The Membrane Filtration Market was valued at USD 18.85 Bn in 2024, and total global Membrane Filtration Market revenue is expected to grow at a CAGR of 7.25% & reaching nearly USD 33 Bn from 2025-2032Membrane Filtration Market Overview

Membrane filtration is an advanced separation technology such as reverse osmosis (RO), ultrafiltration (UF), microfiltration (MF) and nanofiltration (NF) used to purify, concentrate, or fractionate fluids across industrial and municipal sectors. Globally, the market is undergoing a robust transformation, driven by growing demand for high purity products, stricter environmental norms and advancements in membrane design and materials. This report by MMR presents a strategic industry outlook into market that is vital for operational efficiency, regulatory compliance and sustainable production, mainly across water & wastewater treatment, food & beverage, dairy and pharmaceutical industries.To know about the Research Methodology:- Request Free Sample Report As regulatory authorities and consumers emphasize product quality and water sustainability, membrane filtration systems are being rapidly adopted for their precision, efficiency and minimal chemical usage. The market is seeing accelerated investments in polymeric and ceramic membranes, zero liquid discharge systems and energy efficient modules. With membrane filtration emerging as a critical enabler for premium product manufacturing and clean water generation, manufacturers are racing to enhance productivity, reduce fouling and scale mobile or compact systems. Our analysis covers evolving end-user preferences, technology upgrades, and regional initiatives shaping market demand. Asia Pacific dominated the global market, backed by large scale infrastructure development, population driven water demand and industrial expansion in countries like China, India and Japan. North America is closely driven by R&D activity and high compliance in pharmaceuticals and biotech. Major players such as DuPont, Asahi Kasei, Veolia, Toray, Kovalus and GEA are leading innovation by capacity expansion, product launches, and sustainability focused technologies. We provide deep insights into company profiles, technology benchmarking, pricing dynamics and M&A activity to support strategic decision making for stakeholders across this high growth, mission critical sector.

Membrane Filtration Market Dynamics

Increasing Demand for Premium Products to Drive the Membrane Filtration Market Growth As consumers increasingly seek high-quality and pure end products, manufacturers are made to implement advanced filtration processes to meet these evolving expectations. Membrane filtration, with its ability to separate and purify fluids based on size or molecular weight, plays an important role in ensuring the production of premium goods. In sectors such as food and beverage, pharmaceuticals, and biotechnology, where product quality is paramount, membrane filtration is adopted to remove impurities, contaminants, and unwanted particles, thereby enhancing the overall quality and purity of the final output. Whether it is achieving superior taste in beverages, ensuring the efficacy of pharmaceutical formulations, or meeting stringent quality standards in biotech processes, membrane filtration emerges as an important technology to satisfy the increasing demands of consumers for premium products. Availability of Alternatives to Hamper the Membrane Filtration Market Membrane filtration growth is limited by the availability of other technologies such as UV disinfection, chemical treatments, and advanced oxidation processes. Often, these alternatives are more cost-effective as well as environmentally friendly, and cater to particular filtration requirements. Consider for example, the UV disinfection, which is an effective way of killing microorganisms but without depriving the water of useful minerals, thus a suitable method for selective water purification. As per Water Defense, other methods, such as activated carbon filters, distillation and sediment filters, have the added benefit of producing less wastewater and lower maintenance costs and can also remove specific contaminants such as fluoride, arsenic, and large particles. These alternatives are versatile and user-friendly solutions that are appealing to cost-conscious and eco-aware consumers. These technologies will likely limit the adoption of membrane filtration systems, such as reverse osmosis, as demand for sustainable and tailored water purification increases, in segments where such alternatives are capable of meeting the need.Membrane Filtration Market Segment Analysis

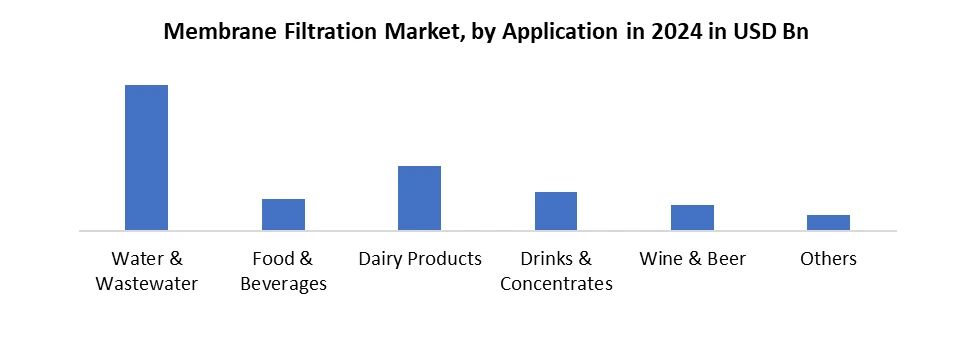

Based on Type, Reverse osmosis technology is expected to hold a significant market share in the global membrane filtration market. Reverse osmosis is a process in which the pressure reverses the natural osmosis process. This process can efficiently remove nearly all inorganic and organic contaminants from water. The increasing demand for water processing in agricultural industries is likely to drive the demand for membrane filtration. For instance, in March 2021, the construction of a USD 65 million Membrane Filtration Reverse Osmosis Facility for Agriculture (MFRO Facility) commenced in Escondido. The project was set up to produce four million gallons per day (MGD) of water with a salt concentration for agricultural irrigation usage. The facility used membrane filtration (MF) and reverse osmosis (RO) technologies to provide a quality irrigation supply.Based on Membrane Material, the ceramic membrane filtration technology witnessed immense demand during the forecast period. Ceramic membrane filtration is commonly used in water treatment systems to generate clean water by eliminating impurities such as bacteria, protozoa, and other substances. For instance, in August 2021, Ceram Tec, a manufacturer of advanced ceramic components, launched porous ceramic membrane tubes. These tubes are made from alumina and developed for nano-, ultra-, and micro-filtration. The new product is used to separate solids from liquids and is used primarily in biotechnology and pharmaceutical applications. Technological advancements in ceramic membranes help increase production efficiency and are expected to positively impact the global membrane filtration market in the upcoming years. Based on Application, the Water and wastewater segment is expected to account for a major share of the global membrane filtration industry, driven by economic and technical factors. According to the Food and Agriculture Organization of the United Nations, approximately 150 million households around the globe are engaged in milk production. The use of membrane technology has revolutionized the dairy sector. Various types of membranes are used in the milk industry for numerous purposes, including extending the shelf life of milk, increasing the quality of dairy products, and concentrating & purification of milk components. Thus, the growing demand for dairy products and various government subsidies are key factors driving the membrane filtration market. The wine and beer sector is also expected to grow at a higher CAGR in the forecast period. Processes such as de-alcoholization of beer and wine, beer recovery from the tank bottom, clarification of malt extract, and obtaining clear malt beverages are performed using a membrane filtration system, driving the demand for such technologies.

Membrane Filtration Market Regional Analysis

Asia Pacific dominated the Membrane Filtration Market in 2024 and is expected to dominate during forecast period (2025-2032) The Asia Pacific region held the largest market share accounting for 41% in 2024. With the rapid growth rate of population in China, India has witnessed a rising in demand for safe water resources and wastewater treatment in this region. According to the National Informatics Centre of India, the total capacity of wastewater treatment plants increased to 26,869 mega litres per day in June 2022. India has provided safe drinking water at home to the 110 million people of the country. Also, according to CWR, they have the aim to increase the water supply by 70% in urban areas of China and improve the wastewater treatment by implementing a 125,900 km pipeline network. This will increase the demand for membrane filtration through the forecast period.Membrane Filtration Market Competitive Landscape

Global Membrane filtration market is highly competitive and innovation driven, with strong regional dynamics and strategic plays by multinational corporations. The market is currently dominated by Asia Pacific region, accounting for largest share by rapid industrialization, growing urban populations, and rising investments in clean water and wastewater treatment. China, India, Japan, and South Korea are at forefront of adoption, backed by supportive policies and expanding applications in the food & beverage, dairy and pharmaceutical sectors. Leading companies, DuPont Water Solutions (U.S.), Asahi Kasei (Japan), Veolia Water Technologies (France), Toray Industries (Japan), GEA Group (Germany) and Kovalus Separation Solutions (U.S.) are shaping the market by their continuous product development and membrane technology enhancements. These players are focusing on high efficiency RO, UF, MF and NF solutions tailored to industry specific needs, such as zero liquid discharge systems, energy saving modules and compact mobile filtration units. The market also features key regional players like Litree Purifying Technology (China), SUEZ (France) and Pentair (U.S.) each strengthening their global presence by local manufacturing, turnkey projects and acquisitions. The competitive intensity is further fuelled by increasing mergers and acquisitions, joint ventures and global R&D initiatives. We provide in-depth competitor profiling of 30 companies, market share analysis, technology benchmarking, and strategic growth mapping. This includes insights into product pipelines, patent landscapes, pricing intelligence, and regional expansion strategies to support informed decision making for clients operating or entering the membrane filtration space. Membrane Filtration Market Key TrendsMembrane Filtration Market Recent Development • 20th June 2025, Kovalus Separation Solutions (U.S) officially opened a new Technology Centre in Aachen, Germany, enhancing R&D capabilities in advanced membrane systems. • 16th December 2024, DuPont (U.S) received the Global Sustainability Leadership Award from the International Desalination and Reuse Association for implementing UN SDG 6 initiatives, including deploying ultrafiltration systems in Tanzania and supporting China’s largest nanofiltration plant in Jiaxing. • 13th November 2024, DuPont (U.S) launched Minerva, a generative AI chatbot providing on-demand technical support for water purification technologies. • October 2024, Asahi Kasai (Japan) introduced Planova FG1, a next-gen virus removal filter offering up to 7× higher flux for biopharma applications. • 18th May 2024, Veolia Water Technologies Solutions (France) announced a bold 50% revenue growth target in the US by 2027, under its GreenUp 24 27 plan, with major investments in ultrafiltration and RO systems targeting industrial reshoring. • 3rd April 2024, Veolia Water Technologies Solutions (France) launched a PFAS-detection campaign in France covering two-thirds of its national network, implementing membrane based PFAS treatment solutions.

Trends Description Rising Demand for Sustainable Filtration Industries are increasingly adopting energy-efficient and low-waste membrane systems to meet ESG goals and stricter environmental regulations. Growth in Food & Beverage Applications Expanding use of UF, MF, and RO membranes in dairy processing, beverage clarification, and juice concentration is boosting market growth. Advancements in Membrane Technology Development of next-gen polymeric and ceramic membranes with improved durability, selectivity, and anti-fouling properties is enhancing performance and reducing maintenance costs. Membrane Filtration Market Scope: Inquire before buying

Global Membrane Filtration Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 18.85 Bn. Forecast Period 2025 to 2032 CAGR: 7.25% Market Size in 2032: USD 33 Bn. Segments Covered: by Type Reverse Osmosis (RO) Ultrafiltration (UF) Microfiltration (MF) Nanofiltration (NF) by Module Design Spiral Wounds Tubular Systems Plates & Frames and Hollow Fibers by Membrane Material Polymeric Ceramic by Application Water & Wastewater Food & Beverages Dairy Products Drinks & Concentrates Wine & Beer Others Membrane Filtration Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Membrane Filtration Market, Key Players

North America 1. DuPont Water Solutions (U.S.) 2. Kovalus Separation Solutions (U.S.) 3. Evoqua Water Technologies (U.S.) 4. Pall Corporation (U.S.) 5. 3M Company (U.S.) 6. Pentair plc (U.S.) 7. Donaldson Company (U.S.) 8. SPX Flow Inc. (U.S.) 9. Applied Membranes Inc. (U.S.) Europe 10. Alfa Laval AB (Sweden) 11. GEA Group AG (Germany) 12. MANN+HUMMEL (Germany) 13. Porvair Filtration Group (UK) 14. SUEZ Water Technologies & Solutions (France) 15. ProMinent GmbH (Germany) 16. Imemflo Filtration Pvt Ltd (Germany) 17. Aquarion AG (Switzerland) 18. Envirochemie GmbH (Germany) 19. Sefar Holding AG (Switzerland) 20. Veolia Water Technologies & Solutions (France) Asia Pacific 21. Asahi Kasei Corporation (Japan) 22. Nitto Denko (Hydranautics) (Japan) 23. Toray Industries, Inc. (Japan) 24. Mitsubishi Chemical Group (Japan) 25. CITIC Envirotech (China) 26. Litree Purifying Technology Co Ltd (China) 27. Origin Water (China) 28. Tianjin MOTIMO (China) Membrane Filtration Market Frequently Asked Questions 1. Who are the key players in the Membrane Filtration Market? Ans. DuPont Water Solutions (U.S.), Asahi Kasei (Japan), Veolia Water Technologies (France), Toray Industries (Japan), GEA Group (Germany) and Kovalus Separation Solutions (U.S.) are some of the key players of Membrane Filtration Market. 2. Which segment dominates the Membrane Filtration Market? Ans. By Application, is the dominating segment in Membrane Filtration Market. 3. How big is the Membrane Filtration Market? Ans. The Global Membrane Filtration Market size reached USD 18.85 Bn in 2024 and is expected to reach USD 33 Bn by 2032, growing at a CAGR of 7.25% during the forecast period. 4. What are the key regions in the global Membrane Filtration Market? Ans. Based On the region, the Membrane Filtration Market has been classified into North America, Europe, Asia Pacific, the Middle, East and Africa, and South America. North America dominates the global Membrane Filtration market. 5. What is the study period of this market? Ans. The Global Market is studied from 2024 to 2032.

1. Membrane Filtration Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Membrane Filtration Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-user Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Global Membrane Filtration Market: Dynamics 3.1. Region wise Trends of Membrane Filtration Market 3.1.1. North America Membrane Filtration Market Trends 3.1.2. Europe Membrane Filtration Market Trends 3.1.3. Asia Pacific Membrane Filtration Market Trends 3.1.4. Middle East and Africa Membrane Filtration Market Trends 3.1.5. South America Membrane Filtration Market Trends 3.2. Membrane Filtration Market Dynamics 3.2.1. Global Membrane Filtration Market Drivers 3.2.1.1. Premium Product Demand 3.2.1.2. Water Treatment Regulations 3.2.2. Global Membrane Filtration Market Restraints 3.2.3. Global Membrane Filtration Market Opportunities 3.2.3.1. Dairy Industry Expansion 3.2.3.2. Biotech Process Adoption 3.2.3.3. Emerging Market Infrastructure 3.2.4. Global Membrane Filtration Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.4.1. Government Water Policies 3.4.2. Membrane Innovation Boom 3.4.3. Sustainability Compliance Pressure 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 3.6. Key Opinion Leader Analysis for the Global Industry 3.7. Analysis of Government Schemes and Initiatives for Industry 4. Membrane Filtration Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Membrane Filtration Market Size and Forecast, By Type (2024-2032) 4.1.1. Reverse Osmosis (RO) 4.1.2. Ultrafiltration (UF) 4.1.3. Microfiltration (MF) 4.1.4. Nanofiltration (NF) 4.2. Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 4.2.1. Spiral Wounds 4.2.2. Tubular Systems 4.2.3. Plates & Frames and Hollow Fibers 4.3. Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 4.3.1. Polymeric 4.3.2. Ceramic 4.4. Membrane Filtration Market Size and Forecast, By Application (2024-2032) 4.4.1. Water & Wastewater 4.4.2. Food & Beverages 4.4.3. Dairy Products 4.4.4. Drinks & Concentrates 4.4.5. Wine & Beer 4.4.6. Others 4.5. Membrane Filtration Market Size and Forecast, By Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Membrane Filtration Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Membrane Filtration Market Size and Forecast, By Type (2024-2032) 5.1.1. Reverse Osmosis (RO) 5.1.2. Ultrafiltration (UF) 5.1.3. Microfiltration (MF) 5.1.4. Nanofiltration (NF) 5.2. North America Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 5.2.1. Spiral Wounds 5.2.2. Tubular Systems 5.2.3. Plates & Frames and Hollow Fibers 5.3. North America Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 5.3.1. Polymeric 5.3.2. Ceramic 5.4. North America Membrane Filtration Market Size and Forecast, By Application (2024-2032) 5.4.1. Water & Wastewater 5.4.2. Food & Beverages 5.4.3. Dairy Products 5.4.4. Drinks & Concentrates 5.4.5. Wine & Beer 5.4.6. Others 5.5. North America Membrane Filtration Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Membrane Filtration Market Size and Forecast, By Type (2024-2032) 5.5.1.1.1. Reverse Osmosis (RO) 5.5.1.1.2. Ultrafiltration (UF) 5.5.1.1.3. Microfiltration (MF) 5.5.1.1.4. Nanofiltration (NF) 5.5.1.2. United States Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 5.5.1.2.1. Spiral Wounds 5.5.1.2.2. Tubular Systems 5.5.1.2.3. Plates & Frames and Hollow Fibers 5.5.1.3. United States Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 5.5.1.3.1. Polymeric 5.5.1.3.2. Ceramic 5.5.1.4. United States Membrane Filtration Market Size and Forecast, By Application (2024-2032) 5.5.1.4.1. Water & Wastewater 5.5.1.4.2. Food & Beverages 5.5.1.4.3. Dairy Products 5.5.1.4.4. Drinks & Concentrates 5.5.1.4.5. Wine & Beer 5.5.1.4.6. Others 5.5.2. Canada 5.5.2.1. Canada Membrane Filtration Market Size and Forecast, By Type (2024-2032) 5.5.2.1.1. Reverse Osmosis (RO) 5.5.2.1.2. Ultrafiltration (UF) 5.5.2.1.3. Microfiltration (MF) 5.5.2.1.4. Nanofiltration (NF) 5.5.2.2. Canada Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 5.5.2.2.1. Spiral Wounds 5.5.2.2.2. Tubular Systems 5.5.2.2.3. Plates & Frames and Hollow Fibers 5.5.2.3. Canada Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 5.5.2.3.1. Polymeric 5.5.2.3.2. Ceramic 5.5.2.4. Canada Membrane Filtration Market Size and Forecast, By Application (2024-2032) 5.5.2.4.1. Water & Wastewater 5.5.2.4.2. Food & Beverages 5.5.2.4.3. Dairy Products 5.5.2.4.4. Drinks & Concentrates 5.5.2.4.5. Wine & Beer 5.5.2.4.6. Others 5.5.3. Mexico 5.5.3.1. Mexico Membrane Filtration Market Size and Forecast, By Type (2024-2032) 5.5.3.1.1. Reverse Osmosis (RO) 5.5.3.1.2. Ultrafiltration (UF) 5.5.3.1.3. Microfiltration (MF) 5.5.3.1.4. Nanofiltration (NF) 5.5.3.2. Mexico Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 5.5.3.2.1. Spiral Wounds 5.5.3.2.2. Tubular Systems 5.5.3.2.3. Plates & Frames and Hollow Fibers 5.5.3.3. Mexico Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 5.5.3.3.1. Polymeric 5.5.3.3.2. Ceramic 5.5.3.4. Mexico Membrane Filtration Market Size and Forecast, By Application (2024-2032) 5.5.3.4.1. Water & Wastewater 5.5.3.4.2. Food & Beverages 5.5.3.4.3. Dairy Products 5.5.3.4.4. Drinks & Concentrates 5.5.3.4.5. Wine & Beer 5.5.3.4.6. Others 6. Europe Membrane Filtration Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Membrane Filtration Market Size and Forecast, By Type (2024-2032) 6.2. Europe Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 6.3. Europe Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 6.4. Europe Membrane Filtration Market Size and Forecast, By Application (2024-2032) 6.5. Europe Membrane Filtration Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Membrane Filtration Market Size and Forecast, By Type (2024-2032) 6.5.1.2. United Kingdom Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 6.5.1.3. United Kingdom Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 6.5.1.4. United Kingdom Membrane Filtration Market Size and Forecast, By Application (2024-2032) 6.5.2. France 6.5.2.1. France Membrane Filtration Market Size and Forecast, By Type (2024-2032) 6.5.2.2. France Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 6.5.2.3. France Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 6.5.2.4. France Membrane Filtration Market Size and Forecast, By Application (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Membrane Filtration Market Size and Forecast, By Type (2024-2032) 6.5.3.2. Germany Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 6.5.3.3. Germany Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 6.5.3.4. Germany Membrane Filtration Market Size and Forecast, By Application (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Membrane Filtration Market Size and Forecast, By Type (2024-2032) 6.5.4.2. Italy Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 6.5.4.3. Italy Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 6.5.4.4. Italy Membrane Filtration Market Size and Forecast, By Application (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Membrane Filtration Market Size and Forecast, By Type (2024-2032) 6.5.5.2. Spain Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 6.5.5.3. Spain Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 6.5.5.4. Spain Membrane Filtration Market Size and Forecast, By Application (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Membrane Filtration Market Size and Forecast, By Type (2024-2032) 6.5.6.2. Sweden Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 6.5.6.3. Sweden Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 6.5.6.4. Sweden Membrane Filtration Market Size and Forecast, By Application (2024-2032) 6.5.7. Russia 6.5.7.1. Russia Membrane Filtration Market Size and Forecast, By Type (2024-2032) 6.5.7.2. Russia Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 6.5.7.3. Russia Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 6.5.7.4. Russia Membrane Filtration Market Size and Forecast, By Application (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Membrane Filtration Market Size and Forecast, By Type (2024-2032) 6.5.8.2. Rest of Europe Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 6.5.8.3. Rest of Europe Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 6.5.8.4. Rest of Europe Membrane Filtration Market Size and Forecast, By Application (2024-2032) 7. Asia Pacific Membrane Filtration Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Membrane Filtration Market Size and Forecast, By Type (2024-2032) 7.2. Asia Pacific Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 7.3. Asia Pacific Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 7.4. Asia Pacific Membrane Filtration Market Size and Forecast, By Application (2024-2032) 7.5. Asia Pacific Membrane Filtration Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Membrane Filtration Market Size and Forecast, By Type (2024-2032) 7.5.1.2. China Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 7.5.1.3. China Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 7.5.1.4. China Membrane Filtration Market Size and Forecast, By Application (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Membrane Filtration Market Size and Forecast, By Type (2024-2032) 7.5.2.2. S Korea Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 7.5.2.3. S Korea Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 7.5.2.4. S Korea Membrane Filtration Market Size and Forecast, By Application (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Membrane Filtration Market Size and Forecast, By Type (2024-2032) 7.5.3.2. Japan Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 7.5.3.3. Japan Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 7.5.3.4. Japan Membrane Filtration Market Size and Forecast, By Application (2024-2032) 7.5.4. India 7.5.4.1. India Membrane Filtration Market Size and Forecast, By Type (2024-2032) 7.5.4.2. India Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 7.5.4.3. India Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 7.5.4.4. India Membrane Filtration Market Size and Forecast, By Application (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Membrane Filtration Market Size and Forecast, By Type (2024-2032) 7.5.5.2. Australia Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 7.5.5.3. Australia Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 7.5.5.4. Australia Membrane Filtration Market Size and Forecast, By Application (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Membrane Filtration Market Size and Forecast, By Type (2024-2032) 7.5.6.2. Indonesia Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 7.5.6.3. Indonesia Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 7.5.6.4. Indonesia Membrane Filtration Market Size and Forecast, By Application (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Membrane Filtration Market Size and Forecast, By Type (2024-2032) 7.5.7.2. Malaysia Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 7.5.7.3. Malaysia Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 7.5.7.4. Malaysia Membrane Filtration Market Size and Forecast, By Application (2024-2032) 7.5.8. Philippines 7.5.8.1. Philippines Membrane Filtration Market Size and Forecast, By Type (2024-2032) 7.5.8.2. Philippines Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 7.5.8.3. Philippines Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 7.5.8.4. Philippines Membrane Filtration Market Size and Forecast, By Application (2024-2032) 7.5.9. Thailand 7.5.9.1. Thailand Membrane Filtration Market Size and Forecast, By Type (2024-2032) 7.5.9.2. Thailand Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 7.5.9.3. Thailand Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 7.5.9.4. Thailand Membrane Filtration Market Size and Forecast, By Application (2024-2032) 7.5.10. Vietnam 7.5.10.1. Vietnam Membrane Filtration Market Size and Forecast, By Type (2024-2032) 7.5.10.2. Vietnam Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 7.5.10.3. Vietnam Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 7.5.10.4. Vietnam Membrane Filtration Market Size and Forecast, By Application (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Membrane Filtration Market Size and Forecast, By Type (2024-2032) 7.5.11.2. Rest of Asia Pacific Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 7.5.11.3. Rest of Asia Pacific Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 7.5.11.4. Rest of Asia Pacific Membrane Filtration Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Membrane Filtration Market Size and Forecast (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Membrane Filtration Market Size and Forecast, By Type (2024-2032) 8.2. Middle East and Africa Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 8.3. Middle East and Africa Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 8.4. Middle East and Africa Membrane Filtration Market Size and Forecast, By Application (2024-2032) 8.5. Middle East and Africa Membrane Filtration Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Membrane Filtration Market Size and Forecast, By Type (2024-2032) 8.5.1.2. South Africa Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 8.5.1.3. South Africa Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 8.5.1.4. South Africa Membrane Filtration Market Size and Forecast, By Application (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Membrane Filtration Market Size and Forecast, By Type (2024-2032) 8.5.2.2. GCC Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 8.5.2.3. GCC Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 8.5.2.4. GCC Membrane Filtration Market Size and Forecast, By Application (2024-2032) 8.5.3. Egypt 8.5.3.1. Egypt Membrane Filtration Market Size and Forecast, By Type (2024-2032) 8.5.3.2. Egypt Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 8.5.3.3. Egypt Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 8.5.3.4. Egypt Membrane Filtration Market Size and Forecast, By Application (2024-2032) 8.5.4. Nigeria 8.5.4.1. Nigeria Membrane Filtration Market Size and Forecast, By Type (2024-2032) 8.5.4.2. Nigeria Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 8.5.4.3. Nigeria Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 8.5.4.4. Nigeria Membrane Filtration Market Size and Forecast, By Application (2024-2032) 8.5.5. Rest of ME&A 8.5.5.1. Rest of ME&A Membrane Filtration Market Size and Forecast, By Type (2024-2032) 8.5.5.2. Rest of ME&A Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 8.5.5.3. Rest of ME&A Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 8.5.5.4. Rest of ME&A Membrane Filtration Market Size and Forecast, By Application (2024-2032) 9. South America Membrane Filtration Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Membrane Filtration Market Size and Forecast, By Type (2024-2032) 9.2. South America Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 9.3. South America Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 9.4. South America Membrane Filtration Market Size and Forecast, By Application (2024-2032) 9.5. South America Membrane Filtration Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Membrane Filtration Market Size and Forecast, By Type (2024-2032) 9.5.1.2. Brazil Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 9.5.1.3. Brazil Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 9.5.1.4. Brazil Membrane Filtration Market Size and Forecast, By Application (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Membrane Filtration Market Size and Forecast, By Type (2024-2032) 9.5.2.2. Argentina Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 9.5.2.3. Argentina Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 9.5.2.4. Argentina Membrane Filtration Market Size and Forecast, By Application (2024-2032) 9.5.3. Colombia 9.5.3.1. Colombia Membrane Filtration Market Size and Forecast, By Type (2024-2032) 9.5.3.2. Colombia Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 9.5.3.3. Colombia Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 9.5.3.4. Colombia Membrane Filtration Market Size and Forecast, By Application (2024-2032) 9.5.4. Chile 9.5.4.1. Chile Membrane Filtration Market Size and Forecast, By Type (2024-2032) 9.5.4.2. Chile Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 9.5.4.3. Chile Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 9.5.4.4. Chile Membrane Filtration Market Size and Forecast, By Application (2024-2032) 9.5.5. Rest of South America 9.5.5.1. Rest of South America Membrane Filtration Market Size and Forecast, By Type (2024-2032) 9.5.5.2. Rest of South America Membrane Filtration Market Size and Forecast, By Module Design (2024-2032) 9.5.5.3. Rest of South America Membrane Filtration Market Size and Forecast, By Membrane Material (2024-2032) 9.5.5.4. Rest of South America Membrane Filtration Market Size and Forecast, By Application (2024-2032) 10. Company Profile: Key Players 10.1. DuPont Water Solutions (U.S.) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Kovalus Separation Solutions (U.S.) 10.3. Evoqua Water Technologies (U.S.) 10.4. Pall Corporation (U.S.) 10.5. 3M Company (U.S.) 10.6. Pentair plc (U.S.) 10.7. Donaldson Company (U.S.) 10.8. SPX Flow Inc. (U.S.) 10.9. Applied Membranes Inc. (U.S.) 10.10. Alfa Laval AB (Sweden) 10.11. GEA Group AG (Germany) 10.12. MANN+HUMMEL (Germany) 10.13. Porvair Filtration Group (UK) 10.14. SUEZ Water Technologies & Solutions (France) 10.15. ProMinent GmbH (Germany) 10.16. Imemflo Filtration Pvt Ltd (Germany) 10.17. Aquarion AG (Switzerland) 10.18. Envirochemie GmbH (Germany) 10.19. Sefar Holding AG (Switzerland) 10.20. Veolia Water Technologies & Solutions (France) 10.21. Asahi Kasei Corporation (Japan) 10.22. Nitto Denko (Hydranautics) (Japan) 10.23. Toray Industries, Inc. (Japan) 10.24. Mitsubishi Chemical Group (Japan) 10.25. CITIC Envirotech (China) 10.26. Litree Purifying Technology Co Ltd (China) 10.27. Origin Water (China) 10.28. Tianjin MOTIMO (China) 11. Key Findings 12. Industry Recommendations 13. Membrane Filtration Market: Research Methodology