The North America Life Reinsurance Market size was valued at USD 91.67 Billion in 2022 and the total North America Life Reinsurance Market revenue is expected to grow at a CAGR of 10.25% from 2023 to 2029, reaching nearly USD 181.50 Billion. The North American life reinsurance market has witnessed rapid growth in recent years as it is used for a variety of reasons, including risk management, capital management, access to technology and services, and alternative asset strategies. An insurer helps its policyholders accomplish their own uncertain upcoming economic risks. It does so by taking on those risks, pooling to diversify, and earning a return on the capital required to back the businesses. Some of the key companies operating in the North American life reinsurance market. This company offers a range of life reinsurance services using different frameworks and strategies. Any insurer's reinsurance policy and framework have a substantial influence on its final performance, business and risk outline, capital position, and capacity to stay solvent and grow, and thus continue to meet its policyholder’s needs well into the future.To know about the Research Methodology :- Request Free Sample Report

North America Life Reinsurance Market Scope and research methodology:

The North America Life Reinsurance Market report provides a comprehensive analysis of the market to stakeholders in the life reinsurance industry. It covers various aspects such as type, products, Distribution Channel, Category, and end users. The research methodology involves analyzing product-type literature, industry releases, annual reports, and other relevant documents of key industry participants. The report highlights industry players’ focus on technological advancements to establish dominance in the North America Life Reinsurance industry. Key players are also strengthening their market positions. The report aims to offer valuable insights and an in-depth analysis of the Market to assist stakeholders in making informed decisions and understanding market dynamics.North America Life Reinsurance Market Dynamics:

Increasing demand for life reinsurance in North America: As life insurance demand grows, life insurers require adequate reinsurance protection to support their expanding portfolios. Factors such as rising incomes, growing awareness of financial protection, and the need for retirement planning contribute to the increased demand for life insurance coverage. Life reinsurance companies help life insurance companies expand into new markets by protecting them against losses in these markets. This has led to an increasing demand for life reinsurance in North America. End-use demand is expected to drive the North America Life Reinsurance Market. Growing Developing Economies in North American Life Reinsurance Markets: The growing middle class and developing economies present significant opportunities for the North American life insurance industry. The highly intense North American life reinsurance sector has promising development prospects, due to the dynamic environment in developing markets, particularly in the United States, where North America Life Reinsurance industry are emerging and under-penetrated. Reinsurers that provide localized expertise and risk solutions have a competitive advantage in these emerging markets. North America's life reinsurance market is hindered by low-interest rates: Life reinsurers' investment income is negatively impacted by low-interest rates. Reinsurers invest in premiums to produce returns and maintain business operations. Reinsurers may find it difficult to achieve investment yields when interest rates are low for an extended period. This might affect their pricing capacity. Life reinsurers are subject to regulatory capital and solvency requirements that guarantee economic stability and policyholder protection. It can be difficult to strike a balance between maintaining adequate capital levels and maximizing profitability and growth. To successfully navigate the regulatory landscape, one must adhere to regulatory requirements and manage capital effectively. Low-interest rates restrain the life reinsurers market and prevent some market segments from utilizing them.North America Life Reinsurance Market Segment Analysis:

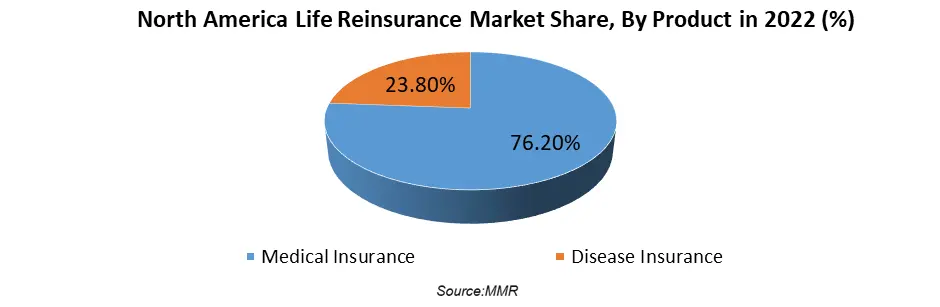

Based on type, Life Reinsurance is segmented into Facultative Reinsurance and Treaty Reinsurance. The facultative reinsurance segment dominated the North America Life Reinsurance Market in 2022 and is expected to continue during the forecast period. Facultative reinsurance allows the life reinsurance company to analyze individual risks and decide whether to accept or reject them. This makes it more attentive than treaty reinsurance. Facultative reinsurance is an analysis conducted by an insurer to cover only risks or a block of risks considered in the insurer's book of business. In a facultative reinsurance procedure, the ceding company and the reinsurer generate a facultative certificate that shows that the reinsurer accommodates a given risk.Based on product, the North America Life Reinsurance Market is segmented into Disease Insurance and Medical Insurance. The medical insurance segment dominates the North America Life Reinsurance industry with a high market share. This is because medical insurance covers a wide range of medical expenses, including doctor's visits, hospital stays, and prescription drugs. Disease insurance, the growth of the medical insurance market is driven by several factors, including the aging population, the rising prevalence of chronic diseases, and the increasing cost of healthcare. Medical insurance premiums are typically lower than disease insurance premiums. This is because medical insurance is a more comprehensive product that covers a wider range of medical expenses.

North America Life Reinsurance Market Country Insights:

The North American life reinsurance market includes the United States, Canada, and Mexico. The United States is the dominant player in the North American life reinsurance market, accounting for over 26.9% of the total market share. The growing middle class in North America is expected to drive demand for life reinsurance products and services, as these people have more disposable income to spend on leisure activities. The US has a large and diverse population with high disposable incomes. This creates a large pool of potential customers for life reinsurance products and services. Demand for life reinsurance products and services is expected to increase in the coming years, as people become more aware of the benefits of these products and services. The US has a strong economy and a favorable regulatory environment for the life reinsurance industry. Other players in the region include Canada and Mexico. The Canadian life reinsurance market is also growing rapidly, driven by factors such as a growing population, a rising middle class, and a strong economy. The Mexican life reinsurance market is also growing but at a slower pace than the Canadian market.Competitive Landscape

Key Players of the North America Life Reinsurance Market profiled in the report include Alleghany, Berkshire Hathaway Life, Everest Re Group, Ltd., Fairfax, Great-West Lifeco, Maiden Re, PartnerRe, RGA Reinsurance Company, SCOR SE, Sompo, Talcott Resolution, The Canada Life Assurance Company, Atlas Mag. This provides huge opportunities to serve many End-uses & customers and expand the North America Life Reinsurance Market.North America Life Reinsurance Market Scope: Inquire before buying

North America Life Reinsurance Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 91.67 Bn. Forecast Period 2023 to 2029 CAGR: 10.25% Market Size in 2029: US $ 181.50 Bn. Segments Covered: by Type 1.Facultative Reinsurance 2.Treaty Reinsurance by Product 1.Disease Insurance 2.Medical Insurance by Distribution Channel 1.Direct Writing 2.Agent and Broker 3.Bank by Category 1.Recurring reinsurance 2.Portfolio reinsurance 3.Retrocession reinsurance by End-Users 1.Children 2.Adults 3.Senior Citizens North America Life Reinsurance Key Players:

1.Alleghany 2. Berkshire Hathaway Life 3. Everest Re Group, Ltd. 4. Fairfax 5.Great-West Lifeco 6.Maiden Re 7.PartnerRe 8. RGA Reinsurance Company 9.SCOR SE 10.Sompo 11.Talcott Resolution 12.The Canada Life Assurance Company 13.Atlas Mag FAQs: 1. What are the growth drivers for the North America Life Reinsurance Market? Ans. Increasing demand for life reinsurance in North America is expected to be the major driver for the North America Life Reinsurance Market. 2. What is the major restraint for the North America Life Reinsurance Market growth? Ans. Low-interest rates are expected to be the major restraining factor for the North America market growth. 3. Which country is expected to lead the global North America Life Reinsurance Market during the forecast period? Ans. The United States is expected to lead the North America market during the forecast period. 4. What is the projected market size & growth rate of the North America Life Reinsurance Market? Ans. The North America Life Reinsurance Market size was valued at USD 91.67 Billion in 2022 and the total North America market revenue is expected to grow at a CAGR of 10.25% from 2022 to 2029, reaching nearly USD 181.50 Billion. 5. What segments are covered in the North America Life Reinsurance Market report? Ans. The segments covered in the North America Life Reinsurance Market report are Type, Product, Distribution Channel, Category and End-use.

1. North America Life Reinsurance Market: Research Methodology 2. North America Life Reinsurance Market: Executive Summary 3. North America Life Reinsurance Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. North America Life Reinsurance Market: Dynamics 4.1. Market Trends 4.2. Market Drivers 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Country 5. North America Life Reinsurance Market: Segmentation (by Value USD and Volume Units) 5.1. North America Life Reinsurance Market, by Type (2022-2029) 5.1.1. Facultative Reinsurance 5.1.2. Treaty Reinsurance 5.2. North America Life Reinsurance Market, by Product (2022-2029) 5.2.1. Disease Insurance 5.2.2. Medical Insurance 5.3. North America Life Reinsurance Market, by Distribution Channel (2022-2029) 5.3.1. Direct Writing 5.3.2. Agent and Broker 5.3.3. Bank 5.4. North America Life Reinsurance Market, by Category (2022-2029) 5.4.1. Recurring reinsurance 5.4.2. Portfolio reinsurance 5.4.3. Retrocession reinsurance 5.5. North America Life Reinsurance Market, by End-Users (2022-2029) 5.5.1. Children 5.5.2. Adults 5.5.3. Senior Citizens 5.6. North America Life Reinsurance Market, by Country (2022-2029) 5.6.1. United States 5.6.2. Canada 5.6.3. Mexico 6. Company Profile: Key players 6.1. Alleghany 6.1.1. Company Overview 6.1.2. Financial Overview 6.1.3. Business Portfolio 6.1.4. SWOT Analysis 6.1.5. Business Strategy 6.1.6. Recent Developments 6.2. Berkshire Hathaway Life 6.3. Everest Re Group, Ltd. 6.4. Fairfax 6.5. Great-West Lifeco 6.6. Maiden Re 6.7. PartnerRe 6.8. RGA Reinsurance Company 6.9. SCOR SE 6.10. Sompo 6.11. Talcott Resolution 6.12. The Canada Life Assurance Company 6.13. Atlas Mag 7. Key Findings 8. Industry Recommendation