ATM Market was worth US$ 22.20 Bn. in 2022 and total revenue is expected to grow at a rate of 4.9% CAGR from 2023 to 2029, the ATM Market is reaching almost US$ 31.04 Bn. in 2029.ATM Market Overview:

An automated teller machine (ATM) is an electronic banking outlet that allows consumers to conduct all fundamental banking activities such as deposits, withdrawals, account balance checks, balance transfers, and check clearing without the assistance of a branch staff or teller. Customers can access financial services at any time of day or night thanks to ATMs. The increase in installation base and maintenance activities has had a significant influence on income generation. It is vital to have an efficient cash management solution in order to accomplish ATM depositing and cash distribution. Cash recycling is a cost-effective cash management system that provides banks with benefits like counterfeit identification, complete and total accuracy, and improved customer service.To know about the Research Methodology :- Request Free Sample Report

ATM Market Dynamics:

Customers in numerous countries select cash as their preferred method of payment due to its convenience. Customers are demanding faster, more reliable, secure, and convenient ways to access cash as technology advances, which is a key driver contributing to the worldwide ATM market's growth. Furthermore, the market's expansion is fuelled by rising demand for ATMs, rising costs of managing, handling, and transporting ATM equipment, and rising ATM security costs. The ATM industry is growing due to an increase in the need for automation in the banking sector in both emerging and developed countries such as the United States, Canada, Italy, and China. Furthermore, during the last several decades, the global banking sector has seen significant technical breakthroughs, such as the integration of IoT data analysis, digital convergence, biometrics, and cyber security, all of which have fuelled market expansion. Customers can use ATMs to open or withdraw FDs, recharge phone bills, pay income tax, and apply for personal loans, in addition to cash withdrawal and checking accounts. Improvements in security methods such as biometrics, fingerprints, EMV adoption, cash recycling, video banking, and two-factor authentication services to prevent fraudulent transactions, on the other hand, are expected to provide attractive market expansion potential. New security features are being introduced by banks to evaluate whether the physical card is a fake or duplicate. For example, the Reserve Bank of India mandated that banks replace their older magnetic stripe cards to EMV chip cards in January 2022, citing the benefits of better authentication and the prevention of scams and fraudulent operations. In the next years, the development in digitalization in developing countries is likely to have a negative impact on the automated teller machine (ATM) industry income. This is due to the increased popularity of digital payment options such as online and mobile banking, digital wallets, and Bitcoin transactions among consumers. These internet banking channels provide convenient, fast, and secure transactions, limiting the growth of the global ATM market.ATM Market Segment Analysis:

ATM Market is segmented into Solution and Cash type. Based on Solution, the market is sub-segmented into Development solution and Managed service. ATM deployment solutions will lead the market in 2022, accounting for more than half of the whole market. Installing, setting up, testing, running, and implementing an ATM are all part of the deployment process. Onsite, offsite, workplace, and mobile ATMs are the several types of ATMs. On-site ATMs are positioned within or near the bank, and can be used in conjunction with the physical branch. These ATMs relieve bank staff' workload by avoiding long lines for withdrawals, cash deposits, and transfers on bank premises. These ATMs also lower the likelihood of errors during withdrawals and deposits, allowing banks to do business smoothly. In the foreseeable future, these factors are expected to drive demand for onsite ATMs. Based on Cash Type, the market is sub-segmented into Cash dispenser, Cash deposit and Cash recycle. Cash dispenser ATMs have made it possible for consumers to withdraw cash for their daily requirements at any time. The increased use of cash in transportation, grocery stores, and stationary stores has resulted in a demand for cash recycling machines that can exchange old currency denominations for new ones. The cash deposit feature allows users to deposit cash into their bank accounts without having to go to the bank and using a highly accurate technology platform.

ATM Market Regional Insights:

The Asia Pacific regional automated teller machine market is expected to grow at a 5.9% CAGR. The increasing deployment of ATMs, mostly in developing nations such as China and India, is credited to the regional market's growth. In most economies in the region, there is a lack of understanding about digital payment options, which reinforces the significance of ATMs for cash-based and other financial activities. The Asia Pacific region has the most ATMs, with over three million deployed worldwide. Due to significant technical improvements in the banking business, the market in Europe has a high growth potential. The Middle East and Africa market is expected to grow at a healthy rate throughout the projected period, owing to increased demand for interactive machines and managed services in the financial sector. Furthermore, due to the cash-based economy, high consumer demand, and government support for electronic banking, MEA is expected to grow rapidly.The objective of the report is to present a comprehensive analysis of the global ATM market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the global ATM market dynamics, structure by analyzing the market segments and project the global ATM market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global ATM market make the report investor’s guide.ATM Market Scope: Inquire before buying

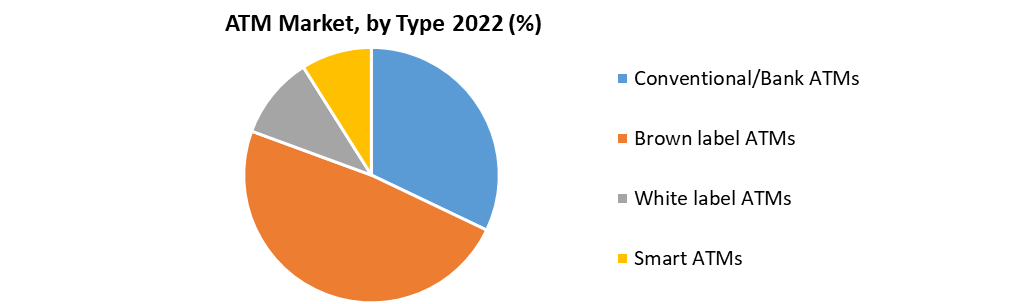

ATM Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 22.20 Bn. Forecast Period 2023 to 2029 CAGR: 4.9% Market Size in 2029: US $ 31.04 Bn. Segments Covered: by Solution Onsite ATMs Offsite ATMs Work site ATMs Mobile ATMs by Size 15'' and Below Above 15'' by Type Conventional/Bank ATMs Brown label ATMs White label ATMs Smart ATMs ATM Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)ATM Market Key Players are:

1. Euronet 2. Diebold 3. GRG Banking 4. Nautilus Hyosung 5. HessCash Systems 6. Hitachi-Omron Terminals Solutions 7. Fujitsu 8. NCR Corporation 9. Triton Systems 10.Tidel Engineering 11.Hitachi-Omron Terminal Solutions Corporation 12.China Electronics Corporation HEXAGON 13.OKI Electric Industry Co., Ltd. 14.Brink's Company 15.Wincor Nixdorf AGFrequently Asked Questions:

1. Which region has the largest share in Global ATM Market? Ans: Asia Pacific region holds the highest share in 2022. 2. What is the growth rate of Global ATM Market? Ans: The Global ATM Market is growing at a CAGR of 4.9% during forecasting period 2023-2029. 3. What is scope of the Global ATM market report? Ans: Global ATM Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 4. Who are the key players in Global ATM market? Ans: The important key players in the Global ATM Market are – Euronet, Diebold, GRG Banking, Nautilus Hyosung, HessCash Systems, Hitachi-Omron Terminals Solutions, Fujitsu, NCR Corporation, Triton Systems, Tidel Engineering, Hitachi-Omron Terminal Solutions Corporation, China Electronics Corporation HEXAGON, OKI Electric Industry Co., Ltd., Brink's Company, and Wincor Nixdorf AG 5. What is the study period of this market? Ans: The Global ATM Market is studied from 2022 to 2029.

1. ATM Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. ATM Market: Dynamics 2.1. ATM Market Trends by Region 2.1.1. North America ATM Market Trends 2.1.2. Europe ATM Market Trends 2.1.3. Asia Pacific ATM Market Trends 2.1.4. Middle East and Africa ATM Market Trends 2.1.5. South America ATM Market Trends 2.2. ATM Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America ATM Market Drivers 2.2.1.2. North America ATM Market Restraints 2.2.1.3. North America ATM Market Opportunities 2.2.1.4. North America ATM Market Challenges 2.2.2. Europe 2.2.2.1. Europe ATM Market Drivers 2.2.2.2. Europe ATM Market Restraints 2.2.2.3. Europe ATM Market Opportunities 2.2.2.4. Europe ATM Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific ATM Market Drivers 2.2.3.2. Asia Pacific ATM Market Restraints 2.2.3.3. Asia Pacific ATM Market Opportunities 2.2.3.4. Asia Pacific ATM Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa ATM Market Drivers 2.2.4.2. Middle East and Africa ATM Market Restraints 2.2.4.3. Middle East and Africa ATM Market Opportunities 2.2.4.4. Middle East and Africa ATM Market Challenges 2.2.5. South America 2.2.5.1. South America ATM Market Drivers 2.2.5.2. South America ATM Market Restraints 2.2.5.3. South America ATM Market Opportunities 2.2.5.4. South America ATM Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For ATM Industry 2.8. Analysis of Government Schemes and Initiatives For ATM Industry 2.9. ATM Market Trade Analysis 2.10. The Global Pandemic Impact on ATM Market 3. ATM Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. ATM Market Size and Forecast, by Solution (2022-2029) 3.1.1. Onsite ATMs 3.1.2. Offsite ATMs 3.1.3. Work site ATMs 3.1.4. Mobile ATMs 3.2. ATM Market Size and Forecast, by Size (2022-2029) 3.2.1. 15'' and Below 3.2.2. Above 15'' 3.3. ATM Market Size and Forecast, by Type (2022-2029) 3.3.1. Conventional/Bank ATMs 3.3.2. Brown label ATMs 3.3.3. White label ATMs 3.3.4. Smart ATMs 3.4. ATM Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America ATM Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America ATM Market Size and Forecast, by Solution (2022-2029) 4.1.1. Onsite ATMs 4.1.2. Offsite ATMs 4.1.3. Work site ATMs 4.1.4. Mobile ATMs 4.2. North America ATM Market Size and Forecast, by Size (2022-2029) 4.2.1. 15'' and Below 4.2.2. Above 15'' 4.3. North America ATM Market Size and Forecast, by Type (2022-2029) 4.3.1. Conventional/Bank ATMs 4.3.2. Brown label ATMs 4.3.3. White label ATMs 4.3.4. Smart ATMs 4.4. North America ATM Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States ATM Market Size and Forecast, by Solution (2022-2029) 4.4.1.1.1. Onsite ATMs 4.4.1.1.2. Offsite ATMs 4.4.1.1.3. Work site ATMs 4.4.1.1.4. Mobile ATMs 4.4.1.2. United States ATM Market Size and Forecast, by Size (2022-2029) 4.4.1.2.1. 15'' and Below 4.4.1.2.2. Above 15'' 4.4.1.3. United States ATM Market Size and Forecast, by Type (2022-2029) 4.4.1.3.1. Conventional/Bank ATMs 4.4.1.3.2. Brown label ATMs 4.4.1.3.3. White label ATMs 4.4.1.3.4. Smart ATMs 4.4.2. Canada 4.4.2.1. Canada ATM Market Size and Forecast, by Solution (2022-2029) 4.4.2.1.1. Onsite ATMs 4.4.2.1.2. Offsite ATMs 4.4.2.1.3. Work site ATMs 4.4.2.1.4. Mobile ATMs 4.4.2.2. Canada ATM Market Size and Forecast, by Size (2022-2029) 4.4.2.2.1. 15'' and Below 4.4.2.2.2. Above 15'' 4.4.2.3. Canada ATM Market Size and Forecast, by Type (2022-2029) 4.4.2.3.1. Conventional/Bank ATMs 4.4.2.3.2. Brown label ATMs 4.4.2.3.3. White label ATMs 4.4.2.3.4. Smart ATMs 4.4.3. Mexico 4.4.3.1. Mexico ATM Market Size and Forecast, by Solution (2022-2029) 4.4.3.1.1. Onsite ATMs 4.4.3.1.2. Offsite ATMs 4.4.3.1.3. Work site ATMs 4.4.3.1.4. Mobile ATMs 4.4.3.2. Mexico ATM Market Size and Forecast, by Size (2022-2029) 4.4.3.2.1. 15'' and Below 4.4.3.2.2. Above 15'' 4.4.3.3. Mexico ATM Market Size and Forecast, by Type (2022-2029) 4.4.3.3.1. Conventional/Bank ATMs 4.4.3.3.2. Brown label ATMs 4.4.3.3.3. White label ATMs 4.4.3.3.4. Smart ATMs 5. Europe ATM Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe ATM Market Size and Forecast, by Solution (2022-2029) 5.2. Europe ATM Market Size and Forecast, by Size (2022-2029) 5.3. Europe ATM Market Size and Forecast, by Type (2022-2029) 5.4. Europe ATM Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom ATM Market Size and Forecast, by Solution (2022-2029) 5.4.1.2. United Kingdom ATM Market Size and Forecast, by Size (2022-2029) 5.4.1.3. United Kingdom ATM Market Size and Forecast, by Type(2022-2029) 5.4.2. France 5.4.2.1. France ATM Market Size and Forecast, by Solution (2022-2029) 5.4.2.2. France ATM Market Size and Forecast, by Size (2022-2029) 5.4.2.3. France ATM Market Size and Forecast, by Type(2022-2029) 5.4.3. Germany 5.4.3.1. Germany ATM Market Size and Forecast, by Solution (2022-2029) 5.4.3.2. Germany ATM Market Size and Forecast, by Size (2022-2029) 5.4.3.3. Germany ATM Market Size and Forecast, by Type (2022-2029) 5.4.4. Italy 5.4.4.1. Italy ATM Market Size and Forecast, by Solution (2022-2029) 5.4.4.2. Italy ATM Market Size and Forecast, by Size (2022-2029) 5.4.4.3. Italy ATM Market Size and Forecast, by Type(2022-2029) 5.4.5. Spain 5.4.5.1. Spain ATM Market Size and Forecast, by Solution (2022-2029) 5.4.5.2. Spain ATM Market Size and Forecast, by Size (2022-2029) 5.4.5.3. Spain ATM Market Size and Forecast, by Type (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden ATM Market Size and Forecast, by Solution (2022-2029) 5.4.6.2. Sweden ATM Market Size and Forecast, by Size (2022-2029) 5.4.6.3. Sweden ATM Market Size and Forecast, by Type (2022-2029) 5.4.7. Austria 5.4.7.1. Austria ATM Market Size and Forecast, by Solution (2022-2029) 5.4.7.2. Austria ATM Market Size and Forecast, by Size (2022-2029) 5.4.7.3. Austria ATM Market Size and Forecast, by Type (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe ATM Market Size and Forecast, by Solution (2022-2029) 5.4.8.2. Rest of Europe ATM Market Size and Forecast, by Size (2022-2029) 5.4.8.3. Rest of Europe ATM Market Size and Forecast, by Type (2022-2029) 6. Asia Pacific ATM Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific ATM Market Size and Forecast, by Solution (2022-2029) 6.2. Asia Pacific ATM Market Size and Forecast, by Size (2022-2029) 6.3. Asia Pacific ATM Market Size and Forecast, by Type (2022-2029) 6.4. Asia Pacific ATM Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China ATM Market Size and Forecast, by Solution (2022-2029) 6.4.1.2. China ATM Market Size and Forecast, by Size (2022-2029) 6.4.1.3. China ATM Market Size and Forecast, by Type (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea ATM Market Size and Forecast, by Solution (2022-2029) 6.4.2.2. S Korea ATM Market Size and Forecast, by Size (2022-2029) 6.4.2.3. S Korea ATM Market Size and Forecast, by Type (2022-2029) 6.4.3. Japan 6.4.3.1. Japan ATM Market Size and Forecast, by Solution (2022-2029) 6.4.3.2. Japan ATM Market Size and Forecast, by Size (2022-2029) 6.4.3.3. Japan ATM Market Size and Forecast, by Type (2022-2029) 6.4.4. India 6.4.4.1. India ATM Market Size and Forecast, by Solution (2022-2029) 6.4.4.2. India ATM Market Size and Forecast, by Size (2022-2029) 6.4.4.3. India ATM Market Size and Forecast, by Type (2022-2029) 6.4.5. Australia 6.4.5.1. Australia ATM Market Size and Forecast, by Solution (2022-2029) 6.4.5.2. Australia ATM Market Size and Forecast, by Size (2022-2029) 6.4.5.3. Australia ATM Market Size and Forecast, by Type (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia ATM Market Size and Forecast, by Solution (2022-2029) 6.4.6.2. Indonesia ATM Market Size and Forecast, by Size (2022-2029) 6.4.6.3. Indonesia ATM Market Size and Forecast, by Type (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia ATM Market Size and Forecast, by Solution (2022-2029) 6.4.7.2. Malaysia ATM Market Size and Forecast, by Size (2022-2029) 6.4.7.3. Malaysia ATM Market Size and Forecast, by Type (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam ATM Market Size and Forecast, by Solution (2022-2029) 6.4.8.2. Vietnam ATM Market Size and Forecast, by Size (2022-2029) 6.4.8.3. Vietnam ATM Market Size and Forecast, by Type(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan ATM Market Size and Forecast, by Solution (2022-2029) 6.4.9.2. Taiwan ATM Market Size and Forecast, by Size (2022-2029) 6.4.9.3. Taiwan ATM Market Size and Forecast, by Type (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific ATM Market Size and Forecast, by Solution (2022-2029) 6.4.10.2. Rest of Asia Pacific ATM Market Size and Forecast, by Size (2022-2029) 6.4.10.3. Rest of Asia Pacific ATM Market Size and Forecast, by Type (2022-2029) 7. Middle East and Africa ATM Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa ATM Market Size and Forecast, by Solution (2022-2029) 7.2. Middle East and Africa ATM Market Size and Forecast, by Size (2022-2029) 7.3. Middle East and Africa ATM Market Size and Forecast, by Type (2022-2029) 7.4. Middle East and Africa ATM Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa ATM Market Size and Forecast, by Solution (2022-2029) 7.4.1.2. South Africa ATM Market Size and Forecast, by Size (2022-2029) 7.4.1.3. South Africa ATM Market Size and Forecast, by Type (2022-2029) 7.4.2. GCC 7.4.2.1. GCC ATM Market Size and Forecast, by Solution (2022-2029) 7.4.2.2. GCC ATM Market Size and Forecast, by Size (2022-2029) 7.4.2.3. GCC ATM Market Size and Forecast, by Type (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria ATM Market Size and Forecast, by Solution (2022-2029) 7.4.3.2. Nigeria ATM Market Size and Forecast, by Size (2022-2029) 7.4.3.3. Nigeria ATM Market Size and Forecast, by Type (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A ATM Market Size and Forecast, by Solution (2022-2029) 7.4.4.2. Rest of ME&A ATM Market Size and Forecast, by Size (2022-2029) 7.4.4.3. Rest of ME&A ATM Market Size and Forecast, by Type (2022-2029) 8. South America ATM Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America ATM Market Size and Forecast, by Solution (2022-2029) 8.2. South America ATM Market Size and Forecast, by Size (2022-2029) 8.3. South America ATM Market Size and Forecast, by Type(2022-2029) 8.4. South America ATM Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil ATM Market Size and Forecast, by Solution (2022-2029) 8.4.1.2. Brazil ATM Market Size and Forecast, by Size (2022-2029) 8.4.1.3. Brazil ATM Market Size and Forecast, by Type (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina ATM Market Size and Forecast, by Solution (2022-2029) 8.4.2.2. Argentina ATM Market Size and Forecast, by Size (2022-2029) 8.4.2.3. Argentina ATM Market Size and Forecast, by Type (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America ATM Market Size and Forecast, by Solution (2022-2029) 8.4.3.2. Rest Of South America ATM Market Size and Forecast, by Size (2022-2029) 8.4.3.3. Rest Of South America ATM Market Size and Forecast, by Type (2022-2029) 9. Global ATM Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading ATM Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Euronet 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Diebold 10.3. GRG Banking 10.4. Nautilus Hyosung 10.5. HessCash Systems 10.6. Hitachi-Omron Terminals Solutions 10.7. Fujitsu 10.8. NCR Corporation 10.9. Triton Systems 10.10. Tidel Engineering 10.11. Hitachi-Omron Terminal Solutions Corporation 10.12. China Electronics Corporation HEXAGON 10.13. OKI Electric Industry Co., Ltd. 10.14. Brink's Company 10.15. Wincor Nixdorf AG 11. Key Findings 12. Industry Recommendations 13. ATM Market: Research Methodology 14. Terms and Glossary