The Kombucha Market size was valued at US 3.50 Bn in 2023 and market revenue is growing at a CAGR of 15.3 % from 2023 to 2030, reaching nearly USD 9.48 Bn by 2030.Kombucha Market Overview:

Kombucha is a fermented functional beverage, that has experienced a meteoric rise in popularity, evolving from a niche health elixir to a mainstream staple in the American beverage market by the early 21st century. This fermented functional beverage, revered for its purported health benefits, has sparked a flurry of commercial activity, with an increasing number of companies vying for a slice of the lucrative Kombucha Market.To know about the Research Methodology :- Request Free Sample Report The growing awareness of the health benefits associated with consuming probiotics. Probiotics, known for their positive effects on gut health and immunity, have gained widespread recognition among consumers seeking functional beverages. Kombucha, with its natural fermentation process, is perceived as a convenient and tasty way to incorporate probiotics into one's diet, boosting the popularity of kombucha. Increasing focus on natural and organic products has driven the demand for Kombucha. Consumers are gravitating towards beverages made from wholesome, natural ingredients, free from artificial additives and preservatives. Kombucha, typically made from tea, sugar, water, and a symbiotic culture of bacteria and yeast (SCOBY), aligns with this preference for clean-label products, driving its Kombucha market growth.

Kombucha Market Dynamics

Driver Health and Wellness Trend Boost the Kombucha Market Growth Increasing emphasis on health and wellness among consumers. As people become more health-conscious and seek out natural alternatives to sugary beverages, kombucha emerges as a popular choice due to its perceived health benefits. Kombucha is lauded for its probiotic properties, which are believed to support gut health and immunity. It is low in calories and sugar compared to many other carbonated drinks, making it appealing to those looking to maintain a healthy lifestyle and manage their weight. The rise of wellness culture and the growing interest in holistic approaches to health have boosted the demand for functional beverages such as kombucha. Consumers are increasingly seeking products that quench their thirst and provide tangible health benefits. Kombucha's association with traditional medicine and its inclusion of ingredients like tea, which is rich in antioxidants, which aligns it with the wellness trend. Also, manufacturers are innovating to cater to this demand, introducing new flavors, variations, and packaging formats to appeal to health-conscious consumers. The health and wellness driver continues to boost the growth of the kombucha market, positioning it as a staple in the beverage industry for consumers seeking both refreshment and functional benefits. Regulatory Challenges limits the Kombucha Market Growth The kombucha market faces regulatory challenges that hinder its full potential. One significant restraint is the ambiguity surrounding the classification and regulation of kombucha by health authorities. Kombucha's fermentation process produces trace amounts of alcohol, which vary depending on factors such as brewing time and conditions. This has led to uncertainty and inconsistency in how kombucha products are regulated, with some jurisdictions treating them as non-alcoholic beverages while others classify them as alcoholic beverages, subjecting them to stricter regulations and taxation. The lack of standardized regulations creates confusion for manufacturers and poses challenges for distribution and marketing efforts. The concerns about food safety and quality control in the production of kombucha have prompted regulatory bodies to impose stringent requirements, complicating compliance for producers. Navigating this regulatory landscape adds complexity and costs to operating in the Kombucha Market, particularly for small and medium-sized businesses. Until clear and consistent regulations are established, the uncertainty surrounding the regulatory environment remains a significant restraint on the growth of the kombucha market. Diversification And Innovation Creates Lucrative Growth Opportunities for The Kombucha Market Growth While traditional kombucha made from fermented tea remains popular, there is ample room for growth by introducing new flavors, formulations, and product lines to provide to diverse consumer preferences. The development of flavored kombucha variants, leveraging a wide array of fruits, herbs, and spices to create unique taste profiles that appeal to different palates. By offering a variety of flavors such as mango, ginger, and berry, kombucha brands attract a broader audience and encourage repeat purchases from existing customers seeking novelty and variety. Also, there is potential for kombucha to be incorporated into other food and beverage categories, such as cocktails, mocktails, and functional foods. By partnering with mixologists, chefs, and food scientists, kombucha manufacturers explore creative applications and collaborations that capitalize on its versatility and health-conscious image. The packaging innovation presents an opportunity for Kombucha market to differentiate kombucha products and enhance convenience for consumers. Formats such as single-serve bottles, cans, or on-the-go pouches provide to different consumption occasions and lifestyles, increasing the market reach of kombucha beyond traditional channels.Kombucha Market Segment Analysis

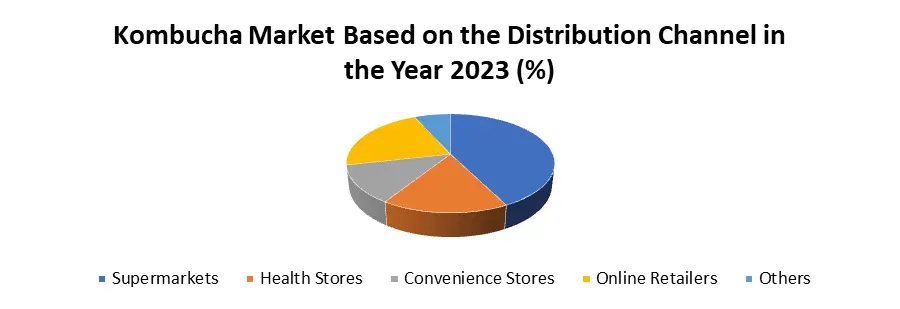

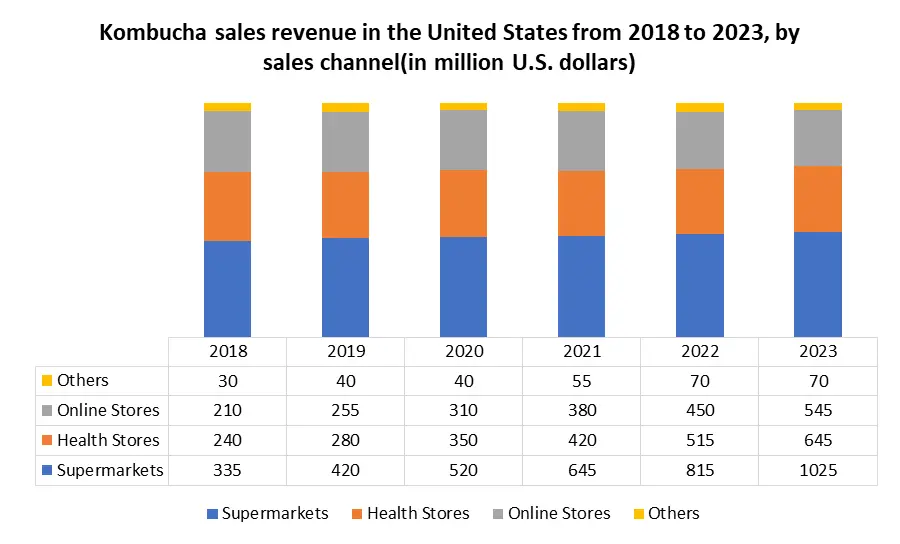

Based on the Distribution Channel, the supermarkets segment dominated the Distribution Channel segment of the Kombucha Market in the year 2023. Supermarkets provide a wide range of products, offering consumers convenience and accessibility. Kombucha brands capitalize on this by ensuring their products are prominently displayed and readily available, increasing visibility and consumer reach. The supermarkets have well-established distribution networks and strong supplier relationships, enabling efficient product distribution across various regions. Supermarkets also often dedicate sections to health and wellness products, where Kombucha fits naturally due to its perceived health benefits. This strategic placement enhances product visibility and attracts health-conscious consumers. The supermarkets frequently run promotional campaigns and offer discounts on Kombucha products, driving sales and reinforcing their dominance in the distribution channel. Overall, the dominance of supermarkets in the Kombucha Market distribution channel is driven by their convenience, extensive reach, strategic positioning, and promotional efforts.

Kombucha Market Regional Analysis:

North America dominated the Kombucha Market in the year 2023. North America's dominance in the Kombucha market stems from factors like the region's growing population of health-conscious consumers, who are increasingly seeking out natural and functional beverages such as Kombucha. This aligns well with Kombucha's image as a probiotic-rich, low-sugar drink with potential health benefits. Also, North America's vibrant culture of innovation and entrepreneurship has spurred the emergence of numerous Kombucha brands. These companies leverage creative marketing strategies, eye-catching packaging, and a wide variety of flavors to appeal to diverse consumer preferences. The well-established distribution networks and retail channels in North America ensure the widespread availability of Kombucha products, making them easily accessible to consumers across different demographics. The rising popularity of vegan and gluten-free diets in the region has further boosted demand for Kombucha, as it is often perceived as a healthier alternative to traditional sugary beverages. North America's combination of health-conscious consumers, innovative brands, efficient distribution channels, and dietary trends has solidified its position as a dominant force in the global Kombucha Market.

Kombucha Market Competitive Analysis:

The Kombucha market is undergoing a significant transformation driven by a combination of innovative product offerings, strategic growth, and shifting consumer preferences toward healthier beverage options. The multiple key players are dominating the Kombucha Market. The Key players mainly focus on innovation collaboration and expansion. Growth Remedy Drinks' development into the UK market with its new Wild Berry flavor, exclusively stocked at Tesco stores, signifies a concerted effort to capture a broader consumer base and increase Kombucha market share. Their plan to introduce additional flavors and expand distribution reflects a proactive approach to meet the growing demand for healthier drink alternatives. The collaboration between Remedy Drinks and RooLife Group Ltd. in China highlights the global appeal of kombucha as consumers worldwide embrace the trend towards healthier lifestyles. This partnership capitalizes on the increasing popularity of "better for you" beverages in China, presenting a lucrative opportunity for market growth and brand expansion. Nova Easy Kombucha's introduction of performance-oriented blends further diversifies the Kombucha market, catering to health-conscious consumers seeking functional beverages. By offering blends such as the 'POWER' kombucha blend with naturally derived caffeine for pre-workout energy and the 'RECOVERY' blend with probiotics for gut health, Nova Easy Kombucha targets specific consumer needs and preferences. These developments underscore the competitive landscape of the Kombucha market, characterized by innovation, expansion, and a focus on meeting evolving consumer demands for healthier, functional beverage options.Kombucha Market Scope: Inquire before buying

Global Kombucha Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.50 Bn. Forecast Period 2024 to 2030 CAGR: 15.3% Market Size in 2030: US $ 9.48 Bn. Segments Covered: by Product Organic Inorganic by Type Natural Flavored by Distribution Channel Supermarkets Health Stores Convenience Stores Online Retailers Others Kombucha Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Kombucha Market Key Players:

North America 1. GT's Kombucha (United States) 2. KeVita Inc. (United States) 3. The Humm Kombucha (United States) 4. Health-Ade Kombucha (United States) 5. Brew Dr. Kombucha (United States) 6. Kombucha Wonder Drink (United States) 7. Reed's Inc. (United States) 8. Búcha Live Kombucha (United States) 9. Hain Celestial (United States) 10. Townshend's Tea Company (United States) 11. Clear Coast Fresh (United States) 12. Flying Embers (United States) 13. Kosmic Kombucha (Canada) 14. Booch Organic Kombucha (Canada) Europe 1. Remedy Drinks (Australia) 2. Lo Bros Kombucha (Australia) 3. Love Kombucha (United Kingdom) 4. Equinox Kombucha (United Kingdom) 5. Captain Kombucha (Portugal) 6. Fix8 (United Kingdom) Frequently Asked Question: 1] What segments are covered in the Global Kombucha Market report? Ans. The segments covered in the Kombucha Market report are based on, Product, Type, Distribution Channel, and Regions. 2] Which region is expected to hold the highest share of the Global Kombucha Market? Ans. The North America region is expected to hold the highest share of the Kombucha Market. 3] What is the market size of the Global Kombucha Market by 2030? Ans. The market size of the Kombucha Market by 2030 is expected to reach US$ 9.48 Bn. 4] What was the market size of the Global Kombucha Market in 2023? Ans. The market size of the Kombucha Market in 2023 was valued at US$ 3.50 Bn. 5] Key players in the Kombucha Market. Ans. GT's Living Foods (United States), KeVita (United States), The Humm Kombucha (United States), Health-Ade Kombucha (United States) and Brew Dr. Kombucha (United States)

1. Kombucha Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Kombucha Market: Dynamics 2.1. Kombucha Market Trends by Region 2.1.1. North America Kombucha Market Trends 2.1.2. Europe Kombucha Market Trends 2.1.3. Asia Pacific Kombucha Market Trends 2.1.4. Middle East and Africa Kombucha Market Trends 2.1.5. South America Kombucha Market Trends 2.2. Kombucha Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Kombucha Market Drivers 2.2.1.2. North America Kombucha Market Restraints 2.2.1.3. North America Kombucha Market Opportunities 2.2.1.4. North America Kombucha Market Challenges 2.2.2. Europe 2.2.2.1. Europe Kombucha Market Drivers 2.2.2.2. Europe Kombucha Market Restraints 2.2.2.3. Europe Kombucha Market Opportunities 2.2.2.4. Europe Kombucha Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Kombucha Market Drivers 2.2.3.2. Asia Pacific Kombucha Market Restraints 2.2.3.3. Asia Pacific Kombucha Market Opportunities 2.2.3.4. Asia Pacific Kombucha Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Kombucha Market Drivers 2.2.4.2. Middle East and Africa Kombucha Market Restraints 2.2.4.3. Middle East and Africa Kombucha Market Opportunities 2.2.4.4. Middle East and Africa Kombucha Market Challenges 2.2.5. South America 2.2.5.1. South America Kombucha Market Drivers 2.2.5.2. South America Kombucha Market Restraints 2.2.5.3. South America Kombucha Market Opportunities 2.2.5.4. South America Kombucha Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Kombucha Industry 2.8. Analysis of Government Schemes and Initiatives For Kombucha Industry 2.9. Kombucha Market Trade Analysis 2.10. The Global Pandemic Impact on Kombucha Market 3. Kombucha Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Kombucha Market Size and Forecast, by Product (2023-2030) 3.1.1. Organic 3.1.2. Inorganic 3.2. Kombucha Market Size and Forecast, by Type (2023-2030) 3.2.1. Natural 3.2.2. Flavored 3.2.3. 3.3. Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. Supermarkets 3.3.2. Health Stores 3.3.3. Convenience Stores 3.3.4. Online Retailers 3.3.5. Others 3.4. Kombucha Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Kombucha Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Kombucha Market Size and Forecast, by Product (2023-2030) 4.1.1. Organic 4.1.2. Inorganic 4.2. North America Kombucha Market Size and Forecast, by Type (2023-2030) 4.2.1. Natural 4.2.2. Flavored 4.2.3. 4.3. North America Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. Supermarkets 4.3.2. Health Stores 4.3.3. Convenience Stores 4.3.4. Online Retailers 4.3.5. Others 4.4. North America Kombucha Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Kombucha Market Size and Forecast, by Product (2023-2030) 4.4.1.1.1. Organic 4.4.1.1.2. Inorganic 4.4.1.2. United States Kombucha Market Size and Forecast, by Type (2023-2030) 4.4.1.2.1. Natural 4.4.1.2.2. Flavored 4.4.1.2.3. 4.4.1.3. United States Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.3.1. Supermarkets 4.4.1.3.2. Health Stores 4.4.1.3.3. Convenience Stores 4.4.1.3.4. Online Retailers 4.4.1.3.5. Others 4.4.2. Canada 4.4.2.1. Canada Kombucha Market Size and Forecast, by Product (2023-2030) 4.4.2.1.1. Organic 4.4.2.1.2. Inorganic 4.4.2.2. Canada Kombucha Market Size and Forecast, by Type (2023-2030) 4.4.2.2.1. Natural 4.4.2.2.2. Flavored 4.4.2.2.3. 4.4.2.3. Canada Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.2.3.1. Supermarkets 4.4.2.3.2. Health Stores 4.4.2.3.3. Convenience Stores 4.4.2.3.4. Online Retailers 4.4.2.3.5. Others 4.4.3. Mexico 4.4.3.1. Mexico Kombucha Market Size and Forecast, by Product (2023-2030) 4.4.3.1.1. Organic 4.4.3.1.2. Inorganic 4.4.3.2. Mexico Kombucha Market Size and Forecast, by Type (2023-2030) 4.4.3.2.1. Natural 4.4.3.2.2. Flavored 4.4.3.2.3. 4.4.3.3. Mexico Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.3.3.1. Supermarkets 4.4.3.3.2. Health Stores 4.4.3.3.3. Convenience Stores 4.4.3.3.4. Online Retailers 4.4.3.3.5. Others 5. Europe Kombucha Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Kombucha Market Size and Forecast, by Product (2023-2030) 5.2. Europe Kombucha Market Size and Forecast, by Type (2023-2030) 5.3. Europe Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Kombucha Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Kombucha Market Size and Forecast, by Product (2023-2030) 5.4.1.2. United Kingdom Kombucha Market Size and Forecast, by Type (2023-2030) 5.4.1.3. United Kingdom Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2. France 5.4.2.1. France Kombucha Market Size and Forecast, by Product (2023-2030) 5.4.2.2. France Kombucha Market Size and Forecast, by Type (2023-2030) 5.4.2.3. France Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Kombucha Market Size and Forecast, by Product (2023-2030) 5.4.3.2. Germany Kombucha Market Size and Forecast, by Type (2023-2030) 5.4.3.3. Germany Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Kombucha Market Size and Forecast, by Product (2023-2030) 5.4.4.2. Italy Kombucha Market Size and Forecast, by Type (2023-2030) 5.4.4.3. Italy Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Kombucha Market Size and Forecast, by Product (2023-2030) 5.4.5.2. Spain Kombucha Market Size and Forecast, by Type (2023-2030) 5.4.5.3. Spain Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Kombucha Market Size and Forecast, by Product (2023-2030) 5.4.6.2. Sweden Kombucha Market Size and Forecast, by Type (2023-2030) 5.4.6.3. Sweden Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Kombucha Market Size and Forecast, by Product (2023-2030) 5.4.7.2. Austria Kombucha Market Size and Forecast, by Type (2023-2030) 5.4.7.3. Austria Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Kombucha Market Size and Forecast, by Product (2023-2030) 5.4.8.2. Rest of Europe Kombucha Market Size and Forecast, by Type (2023-2030) 5.4.8.3. Rest of Europe Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Kombucha Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Kombucha Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Kombucha Market Size and Forecast, by Type (2023-2030) 6.3. Asia Pacific Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Kombucha Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Kombucha Market Size and Forecast, by Product (2023-2030) 6.4.1.2. China Kombucha Market Size and Forecast, by Type (2023-2030) 6.4.1.3. China Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Kombucha Market Size and Forecast, by Product (2023-2030) 6.4.2.2. S Korea Kombucha Market Size and Forecast, by Type (2023-2030) 6.4.2.3. S Korea Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Kombucha Market Size and Forecast, by Product (2023-2030) 6.4.3.2. Japan Kombucha Market Size and Forecast, by Type (2023-2030) 6.4.3.3. Japan Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. India 6.4.4.1. India Kombucha Market Size and Forecast, by Product (2023-2030) 6.4.4.2. India Kombucha Market Size and Forecast, by Type (2023-2030) 6.4.4.3. India Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Kombucha Market Size and Forecast, by Product (2023-2030) 6.4.5.2. Australia Kombucha Market Size and Forecast, by Type (2023-2030) 6.4.5.3. Australia Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Kombucha Market Size and Forecast, by Product (2023-2030) 6.4.6.2. Indonesia Kombucha Market Size and Forecast, by Type (2023-2030) 6.4.6.3. Indonesia Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Kombucha Market Size and Forecast, by Product (2023-2030) 6.4.7.2. Malaysia Kombucha Market Size and Forecast, by Type (2023-2030) 6.4.7.3. Malaysia Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Kombucha Market Size and Forecast, by Product (2023-2030) 6.4.8.2. Vietnam Kombucha Market Size and Forecast, by Type (2023-2030) 6.4.8.3. Vietnam Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Kombucha Market Size and Forecast, by Product (2023-2030) 6.4.9.2. Taiwan Kombucha Market Size and Forecast, by Type (2023-2030) 6.4.9.3. Taiwan Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Kombucha Market Size and Forecast, by Product (2023-2030) 6.4.10.2. Rest of Asia Pacific Kombucha Market Size and Forecast, by Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Kombucha Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Kombucha Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Kombucha Market Size and Forecast, by Type (2023-2030) 7.3. Middle East and Africa Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Kombucha Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Kombucha Market Size and Forecast, by Product (2023-2030) 7.4.1.2. South Africa Kombucha Market Size and Forecast, by Type (2023-2030) 7.4.1.3. South Africa Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Kombucha Market Size and Forecast, by Product (2023-2030) 7.4.2.2. GCC Kombucha Market Size and Forecast, by Type (2023-2030) 7.4.2.3. GCC Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Kombucha Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Nigeria Kombucha Market Size and Forecast, by Type (2023-2030) 7.4.3.3. Nigeria Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Kombucha Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Rest of ME&A Kombucha Market Size and Forecast, by Type (2023-2030) 7.4.4.3. Rest of ME&A Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Kombucha Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Kombucha Market Size and Forecast, by Product (2023-2030) 8.2. South America Kombucha Market Size and Forecast, by Type (2023-2030) 8.3. South America Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 8.4. South America Kombucha Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Kombucha Market Size and Forecast, by Product (2023-2030) 8.4.1.2. Brazil Kombucha Market Size and Forecast, by Type (2023-2030) 8.4.1.3. Brazil Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Kombucha Market Size and Forecast, by Product (2023-2030) 8.4.2.2. Argentina Kombucha Market Size and Forecast, by Type (2023-2030) 8.4.2.3. Argentina Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Kombucha Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Rest Of South America Kombucha Market Size and Forecast, by Type (2023-2030) 8.4.3.3. Rest Of South America Kombucha Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Kombucha Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Kombucha Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. GT's Kombucha (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. KeVita Inc. (United States) 10.3. The Humm Kombucha (United States) 10.4. Health-Ade Kombucha (United States) 10.5. Brew Dr. Kombucha (United States) 10.6. Kombucha Wonder Drink (United States) 10.7. Reed's Inc. (United States) 10.8. Búcha Live Kombucha (United States) 10.9. Hain Celestial (United States) 10.10. Townshend's Tea Company (United States) 10.11. Clear Coast Fresh (United States) 10.12. Flying Embers (United States) 10.13. Kosmic Kombucha (Canada) 10.14. Booch Organic Kombucha (Canada) 10.15. Remedy Drinks (Australia) 10.16. Lo Bros Kombucha (Australia) 10.17. Love Kombucha (United Kingdom) 10.18. Equinox Kombucha (United Kingdom) 10.19. Captain Kombucha (Portugal) 10.20. Fix8 (United Kingdom) 11. Key Findings 12. Industry Recommendations 13. Kombucha Market: Research Methodology 14. Terms and Glossary