The Global South America Life Reinsurance Market size was valued at USD 22.20 Billion in 2022 and the total South America Life Reinsurance Market revenue is expected to grow at a CAGR of 9.23 % from 2023 to 2029, reaching nearly USD 41.19 Billion. The life reinsurance market refers to the sector where the insurance industry focuses on insurance coverage. This is particularly relevant to life insurance companies in South America. Reinsurance is a type of insurance that insurance companies purchase to transfer some of the risks related to the policies they guarantee to other parties called reinsurers. Life reinsurance is essential for life insurance companies to manage risk and capital. The South American life reinsurance market is growing steadily and driven by several factors such as improved economic coverage, growing demand for life insurance usage, and increasing awareness of the importance of life insurance among the people. Government policies and regulatory changes have also contributed to the market's development. The middle-class group is growing in South America and helps drive the South America life reinsurance marketTo know about the Research Methodology :- Request Free Sample Report

South America Life Reinsurance Market Scope and research methodology:

The South America Life Reinsurance Market report provides a comprehensive analysis of the life reinsurance market. It covers various aspects such as type, products, Distribution Channel, Category, and end users. The research methodology involves analyzing product-type literature, industry releases, annual reports, and other relevant documents of key industry participants. The report highlights industry players’ focus on technological advancements to establish dominance in the South America Life Reinsurance Market. Key players are also strengthening their market positions. The report aims to offer valuable insights and an in-depth analysis of the market to assist stakeholders in making informed decisions and understanding market dynamics.Market Dynamics:

Increasing demand for life reinsurance in South America: Demand for the South America life reinsurance market is increasing due to increasing awareness of life reinsurance for businesses and individuals. The insurance industry regulatory framework plays a significant role in the life reinsurance market. This growing awareness and regulatory framework drives the demand for reinsurance as primary insurers seek to fulfill their risks and ensure acceptable coverage for their policyholders. Economic conditions can impact the life reinsurance market. Economic growth, growing incomes, and increasing disposable income levels can lead to more life insurance purchases. A robust economy supports the insurance industry's growth and drives demand for reinsurance. Reinsurers' financial stability and capacity are essential drivers of the South American life reinsurance market. Reinsurers need to demonstrate their ability to honor claims and provide the necessary capital to support primary insurers. Primary insurers consider financial ratings, solid balance sheets, and adequate capitalization when selecting reinsurers. Life reinsurers with strong financial positions are better positioned to secure business and drive market growth. Life reinsurance companies help life insurance companies expand into expanding markets by protecting them against losses in these markets. This has led to an increasing demand for the market. Growth in South America’s economies drives the life reinsurance business. South America life reinsurance market is relatively undeveloped compared to other regions, but growing rapidly. Despite an economic downturn in South America, insurers have maintained high profitability owing to high-interest rates, higher insurance penetration rates, and disposable income. This is despite the economic downturn. These factors include lower investment returns in South America. South America's interest rate increases in the global life reinsurance market due to this increase in interest rates. The governing landscape in South America has changed significantly in response to universal guidelines around solvency and risk-based rules. The projected growth in South America’s economies is expected to increase the amount of insurance and reinsurance business. Urbanization and Altering Socio-Demographics in Developing Countries Fuel the South American Life Reinsurance Market. A growing population in established markets, more urbanization, the formation of a stable middle class, and altering socio-demographics in emerging markets, these factors are likely to drive growth in the life reinsurance market. Market alliances and reduced growth rates have defined the universal life reinsurance market for more than a year. Cession rates for transient lines, which had been declining in some South America life reinsurance markets, appear to be leveling out. This indicates more steady development in the future. Although the traditional mortality commercial remains at the forefront of the life reinsurance industry, South American reinsurers have begun to expand their business mix. Increasing diversification, expansion, and investments in innovation and digital competencies are underway globally, providing both opportunities and challenges for the primary life reinsurers market.South America Life Reinsurance Market Segment Analysis:

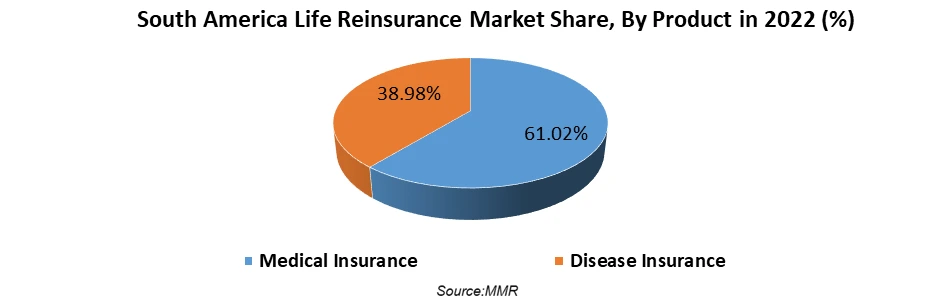

Based on type, Life Reinsurance is segmented into Facultative Reinsurance and Treaty Reinsurance. The treaty segment is the dominating segment in the life reinsurance market. Treaty reinsurance involves insurance companies shifting all risk from their specific book of business to reinsurance. In treaty reinsurance, the primary insurer transfers its entire portfolio of commercial auto or homeowners' risk to the reinsurer. The agreement encompasses not only the policies already written by the ceding company but also future policies that fit within the pre-agreed definitions of risk classes outlined in the treaty. The two parties enter into a long-term agreement, known as a treaty, where the reinsurer accepts all covered business issued by the primary insurance company. This allows for stability and continuity in the reinsurance company. The facultative reinsurance segment dominated the South America Life Reinsurance Market and is expected to continue during the forecast period.Based on product, the South America Life Reinsurance Market is segmented into Disease Insurance and Medical Insurance. The medical insurance segment dominates the South America Life Reinsurance Market with a market share of 61.02%. Medical insurance covers a wide range of medical expenses, like hospital and doctor's visits, and prescription drugs. Medical insurance is more accessible than disease insurance. As compared to disease insurance medical insurance has a wider range of attention and is more reasonable. This is attributed to the point that there are additional medical insurance companies giving medical insurance services than disease insurance companies. The motive for this is that medical insurance is a more widespread product that covers a broader range of medical expenditures in comparison with additional insurance. Because of this, the medical insurance market is dominating the market for the past few decades.

South America Life Reinsurance Market Regional Insights:

Brazil is the leading South America life reinsurance market, followed by Argentina. Brazil is a highly regulated market. SUSEP is very active in modernizing and liberalizing the life reinsurance market. Brazil's life reinsurance market is fully open to foreign reinsurers. There are no rules for placing reinsurance on the local market. It offers a choice for local reinsures of 40% of any facultative and treaty risks. Life reinsurance plays a crucial role in the economic recovery and development of the Brazilian reinsurance market in the region. A well-established insurance market exists in Argentina, but the life reinsurance market faces challenges as well. Currency devaluations, economic instability, and inflation affect the insurance industry and create challenges for reinsurers. Argentina Life Reinsurers have opportunities to deliver risk management solutions and support the main insurers in handling their life insurance portfolios. This creates the opportunity for the life reinsurance business to grow in South AmericaCompetitive Landscape

Key South America Life Reinsurance Market players profiled in the report include RGA Reinsurance Company, Constellation Insurance, Inc., BMS Group, Odyssey Re, Allianz Group, Arch Reinsurance Ltd., Kennedys, Fairfax Financial Holdings Limited, QBE Re and Chesterfield Group South America. This provides huge opportunities to serve many End-uses & customers and expand the market.South America Life Reinsurance Market Scope: Inquire before buying

South America Life Reinsurance Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 22.20 Billion. Forecast Period 2023 to 2029 CAGR: 9.23% Market Size in 2029: US $ 41.19 Billion. Segments Covered: by Type 1. Facultative Reinsurance 2. Treaty Reinsurance by Product 1. Disease Insurance 2. Medical Insurance by Distribution Channel 1. Direct Writing 2. Agent and Broker 3. Bank by Category 1. Recurring reinsurance 2. Portfolio reinsurance 3. Retrocession reinsurance by End-Users 1. Children 2. Adults 3. Senior Citizens South America Life Reinsurance Market Key Players:

1. RGA Reinsurance Company 2. Constellation Insurance, Inc. 3. BMS Group 4. Odyssey Re 5. Allianz Group 6. Arch Reinsurance Ltd. 7. Kennedys 8. Fairfax Financial Holdings Limited 9. QBE Re 10. Chesterfield Group South America FAQs: 1. What are the growth drivers for the South America Life Reinsurance Market? Ans. Growth in South America’s economies is expected to be the major driver for the market. 2. Which type segment is dominating the South America Life Reinsurance Market? Ans. Treaty Reinsurance is dominating segment in the market. 3. Which country is expected to lead the global South America Life Reinsurance Market during the forecast period? Ans. Brazil is expected to lead the market during the forecast period. 4. What is the projected market size & growth rate of the South America Life Reinsurance Market? Ans. The South America Life Reinsurance Market size was valued at USD 22.20 Billion in 2022 and the total market revenue is expected to grow at a CAGR of 9.23 % from 2022 to 2029, reaching nearly USD 41.19 Billion. 5. What segments are covered in the South America Life Reinsurance Market report? Ans. The segments covered in the market report are Type, Product, Distribution Channel, Category, End-use, and Region.

1. South America Life Reinsurance Market: Research Methodology 2. South America Life Reinsurance Market: Executive Summary 3. South America Life Reinsurance Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. South America Life Reinsurance Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. South America Life Reinsurance Market: Segmentation (by Value USD and Volume Units) 5.1. South America Life Reinsurance Market, by Type (2022-2029) 5.1.1. Facultative Reinsurance 5.1.2. Treaty Reinsurance 5.2. South America Life Reinsurance Market, by Product (2022-2029) 5.2.1. Disease Insurance 5.2.2. Medical Insurance 5.3. South America Life Reinsurance Market, by Distribution Channel (2022-2029) 5.3.1. Direct Writing 5.3.2. Agent and Broker 5.3.3. Bank 5.4. South America Life Reinsurance Market, by Category (2022-2029) 5.4.1. Recurring reinsurance 5.4.2. Portfolio reinsurance 5.4.3. Retrocession reinsurance 5.5. South America Life Reinsurance Market, by End-Users (2022-2029) 5.5.1. Children 5.5.2. Adults 5.5.3. Senior Citizens 5.6. South America Life Reinsurance Market, by Country (2022-2029) 5.6.1. Brazil 5.6.2. Argentina 5.6.3. Rest of South America 6. Company Profile: Key players 6.1. RGA Reinsurance Company 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. Constellation Insurance, Inc. 6.3. BMS Group 6.4. Odyssey Re 6.5. Allianz Group 6.6. Arch Reinsurance Ltd. 6.7. Kennedys 6.8. Fairfax Financial Holdings Limited 6.9. QBE Re 6.10. Chesterfield Group South America 7. Key Findings 8. Industry Recommendation