Global Interposer and Fan Out Wafer Level Packaging Market size was valued at USD 33.41 Bn. in 2023 and the total Interposer and Fan Out Wafer Level Packaging revenue is expected to grow by 11.83% from 2024 to 2030, reaching nearly USD 73.08 Bn.Interposer and Fan Out Wafer Level Packaging Market Overview:

Interposer and Fan-Out Wafer Level Packaging (FOWLP) are superior packaging technologies used in the production of semiconductors to improve performance, lessen size, and better integration density for electronic devices. Interposer technology is about merging together a slim silicon or glass base, called interposer, in between different chips or die. It acts as a connector linking the chips and allows them to be connected closely with high effectiveness. This makes possible to combine various kinds of semiconductor technologies, like logic, memory and sensors onto one package; this results in better performance and function.To know about the Research Methodology :- Request Free Sample Report The Interposer and Fan-Out Wafer Level Packaging Market is experiencing vibrant growth because it is being pushed by various important aspects. The focus continues to be on improving performance, with a rising need for electronic devices that are both small in size but still offer high performance. Technologies like interposer and FOWLP assist in the condensed combination of numerous chips, boosting the overall power and capacity of electronic devices. On the other hand, there are certain constraints and issues that must be dealt with. The complexity of integration in FOWLP is a substantial difficulty, necessitating careful deliberation and management to guarantee smooth application. Technical difficulties regarding managing heat well, maintaining signal solidity, and stability also require continuous inventive work and money put into research. In terms of region, the Asia-Pacific region is leading and it's driven by countries such as China, Taiwan, South Korea, Japan and Singapore. These countries have improved technology methods along with strong manufacturing setups which makes them dominant in Interposer and FOWLP markets. TSMC and Broadcom are very important key players. They use their skills in technology, innovation ability as well as position in markets to keep a strong influence over the worldwide semiconductor market. The Interposer and Fan-Out Wafer Level Packaging industry show a hopeful environment with opportunities for progress, even though there are some difficulties that need careful handling and creativity.

Global Interposer and Fan Out Wafer Level Packaging Market Dynamics:

Market Growth Drivers1. Performance Improvement: In the world of consumer electronics, there is a growing trend toward making things smaller while still maintaining high performance. This requirement for creative answers such as Interposer and FOWLP helps in putting many chips close together which boosts the total power and capability of electronic devices.

2. Increased Demand for High-Bandwidth Applications: The rise of high-bandwidth applications such as 5G, AI, AR, and VR requires packing solutions to deal with increased data transfer speeds and reduce latency. Interposer and FOWLP have an important function by allowing the smooth incorporation of high-speed parts that help in faster data processing and communication, fulfilling the requirements for these advanced applications.

3. Cost Reduction and Improved Yield: When considering costs, Interposer and FOWLP technologies provide economic benefits. This is because they allow for the making of smaller and slimmer packages that use less material. Such advancements result in savings on materials and manufacturing expenses and increase the demand for the Interposer and Fan Out Wafer Level Packaging Market. These methods improve yield rates through wafer-level processing which helps to lower overall production costs when compared with conventional methods like wire bonding or flip-chip packaging.

Restraints Restraints in the Interposer and Fan Out Wafer Level Packaging Market1. Complexity of Integration: Integrating various components onto one substrate in FOWLP is not easy. It needs to be planned and organized very well, with a special focus on how several chips, interposers, and other elements are placed and connected. The complexity involved can slow down the rate of adoption because it necessitates companies to invest in skills and resources for the successful implementation of FOWLP.

2. Technical Challenges: Technological difficulties for FOWLP technologies involve making sure there is enough thermal management, signal integrity handling, and keeping reliability throughout the product's life. These problems need ongoing innovation and R&D investment that could act as a hurdle for a few companies.

3. Limited Market Awareness: Even though FOWLP could have many advantages, it might face a lack of knowledge from possible customers. If companies don't know about the benefits or feel that these new packaging technologies are untested and dangerous, they could be reluctant to adopt them. As a result, these are the restraints that can hamper the Interposer and Fan Out Wafer Level Packaging Market.

Market Growth Opportunities Potentials for the growth of the OTT Video Services Market:1. Advancements in Packaging Technology: Better performance, reliability, and ease of production for packaged devices are because of ongoing progress in Interposer and FOWLP materials, methods, and equipment. The progress involves new things like redistribution layers (RDLs) technologies, through-silicon vias (TSVs), wafer-level chip-scale packaging (WLCSP) as well as 3D integration methods that push the use of Interposer and FOWLP solutions.

2. Increasing Adoption in Emerging Markets: Markets such as the Internet of Things (IoT), wearable devices, automotive electronics, and industrial automation are seeing more usage of Interposer and FOWLP technologies in emerging markets. These markets need packaging solutions that are small-sized but also high-performing to handle the needs for connected devices like wearables, independent systems such as self-driving cars smart infrastructure found within factories, etc., which is driving the growth in Interposer and FOWLP industry.

Global Interposer and Fan Out Wafer Level Packaging Market Segment Analysis

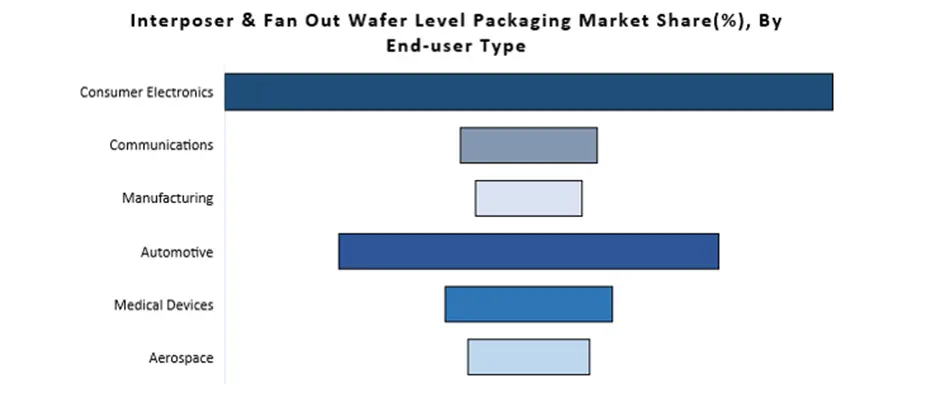

Based on the Packaging Component & Design, The growth of the Fan-out WLP segment is dominating the market. Fan-out WLPs have benefits that make them better than old packaging ways, like enhanced electrical performance, more density in integration, and superior handling of heat. The need for small yet powerful electronic tools such as smartphones, wearable devices, and IoT gadgets has boosted the acceptance of Fan-out WLPs. Fan-out WLPs, back up the idea of heterogeneous integration. This is where various chips are put together in one package. The present tendency is more towards complex designs for semiconductors; therefore, this method seems very reliable and useful for such needs. Also, fan-out WLPs have a good potential to lower down form factor and at the same time enhance energy efficiency. This characteristic makes it very attractive for data centers as well as high-performance computing applications that are significant drivers of growth in both interposer and fan-out WLP markets. Based on the End-User Type, From the analysis of the end-use industry, the market has been divided into sections such as consumer electronics, communications, manufacturing, and automotive; medical devices and aerospace are also included. The automotive part is expected to help push forward the growth of this market in coming years because there is more demand for advanced driver assistance systems (ADAS) as well as self-driving cars. The interposers and fan-out WLPs are very important for making ADAS sensors like LIDAR, RADAR, or cameras which need high performance but low power with small-size electronics. The direction of the market towards electric vehicles (EVs) and hybrid electric vehicles (HEVs) also drives demand for these technologies because it depends on clever power management systems that are efficiently made with interposers and fan-out WLPs. The increasing requirement for safety features like collision avoidance systems and infotainment systems speeds up the use of these packaging techniques in the automotive sector.

Interposer and Fan Out Wafer Level Packaging Market Regional Insights:

Countries from the Asia-Pacific region, especially Taiwan, South Korea, Japan, and Singapore are leading in the Interposer and Fan Out Wafer Level Packaging Market. These places have big businesses that create semiconductors as well as package them which makes these nations important participants in the global semiconductor industry. The reason why this region dominates is attributed to factors such as advancements in technology, robust manufacturing setup along substantial spending on Research and Development. The rise in the need for superior and effective chip packaging methods is driven by increasing requirements for consumer electronics like mobile phones, tablets, and laptops in regions such as China, India as well as South Korea. China is the largest importer of the Interposer and Fan Out Wafer Level Packaging Market. Manufacturing of IC’s creates a good revenue in China. Governments are putting substantial money into research and development activities to support the growth of the semiconductor sector. Hence, the adoption of interposer and fan-out wafer-level packaging technologies is increasing. North America region is expected to gain the popularity in the upcoming years for the interposer and fan-out wafer-level packaging industry. There is a good supply of high-tech manufacturing setup and expert workforce in this region, making interposers and fan-out WLPs here is expected to be done efficiently which helps to grow the market. North America has many important industries needing advanced packaging technologies like aerospace industry, defense sector as well as auto or healthcare. The need for top-level electronic devices that are not only efficient but also small and powerful in these areas pushes them towards using interposers and fan-out WLPs because they meet all specifications while delivering required performance standards too.Competitive Landscape: TSMC, the full form of which is Taiwan Semiconductor Manufacturing Company, is the biggest committed self-governing semiconductor foundry and are the bigeest manufacturer in Interposer & Fan Out Wafer Level Packaging industry. It has a prominent place in the worldwide production of semiconductors, delivering advanced procedures and making services to many clients across the world. TSMC keeps up its competitive edge through being at the forefront of technology, always creating new things and having powerful abilities for manufacturing. Broadcom, a big worldwide technology company, is known for making semiconductors and software solutions for infrastructure. Their products are wide-ranging and cover different markets such as networking, storage, broadband services as well as wireless communications along with industrial uses too. The competitive environment of Broadcom is influenced by its dedication to innovation in technology, planned purchases and powerful market position. Texas Instruments, a worldwide semiconductor company, concentrates on analog and embedded processing technologies. The competitive field of TI is marked by its distinct emphasis on analog and embedded solutions that serve as crucial parts in many different applications like automotive industry or even day-to-day electronic items for consumers such as those found at home and work places. Samsung is an international conglomerate known for its various business activities such as producing semiconductors, creating consumer electronics products along with mobile communications divisions. Samsung is a big company in the semiconductor industry, and it has significant presence especially for memory chips as well as advanced logic chips. The competitive environment of Samsung is affected by its vertical integration strategy, technological abilities and market position. Samsung competes with other main players like Intel, TSMC and SK Hynix in many parts of the semiconductor market.

The objective of the report is to present a comprehensive analysis of the global Interposer and Fan Out Wafer Level Packaging Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which gives a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Global Interposer and Fan Out Wafer Level Packaging Market dynamic, and structure by analyzing the market segments and projecting the Global Interposer and Fan Out Wafer Level Packaging Market size. Clear representation of competitive analysis of key players By Price Range, price, financial position, product portfolio, growth strategies, and regional presence in the Global Interposer and Fan Out Wafer Level Packaging Market make the report an investor’s guide.

Global Interposer and Fan Out Wafer Level Packaging Market Scope:Inquire Before Buying

Global Interposer and Fan Out Wafer Level Packaging Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 33.41 Bn. Forecast Period 2024 to 2030 CAGR: 11.83% Market Size in 2030: US $ 73.08 Bn. Segments Covered: by Packaging Component & Design Interposer FOWLP by Packaging Type 2.5D 3D by Device Type Logic ICs Imaging & Optoelectronics LEDs MEMS/Sensors Memory Devices Others by End-User Type Consumer Electronics Communications Manufacturing Automotive Medical Devices Aerospace Interposer and Fan Out Wafer Level Packaging Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Interposer and Fan Out Wafer Level Packaging Market Key Players

North America 1. Amkor Technology - [United States] 2. Broadcom - [United States] 3. Texas Instruments Incorporated - [United States] 4. LAM RESEARCH CORPORATION - [United States] Europe 1. Infineon Technologies AG - [Germany] 2. STMicroelectronics - [Switzerland] Asia Pacific 1. Samsung - [South Korea] 2. Taiwan Semiconductor Manufacturing Company Ltd. - [Taiwan] 3. SK HYNIX INC. - [South Korea] 4. ASE Technology Holding Co. Ltd. - [Taiwan] 5. United Microelectronics Corporation - [Taiwan] 6. TOSHIBA CORPORATION - [Japan] 7. Powertech Technology Inc. - [Taiwan] 8. Siliconware Precision Industries Co. Ltd. - [Taiwan] 9. VeriSilicon Limited - [China] 10. Murata Manufacturing Co. Ltd. - [Japan] 11. STATS ChipPAC Pte. Ltd. - [Singapore] 12. UTAC - [Singapore] 13. ASTI Holdings Limited - [Singapore] Frequently Asked Questions: 1] What segments are covered in the Interposer and Fan Out Wafer Level Packaging Market report? Ans. The segments covered in the Interposer and Fan Out Wafer Level Packaging Market report are based on Packaging Component and Design, Packaging Type, Device Type, and End-User Type. 2] Which region is expected to hold the highest share in the global Interposer and Fan Out Wafer Level Packaging Market? Ans. North America is expected to hold the highest share of the global Interposer and Fan Out Wafer Level Packaging Market. 3] What is the market size of the global Interposer and Fan Out Wafer Level Packaging Market by 2030? Ans. The market size of the global Interposer and Fan Out Wafer Level Packaging Market by 2030 is US $ 73.08 Bn. 4] Who are the top key players in the global Interposer and Fan Out Wafer Level Packaging Market? Ans. Taiwan Semiconductor Manufacturing Company Ltd., Infineon Technologies, and STMicroelectronics are the top key players in the global Interposer and Fan Out Wafer Level Packaging Market. 5] What was the market size of the global Interposer and Fan Out Wafer Level Packaging Market in 2023? Ans. The market size of the global Interposer and Fan Out Wafer Level Packaging Market in 2023 was US $ 33.41 Bn.

1. Interposer and Fan Out Wafer Level Packaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Interposer and Fan Out Wafer Level Packaging Market: Dynamics 2.1. Interposer and Fan Out Wafer Level Packaging Market Trends by Region 2.1.1. North America Interposer and Fan Out Wafer Level Packaging Market Trends 2.1.2. Europe Interposer and Fan Out Wafer Level Packaging Market Trends 2.1.3. Asia Pacific Interposer and Fan Out Wafer Level Packaging Market Trends 2.1.4. Middle East and Africa Interposer and Fan Out Wafer Level Packaging Market Trends 2.1.5. South America Interposer and Fan Out Wafer Level Packaging Market Trends 2.2. Interposer and Fan Out Wafer Level Packaging Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Interposer and Fan Out Wafer Level Packaging Market Drivers 2.2.1.2. North America Interposer and Fan Out Wafer Level Packaging Market Restraints 2.2.1.3. North America Interposer and Fan Out Wafer Level Packaging Market Opportunities 2.2.1.4. North America Interposer and Fan Out Wafer Level Packaging Market Challenges 2.2.2. Europe 2.2.2.1. Europe Interposer and Fan Out Wafer Level Packaging Market Drivers 2.2.2.2. Europe Interposer and Fan Out Wafer Level Packaging Market Restraints 2.2.2.3. Europe Interposer and Fan Out Wafer Level Packaging Market Opportunities 2.2.2.4. Europe Interposer and Fan Out Wafer Level Packaging Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Interposer and Fan Out Wafer Level Packaging Market Drivers 2.2.3.2. Asia Pacific Interposer and Fan Out Wafer Level Packaging Market Restraints 2.2.3.3. Asia Pacific Interposer and Fan Out Wafer Level Packaging Market Opportunities 2.2.3.4. Asia Pacific Interposer and Fan Out Wafer Level Packaging Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Interposer and Fan Out Wafer Level Packaging Market Drivers 2.2.4.2. Middle East and Africa Interposer and Fan Out Wafer Level Packaging Market Restraints 2.2.4.3. Middle East and Africa Interposer and Fan Out Wafer Level Packaging Market Opportunities 2.2.4.4. Middle East and Africa Interposer and Fan Out Wafer Level Packaging Market Challenges 2.2.5. South America 2.2.5.1. South America Interposer and Fan Out Wafer Level Packaging Market Drivers 2.2.5.2. South America Interposer and Fan Out Wafer Level Packaging Market Restraints 2.2.5.3. South America Interposer and Fan Out Wafer Level Packaging Market Opportunities 2.2.5.4. South America Interposer and Fan Out Wafer Level Packaging Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Interposer and Fan Out Wafer Level Packaging Industry 2.8. Analysis of Government Schemes and Initiatives For Interposer and Fan Out Wafer Level Packaging Industry 2.9. Interposer and Fan Out Wafer Level Packaging Market Trade Analysis 2.10. The Global Pandemic Impact on Interposer and Fan Out Wafer Level Packaging Market 3. Interposer and Fan Out Wafer Level Packaging Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 3.1.1. Interposer 3.1.2. FOWLP 3.2. Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 3.2.1. 2.5D 3.2.2. 3D 3.3. Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 3.3.1. Logic ICs 3.3.2. Imaging & Optoelectronics 3.3.3. LEDs 3.3.4. MEMS/Sensors 3.3.5. Memory Devices 3.3.6. Others 3.4. Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 3.4.1. Consumer Electronics 3.4.2. Communications 3.4.3. Manufacturing 3.4.4. Automotive 3.4.5. Medical Devices 3.4.6. Aerospace 3.5. Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 4.1.1. Interposer 4.1.2. FOWLP 4.2. North America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 4.2.1. 2.5D 4.2.2. 3D 4.3. North America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 4.3.1. Logic ICs 4.3.2. Imaging & Optoelectronics 4.3.3. LEDs 4.3.4. MEMS/Sensors 4.3.5. Memory Devices 4.3.6. Others 4.4. North America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 4.4.1. Consumer Electronics 4.4.2. Communications 4.4.3. Manufacturing 4.4.4. Automotive 4.4.5. Medical Devices 4.4.6. Aerospace 4.5. North America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 4.5.1.1.1. Interposer 4.5.1.1.2. FOWLP 4.5.1.2. United States Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 4.5.1.2.1. 2.5D 4.5.1.2.2. 3D 4.5.1.3. United States Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 4.5.1.3.1. Logic ICs 4.5.1.3.2. Imaging & Optoelectronics 4.5.1.3.3. LEDs 4.5.1.3.4. MEMS/Sensors 4.5.1.3.5. Memory Devices 4.5.1.3.6. Others 4.5.1.4. United States Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 4.5.1.4.1. Consumer Electronics 4.5.1.4.2. Communications 4.5.1.4.3. Manufacturing 4.5.1.4.4. Automotive 4.5.1.4.5. Medical Devices 4.5.1.4.6. Aerospace 4.5.2. Canada 4.5.2.1. Canada Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 4.5.2.1.1. Interposer 4.5.2.1.2. FOWLP 4.5.2.2. Canada Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 4.5.2.2.1. 2.5D 4.5.2.2.2. 3D 4.5.2.3. Canada Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 4.5.2.3.1. Logic ICs 4.5.2.3.2. Imaging & Optoelectronics 4.5.2.3.3. LEDs 4.5.2.3.4. MEMS/Sensors 4.5.2.3.5. Memory Devices 4.5.2.3.6. Others 4.5.2.4. Canada Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 4.5.2.4.1. Consumer Electronics 4.5.2.4.2. Communications 4.5.2.4.3. Manufacturing 4.5.2.4.4. Automotive 4.5.2.4.5. Medical Devices 4.5.2.4.6. Aerospace 4.5.3. Mexico 4.5.3.1. Mexico Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 4.5.3.1.1. Interposer 4.5.3.1.2. FOWLP 4.5.3.2. Mexico Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 4.5.3.2.1. 2.5D 4.5.3.2.2. 3D 4.5.3.3. Mexico Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 4.5.3.3.1. Logic ICs 4.5.3.3.2. Imaging & Optoelectronics 4.5.3.3.3. LEDs 4.5.3.3.4. MEMS/Sensors 4.5.3.3.5. Memory Devices 4.5.3.3.6. Others 4.5.3.4. Mexico Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 4.5.3.4.1. Consumer Electronics 4.5.3.4.2. Communications 4.5.3.4.3. Manufacturing 4.5.3.4.4. Automotive 4.5.3.4.5. Medical Devices 4.5.3.4.6. Aerospace 5. Europe Interposer and Fan Out Wafer Level Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 5.2. Europe Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 5.3. Europe Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 5.4. Europe Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 5.5. Europe Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 5.5.1.2. United Kingdom Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 5.5.1.3. United Kingdom Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 5.5.1.4. United Kingdom Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 5.5.2. France 5.5.2.1. France Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 5.5.2.2. France Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 5.5.2.3. France Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 5.5.2.4. France Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 5.5.3.2. Germany Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 5.5.3.3. Germany Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 5.5.3.4. Germany Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 5.5.4.2. Italy Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 5.5.4.3. Italy Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 5.5.4.4. Italy Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 5.5.5.2. Spain Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 5.5.5.3. Spain Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 5.5.5.4. Spain Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 5.5.6.2. Sweden Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 5.5.6.3. Sweden Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 5.5.6.4. Sweden Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 5.5.7.2. Austria Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 5.5.7.3. Austria Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 5.5.7.4. Austria Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 5.5.8.2. Rest of Europe Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 5.5.8.3. Rest of Europe Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 5.5.8.4. Rest of Europe Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 6. Asia Pacific Interposer and Fan Out Wafer Level Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 6.2. Asia Pacific Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 6.3. Asia Pacific Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 6.4. Asia Pacific Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 6.5. Asia Pacific Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 6.5.1.2. China Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 6.5.1.3. China Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 6.5.1.4. China Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 6.5.2.2. S Korea Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 6.5.2.3. S Korea Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 6.5.2.4. S Korea Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 6.5.3.2. Japan Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 6.5.3.3. Japan Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 6.5.3.4. Japan Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 6.5.4. India 6.5.4.1. India Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 6.5.4.2. India Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 6.5.4.3. India Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 6.5.4.4. India Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 6.5.5.2. Australia Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 6.5.5.3. Australia Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 6.5.5.4. Australia Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 6.5.6.2. Indonesia Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 6.5.6.3. Indonesia Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 6.5.6.4. Indonesia Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 6.5.7.2. Malaysia Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 6.5.7.3. Malaysia Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 6.5.7.4. Malaysia Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 6.5.8.2. Vietnam Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 6.5.8.3. Vietnam Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 6.5.8.4. Vietnam Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 6.5.9.2. Taiwan Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 6.5.9.3. Taiwan Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 6.5.9.4. Taiwan Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 6.5.10.2. Rest of Asia Pacific Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 6.5.10.3. Rest of Asia Pacific Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 6.5.10.4. Rest of Asia Pacific Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 7. Middle East and Africa Interposer and Fan Out Wafer Level Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 7.2. Middle East and Africa Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 7.3. Middle East and Africa Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 7.4. Middle East and Africa Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 7.5. Middle East and Africa Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 7.5.1.2. South Africa Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 7.5.1.3. South Africa Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 7.5.1.4. South Africa Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 7.5.2.2. GCC Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 7.5.2.3. GCC Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 7.5.2.4. GCC Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 7.5.3.2. Nigeria Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 7.5.3.3. Nigeria Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 7.5.3.4. Nigeria Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 7.5.4.2. Rest of ME&A Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 7.5.4.3. Rest of ME&A Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 7.5.4.4. Rest of ME&A Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 8. South America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 8.2. South America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 8.3. South America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type(2023-2030) 8.4. South America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 8.5. South America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 8.5.1.2. Brazil Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 8.5.1.3. Brazil Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 8.5.1.4. Brazil Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 8.5.2.2. Argentina Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 8.5.2.3. Argentina Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 8.5.2.4. Argentina Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Component & Design (2023-2030) 8.5.3.2. Rest Of South America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Packaging Type (2023-2030) 8.5.3.3. Rest Of South America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by Device Type (2023-2030) 8.5.3.4. Rest Of South America Interposer and Fan Out Wafer Level Packaging Market Size and Forecast, by End User Type (2023-2030) 9. Global Interposer and Fan Out Wafer Level Packaging Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Interposer and Fan Out Wafer Level Packaging Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Amkor Technology - [United States] 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Broadcom - [United States] 10.3. Texas Instruments Incorporated - [United States] 10.4. LAM RESEARCH CORPORATION - [United States] 10.5. Infineon Technologies AG - [Germany] 10.6. STMicroelectronics - [Switzerland] 10.7. Samsung - [South Korea] 10.8. Taiwan Semiconductor Manufacturing Company Ltd. - [Taiwan] 10.9. SK HYNIX INC. - [South Korea] 10.10. ASE Technology Holding Co. Ltd. - [Taiwan] 10.11. United Microelectronics Corporation - [Taiwan] 10.12. TOSHIBA CORPORATION - [Japan] 10.13. Powertech Technology Inc. - [Taiwan] 10.14. Siliconware Precision Industries Co. Ltd. - [Taiwan] 10.15. VeriSilicon Limited - [China] 10.16. Murata Manufacturing Co. Ltd. - [Japan] 10.17. STATS ChipPAC Pte. Ltd. - [Singapore] 10.18. UTAC - [Singapore] 10.19. ASTI Holdings Limited - [Singapore] 11. Key Findings 12. Industry Recommendations 13. Interposer and Fan Out Wafer Level Packaging Market: Research Methodology 14. Terms and Glossary