The Global Lecithin Market size was valued at USD 636.35 Mn in 2023 and is expected to reach USD 1076.54 Mn by 2030, at a CAGR of 7.8 %.Lecithin Market Overview:

Lecithin is a naturally occurring fatty substance that belongs to the class of compounds known as phospholipids. It is found in various biological organisms, including plants and animals, and plays a crucial role in cell structure and function. Lecithin is known for its emulsifying properties, which allow it to mix and stabilize substances that do not typically blend well, such as water and oil. This characteristic makes lecithin a common ingredient in various food and industrial applications. Additionally, lecithin has dietary and health-related uses, including its role in providing a source of choline, a nutrient important for brain health and other bodily functions. The graphical representation and structural exclusive information showed the dominating region of the Global Lecithin Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Global Lecithin Market.To know about the Research Methodology :- Request Free Sample Report

Lecithin Market Dynamics

Growing Health Consciousness and Expanding Pharmaceutical Applications Is a Key Driving Factor in Lecithin Market The increased focus on health and wellness has sparked greater consumer demand for natural and functional ingredients in food products. Lecithin, prized as a natural emulsifier and a source of essential nutrients, aligns with health-conscious consumers' preferences. Its integration into healthier food options has become a pivotal driver for the market. Lecithin's emulsifying properties have led to widespread adoption in the food and beverage industry. Lecithin's versatility extends into the pharmaceutical sector, particularly as an excipient in various formulations, especially in drug delivery systems. The continuous advancement in medicines and drug delivery technologies presents growth opportunities, as lecithin contributes to enhancing drug efficacy and patient adherence. The cosmetic and personal care industry has embraced lecithin for its natural attributes and skin-friendly properties. Lecithin's desirability as an ingredient in cosmetics and personal care products has bolstered its presence in this sector, contributing to market expansion. Lecithin's role as a feed ingredient has gained prominence, particularly in the livestock and aquaculture industries. Rising Trend of Non-GMO and Organic Lecithin and Functional Food and Nutraceutical are potential opportunities in the Lecithin Market The expanding market for functional foods and nutraceutical presents an evolving opportunity for lecithin. Its potential applications in products aimed at promoting health and well-being can significantly enhance the nutritional value and functionality of such items, aligning with the changing consumer landscape. Emerging economies are witnessing a surge in demand for processed foods, pharmaceuticals, and cosmetics. The substantial potential for market penetration in these regions offers growth prospects for lecithin manufacturers and suppliers, as they tap into the expanding consumer base. Lecithin allergies can constrain its application in certain food and pharmaceutical products. This necessitates allergen labeling and the exploration of alternative ingredients to accommodate individuals with sensitivities, potentially affecting product formulations and market growth. The market is vulnerable to fluctuations in the prices of raw materials, particularly soybeans, a prevalent source of lecithin. Variability in raw material costs can impact product pricing and profitability, demanding adaptability from manufacturers in response to changing economic conditions. Evolving regulations and quality standards in various regions introduce challenges for lecithin manufacturers. Adherence to diverse regulatory requirements and quality standards is imperative for ensuring market access and consumer safety, adding complexity to market operations. Lecithin contends with competition from alternative emulsifiers and food additives. The availability of substitute products can influence demand for lecithin across different applications. To thrive in such a competitive landscape, manufacturers must effectively differentiate their offerings. Emerging environmental concerns, particularly related to soy-based lecithin, encompass sustainability issues. These concerns may impact consumer preferences and market dynamics, as consumers increasingly seek products with reduced environmental impact and ethically sourced ingredients.

Lecithin Market Segment Analysis

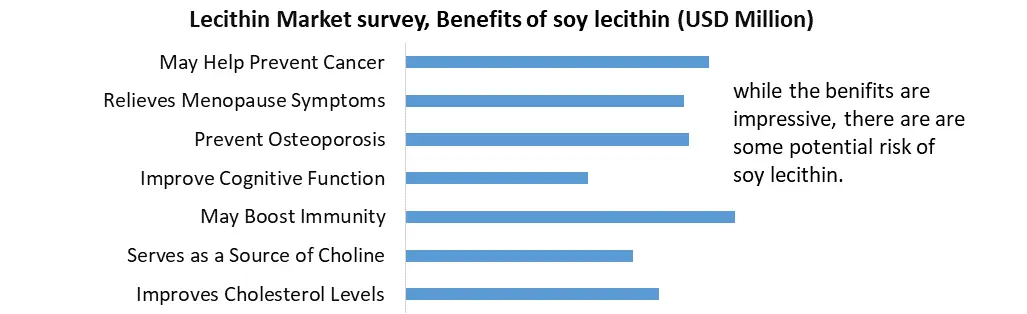

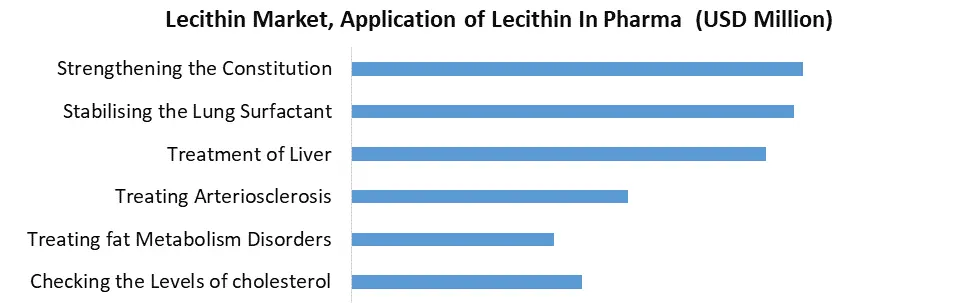

The soy segment predominantly governs the lecithin market due to its widespread utilization as a prominent food additive. Soy lecithin is highly favored and extensively available in both mainstream and specialty food stores. This versatile ingredient is commonly integrated into foods and is also accessible as a dietary supplement for improving health. Sunflower lecithin is favored for its allergen-free nature, non-genetically modified (GMO) status, and plant-based origin. These attributes make it a straightforward substitute for other lecithin types like those derived from animals or genetically modified soy. The pharmaceutical (pharma) lecithin market is anticipated to dominate and secure the largest market share by 2030. The pharmaceutical, food, and cosmetic sectors all embrace lecithin for its emulsifying properties. Lecithin finds potential application in the treatment of hypercholesterolemia, neurological disorders, manic conditions, and liver-related ailments. It has also been employed to modulate the immune system by stimulating both specialized and general defence mechanisms. Among the various application segments, the food and beverage sector holds the largest market share during the forecast period. Lecithin is in high demand wherever its emulsifying and solubilizing characteristics offer advantages. It finds applications in an array of food products, with significant usage in the production of baked goods, confectionery, and instant foods. In the bakery industry, emulsifiers play a pivotal role. Lecithin, with its exceptional properties, can effectively replace synthetic emulsifiers. It brings numerous advantages to baked goods, including improved volume yield, enhanced freshness, better dough properties, optimized fat distribution, and increased fermentation tolerance, all of which contribute to improved product quality and economic efficiency. Lecithin can be highly used in food production due to its properties and food texture, harmless to health, and health-promoting properties are driving the lecithin market growth. Lecithin is used wherever the emulsifying and dissolving properties of the substance offer advantages. Products that benefit most from it are, for instance, baked goods, confectionery, and instant products.By Grad, Pharma lecithin market is expected to hold the largest market share by 2030. The food, drug, and cosmetic sectors all use lecithin for its emulsifying abilities. The treatment of hypercholesterolemia, neurological problems, manic disorders, and liver conditions are among the proposed pharmacological uses of lecithin. By triggering both specialized and general defense systems, it has also been utilized to alter the immune system. To support the use of lecithin for these purposes, however, there are no reliable clinical investigations. In addition to assisting in the maintenance of a healthy heart and cardiovascular system, lecithin offers prevention against arteriosclerosis and cardiac diseases. The nutrients in lecithin and its constituent parts assist brain health. They increase productivity and memory, fight dementia and depression, and shield brain cells from deterioration. Lecithin metabolizes obstructing fat in the liver and lowers the risk of liver deterioration. Lecithin aids in the absorption of nutrients in the intestines of vitamins A and D.

Lecithin Market Regional Analysis

North America is expected to be the fastest growing region in the global lecithin markets, due to the Increasing demand for cosmetics, Supplements and the rising disposable income of regional people is estimated to fuel the growth of the regional market, which is expected to also be added by higher demand for hair care and skincare goods. These cosmetics are used for skin care because they are soothes and soften a variety of skin types. Lecithin are organized in many ways such as Lecithin in Cosmetics, Lecithin Supplements, Organic Lecithin, Lecithin in Pharmaceuticals, and Lecithin as a Nutritional Supplement, Lecithin Granules, and Catheter Materials. Because of its remarkable moisturizing qualities, which keep the skin hydrated and nourished, it is utilized in reparative creams. The main benefits are that it repairs damaged hair and aids in straightening operations, which support the expansion of the local market. Furthermore, the United States is one of the biggest producers as well as consumers of processed foods in the world, which is increasing the demand for lecithin in the region. The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Archer Daniels Midland Company, Bunge Limited, DuPont de Nemours, Inc., Wilmar International Limited, Kewpie Corporation, IMCD N.V., Avril Group, Lipoid GmbH, Stern-Wywiol Gruppe GmbH & Co. KG, and Cargill Corporation. The objective of the report is to present a comprehensive analysis of the Lecithin market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. The report also helps in understanding the Lecithin market dynamics, structure by analyzing the market segments and project the Lecithin market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Lecithin market make the report investor’s guide.Lecithin Market Competitive Landscape

Bayer and Cargill have forged a strategic partnership with the aim of providing innovative digital solutions to Indian smallholder farmers to enhance their agricultural practices. The fundamental objective of this strategic alliance is to revolutionize farming practices and create opportunities for smallholder farmers to optimize the value of their agricultural produce in the marketplace. To accomplish this, the collaboration leverages innovative platforms, including Cargill's 'Digital Saathi,' a mobile-first, AI-driven service platform meticulously tailored to address localized agricultural needs. Additionally, it capitalizes on Bayer's Better Life Farming Centres, a program designed to support over 500,000 smallholder farmers. Together, these endeavors are focused on enhancing market access for smallholder farmers. To accomplish this, the collaboration leverages innovative platforms, including Cargill's 'Digital Saathi,' a mobile-first, AI-driven service platform meticulously tailored to address localized agricultural needs. Additionally, it capitalizes on Bayer's Better Life Farming Centres, a program designed to support over 500,000 smallholder farmers. Together, these endeavors are focused on enhancing market access for smallholder farmers. A pivotal aspect of this partnership is to equip farmers with digital solutions that empower them to make well-informed decisions. This includes providing access to discussion forums and comprehensive information on vital aspects such as market prices, weather forecasts, and insights spanning the entire spectrum from pre-harvest to post-harvest phases. Bayer's digital strategy encompasses the expansion of customized solutions through the Digital Saathi app, with an initial emphasis on corn farming in Karnataka, and plans to subsequently extend these services to cover various crops and regions. This collaboration transcends the realm of digital solutions and also facilitates farmers' access to Bayer's leading corn portfolio, DEKALB, through the Digital Saathi Platform. This integration enhances farmers' agricultural capabilities and bolsters their position within the market. Cargill's Digital Saathi platform is meticulously designed to offer convenient features such as Crop Input e-commerce and Crop Sell Offers. These features ensure that farmers have seamless access to high-quality crop inputs and promote efficient market linkages between farmers and aggregators through a digitally enabled marketplace. This comprehensive approach is intended to empower farmers to make more informed decisions, streamline their agricultural operations, and foster efficient connections within the agricultural ecosystem. Digital Saathi has already made significant progress in engaging with over 50,000 registered small farmers.Lecithin Market Scope: Inquire before buying

Lecithin Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 636.35 Mn. Forecast Period 2024 to 2030 CAGR: 7.8% Market Size in 2030: US $ 1076.54 Mn. Segments Covered: by Source Soybean Sunflower Seed Egg by Grade Food grade Pharma Grade Feed Grade by Application Food & Beverages Animal Feed Pharmaceuticals Other Application by Form Powder Liquid Granules Lecithin Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Lecithin Market, Key Players are:

1. Cargill, Incorporated. (US) 2.Archer-Daniels-Midland Company (US) 3. Bunge Limited (US) 4.American Lecithin Company (US) 5.Global River Food Ingredients Inc. (US) 6.NOW Foods (US) 7.Soya International (US) 8. Clarkson Grain Company, Inc (US) 9.Austrade Inc (US) 10. GIIAVA (India) 11.Haneil Soyatech Pvt. Ltd. (India) 12. Sun Nutrafoods (India) 13.Orison Chemicals Limited (China) 14.Wilmar International Ltd. (Singapore) 15.Thew Arnott & Co. Ltd. (UK) 16.Lipoid GmbH (Germany) 17. LECICO GmbH (Germany) 18.Novastell Essential Ingredients (france) 19.Sime Darby Unimills B.V. (Netherland) 20.Lecital OG (Switzerland) 21.Lasenor EMUL., S.L. (Brazil) Frequently Asked Questions: 1. What is the forecast period considered for the Lecithin market report? Ans. The forecast period for the Lecithin market is 2024-2030. 2. Which key factors are hindering the growth of the Lecithin market? Ans. Lecithin side effects include swelling, itching, rashes, stomach discomfort, and diarrhoea are some of the main issues limiting the growth of the lecithin industry. 3. What is the compound annual growth rate (CAGR) of the Lecithin market for the forecast period? Ans. 7.8% CAGR is the annual growth rate of the lecithin market. 4. What are the key factors driving the growth of the Lecithin market? Ans. Health benefits of lecithin driving market. 5. Which are the worldwide major key players covered for the Lecithin market report? Ans. Cargill, Inc., ADM, Lipoid GmbH, Bunge Limited, American Lecithin Company, Global River Food Ingredients, DuPont de Nemours, Inc. are the major key players.

1. Lecithin Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Lecithin Market: Dynamics 2.1. Lecithin Market Trends by Region 2.1.1. Global Lecithin Market Trends 2.1.2. North America Lecithin Market Trends 2.1.3. Europe Lecithin Market Trends 2.1.4. Asia Pacific Lecithin Market Trends 2.1.5. Middle East and Africa Lecithin Market Trends 2.1.6. South America Lecithin Market Trends 2.1.7. Preference Analysis 2.2. Lecithin Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Lecithin Market Drivers 2.2.1.2. North America Lecithin Market Restraints 2.2.1.3. North America Lecithin Market Opportunities 2.2.1.4. North America Lecithin Market Challenges 2.2.2. Europe 2.2.2.1. Europe Lecithin Market Drivers 2.2.2.2. Europe Lecithin Market Restraints 2.2.2.3. Europe Lecithin Market Opportunities 2.2.2.4. Europe Lecithin Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Lecithin Market Drivers 2.2.3.2. Asia Pacific Lecithin Market Restraints 2.2.3.3. Asia Pacific Lecithin Market Opportunities 2.2.3.4. Asia Pacific Lecithin Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Lecithin Market Drivers 2.2.4.2. Middle East and Africa Lecithin Market Restraints 2.2.4.3. Middle East and Africa Lecithin Market Opportunities 2.2.4.4. Middle East and Africa Lecithin Market Challenges 2.2.5. South America 2.2.5.1. South America Lecithin Market Drivers 2.2.5.2. South America Lecithin Market Restraints 2.2.5.3. South America Lecithin Market Opportunities 2.2.5.4. South America Lecithin Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Key Opinion Leader Analysis For Lecithin Industry 2.9. Analysis of Government Schemes and Initiatives For Lecithin Industry 2.10. The Global Pandemic Impact on Lecithin Market 2.11. Lecithin Price Trend Analysis (2023-30) 2.12. Global Lecithin Market Trade Analysis (2023-2030) 2.12.1. Global Import of Lecithin 2.12.1.1. Ten Largest Importer 2.12.2. Global Export of Lecithin 2.12.3. Ten Largest Exporter 2.13. Product Type Capacity Analysis 2.13.1. Chapter Overview 2.13.2. Key Assumptions and Methodology 2.13.3. Lecithin Manufacturers: Global Installed Capacity 3. Lecithin Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2023-2030) 3.1. Lecithin Market Size and Forecast, by Source (2023-2030) 3.1.1. Soybean 3.1.2. Sunflower Seed 3.1.3. Egg 3.2. Lecithin Market Size and Forecast, by Grade (2023-2030) 3.2.1. Food grade 3.2.2. Pharma Grade 3.2.3. Feed Grade 3.3. Lecithin Market Size and Forecast, by Application (2023-2030) 3.3.1. Food & Beverages 3.3.2. Animal Feed 3.3.3. Pharmaceuticals 3.3.4. Other Application 3.4. Lecithin Market Size and Forecast, by Form (2023-2030) 3.4.1. Powder 3.4.2. Liquid 3.4.3. Granules 3.5. Lecithin Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Lecithin Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 4.1. North America Lecithin Market Size and Forecast, by Source (2023-2030) 4.1.1. Soybean 4.1.2. Sunflower Seed 4.1.3. Egg 4.2. North America Lecithin Market Size and Forecast, by Grade (2023-2030) 4.2.1. Food grade 4.2.2. Pharma Grade 4.2.3. Feed Grade 4.3. North America Lecithin Market Size and Forecast, by Application (2023-2030) 4.3.1. Food & Beverages 4.3.2. Animal Feed 4.3.3. Pharmaceuticals 4.3.4. Other Application 4.4. North America Lecithin Market Size and Forecast, by Form (2023-2030) 4.4.1. Powder 4.4.2. Liquid 4.4.3. Granules 4.5. North America Lecithin Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Lecithin Market Size and Forecast, by Source (2023-2030) 4.5.1.1.1. Soybean 4.5.1.1.2. Sunflower Seed 4.5.1.1.3. Egg 4.5.1.2. United States Lecithin Market Size and Forecast, by Grade (2023-2030) 4.5.1.2.1. Food grade 4.5.1.2.2. Pharma Grade 4.5.1.2.3. Feed Grade 4.5.1.3. United States Lecithin Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Food & Beverages 4.5.1.3.2. Animal Feed 4.5.1.3.3. Pharmaceuticals 4.5.1.3.4. Other Application 4.5.1.4. United States Lecithin Market Size and Forecast, by Form (2023-2030) 4.5.1.4.1. Powder 4.5.1.4.2. Liquid 4.5.1.4.3. Granules 4.5.1.5. Canada Lecithin Market Size and Forecast, by Source (2023-2030) 4.5.1.5.1. Soybean 4.5.1.5.2. Sunflower Seed 4.5.1.5.3. Egg 4.5.1.6. Canada Lecithin Market Size and Forecast, by Grade (2023-2030) 4.5.1.6.1. Food grade 4.5.1.6.2. Pharma Grade 4.5.1.6.3. Feed Grade 4.5.1.7. Canada Lecithin Market Size and Forecast, by Application (2023-2030) 4.5.1.7.1. Food & Beverages 4.5.1.7.2. Animal Feed 4.5.1.7.3. Pharmaceuticals 4.5.1.7.4. Other Application 4.5.1.8. Canada Lecithin Market Size and Forecast, by Form (2023-2030) 4.5.1.8.1. Powder 4.5.1.8.2. Liquid 4.5.1.8.3. Granules 4.5.2. Mexico 4.5.2.1. Mexico Lecithin Market Size and Forecast, by Source (2023-2030) 4.5.2.1.1. Soybean 4.5.2.1.2. Sunflower Seed 4.5.2.1.3. Egg 4.5.2.2. Mexico Lecithin Market Size and Forecast, by Grade (2023-2030) 4.5.2.2.1. Food grade 4.5.2.2.2. Pharma Grade 4.5.2.2.3. Feed Grade 4.5.2.3. Mexico Lecithin Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Food & Beverages 4.5.2.3.2. Animal Feed 4.5.2.3.3. Pharmaceuticals 4.5.2.3.4. Other Application 4.5.2.4. Mexico Lecithin Market Size and Forecast, by Form (2023-2030) 4.5.2.4.1. Powder 4.5.2.4.2. Liquid 4.5.2.4.3. Granules 5. Europe Lecithin Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. Europe Lecithin Market Size and Forecast, by Source (2023-2030) 5.2. Europe Lecithin Market Size and Forecast, by Grade (2023-2030) 5.3. Europe Lecithin Market Size and Forecast, by Application (2023-2030) 5.4. Europe Lecithin Market Size and Forecast, by Form(2023-2030) 5.5. Europe Lecithin Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Lecithin Market Size and Forecast, by Source (2023-2030) 5.5.1.2. United Kingdom Lecithin Market Size and Forecast, by Grade (2023-2030) 5.5.1.3. United Kingdom Lecithin Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Lecithin Market Size and Forecast, by Form(2023-2030) 5.5.2. France 5.5.2.1. France Lecithin Market Size and Forecast, by Source (2023-2030) 5.5.2.2. France Lecithin Market Size and Forecast, by Grade (2023-2030) 5.5.2.3. France Lecithin Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Lecithin Market Size and Forecast, by Form(2023-2030) 5.5.3. Germany 5.5.3.1. Germany Lecithin Market Size and Forecast, by Source (2023-2030) 5.5.3.2. Germany Lecithin Market Size and Forecast, by Grade (2023-2030) 5.5.3.3. Germany Lecithin Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Lecithin Market Size and Forecast, by Form(2023-2030) 5.5.4. Italy 5.5.4.1. Italy Lecithin Market Size and Forecast, by Source (2023-2030) 5.5.4.2. Italy Lecithin Market Size and Forecast, by Grade (2023-2030) 5.5.4.3. Italy Lecithin Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Lecithin Market Size and Forecast, by Form(2023-2030) 5.5.5. Spain 5.5.5.1. Spain Lecithin Market Size and Forecast, by Source (2023-2030) 5.5.5.2. Spain Lecithin Market Size and Forecast, by Grade (2023-2030) 5.5.5.3. Spain Lecithin Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Lecithin Market Size and Forecast, by Form(2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Lecithin Market Size and Forecast, by Source (2023-2030) 5.5.6.2. Sweden Lecithin Market Size and Forecast, by Grade (2023-2030) 5.5.6.3. Sweden Lecithin Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Lecithin Market Size and Forecast, by Form(2023-2030) 5.5.7. Austria 5.5.7.1. Austria Lecithin Market Size and Forecast, by Source (2023-2030) 5.5.7.2. Austria Lecithin Market Size and Forecast, by Grade (2023-2030) 5.5.7.3. Austria Lecithin Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Lecithin Market Size and Forecast, by Form(2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Lecithin Market Size and Forecast, by Source (2023-2030) 5.5.8.2. Rest of Europe Lecithin Market Size and Forecast, by Grade (2023-2030) 5.5.8.3. Rest of Europe Lecithin Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Lecithin Market Size and Forecast, by Form(2023-2030) 6. Asia Pacific Lecithin Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Lecithin Market Size and Forecast, by Source (2023-2030) 6.2. Asia Pacific Lecithin Market Size and Forecast, by Grade (2023-2030) 6.3. Asia Pacific Lecithin Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Lecithin Market Size and Forecast, by Form(2023-2030) 6.5. Asia Pacific Lecithin Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Lecithin Market Size and Forecast, by Source (2023-2030) 6.5.1.2. China Lecithin Market Size and Forecast, by Grade (2023-2030) 6.5.1.3. China Lecithin Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Lecithin Market Size and Forecast, by Form(2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Lecithin Market Size and Forecast, by Source (2023-2030) 6.5.2.2. S Korea Lecithin Market Size and Forecast, by Grade (2023-2030) 6.5.2.3. S Korea Lecithin Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Lecithin Market Size and Forecast, by Form(2023-2030) 6.5.3. Japan 6.5.3.1. Japan Lecithin Market Size and Forecast, by Source (2023-2030) 6.5.3.2. Japan Lecithin Market Size and Forecast, by Grade (2023-2030) 6.5.3.3. Japan Lecithin Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Lecithin Market Size and Forecast, by Form(2023-2030) 6.5.4. India 6.5.4.1. India Lecithin Market Size and Forecast, by Source (2023-2030) 6.5.4.2. India Lecithin Market Size and Forecast, by Grade (2023-2030) 6.5.4.3. India Lecithin Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Lecithin Market Size and Forecast, by Form(2023-2030) 6.5.5. Australia 6.5.5.1. Australia Lecithin Market Size and Forecast, by Source (2023-2030) 6.5.5.2. Australia Lecithin Market Size and Forecast, by Grade (2023-2030) 6.5.5.3. Australia Lecithin Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Lecithin Market Size and Forecast, by Form(2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Lecithin Market Size and Forecast, by Source (2023-2030) 6.5.6.2. Indonesia Lecithin Market Size and Forecast, by Grade (2023-2030) 6.5.6.3. Indonesia Lecithin Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Lecithin Market Size and Forecast, by Form(2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Lecithin Market Size and Forecast, by Source (2023-2030) 6.5.7.2. Malaysia Lecithin Market Size and Forecast, by Grade (2023-2030) 6.5.7.3. Malaysia Lecithin Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Lecithin Market Size and Forecast, by Form(2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Lecithin Market Size and Forecast, by Source (2023-2030) 6.5.8.2. Vietnam Lecithin Market Size and Forecast, by Grade (2023-2030) 6.5.8.3. Vietnam Lecithin Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Lecithin Market Size and Forecast, by Form(2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Lecithin Market Size and Forecast, by Source (2023-2030) 6.5.9.2. Taiwan Lecithin Market Size and Forecast, by Grade (2023-2030) 6.5.9.3. Taiwan Lecithin Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Lecithin Market Size and Forecast, by Form(2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Lecithin Market Size and Forecast, by Source (2023-2030) 6.5.10.2. Rest of Asia Pacific Lecithin Market Size and Forecast, by Grade (2023-2030) 6.5.10.3. Rest of Asia Pacific Lecithin Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Lecithin Market Size and Forecast, by Form(2023-2030) 7. Middle East and Africa Lecithin Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa Lecithin Market Size and Forecast, by Source (2023-2030) 7.2. Middle East and Africa Lecithin Market Size and Forecast, by Grade (2023-2030) 7.3. Middle East and Africa Lecithin Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Lecithin Market Size and Forecast, by Form(2023-2030) 7.5. Middle East and Africa Lecithin Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Lecithin Market Size and Forecast, by Source (2023-2030) 7.5.1.2. South Africa Lecithin Market Size and Forecast, by Grade (2023-2030) 7.5.1.3. South Africa Lecithin Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Lecithin Market Size and Forecast, by Form(2023-2030) 7.5.2. GCC 7.5.2.1. GCC Lecithin Market Size and Forecast, by Source (2023-2030) 7.5.2.2. GCC Lecithin Market Size and Forecast, by Grade (2023-2030) 7.5.2.3. GCC Lecithin Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Lecithin Market Size and Forecast, by Form(2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Lecithin Market Size and Forecast, by Source (2023-2030) 7.5.3.2. Nigeria Lecithin Market Size and Forecast, by Grade (2023-2030) 7.5.3.3. Nigeria Lecithin Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Lecithin Market Size and Forecast, by Form(2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Lecithin Market Size and Forecast, by Source (2023-2030) 7.5.4.2. Rest of ME&A Lecithin Market Size and Forecast, by Grade (2023-2030) 7.5.4.3. Rest of ME&A Lecithin Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Lecithin Market Size and Forecast, by Form(2023-2030) 8. South America Lecithin Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 8.1. South America Lecithin Market Size and Forecast, by Source (2023-2030) 8.2. South America Lecithin Market Size and Forecast, by Grade (2023-2030) 8.3. South America Lecithin Market Size and Forecast, by Application (2023-2030) 8.4. South America Lecithin Market Size and Forecast, by Form(2023-2030) 8.5. South America Lecithin Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Lecithin Market Size and Forecast, by Source (2023-2030) 8.5.1.2. Brazil Lecithin Market Size and Forecast, by Grade (2023-2030) 8.5.1.3. Brazil Lecithin Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Lecithin Market Size and Forecast, by Form(2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Lecithin Market Size and Forecast, by Source (2023-2030) 8.5.2.2. Argentina Lecithin Market Size and Forecast, by Grade (2023-2030) 8.5.2.3. Argentina Lecithin Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Lecithin Market Size and Forecast, by Form(2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Lecithin Market Size and Forecast, by Source (2023-2030) 8.5.3.2. Rest Of South America Lecithin Market Size and Forecast, by Grade (2023-2030) 8.5.3.3. Rest Of South America Lecithin Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Lecithin Market Size and Forecast, by Form(2023-2030) 9. Global Lecithin Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. Production Capacity 9.3.8. Production for 2023 9.3.9. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Lecithin Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Cargill, Incorporated. (US) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Archer-Daniels-Midland Company (US) 10.3. Bunge Limited (US) 10.4. American Lecithin Company (US) 10.5. Global River Food Ingredients Inc. (US) 10.6. NOW Foods (US) 10.7. Soya International (US) 10.8. Clarkson Grain Company, Inc (US) 10.9. Austrade Inc (US) 10.10. GIIAVA (India) 10.11. Haneil Soyatech Pvt. Ltd. (India) 10.12. Sun Nutrafoods (India) 10.13. Orison Chemicals Limited (China) 10.14. Wilmar International Ltd. (Singapore) 10.15. Thew Arnott & Co. Ltd. (UK) 10.16. Lipoid GmbH (Germany) 10.17. LECICO GmbH (Germany) 10.18. Novastell Essential Ingredients (france) 10.19. Sime Darby Unimills B.V. (Netherland) 10.20. Lecital OG (Switzerland) 10.21. Lasenor EMUL., S.L. (Brazil) 11. Key Findings 12. Industry Recommendations 13. Lecithin Market: Research Methodology 14. Terms and Glossary