The Global Life Reinsurance Market size was valued at USD 221.95 Billion in 2022 and the total Life Reinsurance Market revenue is expected to grow at a CAGR of 10.94% from 2023 to 2029, reaching nearly USD 459.06 Billion.Global Life Reinsurance Market Overview:

Life and health insurers commonly utilize life reinsurance to manage their profitability, risk, capital, and access services provided by third-party reinsurers. Life reinsurance is a very common and effective tool used in many organizations. The life reinsurance market has experienced rapid growth in recent years due to its use in risk management, capital management, access to technology and services, and alternative asset strategies. Insurance helps its policyholders manage their uncertain economic risks. Government policies and regulatory changes also contribute to market development.To know about the Research Methodology :- Request Free Sample Report

What does the bundle’s collection provide?

1. Each report within the collection provides a comprehensive analysis of the life reinsurance industry in specific regions. 2. The life reinsurance bundle report comprehensively analyzes the global life reinsurance market. It covers various aspects such as type, products, distribution channel, category, and end users. 3. It also covers growth drivers, upcoming challenges, trends, opportunities, risks, and entry barriers. 4. The research methodology involves analyzing product-type literature, industry releases, annual reports, and other relevant documents of key industry participants. 5. The report highlights industry players' focus on technological advancements to establish dominance in the global life reinsurance market. Key players are also strengthening their market positions. 6. The report aims to offer valuable insights and an in-depth analysis of the market to assist stakeholders in making informed decisions and understanding market dynamics. This economical bundle offers a treasure trove of valuable information and insights. It grants you access to multiple reports at a reduced price than purchasing them individually. Unlock a wealth of knowledge about the market with this cost-effective package. The Growth Potential and Future Scenarios of the Life Reinsurance Market report bundle worth US$ 7900 can now be purchased at a reduced price of US$ 6800 1. North America Life Reinsurance Market (Single User $ 2900) 2. Asia Pacific Life Reinsurance Market (Single User $ 2900) 3. Europe Life Reinsurance Market (Single User $ 2900) 4. Middle East and Africa Life Reinsurance Market (Single User $ 2900) 5. South America Life Reinsurance Market (Single User $ 2900)How this report will help you:

1. The report covers the main trends and drivers of the life reinsurance market, allowing you to make informed decisions regarding your business. 2. The report helps you to identify growth opportunities and expand your market presence in the life reinsurance industry. 3. This report provides valuable insights into market expansion. It offers a detailed analysis of key sectors, and major projects, allowing you to identify target areas for growth and investment. 4. This report analyzes government policies and their impact on the market. It helps you understand the regulatory landscape, anticipate policy changes, and align your business strategies accordingly. 5. By providing historical and forecasted valuations of the life reinsurance market, this report enables you to plan for the future. It assists with budgeting, resource allocation, and setting realistic goals, ensuring your business is well-prepared for upcoming market developments. 6. This report helps identify potential challenges, market volatility, and regulatory factors, allowing you to implement risk mitigation strategies.Reports Offerings in the Bundle:

Report 1: The Growth Potential and Future Scenarios of North America Life Reinsurance Market: Industry Analysis and Forecast (2022-2029).

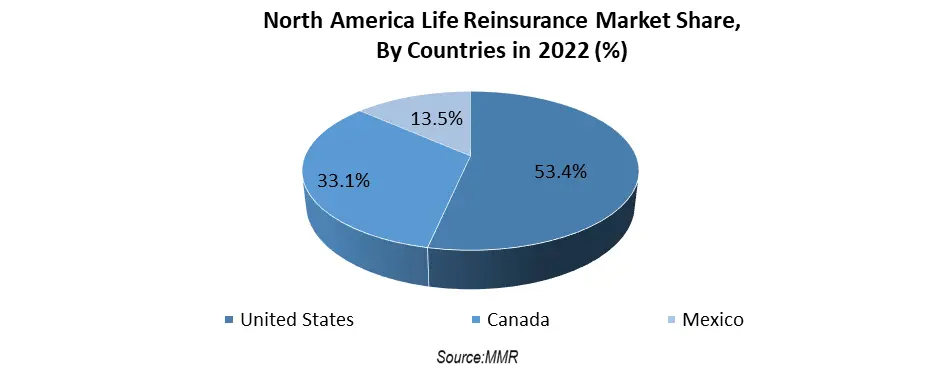

North America Life Reinsurance Market size was valued at USD 91.67 Billion in 2022. The total North America Life Reinsurance Market revenue is expected to grow at a CAGR of 10.25 % from 2023 to 2029, reaching nearly USD 181.50 Billion. The United States dominates the North American life reinsurance market. As incomes in North America rise, life reinsurance products and services will be in increasing demand, as people have more disposable income for leisure and free activities. The United States has a huge and varied population with more disposable income. This generates a large group of potential consumers for life reinsurance products and services. Life reinsurance products and services are likely to grow in demand during the forecast period as people become more aware of their benefits. The United States has a strong budget and an encouraging regulatory environment for the life reinsurance industry.

Report 2: The Growth Potential and Future Scenarios of Asia Pacific Life Reinsurance Market: Industry Analysis and Forecast (2022-2029)

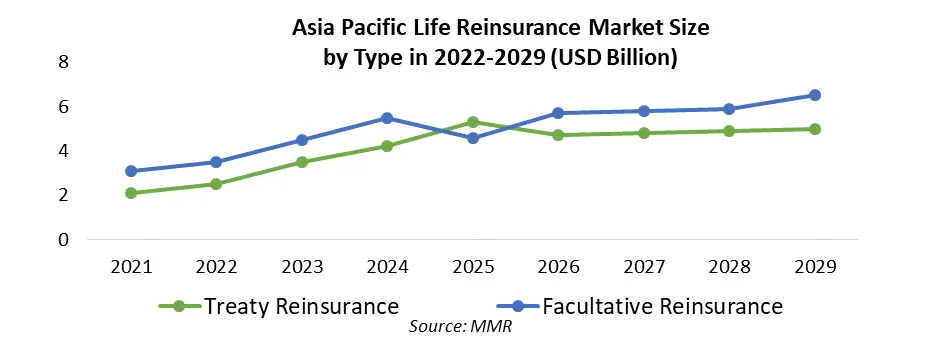

Asia Pacific Life Reinsurance Market size was valued at USD 45.94 Billion in 2022. The total Asia Pacific market revenue is expected to grow at a CAGR of 12.35 % from 2023 to 2029, reaching nearly USD 103.80 Billion. The facultative reinsurance segment dominated the Asia Pacific market in 2022 and is expected to continue during the forecast period. Facultative reinsurance is more commonly employed when the primary insurer seeks additional coverage for individual policies or specific risks that may exceed their risk appetite or capacity. Facultative reinsurance allows the life reinsurance company to analyze individual risks and decide whether to accept or reject them. This makes it more attentive than treaty reinsurance.

Report 3: The Growth Potential and Future Scenarios of Europe Life Reinsurance Market: Industry Analysis and Forecast (2022-2029)

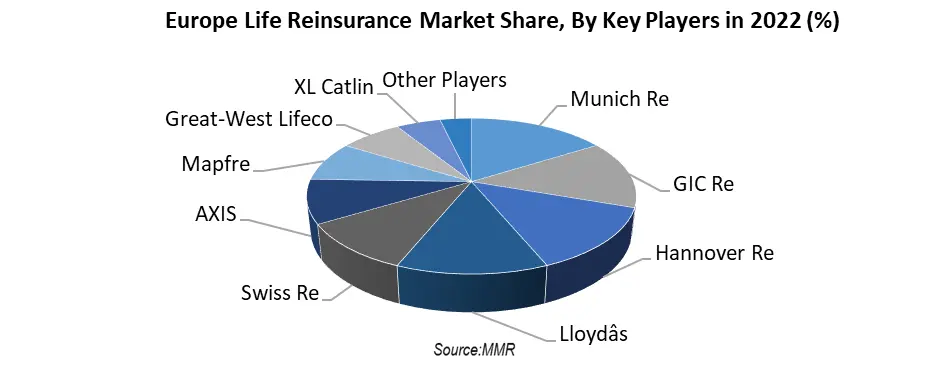

The Europe Life Reinsurance Market size was valued at USD 33.29 Billion in 2022. The total Europe market revenue is expected to grow at a CAGR of 11.95 % from 2023 to 2029, reaching nearly USD 73.36 Billion. Europe has experienced robust economic growth, leading to increased disposable incomes and a rising middle class. As these economies grow, risk management and financial protection are increasingly significant. Individuals and families seek to protect their financial well-being, and life insurance products are in demand. This drives the need for reinsurance to support primary insurers' capacity and risk management. Europe's life reinsurance market is highly competitive with both global and local players. Several prominent local players have a strong presence and play significant roles in the market. These are some of the regional key players that traditionally dominate the European market. These regional key players, along with global reinsurers, contribute to the competitive landscape of the European market.

Report 4: The Growth Potential and Future Scenarios of Middle East and Africa Life Reinsurance Market: Industry Analysis and Forecast (2022-2029).

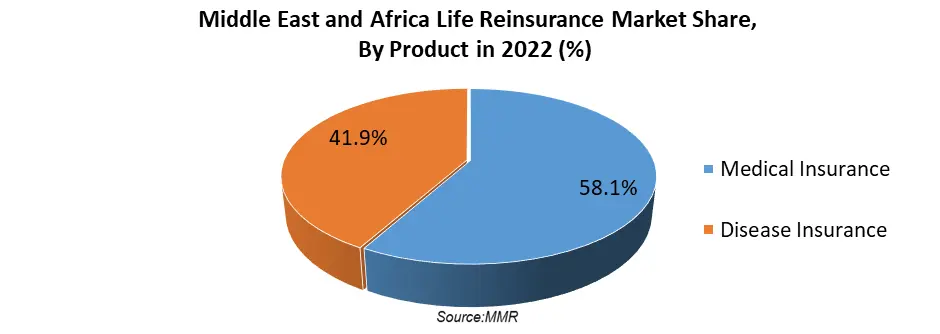

The Middle East and Africa Life Reinsurance Market size was valued at USD 28.85 Billion in 2022. The total Middle East and Africa market revenue is expected to grow at a CAGR of 10.82 % from 2023 to 2029, reaching nearly USD 59.22 Billion. Medical insurance dominates the Middle East and Africa market with a high market share. This is because medical insurance covers a wide range of medical expenses, including doctor's visits, hospital stays, and prescription drugs. Medical insurance is more accessible than disease insurance. As there are more medical insurance companies offering medical insurance products than disease insurance companies. Medical insurance is more comprehensive and affordable than disease insurance. This is why medical insurance dominates the disease insurance segment.

Report 5: The Growth Potential and Future Scenarios of South America Life Reinsurance Market: Industry Analysis and Forecast (2022-2029)

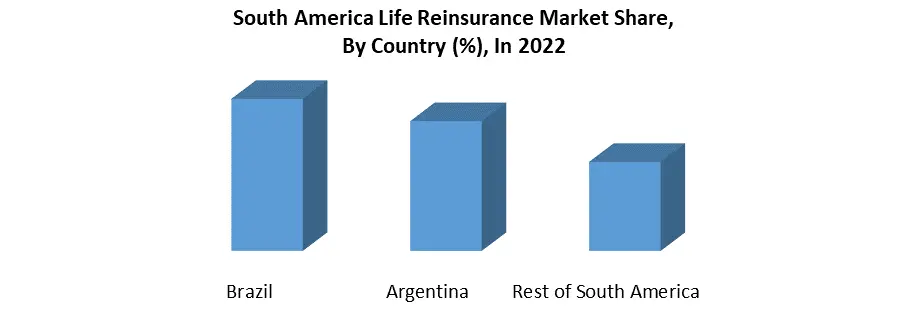

The South America Life Reinsurance Market size was valued at USD 22.20 Billion in 2022. The total South America market revenue is expected to grow at a CAGR of 9.23 % from 2023 to 2029, reaching nearly USD 41.19 Billion. Brazil is the leading South American market, followed by Argentina. Brazil is a highly regulated market. SUSEP is very active in modernizing and liberalizing the market. Brazil's market is fully open to foreign reinsurers. There are no rules for placing reinsurance on the local market. Life reinsurance plays a crucial role in the economic recovery and development of the Brazilian reinsurance market in the region. Argentina Life Reinsurers have opportunities to deliver risk management solutions and support main insurers in handling life insurance portfolios. This creates an opportunity for life reinsurance business growth in South America.

Life Reinsurance Market Scope: Inquire before buying

Life Reinsurance Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 221.95 Billion. Forecast Period 2023 to 2029 CAGR: 10.94% Market Size in 2029: USD 459.06 Billion. Segments Covered: by Type 1. Facultative Reinsurance 2. Treaty Reinsurance by Product 1.. Disease Insurance 2. Medical Insurance by Distribution Channel 1. Direct Writing 2. Agent and Broker 3. Bank by Category 1. Recurring reinsurance 2. Portfolio reinsurance 3. Retrocession reinsurance by End-Users 1. Children 2. Adults 3. Senior Citizens Life Reinsurance Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Life Reinsurance Market, Key Players are

North America 1. Alleghany 2. Berkshire Hathaway Life 3. Everest Re Group, Ltd. 4. Fairfax 5. Great-West Lifeco 6. Maiden Re 7. PartnerRe 8. RGA Reinsurance Company 9. SCOR SE 10. Sompo 11. Talcott Resolution 12. The Canada Life Assurance Company 13. Atlas Mag Asia Pacific 1. China RE 2. Korean Re 3. Mitsui Sumitomo 4. Tokio Marine 5. Pacific Life Re 6. The Toa Reinsurance Company, Limited. 7. General Insurance Corporation of India Limited Europe 1. AXIS 2. GIC Re 3. Hannover Re 4. Lloydâs 5. Mapfre 6. Munich Re 7. Swiss Re 8. XL Catlin Middle East and Africa 1. African Reinsurance Corporation 2. Arch Capital Group Ltd. 3. Guy Carpenter & Company, LLC 4. OdysseyRe. 5. Aon plc 6. Mitsui Sumitomo Insurance Co., Ltd South America 1. Constellation Insurance, Inc. 2. BMS Group 3. Odyssey Re 4. Allianz Group 5. Arch Reinsurance Ltd. 6. Kennedys 7. QBE Re 8. Chesterfield Group South America

1. Life Reinsurance Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Life Reinsurance Market: Dynamics 2.1. Life Reinsurance Market Trends by Region 2.1.1. North America Life Reinsurance Market Trends 2.1.2. Europe Life Reinsurance Market Trends 2.1.3. Asia Pacific Life Reinsurance Market Trends 2.1.4. Middle East and Africa Life Reinsurance Market Trends 2.1.5. South America Life Reinsurance Market Trends 2.2. Life Reinsurance Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Life Reinsurance Market Drivers 2.2.1.2. North America Life Reinsurance Market Restraints 2.2.1.3. North America Life Reinsurance Market Opportunities 2.2.1.4. North America Life Reinsurance Market Challenges 2.2.2. Europe 2.2.2.1. Europe Life Reinsurance Market Drivers 2.2.2.2. Europe Life Reinsurance Market Restraints 2.2.2.3. Europe Life Reinsurance Market Opportunities 2.2.2.4. Europe Life Reinsurance Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Life Reinsurance Market Drivers 2.2.3.2. Asia Pacific Life Reinsurance Market Restraints 2.2.3.3. Asia Pacific Life Reinsurance Market Opportunities 2.2.3.4. Asia Pacific Life Reinsurance Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Life Reinsurance Market Drivers 2.2.4.2. Middle East and Africa Life Reinsurance Market Restraints 2.2.4.3. Middle East and Africa Life Reinsurance Market Opportunities 2.2.4.4. Middle East and Africa Life Reinsurance Market Challenges 2.2.5. South America 2.2.5.1. South America Life Reinsurance Market Drivers 2.2.5.2. South America Life Reinsurance Market Restraints 2.2.5.3. South America Life Reinsurance Market Opportunities 2.2.5.4. South America Life Reinsurance Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Life Reinsurance Industry 2.8. Analysis of Government Schemes and Initiatives For Life Reinsurance Industry 2.9. Life Reinsurance Market Trade Analysis 2.10. The Global Pandemic Impact on Life Reinsurance Market 3. Life Reinsurance Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Life Reinsurance Market Size and Forecast, by Type (2022-2029) 3.1.1. Facultative Reinsurance 3.1.2. Treaty Reinsurance 3.2. Life Reinsurance Market Size and Forecast, by Product (2022-2029) 3.2.1. Disease Insurance 3.2.2. Medical Insurance 3.3. Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 3.3.1. Direct Writing 3.3.2. Agent and Broker 3.3.3. Bank 3.4. Life Reinsurance Market Size and Forecast, by Category (2022-2029) 3.4.1. Recurring reinsurance 3.4.2. Portfolio reinsurance 3.4.3. Retrocession reinsurance 3.5. Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 3.5.1. Children 3.5.2. Adults 3.5.3. Senior Citizens 3.6. Life Reinsurance Market Size and Forecast, by Region (2022-2029) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Life Reinsurance Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Life Reinsurance Market Size and Forecast, by Type (2022-2029) 4.1.1. Facultative Reinsurance 4.1.2. Treaty Reinsurance 4.2. North America Life Reinsurance Market Size and Forecast, by Product (2022-2029) 4.2.1. Disease Insurance 4.2.2. Medical Insurance 4.3. North America Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.1. Direct Writing 4.3.2. Agent and Broker 4.3.3. Bank 4.4. North America Life Reinsurance Market Size and Forecast, by Category (2022-2029) 4.4.1. Recurring reinsurance 4.4.2. Portfolio reinsurance 4.4.3. Retrocession reinsurance 4.5. North America Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 4.5.1. Children 4.5.2. Adults 4.5.3. Senior Citizens 4.7. North America Life Reinsurance Market Size and Forecast, by Country (2022-2029) 4.6.1. United States 4.6.1.1. United States Life Reinsurance Market Size and Forecast, by Type (2022-2029) 4.6.1.1.1. Facultative Reinsurance 4.6.1.1.2. Treaty Reinsurance 4.6.1.2. United States Life Reinsurance Market Size and Forecast, by Product (2022-2029) 4.6.1.2.1. Disease Insurance 4.6.1.2.2. Medical Insurance 4.6.1.3. United States Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 4.6.1.3.1. Direct Writing 4.6.1.3.2. Agent and Broker 4.6.1.3.3. Bank 4.6.1.4. United States Life Reinsurance Market Size and Forecast, by Category (2022-2029) 4.6.1.4.1. Recurring reinsurance 4.6.1.4.2. Portfolio reinsurance 4.6.1.4.3. Retrocession reinsurance 4.6.1.5. United States Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 4.6.1.5.1. Children 4.6.1.5.2. Adults 4.6.1.5.3. Senior Citizens 4.6.2. Canada 4.6.2.1. Canada Life Reinsurance Market Size and Forecast, by Type (2022-2029) 4.6.2.1.1. Facultative Reinsurance 4.6.2.1.2. Treaty Reinsurance 4.6.2.2. Canada Life Reinsurance Market Size and Forecast, by Product (2022-2029) 4.6.2.2.1. Disease Insurance 4.6.2.2.2. Medical Insurance 4.6.2.3. Canada Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 4.6.2.3.1. Direct Writing 4.6.2.3.2. Agent and Broker 4.6.2.3.3. Bank 4.6.2.4. Canada Life Reinsurance Market Size and Forecast, by Category (2022-2029) 4.6.2.4.1. Recurring reinsurance 4.6.2.4.2. Portfolio reinsurance 4.6.2.4.3. Retrocession reinsurance 4.6.2.5. Canada Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 4.6.2.5.1. Children 4.6.2.5.2. Adults 4.6.2.5.3. Senior Citizens 4.6.3. Mexico 4.6.3.1. Mexico Life Reinsurance Market Size and Forecast, by Type (2022-2029) 4.6.3.1.1. Facultative Reinsurance 4.6.3.1.2. Treaty Reinsurance 4.6.3.2. Mexico Life Reinsurance Market Size and Forecast, by Product (2022-2029) 4.6.3.2.1. Disease Insurance 4.6.3.2.2. Medical Insurance 4.6.3.3. Mexico Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 4.6.3.3.1. Direct Writing 4.6.3.3.2. Agent and Broker 4.6.3.3.3. Bank 4.6.3.4. Mexico Life Reinsurance Market Size and Forecast, by Category (2022-2029) 4.6.3.4.1. Recurring reinsurance 4.6.3.4.2. Portfolio reinsurance 4.6.3.4.3. Retrocession reinsurance 4.6.3.5. Mexico Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 4.6.3.5.1. Children 4.6.3.5.2. Adults 4.6.3.5.3. Senior Citizens 5. Europe Life Reinsurance Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Life Reinsurance Market Size and Forecast, by Type (2022-2029) 5.2. Europe Life Reinsurance Market Size and Forecast, by Product (2022-2029) 5.3. Europe Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.4. Europe Life Reinsurance Market Size and Forecast, by Category (2022-2029) 5.5. Europe Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 5.6. Europe Life Reinsurance Market Size and Forecast, by Country (2022-2029) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Life Reinsurance Market Size and Forecast, by Type (2022-2029) 5.6.1.2. United Kingdom Life Reinsurance Market Size and Forecast, by Product (2022-2029) 5.6.1.3. United Kingdom Life Reinsurance Market Size and Forecast, by Distribution Channel(2022-2029) 5.6.1.4. United Kingdom Life Reinsurance Market Size and Forecast, by Category (2022-2029) 5.6.1.5. United Kingdom Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 5.6.2. France 5.6.2.1. France Life Reinsurance Market Size and Forecast, by Type (2022-2029) 5.6.2.2. France Life Reinsurance Market Size and Forecast, by Product (2022-2029) 5.6.2.3. France Life Reinsurance Market Size and Forecast, by Distribution Channel(2022-2029) 5.6.2.4. France Life Reinsurance Market Size and Forecast, by Category (2022-2029) 5.6.2.5. France Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 5.6.3. Germany 5.6.3.1. Germany Life Reinsurance Market Size and Forecast, by Type (2022-2029) 5.6.3.2. Germany Life Reinsurance Market Size and Forecast, by Product (2022-2029) 5.6.3.3. Germany Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.3.4. Germany Life Reinsurance Market Size and Forecast, by Category (2022-2029) 5.6.3.5. Germany Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 5.6.4. Italy 5.6.4.1. Italy Life Reinsurance Market Size and Forecast, by Type (2022-2029) 5.6.4.2. Italy Life Reinsurance Market Size and Forecast, by Product (2022-2029) 5.6.4.3. Italy Life Reinsurance Market Size and Forecast, by Distribution Channel(2022-2029) 5.6.4.4. Italy Life Reinsurance Market Size and Forecast, by Category (2022-2029) 5.6.4.5. Italy Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 5.6.5. Spain 5.6.5.1. Spain Life Reinsurance Market Size and Forecast, by Type (2022-2029) 5.6.5.2. Spain Life Reinsurance Market Size and Forecast, by Product (2022-2029) 5.6.5.3. Spain Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.5.4. Spain Life Reinsurance Market Size and Forecast, by Category (2022-2029) 5.6.5.5. Spain Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 5.6.6. Sweden 5.6.6.1. Sweden Life Reinsurance Market Size and Forecast, by Type (2022-2029) 5.6.6.2. Sweden Life Reinsurance Market Size and Forecast, by Product (2022-2029) 5.6.6.3. Sweden Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.6.4. Sweden Life Reinsurance Market Size and Forecast, by Category (2022-2029) 5.6.6.5. Sweden Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 5.6.7. Austria 5.6.7.1. Austria Life Reinsurance Market Size and Forecast, by Type (2022-2029) 5.6.7.2. Austria Life Reinsurance Market Size and Forecast, by Product (2022-2029) 5.6.7.3. Austria Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.7.4. Austria Life Reinsurance Market Size and Forecast, by Category (2022-2029) 5.6.7.5. Austria Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Life Reinsurance Market Size and Forecast, by Type (2022-2029) 5.6.8.2. Rest of Europe Life Reinsurance Market Size and Forecast, by Product (2022-2029) 5.6.8.3. Rest of Europe Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.6.8.4. Rest of Europe Life Reinsurance Market Size and Forecast, by Category (2022-2029) 5.6.8.5. Rest of Europe Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 6. Asia Pacific Life Reinsurance Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Life Reinsurance Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Life Reinsurance Market Size and Forecast, by Product (2022-2029) 6.3. Asia Pacific Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4. Asia Pacific Life Reinsurance Market Size and Forecast, by Category (2022-2029) 6.5. Asia Pacific Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 6.6. Asia Pacific Life Reinsurance Market Size and Forecast, by Country (2022-2029) 6.6.1. China 6.6.1.1. China Life Reinsurance Market Size and Forecast, by Type (2022-2029) 6.6.1.2. China Life Reinsurance Market Size and Forecast, by Product (2022-2029) 6.6.1.3. China Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.1.4. China Life Reinsurance Market Size and Forecast, by Category (2022-2029) 6.6.1.5. China Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 6.6.2. S Korea 6.6.2.1. S Korea Life Reinsurance Market Size and Forecast, by Type (2022-2029) 6.6.2.2. S Korea Life Reinsurance Market Size and Forecast, by Product (2022-2029) 6.6.2.3. S Korea Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.2.4. S Korea Life Reinsurance Market Size and Forecast, by Category (2022-2029) 6.6.2.5. S Korea Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 6.6.3. Japan 6.6.3.1. Japan Life Reinsurance Market Size and Forecast, by Type (2022-2029) 6.6.3.2. Japan Life Reinsurance Market Size and Forecast, by Product (2022-2029) 6.6.3.3. Japan Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.3.4. Japan Life Reinsurance Market Size and Forecast, by Category (2022-2029) 6.6.3.5. Japan Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 6.6.4. India 6.6.4.1. India Life Reinsurance Market Size and Forecast, by Type (2022-2029) 6.6.4.2. India Life Reinsurance Market Size and Forecast, by Product (2022-2029) 6.6.4.3. India Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.4.4. India Life Reinsurance Market Size and Forecast, by Category (2022-2029) 6.6.4.5. India Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 6.6.5. Australia 6.6.5.1. Australia Life Reinsurance Market Size and Forecast, by Type (2022-2029) 6.6.5.2. Australia Life Reinsurance Market Size and Forecast, by Product (2022-2029) 6.6.5.3. Australia Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.5.4. Australia Life Reinsurance Market Size and Forecast, by Category (2022-2029) 6.6.5.5. Australia Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 6.6.6. Indonesia 6.6.6.1. Indonesia Life Reinsurance Market Size and Forecast, by Type (2022-2029) 6.6.6.2. Indonesia Life Reinsurance Market Size and Forecast, by Product (2022-2029) 6.6.6.3. Indonesia Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.6.4. Indonesia Life Reinsurance Market Size and Forecast, by Category (2022-2029) 6.6.6.5. Indonesia Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 6.6.7. Malaysia 6.6.7.1. Malaysia Life Reinsurance Market Size and Forecast, by Type (2022-2029) 6.6.7.2. Malaysia Life Reinsurance Market Size and Forecast, by Product (2022-2029) 6.6.7.3. Malaysia Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.7.4. Malaysia Life Reinsurance Market Size and Forecast, by Category (2022-2029) 6.6.7.5. Malaysia Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 6.6.8. Vietnam 6.6.8.1. Vietnam Life Reinsurance Market Size and Forecast, by Type (2022-2029) 6.6.8.2. Vietnam Life Reinsurance Market Size and Forecast, by Product (2022-2029) 6.6.8.3. Vietnam Life Reinsurance Market Size and Forecast, by Distribution Channel(2022-2029) 6.6.8.4. Vietnam Life Reinsurance Market Size and Forecast, by Category (2022-2029) 6.6.8.5. Vietnam Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 6.6.9. Taiwan 6.6.9.1. Taiwan Life Reinsurance Market Size and Forecast, by Type (2022-2029) 6.6.9.2. Taiwan Life Reinsurance Market Size and Forecast, by Product (2022-2029) 6.6.9.3. Taiwan Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.9.4. Taiwan Life Reinsurance Market Size and Forecast, by Category (2022-2029) 6.6.9.5. Taiwan Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Life Reinsurance Market Size and Forecast, by Type (2022-2029) 6.6.10.2. Rest of Asia Pacific Life Reinsurance Market Size and Forecast, by Product (2022-2029) 6.6.10.3. Rest of Asia Pacific Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.6.10.4. Rest of Asia Pacific Life Reinsurance Market Size and Forecast, by Category (2022-2029) 6.6.10.5. Rest of Asia Pacific Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 7. Middle East and Africa Life Reinsurance Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Life Reinsurance Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Life Reinsurance Market Size and Forecast, by Product (2022-2029) 7.3. Middle East and Africa Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 7.4. Middle East and Africa Life Reinsurance Market Size and Forecast, by Category (2022-2029) 7.5. Middle East and Africa Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 7.6. Middle East and Africa Life Reinsurance Market Size and Forecast, by Country (2022-2029) 7.6.1. South Africa 7.6.1.1. South Africa Life Reinsurance Market Size and Forecast, by Type (2022-2029) 7.6.1.2. South Africa Life Reinsurance Market Size and Forecast, by Product (2022-2029) 7.6.1.3. South Africa Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.1.4. South Africa Life Reinsurance Market Size and Forecast, by Category (2022-2029) 7.6.1.5. South Africa Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 7.6.2. GCC 7.6.2.1. GCC Life Reinsurance Market Size and Forecast, by Type (2022-2029) 7.6.2.2. GCC Life Reinsurance Market Size and Forecast, by Product (2022-2029) 7.6.2.3. GCC Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.2.4. GCC Life Reinsurance Market Size and Forecast, by Category (2022-2029) 7.6.2.5. GCC Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 7.6.3. Nigeria 7.6.3.1. Nigeria Life Reinsurance Market Size and Forecast, by Type (2022-2029) 7.6.3.2. Nigeria Life Reinsurance Market Size and Forecast, by Product (2022-2029) 7.6.3.3. Nigeria Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.3.4. Nigeria Life Reinsurance Market Size and Forecast, by Category (2022-2029) 7.6.3.5. Nigeria Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Life Reinsurance Market Size and Forecast, by Type (2022-2029) 7.6.4.2. Rest of ME&A Life Reinsurance Market Size and Forecast, by Product (2022-2029) 7.6.4.3. Rest of ME&A Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 7.6.4.4. Rest of ME&A Life Reinsurance Market Size and Forecast, by Category (2022-2029) 7.6.4.5. Rest of ME&A Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 8. South America Life Reinsurance Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Life Reinsurance Market Size and Forecast, by Type (2022-2029) 8.2. South America Life Reinsurance Market Size and Forecast, by Product (2022-2029) 8.3. South America Life Reinsurance Market Size and Forecast, by Distribution Channel(2022-2029) 8.4. South America Life Reinsurance Market Size and Forecast, by Category (2022-2029) 8.5. South America Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 8.6. South America Life Reinsurance Market Size and Forecast, by Country (2022-2029) 8.7.1. Brazil 8.6.1.1. Brazil Life Reinsurance Market Size and Forecast, by Type (2022-2029) 8.6.1.2. Brazil Life Reinsurance Market Size and Forecast, by Product (2022-2029) 8.6.1.3. Brazil Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 8.6.1.4. Brazil Life Reinsurance Market Size and Forecast, by Category (2022-2029) 8.6.1.5. Brazil Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 8.7.2. Argentina 8.6.2.1. Argentina Life Reinsurance Market Size and Forecast, by Type (2022-2029) 8.6.2.2. Argentina Life Reinsurance Market Size and Forecast, by Product (2022-2029) 8.6.2.3. Argentina Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 8.6.2.4. Argentina Life Reinsurance Market Size and Forecast, by Category (2022-2029) 8.6.2.5. Argentina Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 8.7.3. Rest Of South America 8.6.3.1. Rest Of South America Life Reinsurance Market Size and Forecast, by Type (2022-2029) 8.6.3.2. Rest Of South America Life Reinsurance Market Size and Forecast, by Product (2022-2029) 8.6.3.3. Rest Of South America Life Reinsurance Market Size and Forecast, by Distribution Channel (2022-2029) 8.6.3.4. Rest Of South America Life Reinsurance Market Size and Forecast, by Category (2022-2029) 8.6.3.5. Rest Of South America Life Reinsurance Market Size and Forecast, by End-Users (2022-2029) 9. Global Life Reinsurance Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Life Reinsurance Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Alleghany 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Berkshire Hathaway Life 10.3. Everest Re Group, Ltd. 10.4. Fairfax 10.5. Great-West Lifeco 10.6. Maiden Re 10.7. PartnerRe 10.8. RGA Reinsurance Company 10.9. SCOR SE 10.10. Sompo 10.11. Talcott Resolution 10.12. The Canada Life Assurance Company 10.13. Atlas Mag 10.14. China RE 10.15. Korean Re 10.16. Mitsui Sumitomo 10.17. Tokio Marine 10.18. Pacific Life Re 10.19. The Toa Reinsurance Company, Limited. 10.20. General Insurance Corporation of India Limited 10.21. AXIS 10.22. GIC Re 10.23. Hannover Re 10.24. Lloydâs 10.25. Mapfre 10.26. Munich Re 10.27. Swiss Re 10.28. XL Catlin 10.29. African Reinsurance Corporation 10.30. Arch Capital Group Ltd. 10.31.Guy Carpenter & Company, LLC 10.32.OdysseyRe. 10.33.Aon plc 10.34.Mitsui Sumitomo Insurance Co., Ltd 10.35.Constellation Insurance, Inc. 10.36.BMS Group 10.37.Odyssey Re 10.38.Allianz Group 10.39.Arch Reinsurance Ltd. 10.40.Kennedys 10.41.QBE Re 10.42.Chesterfield Group South America 11. Key Findings 12. Industry Recommendations 13. Life Reinsurance Market: Research Methodology 14. Terms and Glossary