Vitamin D Ingredients Market size was valued at US$ 1.35 Bn. in 2023 and the total revenue is expected to grow at a CAGR of 7.2% through 2024 to 2030, reaching nearly US$ 2.19 Bn.Vitamin D Ingredients Market Overview:

Oily fish and certain varieties of mushrooms contain high levels of vitamin D. Vitamin D3, and Vitamin D2 are the two types of the Analog of the Vitamin D Ingredients. Adults, Pregnant women, and Children are the end-users of the Vitamin D Ingredients. Pharmaceutical, Food & Beverages, Cosmetics, and Animal Feed are the applications of the vitamin D ingredients.To know about the Research Methodology :- Request Free Sample Report

Vitamin D Ingredients Market Dynamics:

Vitamin D deficiency is becoming increasingly common, resulting in increased demand for vitamin D components and a rise in the market for vitamin D ingredients. The rising demand for vitamin D ingredients in products is a key driver that might boost the global vitamin D ingredient market to new heights during the forecast period. In the pharmaceutical and food & beverage industries, vitamin D compounds are frequently used. It helps with calcium metabolism and bone mineralization in the body. Besides, the advantages of using vitamin D ingredients on a regular basis are boosting the global vitamin D ingredient market ahead. The global market for vitamin D ingredients is benefiting from regulatory bodies' favourable guidelines for the trading of vitamin D ingredients. Vitamin D manufacturers will be able to sell their product with less limitations as a result of this. Pharmaceutical companies benefit greatly from these advantages since they can readily market vitamin D component goods. Besides, regulatory bodies' increased efforts in advertising benefits associated with the usage of vitamin D products are driving the global vitamin D ingredient market. As a result, there is an increasing need for Vitamin D Ingredients in a number of food applications. Vitamin D drinks are also easy to consume and digest. Due to this factor, customers are getting more interested in vitamin D beverages. Additionally, pharmaceutical companies' increased efforts to promote the use of vitamin D products is expected to boost the global vitamin D ingredients market during the forecast period. Vitamins, minerals, botanicals, enzymes, fatty acids, and proteins, among other dietary supplements, contribute to overall health and well-being by preventing nutritional deficiencies. As a result of the global demographic trend of an ageing population, increased lifestyle-related illnesses, and rising healthcare expenses, dietary supplement preferences are rapidly developing. Increased sales of sports nutrition are expected to have a significant impact on the market, due to rising fitness trends and sports activity, as well as new product debuts. Regulatory agencies are paying more attention to dietary supplement health claims, and the industry is becoming increasingly regulated as a result.

Vitamin D Ingredients Market Segment Analysis:

Based on the Analog, the market is segmented into Vitamin D3, and Vitamin D2. Vitamin D2 segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2024-2030. Yeast and mushrooms are good sources of vitamin D2. Vitamin D2 is used to treat osteomalacia, hypoparathyroidism (abnormal functioning of the parathyroid glands), and hypophosphatemia, as well as to prevent rickets (low levels of phosphate in the blood). The market is expected to be driven by vitamin D2's numerous applications. Based on the Form, the market is segmented into Dry, and Liquid. Dry form segment is expected to grow rapidly at a CAGR of xx% during the forecast period 2024-2030. Manufacturers favour the dry form of vitamin D because it is more stable, easier to handle and store, and can be used in a wide range of products. The majority of vitamin D on the market is synthetic. Vitamins D2 and D3 are primarily found as white crystals, with a limited solubility in vegetable oil. When compared to vitamin D2, the vitamin D3 counterpart is more stable. Vitamin D3 is said to be the most widely used vitamin D analogue on the planet. Based on the Application, the market is segmented into Pharmaceutical, Food & Beverages, Cosmetics, Animal Feed, and Others. Pharmaceutical segment is expected to hold the largest market share of xx% by 2030. This is due to the high cost connected with the IU level or potency level of vitamin D utilised in the pharmaceutical business. Besides, due to its high quality, only a little amount of vitamin D is employed in medicines, hence the volume market is smaller than for other applications.Vitamin D Ingredients Market Regional Insights:

Asia Pacific region is expected to dominate the Vitamin D Ingredients market during the forecast period 2024-2030. Asia Pacific region is expected to hold the largest market share of xx% by 2030. Vitamin D insufficiency is common throughout Asia Pacific, particularly in South and Southeast Asia. Rickets is quite common in China and is caused by a lack of vitamin D. Besides, rising income levels and significant consumer demand for nutritional and healthy products are expected to provide promising prospects for the growth and diversification of the region's functional food and beverage products, resulting in increased consumption of vitamin-infused products. Due to increased demand for animal feed, fortified food items, and simple availability of raw materials, China and India are two of the most promising countries for vitamin D manufacturers to grow. Manufacturers of vitamin D supplements and pharmaceutical product firms such as Alkem Laboratories (India), Cadila Pharmaceuticals (India), Abbott Laboratories (US), and Sanofi S.A. have made it an important destination (France). These are the key factors that are expected to drives the growth of the Asia Pacific region in the market during the forecast period. The objective of the report is to present a comprehensive analysis of the market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the market dynamic, structure by analyzing the market segments and project the market size. Clear representation of competitive analysis of key players by Analog, price, financial position, product portfolio, growth strategies, and regional presence in the market the report investor’s guide.Vitamin D Ingredients Market Scope: Inquiry Before Buying

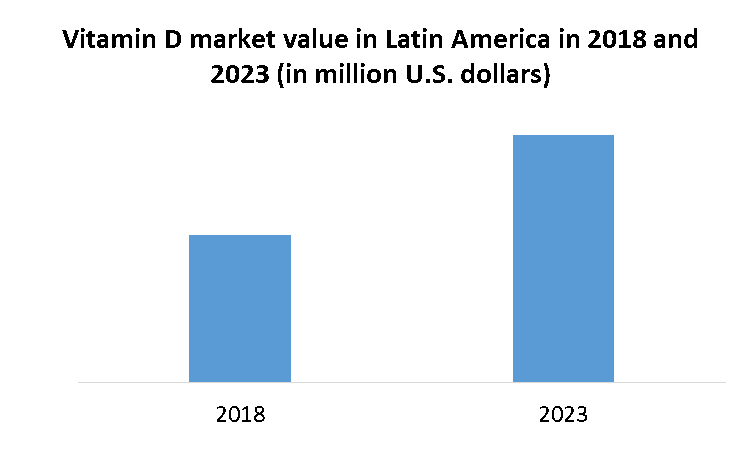

Vitamin D Ingredients Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.35 Bn. Forecast Period 2024 to 2030 CAGR: 7.2% Market Size in 2030: US $ 2.19 Bn. Segments Covered: by Analog Vitamin D3 Vitamin D2 by IU Strength 500,000 IU 100,000 IU 40 MIU Others by Form Dry Liquid by Application Pharmaceutical Food & Beverages Cosmetics Animal Feed Others by End-User Adults Pregnant women Children Vitamin D Ingredients Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Vitamin D Ingredients Market Key Players:

1. Dishman Netherland 2. BASF 3. LycoRed Limited 4. Barr Pharmaceuticals 5. Fermenta Biotech 6. Zhejiang Garden Bio-Chemical High-tech 7. Schiff Nutrition International 8. J.R. Carlson Laboratories 9. Glaxo Smith Kline 10. Royal DSM N.V. 11. Schiff Nutrition International, Inc. 12. Nestle S.A. 13. Pfizer Inc. 14. Koninklijke DSM N.V. 15. ADM Alliance Nutrition Inc. 16. Kraft Foods Group Frequently Asked Questions: 1] What segments are covered in Vitamin D Ingredients Market report? Ans. The segments covered in Vitamin D Ingredients Market report are based on Analog, IU Strength, Form, Application, and End-Users. 2] Which region is expected to hold the highest share in the Vitamin D Ingredients Market? Ans. Asia Pacific is expected to hold the highest share in the Vitamin D Ingredients Market. 3] Who are the top key players in the Vitamin D Ingredients Market? Ans. Dishman Netherland, BASF, LycoRed Limited, Barr Pharmaceuticals, and Fermenta Biotech are the top key players in the market. 4] Which segment holds the largest market share in the Vitamin D Ingredients market by 2030? Ans. Pharmaceutical segment hold the largest market share in the Vitamin D Ingredients market by 2030. 5] What is the market size of the Vitamin D Ingredients market by 2030? Ans. The market size of the Vitamin D Ingredients market is expected to reach at US $ 2.19 Bn. by 2030. 6] What was the market size of the Vitamin D Ingredients market in 2023? Ans. The market size of the Vitamin D Ingredients market was worth US $ 1.35 Bn. in 2023.

1. Vitamin D Ingredients Market: Research Methodology 2. Vitamin D Ingredients Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Vitamin D Ingredients Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Vitamin D Ingredients Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • Latin America 3.12 COVID-19 Impact 4. Vitamin D Ingredients Market Segmentation 4.1 Vitamin D Ingredients Market, by Analog (2023-2030) • Vitamin D3 • Vitamin D2 4.2 Vitamin D Ingredients Market, by IU Strength (2023-2030) • 500,000 IU • 100,000 IU • 40 MIU • Others 4.3 Vitamin D Ingredients Market, by Form (2023-2030) • Dry • Liquid 4.4 Vitamin D Ingredients Market, by Application (2023-2030) • Pharmaceutical • Food & Beverages • Cosmetics • Animal Feed • Others 4.5 Vitamin D Ingredients Market, by End-Users (2023-2030) • Adults • Pregnant women • Children 5. North America Vitamin D Ingredients Market (2023-2030) 5.1 Vitamin D Ingredients Market, by Analog (2023-2030) • Vitamin D3 • Vitamin D2 5.2 Vitamin D Ingredients Market, by IU Strength (2023-2030) • 500,000 IU • 100,000 IU • 40 MIU • Others 5.3 Vitamin D Ingredients Market, by Form (2023-2030) • Dry • Liquid 5.4 Vitamin D Ingredients Market, by Application (2023-2030) • Pharmaceutical • Food & Beverages • Cosmetics • Animal Feed • Others 5.5 Vitamin D Ingredients Market, by End-Users (2023-2030) • Adults • Pregnant women • Children 5.6 North America Vitamin D Ingredients Market, by Country (2023-2030) • United States • Canada • Mexico 6. Asia Pacific Vitamin D Ingredients Market (2023-2030) 6.1. Asia Pacific Vitamin D Ingredients Market, by Analog (2023-2030) 6.2. Asia Pacific Vitamin D Ingredients Market, by IU Strength (2023-2030) 6.3. Asia Pacific Vitamin D Ingredients Market, by Form (2023-2030) 6.4. Asia Pacific Vitamin D Ingredients Market, by Application (2023-2030) 6.5. Asia Pacific Vitamin D Ingredients Market, by End-Users (2023-2030) 6.6. Asia Pacific Vitamin D Ingredients Market, by Country (2023-2030) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Middle East and Africa Vitamin D Ingredients Market (2023-2030) 7.1 Middle East and Africa Vitamin D Ingredients Market, by Analog (2023-2030) 7.2. Middle East and Africa Vitamin D Ingredients Market, by IU Strength (2023-2030) 7.3. Middle East and Africa Vitamin D Ingredients Market, by Form (2023-2030) 7.4. Middle East and Africa Vitamin D Ingredients Market, by Application (2023-2030) 7.5. Middle East and Africa Vitamin D Ingredients Market, by End-Users (2023-2030) 7.6. Middle East and Africa Vitamin D Ingredients Market, by Country (2023-2030) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 8. Latin America Vitamin D Ingredients Market (2023-2030) 8.1. Latin America Vitamin D Ingredients Market, by Analog (2023-2030) 8.2. Latin America Vitamin D Ingredients Market, by IU Strength (2023-2030) 8.3. Latin America Vitamin D Ingredients Market, by Form (2023-2030) 8.4. Latin America Vitamin D Ingredients Market, by Application (2023-2030) 8.5. Latin America Vitamin D Ingredients Market, by End-Users (2023-2030) 8.6. Latin America Vitamin D Ingredients Market, by Country (2023-2030) • Brazil • Argentina • Rest Of Latin America 9. European Vitamin D Ingredients Market (2023-2030) 9.1. European Vitamin D Ingredients Market, by Analog (2023-2030) 9.2. European Vitamin D Ingredients Market, by IU Strength (2023-2030) 9.3. European Vitamin D Ingredients Market, by Form (2023-2030) 9.4. European Vitamin D Ingredients Market, by Application (2023-2030) 9.5. European Vitamin D Ingredients Market, by End-Users (2023-2030) 9.6. European Vitamin D Ingredients Market, by Country (2023-2030) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 10. Company Profile: Key players 10.1. Dishman Netherland 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. BASF 10.3. LycoRed Limited 10.4. Barr Pharmaceuticals 10.5. Fermenta Biotech 10.6. Zhejiang Garden Bio-Chemical High-tech 10.7. Schiff Nutrition International 10.8. J.R. Carlson Laboratories 10.9. Glaxo Smith Kline 10.10. Royal DSM N.V. 10.11. Schiff Nutrition International, Inc. 10.12. Nestle S.A. 10.13. Pfizer Inc. 10.14. Koninklijke DSM N.V. 10.15. ADM Alliance Nutrition Inc. 10.16. Kraft Foods Group