Asia Pacific Blood Glucose Monitoring System Market size was valued at US$ 3.3 Bn. in 2021 and the total Asia Pacific Blood Glucose Monitoring System Market revenue is expected to grow at 9.5 % from 2021 to 2029, reaching nearly US$ 6.8 Bn.Asia Pacific Blood Glucose Monitoring System Market Overview:

The procedure of monitoring blood glucose involves determining the blood's glucose content. It makes it easier to determine whether a blood glucose level is within the given target range. Thus, knowledge about food intake, exercise, insulin, and blood glucose levels is helpful. The blood glucose monitoring tools offer helpful data for managing diabetes. It aids in monitoring the advancement of treatment objectives, observing the impact of diabetic meditation on blood sugar levels, and comprehending the impact of stress and illness on blood sugar levels.To know about the Research Methodology :- Request Free Sample Report There are several different blood glucose monitoring tools, often known as blood glucose metres, available on the market. These tools make it easier to monitor blood sugar levels at home, at clinics, hospitals, etc. They are also made to work with different types of diabetes. The market growth for blood glucose monitors is primarily related to the rising incidence of diabetes, advances in diabetes monitoring and diagnosis technologies, the early identification of diabetes, and the rising demand for continuous glucose monitors. Our research methodology started with gathering information on the main vendors' revenue through secondary research in order to estimate and forecast the market for unified monitoring. To divide the market into segments, by Product (Self-Monitoring Blood Glucose: Systems, Blood Glucose meters, Testing strips, Lancets & Lancing Devices. Continuous Glucose Monitoring Systems, Sensors, Transmitters, Receivers) by Testing Site (Fingertip testing, Alternate Site Testing) by Patient Care Setting (Hospital & Clinics, Self/Home Care) by Application (Type 2 Diabetes, Type 1 Diabetes, Gestational Diabetes) vendors' offerings are taken into account. These segments were then confirmed through primary research by conducting in-depth interviews with important figures, including chief executive officers (CEOs), vice presidents (VPs), directors, and executives. In order to estimate the market size, top-down and bottom-up methods are employed. Primary and secondary research are used to identify the major players in the Asia Pacific Blood Glucose Monitoring System Market and to calculate their market revenues. In contrast to secondary research, which required examining the annual and financial reports of the leading manufacturers, primary research involved conducting interviews with major opinion leaders and business leaders in the industry, including CEOs and marketing executives. Abbott Diabetes Care, Roche, Johnson & Johnson, Dexcom, Medtronic, Arkray is a few of the top significant competitors in the Asia Pacific Blood Glucose Monitoring System Market For the duration of the forecast period, they are continually strategizing about mergers and acquisitions to increase their market shares and growth potential. Covid-19 Impact: The COVID-19 pandemic has a favourable effect on the growth of the Asia-Pacific Blood Glucose Monitoring System Market. Diabetes problems, aberrant glucose variability, and increased blood glucose levels experienced by COVID-19-infected patients who have diabetes. In patients with either type 1 (T1DM) or type 2 diabetes mellitus (T2DM), the prevalence of diabetes significantly increased the severity and mortality of COVID-19, particularly in relation to poor glycemic control. While newly diagnosed diabetes (T1DM and T2DM), as well as newly diagnosed hyperglycemia, have become more widely recognised in the context of COVID-19 and have been linked to worse outcomes. Regular blood glucose monitoring is necessary for patients to prevent aggravation, which emphasises the need of blood glucose monitoring equipment. The pandemic emergency has led to an increase in remote patient and provider care and the removal of many lasting regulatory impairments.

Asia Pacific Blood Glucose Monitoring System Market Dynamics:

Market Drivers: An important motivator for the blood glucose monitoring system is the prevalence of diabetes. The number of diabetes-related causes is steadily rising in developed countries of the India region. Diabetes is more common among the elderly population. For many individuals, frequently visiting the hospital is not possible. Knowing the precise blood glucose levels is simple with a blood monitoring equipment. Demand is additionally being driven by increased knowledge of preventive care. It is expected that people's lives are saved through early diabetes identification. Another element driving up demand for the monitoring system is the awareness of the need for preventative diabetes management. The Testing Site for identifying blood glucose systems is also advanced. The blood glucose monitoring market experience impressive demand growth as a result of this technical improvement. There are awareness campaigns that reduce the number of instances of diabetes in several areas. Diabetes is not a acute illness. However, living an unhealthy lifestyle leads to diabetes. The awareness of monitoring systems is rising in an effort to improve people's healthy lifestyles. The market experience extraordinary demand and revenue rates as a result of these key market drivers. Market Restraints: In many areas, diabetes is still less often diagnosed. A barrier to the blood glucose monitoring market is lower diagnosis. There are fewer diagnoses, especially in emerging economies. In China and India, diabetes treatment is frequently delayed. Many people are not viewing diabetes as a serious illness owing to ignorance. Delaying the disease's treatment have catastrophic health effects. The demand for the blood glucose monitoring market decline as adoption and awareness decline. Additionally, the growth rate for the forecast years is well known. The major factors are raising system awareness. Owing to poor customer preference, adoption is expected to be less widespread. Market Opportunities: The market for blood glucose monitoring have growth potential as more people have access to healthcare services. Health care services are widely accessible in various areas. The market for blood glucose monitoring see increased adoption as a result of the accessibility of these monitoring devices. Even underdeveloped countries are boosting their facility investments. The market for blood glucose monitoring grow as a result of all these causes. Another significant growth element is the government's initiatives to boost preventive healthcare. Prices and subsidies for these monitoring equipment are high owing to government support. Additionally, there is a large patient base and widespread market awareness. More end customers are drawn to the market by all of these. Accessing the target population is simple for the market with government assistance. Medical equipment that is used at home offers growing potential. The home setting segment for blood-monitoring systems have substantial revenue growth over the course of the forecast period. The market for blood glucose monitoring see new development opportunities as a result of all these factors. The market's output is also expected to increase significantly as a result of several potential opportunities.Asia Pacific Blood Glucose Monitoring System Market Segment Analysis:

Based on Product, The Self-Monitoring Blood Glucose Systems segment is expected to grow at the highest CAGR during the forecast period. Owing to the inexpensive price and ease of usage. SMBG is regarded as a crucial component of everyday diabetes care. Self-monitoring of blood sugar involves using a glucose metre to measure a person's blood sugar levels. It is further divided into lancets, testing strips, and blood glucose metres. Owing to its widespread usage and low cost, the testing strip category had the greatest market share. Over the forecast period, the segment is expected to grow at a profitable CAGR. During the forecast period, the continuous blood glucose monitoring (CBGM) devices sector is expected to increase at the greatest rate. For type 1 diabetes patients, who are particularly susceptible to severe and sometimes fatal hypoglycemia, CBGM is a crucial diabetes treatment tool. The continuous and real-time blood sugar readings that these devices provide every five minutes aid in the analysis of the glucose level pattern. Sensors, insulin pumps, transmitters, and receivers are the sub-segments. A small sensor that is implanted under the skin powers CGM. This sensor measures the sugar level, and a wireless transmitter transmits the data to a monitor. The segment with the highest revenue share was transmitter and receiver.Based on Testing Site, The Fingertip testing segment is expected to grow at the highest CAGR during the forecast period. It is easy and quick test to perform. There is success in getting test specimen: With finger prick testing, there is a better success rate in obtaining enough blood for testing. Multiple attempts may be undertaken to collect the necessary amount of blood because it is less intrusive. It is less painful for the majority of patients to perform. When a vein is difficult to find, for example, collecting venous blood from patients can be more painful and time-consuming. Patients frequently factor in the expense of travel and time away from work. Patients found it to be less traumatic and invasive than a venous blood sample. Anonymity - Patient information and test results are kept fully private. Based on Patient Care Setting, The Hospital & Clinics segment is expected to grow at the highest CAGR during the forecast period. Owing to advancing infrastructure and rising hospital healthcare costs over the expected term. Additionally, BGM devices are increasingly being used in outpatient and inpatient hospital settings owing to the accurate data they deliver practitioners in a matter of seconds and the improvement in patients' quality of life. Hospitals have additional systems in place to transfer and store patient data. Additionally, the FDA permitted the use of CGM devices in hospitals during the COVID-19 pandemic, and the likelihood of another pandemic in the future is anticipated to further boost the segment's growth. During the forecast period, the home care segment is expected to develop at the fastest rate. Self-monitoring of blood glucose has revolutionized home-based glucose monitoring, which is the most popular short-term glucose monitoring technique globally. People with or without diabetes can measure their blood sugar levels at home using the self-monitoring blood glucose (SMBG) method. The patient can assess the results of their treatment, including food, insulin, exercise, and stress management, based on the reading.

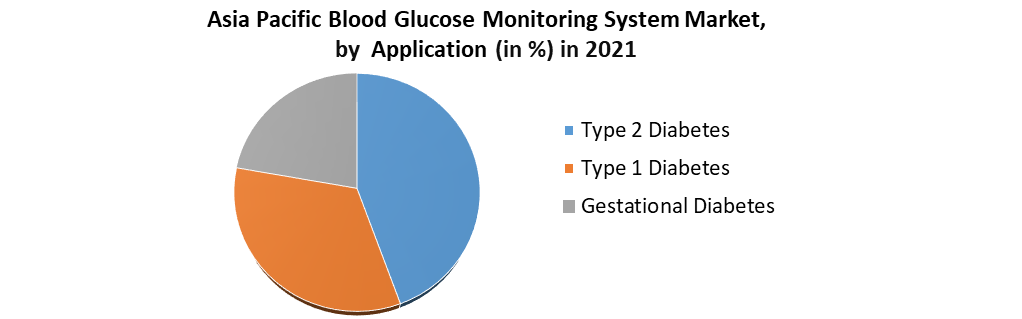

Based on Application, The Type 2 Diabetes segment is expected to grow at the highest CAGR during the forecast period. Driven by a patient population with insulin-dependent type 2 diabetes. For instance, In the South-East Asia (SEA) Region of the International Diabetes Federation (IDF), 90.5 million persons (20-79) will have diabetes in 2021. By 2045, this number is projected to rise to 152.5 million, while in the IDF Western Pacific Region, 206.5 million adults (20-79) are predicted to have diabetes in 2021, rising to 260.5 million by 2045. Blood glucose imbalances that do not conform to normal blood glucose levels are the main diagnosis for diabetes patients. Only doctors can diagnose a condition using the general lab diagnostic tests. Patients whose blood glucose levels fluctuate more frequently require daily monitoring. Patients on insulin must frequently monitor their blood glucose levels and, if required, increase their insulin dosages or switch medications. Additionally, the continuous glucose monitoring system (CGM) is expected to be used more frequently as a result of its scientifically demonstrated effectiveness in lowering the risk of hypoglycemia in type 1 diabetes patients, leading to the type 1 diabetes segment to register a considerable CAGR.

Asia Pacific Blood Glucose Monitoring System Market Regional Insights:

Owing to its advanced technology, rising number of diabetic patients, high health care spending, and growing government support for R&D, China holds a monopoly on the India blood glucose monitoring device market. Additionally, the market in this region has grown thanks to increased R&D activity and the consolidation of significant corporations. India maintains the second spot in the India blood glucose market as a result of the government's support for research and development and the availability of funding for research. Throughout the expected time frame, this is expected to continue to drive the Indian market. Additionally, the market for blood glucose monitoring is growing significantly in nations like Japan, Australia, and the Republic of Korea. Owing to the region's large patient population, high healthcare spending, and quickly evolving healthcare technology, India has the fastest growing blood glucose monitoring market. Moreover, the fastest-growing market globally is expected to be driven by rising demand for novel treatment techniques in nations like South Korea and India. Additionally, it is expected that rising healthcare costs drive demand for more sophisticated technology, which might boost the market for blood glucose monitoring devices in the area. The objective of the report is to present a comprehensive analysis of the Asia Pacific Blood Glucose Monitoring System Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Asia Pacific Blood Glucose Monitoring System Market dynamics, structure by analyzing the market segments and project the Asia Pacific Blood Glucose Monitoring System Market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the Asia Pacific Blood Glucose Monitoring System Market make the report investor’s guide.Asia Pacific Blood Glucose Monitoring System Market Scope: Inquire before buying

Asia Pacific Blood Glucose Monitoring System Market Report Coverage Details Base Year: 2021 Forecast Period: 2022-2029 Historical Data: 2017 to 2021 Market Size in 2021: US $ 3.3 Bn. Forecast Period 2022 to 2029 CAGR: 9.5 % Market Size in 2029: US $ 6.8 Bn. Segments Covered: by Product • Self-Monitoring Blood Glucose Systems o Blood Glucose meters o Testing strips o Lancets & Lancing Devices • Continuous Glucose Monitoring Systems o Sensors o Transmitters o Receivers by Testing Site • Fingertip testing • Alternate Site Testing by Patient Care Setting • Self/Home Care • Hospital & Clinics by Application • Type 2 Diabetes • Type 1 Diabetes • Gestational Diabetes Asia Pacific Blood Glucose Monitoring System Market, by Region

• China • India • Japan • OthersAsia Pacific Blood Glucose Monitoring System Market Key Players

• Abbott Diabetes Care • Roche • Johnson & Johnson • Dexcom • Medtronic • Arkray • Ascensia Diabetes Care • Agamatrix Inc. • Bionime Corporation • Acon • Medisana • Trivida • Rossmax • Diamontech GmbH • 77 Elektronika Kft. • GlySens Incorporated • Novo Nordisk A/S • Nemaura. • PHC Holdings Corporation. FAQs: 1. Which is the potential market for the Asia Pacific Blood Glucose Monitoring System Market in terms of the region? Ans. In China region, the growing business and educational sectors are expected to help drive the use of collaborative screens. 2. What are the opportunities for new market entrants? Ans. The key opportunity in the market is new initiatives from governments that provide funding for Asia Pacific Blood Glucose Monitoring System Markets in educational institutes 3. What is expected to drive the growth of the Asia Pacific Blood Glucose Monitoring System Market in the forecast period? Ans. A major driver in the Asia Pacific Blood Glucose Monitoring System Market is the prevalence of work from home and remote collaboration created by the COVID-19 pandemic 4. What is the projected market size & growth rate of the Asia Pacific Blood Glucose Monitoring System Market? Ans. Asia Pacific Blood Glucose Monitoring System Market size was valued at US$ 2.9.5 Billion in 2020 and the total Asia Pacific Blood Glucose Monitoring System Market revenue is expected to grow at 9.5 % through 2021 to 2029, reaching nearly US$ 6.8 Billion. 5. What segments are covered in the Asia Pacific Blood Glucose Monitoring System Market report? Ans. The segments covered are by Product, Testing Site, Patient Care Setting ,Application and, Region.

1. Asia Pacific Blood Glucose Monitoring System Market Size: Research Methodology 2. Asia Pacific Blood Glucose Monitoring System Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Asia Pacific Blood Glucose Monitoring System Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Asia Pacific Blood Glucose Monitoring System Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • China • India • Japan • Others 3.12. COVID-19 Impact 4. Asia Pacific Blood Glucose Monitoring System Market Size Segmentation 4.1. Asia Pacific Blood Glucose Monitoring System Market Size, by Product (2021-2029) • Self-Monitoring Blood Glucose Systems o Blood Glucose meters o Testing strips o Lancets & Lancing Devices • Continuous Glucose Monitoring Systems o Sensors o Transmitters o Receivers 4.2. Asia Pacific Blood Glucose Monitoring System Market Size, by Testing Site (2021-2029) • Fingertip testing • Alternate Site Testing 4.3. Asia Pacific Blood Glucose Monitoring System Market Size, by Patient Care Setting (2021-2029) • Hospital & Clinics • Self/Home Care 4.4. Asia Pacific Blood Glucose Monitoring System Market Size, by Application (2021-2029) • Type 2 Diabetes • Type 1 Diabetes • Gestational Diabetes 5. China Asia Pacific Blood Glucose Monitoring System Market (2021-2029) 5.1. China Asia Pacific Blood Glucose Monitoring System Market Size, by Product (2021-2029) • Self-Monitoring Blood Glucose Systems o Blood Glucose meters o Testing strips o Lancets & Lancing Devices • Continuous Glucose Monitoring Systems o Sensors o Transmitters o Receivers 5.2. China Asia Pacific Blood Glucose Monitoring System Market Size, by Testing Site (2021-2029) • Fingertip testing • Alternate Site Testing 5.3. China Asia Pacific Blood Glucose Monitoring System Market Size, by Patient Care Setting (2021-2029) • Hospital & Clinics • Self/Home Care 5.4. China Asia Pacific Blood Glucose Monitoring System Market Size, by Application (2021-2029) • Type 2 Diabetes • Type 1 Diabetes • Gestational Diabetes 5.5. China Asia Pacific Blood Glucose Monitoring System Market, by Country (2021-2029) • China • India • Japan • Others 6. India Asia Pacific Blood Glucose Monitoring System Market (2021-2029) 6.1. India Asia Pacific Blood Glucose Monitoring System Market, by Product (2021-2029) 6.2. India Asia Pacific Blood Glucose Monitoring System Market, by Testing Site (2021-2029) 6.3. India Asia Pacific Blood Glucose Monitoring System Market, by Patient Care Setting (2021-2029) 6.4. India Asia Pacific Blood Glucose Monitoring System Market, by Application (2021-2029) 6.5. India Asia Pacific Blood Glucose Monitoring System Market, by Country (2021-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 7. Company Profile: Key players 7.1. Abbott Diabetes Care 7.1.1. Company Overview 7.1.2. Financial Overview 7.1.3. Presence 7.1.4. Capacity Portfolio 7.1.5. Business Strategy 7.1.6. Recent Developments 7.2. Roche 7.3. Johnson & Johnson 7.4. Dexcom 7.5. Medtronic 7.6. Arkray 7.7. Ascensia Diabetes Care 7.8. Agamatrix Inc. 7.9. Bionime Corporation 7.10. Acon 7.11. Medisana 7.12. Trivida 7.13. Rossmax 7.14. Diamontech GmbH 7.15. 77 Elektronika Kft. 7.16. GlySens Incorporated 7.17. Novo Nordisk A/S 7.18. Nemaura. 7.19. PHC Holdings Corporation.