The Ice Cream Market size was valued at USD 82.19 Billion in 2024 and the total Ice Cream revenue is expected to grow at a CAGR of 6.5% from 2025 to 2032, reaching nearly USD 136.03 Billion.Overview of an Ice Cream Market

Ice cream, a frozen dessert typically made from milk or cream infused with sugar, along with spices, such as cocoa or vanilla, and fruits, such as strawberries or peaches. The mixture is cooled below the freezing point of water and stirred to incorporate air spaces and prevent detectable ice crystals from forming. The demand for lactose-free and non-dairy ice cream has risen in its use due to the lactose-intolerant consumer base. The changing consumer base demand for more innovative flavours of ice creams has forced ice cream manufacturing companies to invest in the technological advancement of ice cream flavours. The rising demand for impulse ice cream container types such as Ice-cream bars, cups, cones, and tubs is raising the market growth significantly. The leading brands in China’s high-end ice cream market are one of the reasons for the rising competition in the ice cream market globally. Emerging markets such as India and Brazil are home to a large growing middle-class population, which has created various opportunities for the key companies to expand their supply chain and enter new markets.To know about the Research Methodology :- Request Free Sample Report

Dynamics of Ice Cream Market

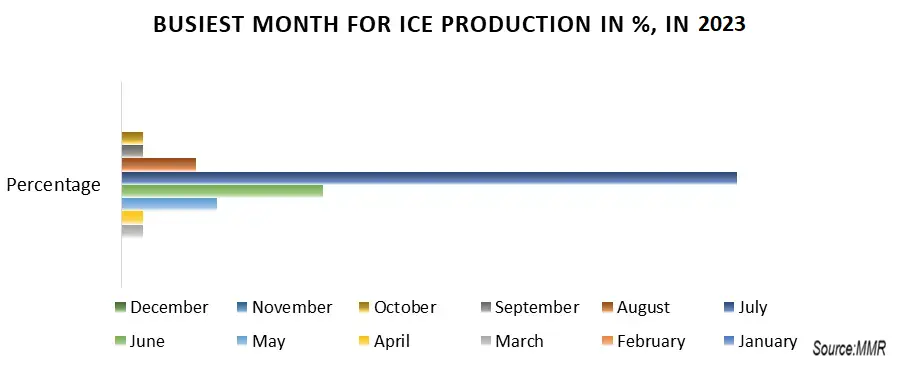

The Evolving Consumer Preference for Ice Cream Market: The rising population directly increases the demand for increased food production and consumption. Consumer preference has been rising for healthier and more natural forms of ice cream products. Healthier ice cream considering consumer preference refers to low-sugar and low-fat ice creams that are plant-based and organic products. The changing consumer preference is a major and crucial factor shaping and demanding the ice cream market. The increasing population in regions such as Asia Pacific holds the largest consumer base for the ice cream market. The artisanal ice cream and functional ice cream types are produced and packed in small batches which is increasing in demand by consumers due to their high-quality ingredients, unique flavours, and different texture, with added probiotics and vitamins considering the health benefits. Technological advancement in production techniques has been developed for making a wider variety of flavours and ice cream textures. Potential Health Concern related to ice Cream: The rising health consciousness among consumers due to the consumption of more high-calorie ice cream is a key restraining factor for the ice cream market growth. Ice cream is a high calorie food product.As 100 grams’ scoop of ice cream contains 207 calories. The rising price of raw materials needed for the production of ice cream, the transportation, and the energy cost needed to keep ice cream cold are potentially affecting consumer affordability. After the pandemic, the global supply of raw materials and the supply of ice cream was disrupted leading to the shortage and delays in production. In addition to this, seasonal variation and climatic patterns that drive the sales of ice cream during hot summer months and unpredictable weather are some of the factors affecting the demand of consumers.Trends in the Ice Cream market: Emerging trends such as lactose-free ice cream is one of the major opportunity for the ice cream market in the upcoming years. The increasing demand for an alternative to dairy-based ice cream due to the lactose-intolerant consumer base in countries is a major opportunity in the ice cream market. Non-dairy ice creams are also gaining popularity in the European region because of health consciousness amongst the people. Technological development in ice cream production for developing a wider range of flavors with increased and improved texture is been raising the growth opportunity in the market.

Intense Competition in Ice Cream Market The increased competition in the market through the establishment of new local companies has been a key challenge for the growth and expansion of key companies in emerging markets. In this highly competitive market, it’s challenging to establish a new “brand” and start producing the best Ice-creams possible. All the giants in this industry are doing R&D and experimenting with their products to introduce surprising elements for consumers. Therefore, this competition has led to rising price wars, reduced profits, and difficulty in launching more new products. The cost of raw materials such as milk, cocoa, and sugar due to the sudden climatic changes and geographical conditions leads to lower production and affects the global supply of ice cream. Government regulations for the strict labelling of content and ingredient usage have been a challenge in raising the production cost and therefore increasing the prices of ice cream.

Segment Analysis of Ice Cream Market

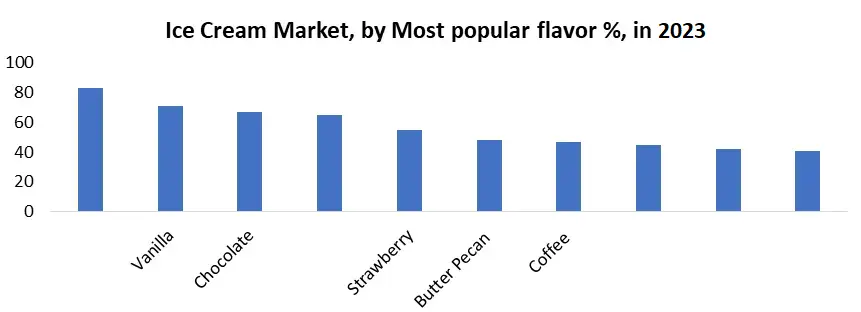

Based on Product: The cups and tubs product segments held the largest revenue in the Ice Cream market in 2022. The rising demand for ice cream as a preferable food product to be eaten after dinner or the post-meal dessert. Each of the ice cream segments depends on various consumer preferences and categories. These products are often categorized by the variety of flavours they provide and being portable and easy to consume makes them on-the-go dessert. The cups ice cream segment provides a small portion of servings in a packed container. This packed container makes the cups segment popular and most preferable by the kids of the age group between 2-10 years. Cups are also used to minimize the portion of servings and to make consumer enjoy their ice cream on the way. The Ice-cream bar shows a very popular product, which was and is convenient to be eaten by all age groups The consumer preference for the product segment plays a vital role in the growth of the market based on various factors including health considerations, taste and flavour choices, and product types.Based on Flavor: Chocolate, vanilla, and cookies n’ cream remain the top three flavours in the country from the report given by the International Dairy Foods Association (IDFA). A few new flavors are also within the top 5 flavours such as strawberry and chocolate chips. Along with trying new flavours the consumer base especially younger consumers likes to try new products that are popular and famous in other countries. The other products include Thai rolled ice cream with real fruits and rice ice cream are the most trending flavour tried by Youngers and adults. Ice cream consumers around the world are most interested in products with more flavours like chocolate-vanilla, fruit, and candy-based ice cream flavours. After chocolate, the most preferred flavour is cookies and cream, which is consumed by most of the Americans. The technological advancement by the companies for the continuous production of ice cream and freezing technology for rapid freezing and avoiding the formation of crystals in ice cream helps in maintaining the flavour of ice creams.

Ice Cream Market Regional Analysis

The consumption of ice cream triggers the release of hormones like dopamine and serotonin, known as positive feeling hormones, providing a scientific reason for the use. The increasing disposable income of the population has resulted in higher expenses on premium food and other products. The cost of ice cream has remained the same for the companies, which directly has raised the demand for the ice cream market in Asian countries. North American region has a large consumer base for the ice cream market and is driven by the new innovative flavours and the rising popularity of ice cream. The largest ice cream market globally is found in the Asia Pacific Region, with the rising population in Asian countries which serves as a primary driver for ice cream market growth. China and India are the leading consumers of ice cream in this region. Consumers here focus on the growing preference for plant-based products, with a focus on healthier options. The consumer base in this region shows more preference for trying new flavours and traditional flavours such as chocolate and vanilla. Also, the health-conscious consumer demand for low-sugar and sugar-free ice cream has risen in this region. Ice creams are sold through various distribution channels such as convenience stores, supermarkets, and special ice cream shops, where the addition of new flavours in shops increases the demand and sales of ice cream. The ice cream market faces seasonal changes and variations in this region and because of fluctuating demands in hot and warm months. The leading companies in North America are focused on the continuous innovation of flavours and new product formulations with better taste. During the seasonal ice cream market companies launch limited edition flavours for attracting more consumer base.

The Competitive Landscape

The ice cream market is fragmented with numerous small and medium-sized players operating in different countries. These players are constantly introducing new flavours, packaging formats, and healthier options to boost sales, which have been declining in developed regions like North America and Western Europe. Nowadays, consumers are increasingly drawn to ice creams made with natural ingredients, low calories, and health claims, prompting manufacturers to focus on developing products with these attributes. Unilever a leading ice cream manufacturer in the industry has made various products of ice cream. They have invented various flavours and texture enhancements to create the desired texture in ice creams and developed stabilizers to maintain the texture and the flavour.Ice Cream Market Scope : Inquire Before Buying

Global Ice Cream Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 82.19 Bn. Forecast Period 2025 to 2032 CAGR: 6.5% Market Size in 2032: USD 136.03 Bn. Segments Covered: by Product Bars & Pops Cups Tubs Cones Other by Flavor Chocolate Vanilla Cookies n Cream Others by Distribution Channel Online Offline Ice Cream Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Ice Cream Market, Key Players

1. Unilever 2. Inspire Brands, Inc. 3. General Mills, Inc. 4. Kwality Wall’s 5. American Dairy Queen Corporation 6. Nestlé 7. Blue Bell Creameries 8. Cold Stone Creamery 9. Danone S.A. 10. NadaMoo 11. Meiji Holdings Co. Ltd 12. Wells Dairy Inc. 13. Mihan Dairy Inc. 14. Lotte Confectionery 15. Mars 16. Turkey Hill FAQs: 1. What are the growth drivers for the Ice Cream market? Ans. Increasing Health Awareness, Shifting Consumer Preferences, etc. are expected to be the major drivers for the Ice Cream market. 2. What is the major restraint for the Ice Cream market growth? Ans. Strong Competition and potential health concern for the lactose-intolerant consumer base is expected to be the major restraining factor for the market growth. 3. Which region is expected to lead the global Ice Cream market during the forecast period? Ans. North America is expected to lead the global Ice Cream market during the forecast period. 4. What is the projected market size & and growth rate of the Ice Cream Market? Ans. The Ice Cream Market size was valued at USD 82.19 Billion in 2024 and the total Ice Cream revenue is expected to grow at a CAGR of 6.5% from 2025 to 2032, reaching nearly USD 136.03 Billion. 5. What segments are covered in the Ice Cream Market report? Ans. The segments covered in the market report are Product, Flavors, Distribution Channel and Region.

1. Ice Cream Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Ice Cream Market: Dynamics 2.1. Preference Analysis 2.2. Ice Cream Market Trends by Region 2.2.1. North America Ice Cream Market Trends 2.2.2. Europe Ice Cream Market Trends 2.2.3. Asia Pacific Ice Cream Market Trends 2.2.4. Middle East and Africa Ice Cream Market Trends 2.2.5. South America Ice Cream Market Trends 2.3. Ice Cream Market Dynamics by Region 2.3.1. North America 2.3.1.1. North America Ice Cream Market Drivers 2.3.1.2. North America Ice Cream Market Restraints 2.3.1.3. North America Ice Cream Market Opportunities 2.3.1.4. North America Ice Cream Market Challenges 2.3.2. Europe 2.3.2.1. Europe Ice Cream Market Drivers 2.3.2.2. Europe Ice Cream Market Restraints 2.3.2.3. Europe Ice Cream Market Opportunities 2.3.2.4. Europe Ice Cream Market Challenges 2.3.3. Asia Pacific 2.3.3.1. Asia Pacific Ice Cream Market Drivers 2.3.3.2. Asia Pacific Ice Cream Market Restraints 2.3.3.3. Asia Pacific Ice Cream Market Opportunities 2.3.3.4. Asia Pacific Ice Cream Market Challenges 2.3.4. Middle East and Africa 2.3.4.1. Middle East and Africa Ice Cream Market Drivers 2.3.4.2. Middle East and Africa Ice Cream Market Restraints 2.3.4.3. Middle East and Africa Ice Cream Market Opportunities 2.3.4.4. Middle East and Africa Ice Cream Market Challenges 2.3.5. South America 2.3.5.1. South America Ice Cream Market Drivers 2.3.5.2. South America Ice Cream Market Restraints 2.3.5.3. South America Ice Cream Market Opportunities 2.3.5.4. South America Ice Cream Market Challenges 2.4. PORTER’s Five Forces Analysis 2.5. PESTLE Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For the Ice Cream Industry 2.8. Analysis of Government Schemes and Initiatives For Ice Cream Industry 2.9. The Global Pandemic Impact on Ice Cream Market 2.10. Ice Cream Price Trend Analysis (2024-2032) 2.11. Global Ice Cream Market Trade Analysis (2024-2032) 3. Ice Cream Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2024-2032) 3.1. Ice Cream Market Size and Forecast, by Product (2024-2032) 3.1.1. Bars & Pops 3.1.2. Cups 3.1.3. Tubs 3.1.4. Cones 3.1.5. Others 3.2. Ice Cream Market Size and Forecast, by Flavors (2024-2032) 3.2.1. Chocolate 3.2.2. Vanilla 3.2.3. Cookies n Cream 3.2.4. Others 3.3. Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 3.3.1. Online 3.3.2. Offline 3.4. Ice Cream Market Size and Forecast, by Region (2024-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Ice Cream Market Size and Forecast by Segmentation (by Value) (2024-2032) 4.1. North America Ice Cream Market Size and Forecast, by Product (2024-2032) 4.1.1. Bars & Pops 4.1.2. Cups 4.1.3. Tubs 4.1.4. Cones 4.1.5. Others 4.2. North America Ice Cream Market Size and Forecast, by Flavors (2024-2032) 4.2.1. Chocolate 4.2.2. Vanilla 4.2.3. Cookies n Cream 4.2.4. Others 4.3. North America Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 4.3.1. Online 4.3.2. Offline 4.4. North America Ice Cream Market Size and Forecast, by Country (2024-2032) 4.4.1. United States 4.4.1.1. United States Ice Cream Market Size and Forecast, by Product (2024-2032) 4.4.1.1.1. Bars & Pops 4.4.1.1.2. Cups 4.4.1.1.3. Tubs 4.4.1.1.4. Cones 4.4.1.1.5. Others 4.4.1.2. United States Ice Cream Market Size and Forecast, by Flavors (2024-2032) 4.4.1.2.1. Chocolate 4.4.1.2.2. Vanilla 4.4.1.2.3. Cookies n Cream 4.4.1.2.4. Others 4.4.1.3. United States Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 4.4.1.3.1. Online 4.4.1.3.2. Offline 4.4.2. Canada 4.4.2.1. Canada Ice Cream Market Size and Forecast, by Product (2024-2032) 4.4.2.1.1. Bars & Pops 4.4.2.1.2. Cups 4.4.2.1.3. Tubs 4.4.2.1.4. Cones 4.4.2.1.5. Others 4.4.2.2. Canada Ice Cream Market Size and Forecast, by Flavors (2024-2032) 4.4.2.2.1. Chocolate 4.4.2.2.2. Vanilla 4.4.2.2.3. Cookies n Cream 4.4.2.2.4. Others 4.4.2.3. Canada Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 4.4.2.3.1. Online 4.4.2.3.2. Offline 4.4.3. Mexico 4.4.3.1. Mexico Ice Cream Market Size and Forecast, by Product (2024-2032) 4.4.3.1.1. Bars & Pops 4.4.3.1.2. Cups 4.4.3.1.3. Tubs 4.4.3.1.4. Cones 4.4.3.1.5. Others 4.4.3.2. Mexico Ice Cream Market Size and Forecast, by Flavors (2024-2032) 4.4.3.2.1. Chocolate 4.4.3.2.2. Vanilla 4.4.3.2.3. Cookies n Cream 4.4.3.2.4. Others 4.4.3.3. Mexico Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 4.4.3.3.1. Online 4.4.3.3.2. Offline 5. Europe Ice Cream Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. Europe Ice Cream Market Size and Forecast, by Product (2024-2032) 5.2. Europe Ice Cream Market Size and Forecast, by Flavors (2024-2032) 5.3. Europe Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 5.4. Europe Ice Cream Market Size and Forecast, by Country (2024-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Ice Cream Market Size and Forecast, by Product (2024-2032) 5.4.1.2. United Kingdom Ice Cream Market Size and Forecast, by Flavors (2024-2032) 5.4.1.3. United Kingdom Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.2. France 5.4.2.1. France Ice Cream Market Size and Forecast, by Product (2024-2032) 5.4.2.2. France Ice Cream Market Size and Forecast, by Flavors (2024-2032) 5.4.2.3. France Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.3. Germany 5.4.3.1. Germany Ice Cream Market Size and Forecast, by Product (2024-2032) 5.4.3.2. Germany Ice Cream Market Size and Forecast, by Flavors (2024-2032) 5.4.3.3. Germany Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.4. Italy 5.4.4.1. Italy Ice Cream Market Size and Forecast, by Product (2024-2032) 5.4.4.2. Italy Ice Cream Market Size and Forecast, by Flavors (2024-2032) 5.4.4.3. Italy Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.5. Spain 5.4.5.1. Spain Ice Cream Market Size and Forecast, by Product (2024-2032) 5.4.5.2. Spain Ice Cream Market Size and Forecast, by Flavors (2024-2032) 5.4.5.3. Spain Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.6. Sweden 5.4.6.1. Sweden Ice Cream Market Size and Forecast, by Product (2024-2032) 5.4.6.2. Sweden Ice Cream Market Size and Forecast, by Flavors (2024-2032) 5.4.6.3. Sweden Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.7. Austria 5.4.7.1. Austria Ice Cream Market Size and Forecast, by Product (2024-2032) 5.4.7.2. Austria Ice Cream Market Size and Forecast, by Flavors (2024-2032) 5.4.7.3. Austria Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Ice Cream Market Size and Forecast, by Product (2024-2032) 5.4.8.2. Rest of Europe Ice Cream Market Size and Forecast, by Flavors (2024-2032) 5.4.8.3. Rest of Europe Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 6. Asia Pacific Ice Cream Market Size and Forecast by Segmentation (by Value) (2024-2032) 6.1. Asia Pacific Ice Cream Market Size and Forecast, by Product (2024-2032) 6.2. Asia Pacific Ice Cream Market Size and Forecast, by Flavors (2024-2032) 6.3. Asia Pacific Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 6.4. Asia Pacific Ice Cream Market Size and Forecast, by Country (2024-2032) 6.4.1. China 6.4.1.1. China Ice Cream Market Size and Forecast, by Product (2024-2032) 6.4.1.2. China Ice Cream Market Size and Forecast, by Flavors (2024-2032) 6.4.1.3. China Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.2. S Korea 6.4.2.1. S Korea Ice Cream Market Size and Forecast, by Product (2024-2032) 6.4.2.2. S Korea Ice Cream Market Size and Forecast, by Flavors (2024-2032) 6.4.2.3. S Korea Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.3. Japan 6.4.3.1. Japan Ice Cream Market Size and Forecast, by Product (2024-2032) 6.4.3.2. Japan Ice Cream Market Size and Forecast, by Flavors (2024-2032) 6.4.3.3. Japan Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.4. India 6.4.4.1. India Ice Cream Market Size and Forecast, by Product (2024-2032) 6.4.4.2. India Ice Cream Market Size and Forecast, by Flavors (2024-2032) 6.4.4.3. India Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.5. Australia 6.4.5.1. Australia Ice Cream Market Size and Forecast, by Product (2024-2032) 6.4.5.2. Australia Ice Cream Market Size and Forecast, by Flavors (2024-2032) 6.4.5.3. Australia Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia Ice Cream Market Size and Forecast, by Product (2024-2032) 6.4.6.2. Indonesia Ice Cream Market Size and Forecast, by Flavors (2024-2032) 6.4.6.3. Indonesia Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia Ice Cream Market Size and Forecast, by Product (2024-2032) 6.4.7.2. Malaysia Ice Cream Market Size and Forecast, by Flavors (2024-2032) 6.4.7.3. Malaysia Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam Ice Cream Market Size and Forecast, by Product (2024-2032) 6.4.8.2. Vietnam Ice Cream Market Size and Forecast, by Flavors (2024-2032) 6.4.8.3. Vietnam Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan Ice Cream Market Size and Forecast, by Product (2024-2032) 6.4.9.2. Taiwan Ice Cream Market Size and Forecast, by Flavors (2024-2032) 6.4.9.3. Taiwan Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Ice Cream Market Size and Forecast, by Product (2024-2032) 6.4.10.2. Rest of Asia Pacific Ice Cream Market Size and Forecast, by Flavors (2024-2032) 6.4.10.3. Rest of Asia Pacific Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 7. Middle East and Africa Ice Cream Market Size and Forecast by Segmentation (by Value) (2024-2032 7.1. Middle East and Africa Ice Cream Market Size and Forecast, by Product (2024-2032) 7.2. Middle East and Africa Ice Cream Market Size and Forecast, by Flavors (2024-2032) 7.3. Middle East and Africa Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 7.4. Middle East and Africa Ice Cream Market Size and Forecast, by Country (2024-2032) 7.4.1. South Africa 7.4.1.1. South Africa Ice Cream Market Size and Forecast, by Product (2024-2032) 7.4.1.2. South Africa Ice Cream Market Size and Forecast, by Flavors (2024-2032) 7.4.1.3. South Africa Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.2. GCC 7.4.2.1. GCC Ice Cream Market Size and Forecast, by Product (2024-2032) 7.4.2.2. GCC Ice Cream Market Size and Forecast, by Flavors (2024-2032) 7.4.2.3. GCC Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria Ice Cream Market Size and Forecast, by Product (2024-2032) 7.4.3.2. Nigeria Ice Cream Market Size and Forecast, by Flavors (2024-2032) 7.4.3.3. Nigeria Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Ice Cream Market Size and Forecast, by Product (2024-2032) 7.4.4.2. Rest of ME&A Ice Cream Market Size and Forecast, by Flavors (2024-2032) 7.4.4.3. Rest of ME&A Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 8. South America Ice Cream Market Size and Forecast by Segmentation (by Value) (2024-2032) 8.1. South America Ice Cream Market Size and Forecast, by Product (2024-2032) 8.2. South America Ice Cream Market Size and Forecast, by Flavors (2024-2032) 8.3. South America Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 8.4. South America Ice Cream Market Size and Forecast, by Country (2024-2032) 8.4.1. Brazil 8.4.1.1. Brazil Ice Cream Market Size and Forecast, by Product (2024-2032) 8.4.1.2. Brazil Ice Cream Market Size and Forecast, by Flavors (2024-2032) 8.4.1.3. Brazil Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.2. Argentina 8.4.2.1. Argentina Ice Cream Market Size and Forecast, by Product (2024-2032) 8.4.2.2. Argentina Ice Cream Market Size and Forecast, by Flavors (2024-2032) 8.4.2.3. Argentina Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Ice Cream Market Size and Forecast, by Product (2024-2032) 8.4.3.2. Rest Of South America Ice Cream Market Size and Forecast, by Flavors (2024-2032) 8.4.3.3. Rest Of South America Ice Cream Market Size and Forecast, by Distribution Channel (2024-2032) 9. Global Ice Cream Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Market Structure 9.4.1. Market Leaders 9.4.2. Market Followers 9.4.3. Emerging Players 9.5. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Hilmar Cheese Company, Inc 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Nestle 10.3. Saputo Inc. 10.4. Glanbia plc. 10.5. Fonterra Co-operative Group Ltd 10.6. Arla Foods 10.7. Alpavit 10.8. Wheyco GmbH 10.9. Carbery Group 10.10. LACTALIS 10.11. Olam International 10.12. Davisco Foods International, Inc. 10.13. Milkaut SA 10.14. Leprino Foods Company 10.15. Maple Island Inc. 10.16. Kerry Group plc. 10.17. Havero Hoogwegt Group 10.18. Amco Protein 11. Key Findings 12. Industry Recommendations 13. Ice Cream Market: Research Methodology