2020, some basic materials have increased by more than 200% year-on-year, n-butanol has increased by more than 167% YoY, acetic acid has increased by more than 166% YoY, and isobutyl alcohol has increased by more than 150% YoY. Propane, polymeric MDI, etc. rose more than 100% YoY, and raw materials such as acetone, TDI, aniline, ethylene, and isopropanol rose more than 50% YoY. On the whole, the oil and natural chemical fiber manufacturing industry ranks at the forefront of the YoY improvement. The Optical Fiber Raw Material Market demand is high in metal mining and processing, and the chemical fiber manufacturing industry rank at the forefront of the YoY improvement. As of the beginning of March, 1,4-butanediol (BDO), the basic material used to make PBT, was quoted at 31,500 CNY/Ton; the price of bisphenol A used to make PC rose to 24,133.33 CNY/Ton; the basis for making PP, the material propylene, rose to 8459 CNY/Ton; the international crude oil price of basic materials used to make PVC and ointment rose from 30 US dollars/barrel to 85 US dollars/barrel. The price of steel used to manufacture steel-plastic composite belts rose to 5270 CNY/Ton. In addition, the Optical Fiber Raw Material Market price of LLDPE related to sheathing material polyethene (PE) has increased to around 8950-9200 CNY/Ton. The spot price of LDPE, a major European indicator, rose to 1,800 euros/Ton; the price of low-smoke halogen-free polyolefin (EVA) rose to 21,000-22,000 CNY/Ton; the current price of glass fibre yarn has exceeded 6,000 CNY/Ton; 6625 CNY/Ton. The above data shows that the price-rising trend will continue in the short term. The soaring price of basic materials has put pressure on optical fiber and cable material manufacturers, and it has also brought pressure on optical fiber and cable companies. It is understood that under the pressure of rising prices of basic materials, the Optical Fiber Raw Material industry is also "rising". Global penetration in FTTH (Fibre to the home) is very low and has huge potential for growth Fiber to the home (FTTH) is a type of fibre optic communication that involves the use of optical fibers to provide high-speed internet, voice, and video services directly to homes and businesses. Despite the numerous benefits of FTTH, such as faster internet speeds, lower latency, and higher bandwidth capacity, the global penetration rate is still low. As of 2021, only about 20% of households worldwide have access to FTTH, leaving a huge potential for growth in the Optical Fiber Raw Material Market. Several factors contribute to the slow adoption of FTTH. One major factor is the high cost of deploying fiber optic cables, which can be a barrier for telecommunication companies to invest in infrastructure. Another factor is the lack of government incentives or regulations to encourage the deployment of FTTH. However, with the increasing demand for high-speed internet and the emergence of new technologies such as 5G and the Internet of Things (IoT), the potential for growth in the FTTH Optical Fiber Raw Material Market is significant. For example, the COVID-19 pandemic has accelerated the adoption of remote work and online learning, increasing the demand for reliable and high-speed internet connections. Countries such as South Korea and Japan have been at the forefront of FTTH adoption, with penetration rates exceeding 80%. In contrast, many developing countries, such as those in Africa, have a much lower penetration rate, with less than 1% of households having a ccess to FTTH. To increase the adoption of FTTH, governments can provide incentives for telecommunication companies to invest in infrastructure, such as tax breaks or subsidies. Additionally, partnerships between telecommunication companies and local governments can help to lower the cost of deployment and increase the availability of FTTH to underserved areas.

Optical Fiber Raw Material Market Segment Analysis:

By Row Material: the Optical Fiber Row Material Market is segmented into Silicon Tetrachloride (SiCl4), Germanium Tetrachloride (GeCl4), and Phosphorus Oxychloride (POCl3). Silicon Tetrachloride (SiCl4) is expected to dominate the Optical Fiber Row Material Market during the forecast period. Silicon tetrachloride (SiCl4) is a highly sought-after raw material in the optical fiber industry. This is because SiCl4 is a precursor for producing high-purity silicon dioxide (SiO2) that is used in the manufacture of optical fibers. The process of making high-purity SiO2 involves reacting SiCl4 with oxygen in a high-temperature furnace, which produces a vapour of SiO2. This vapour is then deposited onto a preform, which is a glass rod that is slowly rotated and heated to form the optical fiber. SiCl4 is preferred over other sources of silicon because it is highly pure, readily available, and reacts well with oxygen. In addition, SiCl4 is a volatile liquid that can be easily vaporized, making it easy to transport and handle in the manufacturing process. The high demand for SiCl4 in the Optical Fiber Raw Material industry has driven up its price in recent years. For example, in 2021, the price of SiCl4 increased by more than 50% compared to the previous year due to the high demand for optical fibers driven by the growth of 5G networks and other data-intensive applications. By End User Industry: the Optical Fiber Raw Material Market is segmented into IT and Telecom, Aerospace, Healthcare, Energy and Utilities, Manufacturing, and Others. IT and Telecom held the largest market share in 2022. Fiber optics technology is widely adopted for data transmission and communication services, offering potential growth opportunities. This technology enables high-speed information transfer for long and short-range communications and is driving the growth of video-on-demand (VoD), cloud-based applications, and audio-video immersive reality services. Wireless 5G and wireline optical networks complement each other to provide secure connectivity, facilitating the development of smart ecosystems using optical fibers. Optical fiber cable (OFC) manufacturers are preparing to meet the increased fiberization required to power 5G services and meet the demands of fiber-to-the-home (FTTH) fixed broadband. The rapid development of emerging applications necessitates an advanced network, which fiber optics can support. Modern network feature requirements suggest that smart manufacturing, smart grid, smart agriculture, and enterprise cloudification may become major fiber-optic network scenarios. In the Industry 4.0 era, an all-optical network empowers traditional industries, and telecom networks can be upgraded for real-time monitoring and industrial data communication using fiber optics.Optical Fiber Raw Material Market Regional Insights:

Asia Pacific region is expected to dominate the Optical Fiber Row Material Market during the forecast period. The Asia Pacific region is a major player in the global optical fiber raw material market. The region has a large telecommunications industry, with countries such as China, Japan, South Korea, and India contributing significantly to the growth of the market. The increasing demand for high-speed internet connectivity, the growth of cloud-based services, and the adoption of Internet of Things (IoT) devices are some of the factors driving the demand for optical fiber raw materials in the region. China is one of the leading producers and consumers of optical fiber raw materials in the Asia Pacific region. The country has a large telecommunications industry and has invested heavily in the development of high-speed internet infrastructure. The government's ambitious "Made in China 2025" plan has also been a major contributor to the growth of the optical fiber raw material market in the country. The plan aims to transform China into a high-tech manufacturing hub and promote the development of advanced technologies, including 5G, IoT, and AI. Japan is another significant market for optical fiber raw materials in the Asia Pacific region. The country has a mature telecommunications industry and has been a pioneer in the development of fiber optic technology. The government's efforts to promote the adoption of IoT devices and the development of smart cities have also contributed to the growth of the market in the country. South Korea is another major player in the optical fiber raw material market in the Asia Pacific region. The country has a large telecommunications industry and has invested heavily in the development of 5G infrastructure. The government's "Digital New Deal" initiative aims to promote the development of digital infrastructure and technologies, including AI, 5G, and cloud computing. These efforts are expected to drive the demand for optical fiber raw materials in the country. India is also a significant market for optical fiber raw materials in the Asia Pacific region. The country has a large and rapidly growing telecommunications industry, driven by the increasing demand for high-speed internet connectivity and the adoption of IoT devices. The government's "Digital India" initiative aims to transform the country into a digitally empowered society and knowledge economy. The initiative includes the development of high-speed broadband infrastructure and the deployment of Wi-Fi hotspots in public places. These efforts are expected to drive the demand for optical fiber raw materials in the country.Global Optical Fiber Raw Material Market Scope: Inquire before buying

Global Optical Fiber Raw Material Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 0.9 Bn. Forecast Period 2023 to 2029 CAGR: 11.8 % Market Size in 2029: US $ 2.20 Bn. Segments Covered: by Row Material Silicon Tetrachloride (SiCl4) Germanium Tetrachloride (GeCl4) Phosphorus Oxychloride (POCl3) by End User Industry IT and Telecom Aerospace Healthcare Energy and Utilities Manufacturing Other Optical Fiber Raw Material Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Optical Fiber Raw Material Market Key Players:

1. Corning (USA) 2. Prysmian Group (Italy) 3. Sumitomo Electric Industries (Japan) 4. Fujikura Ltd. (Japan) 5. Yangtze Optical Fiber and Cable Co. Ltd. (China) 6. Sterlite Technologies Ltd. (India) 7. YOFC (China) 8. Nexans (France) 9. CommScope (USA) 10.Furukawa Electric Co. Ltd. (Japan) 11.General Cable Corporation (USA) 12.Birla Furukawa Fibre Optics Pvt. Ltd. (India) 13.Accelink Technologies Co., Ltd. (China) 14.Ofs Fitel, LLC (USA) 15.Fiberhome Telecommunication Technologies Co. Ltd. (China) 16.LS Cable & System Ltd. (South Korea) 17.Jiangsu Zhongtian Technology Co., Ltd. (China) 18.CTC Global Corporation (USA) 19.Fujitsu Ltd. (Japan) 20.Finolex Cables Ltd. (India) FAQs: 1. What are the growth drivers for the Optical Fiber Raw Material Market? Ans. The increasing prevalence investment by key market players, is expected to be the major driver for the Optical Fiber Raw Material Market. 2. What is the major restraint for the Optical Fiber Raw Material Market growth? Ans. Fluctuating Price are expected to be the major restraining factor for the Optical Fiber Raw Material Market growth. 3. Which region is expected to lead the global Optical Fiber Raw Material Market during the forecast period? Ans. Asia Pacific is expected to lead the global Optical Fiber Raw Material Market during the forecast period. 4. What is the projected market size & growth rate of the Optical Fiber Raw Material Market? Ans. The Optical Fiber Raw Material Market size was valued at USD 09 Billion in 2022 and the total Optical Fiber Raw Material Market revenue is expected to grow at a CAGR of 11.9% from 2023 to 2029, reaching nearly USD 2.20 Billion. 5. What segments are covered in the Optical Fiber Raw Material Market report? Ans. The segments covered in the Optical Fiber Raw Material Market report are Type, End-use, and Region.

1. Optical Fiber Raw Material Market: Research Methodology 2. Optical Fiber Raw Material Market: Executive Summary 3. Optical Fiber Raw Material Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Optical Fiber Raw Material Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Optical Fiber Raw Material Market: Segmentation (by Value USD and Volume Units) 5.1. Optical Fiber Raw Material Market, by Row Material (2022-2029) 5.1.1. Spring Return 5.1.2. Non Spring Return 5.2. Optical Fiber Raw Material Market, by End User Industry (2022-2029) 5.2.1. Smart 5.2.2. Convention 5.3. Optical Fiber Raw Material Market, by Region (2022-2029) 5.3.1. North America 5.3.2. Europe 5.3.3. Asia Pacific 5.3.4. Middle East and Africa 5.3.5. South America 6. North America Optical Fiber Raw Material Market (by Value USD and Volume Units) 6.1. North America Optical Fiber Raw Material Market, by Row Material (2022-2029) 6.1.1. Hypermarkets and Supermarkets 6.1.2. Spring Return 6.1.3. Non Spring Return 6.2. North America Optical Fiber Raw Material Market, by End User Industry (2022-2029) 6.2.1. Smart 6.2.2. Convention 6.3. North America Optical Fiber Raw Material Market, by Country (2022-2029) 6.3.1. United States 6.3.2. Canada 6.3.3. Mexico 7. Europe Optical Fiber Raw Material Market (by Value USD and Volume Units) 7.1. Europe Optical Fiber Raw Material Market, by Row Material (2022-2029) 7.2. Europe Optical Fiber Raw Material Market, by End User Industry (2022-2029) 7.3. Europe Optical Fiber Raw Material Market, by Country (2022-2029) 7.3.1. UK 7.3.2. France 7.3.3. Germany 7.3.4. Italy 7.3.5. Spain 7.3.6. Sweden 7.3.7. Austria 7.3.8. Rest of Europe 8. Asia Pacific Optical Fiber Raw Material Market (by Value USD and Volume Units) 8.1. Asia Pacific Optical Fiber Raw Material Market, by Row Material (2022-2029) 8.2. Asia Pacific Optical Fiber Raw Material Market, by End User Industry (2022-2029) 8.3. Asia Pacific Optical Fiber Raw Material Market, by Country (2022-2029) 8.3.1. China 8.3.2. S Korea 8.3.3. Japan 8.3.4. India 8.3.5. Australia 8.3.6. Indonesia 8.3.7. Malaysia 8.3.8. Vietnam 8.3.9. Taiwan 8.3.10. Bangladesh 8.3.11. Pakistan 8.3.12. Rest of Asia Pacific 9. Middle East and Africa Optical Fiber Raw Material Market (by Value USD and Volume Units) 9.1. Middle East and Africa Optical Fiber Raw Material Market, by Row Material (2022-2029) 9.2. Middle East and Africa Optical Fiber Raw Material Market, by End User Industry (2022-2029) 9.3. Middle East and Africa Optical Fiber Raw Material Market, by Country (2022-2029) 9.3.1. South Africa 9.3.2. GCC 9.3.3. Egypt 9.3.4. Nigeria 9.3.5. Rest of ME&A 10. South America Optical Fiber Raw Material Market (by Value USD and Volume Units) 10.1. South America Optical Fiber Raw Material Market, by Row Material (2022-2029) 10.2. South America Optical Fiber Raw Material Market, by End User Industry (2022-2029) 10.3. South America Optical Fiber Raw Material Market, by Country (2022-2029) 10.3.1. Brazil 10.3.2. Argentina 10.3.3. Rest of South America 11. Company Profile: Key players 11.1. Corning (USA). 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Prysmian Group (Italy) 11.3. Sumitomo Electric Industries (Japan) 11.4. Fujikura Ltd. (Japan) 11.5. Yangtze Optical Fiber and Cable Co. Ltd. (China) 11.6. Sterlite Technologies Ltd. (India) 11.7. YOFC (China) 11.8. Nexans (France) 11.9. CommScope (USA) 11.10. Furukawa Electric Co. Ltd. (Japan) 11.11. General Cable Corporation (USA) 11.12. Birla Furukawa Fibre Optics Pvt. Ltd. (India) 11.13. Accelink Technologies Co., Ltd. (China) 11.14. Ofs Fitel, LLC (USA) 11.15. Fiberhome Telecommunication Technologies Co. Ltd. (China) 11.16. LS Cable & System Ltd. (South Korea) 11.17. Jiangsu Zhongtian Technology Co., Ltd. (China) 11.18. CTC Global Corporation (USA) 11.19. Fujitsu Ltd. (Japan) 11.20. Finolex Cables Ltd. (India). 12. Key Findings 13. Industry Recommendation